- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A complete guide for international buyers investing in Dubai property

Image Source: unsplash

Foreigners can buy property in Dubai. You do not need residency or face age limits as a non-resident investor. The 2002 Freehold Law lets foreigners buying property in Dubai own land and buildings outright in over fifty areas. You gain full control, with the right to sell, lease, or pass your property to family. Dubai’s property market attracts investors from many countries.

Dubai’s real estate market stands out because foreigners account for a major share of transactions.

- Indian buyers hold 28% of deals.

- Mexican and Pakistani investors each make up 11%.

- Other nationalities, including UK and Canadian investors, add 6% each.

Buying property in Dubai offers strong property investment opportunities for foreigners, making it easy for you to join a thriving market.

Key Takeaways

- Foreigners can fully own property in Dubai’s freehold areas without residency or age limits, gaining rights to sell, lease, or inherit.

- Buying property involves a clear 10-step process, including choosing location, working with licensed agents, legal checks, and registering ownership.

- Freehold properties offer permanent ownership and more control than leasehold, which limits use to a set period without land ownership.

- Dubai’s property market offers high rental yields, tax advantages, and the chance to get a long-term residence visa through investment.

- Investors should research market risks, check developer reputations, confirm freehold status, and work with trusted professionals to protect their investment.

Foreign Ownership

Buying Property in Dubai as a Foreigner

You can buy property in Dubai as a foreigner with full legal rights in many areas. The 2002 Freehold Law gives you the ability to own land and buildings outright in designated freehold zones. This law changed the real estate market and made Dubai a top choice for foreign property buyers. You do not need to live in Dubai or meet any age restrictions to start buying property. You only need a valid passport to begin the process.

When buying property in Dubai as a foreigner, you follow a clear process:

- Check if you are eligible to buy property in Dubai. Foreigners can buy in specific freehold areas such as Palm Jumeirah and Dubai Marina.

- Choose your property. You can select from off-plan or ready properties. Consider the location and the reputation of the developer.

- Work with a licensed real estate agent registered with the Dubai Land Department (DLD).

- Complete due diligence. You should verify the title deed, check the developer’s credibility, and make sure there are no legal disputes.

- Sign the Memorandum of Understanding (MOU) and pay a deposit. The deposit is usually held in escrow for your protection.

- Secure financing if you need it. Mortgages are available to foreigners, but you must meet certain conditions.

- Obtain a No Objection Certificate (NOC) from the developer. This confirms there are no outstanding dues on the property.

- Transfer ownership at the DLD. You pay transfer fees and receive the title deed.

- Register your property with the DLD for full legal recognition.

- If you qualify, you can apply for a UAE residence visa based on your property investment.

Note: Foreigners can buy, sell, and rent property in Dubai without special permissions. The 2002 Freehold Law gives you the right to sell, lease, or pass your property to your heirs. You must buy from government-approved developers and register your ownership with the Dubai Land Department.

You have rights similar to citizens within these zones. You can sell, rent, or transfer your property to dependents or other people. Your beneficiaries can inherit your property if you pass away. Dubai does not charge personal income tax, capital gains tax, or traditional property tax on real estate investments. You should always work with experienced real estate agents and legal experts to avoid legal risks.

Freehold and Leasehold Zones

Dubai divides its real estate market into freehold and leasehold zones. As a foreigner, you can buy property in Dubai in designated freehold areas. These areas give you full ownership of the property and the land. You can sell, lease, or pass on your property as inheritance.

Key Freehold Areas for Apartments:

- Arjan

- Barsha Heights (Tecom)

- Bluewaters Island

- Business Bay

- Downtown Dubai

- Dubai Marina

- Jumeirah Beach Residence (JBR)

- Jumeirah Lake Towers (JLT)

Key Freehold Areas for Villas:

- Arabian Ranches

- Emirates Hills

- Jumeirah Islands

- Palm Jebel Ali

- The Lakes

- The Meadows

- The Springs

Freehold Areas for Both Apartments and Villas:

- Al Barari

- Al Furjan

- DAMAC Hills

- Dubai Hills Estate

- Dubai Silicon Oasis

- Jumeirah Village Circle (JVC)

- Mohammad Bin Rashid City (MBR City)

- Palm Jumeirah

- Sobha Hartland

You can also find leasehold zones in Dubai. In these areas, you do not own the land. Instead, you get the right to use the property for a set period, usually between 30 and 99 years. Leasehold zones include Green Community, Discovery Gardens, and some projects in Dubai Silicon Oasis. Leasehold ownership lets you occupy and use the property, but you cannot own the land itself.

Tip: Always confirm if the property you want is in a freehold or leasehold zone. Freehold gives you more control and flexibility as a foreign property buyer.

