- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Guide to the Top Credit Union Business Accounts This Year

Image Source: pexels

If you want small business banking that puts you first, a credit union business account stands out this year. Many credit unions operate as member-owned cooperatives, so you get lower fees, better rates, and no monthly service fees. You also receive personalized service and access to financial advice. According to recent rankings, the best credit unions for business banking include Alliant, Consumers, Digital Federal, and Navy Federal. They offer strong APY, flexible options, and top-rated support. You can find the right fit whether you need a business bank account or want to grow your business.

Key Takeaways

- Credit union business accounts often have lower fees and better interest rates than traditional banks, helping you save money.

- Many credit unions offer no monthly service fees, easy online banking, and personalized support tailored to small businesses.

- Check membership rules and required documents before applying to ensure you qualify and prepare your paperwork.

- Compare account features like APY, fees, and transaction limits to find the best fit for your business needs.

- Switching to a credit union can give you better service, local support, and tools to help your business grow.

Best Credit Unions for Business Accounts

Image Source: unsplash

When you look for the best business checking accounts, you want options that fit your needs and help your business grow. The best credit unions for business accounts stand out because they offer no monthly service fees, strong digital tools, and personalized support. Let’s walk through each top pick so you can see which credit union business account matches your goals.

Navy Federal Credit Union

If you have a connection to the military, Navy Federal Credit Union gives you a strong business banking experience. You get no monthly service fees on basic business checking accounts, and you can open an account with as little as $250. Navy Federal allows up to two signers on standard accounts and offers 24/7 access to your funds. You can make 30 non-electronic transactions for free each month, and after that, you pay $0.25 per transaction. Their APY ranges from 0.01% on basic checking to 0.45% on premium accounts. Navy Federal also supports veteran-owned businesses and provides access to small business professionals for advice.

