- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

PNC Bank Review: Is PNC Bank the best choice for you?

Image Source: pexels

If you want a bank that blends easy digital tools with strong branch access, this pnc bank review might show that pnc could be the best choice for you. You get access to over 2,600 pnc bank branches and more than 9,500 pnc-branded ATMs across the country. Here’s a quick look:

| Location Type | Number |

|---|---|

| pnc bank Branches | 2,629 |

| pnc-branded ATMs | 9,523 |

With pnc’s Virtual Wallet, checking options, ATM fee reimbursements, and high-yield savings, you might find what you need. But watch out for high fees and mixed reviews on customer service. Some top rates only show up in certain states. This review will help you see if pnc fits your checking and savings needs.

Key Takeaways

- PNC Bank offers a large network of branches and ATMs combined with strong digital tools like the Virtual Wallet app to help you manage your money easily.

- You can avoid many monthly fees by meeting simple requirements like keeping a minimum balance or setting up direct deposits.

- PNC reimburses some out-of-network ATM fees on certain accounts, helping you save money when using other banks’ ATMs.

- The bank provides competitive high-yield savings and flexible checking accounts, but the best rates and features may only be available in select states.

- Customer service reviews are mixed, so consider your preference for in-person help versus digital support before choosing PNC.

PNC Bank Review: Pros and Cons

When you look at a pnc bank review, you want to see both the good and the bad. This section breaks down what makes pnc stand out and what might make you think twice before opening an account. Let’s dive into the main advantages and drawbacks so you can decide if pnc bank is the right fit for you.

Advantages

You get a lot of benefits when you choose pnc bank. Here are some of the top reasons people like banking with pnc:

- Competitive interest rates on savings accounts in certain regions. If you live in a state where pnc offers its best rates, you can earn more on your savings.

- Reimbursement of non-PNC ATM fees on most accounts. You can use other banks’ ATMs and get some or all of your fees back, depending on your account type.

- Budgeting and money management tools through the Virtual Wallet feature. This tool helps you track your spending, set savings goals, and avoid overdrafts.

- A large branch network. Pnc bank has over 2,600 branches in 28 states and the District of Columbia, so you can find help in person if you need it.

- A wide variety of banking products and services. You can use person-to-person payments with Zelle, deposit checks remotely with the mobile app, and manage your money on the go.

- Virtual Wallet app features like Low Cash Mode. This gives you alerts when your balance is low and breaks down your spending by category.

Tip: If you want to avoid ATM fees, look for accounts like Performance Select Checking. These accounts waive out-of-network ATM fees and reimburse you for some charges from other banks.

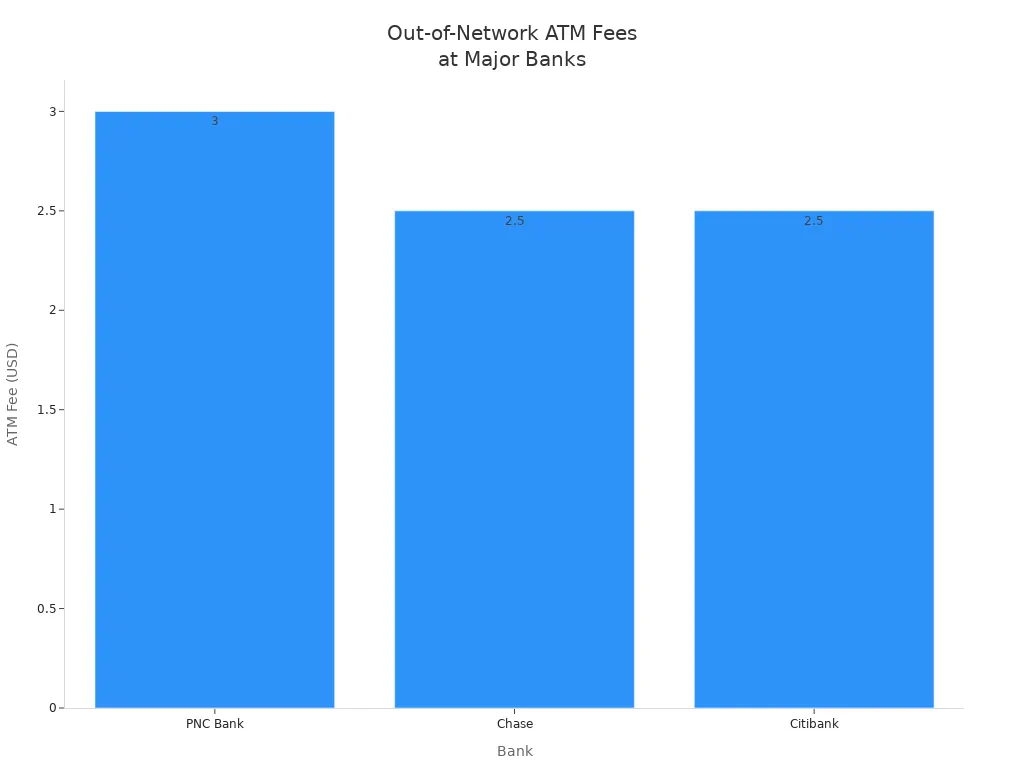

Here’s how pnc bank’s ATM fees compare to other major banks:

