- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best travel insurance in Australia (2025 Comparison)

Image Source: unsplash

When you look for the best travel insurance in Australia, you want real value and peace of mind. WorldTrips, Travel Insurance Saver, Allianz, and Cover-More stand out as the best travel insurance providers for 2025. They offer strong cancellation cover, trusted support, and the best travel insurance with covid cover. Many Australians choose travel insurance in Australia for protection against high medical costs, cancellation cover, and new travel risks. The best brands shine with essential travel insurance and flexible cancellation cover. Use expert reviews and insurance comparison tools to find the best travel insurance for your trip. Your needs may change based on your destination, so a good travel insurance comparison helps you get the best.

Key Takeaways

- Choose travel insurance that fits your trip by comparing coverage, price, and benefits using trusted tools.

- Look for policies with strong emergency medical cover, high cancellation limits, and 24/7 assistance.

- Check for coverage of pre-existing conditions and adventure activities if they apply to you.

- Read the fine print carefully to understand exclusions, claim rules, and policy limits.

- Buy your travel insurance early to get full protection, including cancellation cover before your trip.

Quick Comparison

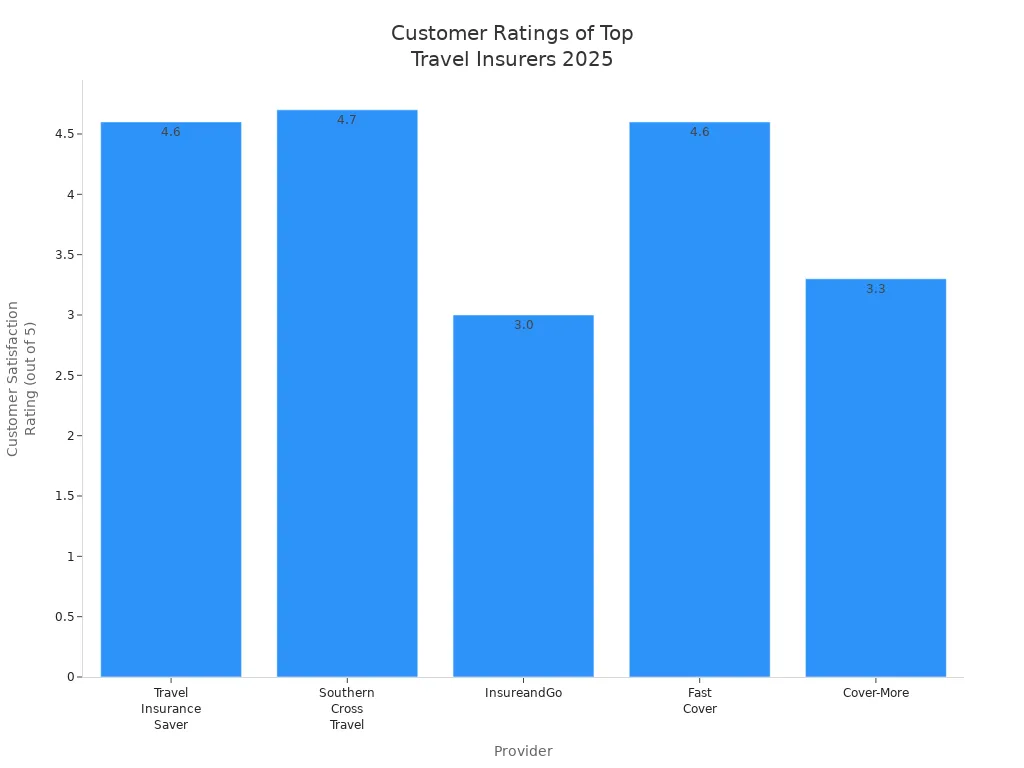

Best Travel Insurance Providers

When you want the best travel insurance for your trip, you need to see how the top brands stack up. Here’s a quick look at the best travel insurance providers in Australia for 2025. These companies offer comprehensive travel insurance with strong cancellation cover, high customer satisfaction, and extra benefits that make them stand out.

