- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is Western Union safe? 2025 full guide

Image Source: pexels

You can trust Western Union safety for your transfers in 2025. The company processes a significant share of global transfers, especially in key corridors such as the USA to Mexico, where its market share reaches about 20%. However, you need to stay alert. Scammers often target transfers with tactics like phishing, romance scams, and business impersonation.

- Phishing scams steal your information.

- Romance scams trick you into sending transfers for fake emergencies.

- Business imposter scams request money using fake company identities.

You should always verify the recipient before sending transfers. This simple step protects your money every time you use Western Union.

Key Takeaways

- Western Union uses strong security measures like encryption, identity checks, and fraud monitoring to protect your money and personal data.

- Always verify the recipient’s identity before sending money to avoid scams and ensure your transfer is safe.

- Use secure devices and strong passwords, enable two-factor authentication, and keep your account details private to protect your account.

- Be aware of common scams targeting money transfers and report any suspicious activity immediately to Western Union and local authorities.

- Track your transfers with the Money Transfer Control Number (MTCN) and act quickly if you notice delays or problems with your transfer.

Western Union Safety

Image Source: pexels

Security Features

You can rely on western union safety because the company uses many strong security features. These features protect your money and personal information every time you send a transfer. Here are some of the main ways western union safety works for you:

- Western Union uses end-to-end encryption, including SSL and TLS certifications, to keep your data safe during transfers.

- The app supports biometric login options, such as Touch ID, face, or fingerprint recognition, so only you can access your account.

- Multi-factor authentication is required for online payments. You may need to enter a PIN, password, or use biometric verification.

- For transfers above $1,000 USD (about 800 GBP), you must verify your identity. This step increases security and allows you to send up to $62,000 USD (about 50,000 GBP) after verification.

- In-person transfers also require ID checks for larger amounts, adding another layer of protection.

- Western Union gives you tips on password security and recommends using antivirus software to protect your devices.

- The company provides clear consumer protection guidelines. These warn you about common scams and remind you to verify recipients before sending money.

Tip: Always create strong, unique passwords and never share your login details with anyone. Use a password manager to help you remember complex passwords.

Western union safety also includes advice on how to spot phishing attempts. You should only send money to people you know and trust. If you get a suspicious message, contact Western Union directly to check if it is real. The company uses cookies and device information to detect fraud and block suspicious activity. These steps help keep your transfers secure and support consumer protection.

Regulatory Compliance

Western Union must follow strict rules to keep your money safe. These rules come from government agencies that watch over financial companies. Western union safety depends on following these laws and fixing problems when they happen.

