- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What are the strongest currencies in the world? (2025)

Image Source: unsplash

The strongest currencies in the world in 2025 include the Kuwaiti Dinar, Bahraini Dinar, Omani Rial, and Jordanian Dinar. These currencies lead the global rankings for strength and stability, not just popularity or usage. The table below shows their value against usd and highlights why each one holds a strong position compared to the dollar.

| Currency | Exchange Rate (1 unit to USD) | Key Economic Reasons |

|---|---|---|

| Kuwaiti Dinar (KWD) | 3.27 USD | Large oil reserves, high per capita income |

| Bahraini Dinar (BHD) | 2.65 USD | Oil exports, strong financial sector |

| Omani Rial (OMR) | 2.59 USD | Oil exports, economic diversification |

| Jordanian Dinar (JOD) | 1.41 USD | Political stability, trade and logistics hub |

People often see the Kuwaiti Dinar as the strongest currency in the world, making it the most expensive currency by value. Other top 10 strongest currencies, like the Bahraini Dinar and Omani Rial, also rank high as strong currency choices. These exchange rates show how a strong currency can outperform the dollar and become the most expensive currency in the global market.

Key Takeaways

- The Kuwaiti Dinar, Bahraini Dinar, Omani Rial, and Jordanian Dinar rank as the strongest currencies in 2025 due to their high value against the U.S. dollar.

- Strong currencies come from stable economies, low inflation, resource wealth like oil, and sound government policies that support financial stability.

- The U.S. dollar remains the most widely used currency globally but is not the strongest by value; its strength lies in trust, market size, and global influence.

- A strong currency boosts purchasing power for travelers and attracts investors but can make exports more expensive and affect trade balances.

- Staying informed about currency values and economic factors helps travelers and investors make smarter financial decisions and plan better.

Strongest Currencies in the World

Image Source: pexels

Top 10 Strongest Currencies

The top 10 strongest currencies in the world for 2025 show how different countries maintain high value against the U.S. dollar. The Kuwaiti Dinar stands as the strongest currency in the world, with the Bahraini Dinar and Omani Rial following closely. These currencies have high value against USD, making them the most expensive currency choices for travelers and investors. The British Pound Sterling and Swiss Franc also rank among the top strongest currencies, reflecting their stable economies and global influence. The table below lists the top 10 strongest currencies, their countries, currency codes, and value against USD.

| Rank | Country | Currency Name | Currency Code | Value Against 1 USD |

|---|---|---|---|---|

| 1 | Kuwait | Kuwaiti Dinar | KWD | 1 USD = 0.31 KWD |

| 2 | Bahrain | Bahraini Dinar | BHD | 1 USD = 0.38 BHD |

| 3 | Oman | Omani Rial | OMR | 1 USD = 0.38 OMR |

| 4 | Jordan | Jordanian Dinar | JOD | 1 USD = 0.71 JOD |

| 5 | United Kingdom | British Pound Sterling | GBP | 1 USD = 0.75 GBP |

| 6 | Gibraltar | Gibraltar Pound | GIP | 1 USD = 0.75 GIP |

| 7 | Cayman Islands | Cayman Islands Dollar | KYD | 1 USD = 0.81 KYD |

| 8 | Switzerland | Swiss Franc | CHF | 1 USD = 0.83 CHF |

| 9 | Eurozone (Europe) | Euro | EUR | 1 USD = 0.87 EUR |

| 10 | United States | United States Dollar | USD | 1 USD = 1.00 USD |

The Kuwaiti Dinar leads the list as the most expensive currency in the world. The Bahraini Dinar and Omani Rial also show high value against USD. The British Pound Sterling and Swiss Franc remain strong currency options due to their stable economies and trusted financial systems. The Cayman Islands Dollar and Gibraltar Pound keep their strength through financial sector support and pegging to the British Pound. The Euro and U.S. Dollar round out the top 10 strongest currencies, reflecting their importance in global trade.

Why These Currencies Are Strong

The strongest currencies in the world share several important features. Economic stability and low inflation help these currencies keep their high value. Countries like Kuwait, Bahrain, and Oman support their currencies with large oil reserves and careful fiscal policies. The Kuwaiti Dinar, for example, benefits from strong oil exports and a high per capita income. The Bahraini Dinar and Omani Rial also rely on oil wealth and stable government policies.