Buying property in Dubai as a foreigner gives you access to a wide range of options. You can choose from apartments, villas, or townhouses in some of the city’s most popular neighborhoods. Property ownership in Dubai offers strong legal protection and attractive investment opportunities for foreigners.

Eligibility & Requirements

Who Can Buy Property in Dubai

You can buy property in Dubai if you meet the eligibility criteria for foreigners. Dubai allows foreigners to own property in specific freehold zones. You do not need to live in Dubai or hold a residence visa. You only need a valid passport and must be at least 21 years old. Dubai’s property laws let you own 100% of freehold properties in approved areas. You can buy, sell, or lease your property in these zones.

Note: Foreigners cannot buy property everywhere in Dubai. The government restricts ownership to certain freehold areas. These include popular places like Dubai Marina, Downtown Dubai, and Business Bay.

Foreigners from any country can invest in Dubai real estate. You do not face nationality-based restrictions in these freehold zones. If you want to buy through a company, you must use approved company structures, such as a Jebel Ali Free Zone offshore company or a Dubai Multi Commodities Centre company. Funds or trusts cannot own property in Dubai.

Documents Needed

You must prepare several documents to meet the legal requirements to buy property in Dubai. The process is clear and secure. Here is what you need:

- Valid passport (for all buyers)

- Proof of age (you must be at least 21 years old)

- Signed Memorandum of Understanding (MOU) with a 10% deposit

- No Objection Certificate (NOC) from the developer

- Completed property registration with the Dubai Land Department

If you apply for a mortgage, you also need:

- Pay certificates

- Recent bank statements

- Proof of residency, such as a DEWA bill or rental agreement

You do not need a residence visa to buy property in Dubai. Residents must show their visa and Emirates ID.

To check if your property documents are real, you can use the Dubai Land Department’s digital system. Follow these steps:

- Download the Dubai REST app or visit the DLD website.

- Use the title deed verification service.

- Enter the title deed number, year, and property type or scan the QR code.

- Submit the details to get instant results.

This system helps you avoid fraud and ensures your property ownership in Dubai is safe.

Types of Properties

Freehold vs Leasehold

When you look at the types of properties foreigners can buy in Dubai, you will see two main options: freehold and leasehold. Freehold properties give you full ownership of both the land and the building. You can sell, lease, or pass your property to your heirs without restrictions. Leasehold properties allow you to use the property for a set period, usually up to 99 years, but you do not own the land. After the lease ends, the property returns to the freeholder unless you renew the lease.

Here is a table to help you compare freehold and leasehold properties in Dubai:

| Aspect | Freehold | Leasehold |

|---|---|---|

| Ownership Duration | Permanent ownership of land and property | Limited to lease term (up to 99 years) |

| Control & Modifications | Unrestricted control; you can modify and use freely | Restricted; need freeholder approval for changes |

| Costs & Fees | Pay maintenance costs only | Pay ground rent, service charges, and possible extension fees |

| Resale & Mortgage | Easier resale and mortgage approval | Value declines as lease shortens; mortgage approval is harder |

| Inheritance Rights | Yes, property can be passed to heirs | Generally no, unless lease terms specify |

| Visa Eligibility | Can qualify for UAE residence visa | Usually not eligible |

You will find that freehold properties offer more security and flexibility. Leasehold properties may have lower upfront costs, but they come with more rules and less long-term value.

Tip: Always check if the property is freehold or leasehold before you buy. Freehold gives you more control and better investment potential in Dubai.

Off-Plan and Ready Properties

Dubai offers two main types of properties foreigners can buy: off-plan and ready properties. Off-plan properties are those you purchase before the building is finished. Ready properties are completed homes or apartments that you can move into right away.

According to 2024 market insights, off-plan sales make up 63% of all property transactions in Dubai. Ready properties account for the remaining 37%. This shows that most buyers in Dubai choose off-plan options.

Here are the main benefits and risks of buying off-plan properties in Dubai:

-

Benefits:

- You get access to a wider selection of units early.

- Prices are often lower than ready properties.

- You may see your property value rise as the project nears completion.

- Developers offer flexible payment plans.

- You can sometimes resell before the project is finished.

- New buildings often include modern features and amenities.

-

Risks:

- Construction delays can happen.

- Some developers may face financial problems.

- Property values can change before completion.

- You invest in something not yet built, which adds uncertainty.

You can reduce risks by checking the developer’s reputation, making sure the project is registered with RERA, and working with trusted agents. Ready properties in Dubai give you immediate use and less risk, but off-plan options can offer better prices and more choices.

