- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

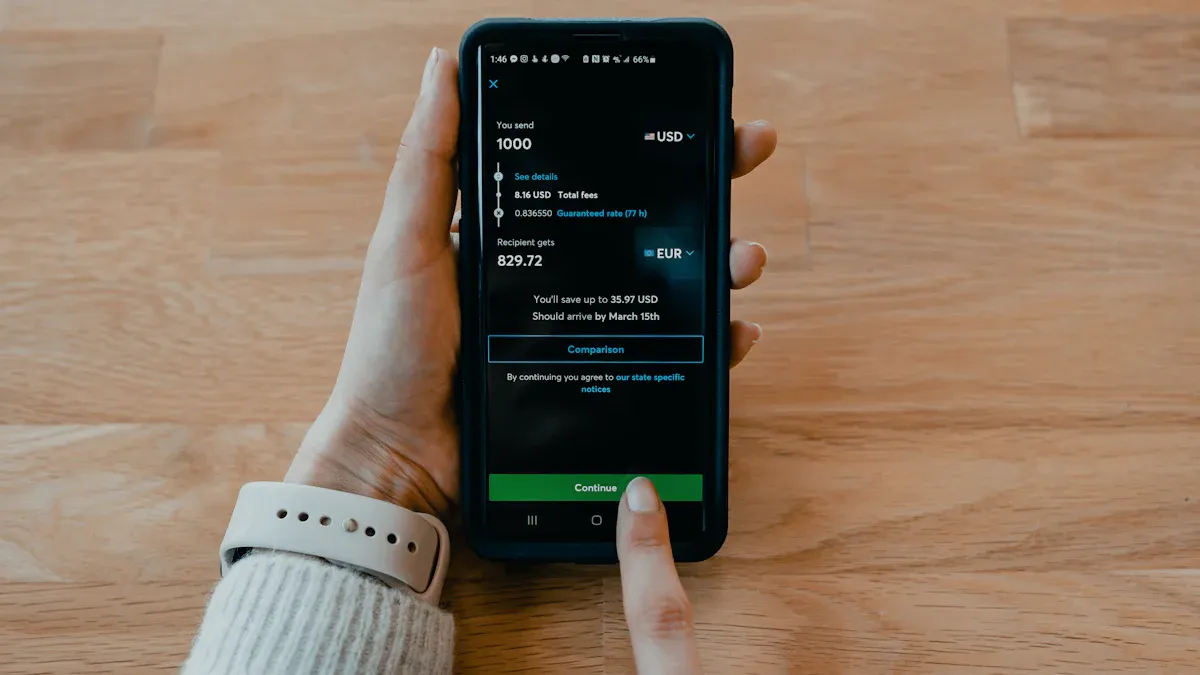

What is a wire transfer: A thorough overview

Image Source: unsplash

A wire transfer sends money from one bank account to another using electronic fund transfers. People often choose a wire transfer for large payments or when they need to move money quickly and securely. Many businesses and individuals rely on this method for urgent or international payments. On average, each wire transfer moves about $5.30 million, based on recent data:

| Month | Average Value per Transfer (in millions USD) |

|---|---|

| 2025:June | 5.30 |

| 2025:May | 5.43 |

| 2025:April | 5.60 |

The volume of money transfer transactions continues to grow as digital platforms make sending funds easier and faster around the world.

Key Takeaways

- Wire transfers move money quickly and securely between bank accounts, making them ideal for large or urgent payments.

- They usually process the same day for domestic transfers and take 1 to 5 business days for international transfers.

- Wire transfers have higher fees than other methods but offer strong security and clear records.

- Always double-check recipient details before sending, as wire transfers are generally irreversible.

- Alternatives like ACH transfers and fintech apps cost less and allow reversals but may be slower or less suitable for large or urgent payments.

What is a wire transfer

Image Source: pexels

Definition

A wire transfer is an electronic payment that moves funds quickly and securely between bank accounts. Banks and money service businesses use secure systems such as SWIFT for international transfers and Fedwire or CHIPS for transfers within the United States. This process allows people and businesses to send large sums of money with speed and reliability. Under the Electronic Fund Transfer Act (EFTA) and Regulation E, most wire transfers do not fall under the same rules as other electronic fund transfers. However, a recent federal court decision clarified that when a consumer starts a wire transfer through an electronic banking platform, the initial instruction may receive EFTA protection. When people use remittance transfer services to send money abroad, these transactions receive special federal consumer protections under U.S. law.