| Feature | Details |

|---|---|

| Monthly Service Fee | None (Basic Checking) |

| Number of Signers Allowed | Up to 2 |

| Transactions Included | 30 free non-electronic; $0.25 each after |

| APY Range | 0.01% - 0.45% |

| Minimum Opening Deposit | $250 (sole proprietorship), $255 (other entities) |

| Overdraft Protection | Available |

| Digital Banking | Yes, 24/7 access |

| Unique Benefit | Focus on military and veteran-owned businesses |

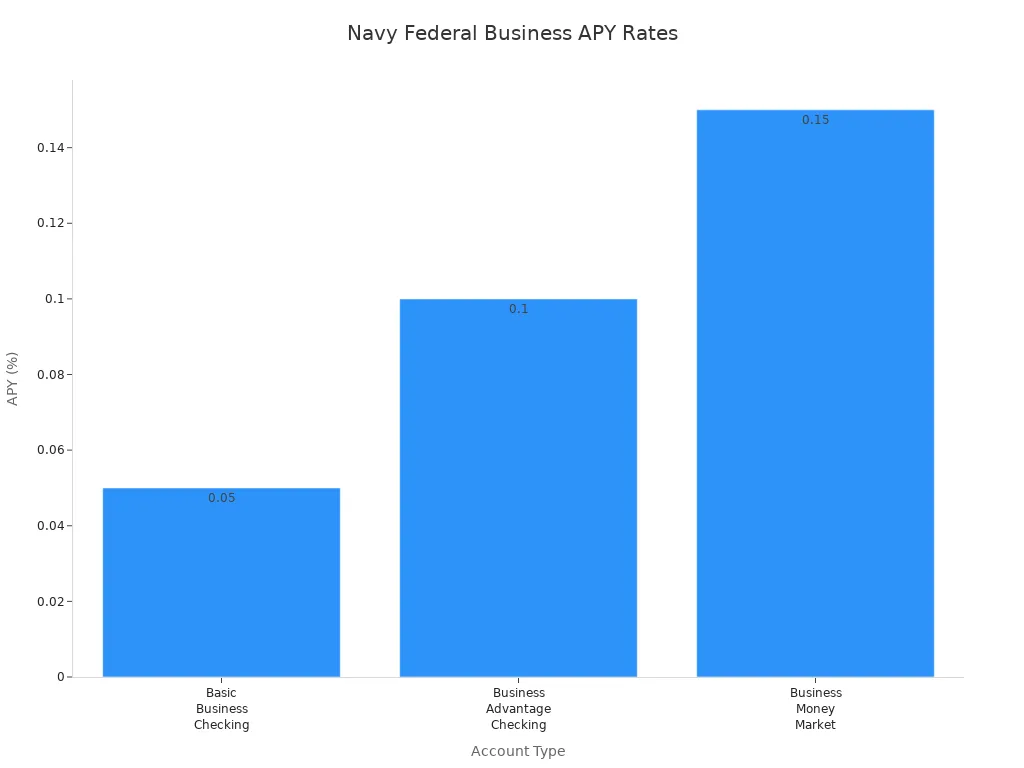

You can see how Navy Federal’s APY rates compare across account types in the chart below:

Consumers Credit Union

Consumers Credit Union is a top choice if you want high APY and no monthly service fees. You can open a business checking account with no minimum balance, and you may earn up to 4.09% APY on checking—one of the highest rates among the best business checking accounts. Consumers Credit Union also offers business savings, money market accounts, CDs, and a full suite of payment and lending services. You get access to online banking, payroll, merchant services, and educational resources. Membership is open nationwide with a $5 fee.

| Category | Unique Benefits for Business Account Holders at Consumers Credit Union |

|---|---|

| Business Banking | Business checking, savings, money market accounts, CDs |

| Payment Services | Payroll/payment services, merchant services |

| Lending Options | SBA loans, commercial real estate mortgages, equipment and vehicle loans, business line of credit, credit cards |

| Investment Services | Investment options for businesses and employees |

| Educational Support | Seminars, speakers, and business banking educational resources |