Political stability and good governance play a key role in currency strength. The Jordanian Dinar stays strong because of steady leadership and a growing trade sector. The British Pound Sterling and Swiss Franc both reflect countries with long histories of political stability and trusted financial institutions. The British Pound Sterling, in particular, gains strength from the United Kingdom’s large financial sector and global economic influence. The Swiss Franc stands out for its safe-haven status, as investors trust Switzerland’s neutral stance and strong banking system.

Central bank policies also affect the value against USD. Higher interest rates can attract foreign investment, which increases demand for a strong currency. The Swiss Franc and British Pound often benefit from these policies. The Euro remains one of the strongest currencies in the world because of the combined economic power of the Eurozone countries.

Geopolitical events can influence the rankings of the top 10 strongest currencies. For example, the U.S. dollar often strengthens during global uncertainty, as investors see it as a safe choice. However, local events like Brexit caused the British Pound to drop in value, showing how political changes can affect even the strongest currencies.

Note: The most expensive currency does not always mean the most widely used. The Kuwaiti Dinar, Bahraini Dinar, and Omani Rial have high value against USD, but the U.S. dollar and Euro remain the most traded currencies worldwide.

The top strongest currencies in 2025 reflect a mix of resource wealth, stable economies, and sound fiscal policies. The British Pound, Swiss Franc, and Euro continue to show resilience, while the Kuwaiti Dinar holds its place as the strongest currency in the world.

Kuwaiti Dinar and Other Top Currencies

Kuwaiti Dinar Overview

The Kuwaiti Dinar stands as the world’s strongest currency in 2025. As of July 28, 2025, the exchange rate shows that 1 Kuwaiti Dinar equals about 3.28 U.S. Dollars. This high value means that even small amounts of the Kuwaiti Dinar can buy more in U.S. Dollars compared to other currencies. The exchange rate has remained stable over the past five years, with only minor changes. For example, the rate moved between 3.273 and 3.279 USD per Kuwaiti Dinar in the last week of July 2025. These small shifts show that the currency does not experience large swings in value. Over the past year, the Kuwaiti Dinar decreased by only 0.18% against the U.S. Dollar, which highlights its stability.

| Date | 1 KWD to USD | Change (%) |

|---|---|---|

| July 24, 2025 | 3.277 | -0.02 |

| July 28, 2025 | 3.280 | +0.07 |

The Kuwaiti Dinar’s steady value makes it a trusted currency for trade and investment.

Factors Behind Strength

Several factors help the Kuwaiti Dinar keep its top position. Kuwait has large oil reserves, which bring in strong revenue and support the country’s economy. The government uses careful fiscal planning to manage these resources. Low inflation rates also help keep the currency stable. The central bank sets policies that protect the value of the Kuwaiti Dinar and limit sudden changes.

Other top currencies, such as the Bahraini Dinar and Omani Rial, also show strength for similar reasons. The Bahraini Dinar benefits from a diversified economy and a fixed exchange rate system. The Omani Rial gains support from oil reserves, low inflation, and government-backed stability. These countries use disciplined monetary policies and strong economic planning to keep their currencies strong.

Stable leadership, resource wealth, and sound financial management are key reasons why these currencies remain among the world’s strongest.

What Makes a Currency Strong

Economic Stability

Economic stability stands as one of the most important factors that contribute to currency strength. When a country shows steady growth, low inflation, and a healthy balance of trade, its currency often becomes more valuable. Investors look for signs of stability before they decide to buy a strong currency. Some of the main economic indicators that influence currency strength include:

- Interest rates

- Gross Domestic Product (GDP)

- Inflation rates

- Income and wages

- Unemployment rates

- Purchasing Power Parity (PPP)

- Economic policies

- International trade dynamics

A stable economy attracts foreign investment, which increases demand for the currency and helps it stay strong. Political events, such as elections or leadership changes, can cause quick changes in currency value. For example, when a country faces political turmoil, investors may lose confidence and move their money elsewhere, causing the currency to weaken.

Resource Wealth

Resource wealth, especially in oil or minerals, can boost a country’s currency strength. Countries with large oil reserves, such as Kuwait and Oman, often have strong currencies because oil exports bring in steady income. This income supports government spending and attracts foreign investment. However, the relationship between resource wealth and a strong currency is complex. If a country relies too much on one resource, it may face problems when prices fall or if sanctions are imposed. For example, Russia’s currency has faced instability when oil prices dropped or when sanctions limited trade.

Resource wealth can help a country grow and develop its financial sector. Still, overreliance on resources may slow down other parts of the economy. A balanced approach, where resource income supports broader economic growth, often leads to a stronger currency.

