- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Finally Got an Offer, But Struggling with Tuition Fees?

Image Source: unsplash

You may have just received an offer, full of excitement, but high tuition fees have stopped you in your tracks. Many Chinese students have to sell property or rely on family support to pay for U.S. tuition. U.S. public universities charge much higher tuition for international students than for local students, which puts heavy pressure on you and your family. You not only face financial burdens but also worry about whether you can successfully complete your studies and repay your family’s investment.

Key Takeaways

- After receiving an offer, tuition fees are usually high, so you need to plan funds in advance to avoid payment difficulties due to foreign exchange limits and payment method restrictions.

- Scholarship approval takes a long time and may not be granted, so it’s advisable to prepare a self-funded plan simultaneously to avoid delays in payment affecting enrollment.

- Cross-border remittances may face delays or errors in information, so be sure to verify remittance details and maintain communication with banks and schools to ensure tuition arrives on time.

- Use multiple channels to address tuition pressure, including installment payments, applying for scholarships and grants, education loans, and on-campus jobs, to reasonably utilize resources and reduce the burden.

- If facing financial difficulties, proactively communicate with the school to apply for a payment extension or aid, and stay vigilant against tuition scams, ensuring payments are made through official channels to secure funds.

Tuition Challenges After Receiving an Offer

Image Source: pexels

Insufficient Fund Preparation

After receiving an offer, the first step is to prepare tuition. Many students find that tuition amounts to tens of thousands of dollars (USD), which, at the current exchange rate, translates to a huge sum in RMB. You may encounter these issues:

- Personal annual foreign exchange limits restrict you to exchanging a maximum of $50,000 (USD) per year. If tuition exceeds this limit, you need to seek help from family or friends to exchange currency, which involves very complicated procedures.

- Credit card payments, while fast, come with high fees of 2%-4% and have limits on the amount. Some schools only accept U.S. credit cards, and the billing address must be in the U.S., making payment even more difficult for you.

- Traditional remittance methods like wire transfers or bank drafts are cumbersome and slow to process. You need to visit a Hong Kong bank counter in person, fill out multiple pieces of information, and any mistake can easily lead to errors.

When preparing funds, you must plan in advance to avoid missing the enrollment opportunity after receiving an offer due to insufficient funds.

Scholarships Not Approved

Many students, after receiving an offer, pin their hopes on scholarships to ease financial pressure. But the scholarship approval process is long, typically taking more than 10 business days. The process includes:

- The college review committee finalizes the list, which must be publicized within the college for at least 5 business days.

- After no objections during the publicity period, the list is submitted to the school’s review leadership office.

- The school’s review leadership group reviews and compiles the list, then publicizes it university-wide for at least 5 business days.

If your scholarship is not approved, you must pay the full tuition out of pocket. Since official data on the proportion of unapproved scholarships is not disclosed, you need to prepare for both scenarios to avoid delays in payment affecting your enrollment timeline.

Remittance and Arrival Delays

When paying tuition after receiving an offer, you often encounter delays in funds arriving. Common reasons include:

- Cross-border remittances involve multiple reviews by the sending bank, intermediary bank, and receiving bank, leading to extended arrival times.

- Incorrectly filled remittance information can result in funds being returned, with delays potentially lasting weeks or even months.

- Differences in holidays between countries and regions can affect arrival times, with weekends or holidays causing further delays.

- Bank payment limits or issues with online banking controls may also affect payment and fund arrival.

If tuition fails to arrive on time, the consequences can be severe:

- You may need to pay late fees, increasing the total cost.

- Course registration may be restricted, preventing you from enrolling in required courses.

- Long-term non-payment may affect your credit record, potentially leading to delayed graduation or even withdrawal.

After receiving an offer, be sure to verify remittance information in advance, keep communication lines open, and contact the bank and school promptly in case of delays to avoid significant losses due to minor errors.

Solutions

Image Source: pexels

Installment Payments

You can prioritize installment payment options to alleviate tuition pressure. Many U.S. universities allow students to split tuition into 2-4 installments. You simply select the “installment payment plan” on the school’s website or student system, follow the prompts to fill in information, and pay the first installment. Installment payments typically do not charge extra interest, but some schools may impose a small administrative fee (approximately $10-$50 USD per installment). You must pay attention to each installment’s payment deadline to avoid late fees or impacts on registration eligibility.

Tip: Installment payments are suitable for students with short-term cash flow difficulties. You should understand the school’s policy in advance, plan funds reasonably, and ensure timely payments for each installment.