Wire transfers stand out because they are fast, irreversible, and managed by banks or licensed providers. The process creates a clear record, which helps both senders and recipients track the movement of funds.

Key features

| Feature | Wire Transfers | Other Electronic Payment Methods (EFTs) |

|---|---|---|

| Speed | Immediate or same-day funds availability; ideal for urgent or large transactions, including international transfers. | Generally slower; may take hours to days due to batch processing or intermediaries. |

| Security | High security with direct bank-to-bank transfers using secure protocols (Fedwire, SWIFT); additional security features and clear paper trail. | Secure but may have varying security levels; often involve intermediaries and less immediate processing. |

| Cost | Higher fees, especially for international transfers. | More cost-effective with lower fees, suitable for routine transactions. |

| Use Cases | Large transactions (e.g., real estate, business payments), urgent or international transfers. | Routine domestic payments, recurring transactions, lower amounts. |

| Reversibility | Generally irreversible once initiated, requiring careful verification. | Often reversible or with more flexible dispute resolution options. |

A wire transfer offers several important features:

- Fast processing, often within the same day.

- High security, with direct communication between banks.

- Higher fees compared to other electronic payments.

- Irreversible transactions, which means senders must check details carefully.

- Clear records for tracking and proof of payment.

Banks and financial regulators oversee wire transfer operations to protect users and prevent illegal activities. The Financial Crimes Enforcement Network (FinCEN) leads federal regulation for money transmission services, including wire transfers, under anti-money laundering rules. State authorities also regulate these services within their borders. Other agencies, such as the Federal Reserve Board, Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), and Consumer Financial Protection Bureau (CFPB), supervise banks and non-banks to ensure safety and consumer protection. These agencies work together through councils like the Federal Financial Institutions Examination Council (FFIEC) and the Financial Stability Oversight Council (FSOC).

Common uses

People and businesses use wire transfers in many situations.

- They send urgent payments when time matters.

- They move large amounts of money for purchases such as real estate or business deals.

- They rely on wire transfers for international payments, especially when other options are too slow.

- Remittance transfer services help people send money to family or friends in other countries.

- Wire transfers provide a reliable and secure way to handle high-value or time-sensitive transactions.

A wire transfer remains a trusted choice for anyone who needs to complete a money transfer quickly and safely. Remittance transfer providers also play a key role in helping people send funds across borders, offering both speed and legal protections.

How does a wire transfer work

Image Source: unsplash

Step-by-step process

Understanding how does a wire transfer work helps people send money safely and quickly. Banks and financial institutions follow a clear process to transfer funds between accounts. Here is a typical step-by-step process:

- Decide if the transfer is a domestic wire transfer or an international wire transfer by checking the recipient’s location.

- Contact the bank or financial provider to learn about their wire transfer process and what information they need.

- Gather all required details for both the sender and the recipient, such as account numbers and routing numbers.

- Fill out the wire transfer form at the bank, online, or through a trusted provider. Show a valid government-issued ID.

- Review all information carefully. Wire transfers are usually irreversible, so double-check every detail before submitting.

- Pay any fees and submit the request. The bank will give a confirmation receipt.

- Notify the recipient that the funds are on the way and follow up to make sure the money arrives.

Banks process domestic wire transfers within 24 hours in most cases. International wire transfers may take one to five business days. Each bank sets its own cut-off times for same-day processing, so checking with the bank helps avoid delays.

Tip: Always confirm the recipient’s details before sending money. Mistakes can cause delays or even loss of funds.

Required information

Banks need specific information to process a wire transfer. The sender must provide accurate details for both parties. For a domestic wire transfer, the following information is required:

- Sender’s full name, address, and phone number

- Recipient’s full name, address, and phone number

- Recipient’s bank name

- Recipient’s account number

- Recipient’s bank routing number

- Transfer amount

- Purpose of the transfer (sometimes optional)

For international wire transfers, banks need extra details:

- SWIFT/BIC code (unique bank identifier)

- IBAN number (international bank account number)

- Currency type, if not in USD

Providing all this information ensures the bank can transfer funds to the correct account. Verifying every detail before sending helps prevent errors and delays.