Fiscal Policy

Fiscal policy, which includes government spending and debt management, also plays a key role in currency strength. When a government manages its budget well and keeps debt at a reasonable level, it builds confidence among investors. Budget surpluses can support investment and reduce the need for foreign borrowing, which strengthens the currency over time.

When a country runs large deficits, it may need to borrow more from foreign investors. This can raise interest rates and attract short-term investment, causing the currency to appreciate for a while. However, if deficits continue for too long, foreign investors may worry about the country’s ability to repay its debt. This concern can lead to a weaker currency in the long run. Central banks, such as the Federal Reserve in the United States, also influence currency strength through monetary policy and by supporting government bond markets.

The factors that contribute to currency strength include economic stability, resource wealth, and sound fiscal policy. Countries that manage these areas well often enjoy a strong currency and greater financial security.

United States Dollar Comparison

Image Source: pexels

U.S. Dollar Role Globally

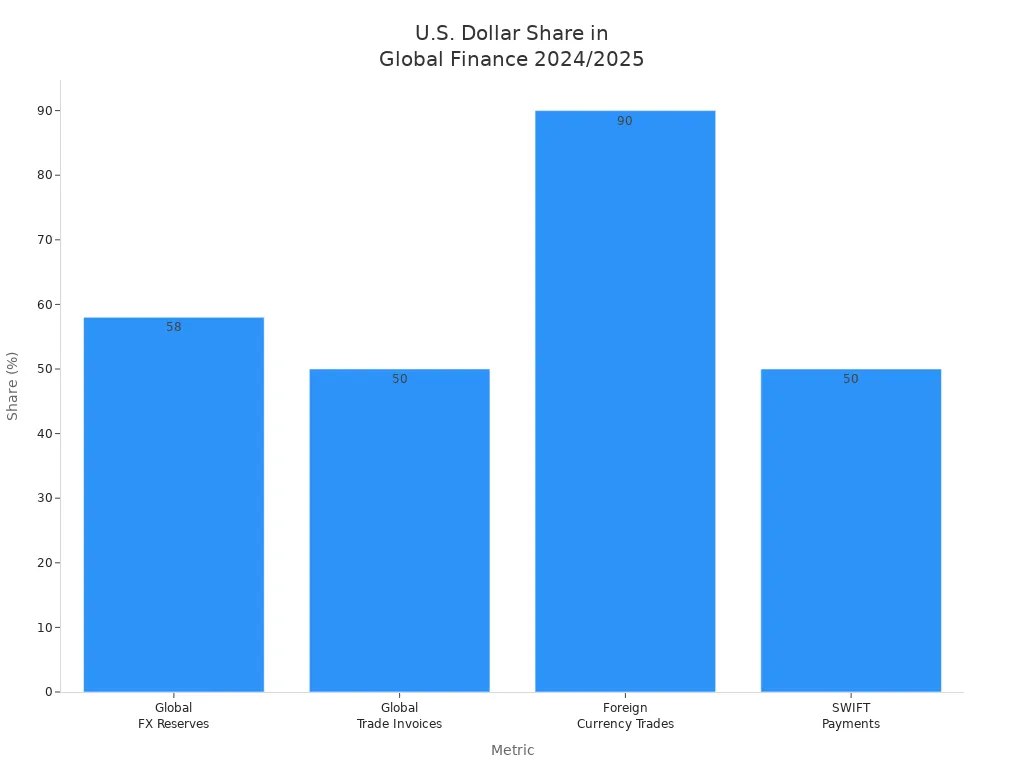

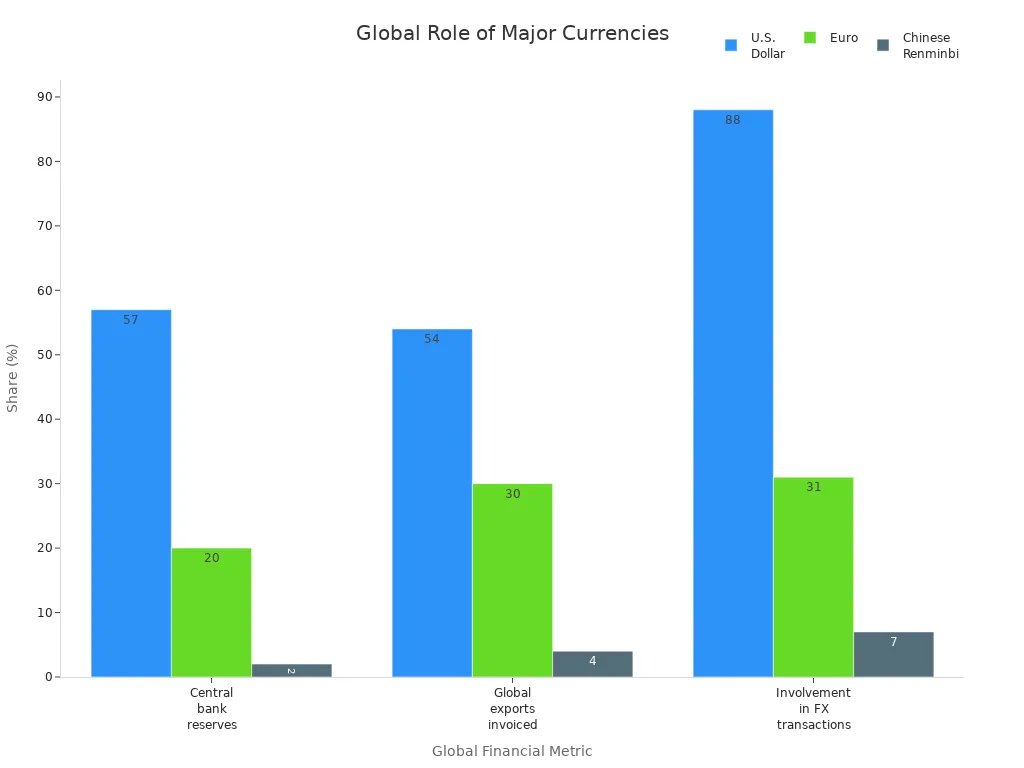

The u.s. dollar holds a unique position in the world economy. It serves as the main currency for international trade, finance, and reserves. As of 2025, the dollar accounts for about 54% of global export invoicing and nearly 57% of official foreign exchange reserves. Around 88% of all foreign exchange transactions involve the u.s. dollar. This widespread use comes from the size and stability of the United States economy, as well as the depth of its financial markets.

The dollar also dominates global payments. In January 2025, it made up more than half of all SWIFT payments. No other currency matches the liquidity, trust, or market depth of the u.s. dollar. The United States offers the world’s largest bond, stock, and real estate markets, which attract investors and central banks. The dollar’s role as a safe-haven currency means that people and governments turn to it during times of uncertainty.

| Metric | U.S. Dollar Share (2024/2025) | Notes |

|---|---|---|

| Global Foreign Exchange Reserves | ~58% (end of 2024) | Still the dominant reserve currency |