| Bank | Out-of-Network ATM Fee | Fee Waiver Conditions |

|---|---|---|

| PNC Bank | $3 | Waived for Performance Select Checking and first 2 transactions for Performance Checking |

| Chase | $2.50 | Waived for certain premium accounts |

| Citibank | $2.50 | Waived for certain premium accounts or transaction limits |

| Ally | N/A | ATM fees reimbursed up to $10 per statement cycle |

| First Internet Bank | N/A | ATM fees reimbursed up to $10 per statement cycle |

| Fidelity | N/A | Unlimited ATM fee reimbursements |

You also get free access to thousands of pnc ATMs, free overdraft protection, and unlimited check writing. These features make pnc bank a strong choice if you want flexibility and easy access to your money.

Drawbacks

No pnc bank review would be complete without looking at the downsides. Some customers have reported problems that you should know about before you open an account.

- Many people say customer service is terrible or the worst. You might find staff unhelpful or slow to solve problems.

- Some customers have trouble with fraud and unauthorized charges. Getting your money back can be hard and take a long time.

- The bank’s policies can be confusing. You might not always understand the rules or find them helpful.

- Account management issues happen, like lost documents or poor problem resolution.

- You could face problems with check deposits and cashing, including unexpected fees.

- Delays in fund availability and unexplained credit limit reductions are common complaints.

- The overall customer sentiment is mostly negative. Many people say they want to switch banks, and the Net Promoter Score is very low.

When it comes to fees, pnc bank charges a $3 out-of-network ATM fee, which is higher than some other banks. Not all regional banks refund ATM fees, but pnc does offer some reimbursements. This puts pnc in a competitive spot among national banks, but it’s not the most generous.

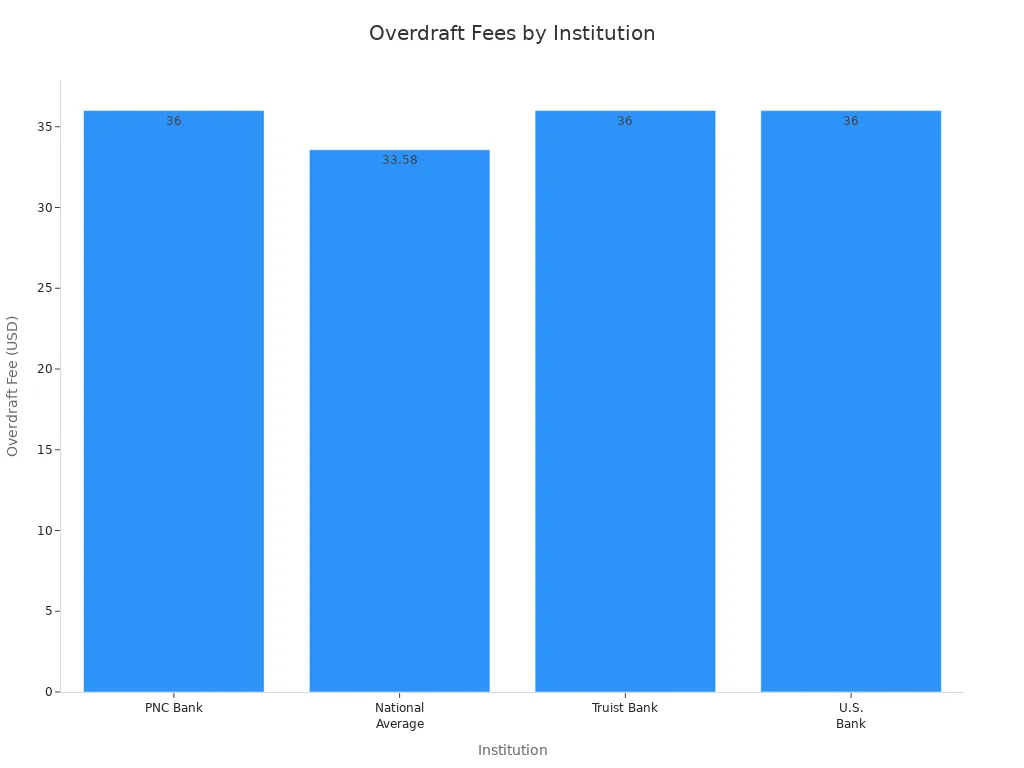

Overdraft fees are another thing to watch. Here’s a quick look at how pnc bank compares to other banks:

| Institution | Overdraft Fee | Conditions/Notes |

|---|---|---|

| PNC Bank | $36 | Fee charged after account is overdrawn by >$5; max one fee per day; $0 NSF fee; 24-hour grace period |

| National Average | $33.58 | Average overdraft fee as of October 2021 |

| Truist Bank | $36 | Similar fee structure to PNC |

| U.S. Bank | $36 | Similar fee structure to PNC |

You pay $36 for an overdraft at pnc bank, which is a bit higher than the national average. The good news is that pnc only charges one overdraft fee per day and gives you a 24-hour grace period to fix your balance. They also got rid of non-sufficient funds (NSF) fees, which helps lower your costs if you make a mistake.

Note: If you care about customer service or want the lowest fees, you might want to read more pnc bank reviews or look at other banks before making your choice.