| Online Services | Online business banking platform |

| Community Benefits | Community care initiatives and member perks |

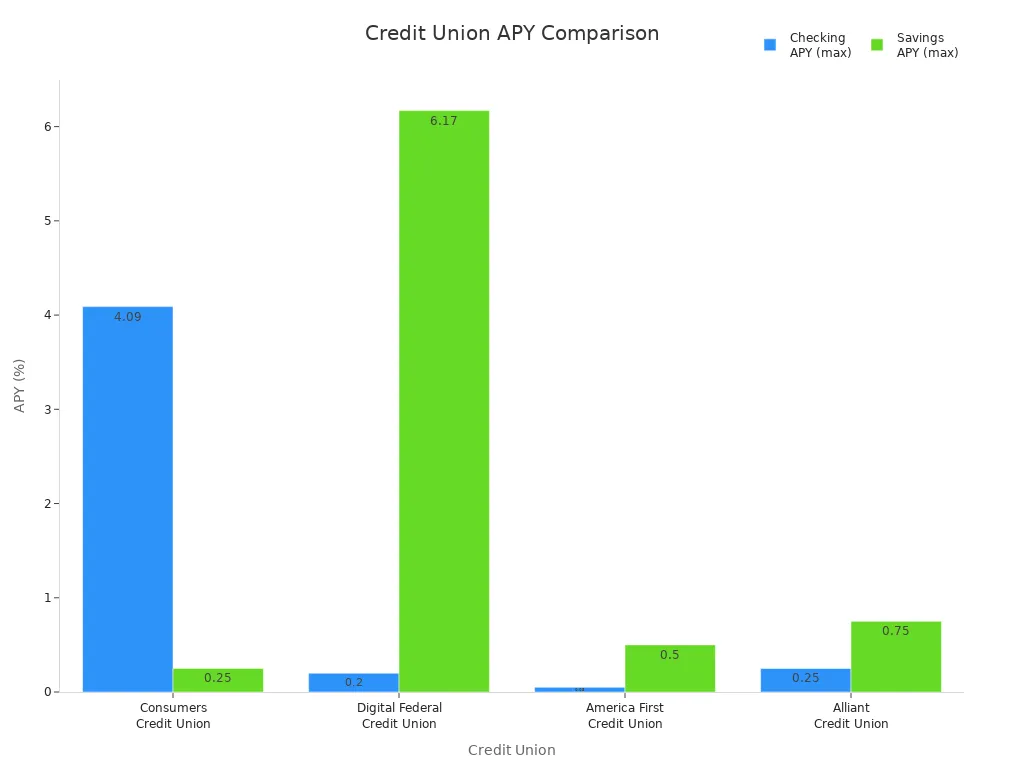

You can compare APY rates for checking and savings at top credit unions here:

Digital Federal Credit Union

Digital Federal Credit Union (DCU) gives you a simple, fee-free experience. You can open a business checking account with no minimum deposit and pay no monthly fees. DCU lets you earn interest starting at just one cent in your account. You get 20 free deposits per day, and each extra deposit costs $0.10. DCU allows up to four debit cards per account and offers unlimited free check writing. You can also access business savings, trust accounts, and business credit cards.

| Feature | Details |

|---|---|

| Minimum to Open | $0.00 |

| Monthly Fee | $0.00 |

| Minimum Balance to Earn Interest | $0.01 |

| Free Deposits per Day | 20 |

| Fee per Deposit Over Limit | $0.10 per item |

| Check Writing Fees | Unlimited, no fees |

| Debit Cards | Up to 4 per account |

America First Credit Union

America First Credit Union is a strong pick if you want a business checking account with a competitive APY. Their Premier Business Checking offers 1.18% APY, which is higher than many other credit unions. You pay $8 per month for maintenance, but you get low per-item fees—$0.15 per deposit and $0.15 per written check. America First also gives you earnings credits based on your balance, which can help offset fees. This account works well for businesses with high transaction volumes.

| Feature | Details |

|---|---|

| Account Name | Premier Business Checking |

| Current APY | 1.18% |

| Fee per Deposit | $0.15 |

| Fee per Written Check | $0.15 |

| Monthly Maintenance Fee | $8 |

| Fee Offset | Earnings credits |

Alliant Credit Union

Alliant Credit Union focuses on personal banking, so you won’t find dedicated business checking accounts here. However, you can use their digital banking tools, high-rate savings, and checking products for your business if you operate as a sole proprietor. Alliant offers online banking, mobile apps, and access to over 80,000 fee-free ATMs. Their checking account pays 0.25% APY and has no monthly service fees.

| Product Type | Details |

|---|---|

| Savings Accounts | High-Rate Savings (3.10% APY), other savings options |

| Checking Accounts | High-Rate Checking (0.25% APY), no minimum balance |

| Certificates (CDs) | 3.10%-4.10% APY, 3 months to 5 years |

| Credit Cards | Cashback Signature Credit Card |

Redwood Credit Union

Redwood Credit Union is a great choice for California small businesses. You can open business checking accounts if your business operates in select California counties. Redwood offers Business Essential, Business Choice, and Business Analysis Checking, plus money market and savings options. You get no monthly maintenance or transaction fees on many accounts, and you can access over 30,000 ATMs nationwide. Redwood also provides business sweeps, remote deposit capture, and accounting software integration. Non-profits may qualify for fee waivers.

- Business must operate in specific California counties.

- Multiple account types: Essential, Choice, Analysis Checking.

- No monthly maintenance or transaction fees on many accounts.

- Tiered APY rates on money market accounts.

- Business services: merchant services, SBA loans, credit cards.

San Francisco Federal Credit Union

San Francisco Federal Credit Union supports local businesses with a range of business checking accounts, savings, and money market options. You can get a Business Platinum Visa credit card, ATM surcharge rebates, and free overdraft protection. SFFCU offers immediate crediting of deposited checks and strong fraud protection. You also get access to financial counseling, online and mobile banking, and commercial lending. Their focus on community-driven support makes them a favorite for small businesses in the Bay Area.