| Provider | Coverage Limits (Medical / Luggage / Cancellation) | Average Premiums (Qualitative) | Customer Satisfaction Ratings | Special Benefits / Notes |

|---|---|---|---|---|

| WorldTrips | Emergency medical up to $50,000, AD&D up to $25,000, repatriation, covers ages under 18 and over 69, acute onset of pre-existing conditions | Affordable for most trips | 4.5/5 (expert reviews) | Covers acute onset of pre-existing conditions, strong repatriation, no age limit, detailed AD&D coverage |

| Travel Insurance Saver | Unlimited medical (incl. COVID-19), $20,000 luggage, $20,000 cancellation | Praised for value and affordability | 4.6/5 experience rating | No age limit, $1M personal liability, budget-friendly, no missed connections cover |

| Allianz | Emergency medical up to $50,000, medical transport up to $250,000, baggage, travel delay, no age restrictions | Premium pricing | 4.2/5 (expert reviews) | Multilingual support, no age limit, strong medical transport, A+ rated by A.M. Best |

| Cover-More | Unlimited medical (incl. COVID-19), $15,000 luggage, $5,000 cancellation | Higher than most competitors | 3.3/5 from ~3,000 reviews | Covers 142 activities, age limit up to 99, good for adventure and seniors |

| Fast Cover | Unlimited cancellation, $7,500 luggage, unlimited medical | Often cheaper than Cover-More | 4.6/5 from 2,000+ reviews | Good for big trips, age limit under 89, $5M liability |

| 1Cover | Unlimited medical, cancellation, luggage, car rental excess | Good value for money | 4.3/5 from 4,750 reviews | Fast claims, unlimited medical, strong cancellation cover |

| Southern Cross (SCTI) | Unlimited medical (incl. COVID-19), $5,000 luggage, $2,500 cancellation | Cheaper than Cover-More and Allianz | 4.7/5 from 3,010 reviews | 96% claim approval, clear PDS, good claims service, cancellation cap low for expensive trips |

| InsureandGo | $50,000 cancellation, $8,000 luggage, $7,500 rental car excess | Budget-friendly | Mixed reviews | Covers 120+ activities, $2.5M liability, complex PDS |

Tip: Use comparison tools like Canstar, Wise, Squaremouth, and CHOICE to check the latest ratings and find the best travel insurance for your needs.

Key Features Compared

You want comprehensive travel insurance that covers more than just the basics. The best travel insurance providers offer strong cancellation cover, unlimited overseas medical, and extra perks. Here’s what you should look for:

- Comprehensive travel insurance with unlimited medical and high cancellation cover

- Fast claims process and high customer satisfaction

- Special benefits like coverage for pre-existing conditions, adventure sports, and no age limits

- Clear policy documents and easy-to-understand exclusions

Some providers, like WorldTrips, give you coverage for acute onset of pre-existing conditions and strong repatriation benefits. Allianz stands out for its multilingual support and no age restrictions. Travel Insurance Saver and Fast Cover both offer affordable comprehensive travel insurance with high cancellation cover and good value.

When you do a travel insurance comparison, always check the fine print. Some policies have limits on cancellation cover or exclude certain activities. The best travel insurance gives you peace of mind, especially if you want comprehensive protection for your trip.

How to Choose

Image Source: pexels

Assessing Coverage

When you start buying travel insurance, think about your trip and what you need. Look at your itinerary and planned activities. Do you want comprehensive travel insurance for adventure sports or just essential travel insurance for a short visit? Make sure your travel insurance policy includes emergency medical cover, cancellation cover, and 24/7 emergency assistance. If you plan multi-trip travel insurance, check that your policy covers all destinations. Always ask, what does travel insurance cover for your situation? Some policies offer unlimited emergency medical cover, while others set limits. If you have pre-existing conditions, find a travel insurance policy that includes them. Many policies in Australia require add-ons for high-risk activities like surfing or scuba diving.

