- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

International Money Transfers with Efecty: Complete Guide

Image Source: unsplash

You can send international money transfers to Colombia with Efecty by following a few clear steps. First, choose a trusted provider for your transfers. Next, generate a voucher online. Then, pay in cash at one of Efecty’s many official locations across Colombia. The person in Colombia can pick up the money quickly. Efecty secures your payments by only accepting payments at official sites, checking your ID, and confirming payments in real time. These steps help protect your money and make cross-border payments safe.

Key Takeaways

- Choose a trusted provider that supports Efecty to send money safely to Colombia.

- Generate a voucher online and pay in cash at official Efecty locations for quick transfers.

- Recipients can pick up money fast by showing valid ID and the payment code at Efecty points.

- Compare fees and exchange rates from different providers to save money on transfers.

- Always use official Efecty sites and protect your personal information to avoid fraud.

International Money Transfers Overview

Image Source: unsplash

What Is Efecty?

You can use Efecty as a trusted provider for international money transfers in Colombia. Efecty offers financial services that focus on cash payments, electronic transfers, and digital payment methods. You find Efecty service points in almost every city and town in Colombia. Efecty processes about 20 million transactions each year. With a 41% market share, Efecty leads the Colombian money transfer industry. You can rely on Efecty for secure payments and fast transfers. Many fintechs and financial services companies partner with Efecty to expand their reach.

How International Transfers Work

International money transfers help you send money across borders quickly. You start by choosing a provider or fintech that supports transfers to Colombia. You enter the recipient’s details and pay for the transfer using your preferred payment methods. The provider gives you a transaction number. You share this number with the recipient in Colombia. The recipient visits an Efecty location, provides the transaction code, and shows valid identification. Efecty then releases the money in cash. This process supports both electronic transfers and cash payments. Many fintechs and digital services make these transactions fast and reliable.

Note: Cash pickup services like Efecty work well when the recipient needs immediate access to money or does not have a bank account. Transfers often complete within minutes.

