- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

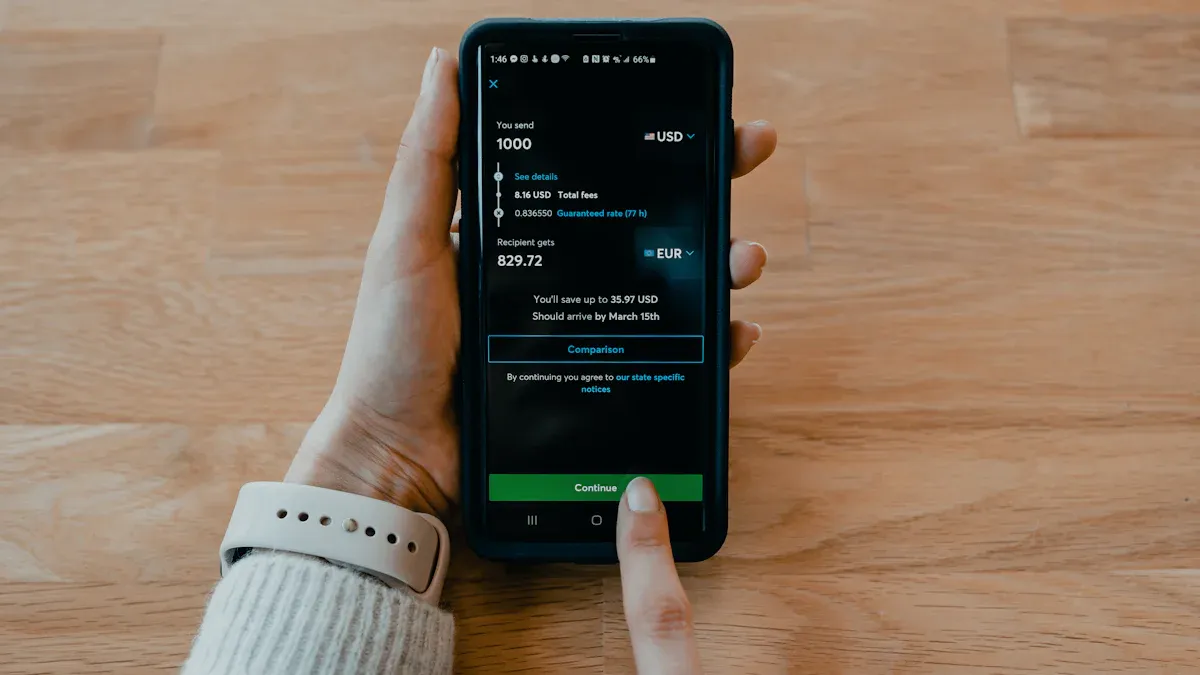

Simplify Transfers: Steps, Fees, and Timing for HDFC to Chase Bank Online Transfers

Image Source: unsplash

Do you find the international remittance process cumbersome? Now, transfers are simplified. You only need to prepare some basic information to successfully complete an online transfer from HDFC to Chase Bank. Many users often worry about filling in incorrect details or missing important information during the process. By following the correct steps, you can significantly reduce the risk of failure. Whether it’s your first transfer or you have prior experience, a clear process can provide assistance.

Key Takeaways

- Prepare accurate recipient and bank details, ensuring the name, account number, and SWIFT code are correct to avoid transfer failures.

- Log in to HDFC online banking or mobile app, add the beneficiary and wait for the cooling-off period, then enter the transfer amount and purpose for a simple and secure operation.

- Understand and choose the appropriate fee payment method, review HDFC and Chase Bank fee standards to save on transfer costs.

- International transfers generally take 3 to 7 business days to arrive; consider transfer timing and holiday impacts, and check transfer status promptly.

- Verify all information, protect account security, and contact bank customer service promptly if issues arise to ensure funds arrive safely and smoothly.

Required Information

Recipient Information

You need to prepare the recipient’s detailed information in advance. This includes the recipient’s full name (matching the Chase Bank account), the Chase Bank account number, the recipient’s contact address, and phone number. You also need to confirm that the information provided by the recipient has no spelling errors. Accurate information ensures your transfer is completed smoothly. If the name or account number is incorrect, the bank will reject the remittance, and the funds may even be returned.

Tip: You can ask the recipient to take a photo or screenshot of their bank information page to avoid errors during manual input.

