- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What is the best place to order checks?

Image Source: unsplash

You want the best place to order checks because you care about safety, price, and convenience. According to the 2024 Survey and Diary of Consumer Payment Choice, 35% of Americans still pay with checks each month. Many people choose banks, credit unions, or a reputable seller for several reasons:

- Security and anti-fraud features

- High quality and good prices

- Fast delivery

- Great customer service

- Support for local businesses

You find the best places to order checks by comparing trusted banks with top online options.

Key Takeaways

- Banks and credit unions offer strong security and reliable service but usually charge higher prices for checks.

- Online retailers provide lower prices, many design options, and fast shipping, making them a convenient choice.

- Check printing companies combine advanced security features with customization and affordable prices.

- Always double-check your personal and bank details before ordering to avoid errors and delays.

- Protect your information by ordering from trusted providers, using secure websites, and monitoring your bank account regularly.

Best Places to Order Checks

Banks and Credit Unions

You can always trust banks and credit unions when you want to order checks. Many people choose these institutions because they offer strong security and reliable service. You get peace of mind knowing your checks meet strict banking standards. Some banks and credit unions, such as Ally Bank, Navy Federal Credit Union, and USAA Federal Savings Bank, even provide free checks for certain account holders. If you have a premier account, you might qualify for free standard checks as well.

When you compare prices, you notice that banks usually charge more than other options. The average cost for single checks from major banks ranges from $0.38 to $0.65 per check. Duplicate checks cost about $0.43 to $0.74 each. Some credit unions offer free or low-cost checks, depending on your account type. Here is a quick look at the cost differences:

| Provider Type | Single Check Cost Range | Duplicate Check Cost Range |

|---|---|---|

| Major Banks | $0.38 - $0.65 | $0.43 - $0.74 |

| Non-bank Providers | $0.05 - $0.24 | $0.08 - $0.31 |

| Some Credit Unions & Online Banks | Free (varies) | Free (varies) |

You get strong fraud protection and customer support from banks and credit unions. However, you may pay more and have fewer design choices. If you want the best place for security and do not mind paying extra, your bank or credit union is a solid choice.

Online Retailers

If you want to save money and enjoy more choices, you should consider ordering checks online. Online merchants like Walmart Checks, Costco Checks, and Sam’s Club Checks offer some of the lowest prices and fastest delivery. You can also find hundreds of designs and styles to match your personality.