PNC Bank Overview

Image Source: unsplash

PNC Bank gives you a mix of old-school banking and modern digital tools. You get the safety of FDIC insurance, so your money stays protected up to $250,000. If you like having options, you can visit a branch, use an ATM, or manage your accounts online. PNC Bank stands out because it tries to make banking easy for everyone.

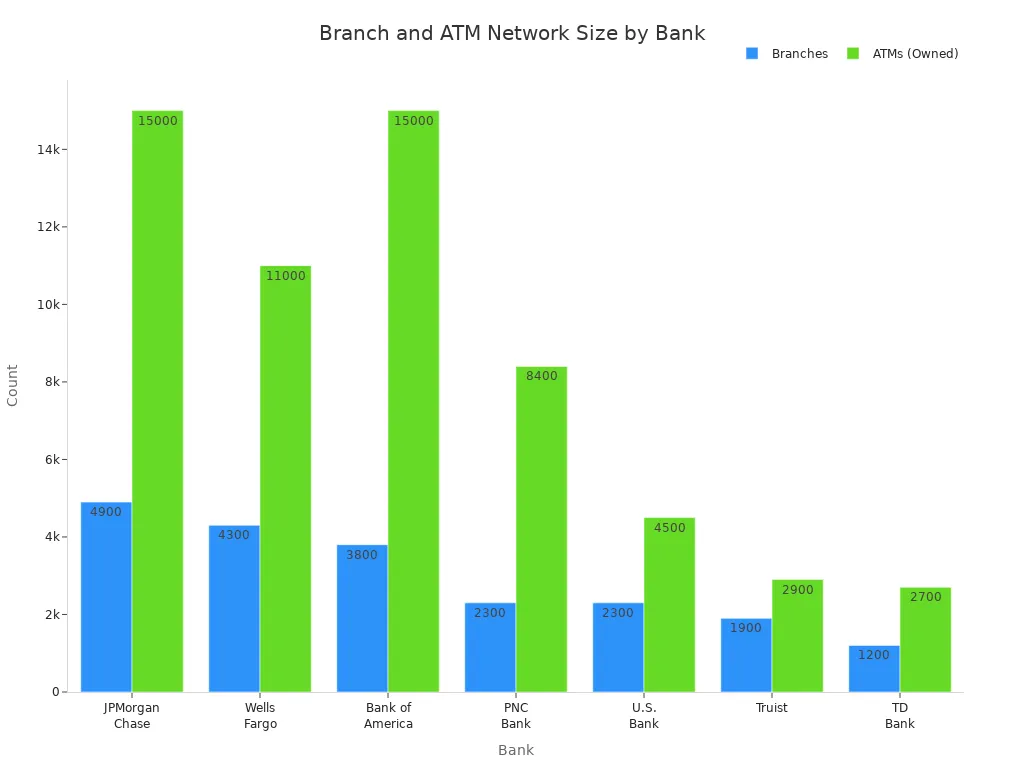

Branches and ATMs

You might want a bank with lots of places to get cash or talk to someone in person. PNC Bank has over 2,300 branches and about 8,400 ATMs that it owns. When you count partner ATMs, you get access to nearly 60,000 machines. That means you can find a PNC ATM almost anywhere you go. While PNC Bank does not have as many branches as Chase or Wells Fargo, it still gives you more locations than banks like TD Bank or Capital One.

Here’s how PNC Bank compares to other big banks:

| Bank | Branches (approx.) | ATM Network (approx.) |

|---|---|---|

| JPMorgan Chase | 4,900 | 15,000+ |

| Wells Fargo | 4,300 | 11,000+ |

| Bank of America | 3,800 | Nearly 15,000 |

| PNC Bank | 2,300 | 8,400 owned; ~60,000 with partners |

| U.S. Bank | 2,300 | 4,500+ |

| Truist | 1,900+ | 2,900+ |

| TD Bank | 1,200 | 2,700+ |

| Capital One | <300 | Large fee-free ATM network |

You also get ATM fee reimbursement on many accounts. This helps you save money if you use an ATM outside the PNC network.

Virtual Wallet

PNC Bank’s Virtual Wallet gives you a smart way to manage your money. You get three accounts in one: Spend (for daily use), Reserve (for short-term savings), and Growth (for long-term savings). The digital tools help you set savings goals, track your spending, and avoid overdraft fees with Low Cash Mode. You can use Zelle for quick payments, deposit checks with your phone, and lock your debit card if you lose it.

Here’s a quick look at what each Virtual Wallet version offers:

| Virtual Wallet Version | Key Features | Benefits to Account Holders |

|---|---|---|

| Standard Virtual Wallet | Spend, Reserve, Growth; digital tools; Low Cash Mode; mobile banking | Manage money, avoid overdrafts, set savings goals |

| Performance Spend | All Standard features; higher interest on Growth; some ATM fee reimbursements | Earn more, save on ATM fees |

| Performance Select | All Performance Spend features; highest interest; most ATM fee reimbursements; free wire transfers | Maximize earnings, minimize fees |

| Student Virtual Wallet | $0 monthly fee for up to 6 years; digital tools; overdraft protection | No fees, overdraft protection, build good habits |

You can also get a $400 checking bonus if you meet certain requirements. This makes opening a new account with PNC Bank even more attractive.