Bank Account and SWIFT Code

You must provide Chase Bank’s SWIFT code. The SWIFT code is like the bank’s global ID. The SWIFT code you enter must be completely accurate. If you enter the wrong SWIFT code, the bank system will automatically return your remittance. This not only leads to transfer failure but may also incur additional fees and delay the processing time. In some cases, the remittance may get stuck at an intermediary bank, requiring you to contact HDFC Bank to assist in recalling the funds. You also need to provide Chase Bank’s detailed address. It’s recommended to double-check all bank details before transferring.

Common required fields are as follows:

| Information Type | Description |

|---|---|

| Recipient Name | Must match the bank account |

| Bank Account Number | Chase Bank account number |

| SWIFT Code | Chase Bank’s dedicated international code |

| Bank Address | Detailed address of the Chase Bank branch |

| Recipient Address | Recipient’s residential or contact address |

Additional Documents

Sometimes, the bank may require you to specify the purpose of the transfer. You can select options like “tuition,” “living expenses,” or “family remittance.” In some cases, HDFC Bank may also require you to upload the recipient’s identification or proof of the receiving account. You need to prepare electronic copies of these documents in advance. You should also note that if the transfer amount exceeds a certain threshold (e.g., equivalent to USD 10,000), the bank may require additional documentation. You can contact HDFC Bank’s customer service in advance to understand the latest requirements.

Note: All information must be authentic and accurate. If you’re unsure about any detail, pause the operation and confirm with the bank or recipient again to avoid unnecessary trouble and losses.

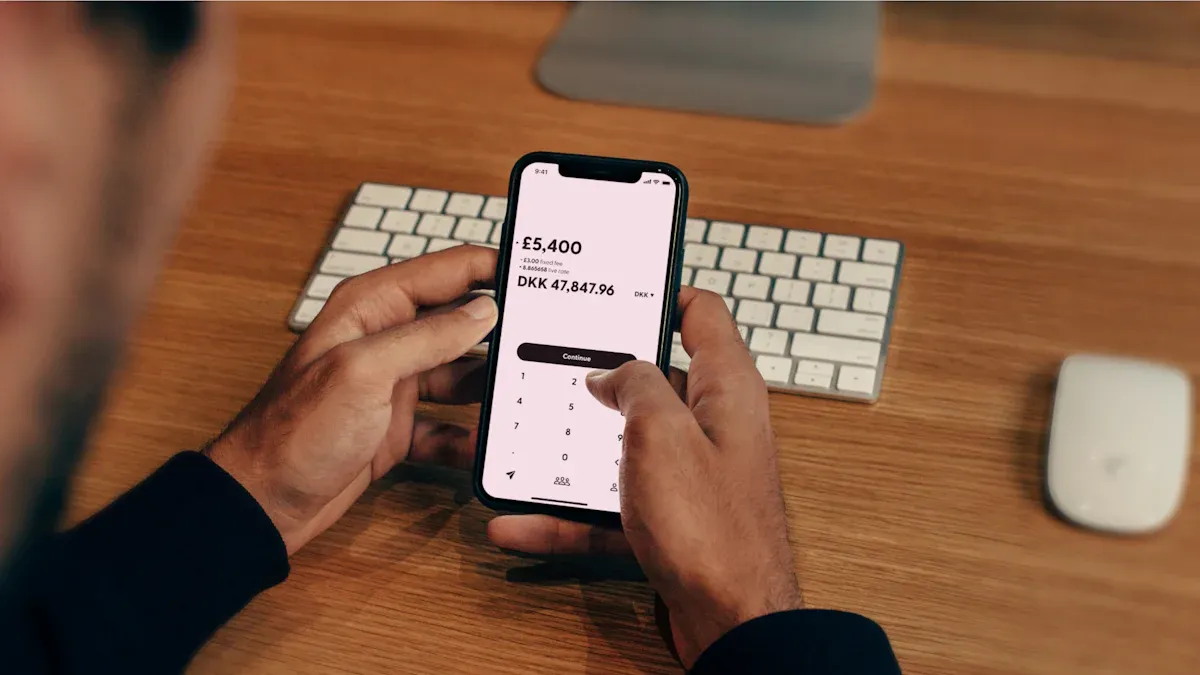

Simplify Transfers: Process Steps

Image Source: unsplash

Log in to HDFC Online Banking

You can log in to your account through HDFC Bank’s official website or mobile banking app. It’s recommended to prioritize the mobile banking app as its interface is more intuitive. After logging in, locate the “Fund Transfer” or “International Remittance” option in the main menu. The HDFC online banking and app interface will have clear “Transfer” or “Remittance” buttons. You need to enter your username and password, and in some cases, a one-time password (OTP). If it’s your first login, set up security questions and mobile verification in advance to ensure account security.