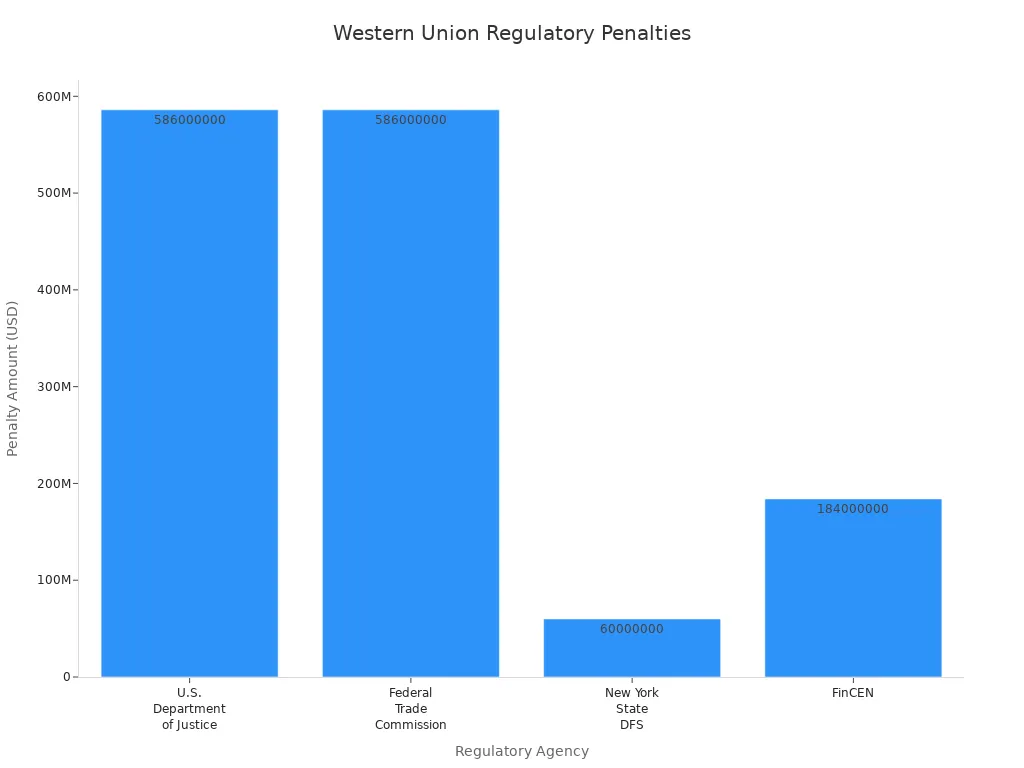

In the past five years, regulators have fined Western Union for not meeting some anti-money laundering (AML) and consumer protection standards. The company has paid large penalties and agreed to improve its compliance programs. Here is a summary of recent actions:

| Regulatory Agency | Penalty / Action | Description |

|---|---|---|

| U.S. Department of Justice (DOJ) | $586 million forfeiture via Deferred Prosecution Agreement (DPA) | Western Union admitted to failing to maintain an effective AML program and aiding wire fraud; required to improve compliance, discipline agents, and report suspicious activity. |

| Federal Trade Commission (FTC) | $586 million monetary judgment | Alleged failure to implement anti-fraud policies; required to maintain a strong anti-fraud program, train agents, monitor fraud, and refund fraudulently induced transfers. |

| New York State Department of Financial Services (DFS) | $60 million penalty | AML violations, including failure to report suspicious remittances linked to human trafficking and not acting against problematic agents. |

| Financial Crimes Enforcement Network (FinCEN) | $184 million civil money penalty | Willful violations of the Bank Secrecy Act; failed to implement an effective AML program and timely suspicious activity reports. |

| Independent Compliance Auditor | Monitoring for 3 years | Ensures Western Union follows the FTC order and AML obligations. |

These penalties show that regulators take western union safety seriously. Western Union now works with an independent auditor to make sure it follows all rules. The company must train its agents, monitor for fraud, and refund money lost to scams. You benefit from these changes because they make the system safer and support consumer protection.

Note: Regulatory compliance means Western Union must report suspicious activity and act quickly if something goes wrong. This helps protect your money and keeps the system fair for everyone.

Money Transfer Security

Encryption and Fraud Prevention

You want your money transfer security to be strong every time you send funds. Western Union works hard to protect your information and your money. The company uses encryption to help keep your data safe during online money transfer and in the app. This means your details stay private when you send or receive transfers.

- Western Union uses encryption to protect users.

- The company commits to keeping user data secure.

- Western Union states it uses encryption for money transfers.

- The company emphasizes its focus on data security.

- Western Union does not share technical details about the encryption standards or protocols it uses.

Western Union also invests in advanced technology to stop fraud. The company uses big data, artificial intelligence, and machine learning to watch for unusual activity. These tools help spot problems as they happen. When you make a secure money transfer, Western Union checks your transaction against global watch lists. The system learns from past cases and gets better at finding risks. This approach helps keep the number of fraud cases low and reduces the amount of money lost to scams.

Note: Western Union’s team includes experts in law enforcement, data analytics, and intelligence. They work together to improve money transfer security and protect your transfers.

