- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Learn Everything About Sending Money from the US to Korea

Image Source: pexels

When sending money from the US to Korea, finding the easiest and most cost-effective method is crucial. The suitable method may vary depending on purposes like family support, tuition payments, or investments. Over the past five years, the annual remittance volume between the US and Korea is estimated to exceed 2 trillion KRW (approximately 1.5 billion USD at 1 USD ≈ 1,350 KRW). Accurate information, such as the recipient’s English name, bank name, account number, and SWIFT code, is required for remittances. This article provides practical information you can apply immediately.

Key Takeaways

- When sending money from the US to Korea, ensure accurate information like the recipient’s English name, bank name, account number, and SWIFT code is prepared.

- Various methods, including bank transfers, online remittance services, cash transfers, digital payments, and cryptocurrency transfers, are available; choosing based on purpose and amount can save fees and time.

- Checking and preparing remittance limits and required documents in advance can reduce delays or errors.

- Carefully comparing exchange rates and fees while using trusted services ensures safe and economical transfers.

- After sending money, always verify the transaction details and contact customer support immediately if issues arise.

Remittance Preparation

Image Source: unsplash

Essential Information

To send money from the US to Korea, you must first prepare accurate information. Incorrect input may delay or return the remittance. The table below helps you easily check the required information:

| Item | Example & Details |

|---|---|

| Recipient’s English Name | Example: HONG GIL DONG (account holder’s English name) |

| Bank Name (English) | SHINHAN BANK (Shinhan Bank English name) |

| Bank English Address | 20, SEJONG-DAERO 9-GIL, JUNG-GU, SEOUL, SOUTH KOREA |

| SWIFT Code | SHBKKRSE (Shinhan Bank’s SWIFT code) |

| Account Number | KRW or foreign currency deposit account number |

| Domestic Recipient’s Phone Number | Example: 82-10-9999-0001 |

You can check the SWIFT code and English address on the bank’s app or website. When sending money to Kakao Bank, you also need the account number, English name, mobile phone number, bank name, bank name, and SWIFT code. Accurate information input ensures the money transfer process proceeds smoothly.

Document Verification

When the remittance amount exceeds limits or has a special purpose, additional documents are required. You need to prepare the following documents:

- Identification: Passport, driver’s license, resident ID, etc.

- Proof of remittance purpose: Scholarship receipt, enrollment certificate, admission confirmation, etc.

- Additional verification documents: Parental consent form, remittance plan explanation, etc.

- Required documents may vary by bank, so confirm before sending.

Visiting a bank in person allows staff to guide you on necessary documents. For online remittances, you may need to upload ID copies.

Limits and Restrictions

When sending money from the US to Korea, you must check limits and restrictions. The table below helps you understand remittance targets, limits, and required documents:

| Transaction Target | Remittance Limit | Transaction Purpose | Supporting Documents |

|---|---|---|---|

| Overseas Residents (Students, etc.) | No limit (declaration required for over 100,000 USD annually) | Overseas living expenses | Enrollment certificate, admission confirmation, etc. |

| Korean Residents | Within 100,000 USD annually (per transaction over 5,000 USD) | Living expenses, pocket money, ceremonial expenses, etc. | No additional documents required |

| Overseas Koreans (Permanent Residents, etc.) | Within personal asset range | Transfer of domestic assets overseas | Passport, permanent residency/citizenship documents, etc. |

| Foreigners or Non-Residents | Within 50,000 USD annually (proof required for excess) | Salary remittance earned in Korea | Salary statement, income proof, etc. |

Exchange Rate Info: 1 USD ≈ 1,350 KRW (June 2024 benchmark)

Remittances exceeding 100,000 USD annually are reported to the Korean National Tax Service or Financial Supervisory Service. Transactions under 5,000 USD per transfer are not counted toward the limit and require no registration. Required documents vary by purpose, so preparing them in advance ensures faster and safer remittances.