Tip: Match your travel insurance coverage to your trip. Use comparison tools to see which comprehensive travel insurance options fit your needs.

Exclusions and Limitations

Every travel insurance policy has exclusions. You need to know what is not covered. Here’s a quick table of common exclusions in Australia:

| Common Exclusion Category | Explanation |

|---|---|

| Pre-existing medical conditions | Often excluded or need special approval. |

| High-risk or adventure activities | Usually not covered unless you buy an add-on. |

| Travel to restricted areas | No coverage if you go against government advice. |

| Pandemics or epidemics | Some policies treat COVID-19 like other illnesses, but check the details. |

| Losses due to negligence | Claims denied if you leave bags unattended or act recklessly. |

Always read the fine print. If you want comprehensive protection, make sure your travel insurance policy covers your main risks.

Claims Process

A good claims process makes a big difference. In Australia, some providers like Southern Cross Travel Insurance have a 96% approval rate and resolve claims quickly. Others, like Cover-More, get mixed reviews for claims. Keep all receipts and documents. Use mobile apps if your provider offers them. Fast claims and 24/7 emergency assistance help you get back on track fast.

Price and Value

Price matters, but value is key. Compare premiums in USD and look at what you get for your money. Comprehensive travel insurance may cost more, but it gives you better emergency and cancellation cover. Multi-trip travel insurance can save you money if you travel often. Check if your credit card offers any travel insurance coverage.

Australia-Specific Needs

Travel insurance in Australia should fit your lifestyle. If you travel for adventure, choose a travel insurance policy with coverage for sports. Families may want extra cancellation cover and 24/7 emergency assistance. For international travel insurance, make sure your policy covers emergency medical cover and repatriation. Always buy travel insurance soon after booking to maximize your protection.

Provider Reviews

Image Source: unsplash

WorldTrips – Best Overall

You want a provider that delivers comprehensive travel insurance with strong emergency support. WorldTrips stands out as the best overall choice for many Australians in 2025. You get comprehensive coverage for emergency medical cover, cancellation cover, and repatriation. WorldTrips covers travelers of all ages, including children and seniors over 69. You also benefit from coverage for the acute onset of pre-existing conditions, which is rare among competitors.

- Insider rating: 4.83 out of 5 stars

- AM Best Financial Strength Rating: A

- Parent company Tokio Marine holds an A++ rating

You can rely on 24/7 emergency assistance and flexible multi-trip travel insurance options. WorldTrips offers affordable premiums for most trips, making it a great fit if you want comprehensive protection without breaking the bank. Some policies may have lower limits for certain benefits, so always check your policy details.

Travel Insurance Saver – Best Value

If you want comprehensive travel insurance that balances price and coverage, Travel Insurance Saver is a top pick. You get unlimited emergency medical cover, $20,000 for luggage, and $20,000 cancellation cover. This provider does not set an age limit, so you can buy coverage for the whole family or for seniors. You also get $1 million personal liability coverage, which adds peace of mind.

Travel Insurance Saver is known for its budget-friendly premiums and straightforward claims process. You can access 24/7 emergency assistance and choose multi-trip options if you travel often. The main drawback is the lack of missed connections cover, so check if this matters for your trip.

Allianz – Best for International Travel

Allianz is a leader in international travel insurance. You get a wide range of flexible plans, including Basic, Comprehensive, Multi-Trip, and options for specific needs like adventure or cruises. Allianz stands out with customizable add-ons, such as Adventure Pack, Snow Pack, and Cruise Pack, so you can tailor your comprehensive travel insurance to your trip.

You benefit from coverage for certain pre-existing conditions after disclosure, pregnancy-related complications before 24 weeks, and COVID-19 related emergencies. Allianz also offers a global support network and 24/7 emergency assistance. Their digital tools, like the My Allianz Portal, make claims and policy management easy.