Tip: If you’re using HDFC online banking in China or other countries, consider enabling a VPN to ensure a stable network connection and avoid interruptions due to unstable networks.

Add Beneficiary

Before making an international remittance, you need to add the Chase Bank recipient as a beneficiary. Go to the “Add Beneficiary” page, select “International Beneficiary” or “Overseas Account.” You need to enter the recipient’s name, Chase Bank account number, SWIFT code, recipient address, and bank address. The system will ask you to confirm the information to ensure accuracy. After adding the beneficiary, HDFC Bank typically conducts a security verification, such as sending an SMS verification code to your phone. Once the beneficiary is successfully added, there’s usually a cooling-off period (typically 30 minutes to 24 hours) during which you cannot transfer immediately. This is to prevent account misuse.

Tip: You can add the beneficiary a day in advance and proceed with the transfer after the cooling-off period to save waiting time and simplify the transfer process.

Enter Transfer Details

After successfully adding the beneficiary, you can go to the “International Remittance” page. Select the account you want to transfer from, enter the transfer amount (in USD). The system will automatically display the current exchange rate, and you can refer to HDFC Bank’s USD to INR rate for that day. You also need to specify the transfer purpose, such as “tuition,” “living expenses,” or “family remittance.” In some cases, the system may require you to upload relevant proof documents, such as tuition bills or recipient identification. Prepare electronic copies of these documents in advance and select them for upload.

You can choose a one-time transfer or a recurring transfer. One-time transfers are suitable for temporary remittances, while recurring transfers are ideal for fixed monthly remittances, such as regular transfers to family in a Chase Bank account. Recurring transfers allow you to set up automatic deductions, eliminating the hassle of manual operations each time and simplifying transfers.

| Transfer Type | Applicable Scenarios | Advantages |

|---|---|---|

| One-Time Transfer | Temporary remittances | Flexible operation, available anytime |

| Recurring Transfer | Fixed periodic remittances | Automatic deductions, time-saving |

Confirm and Submit

After entering all information, carefully review each detail. Confirm that the recipient’s name, account number, SWIFT code, amount, and purpose are correct. The system will display a transfer summary for you to check again. If everything is correct, click the “Confirm” or “Submit” button. HDFC Bank will send another one-time password to your phone; enter it, and the system will indicate that the transfer has been submitted. You can take a screenshot of the transfer receipt for future reference.

Note: After submitting the transfer, the funds will be frozen in your account pending bank processing. You can check the transfer status anytime in online banking or the app.

Track Status

After submitting the transfer, you can check the progress in the “Transaction History” or “International Remittance Records” section of HDFC online banking or the mobile app. The system will display statuses such as “Processing,” “Completed,” or “Failed.” If there’s a delay or issue, the system will provide prompts. You can contact HDFC Bank customer service for detailed assistance based on the prompts. In some cases, Chase Bank will notify you of the funds’ arrival via SMS or email. You can ask the recipient to monitor their Chase Bank account balance for changes.

Suggestion: Regularly log in to HDFC online banking to track transfer progress and ensure fund safety. If issues arise, contact bank customer service immediately to simplify transfers.

Fee Details

HDFC Fees

When initiating an international remittance from HDFC Bank, the bank charges a certain fee. Generally, HDFC charges a fixed fee based on the transfer amount, typically between USD 25-35. You also need to note that, in some cases, HDFC adjusts the fee standard based on the remittance currency and destination country. If you opt for expedited processing, the fee may be higher. You can check the latest fee standards through HDFC online banking or customer service before remitting. Ensure you have sufficient USD balance in advance to avoid transfer failures due to insufficient fees.