Efecty in Colombia

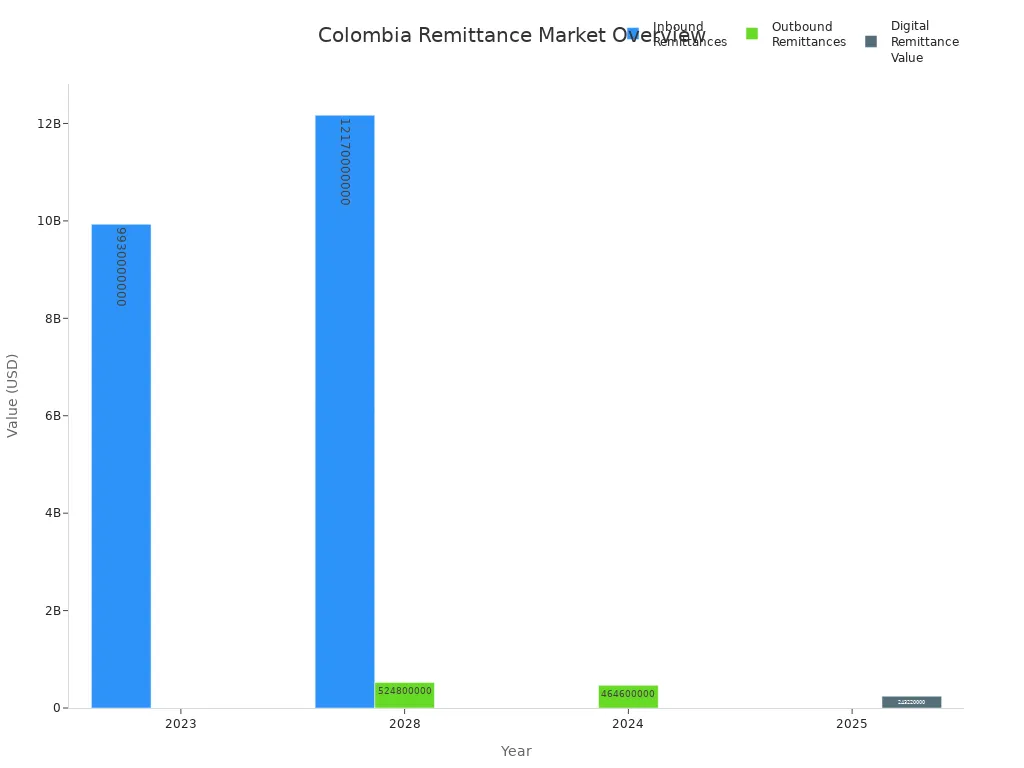

Efecty plays a major role in Colombia’s financial services sector. You can find more than 11,000 Efecty service points nationwide. Efecty covers both large cities and small towns, making payments and transfers accessible to everyone. The company processes millions of transactions each year, supporting both international transfers and local payments. Many fintechs use Efecty’s network to offer digital and cash-based services. The table below shows Colombia’s remittance market size and growth:

| Attribute | Value (USD) | Notes |

|---|---|---|

| Inbound Remittances 2023 | 9.93 billion | Colombia’s remittance inflows |

| Inbound Remittances 2028 | 12.17 billion | Projected with CAGR of 3.7% |

| Outbound Remittances 2024 | 464.6 million | Projected value |

| Outbound Remittances 2028 | 524.8 million | Projected with CAGR of 3.1% |

| Digital Remittance Value 2025 | 243.22 million | Projected digital transaction value |

| CAGR (Inbound) | 3.7% | Compound Annual Growth Rate |

Colombia’s digital remittance value is expected to reach about $243.22 million by 2025. The United States leads the global market with $44.64 billion in digital remittance value. Colombia’s share is growing, but it remains smaller compared to major markets. You see more fintechs and digital services entering the market, making international transfers and payments easier for everyone.

How to Send Transfers

Choosing a Provider

You start your international money transfers by selecting a trusted provider that works with Efecty. Many global fintech companies and payment platforms offer transfers to Colombia. You can compare their fees, exchange rates, and delivery times. Some providers focus on electronic transfers, while others specialize in cash pickups. Make sure the provider supports Efecty as a payout option in Colombia. You should check reviews and ratings to find a reliable service. Always use official websites or apps to avoid scams and protect your money.

Tip: Look for providers that offer secure online payment options. This helps you keep your financial information safe during the transfer process.

Generating a Voucher

After you choose your provider, you need to generate a voucher for your transfer. The provider will ask for the recipient’s details, including their full name and identification number. You enter the amount you want to send and select Efecty as the payout method. The system creates a unique payment reference number or code. This code links your transfer to the recipient in Colombia.

For electronic transfers, you often receive payment instructions online. Some providers use a secure online payment system, such as PSE, to confirm your payment. If you pay at a physical location, you must print or save the voucher with the reference number. You share this code with the recipient in Colombia so they can collect the money.

Note: Double-check all recipient details before confirming the transfer. Mistakes can delay payments or cause problems during pickup.

Paying at Efecty Locations

You complete the payment by visiting an Efecty location in Colombia. Efecty accepts cash payments for international transfers at its service points. You present your identification and the voucher or reference number to the cashier. The staff verifies your information and processes the payment. Efecty does not accept other payment methods for these transfers at physical locations, so you must bring enough cash.

Efecty’s network covers more than 11,000 locations across Colombia. You can find service points in cities and small towns. Always use official Efecty locations to ensure the security of your payments. Staff at these sites follow strict procedures to protect your money and personal information. They confirm each transaction in real time and provide a receipt for your records.

Security Reminder: Only pay at official Efecty locations. Never share your voucher code or personal details with anyone except the recipient. This helps prevent fraud and keeps your transfers safe.

You can see the main steps for sending money with Efecty in the table below:

| Step | Action | Details |

|---|---|---|

| 1 | Choose Provider | Select a service that supports Efecty in Colombia |

| 2 | Enter Details | Provide recipient’s name, ID, and amount |

| 3 | Generate Voucher | Receive a unique payment reference number |

| 4 | Pay at Efecty | Visit an Efecty location and pay in cash |

| 5 | Share Code | Give the reference number to the recipient |

| 6 | Pickup | Recipient collects money at Efecty with ID and code |

You follow these steps to complete international transfers quickly and securely. Efecty’s focus on cash payments and real-time verification helps you trust the process. You can rely on Efecty’s wide network in Colombia for fast and safe payments.