If you use online money transfer, you benefit from these security measures. The company’s risk-based program helps you send money safely. You can trust that Western Union takes money transfer security seriously and works to keep your transfers safe.

Identity Verification

Identity verification is a key part of money transfer security. Western Union requires you to prove who you are before you send or receive money. This step helps stop illegal activity and keeps your transfers safe.

When you send money online, you must verify your identity. You need to be at least 18 years old. Sometimes, Western Union asks for extra details during the process. For transfers over $1,000 USD, you must provide a government-issued ID. You may need to show your ID through a video chat or at an agent location. This is part of strong customer authentication.

To pick up money at a Western Union agent, you must show a valid photo ID. Acceptable IDs include passports and national identity cards. In some places, you may also need to show proof of your current address, like a utility bill. Driver’s licenses may not always be accepted. Always check with your local agent to know what you need.

- Western Union uses multi-factor authentication, such as PINs, passwords, and biometric data, to secure transfers.

- Identity verification is required for transfers over $1,000 USD.

- The company uses biometric verification and real-time data checks.

- These steps help reduce fraud and build trust in secure money transfer.

- Western Union’s layered protections have worked for over 150 years.

Tip: Always use your real name and correct details when sending or receiving transfers. This helps Western Union complete identity verification and keeps your money transfer security strong.

Western Union’s focus on identity verification and strong customer authentication gives you peace of mind. You know your online money transfer is protected. These steps make sure only the right person can receive the money. When you follow the rules and use secure devices, you help keep your transfers safe.

Send Money Safely

Verifying Recipients

You need to verify the recipient before you send money safely with Western Union. This step protects you from scams and helps ensure your secure money transfer. Many people lose money because they send funds to unverified recipients. Western Union does not act as an escrow service, so you must take extra care.

Follow these steps to verify the recipient:

- Confirm the recipient’s identity and check that the transaction is legitimate.

- Collect and verify the recipient’s full name as shown on their government-issued ID.

- For bank transfers, check the bank name, address, account number or IBAN, and SWIFT/BIC code.

- Confirm where the recipient will collect the payment if you use cash pickup.

- Make sure your own identity is verified by Western Union, which may include showing your government-issued ID and using multi-factor authentication.

If you send money to someone you do not know, you risk falling victim to scams. These include fake lottery claims, impersonation, and fraudulent sales. Western Union cannot guarantee the performance of buyers or sellers in online transactions. Always report suspected fraud to Western Union’s Fraud Hotline and local law enforcement.

Using Secure Devices

You should use secure devices for all online money transfers. Unsecured devices can put your personal and financial information at risk. Hackers may access your data if you use public Wi-Fi or devices without security protections.

To send money safely, follow these tips:

- Use the latest version of the Western Union app or website.

- Enable device security features like passcodes, fingerprint login, or facial recognition.

- Avoid entering passwords on shared or public computers.

- Install security software and keep it updated.

- Lock your phone and use complex passwords.

- Monitor your accounts for suspicious activity and report fraud immediately.

If your device is lost or stolen, lock or wipe it remotely to prevent unauthorized access. These steps help you maintain secure money transfer practices every time you send money abroad or use online money transfer services.

Avoiding Scams

Image Source: pexels

Recognizing Fraud

You need to know how scammers target users of a trusted money transfer service. Many scams use tricks to make you act fast or trust the wrong person. Here is a table showing the most common fraud tactics that target Western Union users:

| Fraud Tactic | Description | Common Features / Victim Interaction |

|---|---|---|

| Advance fee scam | You pay upfront for a service or prize that never arrives. | Scammers ask for more payments after the first. |

| Antivirus scam | You get told your computer has a virus and must pay to fix it. | Uses fear and asks for payment by money transfer. |

| Charity scam | Fake charities ask for donations after disasters or emergencies. | Real charities do not ask for money transfers to individuals. |

| Emergency scam | Someone pretends to be a friend or family member in trouble and needs money fast. | Uses urgency and personal details to trick you. |