- Business checking accounts for Corporations, LLCs, and Sole Proprietorships.

- Business savings and money market accounts.

- Business credit cards with rewards and overdraft protection.

- ATM surcharge rebates and immediate check deposit crediting.

- Personalized service and community support.

SAFE Credit Union

SAFE Credit Union gives you a full suite of business banking tools. You can open business checking accounts, savings, money market, and certificates. SAFE offers merchant services, remote deposit, and SEP plans for employee retirement. Their digital tools include online and mobile banking, card controls, alerts, bill pay, and digital wallet integration. You also get access to financial guides, calculators, and webinars to help your business thrive.

- Business checking, savings, money market, and certificates.

- Merchant services and remote deposit.

- Online and mobile banking with 24/7 access.

- Card controls and fraud protection.

- Financial wellness resources.

Los Angeles Federal Credit Union

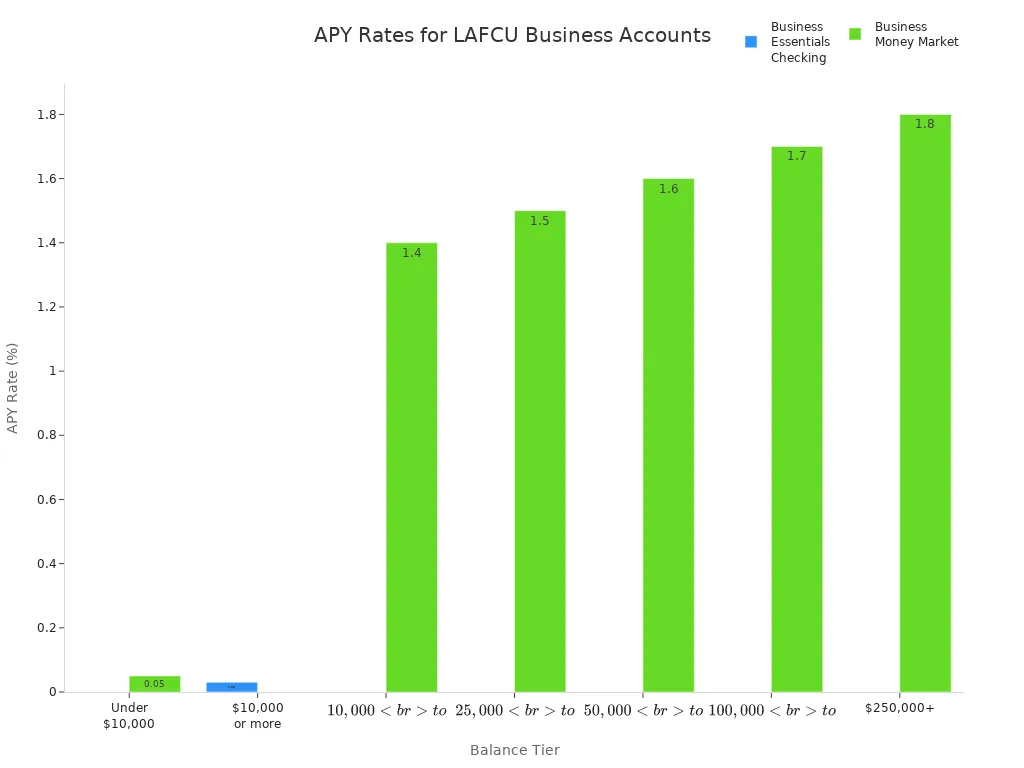

Los Angeles Federal Credit Union serves businesses in Southern California. You can open business checking accounts for many business types, including sole proprietorships, LLCs, and corporations. LAFCU requires standard business documents and limits accounts with high transaction volumes. Their Premier Checking account pays up to 0.10% APY for balances over $10,000, but you pay a $25 monthly fee. Their Business Money Market account offers tiered APY rates up to 1.80% for large balances.