Applying for Scholarships/Grants

After receiving an offer, you can actively apply for scholarships and grants. Both U.S. and Chinese universities offer various scholarship and grant programs with broad coverage and substantial amounts. The table below helps you quickly understand common types and application requirements:

| Scholarship/Grant Type | Description | Application Requirements |

|---|---|---|

| Merit-Based Scholarship | Awarded to students with excellent academic performance | Must meet minimum GPA standards, submit transcripts |

| Need-Based Grant | Distributed based on family financial situation | Provide proof of family financial status, complete application form |

| Athletic Scholarship | For outstanding athletes | Demonstrate athletic ability and provide relevant proof |

| Minority and Special Group Awards | Encourage students from specific backgrounds | Prove identity background, may require recommendation letters |

| Field-Specific Awards | For specific majors (e.g., medicine, engineering) | Relevant academic background and proof of grades |

When applying, you need to prepare transcripts, proof of family financial status, recommendation letters, and a personal statement. Scholarships are divided into Merit-Based (based on academic performance) and Need-Based (based on financial need) categories. Some schools adopt a Need-Blind policy, where financial status is not considered during admission. You should pay attention to application deadlines and prepare materials in advance.

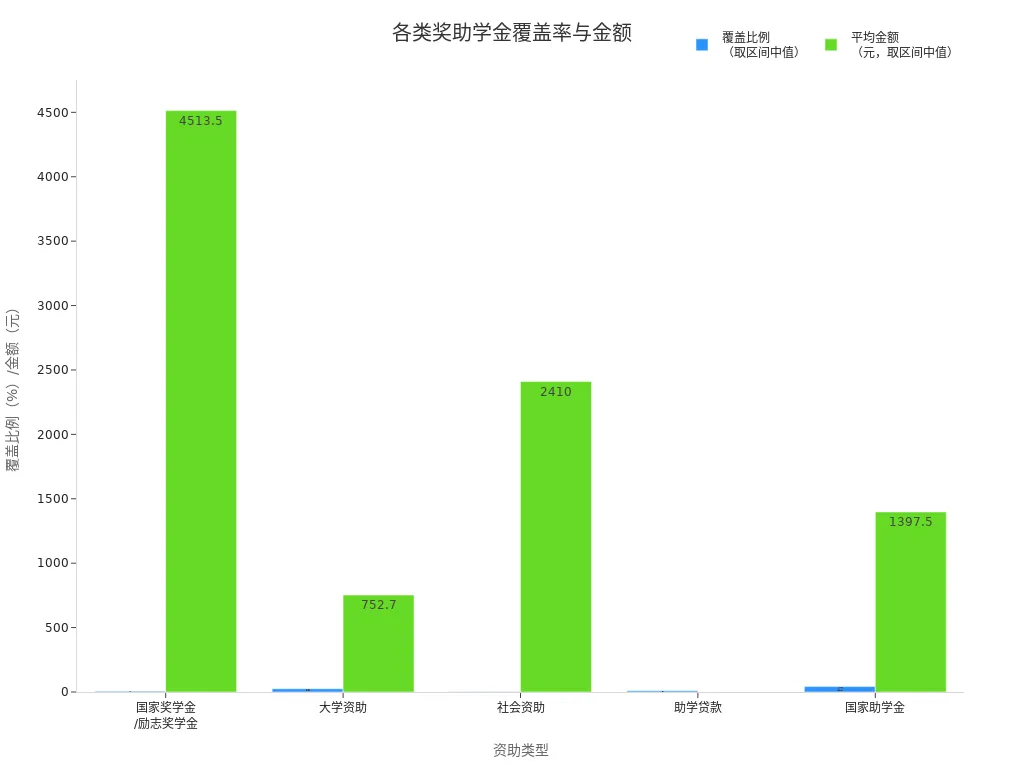

The coverage ratio and amounts for scholarships and grants at U.S. universities vary significantly. You can refer to the chart below to understand the coverage rates and average amounts for different types of funding:

If you receive a scholarship or grant, it can significantly reduce your tuition burden. Some scholarship amounts can exceed $20,000 USD per year. You should closely monitor the school’s website and scholarship announcements and actively pursue multiple funding opportunities.