Domestic vs. international

The process for domestic wire transfers and international wire transfers shares many steps, but there are important differences. The table below shows how wire transfers work in each case:

| Aspect | Domestic Wire Transfers | International Wire Transfers |

|---|---|---|

| Definition | Transfers within the same country or US territories | Transfers where the sender or receiver is outside the US or US territories |

| Processing Time | Usually same day or within a few hours to 1 business day | 1-5 business days, depending on countries and banks |

| Required Information | Recipient’s name, phone, address, bank name, routing and account numbers | All domestic details plus SWIFT/BIC code, IBAN, and sometimes currency type |

| Fees | Lower fees | Higher fees, including possible intermediary and currency conversion fees |

| Intermediary Banks | Usually direct transfer | Often uses intermediary banks, which can cause delays and extra fees |

| Currency | Usually in local currency (USD in US) | May involve foreign exchange rates and currency conversion |

| Restrictions | Limited to US and US territories | Some regions unsupported; subject to foreign exchange and regulatory rules |

| Initiation Process | Provide sender and recipient info, confirm details | Similar process but with more details and checks due to international regulations |

Domestic wire transfers move money within the same country and usually finish faster. International wire transfers send money across borders, so they need more information and may take longer. Extra steps, such as currency conversion and compliance checks, can add time and cost. Intermediary banks may also handle the transfer, which can lead to additional fees.

Knowing how does a wire transfer work helps people choose the right method for their needs. Understanding how wire transfers work, including the differences between domestic wire transfers and international wire transfers, ensures a smooth and secure experience when they transfer funds.

How much does a wire transfer cost

Typical fees

Banks and financial institutions charge different fees for wire transfers. The cost depends on whether the transfer is within the United States or sent to another country. Outgoing transfers usually cost more than incoming ones. Many banks also offer fee waivers for premium account holders or online transfers. The table below shows common fees at major banks:

| Bank | Incoming Fee (USD) | Outgoing Fee (USD) | Incoming International Fee (USD) | Outgoing International Fee (USD) |

|---|---|---|---|---|

| Bank of America | $0-$15 | $30 | $15 | $45 |

| Wells Fargo | $0 | $25-$40 | $0 | $25-$40 |

| Chase | $0-$15 | $25-$35 | $0-$15 | $40-$50 |

| Citi | $15 | $17.50-$25 | $15 | $25-$35 |

| PNC | $15 | $25 | $15 | $40 |

| U.S. Bank | $15-$20 | $30 | $25 | $50 |

Some banks waive fees for certain accounts or online transfers.