Allianz also provides specialized health insurance for international students and visitors, meeting visa requirements and offering a strong network of medical providers. You get family and group travel benefits, making Allianz a strong choice for many travelers.

Many customers praise Allianz for eventually approving claims and providing reimbursement after emergencies. Some report prompt payment for emergency medical evacuations and clear communication. However, you may experience delays in claim processing, sometimes waiting weeks or months. Customer service can be inconsistent, with some users frustrated by slow responses and lack of updates.

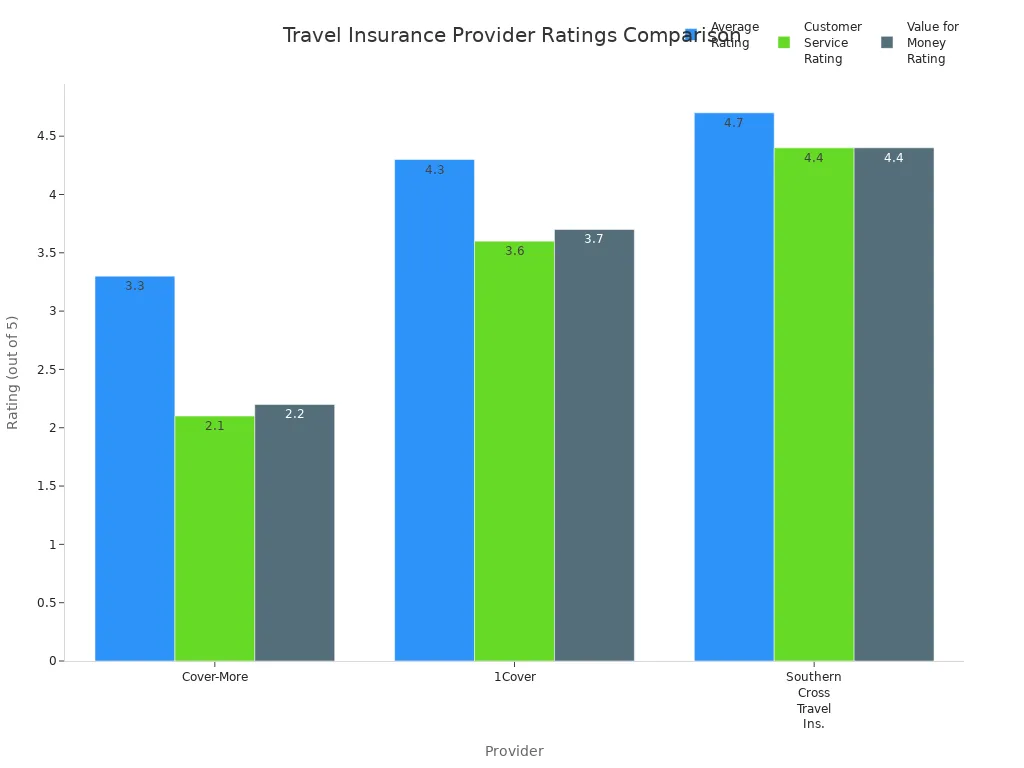

Cover-More – Best for Claims Support

Cover-More is a popular choice for comprehensive travel insurance, especially if you want strong claims support. You get unlimited emergency medical cover, $15,000 for luggage, and $5,000 cancellation cover. Cover-More covers 142 activities, so you can enjoy adventure sports with peace of mind.

You can submit claims online through a dedicated portal, and you should receive a response within 10 business days. However, customer feedback shows mixed results. Some claims take longer than expected, and efficiency can be inconsistent compared to other providers.

| Provider | Average Rating (out of 5) | Positive Reviews (%) | Customer Service Rating | Value for Money Rating | Claim Resolution Feedback |

|---|---|---|---|---|---|

| Cover-More | 3.3 | 57 | 2.1 | 2.2 | Mixed; some claims take longer; inconsistent efficiency |

You get 24/7 emergency assistance and multi-trip options, but you may want to compare claims experiences with other providers before deciding.