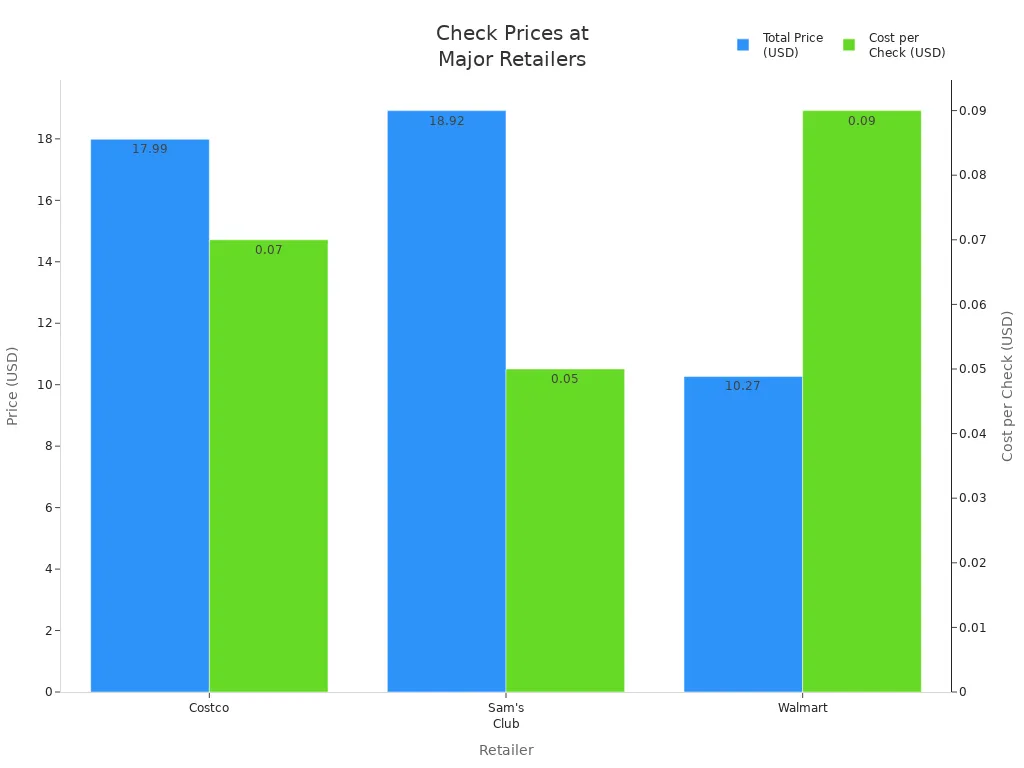

Here is a table showing the price range for leading online retailers:

| Retailer | Price (USD) | Quantity | Cost per Check | Notes on Membership and Shipping |

|---|---|---|---|---|

| Costco | $17.99 | 240 | 7 cents | Membership required; free standard shipping; bulk purchase only |

| Sam’s Club | $18.92 | 400 | 5 cents | Bulk purchase; good savings; shipping details vary |

| Walmart | $10.27 | 120 | 9 cents | No membership required; free standard shipping |

Walmart Checks gives you the lowest upfront price for a smaller quantity. Sam’s Club offers the lowest cost per check if you order in bulk. Costco provides high-security checks but requires a membership. These online merchants make ordering checks online easy and affordable.

You also get strong security features from reputable online retailers. They use secure servers, SSL technology, and fraud detection tools. Many, like Checks In The Mail and Carousel Checks, have been in business for decades and follow Check 21 federal regulations. You can trust their commitment to privacy and safety.

| Retailer Name | Reputation Criteria & Features |

|---|---|

| Checks In The Mail | Over 100 years in business, sells over 1 billion checks annually, reliable, inexpensive, hundreds of designs. |

| Carousel Checks | Basic checks, best value, delivery up to 4 weeks. |

| Costco Checks | Extensive security features: fluorescent fibers, heat-sensitive inks, holograms, watermarks. |

| Walmart Checks | Large retailer, many check options at low prices. |

| Bradford Exchange Checks | Over 800 different check designs, online gift retailer. |

| CheckAdvantage | 2,500 original designs, free shipping. |

| Sam’s Club Checks | Good for bulk orders and printer-compatible checks. |

| Vistaprint | Offers personal checks along with other printed goods. |

You can see that the best places to buy personal checks online offer a mix of low prices, strong security, and lots of design options. If you want cheap checks online, these retailers are your best bet.

Check Printing Companies

You may want even more control over your checks. A check printing service like Deluxe or Checkmate gives you advanced security and customization. These companies have decades of experience and use the latest technology to protect your money.

Check printing companies offer features like foil holograms, prismatic printing, and tamper-evident coatings. You can personalize your printed checks with logos, colors, and fonts. Deluxe, for example, meets or exceeds all industry standards and offers a 100% satisfaction guarantee. Checkmate provides some of the lowest prices in the industry and lets you preview your check before printing.

| Feature | Deluxe |

|---|---|

| Security Features | High-security laser checks with standard security features; option to upgrade to enhanced security |

| Software Compatibility | Compatible with over 80 accounting software systems including QuickBooks, Sage, and NetSuite |

| Customization | Options to personalize checks with logos, colors, fonts, and branding elements |

| Satisfaction Guarantee | 100% satisfaction guarantee with replacement or refund policy |

| Ordering Convenience | Secure, easy-to-use online ordering platform with free shipping and no minimum purchase |

| Industry Standards Compliance | Meets or exceeds ANSI X9 industry standards for check printing |

| Customer Support | Customer service available to assist with customization and specifications |

| Experience | Over 100 years of experience in check printing |

| Additional Products | Coordinating accessories like deposit slips, envelopes, binders, and endorsement stamps |

| Feature | Checkmate Service Line |

|---|---|

| Pricing | Low-cost laser check printing, among the lowest prices in the industry |

| Security Features | Regular and custom security foil holograms providing advanced anti-counterfeiting protection |

| Experience | Decades of industry experience with leadership having a family history over 50 years in check printing |

| Customer Service | Personalized service with direct phone support, no phone menus |

| Proof Preview | Allows customers to view a proof of their check before printing to ensure accuracy |

| Technology | Uses state-of-the-art equipment for laser-printed checks |

| Product Range | Business and personal checks, envelopes, deposit slips |

| Affordability + Security | Combines budget-friendly pricing with enhanced fraud protection |