How to Buy Property in Dubai

Step-by-Step Buying Process

If you want to buy property in Dubai, you need to follow a clear process. This step-by-step guide to buy property helps you avoid mistakes and protects your investment. Here is how to buy property in Dubai as a foreigner:

- Choose the Right Location

Start by picking an area that matches your lifestyle and investment goals. Look at amenities, schools, transport, and future growth. - Set Your Budget

Decide how much you can spend. Include extra costs like agent fees, transfer charges, and maintenance. If you need a mortgage, check if you qualify as a foreigner. - Find a Trusted Agent

Work with a RERA-licensed real estate agent who knows your chosen area. Agents help you find good deals and guide you through the process. - Shortlist and Inspect Properties

Visit different properties. Check the building quality, facilities, and neighborhood. - Make an Offer and Sign the MoU

Negotiate the price. Once you agree, sign a Memorandum of Understanding (MoU) and pay a deposit, usually 10% of the price. - Do Legal Checks

Hire a legal advisor if needed. Review all documents, check the title deed, and make sure there are no unpaid dues. - Get a No Objection Certificate (NOC)

Apply for an NOC from the developer. This confirms there are no outstanding payments on the property. - Transfer Ownership at the Dubai Land Department

Both you and the seller go to the Dubai Land Department. Pay the transfer fee (4% of the property value in USD) and admin fees. Sign the final agreement. - Receive the Title Deed

After payment, you get the title deed in your name. Now you legally own the property. - Register Utilities and Move In

Set up water and electricity with DEWA. You can now move in or rent out your property.

This step-by-step guide to buy property makes buying property in Dubai simple for foreigners. You can also use this process if you are a non-resident investor.

Tip: Always keep copies of all documents and receipts during the process.

Working with Agents and Developers

When you buy property in Dubai, you will work with real estate agents and developers. Foreigners should always choose agents registered with the Dubai Land Department. These agents know the rules and can help you avoid scams.

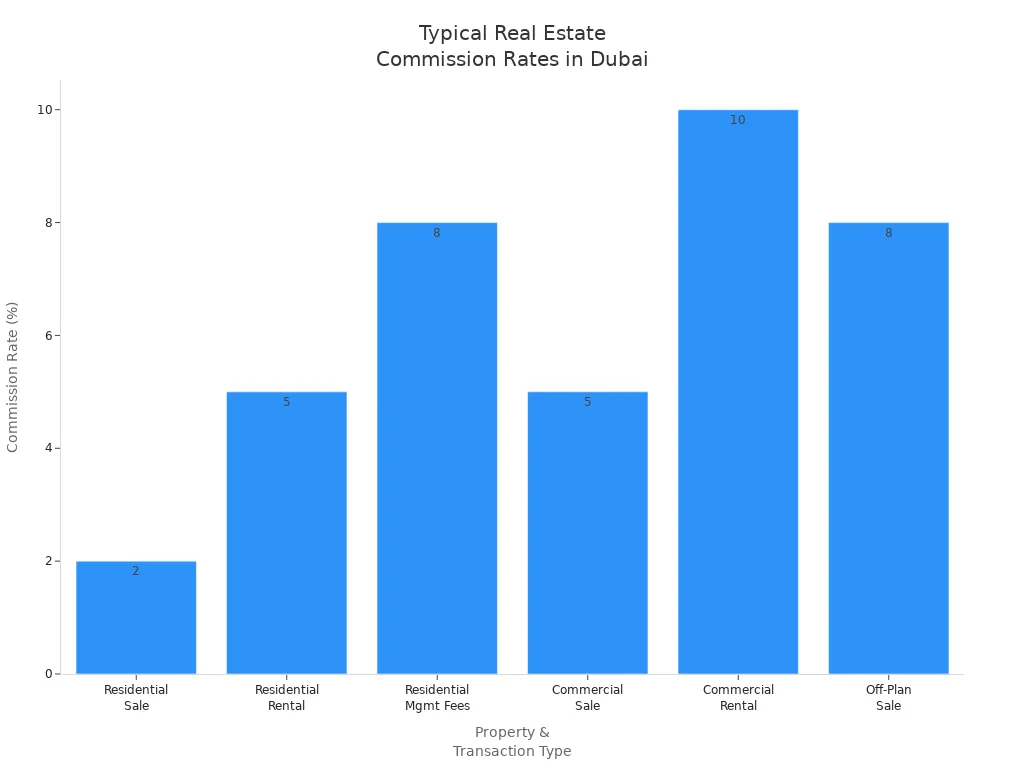

Here is a table showing typical commission rates and service fees:

| Property Type | Transaction Type | Typical Commission Rate | VAT Application | Payer of Commission |

|---|---|---|---|---|

| Residential Sale | Sale | ~2% of sale value + 5% VAT | VAT applies on sales | Buyer or seller as per contract |

| Residential Rental | Rental | 5% of annual rent (tenant pays) | No VAT on rental commissions | Tenant pays commission |

| Residential Rental | Management Fees | 0% to 8% (landlord pays depending on services) | No VAT on rental commissions | Landlord pays if management services used |

| Commercial Sale | Sale | 2% to 5% of purchase price | VAT applies on sales | Buyer or seller as per contract |

| Commercial Rental | Rental | 5% to 10% of annual rent (tenant pays) | No VAT on rental commissions | Tenant pays commission |

| Off-Plan Properties | Sale | 2% to 8% | VAT applies on sales | Buyer or seller as per contract |