Major Money Transfer Methods

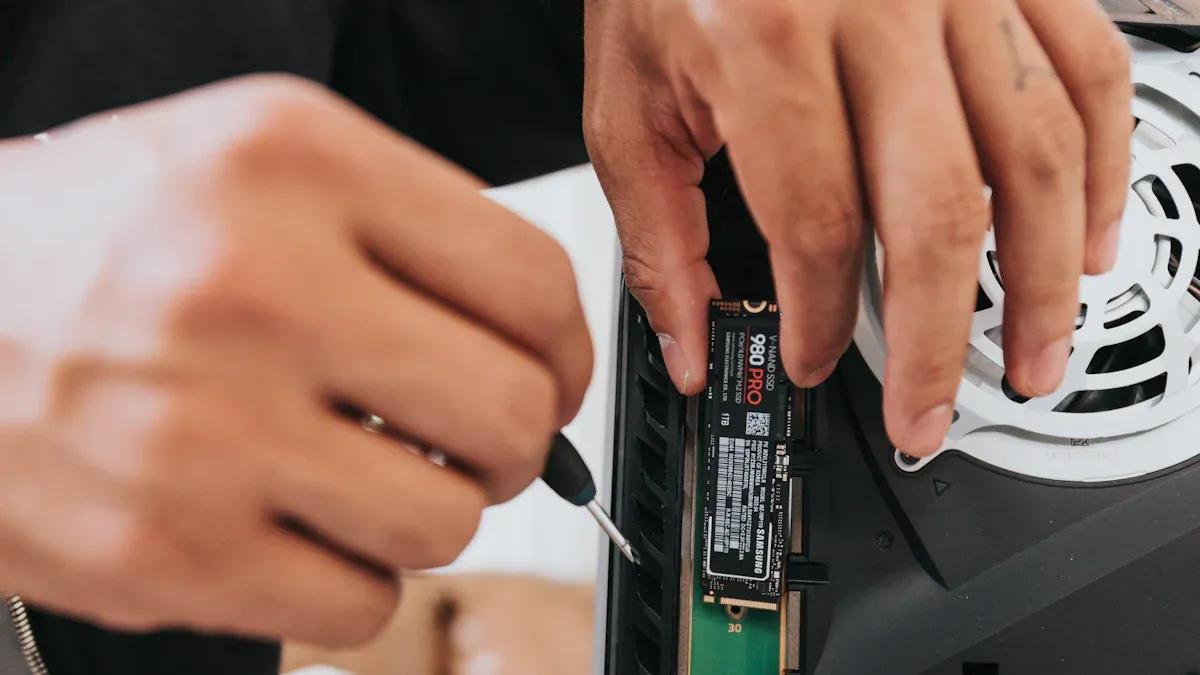

Image Source: unsplash

Bank Transfer

Bank transfer is the most traditional money transfer method from the US to Korea. Major US banks (Bank of America, Chase, etc.) use the SWIFT system for remittances. Transfers can be requested in person (bank visit) or online (online banking, mobile app). Accurate recipient information, including English name, bank name, account number, and SWIFT code, is required. Fees vary by bank; for Bank of America, it’s about $45 (June 2024, 1 USD ≈ 1,350 KRW), with additional currency conversion fees. Fees may be charged by the sending bank, intermediary banks, and receiving bank. Transfer time averages 1-3 business days, but can take up to 5 days. The table below summarizes key bank transfer details:

| Bank Name | International Transfer Fee | Conversion Fee | Estimated Total Cost | Time Required |

|---|---|---|---|---|

| Bank of America | ~$45 | Separate | $45 + conversion fee | 1-3 business days |

| Chase | ~$5-$20 | Separate | $5-$20 + conversion fee | 1-3 business days |

Bank transfers are safe and reliable for large amounts, but check fees and exchange rate conditions.

For transfers over $10,000, negotiate with the bank for 50-90% preferential rates.