You get the best place to order checks when you choose a check printing company that combines affordability, security, and customization. Many of these companies also offer cheap personal checks and bulk discounts, making them one of the best places to buy personal checks if you want both value and peace of mind.

Check printing companies use advanced security features to protect your checks from fraud. These features include intricate design borders, anti-copy technology, foil holograms, toner adhesion, thermochromic ink, and chemical wash detection areas. You can see the most common security features in the chart below.

If you want cheap checks online, a check printing service or online merchants like Checks In The Mail, Carousel Checks, or Super Value Checks can help you save money and stay secure. You get more choices, better prices, and strong protection for your financial information. When you look for the best places to buy personal checks, always compare security, price, and convenience to find the right fit for your needs.

Comparing the Best Place to Order Checks

Price Comparison

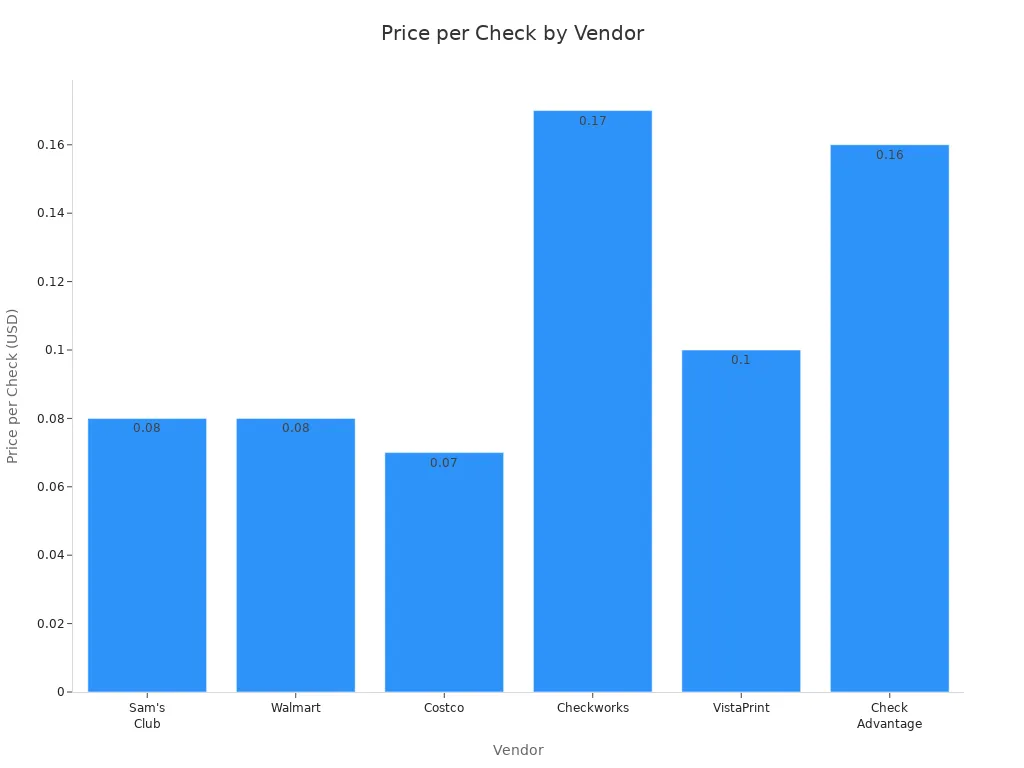

When you compare prices, you see big differences between banks, online retailers, and check printing companies. Banks usually charge the most for checks. You might pay up to $43 for 200 checks from a traditional printer like Deluxe. Online check printers and big-box stores help you save money. For example, Sam’s Club and Walmart both offer about 120 checks for $9.81, which is only $0.08 per check. Costco gives you 250 checks for $16.18, which is about $0.07 per check. Online companies like Checkworks and VistaPrint have moderate prices, but some, like Check Advantage, cost more unless you find a discount.