Education Loans

You can also opt for education loans to address tuition issues. A common channel for Chinese students is the hometown-based credit student loan. You and your parents act as co-borrowers, with a straightforward process and low risk. The table below summarizes key information:

| Aspect | Details |

|---|---|

| Main Application Channel | Hometown-based credit student loan, co-borrowed by student and parents, easy to operate |

| Loan Interest Rate | National student loans follow LPR minus 60 basis points (LPR-60BP), with interest subsidized by the government during study; commercial loan rates are slightly higher |

| Loan Amount | Up to $2,200 USD per year for undergraduates, $2,800 USD for graduate students (based on an exchange rate of 7.2) |

| Loan Term | Study duration plus 15 years, up to a maximum of 22 years, with a 5-year grace period for principal repayment |

| Risk Control | Managed by policy banks, with joint repayment by student and parents, controllable risk |

When applying, you need to register online, fill in information, and submit materials, undergoing multiple reviews by the school and bank. The repayment cycle is generally around the 20th of each month, supporting automatic deductions via Alipay or UnionPay cards. You can apply for early repayment between the 1st and 10th of each month. If you need an extension before graduation, you must apply 30 days in advance and submit supporting documents. You should pay attention to account security, regularly update passwords, and prevent information leaks.

Note: Loan approvals have a time cycle, so you should prepare in advance to avoid delays in tuition payment due to unavailable funds.

Part-Time Work and Work-Study Programs

During your studies in the U.S., you can earn income through on-campus part-time jobs and work-study programs. On-campus job opportunities are plentiful, including roles like library assistant, computer lab assistant, student service center staff, and campus dining staff. You can work up to 20 hours per week, and up to 40 hours during holidays, with hourly wages typically ranging from $8-$12 USD, tax-free. Off-campus jobs require school approval, typically after one year of enrollment and meeting academic requirements.

At Chinese universities, work-study positions pay about $1.7 USD per hour, with fixed monthly positions offering around 40 hours, yielding approximately $68 USD per month. Students from financially disadvantaged families may receive higher wages. You must follow school regulations, balance study and work time, and avoid impacting your academics.

On-campus jobs not only help cover living expenses but also build social experience and enhance communication and management skills.

Negotiating with the School

If you face temporary financial difficulties, you can proactively communicate with the school to apply for a payment extension or temporary financial aid. Common reasons for extensions include cash flow issues, foreign exchange limits, or personal emergencies. You need to email the admissions office in advance, attaching relevant supporting documents. Extensions are typically granted for 1-4 weeks, with lower success rates for second extensions.

Schools also offer one-time temporary subsidies, special relief funds, and essential living supplies for financially disadvantaged students. You can apply through the school’s online service platform or platforms like Yiban, with subsidies issued after college and school reviews. Some schools also provide psychological support and remote career guidance to help you reduce stress and complete your studies smoothly.

Proactive communication and timely feedback are key to resolving tuition issues. You should maintain contact with the school to secure maximum support.

Precautions

Remittance Process

When preparing for cross-border remittances, you need to understand the basic process. The general process is as follows:

- You need to be a personal online banking customer of a Hong Kong bank, prepare valid identification and a registration card, and open a multi-currency current account.

- Visit a bank branch to apply for a U-Shield and activate overseas transfer permissions.

- Submit remittance instructions through online banking, processed in real-time from 9:00 to 16:00 on weekdays.

- The bank deducts the payment and sends the remittance information, with arrival time depending on the receiving bank’s system.

| Process Step | Details |

|---|---|

| Prerequisites | Must be a Hong Kong bank personal online banking customer, hold valid ID and registration card, and have a multi-currency account |

| Activation Process | Apply for a U-Shield at a bank branch to activate overseas transfer permissions |

| Submitting Remittance Instructions | Available 24/7 via online banking, processed in real-time from 9:00-16:00 on weekdays |

| Remittance Processing | Bank deducts funds in real-time, sends payment information, arrival time depends on the receiving bank’s system |

| Timeframe | Counter remittances take 1-2 business days, online channels can be as fast as 24 hours, typically 3-7 business days |

Arrival Time

You should pay special attention to arrival times to avoid penalties from the school due to delays. Different banks and remittance methods have varying arrival speeds:

- Counter remittances generally take 1-2 business days, while online channels can be as fast as 24 hours, typically 3-7 business days.

- Remittances processed on weekends or holidays will be delayed.

- Wire transfers usually take 2-3 business days, while express remittances can arrive in 10-15 minutes.

- Large-amount remittances require longer review times, so consult the bank in advance.

It’s recommended to plan remittance timing in advance to ensure tuition arrives on time, smoothly completing registration and internship permit applications.

Fund Security

You must prioritize fund security during the remittance process. Common risks include:

- Fraudsters using fake payment channels to trick you into paying tuition, leading to fund loss.

- Traditional bank transfers involve multiple banks, and fees and exchange rate fluctuations may result in insufficient funds arriving.

- Incorrect or missing information can make it difficult to confirm payments.