| Share in Global Trade Invoices | ~50% | Underpins about half of global trade invoices and international loans |

| Share in Foreign Currency Trades | ~90% | Involved in most foreign currency trades |

| SWIFT Payment Share (early 2025) | >50% | Confirms dominant role as medium of exchange |

The euro is the second most held reserve currency, but it only makes up about 20% of global reserves. Other currencies, such as the British pound, Japanese yen, and Chinese renminbi, hold much smaller shares. The united states dollar’s dominance allows the U.S. to influence global finance and trade.

Why U.S. Dollar Is Not the Strongest

The u.s. dollar leads the world in usage, but it does not have the highest value compared to other currencies. The Kuwaiti Dinar and Bahraini Dinar have higher nominal values. Several factors explain this difference. Kuwait and Bahrain support their currencies with large oil revenues and fixed exchange rate policies. These countries keep inflation low and manage their finances carefully. Their currencies are pegged to baskets of currencies or directly to the dollar, which helps maintain high values.

The united states dollar, on the other hand, floats freely in the market. Its value depends on supply and demand, investor confidence, and the strength of the U.S. economy. The dollar’s global role comes from the size of the U.S. financial markets, the trust in U.S. institutions, and the country’s economic power. These factors make the dollar the most used and trusted currency, but not the most expensive by exchange rate.

Research shows that investor demand and global savings drive over 90% of the dollar’s strength. The dollar’s value can change with shifts in market appetite or global capital flows. Other currencies may have higher nominal values, but they do not have the same level of global trust, liquidity, or usage.

- The Kuwaiti Dinar and Bahraini Dinar benefit from oil wealth and strict currency management.

- The u.s. dollar’s value reflects its broad use, deep markets, and investor confidence, not just its exchange rate.

- No other currency offers the same combination of liquidity, safety, and global acceptance.

The united states dollar remains the world’s leading currency because of its economic foundations, not its nominal value. Its strength lies in trust, market size, and global influence.