| Vendor | Approximate Price for ~100 Checks | Price per Check (approx.) | Notes on Pricing and Quality |

|---|---|---|---|

| Sam’s Club | Around $9.81 for 120 checks | About $0.08 | Among the cheapest options; bulk orders |

| Walmart | Around $9.81 for 120 checks | About $0.08 | Competitive pricing, big-box retailer |

| Costco | Around $16.18 for 250 checks | About $0.07 | Larger quantity; offers security features |

| Checkworks | $16.99 for 100 duplicate checks | About $0.17 | More expensive than big-box stores |

| VistaPrint | $15 for 150 checks | About $0.10 | Moderate pricing |

| Check Advantage | $19.25 for 120 duplicate checks | About $0.16 | Higher price among online printers |

Some banks and credit unions offer free checks if you meet certain requirements. For example, Cadence Bank gives students under 25 their first box of checks for free. You must meet age and account rules to qualify.

Security Features

You want your checks to be safe from fraud. Banks, online retailers, and check printers all use advanced security features. These include heat-sensitive ink, verification grids, chemical protection paper, and foil holograms. Some checks have microprinting and watermarks that are hard to copy. Online check printers often match or exceed the security you get from banks. You can see the most common security features in this table:

| Security Feature | Description & Fraud Protection Mechanism |

|---|---|

| Heat-Sensitive Ink | Ink disappears or changes with heat, proving authenticity. |

| Verification Grid | Pattern behind signature vanishes on copies, showing tampering. |

| Chemical Protection Paper | Paper stains if chemicals are used, exposing fraud. |

| Foil Hologram | 3D seal that cannot be copied, adds strong security. |

| Microprinting | Tiny text that looks like a line when copied, stops duplication. |

| True Watermark | Embedded in paper, visible in light, cannot be scanned or printed. |