Note: Agents only receive their commission after the contract is registered with the Dubai Land Department. If more than one agent is involved, they share the commission as agreed.

Developers in Dubai often offer off-plan properties. If you buy from a developer, check their reputation and make sure the project is registered with RERA. Developers may offer flexible payment plans, but always read the contract carefully.

Legal and Financial Steps

Legal and financial considerations for foreign property buyers are very important. You must follow the law to protect your rights and money. Here are the main steps:

- Due Diligence

Check that the seller owns the property. Review the title deed and make sure there are no unpaid bills or legal issues. - Sale Contract

Sign a sale contract or term sheet. This document lists the price, payment terms, and other details. Make sure it follows Dubai’s Civil Code. - No Objection Certificate (NOC)

Visit the developer’s office with the seller. Submit the needed documents and pay the NOC fee (usually between USD 135 and USD 1,350, based on exchange rates). - Transfer and Registration

Go to the Dubai Land Department’s Real Estate Registration Trustee Office. Pay the transfer fee (4% of the property value in USD), admin fees (USD 540 to USD 1,080), and trustee office fees. Sign the final transfer agreement. - Receive the Title Deed

After all payments, you get the new title deed in your name. Now you are the legal owner. - Mortgage Registration

If you use a mortgage, pay the registration fee (0.25% of the loan amount in USD). Some banks, such as those in Hong Kong, offer mortgage services to foreigners.

Note: All payments should go into escrow accounts. This protects both you and the seller.

Foreigners face some challenges when buying property in Dubai. You may need to pay a higher down payment because banks see non-resident investors as higher risk. Fewer banks offer loans to foreigners, so you have limited choices. You must show strong proof of income and a good credit history. Mortgage terms can be complex, with different interest rates and early repayment charges. Currency exchange rates can also affect your payments.

- Tips for Foreigners:

- Build a strong financial profile with stable income.

- Use mortgage brokers who know the Dubai market.

- Consider private lenders or developer financing if banks do not approve your loan.

- Watch for currency exchange risks, as they can change your monthly payments.

Understanding these legal and financial considerations for foreign property buyers helps you avoid problems and makes buying property in Dubai safer.