Effects of Strongest Currencies

Imports and Exports

A strong currency changes the way countries trade. When a currency appreciates, exports become more expensive for foreign buyers. This often leads to a drop in export volumes because goods cost more in other countries. For example, when the british pound rises in value, products from the United Kingdom become less competitive abroad. At the same time, imports become cheaper. Consumers and businesses can buy more foreign goods for the same amount of money. This shift benefits buyers but can hurt local producers who face more competition from imported goods. Studies show that strong currencies can tighten financial conditions for exporters, making it harder for them to get credit. As a result, trade balances may shift, with imports rising and exports falling. Over time, this can affect economic growth, especially if the country relies on selling goods overseas.

Investment and Savings

Strong currencies often signal a stable and attractive business environment. Investors look for places where their money will hold its value. When a currency like the british pound or swiss franc strengthens, it draws in foreign investment. People want to put their savings in assets that are less likely to lose value. This inflow of capital can boost the economy and support new projects. However, a strong currency can also make local products less competitive in global markets. Investors may see higher returns when the currency appreciates, but they also face risks if the exchange rate changes suddenly. Holding assets in strong currencies can protect against inflation and currency swings, but it can also make investment returns unpredictable when converted back to another currency.

| Advantages for Investors | Disadvantages for Investors |

|---|---|

| Protection from inflation | Lower returns when converting back to weaker currencies |

| Gains from currency appreciation | Reduced export competitiveness |

| Stable investment environment | Risk from sudden currency changes |

Travel and Purchasing Power

Travelers benefit when their home currency is strong. They can exchange their money for more foreign currency, making trips abroad more affordable. For example, when the british pound is strong, travelers from the United Kingdom can enjoy more experiences for less money in countries with weaker currencies. A strong currency increases purchasing power, allowing tourists to buy more goods and services. On the other hand, visitors to countries with the strongest currencies may find prices higher, as their own money converts into fewer local units. Exchange rates, inflation, and fees can also affect how much travelers can spend. People can maximize their travel budgets by watching exchange rates and choosing the right time to exchange money.

Understanding the world’s strongest currencies helps travelers and investors make smarter choices. The table below highlights key takeaways:

| Key Takeaways for Investors and Travelers | Explanation |

|---|---|

| Some currencies have higher value than USD, EUR, and GBP | Consider these for better value or stability |

| Strong currencies rely on stable economies and high reserves | Informed decisions come from knowing economic fundamentals |

| Top 10 strongest currencies include KWD, BHD, OMR, JOD, GBP, GIP, KYD, CHF, EUR, and USD | Identifying these helps with investment and travel planning |

| Economic strengths include oil exports, financial sectors, and stability | Assess currency risk and potential with these factors |

| Strong currencies increase purchasing power abroad | Understand impacts on travel and trade costs |

- Travelers can plan budgets by watching exchange rates.

- Investors use currency strength to guide portfolio choices.

- Reliable sources like Xe and the U.S. Treasury Fiscal Data site offer real-time and official exchange rates.

Staying updated on currency trends supports better financial decisions and global awareness.

FAQ

What is the difference between a strong currency and a widely used currency?

A strong currency has a high value compared to others, like the Kuwaiti Dinar. A widely used currency, such as the U.S. dollar, is accepted in many countries and used for most global trade.

Why do oil-rich countries often have strong currencies?

Oil-rich countries earn large amounts of USD from exports. This steady income supports their economies and helps keep their currencies stable and valuable. Careful government policies also play a key role.

Can a strong currency hurt a country’s economy?

A strong currency can make exports more expensive for other countries. This may reduce sales abroad and hurt local businesses. However, it also makes imports cheaper for consumers.

How do travelers benefit from strong currencies?

Travelers with strong currencies can buy more goods and services abroad. Their money has greater purchasing power, which makes travel and shopping in other countries more affordable.

Where can people check real-time exchange rates?

People can check real-time exchange rates on trusted websites like Xe or the U.S. Treasury Fiscal Data site. Many banks in Hong Kong also provide up-to-date currency information online.

Understanding the strongest currencies in the world shows how exchange rates shape investment returns, travel budgets, and cross-border payments. But no matter how powerful a currency is, hidden fees and poor conversion rates can reduce your real value. That’s why BiyaPay gives you a smarter way to manage global money. With remittance fees starting at just 0.5%, real-time FX rates, and same-day delivery, BiyaPay makes moving money across currencies simple, fast, and cost-effective. You also get seamless fiat-to-crypto and crypto-to-fiat conversions for maximum flexibility.

Don’t let banks take away your edge. Register with BiyaPay today and enjoy transparent, low-cost currency exchange built for the global economy.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.