Chase Receiving Fees

When Chase Bank receives an international remittance, it charges two fees. The first is a telegraphic transfer fee of CNY 150, equivalent to approximately USD 21 (based on the real-time exchange rate). The second is a fee of one-thousandth of the remittance amount. For example, for a USD 5,000 remittance, Chase charges about USD 5 as a fee. Remind the recipient to check the received amount, as it will be reduced by these fees. Fees may vary slightly by branch, so it’s recommended to have the recipient confirm with Chase customer service for specific fee standards.

Intermediary Bank Fees

International transfers typically pass through one or more intermediary banks. Each intermediary bank charges a fee ranging from USD 10-50. You can refer to the table below for intermediary bank fee details:

| Bank Name | Handling Fee (USD) | Telegraphic Fee (USD) | Total Fee (USD) |

|---|---|---|---|

| Bank A | 20 | 15 | 35 |

| Bank B | 18 | 12 | 30 |

| Bank C | 25 | 10 | 35 |

You can choose the fee payment method during the remittance. Common options include:

- OUR: You bear all fees, and the recipient receives the full amount.

- SHA: You and the recipient share the fees, reducing the received amount.

- BEN: The recipient bears all fees, reducing the received amount the most.

When you choose OUR, the recipient receives the full remittance amount. With SHA or BEN, the recipient’s actual received amount is reduced. Choose the appropriate method based on your needs.

Cost-Saving Tips

You can effectively save on international transfer fees with these methods:

- Try to initiate transfers on weekday mornings to avoid peak times and reduce the number of intermediary banks.

- For larger transfer amounts, choose the OUR method to avoid multiple small transfers incurring multiple fees.

- Watch for promotional offers from HDFC and Chase, which sometimes include fee waivers.

- Consult other banks, such as Hong Kong banks, for international remittance services and compare their fees and processing speeds.

Tip: Before transferring, have both you and the recipient check with your respective banks for the latest fee policies to avoid losses due to information discrepancies.

Processing Time

Image Source: unsplash

Expected Timeline

When initiating an international transfer from HDFC to Chase Bank, you typically need to wait a few business days. The processing timeline for wire transfers between U.S. banks and international remittances follows these patterns:

- Wire transfers between U.S. banks generally take 1 to 5 business days to arrive. In most cases, funds complete the entire process within 3-5 business days.

- International remittances (including HDFC to Chase Bank) typically take 3 to 7 business days. Electronic channels result in faster review and transfer speeds, while counter channels may take longer.

- Transfers initiated on Friday afternoons or weekends will be processed on the next business day, extending the processing time during weekends or U.S. and Chinese statutory holidays.

You can refer to the experience of Hong Kong banks, where cross-border remittances generally take 3-5 business days. The actual processing time is also affected by the bank’s internal processing speed.

Influencing Factors

The processing time is not fixed. You need to consider the following key factors:

- Transfer initiation time: Both Chase Bank and HDFC have daily wire transfer cut-off times. If you initiate before the cut-off, the bank processes it that day; after the cut-off, it’s deferred to the next business day.

- Number of intermediary banks: International remittances typically pass through one or two intermediary banks. The more intermediary banks, the longer the processing time.

- Anti-money laundering reviews: Large transfers or sensitive purposes may trigger compliance reviews, extending the processing timeline.

- Holidays: U.S. and Chinese holidays affect bank processing speeds. Transfers around holidays will take significantly longer.

Tip: Check Chase Bank’s wire transfer cut-off time, typically 4:00 PM Eastern Time. Initiating before the cut-off speeds up processing.

Status Tracking

You can check the transfer progress anytime in the HDFC and Chase Bank online banking systems. Follow these steps:

- Log in to HDFC online banking or mobile app and go to the “International Remittance” page.

- Select the added Chase Bank beneficiary to view transfer records and status.

- After submitting the transfer, the system will display statuses like “Processing,” “Completed,” or “Failed.”

- You can also ask the recipient to check their Chase Bank account balance and incoming notifications in online banking.

- Transfers generally complete within 2-5 business days, but holidays or incorrect information may extend the time.

Verify all recipient information carefully before transferring to ensure the SWIFT code and account number are correct. This reduces delays and ensures faster fund arrival.

Precautions

Information Verification

When entering transfer details, carefully verify each item. The recipient’s name, bank account number, SWIFT code, and bank address must be accurate. Save a screenshot of the bank details provided by the recipient for easy reference. Before each transfer, double-check all details to avoid failures due to minor errors. Also, check if the transfer amount exceeds HDFC Bank’s limits. For large amounts, the bank may require additional documentation. Contact customer service in advance to understand the latest policies and simplify transfers.