| Account Type | Balance Tier | APY Rate | Monthly Fee |

|---|---|---|---|

| Premier Checking | $0 - $2,499.99 | 0.00% | $25.00 |

| Premier Checking | $2,500 - $9,999.99 | 0.05% | $25.00 |

| Premier Checking | $10,000 and above | 0.10% | $25.00 |

| Account Type | Balance Tier | APY Rate |

|---|---|---|

| Business Essentials Checking | Under $10,000 | 0.00% |

| Business Essentials Checking | $10,000 or more | 0.03% |

| Business Money Market | Under $10,000 | 0.05% |

| Business Money Market | $10,000 to $24,999 | 1.40% |

| Business Money Market | $25,000 to $49,999 | 1.50% |

| Business Money Market | $50,000 to $99,999 | 1.60% |

| Business Money Market | $100,000 to $249,999 | 1.70% |

| Business Money Market | $250,000+ | 1.80% |

You can see how APY rates increase with higher balances in the chart below:

Here’s a quick comparison table to help you see the differences at a glance:

| Credit Union | Monthly Fees | APY (Checking) | APY (Savings/MM) | Minimum to Open | Unique Benefits |

|---|---|---|---|---|---|

| Navy Federal | $0–$20 | 0.01%–0.45% | 0.01%–0.15% | $250–$255 | Military focus, 24/7 access, business support |

| Consumers Credit Union | $0 | Up to 4.09% | 0.03%–0.25% | $0 | High APY, nationwide, full business services |

| Digital Federal Credit Union | $0 | Up to 0.20% | 0.16%–6.17% | $0 | No fees, 20 free deposits/day, unlimited checks |

| America First Credit Union | $0–$8 | 0.05%–1.18% | 0.05%–0.50% | $0–$1 | Earnings credits, high APY for checking |

| Alliant Credit Union | $0 | 0.25% | 0.75% | Not specified | Digital tools, high-rate personal accounts |

| Redwood Credit Union | $0–$3 | Not specified | Tiered, up to 1.80% | $100 | CA focus, no fees, business services, QuickBooks |

| San Francisco Federal CU | Not specified | Not specified | Not specified | Not specified | Community focus, ATM rebates, instant deposits |

| SAFE Credit Union | Not specified | Not specified | Not specified | Not specified | Digital tools, merchant services, wellness |

| Los Angeles Federal CU | $0–$25 | 0.00%–0.10% | 0.05%–1.80% | Not specified | Tiered APY, SoCal focus, broad eligibility |

When you compare the best credit unions for business banking, you see a range of options. Some offer the best business checking accounts with no monthly service fees, while others give you high APY or special support for local businesses. Take time to review each credit union business account and see which one fits your business best.

Credit Union Business Account Features

Image Source: pexels

Account Types and APY

When you explore business banking accounts at credit unions, you find a variety of business products designed for different needs. Most credit unions offer business checking accounts, business money market accounts, business share certificates (CDs), and business savings. Each account type comes with its own APY range and minimum balance requirements. Take a look at this table to see how the best business checking accounts and other business products compare:

| Business Account Types | Minimum Balance | APY Range |

|---|---|---|

| Business Checking | $50 - $25,000+ | 0.25% - 0.40% |

| Business Money Market | $2,500 - $250,000+ | 0.55% - 2.50% |

| Business Share Certificates | $500 minimum | 3.00% - 4.15% (3-60 mo) |

You usually get higher APY with money market accounts and CDs, but you may need to lock in your funds for a set term. Business savings accounts often have lower APY, but they give you more flexibility. If you want to maximize your returns, compare APY rates and terms across different business banking accounts.

Tip: Online business checking accounts at credit unions often come with no monthly service fees and competitive APY, making them a smart choice for growing your funds.