Cash Pickup Process

Image Source: unsplash

Collecting Funds

You can collect money sent from abroad at any Efecty location in Colombia. The process is simple and fast. When someone sends you money through a provider that supports Efecty, the funds become available almost instantly. You do not need to wait for long processing times. Here is how you complete a cash pickup in Colombia:

- The sender completes the transfer using a trusted provider.

- The money becomes available for you in Colombia right away.

- You visit any Efecty point across Colombia.

- You withdraw the money immediately after verification.

This process makes cash pickup a convenient choice for many people who need quick access to funds.

Required Identification

To receive money at Efecty, you must bring the correct documents. Efecty staff will ask you to request a “Corporate Withdrawal.” You need to provide the agreement number and the unique PIN given by the sender. Most importantly, you must show a valid ID. Without proper identification, you cannot complete the cash pickup. Always check that your ID is current and matches the name on the transfer.

Tip: Double-check the details with your sender before you go to Efecty. This helps you avoid delays and ensures you receive your money without problems.

Security Measures

Efecty takes security seriously to protect your transfers in Colombia. Staff verify your identity and the transaction details before releasing any money. They only process cash pickup requests at official Efecty locations. You should never share your PIN or agreement number with anyone except trusted contacts. Efecty’s real-time verification and strict procedures help keep your money safe during every step of the process.

Fees and Exchange Rates

Transfer Costs

When you send money to Colombia using Efecty, you pay fees for the service. These fees depend on the provider you choose, the amount you send, and the payment methods you use. Many fintechs offer lower fees than traditional financial services. Some digital platforms show you the total cost before you confirm the transaction. You can compare different services to find the best deal. Always check if there are extra charges for cash pickups or special payment methods. Some providers add a small fee for using digital payment methods, while others include it in the total price.

| Provider Type | Typical Fee (USD) | Notes |

|---|---|---|

| Fintechs | $2 - $10 | Lower fees, transparent pricing |

| Traditional Services | $10 - $20 | Higher fees, slower transactions |

| Digital Platforms | $0 - $5 | Sometimes offer fee-free promotions |

Note: Some fintechs and digital services offer promotions or discounts for first-time users. Always review the fee structure before sending payments.

Exchange Rate Info

Exchange rates affect how much money your recipient gets in Colombia. The foreign exchange market sets these rates. The price of one currency in terms of another changes based on supply and demand. People and businesses need foreign currency for payments, investments, and other transactions. When demand for a currency rises, its value increases. When supply is high, the value may drop. Fintechs and financial services use these market rates to set their own exchange rates for international transactions. Some services add a small margin to the rate, so always check the final amount before you confirm your payment.

Tips to Save

You can save money on international payments by following a few smart strategies:

- Use digital platforms or fintechs instead of traditional financial services. These services often have lower fees and better exchange rates.

- Choose payment methods that match your account’s currency. This helps you avoid extra conversion fees.

- Open a multi-currency or virtual account if you receive payments often. This reduces the number of currency exchanges and saves money.

- Use local payment methods, such as ACH in the USA or SEPA in Europe, to lower intermediary fees and speed up transactions.

- Look for providers that lock in exchange rates for a short period. This protects you from sudden changes in the market.

- Avoid using credit cards for international transactions. They usually have higher fees and less favorable exchange rates.

Tip: Compare several fintechs and digital services before sending money to Colombia. Small differences in fees and exchange rates can make a big impact on the final amount your recipient receives.

Processing and Delivery Times

Typical Timeframes

When you send transfers with Efecty, you want to know how long it takes for the money to arrive. Efecty confirms your payment in real time. This means that once you pay at an official location, the system updates the status of your transaction right away. The recipient in Colombia can usually pick up the cash almost immediately after you complete the payment. For most transfers, the funds become available within minutes.

After Efecty confirms the payment, the money is ready for pickup. However, the final settlement to the merchant happens two business days after confirmation. This step does not affect your ability to collect the cash if you are the recipient. You can trust Efecty for fast and reliable financial transactions. If you need to send money quickly, Efecty’s process helps you avoid long waits.

Tip: Always check the operating hours of the Efecty location where the recipient will pick up the money. Some service points may close early or have limited hours on weekends.

Tracking Transfers

You may want to track your transfers to make sure the money arrives safely. Efecty offers a way to check the status of your transaction using digital tools. The main method for tracking is through an API, which is a special program that lets you see updates in real time. Here are some ways you can track your transfers:

- Use the merchant payment code or payment hash to check the payment status through the API.