- Using unofficial channels for remittances carries high risks and is prone to fraud.

- International students unfamiliar with the financial environment are easy targets for scams.

You should pay tuition through school-verified official channels, regularly monitor account balances and transaction records, and contact the bank promptly in case of anomalies.

Avoiding Scams

You must stay vigilant against various tuition-related scams. Common tactics include:

- Impersonation scams, where fraudsters use stolen social media accounts of classmates to induce you to transfer money.

- Part-time job scams, luring you with high rewards to pay funds upfront.

- Impersonating admissions office staff, demanding deposits or registration fees.

- Fabricating emergencies, such as a child’s illness or kidnapping, to trick you into transferring money.

You should protect personal information, avoid trusting unfamiliar calls or messages, and verify identities before making transfers. If you encounter suspicious situations, promptly seek help from teachers, parents, or the police, and never transfer money casually.

Case Studies and Q&A

Real Case Studies

You can draw inspiration from Zhao Yan’s experience. She faced tuition pressure upon enrollment but proactively applied for the school’s green channel and high-coverage student loans. Zhao Yan also actively pursued scholarships and earned income through work-study positions. Through these methods, she achieved financial independence and reduced her family’s burden. You can also follow the example of Wu Mingli and Sun Yanlei, who sought help from government-funded programs when facing financial difficulties. For instance, the Hope Project provided them with tuition support, enabling them to complete their studies smoothly. These cases show that you can address tuition challenges through multiple channels while fostering self-reliance. You should proactively utilize school, social, and government resources, plan finances reasonably, and ensure smooth academic progress.

Common Questions

When paying tuition, you often encounter the following questions:

- How is tuition calculated? Credit-based fees include major tuition and credit fees, charged annually and per semester, with actual amounts varying based on the number of credits taken.

- Why is this year’s tuition higher than last year? The credit system allows payment based on actual credits taken, so tuition amounts may fluctuate.

- Can tuition be paid in installments? You can choose bank batch deductions, on-site centralized payments, or self-service payments, and some schools also support installment payment plans.

- What if you forget to pay tuition? You can set calendar reminders, regularly check your account, and create a budget plan. Late payments may affect scholarship eligibility or academic progress, so contact the school’s finance department promptly to apply for an extension or penalty waiver.

- What does tuition cover? Taking Oxford University as an example, tuition includes teaching, academic services, and facility fees but excludes accommodation and living expenses. Living expense budgets are approximately $10,575 USD to $15,380 USD per year, subject to the school’s official website.

When you have questions, you can consult the school’s finance office or check the school’s website to ensure a smooth payment process and avoid unnecessary losses.

After receiving an offer and facing tuition challenges, you can try multiple channels to resolve them:

- Apply for national student loans, scholarships, grants, and work-study positions to enhance self-reliance.

- Proactively communicate with the school, utilizing green channels and online systems to ensure smooth payment.

- Plan funds reasonably, monitor school notifications, and avoid delays affecting your studies.

College entrance exam admission rates and graduate employment rates continue to rise, indicating that many students successfully complete their studies by reasonably utilizing resources. Real cases show that proactive communication and diverse support give you more confidence to pursue your dreams.

FAQ

What payment methods can be used for tuition?

You can choose Hong Kong bank wire transfers, credit cards, third-party payment platforms, or the school’s designated online payment system. It’s recommended to prioritize official channels recommended by the school to ensure fund security.

What are the consequences if tuition arrives late?

You may be charged late fees, which could affect course registration. Some schools may also suspend your student account. You should contact the school’s finance department promptly to explain the situation.

How is the tuition exchange rate calculated?

When paying tuition, the bank settles based on the real-time exchange rate of USD to RMB on the day of payment. You can monitor exchange rate changes in advance and choose an optimal time to remit.

What grants or scholarships can you apply for?

You can apply for merit-based scholarships, financial hardship grants, or specialized awards. Each scholarship has different application requirements. You should prepare materials in advance and monitor school announcements.

What does tuition cover?

Tuition typically includes academic courses, teaching services, and some facility fees. It does not include accommodation or living expenses. You should check the school’s website for specific fee details.

After securing an offer, many students struggle with tuition payments abroad. Traditional bank transfers often mean high fees, poor exchange rates, and delayed processing — sometimes jeopardizing enrollment. With BiyaPay, you gain real-time currency conversion for both fiat and crypto, enjoy fees as low as 0.5%, and benefit from same-day settlement. Fast registration and secure compliance ensure that paying your tuition no longer feels overwhelming.

Take control of your education journey today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.