| SMS/Smishing | You get a text message with a link or request for personal info. | Uses urgent language and phishing tactics. |

| Tax scam | Scammers pretend to be government agents demanding tax payments. | Threatens arrest or fines if you do not pay right away. |

| Telemarketing scam | Fake offers or prizes come by phone, asking for payment by money transfer. | Scammers block you after you send money. |

| Military scam | Someone claims to be military personnel needing money. | Often linked to fake relationships or emergencies. |

| Mystery shopping scam | You get a fake check and are told to send some money back. | The check bounces, and you lose your money. |

| Overpayment scam | Scammers send a check for too much and ask you to refund the extra. | The original check is fake and you lose the refund. |

| Phishing | Fake emails or calls try to steal your personal information or passwords. | Leads to identity theft or unauthorized transfers. |

You can spot fraud by looking for urgent requests, threats, or offers that seem too good to be true. Always check the sender’s details and never click on suspicious links. Western Union will never ask for your password or ID by email.

Protecting Yourself

You can protect yourself from scams by following simple steps. Only send money through a trusted money transfer service to people you know well. Never respond to requests from strangers or people you have not met in person. Use strong passwords and keep your personal information private.

Here are some tips for your protection:

- Report any scam to the police, your bank, and Western Union’s fraud hotline.

- Gather evidence like emails, call logs, and screenshots when you report.

- Contact your bank to dispute any fraudulent charges and request a refund.

- Place a credit freeze with major credit bureaus to stop new accounts in your name.

- Monitor your accounts and credit reports for signs of financial fraud.

You should also keep your antivirus software updated and enable two-factor authentication for extra protection. If you get a suspicious email, forward it to spoof@westernunion.com and delete it. Stay alert to common scam scenarios, such as emergency requests or fake job offers. Your awareness and quick action help keep your money safe when using a trusted money transfer service.

Track and Resolve Transfers

Tracking Transfers

You can easily track your international wire transfers with Western Union. The company gives you a unique 10-digit Money Transfer Control Number (MTCN) for every transfer. This number helps you and the receiver check the status of your transfers at any time. You can use the Western Union website, mobile app, phone, or visit an agent location to track your international wire transfer.

To track your international wire transfers, follow these steps:

- Go to the Western Union website and select “Track transfer.”

- Choose if you are the sender or receiver.

- Enter the MTCN. If you do not know the MTCN, select “Don’t know the MTCN?” and provide other details like the sender’s phone number, names, transfer amount, and date.

- Complete any extra verification steps if asked.

Western Union updates the status of your international wire transfers in real time. You can see if your transfers are in progress, ready for collection, or already collected. The MTCN is printed on your receipt and shown in your online transfer history. The receiver needs the MTCN and a government-issued ID to collect funds. Western Union does not send automatic notifications, so you must check the status yourself.

Note: Real-time tracking gives you peace of mind, but delays can happen. Incorrect recipient information, weekends, holidays, large transfer amounts, or compliance checks may slow down your international wire transfers.

What to Do If Something Goes Wrong

If your international wire transfers do not arrive or get delayed, you should act quickly. Start by checking all transfer details to make sure there are no mistakes in account numbers or names. Confirm that the sender has enough funds and that the transfer was sent.

Here is what you should do if you have problems with your transfers:

- Double-check all transfer details for errors.

- Ask the sender to confirm the transfer has been sent.

- Contact your bank to ask about the status of your international wire transfers.

- Request a SWIFT trace for international money transfers to follow the path of your funds.

- If you still cannot find your transfer, file a complaint with a regulatory body.

Western Union offers several customer support options to help you resolve issues with your international wire transfers:

- Call Customer Care at 1800 325 6000 or use the website chat.

- Visit a local agent location for in-person help.

- Use the National Relay Service if you have hearing or speech impairments.

- For complex problems, contact the Executive Resolutions Team.