Fees and Requirements

You want to keep more of your money, so understanding fees and requirements is key. Many of the best business checking accounts at credit unions feature no monthly service fees if you meet certain balance requirements. Here’s a quick look at common fees and minimums:

| Fee/Requirement | Details/Amount |

|---|---|

| Monthly Service Fee | $10 (waived with $5,000+ average daily balance or active business loan $50,000+) |

| Minimum Balance to Avoid Fees | $1,000 - $10,000 depending on account type |

| Minimum Opening Deposit | $100 |

| Card Replacement Fee | $5 per card; $75 expedited |

| Cash/Coin Exchange Fee | 0.1% on cash/coin over $5,000 per month |

| NSF Fee | $32 per declined transaction |

| Wire Transfer Fee | $20 per wire |

| Inactive/Dormant Account Fee | $7 per account per month |

| Stop Payment Fee | $30 per check/ACH |

Some business banking services, like ACH processing, come with no extra charge. You may also get a set number of free checks each month. Always review the fee schedule before opening a credit union business account.

Membership and Eligibility

To open business banking accounts at a credit union, you need to meet membership requirements. Credit unions set eligibility based on community, industry, or other fields of membership. The National Credit Union Administration (NCUA) regulates these rules and insures your deposits up to $250,000 per account holder.

Most credit unions ask you to open a membership savings account with a small deposit, often $5. You also need to provide documents that prove your business registration and personal identification for all owners or signers. Here’s a quick guide:

| Business Entity Type | Membership Eligibility Requirement | Minimum Deposit Requirement | Key Documentation Required |

|---|---|---|---|

| Sole Proprietorship | Sole proprietor must be a member or eligible | $5 membership savings account | Business name certificate, SSN/EIN, personal ID |

| Partnership | All partners must be members or eligible | $5 membership savings account | Partnership certificate, EIN, personal ID for partners |

| Corporation | All owners/operators must be members or eligible | $5 membership savings account | Articles of Incorporation, EIN, personal ID, account resolution |

| Limited Liability Company | All members must be members or eligible | $5 membership savings account | Articles of Organization, EIN/SSN, personal ID |

You can join many credit unions even if you live outside their main area, especially if they have broad membership rules. Once you join, you get access to a full range of business products and business banking services.

Choosing a Credit Union Business Account

Matching Account to Business Needs

Picking the right credit union business account can make a big difference for your company. You want an account that fits your business goals and daily operations. Here are some important steps to help you match an account to your needs:

- Check if you qualify for membership based on your location, employer, or community group.

- Look at the fee structure. Pay attention to monthly service fees, minimum balances, and transaction costs.

- Review the online and mobile banking features. Make sure you can manage your money easily from anywhere.

- Think about how many branches and ATMs you can access. This matters if you handle cash or need in-person help.

- Explore the range of business products. Some credit unions offer business checking accounts, savings, loans, and credit cards.

- Confirm that your deposits are federally insured and know the coverage limits.

- Plan for the future. If you need to send or receive international payments, check if the credit union supports this.

- Ask about the credit union’s approach to member service and community involvement. Personalized support can help your business grow.

Tip: Before you decide, ask yourself these questions:

- Does this account support my business type and size?

- Are the digital tools easy to use?

- Will I save money on fees compared to other options?

- Can I get help when I need it?

Application Process

Opening a business account at a credit union is simple if you prepare the right documents. The paperwork you need depends on your business type. Here’s a quick guide:

| Business Type | Required Documents |

|---|---|

| Sole Proprietorship | Filed and Published Fictitious Business Name Statement (if needed), valid photo ID, business license (if needed) |

| General Partnership | Partnership Agreement, Fictitious Business Name Statement (if needed), valid photo IDs for partners |

| Limited Liability Company | Articles of Organization, Operating Agreement, Fictitious Name Certificate (if needed), valid photo IDs, Tax ID |

| Corporation | Articles of Incorporation, Corporate Resolution or Minutes, Fictitious Name Statement (if needed), Tax ID, photo IDs |

| Non-Profit Organization | Organization Charter or By-laws, Articles of Incorporation, Meeting Minutes, Statement of Information |

You may also need to make a small opening deposit, such as $200. Some credit unions ask for extra documents if your business is out-of-state or has a unique structure. Always double-check with the credit union before you apply.