- The API gives you a response with details such as payment status, payment hash, voucher ID, and important dates.

- You get updates as soon as the payment is confirmed or if there are any issues.

Efecty does not provide a separate tracking tool for customers outside of the API system. If you use a provider that works with Efecty, you may receive updates by email or through the provider’s website. Always keep your transaction code and voucher information safe. These details help you or the recipient check the progress of your transfers if needed.

Cross-Border Payments Tips

Limits and Restrictions

You need to know the rules before making cross-border payments with Efecty in Colombia. The government sets strict limits to keep transfers safe and legal. Efecty follows regulations from the Financial Superintendence, Banco de la República, and DIAN. These rules require all currency exchanges to use authorized channels. You must complete identity checks, called Know Your Customer (KYC), for all transactions. Efecty also uses anti-money laundering programs and keeps records of your payments. Businesses must follow Law 1581, report to DIAN, and use electronic invoicing. All payments between people or companies in Colombia must use Colombian pesos or approved clearing accounts. These steps help fintechs and financial services protect you and keep digital transfers secure.

Note: If you send large amounts or make frequent transactions, Efecty may ask for extra documents or more details about your payments.

Common Issues

Sometimes, you may face problems with cross-border payments or digital transfers. Delays or failed transactions can happen for many reasons. Here are steps you can take to solve these issues:

- Check the error code for your transfer to find out why it failed.

- Make sure all your payment details are correct and try again.

- If your card is blocked, use other payment methods or contact your bank.

- Confirm your information matches what you gave to the provider.

- If you still have trouble, contact Efecty or your fintech’s support team.

You can avoid many problems by double-checking your details and using trusted services. Most fintechs and financial services offer help if your payments do not go through.

Fraud Prevention

Fraud can affect cross-border payments and digital services in Colombia. Scammers use tricks like phishing emails, fake shopping sites, and fake apps to steal your money or data. Some criminals try to get your personal information to make illegal transactions. You can protect yourself by following these tips:

- Never share your payment codes or personal details with strangers.

- Only use official fintechs and financial services for your transfers.

- Watch out for emails or messages that ask you to click on links or update your account.

- Check that the website or app you use is real and secure.

Efecty and other services use strong security checks to keep your payments safe. They monitor transactions, verify your identity, and follow strict rules to stop money laundering and fraud. You play a key role in keeping your transfers secure by staying alert and using safe payment methods.

You can send money to Colombia with confidence by following these steps:

- Choose a trusted provider that supports Efecty services in Colombia.

- Generate a voucher and pay at an official Efecty location.

- Share the reference code so your recipient in Colombia can collect funds quickly.

- Bring valid identification and use only official service points for security.

- Efecty offers robust security, transparent fees, and over 10,000 locations across Colombia, making services accessible and cost-effective.

For any unresolved questions about transfers or services in Colombia, visit the official FAQ & Support page. Always compare fees and exchange rates to get the best value when sending money to Colombia.

FAQ

How much money can you send through Efecty at one time?

You can send up to $2,000 USD per transaction. Some providers may set lower limits. Always check with your chosen service before sending large amounts.

What identification do you need to pick up money at Efecty?

You must show a valid government-issued photo ID. This can be a Colombian citizenship card, foreigner ID, or passport. The name must match the transfer details.

Can you track your transfer after sending it?

Yes. You can track your transfer using the reference code from your provider. Some services offer online tracking. Always keep your transaction code safe.

What should you do if your transfer does not arrive?

First, check the status with your provider. Make sure all details are correct. If you still have issues, contact Efecty or your provider’s customer support for help.

Efecty is a trusted way to receive cash in Colombia, but for many senders abroad the process can still mean high fees, long waits, and reliance on physical locations. If you want faster, cheaper, and more transparent transfers, BiyaPay gives you a smarter option. With remittance fees starting at just 0.5%, real-time FX rates you can check instantly, and same-day delivery when you transfer on the day, BiyaPay helps you move money without the extra stress. You can send and convert both fiat and digital currencies, making cross-border payments more flexible and secure.

Skip the long lines and hidden fees — register with BiyaPay today and make your international transfers simple, reliable, and affordable.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.