Costs and Taxes

Image Source: unsplash

Purchase Price and Fees

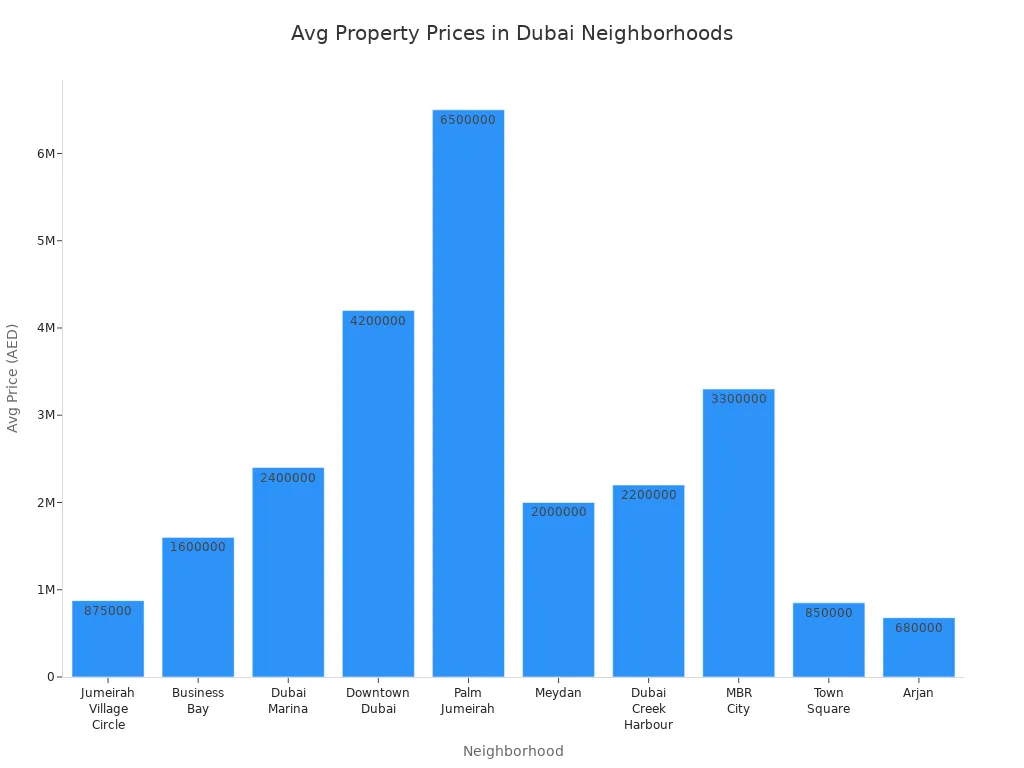

When you buy property in Dubai, you need to understand the average cost of real estate in dubai. Prices depend on the neighborhood, property type, and size. Here is a table showing average prices in popular areas, converted to USD using the latest exchange rates:

| Neighborhood | Property Type | Average Price (USD) |

|---|---|---|

| Jumeirah Village Circle | Studio | $238,000 |

| Business Bay | 1 Bedroom | $435,000 |

| Dubai Marina | 2 Bedroom | $653,000 |

| Downtown Dubai | 3 Bedroom | $1,143,000 |

| Palm Jumeirah | 3 Bedroom | $1,770,000 |

| Meydan | 2 Bedroom | $545,000 |

| Dubai Creek Harbour | 2 Bedroom | $600,000 |

| MBR City | 3 Bedroom | $900,000 |

| Town Square | 1 Bedroom | $230,000 |

| Arjan | Studio | $180,000 |

You can find entry-level studios in Dubai’s International City for about $64,000. Jumeirah Village Circle offers 1-bedroom apartments from $190,000 to $258,000. Downtown Dubai and Palm Jumeirah have higher prices due to luxury amenities and prime locations.

Transfer and Registration Charges

Dubai property transactions include several mandatory fees. You must pay these charges to complete your purchase. The table below lists the main fees in USD (using current exchange rates):

| Fee Type | Amount / Rate | Notes |

|---|---|---|

| Property Transfer Fee | 4% of property value | Usually paid by buyer, sometimes split with seller |

| Property Registration Fee | $545 if property < $136,000 | $1,090 if property ≥ $136,000 |

| Title Deed Fee | $68 | Fixed fee for title deed |

| Administrative Fees | $22 for flats/offices | $117 for land plots; $11 for off-plan properties |

| Mortgage Registration Fee | 0.25% of mortgage amount + $79 | Applies if you use a mortgage |

Note: Transfers between close relatives have reduced fees. Off-plan properties require an extra $820 for the Oqood certificate.

Ongoing Costs

Owning property in Dubai means you must pay annual service charges and maintenance fees. These costs cover security, cleaning, landscaping, and facility upkeep. You pay these fees even if your property is empty. Service charges are regulated by RERA and calculated per square foot. Rates range from $0.82 to $8.20 per square foot per month, depending on location and property type. Apartments in premium areas like Downtown Dubai or Palm Jumeirah have higher charges, sometimes over $16 per square foot each year.

- Service charges cover maintenance of common areas, utilities, and security.

- You must pay these fees through approved online platforms.

- Non-payment can lead to penalties or restricted access to amenities.

- The Dubai Land Department provides a calculator to help you estimate annual costs.

- Annual budgets for service charges are audited and approved by RERA.

You should always check service charges before buying. Understanding these ongoing costs helps you plan your budget and protect your investment in Dubai.

Best Places to Buy Property in Dubai

Image Source: unsplash

If you want to find the best places to buy property in dubai, you have many strong options. Each area offers unique benefits for investors and residents. Here are five top areas to buy property in dubai that stand out for their growth, rental yields, and lifestyle.