Credit Union vs. Business Bank Account

Pros and Cons for Small Businesses

When you compare a credit union business account to a business bank account, you notice some big differences. Credit unions focus on their members, so you often pay less in fees and get better rates. Banks, on the other hand, usually charge more and offer lower interest on your deposits. If you want to see the differences at a glance, check out this table:

| Feature | Credit Union Business Accounts | Business Bank Accounts |

|---|---|---|

| Best For | Strong customer service, higher interest, low fees | More branches, advanced tech, wider services |

| Membership Requirement | Yes, sometimes with restrictions | No membership needed |

| Interest Rates (APY) | Higher on deposits, lower on loans | Lower on deposits, higher on loans |

| Monthly Fees | $0 to $20 | $0 to $40 |

| Loan Rates | Lower due to nonprofit status | Higher due to for-profit status |

| Technology & Online Banking | Sometimes limited | More advanced |

| Physical Locations | Fewer branches and ATMs | More branches and ATMs |

| Pros | Better rates, lower fees, personal service | More options, more locations |

| Cons | Membership rules, fewer branches and products | Higher fees, less favorable rates |

You save money with a credit union business account. Many credit unions do not charge monthly maintenance fees, while banks might charge $12 to $15 each month. That adds up to $144 to $180 per year. Overdraft fees are also lower at credit unions. You might pay nothing at a credit union, but banks can charge $35 or more for each overdraft. Credit unions also give you higher interest on savings, sometimes five to ten times more than banks. However, banks usually have more branches and better online tools.

Note: Credit unions are not-for-profit. They return profits to members through better rates and lower fees. Banks are for-profit and focus on making money for shareholders.

When to Choose a Credit Union

You should consider a credit union if you want to save money and get personal service. Credit unions work well for small business banking when you value lower fees and flexible lending. They often approve loans more easily and offer lower interest rates. If you need a business bank account for everyday transactions, a credit union can help you keep costs down.

Here are some situations where a credit union makes sense:

- You want lower fees for your business accounts.

- You need a loan with a good rate and flexible approval.

- You prefer talking to someone who knows your business.

- You do not need a large branch network or advanced online banking.

- Your business benefits from local support and community programs.

If your business needs lots of branches, advanced technology, or international services, a traditional bank might fit better. But if you want to build a relationship and save on costs, a credit union is a smart choice for your business.

You have many great credit union business account options, each with unique perks for small businesses. Take time to compare features, fees, and eligibility so you find the best fit. Once you choose, follow these steps for a smooth switch:

1. Open your new account and gather your account details.

2. List and update all automatic payments and deposits.

3. Move your funds and set up new payments.

4. Watch your old account for any pending transactions.

5. Close your old account when everything clears.

Choosing a credit union can help you save money, get better support, and grow your business for the long run.

FAQ

What documents do you need to open a credit union business account?

You usually need your business license, tax ID, and personal ID. Some credit unions may ask for partnership agreements or articles of incorporation. Always check with the credit union before you visit.

Can you open a credit union business account online?

Many credit unions let you start the process online. You may need to visit a branch to finish your application or show your documents. Some credit unions offer full online account opening for certain business types.

Are credit union business accounts insured?

Yes, the National Credit Union Administration (NCUA) insures your business deposits up to $250,000 per account holder. This insurance works like the FDIC coverage at banks.

Do credit unions offer business loans and credit cards?

Most credit unions provide business loans, lines of credit, and credit cards. You can also find equipment loans and commercial real estate loans. Ask your credit union about their business lending options and rates.

Whether you’re sending money abroad or managing multi-currency exchanges, you no longer need to worry about excessive fees or long waiting times. BiyaPay provides a seamless channel that supports free conversion between multiple fiat currencies and digital assets, with real-time exchange rate checks displayed transparently to help you seize the right moment. With remittance fees as low as 0.5%, combined with same-day transfers, and coverage across most countries and regions worldwide, your global transactions become faster and more reliable.

Start today with BiyaPay and enjoy smarter cross-border remittance and currency exchange.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.