Common Errors

Many users encounter common errors during international remittances, such as incorrect SWIFT codes or mismatches between the recipient’s name and bank account. Some users forget to upload required proof documents, leading to failed bank reviews. Pay special attention to these details during the process. The table below lists common errors and solutions:

| Common Error | Solution |

|---|---|

| Incorrect SWIFT code | Check official bank information and re-enter |

| Mismatched account name and recipient name | Contact the recipient to confirm details |

| Incomplete document uploads | Provide missing documents |

Handling Failures and Delays

If your transfer fails or is delayed, don’t panic. First, check the transfer status in HDFC online banking or the app. If the system shows “Processing” for too long, contact HDFC Bank customer service to inquire about the specific reason. If funds are returned, it’s usually due to incorrect information or intermediary bank issues. Update or correct the details based on bank prompts. You can also ask the recipient to contact Chase Bank to confirm incoming notifications. Prompt communication helps resolve issues quickly.

Security Tips

Protect your account information during international transfers. Avoid connecting to unsecured Wi-Fi in public places. Log out of online banking or the app after each operation. Change your password regularly to enhance account security. If you have questions, prioritize contacting bank customer service. Chase Bank offers Chinese-language customer service to help resolve international transfer issues. HDFC Bank currently has no clear Chinese customer service information. If you’re not fluent in English, ask the recipient to assist with communication. Monitor account changes closely and address any anomalies promptly to keep your funds safe and simplify transfers.

During the HDFC to Chase Bank international transfer process, following the steps simplifies transfers. Always verify recipient details and the SWIFT code to avoid delays due to errors. The main process is as follows:

- Log in to HDFC online banking and select international remittance.

- Enter detailed recipient information, ensuring accuracy.

- Input the amount, complete authentication, and confirm fees.

- Track the transfer status to ensure fund safety.

- HDFC and Chase Bank charge different fees, with transparent amounts and processing times.

- You can check progress anytime and contact bank customer service if issues arise.

- It’s recommended to fully utilize the bank’s Chinese customer service to enhance the transfer experience.

FAQ

What currencies can you use for transfers from HDFC to Chase Bank?

You can choose USD as the primary currency. HDFC supports multiple foreign currencies, but USD transfers are the fastest. Pay attention to daily exchange rate changes.

Will funds be returned if a transfer fails?

The bank will return funds to your HDFC account. Verify the information, correct errors, and reinitiate the transfer. The return process may take 3-7 business days.

Are there minimum or maximum amount limits for HDFC international transfers?

HDFC sets minimum and maximum remittance amounts. The minimum is generally USD 100, with the maximum depending on your account type and regulatory requirements. Contact bank customer service in advance.

Can you cancel a submitted international transfer?

You can try to cancel before the bank processes it. If already processed, cancellation is not possible. Contact HDFC customer service to understand the specific process.

How can you confirm receipt of funds at Chase Bank?

Ask the recipient to log in to Chase Bank’s online banking or app to check the account balance and incoming notifications. The bank will also send SMS or email alerts for fund arrivals.

Tired of high fees, long processing times, and hidden charges when sending money abroad? Traditional banks often require excessive paperwork and add intermediary costs. With BiyaPay, you get a smarter and more efficient way to transfer:

- Fees as low as 0.5%, significantly lower than banks

- Real-time FX rates and conversions, so you always know the exact amount

- Support for multiple fiat and crypto currencies, tailored to your needs

- Quick registration — start in just minutes

Whether it’s paying tuition, supporting family, or managing international transfers, BiyaPay helps you save money, gain speed, and ensure security.

Start your smarter transfers today with BiyaPay.

Bank transfers from HDFC to Chase can take 3–7 business days, cost $25–35 in fees plus Chase and intermediary deductions, and sometimes face delays if details aren’t perfect. For those who need a faster and more affordable way to send money internationally, BiyaPay offers a modern solution. With remittance fees as low as 0.5%, real-time exchange rates, and support for same-day delivery when requirements are met, BiyaPay helps you cut costs, save time, and reduce errors.

Instead of waiting days and worrying about hidden charges, switch to BiyaPay and experience secure, seamless transfers designed for the digital age.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.