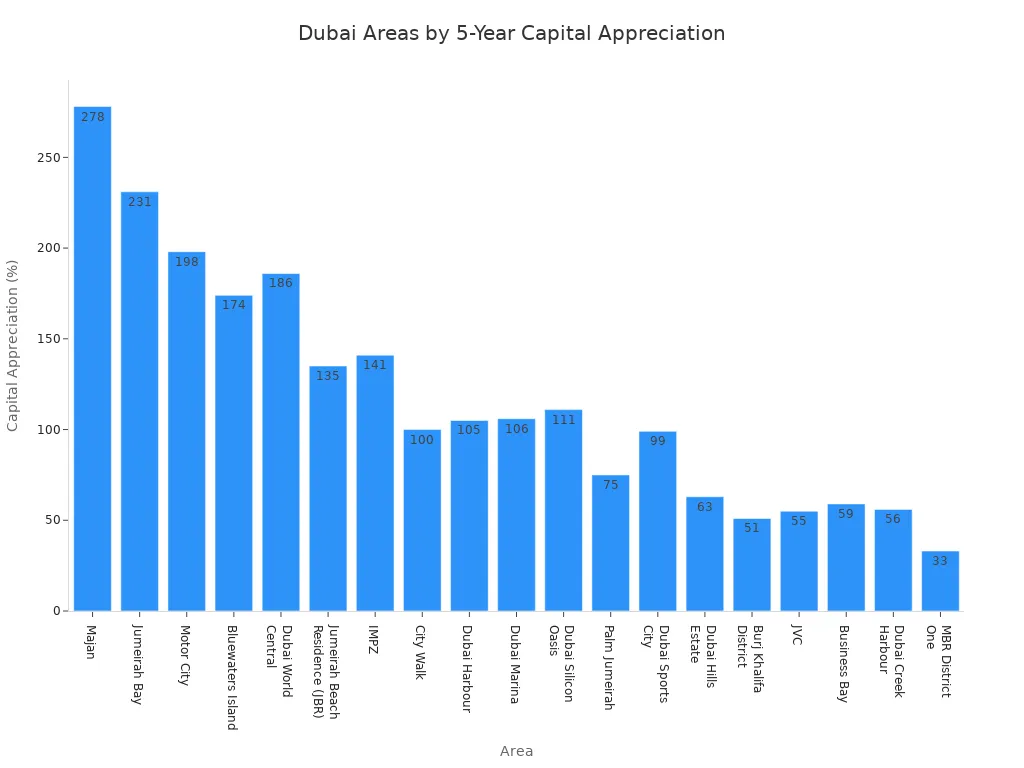

Downtown Dubai

Downtown Dubai sits at the heart of the city. You see famous landmarks like the Burj Khalifa and Dubai Mall here. This area has shown a 20% price increase recently, making it one of the best places to buy property in dubai for capital appreciation. The average price per square foot is about $772 (2,836 AED), and prices have grown nearly 20% over the past decade. Rental yields in Downtown Dubai are lower than some other areas, but you get strong long-term value. Many investors choose this area for its luxury apartments and steady demand.

| Area | 2014 Price (USD/sqft) | 2025 Price (USD/sqft) | Total Appreciation |

|---|---|---|---|

| Downtown Dubai | $646 | $772 | 19.6% |

Note: Downtown Dubai offers a mix of luxury and traditional homes, with a respectable ROI of 5.2%. You get a prime location and strong capital growth.

Dubai Marina

Dubai Marina is one of the most popular areas for both investors and renters. You find high-rise towers, waterfront views, and easy access to shops and restaurants. This area has seen a 106% capital appreciation over five years. Rental yields range from 5% to 7%, with one-bedroom apartments often giving the best returns. Dubai Marina remains a top choice for those looking for the best places to buy property in dubai due to its strong demand and lifestyle appeal.

Dubai Marina stands out for its scenic marina, limited new construction, and high rental demand. You can expect a relatively low-risk investment with an ROI around 6%.