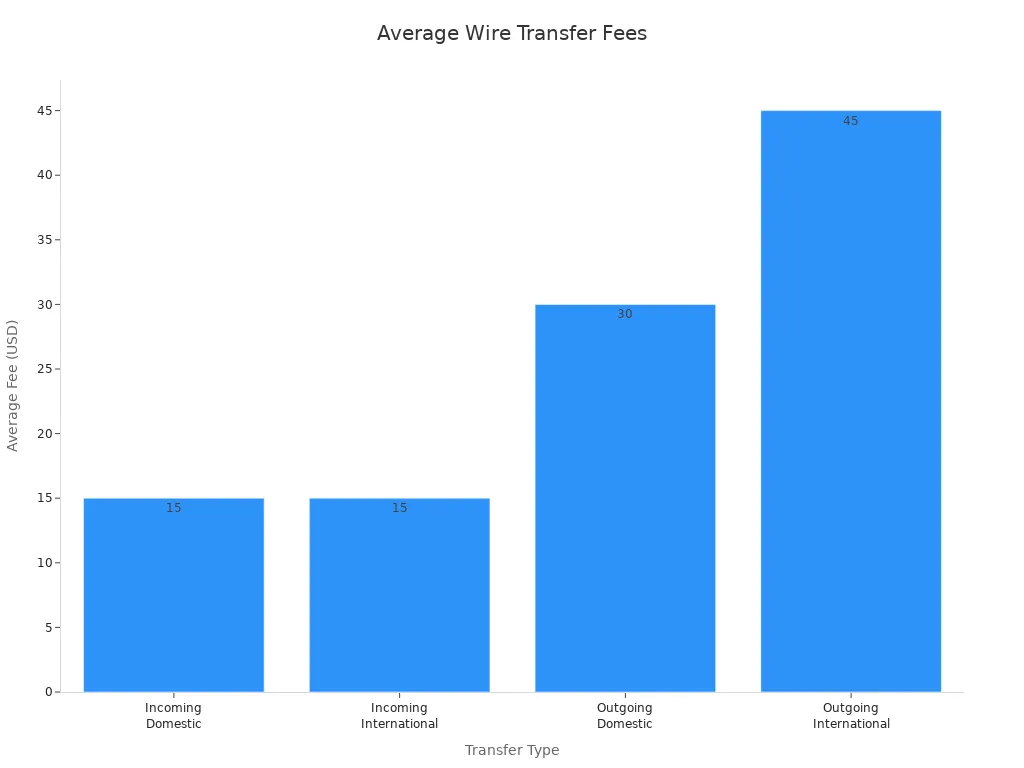

The average fee for sending money within the United States is about $30. Sending money to another country costs about $45. Receiving money usually costs less, around $15. The chart below compares average fees for different types of transfers:

Factors affecting cost

Several factors influence how much does a wire transfer cost. The destination country can raise the price, especially if the currency is rare. The amount sent also matters. Sending a large sum may get a better exchange rate, while many small transfers cost more in total. The speed of delivery affects the fee. Faster transfers often cost more. The method used to start the transfer changes the price. Online transfers are usually cheaper than those made in person or by phone. The payment provider also plays a role. Some specialist companies offer lower fees and better exchange rates than banks. The table below lists common factors and their impact:

| Factor | Explanation | Example |

|---|---|---|

| Destination Country | Rare currencies cost more | Sending to a small country |

| Transfer Amount | Large sums may get better rates | $10,000 transfer vs. $100 |

| Delivery Speed | Faster service costs more | Same-day vs. 3-day delivery |

| Initiation Method | Online is cheaper than in-person | $25 online, $40 in branch |

| Provider | Banks may charge more than fintech apps | Bank vs. online service |

| Exchange Rates | Poor rates increase total cost | Hidden markup on conversion |

Hidden charges

Wire transfers can include hidden or unexpected costs. These charges may not appear in the main fee list. Some common hidden fees include:

- Exchange rate markups: Banks often use a less favorable rate than the market rate, which increases the total cost.

- Intermediary bank fees: Transfers that pass through other banks may lose $10 to $100 or more along the way.

- Receiving fees: The recipient’s bank may charge $10 to $30 to accept the funds.

- Fees deducted from the amount sent: Some banks take their fee out of the money, so the recipient gets less.

- Double fees: Both the sender and the receiver may pay fees, raising the total cost.

- Extra charges for faster service: Same-day transfers often cost more.

- Payment instructions: The sender or receiver may pay all or part of the fees, depending on the chosen option (OUR, SHA, BEN).

Note: Always ask the bank or provider for a full breakdown of costs before sending money. This helps avoid surprises and ensures the recipient gets the expected amount.

How fast are wire transfers

Domestic transfer speed

Wire transfers within the same country move funds quickly. Most banks complete these transfers within one business day. Some systems, like Fedwire, allow near-instant processing. Transfers between accounts at the same bank can take only a few minutes. The Expedited Funds Availability Act (EFAA) requires that funds from wire transfers become available within one business day.

Banks set cutoff times for same-day processing. For example, Bank of America uses 8 p.m. ET, Citibank uses 6 p.m. ET, Chase Bank uses 4-5 p.m. ET, and Wells Fargo uses 5 p.m. ET. If a person starts a transfer after the cutoff, the bank processes it the next business day. Banks do not process wire transfers on weekends or federal holidays, which can delay the arrival of funds.

Note: Transfers through non-bank services may process even faster, sometimes within minutes.

International transfer speed

International wire transfers usually take longer than domestic ones. Most transfers reach the recipient in 1 to 5 business days. The exact time depends on the destination country, the banks involved, and the time zones. Transfers between major banks in developed countries can finish in 24 hours. In most cases, the process takes about 2 business days.