Checking

Account Options

You have several checking account choices with PNC. The most popular option is the Virtual Wallet, which combines three accounts in one to help you manage spending, saving, and planning. If you want more perks, you can upgrade to Virtual Wallet with Performance Spend or Performance Select. These higher tiers give you more benefits, like more ATM fee reimbursements and higher interest on your savings.

PNC offers some of the best checking accounts if you want flexibility and digital tools. You can open a new checking account online or at a branch. Right now, PNC has special promotions for new customers. You can earn a bonus by meeting direct deposit requirements within 60 days of opening your account. Here’s a quick look at the current bonus offers:

| Bonus Amount | Account Type | Qualifying Direct Deposit Requirement (within 60 days) | Additional Requirements & Notes |

|---|---|---|---|

| $100 | Virtual Wallet | $500+ recurring direct deposits | Open new account online or in-branch with coupon; account must remain open until reward is credited; excludes existing/recent accounts and recent promo recipients. |

| $200 | Virtual Wallet with Performance Spend | $2,000+ recurring direct deposits | Same as above |

| $400 | Virtual Wallet with Performance Select | $5,000+ recurring direct deposits | Same as above |

Tip: Qualifying direct deposits include payroll, pension, or Social Security payments. Transfers from other accounts or cash deposits do not count.

If you want no monthly fees, you can avoid them by meeting certain requirements. For example, keep a minimum balance or set up direct deposit. This makes PNC checking accounts a good fit if you want to avoid extra costs.

Fees and Overdrafts

PNC checking accounts come with monthly maintenance fees, but you can often waive them. Here’s what you need to know:

- Virtual Wallet: $7 monthly fee. Waived if you keep a $500 combined balance or $500 in direct deposits.

- Virtual Wallet with Performance Spend: $15 monthly fee. Waived with $2,000 in direct deposits or a $2,000 average balance.

- Virtual Wallet with Performance Select: $25 monthly fee. Waived with $5,000 in direct deposits or a $5,000 combined balance.

You can also get no monthly fees if you qualify for age-based waivers or work for PNC. Linking accounts can help you avoid fees on both checking and savings.

When it comes to overdraft fees, PNC charges $36 if your account goes over by more than $5. The good news is you only pay one overdraft fee per day, and you get a 24-hour grace period to fix your balance. PNC has made changes to lower overdraft fee revenue, which means you might pay less compared to other banks.

If you want one of the best checking accounts for managing your money and avoiding high fees, PNC checking could be a smart choice. You get strong digital tools, easy ways to avoid fees, and solid promotions for new accounts. This makes PNC a good option if you want checking and savings in one place.

Savings

When you look for a place to grow your money, you want savings options that work for you. PNC gives you a few choices, but the high-yield savings account stands out if you want to earn more interest.

High-Yield Savings

PNC’s high-yield savings account offers one of the best rates you can find at a traditional bank. You do not need a minimum deposit to open this account, and you will not pay a monthly service fee. The APY can reach up to 3.95%, which puts it close to the best high-yield online savings accounts. Here is a quick look at the current rates:

| Account Type | APY Range | Notes |

|---|---|---|

| PNC High Yield Savings® | ~3.80% - 3.95% | Most consistent APY is 3.80% as of 7/28/2025 |

You can open this high yield savings account with no balance requirement. This makes it easy for you to start saving right away. If you want to earn more on your savings, this account can help you reach your goals faster. However, PNC does not offer this high-yield savings account in every state. You should check if it is available where you live.

When you compare PNC’s high-yield savings account to the best savings accounts from online banks, you will see similar rates. Many online banks also offer high APYs with no minimums. If you want the highest rates, you might want to look at online options too.

Standard Savings

PNC also has standard savings accounts. These accounts pay much lower rates, usually between 0.01% and 0.03% APY. You only need $1 to start earning interest, but there is a $5 monthly service fee. You can avoid this fee if you keep a $300 balance, link your savings to a PNC checking account, or set up a $25 auto transfer each month.

| Requirement/Condition | Details |

|---|---|

| Minimum deposit to open | $0 |

| Minimum balance to earn interest | $1 |

| Monthly service fee | $5 |

| Ways to waive fee | $300 balance, link to checking, $25 auto transfer, or account holder under 18 |

If you want simple savings and do not care about high rates, the standard savings account could work for you. But if you want your money to grow, the high yield savings account is the better choice.

Tip: If you want to keep both checking and savings in one place, PNC makes it easy to link your accounts and move money between them.

You will benefit most from PNC’s savings options if you want strong digital tools and easy access to your money. If you live in a state where the high-yield savings account is available, you can get a rate that matches the best high-yield online savings accounts. If you want the best rates and do not need branch access, online banks might be a better fit.