Tip: Keep all receipts and records of your international wire transfers. These documents help you and Western Union solve problems faster.

If you want to know how to receive an international wire transfer, always provide the correct MTCN and a valid ID. This ensures you get your funds without delay.

Transfer Money Safely Tips

Account Security

You play a key role in keeping your Western Union account secure. Start by using a strong password that combines letters, numbers, and symbols. Change your password often and never share it with anyone. Always enable two-factor authentication. This extra step sends a code to your phone or email each time you log in, making it harder for others to access your account.

When you access your account online, use a secure internet connection. Avoid public Wi-Fi or use a VPN if you must connect in public places. Download the official Western Union app or visit the official website for all transactions. Never click on links from unknown emails or messages. These steps help you transfer money safely and protect your personal information.

Western Union uses advanced encryption and fraud prevention systems to protect your data. The company monitors transactions for suspicious activity and requires identity verification with official documents. You should also keep your transaction details private and double-check recipient information before sending funds. These security recommendations help prevent unauthorized access and fraud.

Tip: Keep your government-issued ID and proof of address ready for larger transfers. This helps you complete identity verification quickly and ensures smooth transactions.

Staying Informed

Staying informed about new threats helps you transfer money safely. In 2025, a major data breach affected thousands of Western Union users. This event shows that risks can change quickly. Western Union now works with industry experts to improve security and protect your information.

You can find helpful resources to stay updated. Western Union offers newsletters, alerts, and a fraud awareness blog with tips on avoiding scams. The company also provides a Fraud Hotline in 85 countries for immediate help if you notice suspicious activity. Educational materials explain how to verify your identity and use secure online methods for transfers.

Review your account settings often. Watch for updates about new security features or threats. By learning about the latest risks and following best practices, you help keep your online transfers safe.

Western Union gives you strong security with encryption, identity checks, and 24/7 fraud monitoring. You help keep your money safe by following best practices:

- Always verify recipient details before sending funds.

- Use secure payment methods and protect your account with strong passwords.

- Watch for scams and report suspicious activity right away.

- Track your transfers using the Money Transfer Control Number (MTCN).

Stay alert and use Western Union’s security features. If you notice anything unusual, contact customer support for help. When you follow these steps, you make your transfers safer and more reliable.

FAQ

How long do international wire transfers take with Western Union?

You can expect international wire transfers to take from a few minutes up to several days. The time depends on the country, the payment method, and the bank’s processing speed. Some international wire transfers complete instantly, while others may need extra checks.

What information do you need for international wire transfers?

You need the recipient’s full name, bank account number, and the bank’s SWIFT or BIC code for international wire transfers. Always double-check these details before you send money. Incorrect information can delay or stop international wire transfers.

Can you cancel or change international wire transfers after sending?

You can sometimes cancel international wire transfers if the recipient has not collected the money. Contact Western Union support as soon as possible. If the funds have already been picked up, you cannot reverse international wire transfers.

Are international wire transfers with Western Union safe?

Western Union uses strong security features for international wire transfers. You get encryption, identity checks, and fraud monitoring. Always verify the recipient and use secure devices. These steps help keep your international wire transfers safe.

What should you do if international wire transfers do not arrive?

If your international wire transfers do not arrive, check the transfer status using your Money Transfer Control Number. Contact Western Union support for help. You may also need to contact the receiving bank if there are delays with international wire transfers.

Western Union remains a trusted global brand, but high fees, slower settlement times, and scam risks mean you may want a modern alternative. That’s where BiyaPay steps in. With remittance fees starting at just 0.5%, instant real-time FX rates you can check before you send, and same-day transfers when you initiate on the same day and meet compliance checks, BiyaPay makes cross-border payments faster, cheaper, and more transparent. Plus, it supports both fiat and crypto conversions, giving you more flexibility when sending money abroad.

Take control of your international transfers today — register with BiyaPay and enjoy security, speed, and savings.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.