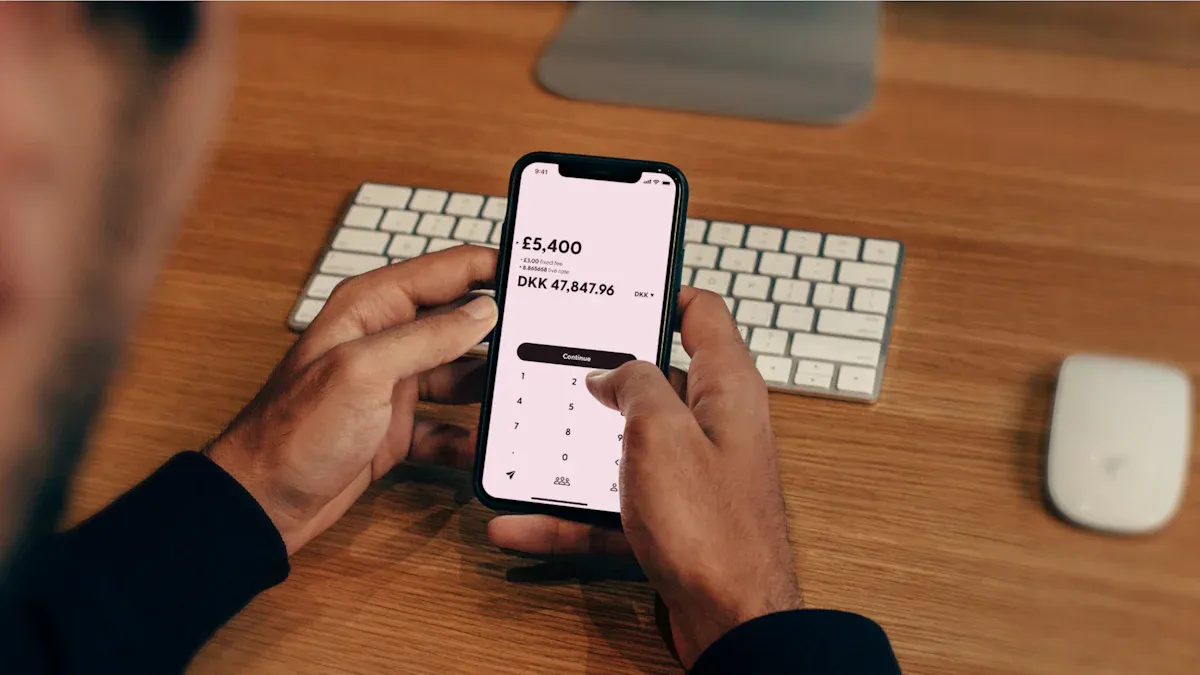

Online Remittance Services

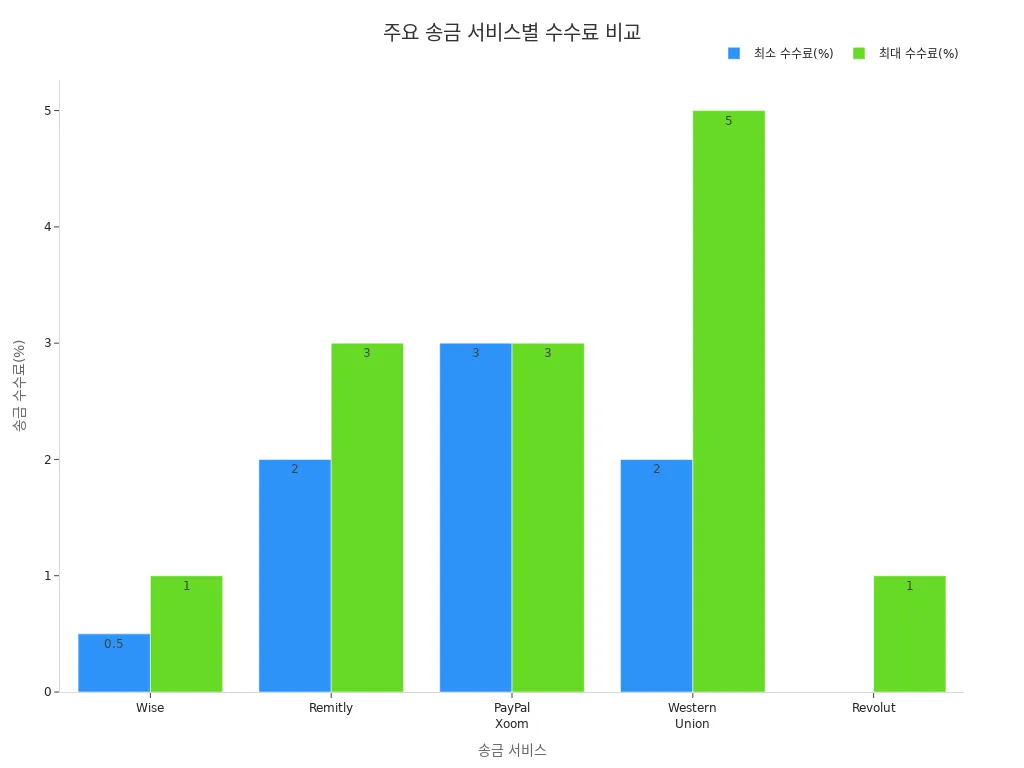

Online remittance services are among the most popular money transfer methods today. Services like Wise, Remitly, Xoom, and WireBarley allow easy transfers via apps or websites with transparent fees and rates. Wise applies real-time mid-market rates with fees of 0.5-1%. Remitly’s express option completes transfers in minutes. PayPal Xoom integrates with PayPal for convenience but may charge over 3% in fees. Western Union supports cash pickup worldwide but may have unfavorable rates. The table below compares key features of online remittance services:

| Service Name | Transfer Fee (USD) | Exchange Rate Margin | Transfer Speed | Key Features & Pros/Cons Summary |

|---|---|---|---|---|

| Wise | 0.5-1% | Low | 1-2 days | Low fees, preferential rates, fast |

| Remitly | 2-3% | Moderate | Minutes to 1 day | Urgent transfers, various options |

| PayPal Xoom | 3%+ | Moderate | Minutes | PayPal integration, high fees |

| Western Union | 2-5% | High | Minutes to 1 day | Cash pickup, high fees |

| Revolut | Free to 1% | Low | Instant | Multi-currency, low-cost transfers |

Compare remittance limits, fees, and rates for online services.

Wise is favored for low fees and transparency.

Remitly is ideal for urgent transfers.

Cash Transfer Services

Cash transfer services are useful for sending money to recipients without bank accounts. Western Union and MoneyGram are prominent examples. After sending from the US, recipients can collect cash at designated locations in Korea with ID and their English name. Fees vary by amount and country, typically $5-$30. Total costs may range from $20-$50 or more. Exchange rates may be less favorable than banks, so check margins before sending. Transfer limits vary by service; check official websites. Transfer time is usually 1-3 days, and confirm in advance for urgent cases.

Cash transfers are fast and convenient but require careful fee and rate comparison.

Their wide cash pickup network suits emergencies.

Digital Payment Services

Digital payment services (PayPal, Venmo, etc.) are emerging methods for sending money from the US to Korea. PayPal supports international transfers via Xoom, requiring real-name verification, with a per-transaction limit of $5,000 and an annual limit of $50,000. Transfers and receipts are restricted to designated accounts. Fees include currency conversion, transfer, and foreign partner payment fees, with rates available online.

| Item | Details |

|---|---|

| Real Name Transaction | Verification required |

| Transfer Limit | $5,000 per transaction, $50,000 annually |

| Designated Account | Only registered accounts for sending/receiving |

| Fees | Conversion, transfer, foreign payment fees |

| Rate Applied | Rate info provided on website |

| Payment & Receipt | Paid after fee deduction and currency conversion |

Digital payments are convenient but verify limits and fee structures.

Cryptocurrency Transfers

Cryptocurrency transfers are gaining attention recently. Using blockchain networks, transfers are fast and low-cost without intermediaries. Stablecoins enable transfers in seconds to minutes without conversion costs. Fees are just a few cents, extremely low. However, cryptocurrencies have high price volatility and face regulatory risks. Security risks like exchange hacks, wallet theft, and phishing also exist. Below are potential risks for cryptocurrency transfers:

- Exchange hacking (e.g., FTX, Binance)

- Personal wallet hacking

- Cross-chain bridge attacks

- Phishing, malware, key theft

Cryptocurrency transfers excel in speed and cost but require awareness of security and regulatory risks.

Trusted exchanges and secure wallets are critical.

Remittance Checklist

Exchange Rate Comparison

You must check exchange rates before sending. When rates rise, sending the same amount requires more KRW. For example, sending $10,000 for tuition at a 1 USD = 1,350 KRW rate versus 1,400 KRW increases the cost burden. Lower rates reduce costs. Rate fluctuations directly impact remittance amounts.

Rate policies vary by service. Banks charge conversion fees, and some offer preferential rates. Online services provide real-time rates for convenience. Compare rates across providers before sending.

Fee Verification

Fees differ significantly by service. Low fees may hide costs if rates are unfavorable. The table below shows fee differences for sending 10 million KRW (~$7,400 USD, 1 USD = 1,350 KRW):

| Service | Fee for 10M KRW (USD) |

|---|---|

| Commercial Banks | ~$74-81 |

| Moin Service | ~$30-37 |

Moin offers lower costs due to real-time rates, simple processes, and extra rate benefits. Verify both total fees and rates before sending.

Security & Scam Prevention

Use trusted services and verify remittance details, recipient info, and bank names.

- Save transaction records and recheck recipient accuracy.

- Use official apps or websites for transfers.

- Avoid suspicious links or emails.

- Review details post-transfer.

Untrusted platforms or scams can lead to financial loss. Always use official channels and manage personal info securely.