Delays can happen if the transfer passes through intermediary banks, needs currency conversion, or faces extra checks. If a transfer takes more than 5 business days, the sender should contact the bank to trace the payment.

Factors impacting timing

Several factors affect how fast are wire transfers. The most common reasons for delays include:

- The time of day when the sender initiates the transfer

- Bank cutoff times for same-day processing

- Weekends and bank holidays

- Verification and security checks

- Errors in recipient account details

- Currency conversion requirements

- Use of intermediary banks

- Regulatory compliance checks, such as anti-money laundering reviews

- Technical issues at the bank or payment provider

- The recipient bank’s own processing time

A table below summarizes these factors:

| Factor | Impact on Speed |

|---|---|

| Initiation time | Transfers after cutoff are delayed |

| Weekends/holidays | Processing paused |

| Verification checks | May add hours or days |

| Recipient details errors | Can cause significant delays |

| Currency conversion | Adds extra steps |

| Intermediary banks | Slows down the process |

Understanding how fast are wire transfers helps people plan their payments and avoid surprises.

How safe are wire transfers

Security measures

Banks use many security measures to protect wire transfers. They send banking information through encrypted channels. They do not allow changes to banking details by email. Instead, they require phone or video confirmation for any updates. Banks ask all parties to confirm that they understand secure communication rules. Many banks use small test payments before sending large amounts. Payee confirmation systems help make sure the money goes to the right person.

Banks also set up detailed wire transfer policies. These include separating the roles of people who start and approve transfers. Staff receive training to spot fraud and social engineering tricks. Banks verify requests by calling known contacts. They work with IT teams to keep systems secure and block spam. Many banks use special accounts for wire transfers and set limits on transactions. Daily account monitoring helps spot suspicious activity quickly. Banks must follow laws like the SHIELD Act and the Red Flags Rule, which require strong security programs and identity theft prevention.

Common risks

Wire transfers move money fast, but this speed can attract scammers. Wire transfers are usually irreversible. Once the money leaves, it is hard to get back. Scammers often send fake requests for money by email, phone, or message. They may pretend to be someone the sender knows. Some scams involve fake checks, urgent requests, or last-minute changes to payment instructions. Real estate scams, romance scams, and overpayment schemes are common. Red flags include spelling mistakes, pressure to act quickly, and refusal to meet face-to-face. People should always verify wire instructions by calling official numbers.

What to do if something goes wrong

If a wire transfer goes to the wrong person or seems fraudulent, quick action is key. The sender should alert their bank right away and ask for a wire fraud recall. The bank may contact the receiving bank to freeze the funds. The sender should report the case to the FBI’s Internet Crime Complaint Center and local police. All parties involved should be informed. Keeping records of all actions helps with investigations. Banks only resolve a small number of fraud cases. For example, JP Morgan Chase reimburses 2% of cases, Wells Fargo 4%, and Bank of America 24%. This shows that recovering lost funds is rare. People must check all details before sending money. How safe are wire transfers depends on careful steps and strong security.

Alternatives to wire transfer

ACH transfers

ACH transfers are a popular option for moving money between banks in the United States. Many people use ACH for payroll, bill payments, and routine transactions. These transfers process in batches, so they usually take one to three business days. Some banks offer same-day ACH for faster service. ACH transfers cost less than wire transfers. Most banks charge between $0 and $1.50 per transaction for businesses, and many consumers pay nothing. Security is strong, with encryption and fraud checks. Unlike wire transfers, ACH payments can be reversed if there is an error or fraud. However, ACH is best for regular payments, not urgent or international transfers.

| Feature | ACH Transfers | Wire Transfers |

|---|---|---|

| Cost | $0–$1.50 per transaction (often free) | $15–$75+ per transaction |

| Speed | 1–3 business days (some same-day) | Hours or same day |

| Security | Reversible, encrypted | Irreversible, strong verification |

| Usage | Routine payments | Urgent, large, or international payments |

| International Use | Limited | Widely used |

Fintech apps

Fintech apps have changed how people send money. PayPal lets users send funds to over 110 countries and supports many currencies. Venmo is popular for peer-to-peer payments in the United States, making it easy to split bills or pay friends. Wise (formerly TransferWise) offers low-cost international transfers with real exchange rates and multi-currency accounts. Revolut provides multi-currency accounts, budgeting tools, and free transfers in some regions. Cash App allows instant payments, direct deposits, and even investing. These apps give users more wire transfer alternatives, often with lower fees and faster service than banks. However, some apps have limits on transfer amounts or regions.