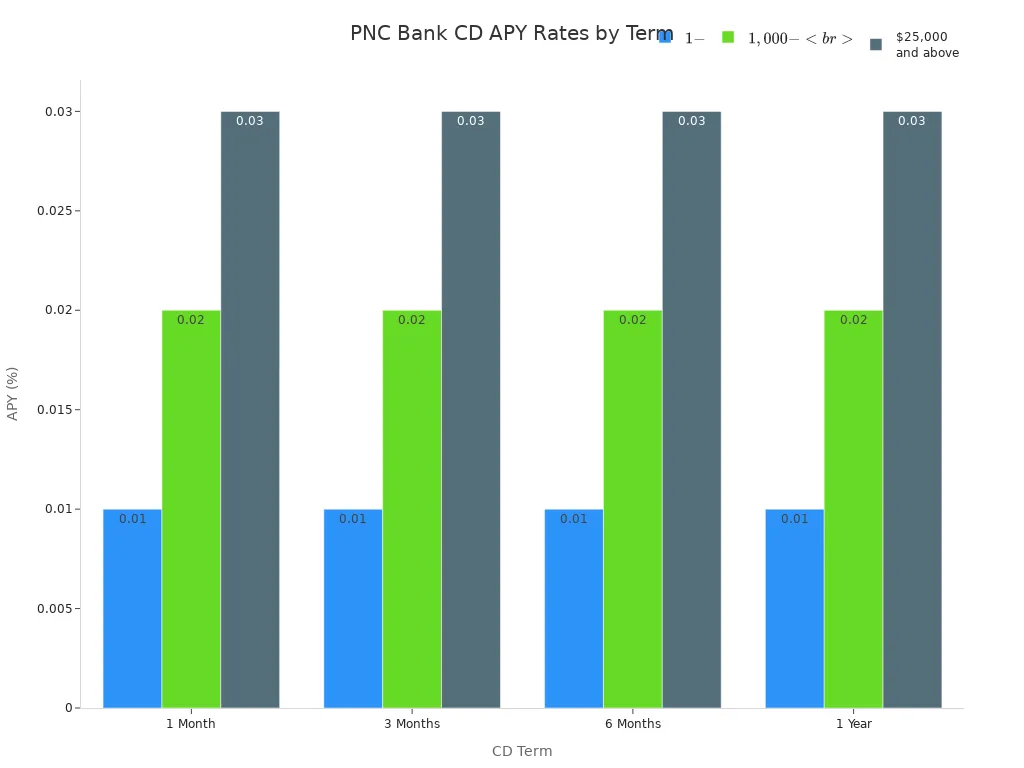

CDs

Terms and Rates

If you want to lock in your savings, PNC Bank offers certificates of deposit (CDs) with a wide range of terms. You can choose from as short as 1 month up to 10 years. The rates you get depend on how much you deposit and the term you pick. Most standard CD rates at PNC are low compared to what you might find at online banks. For example, if you open a 1-year CD, you might see rates like these:

| Term | Balance Tier | APY |

|---|---|---|

| 1 Month | $1 - $999.99 | 0.01% |

| 1 Month | $1,000 - $24,999.99 | 0.02% |

| 1 Month | $25,000 and above | 0.03% |

| 1 Year | $1 - $999.99 | 0.01% |

| 1 Year | $1,000 - $24,999.99 | 0.02% |

| 1 Year | $25,000 and above | 0.03% |

PNC sometimes offers promotional CDs with much higher rates. For example, you might find a 4-month CD at 4.03% APY if you deposit at least $1,000. These best cd rates are not available everywhere. PNC gives the highest rates only in certain states, usually where they have branches. If you live in a place like Philadelphia, you might see promotional rates as high as 4.10% APY. In other areas, you may only get the standard rates, which are much lower than the best cd rates from top online banks.

Note: Online banks like LendingClub and Barclays often offer higher rates than PNC’s standard CDs. Always check the latest rates before you decide.

Early Withdrawal

You might need your money before your CD matures. If you withdraw early, PNC charges a penalty. The penalty depends on your CD’s term. For most CDs, you could lose some or all of the interest you earned, or even six months’ worth of interest for longer terms. If you take money out within the first six days, federal law says you must pay at least seven days’ simple interest. PNC also has a Ready Access CD, which lets you withdraw money penalty-free within the first seven days after opening.

Before you open a CD, read your account agreement. The rules for early withdrawal can change based on your CD’s details. If you want flexibility, look at the Ready Access CD or keep your money in a high-yield savings account.

Money Market

Features

If you want a flexible way to grow your savings, you might like PNC Bank’s money market account. This account gives you a higher interest rate than most regular savings accounts. You can open it with no minimum deposit, and you only need $1 to start earning interest. You can make unlimited deposits, so you can add money whenever you want. You get up to six withdrawals each month without a fee, which helps if you need to move money around.

Here’s a quick look at what you get with the PNC Premiere Money Market Account:

| Feature | Details |

|---|---|

| Interest Earning Potential | Higher than standard savings |

| Minimum to Open | $0 |

| Minimum to Earn Interest | $1 |

| Withdrawals | Up to 6 per month without a fee |

| Deposits | Unlimited |

| Overdraft Protection | Available if you link to a PNC checking account |

| Check-Writing | Not available |

| ATM Access | Yes, with a PNC Bank Card |

| FDIC Insurance | Yes, up to the legal limit |

| Digital Tools | Online/mobile banking, mobile deposit, auto transfers, alerts |

You can manage your account online or with the mobile app. You can also set up automatic transfers to help your savings grow faster. If you want to avoid overdrafts, you can link your money market account to your checking account.