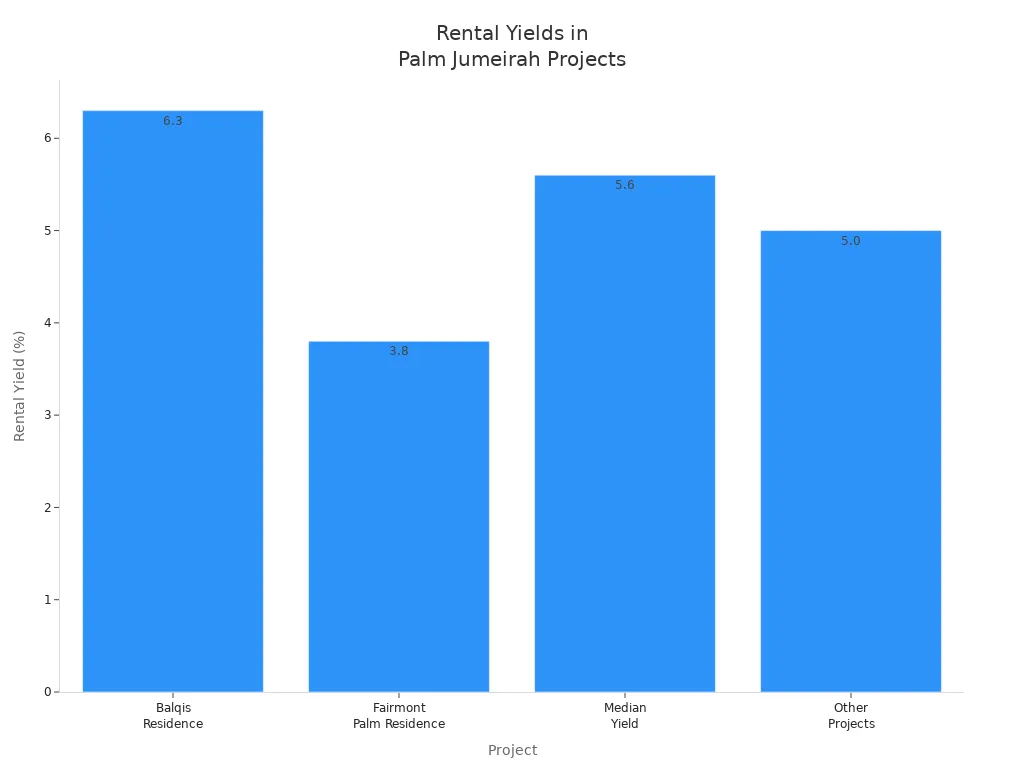

Palm Jumeirah

Palm Jumeirah is an iconic man-made island known for luxury villas and apartments. Property prices here have increased by 30% recently, and the area has a five-year capital appreciation of 75%. Rental yields range from 3.8% to 6.3%, with a median of 5.6%. Studios and smaller apartments often have the highest rent per square foot. Palm Jumeirah attracts buyers who want exclusivity and strong appreciation potential.

Tip: Palm Jumeirah offers branded residences, resorts, and some of the highest price points in Dubai, making it a top area for luxury investment.

Jumeirah Village Circle

Jumeirah Village Circle (JVC) is one of the fastest-growing areas in Dubai. You find affordable apartments and villas, making it attractive for first-time buyers and investors. The average price per square foot is about $341 (1,253 AED) for apartments. Rental yields reach up to 7.66%, among the highest in Dubai. Prices have risen by 55% over five years, and rental rates have jumped 7% to 16% recently. JVC’s high transaction volume and accessibility make it one of the best places to buy property in dubai for value and growth.

| Property Type | Average Price (USD) | Rental Yield (%) |

|---|---|---|

| General Properties | $218,000 | ~7.4 |

| Villas & Townhouses | $654,000+ | 7.34 – 8.38 |

Business Bay

Business Bay sits next to Downtown Dubai and offers a mix of residential and commercial towers. This area has seen a 59% capital appreciation over five years. Rental yields for apartments range from 6% to 8%, while villas offer 4.5% to 7%. Business Bay’s strategic location and modern lifestyle attract both investors and professionals. You get easy access to major business hubs and transport links.

| Community Type | Rental Yield Range (%) |

|---|---|

| Apartments (average) | 6 – 8 |

| Villas (average) | 4.5 – 7 |

Business Bay is one of the top areas to buy property in dubai for those seeking high yields and strong growth near the city center.

You can see that the best places to buy property in dubai offer a mix of high capital appreciation, strong rental yields, and vibrant lifestyles. These areas continue to attract investors from around the world.

Benefits of Buying Property

High Rental Yields

You will find that one of the main benefits of buying property in Dubai is the high rental yield. Rental yields in Dubai usually range from 6% to 8%. In some prime areas, yields can reach up to 10%. This is much higher than what you see in other global cities. For example, London, New York, Singapore, and Hong Kong often offer yields between 2% and 4%. The strong demand from a growing expatriate population and a favorable regulatory environment help keep yields high. You also benefit from lower acquisition and holding costs. These factors make property investment in Dubai attractive for investors who want steady rental income.

| City | Average Rental Yield (%) |

|---|---|

| Dubai | 6 to 10 (some areas up to 10%) |

| London | 2.5 to 4 |

| New York | 2.9 to 3.5 |

| Hong Kong | 2 to 3 |

| Singapore | 2 to 3.8 |

Tax Advantages

You enjoy several tax advantages when you invest in Dubai real estate. Dubai does not charge personal income tax on rental income or profits from property sales. You do not pay capital gains tax or annual property tax. This means you keep more of your earnings compared to investors in other countries. You only pay a one-time 4% property transfer fee to the Dubai Land Department, usually split between buyer and seller. Other fees include administrative charges, agent commissions, and a 0.25% mortgage registration fee if you use a loan. Residential properties are exempt from VAT. Dubai also has agreements with over 100 countries to prevent double taxation. There is no withholding tax on income or money you send abroad. These benefits of buying property in Dubai create a tax-efficient environment for investors.