Convenience

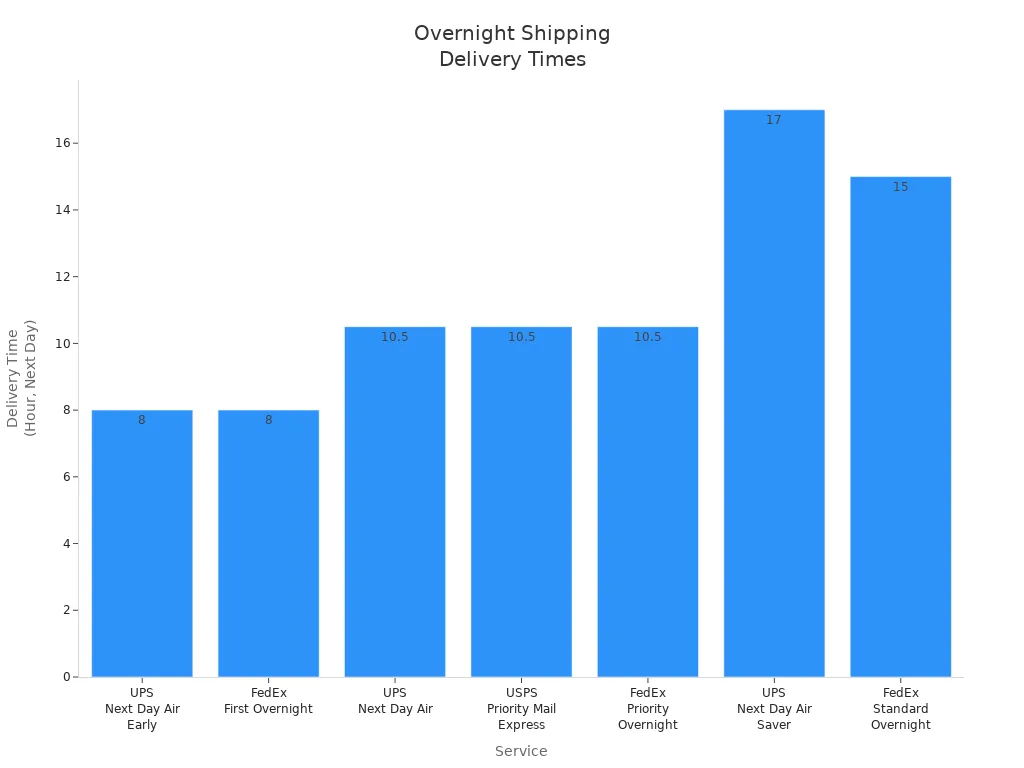

You want to order checks quickly and easily. Online retailers and check printers make the process simple. You can choose from hundreds of designs and order from home. Many online companies offer fast shipping. For urgent needs, you can get overnight delivery from UPS, USPS, or FedEx. Some services even offer same-day delivery in select cities.

| Provider | Fastest Shipping Option | Typical Delivery Time | Delivery Time Details |

|---|---|---|---|

| USPS | Priority Mail Express | Next-day delivery | Delivery by 10:30 a.m., includes Sunday delivery option |

| UPS | Next Day Air Early | Next-day delivery | Delivery by 8 a.m., also offers 10:30 a.m. and end of day options |

| FedEx | First Overnight | Next-day delivery | Delivery by 8 a.m. to major cities; also Priority Overnight (10:30 a.m.) and Standard Overnight (3 p.m.) options |

| Others | Hyperlocal & Same-day Delivery | Same-day to 1-hour delivery | Walmart GoLocal, Amazon Prime hubs, gig services |

You get the most convenience and best value when you order checks online. You can compare prices, pick your favorite design, and choose fast shipping. If you want free checks, check if your bank or credit union offers them for your account type.

How to Order Checks

Image Source: pexels

From Your Bank

You can order checks directly from your bank. This method gives you strong security and peace of mind. Follow these steps to get started:

- Choose how you want to order: online banking, mobile app, phone call, or in person at a branch.

- Select your preferred check style. Some banks offer basic designs, while others have more options.

- Enter your personal details, including your name and address.

- Provide your bank account number, routing number, and the starting check number.

- If you need to update your name or address, contact your bank’s customer service or visit a branch.

Banks protect your information with strict security measures. They use encryption, access controls, and employee background checks. Your data stays safe during the entire process.

Tip: Always double-check your account details before you order checks to avoid errors.

From Online Retailers

Ordering checks online gives you more choices and lower prices. Here’s how to order checks from an online retailer:

- Pick a trusted online check printer, such as Walmart Checks or Costco Checks.

- Choose your favorite design and decide if you want single or duplicate checks.

- Enter your personal and bank information: name, address, routing number, account number, and starting check number.

- Customize your order with security features, logos, or fonts.

- Review your order and approve the final design before submitting.

Online retailers use SSL encryption and identity verification tools to protect your information. They may ask you to confirm your identity or address to prevent fraud.

Note: Only order checks from reputable online retailers to keep your financial data secure.

From Check Printers

Check printing companies offer advanced customization and security. To order printed checks from a check printer, follow these steps:

- Select the type and quantity of checks you need.

- Enter your business or personal details and bank account information.

- Add custom features like logos, colors, or special fonts.

- Review a proof of your check to catch any mistakes.

- Approve your order and track your shipment.

Check printers use MICR technology and secure ordering platforms. You can review your proof before printing to ensure accuracy.

Tip: Always check that your printed checks are compatible with your bank and accounting software.

Information Needed to Order Checks

Image Source: unsplash

Personal Details

You need to provide accurate personal details when you order checks. This information appears on every check you write, so it must be correct. Most check providers ask for your full name, current address, and sometimes your phone number. Some companies let you add a business name or a second signer if you have a joint account.

Tip: Double-check your spelling and address before you submit your order. Mistakes can cause delays or make your checks unusable.