Transfer Time

Transfer times vary by service and situation.

- AI-based prediction services from banks provide estimated times.

- Real-time progress tracking is available.

- Basic info like sending bank, currency, and amount allows status checks.

If delayed, services explain reasons. Monitoring the entire process from start to arrival helps address unexpected delays quickly.

Confirm estimated times before sending. For urgent needs, choose express or fast transfer services.

Transfer Process and Tips

Step-by-Step Procedure

Using Citi Bank in Hong Kong online banking as an example, you can send money from the US to Korea with these steps](https://www.citibank.co.kr/FxdFxgdPrcd0100.act):

- Access the Citi Bank official website.

- Log in with a joint certificate.

- Select ‘Foreign Exchange/Global’ from the menu, then click ‘Remittance.’

- Choose ‘International Remittance’ from the ‘Remittance’ submenu.

- Enter the remittance amount, recipient’s English name, bank name (English), bank name (account number), deposit number, account number, and SWIFT code, and other essential information.

- Reconfirm entered details.

- Complete authentication and submit the transfer.

Amounts are in USD, with exchange rates (1 USD ≈ 1,350 KRW, June 2024, benchmark rate) affecting the KRW received amount. Save Save records and verify recipient info until the end.

Error Handling

If recipient info mismatches, errors like “‘Other Receipt Failure” may occur. Refer to the table below for quick resolution:

| Issue Type | Possible Issues/Symptoms | Solutions & Recommendations |

|---|---|---|

| Transfer Error | Mismatch in bank name, account number, or real-name holder causing errors | Recheck bank name, account number, and real name. Adjust limits if needed via bank app or customer service. |

| Customs Delay | Mismatch between recipient name and customs clearance code preventing clearance | Verify recipient name matches customs code. Respond to customs agents with accurate info if contacted. |

Incorrect recipient details may delay or return funds. Contact the bank app or customer service immediately to resolve errors.

Secure Receipt

To ensure safe receipt, recipients should:

- Provide only essential info like account number, bank name, and holder name.

- Share additional details like SWIFT codes or bank addresses if required, but avoid unnecessary personal data.

- Check transfer details directly via the service’s transaction history.

- If a sender requests a secure transfer cancellation, the recipient decides approval.

- In disputes, the service may hold or cancel funds, resolved by agreement or court ruling.

Confirm details via remittance rules or customer support for accuracy. Always check details post-transfer and address issues promptly.

Choose the right method based on your situation to save on fees and time. The table below helps select the best method for your purpose:

| Scenario | Recommended Method | Features & Fees (USD, 1 USD ≈ 1,350 KRW) |

|---|---|---|

| Small Amount (<$5,000) | Online bank mobile app | ~$4, simple process, 2-5 days |

| Large Amount | Bank visit | Declaration & documents required, fees vary |

| Family Transfers | Online banking or bank visit | Simplified process, fast handling |

Before sending, confirm recipient’s English name, account number, SWIFT code, amount, and fee bearer. Careful selection ensures safe and efficient transfers.

FAQ

What is the cheapest way to send money from the US to Korea?

Online services like Wise or Remitly are typically the cheapest, with fees of 0.5-3%. Rates are applied in real-time, with 1 USD = 1,350 KRW (June 2024 benchmark).

What if I exceed the transfer limit?

Prepare additional documents like ID and proof of purpose. Hong Kong banks require declaration for over $100,000 annually.

How can I check a delayed transfer?

Use the service’s transaction history function.

Contact customer support for progress updates.

How can I send money if the recipient has no bank account?

Use cash pickup services like Western Union or MoneyGram. Recipients can collect funds with ID and English name at designated locations.

How to easily compare transfer fees and rates?

Check fees and rates on official websites.

- Wise, Remitly, and Hong Kong banks offer real-time comparisons.

- June 2024 benchmark rate: 1 USD = 1,350 KRW.

Sending money from the US to Korea doesn’t have to mean high fees, long waits, and hidden charges.

With BiyaPay, your transfers become smarter, faster, and more affordable.

Why choose BiyaPay?

- Transfer fees from just 0.5%—much lower than banks or traditional services

- Real-time FX rates so you always know the exact amount

- Same-day arrival, supporting both fiat and crypto transfers

- No hidden costs, perfect for tuition, family support, and cross-border business

Take the stress out of international remittances—choose BiyaPay for a faster, safer way to move money.

Get started today at BiyaPay

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.