Fast Cover – Best for Family and Cruises

Fast Cover is a strong choice if you travel with family or plan a cruise. You get unlimited cancellation cover, $7,500 for luggage, and unlimited emergency medical cover. Fast Cover offers comprehensive travel insurance with a focus on big trips and group travel.

You can buy coverage for travelers under 89 years old, and you get $5 million personal liability. Fast Cover is often cheaper than Cover-More, making it a good value for families. You also get 24/7 emergency assistance and flexible multi-trip travel insurance options.

Some policies may have lower limits for expensive trips, so check your policy if you plan a luxury cruise or long journey.

1Cover – Best for Comprehensive Travel Insurance

You want comprehensive travel insurance that covers almost everything? 1Cover is a top pick for Australians who want broad, flexible, and inclusive coverage. You get unlimited overseas emergency medical cover, including COVID-19, and coverage for 35 pre-existing medical conditions with disclosure. 1Cover also covers personal liability up to $5 million, lost luggage up to $15,000, and car hire excess up to $8,000.

| Coverage Feature | Details |

|---|---|

| Medical & Hospital Expenses | Unlimited overseas coverage including COVID-19 medical expenses |

| Pre-existing Medical Conditions | Coverage for 35 conditions with disclosure |

| Personal Liability | Covered up to $5 million |

| Credit Card Fraud | Covered up to $5,000 |

| Lost Luggage | Coverage up to $15,000 with options to increase |

| Connecting Flights | Covered if layover exceeds 4 hours, including COVID-related delays |

| Car Hire Excess | Coverage up to $8,000 |

| Pregnancy Coverage | Covered up to 24 weeks for single pregnancy, 19 weeks for multiples |

| Sports & Activities | Over 100 covered; winter sports available as an add-on |

| Age Coverage | Available to all ages; children up to 19 included under adult plan conditions |

| Emergency Assistance | 24/7 phone support and timely email responses |

| Discounts | 5% discount for online purchase of comprehensive plan |

Customers love 1Cover for competitive pricing, excellent customer service, and prompt claim resolution. Many claims are resolved in less than a week. You can extend your policy and get coverage for travel delays and emergencies. Some users report confusion about policy terms, so always read your policy carefully.

Insure and Go – Best for Budget

If you want comprehensive travel insurance on a budget, Insure and Go is a smart choice. You get $50,000 cancellation cover, $8,000 for luggage, and $7,500 rental car excess. Insure and Go covers over 120 activities and offers $2.5 million personal liability.

You can expect claim settlement in about 10 business days, which is competitive with other budget providers like Cover-More and Budget Direct. Insure and Go is a good fit if you want affordable comprehensive coverage and fast claims. Some users find the policy documents complex, so take time to review your coverage.

| Provider | Average Claim Settlement Time |

|---|---|

| InsureandGo | 10 business days |

| Cover-More | 10–15 business days |

| Budget Direct | 10 working days |

You get 24/7 emergency assistance and multi-trip options, making Insure and Go a flexible choice for frequent travelers.

NIB – Best for Medical Coverage

NIB is a strong option if you want comprehensive travel insurance with a focus on emergency medical cover. You get high limits for emergency medical expenses, strong cancellation cover, and 24/7 emergency assistance. NIB offers flexible multi-trip travel insurance and covers a wide range of pre-existing conditions with approval.

You can buy coverage for adventure sports and family travel. NIB is known for its easy claims process and clear policy wording. If you want peace of mind for international travel insurance, NIB is a reliable choice.

Common Mistakes

When you buy a travel insurance policy, you want to avoid the mistakes that can leave you without help when you need it most. Many Australians make simple errors that can cost them thousands of USD or leave them stranded without emergency assistance. Southern Cross Travel Insurance points out that people often skip professional advice and end up with the wrong travel insurance policy. Let’s look at the most common mistakes and how you can avoid them.