Here is a quick list of the personal details you should prepare:

- Full legal name (as it appears on your bank account)

- Mailing address (where you want the checks delivered)

- Phone number (for order confirmation or delivery issues)

- Optional: Business name or joint account holder’s name

If you move or change your name, update your details with your bank before ordering new checks. This step helps you avoid confusion and protects your financial identity.

Account Information

You must enter your bank account information to print valid checks. This step is critical because errors can lead to bounced checks, payment delays, or even fraud. Always use the exact numbers from your bank documents.

The key account details you need include:

- Bank routing number

- Bank account number

- Starting check number (to keep your records in order)

If you provide incorrect account information, your checks may get flagged for suspicious activity. Banks may reject payments, and you could face fees or fraud risks. Thieves sometimes steal checks during shipping and use the information to create counterfeit checks. You can reduce these risks by ordering from a reputable provider and choosing checks with strong security features like microprinting, security pantographs, and compliance with Check 21 regulations.

Many online check printers use SSL encryption and secure servers to protect your data. Some companies, such as checksforless.com, promise not to share your information with third parties and offer extra identity theft protection.

Note: Always review your order before finalizing. Secure your checks as soon as they arrive to prevent theft or misuse.

Security When You Order Checks

Security Features to Look For

You want your checks to be safe from check fraud and theft. When you order checks, always look for high-security checks with advanced features. These features make it hard for criminals to alter or copy your checks. You can use the table below to see which security features matter most:

| Security Feature | Purpose |

|---|---|

| Chemically Sensitive Paper | Stops criminals from changing information with chemicals. |

| Padlock Icon | Shows the check meets strict security standards. |

| Microprinting (MP Line) | Uses tiny print that is hard to copy, making counterfeiting difficult. |

| Watermarks | Adds a hidden mark that proves the check is real. |

| Holograms | Creates a 3D image that is almost impossible to duplicate. |

| Heat-Sensitive Ink | Changes color with heat, showing if someone tries to tamper with the check. |

You should also choose checks from companies that use secure printing and order validation. These steps help prevent unauthorized orders and protect your money. Always order from a provider that uses a secure website with SSL encryption. This keeps your personal information safe during the order process. Discreet packaging and tamper-evident shipping also help stop theft before your checks reach you.

Tip: Store your checks in a locked place and use fraud-resistant pens to stop check washing.

Protecting Your Information

You need to protect your personal and financial information every time you order checks. Many people handle your checks, so you must stay alert to the risk of check fraud. Follow these best practices to keep your information safe:

- Order checks only from companies that follow industry security standards and belong to the Check Payment Systems Association.

- Review the company’s privacy policy. Make sure they do not sell your information to third parties.

- Give only the information needed for check printing. Never include your Social Security number or birth date.

- Use secure websites with HTTPS when ordering online. Avoid public Wi-Fi and keep your antivirus software updated.

- Request signature confirmation for mailed checks. If you travel, ask the post office to hold your mail.

- Mail checks from a post office or use security envelopes to hide your checks from view.

- Monitor your bank account daily. Set up alerts for unusual activity to catch fraud early.

- Shred old checks after use, especially if you deposit them with your phone.

You can also use services like Positive Pay and USPS Informed Delivery for extra check fraud protection. These tools help you spot suspicious activity and keep your checks safe from fraud.

Saving Money on Checks

Discounts and Promo Codes

You can save a lot when you order checks by using discounts and promo codes. Many online retailers and check printers offer special deals that lower your total cost. You often see percentage discounts, fixed price deals, and even buy-one-get-one-free offers. Some companies give you free shipping or extra boxes at no extra charge. You also find discounts on accessories like address labels and checkbook covers. New customers get special introductory prices, while loyal buyers enjoy exclusive reorder deals. Seasonal sales, such as Black Friday or Memorial Day, bring even bigger savings.

| Discount Type | Examples |

|---|---|

| Percentage Discounts | Up to 65% off sitewide, 20% off business checks |

| Fixed Price Deals | 2 boxes for $22, $6.99 per box |

| Buy-One-Get-One-Free (BOGO) | BOGO offers on check orders |

| Free Shipping | Free shipping on sitewide orders |

| Free Additional Boxes | Free 4th box with purchase |

| Accessory Discounts | 30% off address labels and checkbook covers |

| Special Customer Deals | Introductory and reorder discounts |

| Holiday Promotions | Black Friday, Cyber Monday, Presidents’ Day, and more |

| Extra Benefits | Cash back, fraud protection add-ons (EZShield) |

Tip: Always check the Special Offers section before you buy. Deals change often, so you can find cheap checks online if you shop at the right time.

