- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Ways to Send Money Without Using Venmo

Image Source: pexels

Looking for venmo alternatives to help you send and receive money? You have plenty of great choices. Apps like venmo, such as Zelle, PayPal, Cash App, Apple Pay, and Google Pay, rank among the most popular for personal transfers. Here’s a quick look at how these apps compare:

| App | Popularity (Users) | Key Features |

|---|---|---|

| Zelle | Billions moved monthly | Instant bank transfers, no fees |

| PayPal | Used globally | Fast, secure, works in 160+ countries |

| Cash App | Rapid user growth | No-fee cash out, debit card support |

| Apple Pay | Apple device integration | Secure, easy for iPhone users |

| Google Pay | Google ecosystem | Fast, secure, works across Android devices |

You will find that each of these alternatives offers unique features, fees, and security. Explore the reviews below to discover which apps like venmo work best for sending money your way.

Key Takeaways

- Many apps like Zelle, PayPal, Cash App, Apple Pay, and Google Pay offer fast, secure ways to send money without Venmo.

- Look for apps with low or no fees, instant transfers, and strong security features like two-factor authentication and encryption.

- Choose an app that fits your device, personal needs, and whether you need to send money locally or internationally.

- Apps like Wise and WorldRemit are best for international transfers with low fees and real exchange rates.

- Always check user reviews, privacy policies, and customer support before picking a money transfer app.

Venmo Alternatives Overview

Image Source: unsplash

What Are Venmo Alternatives?

When you look for venmo alternatives, you want apps or services that let you send and receive money easily. These alternatives help you move funds between friends, family, or even businesses. Many of them support peer-to-peer payments, which means you can pay someone directly from your phone or computer.

You might notice that each alternative offers different ways to complete a money transfer. Some let you send money to a bank account, a mobile wallet, or even for cash pickup. Others focus on speed, with transfers that happen instantly or within minutes. You also want to watch for fees, exchange rates, and transfer limits. Some apps work in many countries, while others only support certain regions.

Here’s a quick table to show what matters when you compare venmo alternatives:

| Criteria | Description / Examples |

|---|---|

| Delivery Methods | Bank deposit, mobile wallet, cash pickup, debit card |

| Transfer Speed | Instant, minutes, or up to a few days |

| Transfer Fees | Low, clear fees with no hidden charges |

| Exchange Rates | Market rates, conversion costs, currency spreads |

| Transfer Limits | Minimum and maximum per transaction or month |

| Countries Served | Where you can send or receive money |

You should also think about exchange rate markups, payment method options, and if the app works in the country you need.

Why Consider Alternatives?

You might wonder why so many people search for venmo alternatives. One big reason is privacy. Venmo shows your transactions on a social feed, which can expose your payment details. If you want more privacy, you may want an app that keeps your transfers private.

Fees are another concern. Venmo charges for instant transfers and credit card payments. These costs can add up, especially if you send money often. Some alternatives offer lower fees or even free transfers.

Security matters, too. Some users worry about scams or account freezes. Venmo does not always offer buyer or seller protection, which can be risky if you pay someone you do not know. You may want an alternative with better fraud protection or customer support.

Other reasons include:

- Limits on how much you can send or withdraw at once.

- Lack of business features like payment reminders or receipts.

- Limited support for international money transfer.

- Better rates, faster transfers, and more flexibility from other apps.

- Need for peer-to-peer payments that work with your device or bank.

Tip: Always check user reviews and customer support quality before choosing a new app. The right venmo alternatives can make your peer-to-peer experience safer and easier.

Money Transfer Comparison

Image Source: pexels

Fees and Limits

When you look at apps like venmo, you want to know how much it costs to send and receive money. You also want to know if there are any limits on how much you can move at once. Each app sets its own rules for fees and transfer amounts. Some charge for instant transfers or credit card payments. Others let you move money for free if you use a bank account.

Here’s a table to help you compare the fees and limits for some of the top apps like venmo:

| App | Typical Fees (Personal) | Maximum Transfer Limit (Verified) | Notes |

|---|---|---|---|

| Venmo | Free for standard; 1.75% for instant | $6,999.99/week (P2P); $60,000/week overall | Fees for instant cash-out, credit cards |

| Zelle | No fees | $500–$2,500+/day (varies by bank) | Limits set by your bank |

| PayPal | Free for bank transfers; 2.9% for cards | Up to $60,000/transaction | Fees for currency conversion, cards |

| Cash App | Free for standard; 0.5–1.75% for instant | $7,500/week | Fees for instant deposit, cards |

| Wise | Low, transparent fees | Varies by country and currency | Real exchange rates, no hidden fees |

| Apple Cash | Free for bank transfers; 1.5% for instant | $10,000/transfer; $20,000/7 days | Only for U.S. users |

| Google Pay | Free for personal transfers | Varies by bank/card | Linked to Google account |

| Meta Pay | Free for P2P | Varies | Used on Facebook, Instagram, Messenger |

| Chime Pay | Free | $2,000/month | No fees for sending money |

| Revolut | Free for standard; fees for currency exchange | $1,000–$25,000/month | Limits depend on account type |

| Payoneer | Fees for receiving, withdrawing | Varies | Best for business, freelancers |

| WorldRemit | Low, clear fees | Varies by country | Good for international transfers |

Note: Some apps like Gerald do not use fixed transfer limits. Instead, they offer cash advances up to half your paycheck, which you can move to your bank account.

You can see that apps like venmo have different rules for fees and limits. Zelle and Chime Pay Anyone stand out for no-fee transfers. Wise and WorldRemit keep costs low for international money transfer. PayPal and Cash App charge for instant transfers and card payments. Always check the latest details in the app before sending money.