- No personal income tax on rental income

- No capital gains tax on property sales

- No annual property tax

- One-time 4% property transfer fee

- No VAT on residential properties

- No withholding tax on repatriated funds

Residency and Investor Visas

Dubai offers you the chance to gain residency through property investment. If you invest at least 2 million AED (about $545,000 USD at current exchange rates) in real estate, you can apply for a 10-year Golden Visa. This visa lets you sponsor your spouse, children, parents, and up to three domestic workers. You do not need to stay in Dubai for a minimum period to keep your visa. The application process is simple and can be done online. You must visit Dubai for the residency procedures. The visa gives you the right to live, work, and invest in Dubai. You also enjoy security and flexibility, making it easier to manage your property investment. These benefits of buying property attract many investors who want long-term stability.

Risks and Pitfalls

Market Volatility

You should know that Dubai’s property market has seen big changes in prices over the years. In the past, property prices in some areas dropped sharply, especially during the 2008 recession. Many residents left, and prices collapsed. The city’s focus on real estate and energy made it sensitive to economic changes. Oversupply in some areas led to low occupancy rates, sometimes as low as 30-40%. This caused prices to stay low compared to other regions.

Recent years have brought more stability. The table below shows how price volatility has changed:

| Period | Volatility (Standard Deviation of Price Changes) |

|---|---|

| 2005-2011 | 38.30% |

| 2012-2018 | 22.11% |

| 2019-2024 | 23.27% |

You can see that volatility has dropped, but it still exists. Population growth now links more closely to property prices, with a moderate positive correlation. Government reforms and new visa programs have helped, but Dubai’s market remains sensitive to global events. You should always research the history of price changes in different areas before you invest.

Legal and Contractual Issues

When you buy property in Dubai, you face several legal and contractual risks. Many buyers in different areas run into problems because they do not check all the details. Here are some common issues:

- Developers have rights if you miss payments, including canceling your contract.

- You must check the exact size of your property to avoid disputes.

- Always verify the developer’s credentials and make sure your property is registered.

- Written contracts matter more than verbal promises.

- You need to understand the difference between freehold and leasehold rights in various areas.

- Title deeds and ownership structures must be clear.

- Dispute resolution clauses in contracts protect you if problems arise.

- Due diligence on the developer’s reputation and project status is important.

- You must follow rules for escrow accounts and know all fees and taxes.

You should work with legal experts who know Dubai’s property laws. This helps you avoid costly mistakes in all areas of the city.

Off-Plan Delays

Off-plan properties in Dubai can offer good deals, but you must watch for delays. Many buyers in different areas have faced late handovers. Delays happen for several reasons:

- Construction problems, such as labor shortages or supply issues

- Permit and approval delays

- Developers facing funding problems

- Changes in project plans

- Poor project management

Dubai’s rapid growth puts pressure on resources in many areas. Regulatory changes and economic shifts can also slow projects. Lack of clear updates from developers adds to the problem. If you face a delay, you can talk to the developer, ask for compensation, or take legal action. The Dubai Land Department and RERA oversee developers to reduce these risks. Always check the developer’s track record in different areas before you buy off-plan.

You can buy property in Dubai with a clear process. Investors need a valid passport and must choose from approved freehold zones. Many investors see high rental yields and tax advantages. Risks like market changes and off-plan delays exist, so investors should research each area. Smart investors check all documents, confirm freehold status, and work with trusted agents.

Tip: Investors should always consult legal and real estate professionals before making decisions.

FAQ

Can you buy property in Dubai without living there?

Yes, you can buy property in Dubai even if you do not live there. You only need a valid passport. You do not need a residence visa or local address.

What is the minimum investment for a Dubai property visa?

You must invest at least 2 million AED (about $545,000 USD at current exchange rates) in real estate to apply for a 10-year Golden Visa. This visa lets you live and work in Dubai.

Are there annual property taxes in Dubai?

Dubai does not charge annual property taxes. You pay a one-time 4% transfer fee when you buy. You also pay yearly service charges for maintenance. These costs depend on your property size and location.

Can you get a mortgage as a foreigner in Dubai?

Yes, you can get a mortgage as a foreigner. Most banks require a higher down payment from non-residents. Here is a quick comparison:

| Buyer Type | Minimum Down Payment (%) |

|---|---|

| Resident | 20 |

| Non-Resident | 25–35 |

Investing in Dubai real estate can be highly rewarding, but many international buyers face hidden challenges when transferring funds across borders—high remittance fees, opaque currency conversion, and settlement delays that risk disrupting property deals. With BiyaPay, you gain full control of your cross-border transactions. Our platform offers real-time exchange rates, ultra-low transfer fees starting at just 0.5%, and seamless conversion between multiple fiat and digital currencies. Most importantly, your funds can arrive the same day, ensuring smooth property purchases or rental investments.

Start your investment journey with a trusted global payment partner. Register now with BiyaPay to simplify your international transactions and secure your Dubai property with confidence.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.