Bulk Orders

You get the best value when you order checks in bulk. Many companies give deep discounts when you buy more boxes at once. If you run a business or write many checks, you should order enough for the whole year. This way, you avoid running out and paying higher prices later. Some sellers even promise to beat any lower price by 10% if you find a better deal on comparable items. Bulk orders help you get cheap checks and keep your costs low.

- Save more by ordering higher volumes of checks.

- Price beat guarantees can lower your cost even further.

- Plan ahead and buy for the year to maximize your savings.

Note: Bulk orders are the best way to get discounted checks for both personal and business needs.

Shipping Costs

Shipping costs can add up if you do not pay attention. Some online check retailers charge a flat fee for shipping and handling. For example, Affordable Checks charges $13 per order, no matter how many checks you buy. This means you save more when you order larger quantities at once. Some companies offer free shipping if you use a promo code or buy during a special sale. Always compare shipping fees before you place your order.

| Order Quantity | Price (USD) | Shipping & Handling Fee (USD) |

|---|---|---|

| 600 checks | $69.95 | $13 |

| 1200 checks | $129.95 | $13 |

Tip: Look for free shipping offers or combine orders to lower your per-check shipping cost.

Alternatives to Checks

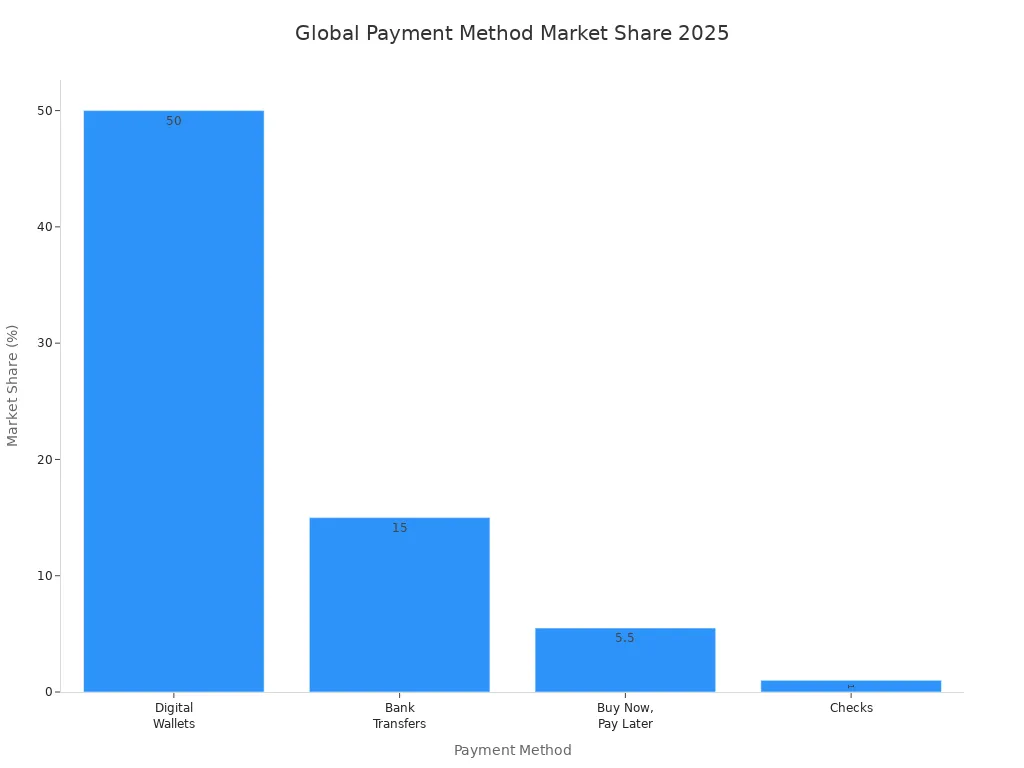

Digital Payments

You have more options than ever before when you want to move money. Digital payments now lead the way. You can use digital wallets, bank transfers, or even buy now, pay later services. These methods give you speed, security, and convenience that checks cannot match.