Tip: If you want easy access to your money and a better rate than a basic savings account, this account could be a good fit.

Fees

You might worry about fees with a money market account. PNC Bank charges a $12 monthly service fee for the Premiere Money Market Account. You can avoid this fee if you keep an average monthly balance of $5,000 or link your account to select PNC checking accounts. If you do not meet these requirements, the fee will apply. There is no minimum balance required to keep the account open, and you do not need direct deposits or account linking unless you want to waive the monthly fee.

If you want a money market account with no monthly fees or balance requirements, you can look at PNC’s Private Bank Money Market account. This account does not charge any monthly service fees and does not require a minimum balance. You do not need to set up direct deposit or link other accounts.

You will benefit most from a PNC money market account if you want to earn more on your savings, need easy access to your funds, and can meet the balance requirements to avoid fees. If you want check-writing, you may need to look at other banks, since PNC does not offer this feature with its money market accounts.

Business Accounts

If you run a business, you want a bank that makes managing money easy. PNC Bank gives you three main business checking account options. Each one fits a different business size and need. You can open an account with just $100. None of these accounts pay interest, but you get tools to help you track spending and manage cash flow.

Account Types

Here’s a quick look at the three business checking account choices from PNC Bank:

| Account Name | Target Business Size | Free Transactions per Month | Free Cash Deposits per Month | Monthly Fee (Waived First 3 Months) | Key Features |

|---|---|---|---|---|---|

| Business Checking for Basic Needs | Small businesses and startups | Up to 150 | $5,000 | $12 | Free online banking, bill pay, debit card, rewards |

| Business Checking Plus | Businesses with higher volume | Up to 500 | $10,000 | $22 | Includes personal Virtual Wallet for owners |

| The Treasury Enterprise Plan | Larger businesses with big needs | Up to 2,500 | $50,000 | $50 | Earnings credit, free beneficiary accounts, PINACLE tools |

You get free online banking and a Visa Business Debit Card with every checking account. If you own a small business or startup, the basic option might be enough. If your business handles more transactions, you may want to look at Business Checking Plus or The Treasury Enterprise Plan.

Tip: PNC waives the monthly fee for the first three months on all business checking accounts. This gives you time to see if the account fits your needs.

Fees

You need to watch out for monthly maintenance fees. The basic business checking account charges $12 each month, but you can avoid this by keeping a set balance or meeting other requirements. The Plus account has a $22 fee, and the Treasury Enterprise Plan charges $50. These fees can add up, so make sure you pick the right account for your business.

PNC charges a $36 overdraft fee if your checking account goes negative and you do not have enough funds to cover a payment. You can use Low Cash Mode to get alerts when your balance is low. This helps you avoid extra fees. You can also link your checking account to another PNC account for overdraft protection. If you do not have enough money in your linked account, you may still get charged.

PNC’s business checking accounts work well if you want lots of free transactions and easy digital tools. You may not like the fees if you keep a low balance or need interest on your account. If you want to avoid high fees, check the requirements for each account before you sign up.

Digital Banking with PNC

Image Source: unsplash

Mobile App

You want a banking app that works well and keeps your money safe. The PNC mobile app gets high marks from users. On the Apple App Store, it has a 4.9 out of 5 stars rating. On the Google Play Store, it holds a 4.5 out of 5 stars rating. These scores come from thousands of reviews and show that people like using the app. Many users say the app is easy to use and helps them manage their accounts quickly. You can check your balance, deposit checks, pay bills, and send money with just a few taps. The app also gives you alerts about your account, so you always know what is happening with your money.

If you want to keep your account safe, the app offers strong security. You can use fingerprint or face recognition to log in. The app lets you lock your debit card if you lose it. You can also set up alerts for any unusual activity.

Online Features

PNC gives you many tools to make digital banking simple and secure. You can use online banking to see your account details, transfer money, and pay bills. The website works well on all major browsers, so you can log in from your computer or phone.

Here are some security features you get with PNC:

- PNC Easy Lock lets you lock your debit card to stop new purchases or withdrawals.

- You can use PNC Pay and Apple Pay for secure payments.

- Contactless payments help you pay quickly and safely.

- PazeSM keeps your card number private during online shopping.

- Zelle lets you send money to people you trust.

- PNC sends alerts by email or text for important account events.

- The bank offers fraud and identity theft protection.

- The Online Banking and Bill Pay Guarantee covers you if someone makes an unauthorized transaction.

You can feel confident using PNC’s digital banking tools. The mix of strong security and easy-to-use features makes it a good choice if you want to manage your money online.

Customer Service

Support Options

You have several ways to reach PNC Bank’s customer support. If you like talking to someone face-to-face, you can visit one of their 2,579 branches. You can also call their customer support line, use email, or try the online chat feature. For technical issues, PNC offers 24/7 support. Many people use the digital banking platform, which handles over a billion transactions each year.

Here’s a quick look at how long you might wait for help:

| Support Channel | Average Response Time |

|---|---|

| In-Branch Support | 12 minutes |

| Online Chat | 3.5 minutes |

| Phone Support | 7 minutes |

Online chat is the fastest way to get answers. If you prefer phone support, you usually wait less than 10 minutes. PNC’s digital tools make it easy to get help when you need it. Many users say they like the quick response times and the many ways to contact customer support. This helps boost customer satisfaction, especially for people who use digital banking.