| Fintech App | Key Features | Advantages | Limitations |

|---|---|---|---|

| Wise | Low-cost international, real rates, multi-currency | Transparent fees, fast, global reach | Service limits, transfer caps |

| Revolut | Multi-currency, budgeting, crypto, virtual cards | Free transfers, global, exchange rates | Account freezing, fees on weekends |

| Cash App | Instant payments, deposits, investing | Seamless, no maintenance fees | Low limits, fees on some transfers |

| PayPal | Global transfers, digital wallet | Wide coverage, easy online | Not all features detailed |

| Venmo | Peer-to-peer, social payments | Easy, popular in U.S. | No international, public data |

Pros and cons

Wire transfer alternatives offer many benefits. ACH transfers and fintech apps cost less and provide more flexibility for routine payments. They also allow reversals in some cases, which adds a layer of safety. However, these options may not work well for urgent or high-value international payments. Wire transfers remain the best choice for large, time-sensitive transactions, but they come with higher fees and cannot be reversed. People should compare all money transfer services to find the best fit for their needs.

| Advantages of Wire Transfers | Disadvantages of Wire Transfers |

|---|---|

| Fast processing, often same-day or within minutes. | Higher fees compared to other electronic payment methods. |

| Secure due to strict bank regulations and verification. | Irreversible once initiated, increasing risk of errors. |

| Suitable for large and international transactions. | Dependent on bank hours, possible delays. |

| Direct bank-to-bank transfer ensures certainty. | Requires detailed recipient information. |

| Convenient for urgent or large payments. | Transactions are traceable, less anonymous. |

Tip: People should review all wire transfer alternatives before sending money, especially if cost, speed, or flexibility matters most.

A wire transfer moves money quickly and securely, making it a strong choice for large or urgent payments. When deciding between payment methods, people should consider cost, speed, security, and convenience.

- Wire transfers cost more but send funds faster and allow higher limits.

- ACH payments work well for recurring or smaller transactions due to lower fees and reversibility.

Before sending money, always:

- Verify recipient details.

- Watch for suspicious requests.

- Take time to confirm instructions.

For more help, banks offer online guides, support lines, and educational materials.

FAQ

What information does someone need to send a wire transfer?

A sender needs the recipient’s full name, address, bank name, account number, and routing number. For international transfers, the sender also needs the SWIFT/BIC code and sometimes the IBAN. Double-checking these details helps prevent errors.

Can a person cancel a wire transfer after sending it?

Wire transfers usually cannot be canceled once the bank processes them. If a mistake happens, the sender should contact the bank immediately. Quick action may help, but recovery is rare.

How much money can someone send with a wire transfer?

Banks set their own limits for wire transfers. Some allow transfers up to $100,000 or more per day. Limits may depend on the account type and the bank’s policies. Always check with the bank before sending large amounts.

Are wire transfers safe for large payments?

Wire transfers use strong security measures. Banks encrypt data and verify identities. These steps protect large payments. However, wire transfers are not reversible, so the sender must confirm all details before sending money.

What happens if the recipient’s information is wrong?

If the recipient’s information is incorrect, the transfer may fail or go to the wrong account. The sender should contact the bank right away. The bank may try to recover the funds, but success is not guaranteed.

Wire transfers remain a trusted method for large or urgent payments, but high fees, exchange rate markups, and slow international processing often make them less practical. With BiyaPay, you can send money smarter: enjoy remittance fees as low as 0.5%, real-time FX rates, and same-day delivery for qualifying transfers. Whether you’re paying suppliers abroad, supporting family, or managing digital assets, BiyaPay gives you the transparency and speed traditional banks lack.

Join thousands of global users who already save time and money. Start today by registering with BiyaPay and experience the future of cross-border payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.