Overlooking Exclusions

You might think your travel insurance policy covers everything, but exclusions can surprise you. Many policies do not include certain activities or pre-existing conditions. If you plan to try adventure sports or have a health issue, check your travel insurance policy for exclusions. Some policies do not offer cancellation cover for specific reasons, like government warnings or pandemics. Always read the list of what is not included so you do not get caught off guard during an emergency.

Underinsuring or Overinsuring

Some travelers buy the cheapest travel insurance policy and end up with too little coverage. Others pay for a comprehensive plan with benefits they do not need. You should match your travel insurance policy to your trip. If you travel often, a multi-trip plan might save you money. Make sure your coverage includes enough emergency medical, cancellation cover, and assistance for your needs. Too little coverage can leave you with big bills, while too much means you pay for extras you never use.

Ignoring Fine Print

It is easy to skip the fine print, but this is where you find the details that matter. Your travel insurance policy will list limits for emergency medical, cancellation cover, and assistance. Some policies have waiting periods or require you to report incidents within a set time. If you do not follow these rules, your claim might be denied. Always read your travel insurance policy carefully before you buy.

Not Disclosing Pre-Existing Conditions

If you have a health condition, you must tell your insurer. Many people skip this step, hoping to save money. If you do not disclose a pre-existing condition, your travel insurance policy might not pay for emergency treatment or assistance. Some policies offer comprehensive coverage for certain conditions if you declare them. Always answer health questions honestly to make sure your coverage is valid.

Delaying Purchase

Many travelers wait until the last minute to buy a travel insurance policy. This can be risky. If you buy late, you might miss out on cancellation cover for things like illness or natural disasters. Southern Cross Travel Insurance found that some people let their coverage expire before their trip ends, leaving them without emergency assistance. Buy your travel insurance policy as soon as you book your trip to get the most comprehensive protection.

Tip: The Australian government does not pay for your emergency medical or repatriation costs overseas. Your travel insurance policy is your safety net. Always make sure you have valid coverage for your entire trip.

You have many great choices for comprehensive travel insurance in Australia. The best providers offer strong emergency support, high cancellation cover, and reliable assistance. Customers praise fast and helpful service, which builds confidence when you need help most.

- Use trusted comparison tools like CHOICE to find the best fit for your trip.

- Always read your policy documents and check for exclusions.

- Think about your needs, such as comprehensive medical coverage, cancellation cover, and emergency assistance.

Before buying travel insurance, get a quote and compare policies. Secure the right coverage so you can travel with peace of mind.

FAQ

What does travel insurance usually cover?

You get coverage for emergency medical expenses, trip cancellation, lost or stolen luggage, and personal liability. Some plans also include COVID-19 cover, adventure sports, and rental car excess. Always check your policy for details and limits.

When should you buy travel insurance for your trip?

Buy travel insurance as soon as you book your trip. Early purchase gives you cancellation protection right away. If you wait, you might miss out on coverage for unexpected events before your departure.

Can you get travel insurance if you have pre-existing medical conditions?

Yes, you can. Many providers let you declare pre-existing conditions during the application. Some charge extra or require approval. Always answer health questions honestly to make sure your coverage stays valid.

How do you make a claim if something happens overseas?

Contact your insurer’s emergency assistance team right away. Keep all receipts, reports, and documents. Most providers let you submit claims online or through their app. Fast action helps your claim get processed quickly.

Tip: Always read your policy’s claims instructions before you travel. This helps you know what to do if you need help.

Choosing the right travel insurance helps protect your trip from unexpected risks, but what about your money while abroad? High foreign transaction fees and slow international transfers can add stress when you least need it. That’s where BiyaPay comes in. With remittance fees as low as 0.5%, transparent real-time FX rates, and same-day delivery when you transfer on the day, BiyaPay ensures your funds move as smoothly as your journey. Whether you need to cover tuition, emergency expenses, or family support, BiyaPay makes global payments fast, secure, and compliant.

Start today with BiyaPay and enjoy peace of mind for both your travel and your money.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.