Reviews

When you look at customer reviews, you see a mixed picture. Some people praise the fast digital service and easy access to support. Others share stories about problems that made their customer experience stressful.

Here are some common complaints from recent reviews:

- Poor communication and unresponsiveness, like ignored calls or no follow-up.

- Long wait times and trouble accessing accounts, which can cause financial stress.

- Staff described as unhelpful, rude, or dismissive.

- Locked accounts without clear reasons and mishandled funds.

- Disputes that do not get resolved and managers who do not respond.

- Sensitive situations, such as accounts for deceased customers, handled poorly.

- Many customers feel anxious or helpless because of these issues.

You should know that fees often come up in complaints. People mention surprise charges and confusion about fee policies. Branch service also gets mixed feedback. Some customers feel supported, while others feel ignored.

If you want a bank with strong digital customer support, PNC does well. If you value in-person help or worry about fees, you may want to review your options. Your customer experience will depend on how you use the bank’s services and which support channels you prefer.

Fees and Overdrafts

Service Fees

When you open an account at PNC Bank, you want to know what bank fees you might pay. PNC charges monthly service fees for both checking and savings accounts. Here’s a quick table to help you see the main fees and how you can avoid them:

| Account Type | Monthly Fee | How to Avoid Monthly Maintenance Fee |

|---|---|---|

| Checking | $7 | - Keep $500 in direct deposits- Keep $500 in Spend and Reserve accounts- Be 62 or older- Be a PNC employee |

| Savings | $5 | - Keep $300 average monthly balance- Link to Performance or Performance Select checking- Set up $25+ Auto Savings transfer- Account owner under 18 |

You can skip these bank fees if you meet the right requirements. Many people choose accounts with no monthly fees by keeping enough money in their accounts or setting up direct deposits. If you are under 18 or over 62, you also get a break on some fees.

PNC also charges a $3 fee when you use a non-PNC ATM in the United States. If you use an ATM outside the U.S., the fee is $5. Some checking accounts, like Performance Select, will waive these fees or reimburse you for up to two non-PNC ATM fees each month, with a maximum of $5 back per month. This helps you save on bank fees if you travel or use other ATMs.

Tip: Always check your account type to see if you qualify for ATM fee reimbursement. This can help you avoid extra charges.

Overdraft Policy

Overdraft fees can add up fast if you spend more than you have in your account. At PNC, the overdraft fee is $36 for each transaction that puts your account below zero by more than $5. You only get charged once per day, even if you have more than one overdraft. PNC gives you a 24-hour grace period to fix your balance before the fee hits your account. This policy helps you avoid paying too many bank fees if you make a mistake.

You can also link your checking to a savings account for overdraft protection. This way, if you run out of money, PNC will move funds from your savings to cover the payment. This can help you avoid the $36 fee. Remember, not all banks offer this kind of protection, so it is a good feature to have.

If you want to keep your costs low, always watch your balance and use the tools PNC offers. This will help you avoid extra fees and keep more of your money.

PNC Bank vs. Competitors

Comparison Table

You probably want to see how pnc bank stacks up against other big names. Here’s a quick table that compares the basics for checking and savings accounts, fees, and digital features:

| Feature | PNC Bank | Chase | Bank of America | Wells Fargo |

|---|---|---|---|---|

| Checking Monthly Fee | $7 (waivable) | $12 (waivable) | $12 (waivable) | $10 (waivable) |

| Savings Monthly Fee | $5 (waivable) | $5 (waivable) | $8 (waivable) | $5 (waivable) |

| Out-of-Network ATM Fee | $3 | $3 | $2.50 | $2.50 |

| Overdraft Fee | $36 | $34 | $10 | $35 |

| Savings APY | 0.01% (standard) | 0.01% | 0.01% | 0.01% |

| CD Rates (up to) | 4.10% (promo) | 4.00% (promo) | 4.00% (promo) | 4.00% (promo) |

| Digital Tools | Virtual Wallet | Chase Mobile | Erica, Zelle | Control Tower |

| Branches (approx.) | 2,300+ | 4,900+ | 3,800+ | 4,300+ |

Note: All four banks offer waivable monthly fees and strong digital banking tools. Their standard savings rates are low, but you can sometimes find higher promotional CD rates.

Key Differences

You might notice that pnc bank charges lower monthly fees for basic checking than Chase. Both banks let you avoid these fees if you meet certain requirements. Savings account fees are similar, and you can skip them by keeping a minimum balance or linking accounts. When you look at savings rates, all four banks offer just 0.01% APY for standard accounts. Sometimes, you can find higher rates on CDs, but these are usually promotional and may not last.

If you care about digital banking, you will find that all these banks invest in strong apps and online features. PNC’s Virtual Wallet stands out for its money management tools and ATM fee reimbursements. Chase gives you a bigger branch network and popular sign-up bonuses, but the savings rates stay low.

Customer experience matters, too. PNC Bank leads in customer satisfaction among the largest U.S. banks. You will likely face fewer problems with fees or payment issues at PNC or Chase. Wells Fargo’s reputation still suffers from past scandals, which affects how people feel about their service. Bank of America and Wells Fargo both offer many branches, but their savings rates and fees do not stand out.