- Digital wallets, like Apple Pay and Google Pay, now handle about half of all global payments.

- Bank transfers, including real-time payments, make up 15% of the market.

- Buy now, pay later services are growing fast, especially with younger shoppers.

- Checks now account for less than 1% of payments worldwide.

| Payment Method | Estimated Global Market Share (2025) | Key Regions of Use |

|---|---|---|

| Digital Wallets | Approximately 50% | North America, Europe, Asia |

| Bank Transfers | Approximately 15% | Asia (India), USA, EU |

| Buy Now, Pay Later (BNPL) | Around 5-6% | Europe, Australia, North America |

| Checks | Less than 1% | Mostly phased out |

Digital payments cost less and protect you better. You avoid bank fees, handling costs, and bounced check charges. Digital wallets charge a small fee per transaction but offer more security. Pay-by-bank options save you up to 72% compared to card payments. You also get advanced fraud detection and faster processing.

Note: Digital payments use encryption, tokenization, and two-factor authentication. These tools keep your money and information safe.

When to Use Alternatives

You should use digital payments when you want speed and safety. Electronic payments process in minutes. You do not need to wait for checks to clear or worry about lost mail. Digital payments also help you avoid fraud. Checks remain the top target for payment fraud, making up 66% of all cases. Digital payments use layers of security, such as biometric authentication and end-to-end encryption.

Choose digital payments for these situations:

- Paying bills online

- Sending money to friends or family

- Shopping at stores or online

- Handling business payments or payroll

- Working remotely or managing payments from anywhere

Checks still work for some needs, such as paying rent or when a business only accepts them. However, digital payments give you more control and less risk. You save time, reduce paperwork, and enjoy better tracking. You also help the environment by cutting down on paper use.

Tip: Switch to digital payments for most transactions. You get more convenience, lower costs, and stronger protection than checks can offer.

You can find the best place to order by comparing price, design options, security features, and convenience.

Always look for strong security, available discounts, and reliable shipping.

Avoid common mistakes by double-checking your details and using secure mailing methods.

If you follow these steps, you make a smart choice and protect your money. Use the tips in this guide to order with confidence and save more.

FAQ

How do you know if an online check provider is safe?

You should look for SSL encryption, a padlock icon in your browser, and clear privacy policies. Trusted providers display security badges and follow Check Payment Systems Association standards. Always read reviews before you order.

Can you order checks without going to your bank?

Yes, you can order checks online from reputable retailers or check printing companies. You only need your account and routing numbers. Many online services offer more designs and lower prices than banks.

What should you do if your checks get lost in the mail?

Contact your bank right away. Ask them to stop payment on missing checks. Monitor your account for any unauthorized activity. Most banks, including those in Hong Kong, help you protect your money.

Are there extra fees when you order checks online?

Some online check providers charge shipping or handling fees. You may also pay for security upgrades or faster shipping. Always check the total price before you place your order.

Can you use checks from any provider with your bank?

Most banks accept checks from any reputable provider if the checks meet banking standards. Always confirm with your bank, especially if you use a Hong Kong bank, to avoid problems with deposits or payments.

Paper checks still work for some, but they come with hidden costs, slower delivery, and higher fraud risks. If you’re looking for a safer and smarter alternative, BiyaPay helps you move money without the downsides of traditional checks. With remittance fees as low as 0.5%, real-time exchange rates, and same-day delivery for qualifying transfers, you can cut costs, gain speed, and protect your financial information. Whether you’re paying bills, sending funds across borders, or converting between multiple currencies, BiyaPay keeps transactions seamless and secure.

Checks may still be around, but digital payments are the future. Take the next step today—register with BiyaPay and experience modern money management designed for convenience, security, and savings.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.