If you want higher savings rates, you might look at online banks. For most people, the choice comes down to which features, rates, and customer experience fit your needs best.

Best Choice for You?

Choosing the right bank can feel overwhelming. You want a place that fits your lifestyle, helps you manage your money, and gives you peace of mind. Let’s break down who will find PNC Bank the best choice for you, and who might want to look at other options.

Who Should Choose PNC

You should consider PNC Bank if you want a mix of digital convenience and in-person service. PNC stands out for its strong mobile app, easy-to-use online banking, and a large network of branches and ATMs. If you like using tools to track your spending or set savings goals, the Virtual Wallet can help you stay on top of your finances.

Here are the types of customers who get the most from PNC Bank:

- Personal banking customers: If you need checking and savings accounts, credit cards, or loans, PNC offers a wide range of products. You can also find help with investing, mortgages, and wealth management.

- Small business owners: PNC gives you business checking accounts, cash flow tools, and rewards. You can manage your business finances with digital banking and get support when you need it.

- Corporate and institutional clients: If you run a larger company, PNC’s advanced financial technology, like the Akoya integration for PINACLE Connect, gives you secure and transparent data access.

- People who want digital tools: PNC’s mobile app and online banking make it easy to move money, pay bills, and get alerts. You can use features like Low Cash Mode to avoid overdrafts.

- Anyone who values branch access: With thousands of branches and ATMs, you can get help in person or withdraw cash almost anywhere.

Tip: If you want a bank that offers both digital and traditional services, PNC could be the best choice for you.

You may also like PNC if you want ATM fee reimbursements, high-yield savings (in select states), and special bonuses for opening new accounts. If you often need customer support, PNC offers many ways to get help, including phone, chat, and in-branch service.

Who Should Look Elsewhere

PNC Bank is not perfect for everyone. You might want to look at other banks if you care most about the lowest fees or the highest interest rates everywhere. Here are some reasons you may want to choose a different bank:

- You want the highest savings rates nationwide: PNC’s best rates are only available in certain states. Online banks often offer higher rates with no location limits.

- You want no monthly fees without requirements: Some online banks and credit unions have no monthly fees, no matter your balance or deposits.

- You need top-rated customer support every time: PNC gets mixed reviews for customer support. Some people have trouble with slow responses or confusing policies.

- You want more advanced features for investing: If you need complex investment tools or international banking, you may find better options elsewhere.

- You need check-writing from your money market account: PNC does not offer this feature, but some banks do.

If you live outside PNC’s main service areas, you may not get the best rates or easy branch access. You should also compare PNC’s fees and features with other banks to see what fits your needs.

Note: Always think about what matters most to you—fees, digital tools, customer support, or branch access—before you decide.

How to Decide if PNC is the Best Choice for You

Ask yourself these questions:

- Do you want both digital banking and branch access?

- Can you meet the requirements to avoid monthly fees?

- Is PNC’s high-yield savings available in your state?

- Do you need strong customer support and easy ways to get help?

- Are you looking for business or corporate banking solutions?

If you answered “yes” to most of these, PNC Bank could be the best choice for you. If not, you might want to explore online banks or credit unions for better rates or fewer fees.

PNC Bank gives you strong digital tools, a big branch network, and helpful features like Virtual Wallet and ATM fee refunds. You might like PNC if you want easy money management and branch access. Some people may not like the higher fees or mixed customer service. Before you choose, think about what matters most—fees, digital tools, branch locations, or savings rates. The best bank for you fits your own needs.

FAQ

How do you avoid monthly fees at PNC Bank?

You can skip monthly fees by keeping a minimum balance, setting up direct deposits, or linking your accounts. For example, keep $500 in your checking or set up $500 in direct deposits each month. Check your account type for specific requirements.

Does PNC Bank offer ATM fee reimbursements?

Yes, some PNC accounts reimburse you for out-of-network ATM fees. Performance Select Checking gives you the most reimbursement. Here’s a quick look:

| Account Type | ATM Fee Reimbursement |

|---|---|

| Performance Select Checking | Unlimited |

| Performance Spend | First 2 per month |

| Standard Virtual Wallet | None |

Can you open a PNC account online?

Yes, you can open most PNC accounts online. Visit the PNC website, choose your account, and follow the steps. You need your Social Security number, a valid ID, and your address. The process takes just a few minutes.

What should you do if you have a problem with your PNC account?

Contact PNC right away. You can call customer service, use online chat, or visit a branch. Keep your account details handy. If you need to report fraud, use the PNC fraud hotline for faster help.

While PNC Bank blends branch access with digital tools, high fees and limited savings rates may leave you looking for alternatives. If you want more flexibility and lower costs when managing your money across borders, BiyaPay offers a modern solution. With remittance fees from just 0.5%, BiyaPay ensures your funds move quickly, transparently, and securely. It also supports seamless fiat-to-crypto and crypto-to-fiat conversions, giving you more control than traditional banks.

Stop losing money on hidden fees and delays. Register with BiyaPay today and experience a faster, cheaper, and more reliable way to move your money.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.