Security Features

You want your money transfer to be safe. Apps like venmo use many tools to protect your account and your money. Some connect directly to your bank, while others use extra steps to keep hackers out.

Most top apps like venmo use these security features:

- End-to-end encryption. This turns your data into code so no one else can read it.

- Biometric authentication. You can use your fingerprint or face to unlock your account.

- Two-factor authentication (2FA). You get a code on your phone or email to log in.

- Fraud detection. The app watches for strange activity and blocks bad transactions.

Zelle connects with many U.S. banks. This means you do not need a third-party app, which lowers risk. You can send and receive money right from your bank’s app. PayPal and Cash App use encryption and fraud checks. They also let you freeze your card or check your account for strange charges. PayPal gives you purchase protection, so you do not have to share your card details with sellers.

Wise, Revolut, and Payoneer also use strong security. They protect your account with 2FA and watch for fraud. Apple Cash and Google Pay use device security, like Face ID or fingerprint, to keep your money safe.

Tip: Always turn on two-factor authentication and use a strong password. This helps keep your peer-to-peer payments secure.

Best Use Cases

Not every app fits every need. Some apps like venmo work best for quick payments between friends. Others shine when you need to send money across borders or pay for things online.

Here’s a table to show what each app does best:

| App | Best For | Common Transaction Types |

|---|---|---|

| Venmo | Peer-to-peer payments in the U.S. | Splitting bills, paying friends |

| Zelle | Fast bank-to-bank transfers | Peer-to-peer, rent, gifts |

| PayPal | Online shopping, global payments | Peer-to-peer, business, online checkout, crypto |

| Cash App | Peer-to-peer, small business, investing | Peer-to-peer, in-store, stocks, Bitcoin |

| Wise | International money transfer | Peer-to-peer, business, multi-currency |

| Apple Cash | iPhone users, in-store and online purchases | Peer-to-peer, retail, web purchases |

| Google Pay | Android users, freelancers, business payments | Peer-to-peer, business, in-store, online |

| Meta Pay | Social media payments | Peer-to-peer, business, donations |

| Chime Pay | No-fee peer-to-peer transfers | Peer-to-peer, bill splitting |

| Revolut | Travel, multi-currency spending | Peer-to-peer, currency exchange, travel |

| Payoneer | Freelancers, global business | Peer-to-peer, business, cross-border payments |

| WorldRemit | Sending money to family abroad | Peer-to-peer, cash pickup, bank deposit |

If you want to send and receive money in the U.S., Zelle, Venmo, and Cash App work well. Zelle is fast and free if your bank supports it. Cash App lets you buy stocks or Bitcoin. Apple Cash and Google Pay are great if you use Apple or Android devices.

For international money transfer, Wise, PayPal, Payoneer, and WorldRemit stand out. Wise uses real exchange rates and low fees. PayPal supports many countries and currencies. Payoneer is good for freelancers and businesses who need to get paid from other countries. WorldRemit helps you send money to family or friends in over 130 countries.

Note: Venmo does not support international transfers. You need to use apps like Wise, PayPal, or Payoneer for sending money outside the U.S.

Apps like venmo cover many needs. You can split a pizza, pay rent, shop online, or send money to family in another country. Choose the app that matches your needs, device, and where you want your money to go.

Apps Like Venmo

Key Features

When you look for apps like venmo, you want to know what makes each one stand out. Many venmo alternatives offer unique features that can make sending money easier, faster, or safer. Some focus on quick transfers. Others help you send money across borders. A few even let you invest or shop with your balance.

Here’s a table that shows the standout features of some top apps like venmo:

| App | Standout Features | Device/Platform Integration | Fee Structure |

|---|---|---|---|

| Wise | Real exchange rates, low-cost international transfers, supports 80+ countries | Web, iOS, Android | Low, transparent fees; no hidden charges |

| PayPal | Global reach, buyer protection, PayPal Credit, links to banks and cards | Web, iOS, Android | Complex fees; free for bank transfers |

| Zelle | Direct bank integration, instant transfers, no fees | Integrated with many US banks’ apps | No fees for sending or receiving |

| Cash App | P2P payments, invest in stocks and Bitcoin, free debit card, instant deposits | iOS, Android | Free for standard; fees for instant transfers |

| Apple Cash | Send money via Messages, Apple device integration, accepted at many US retailers | iOS, Apple Watch | Free for bank transfers; instant transfer fee |

| Google Pay | Tap-to-pay, works with Google apps, Gmail integration | Android, iOS, Gmail | No fees for P2P; fees for instant cash out |

| Meta Pay | Payments in Facebook Messenger and Instagram | Facebook, Messenger, Instagram | No fees for personal transfers |

| Chime Pay | No-fee transfers, works with Chime accounts | iOS, Android | No fees |

| Revolut | Multi-currency accounts, budgeting tools, currency exchange, travel perks | iOS, Android, Web | Free and paid plans; some features require upgrade |

| Payoneer | Multi-currency payments, local receiving accounts, good for freelancers and businesses | Web, iOS, Android | Fees for receiving and withdrawing |

| WorldRemit | Send to 130+ countries, cash pickup, mobile money, bank deposit | Web, iOS, Android | Low, clear fees |

| Bloom | Financial wellness tools, P2P payments, budgeting | iOS, Android | Varies |

| WePay | Payment processing for platforms and marketplaces | Web, API integration | Fees for merchants |

| Square Payments | In-person and online payments, POS integration, business tools | iOS, Android, Web | Fees for merchants |

| Stripe Pay | Online payment processing, supports many currencies, developer-friendly | Web, API integration | Fees for merchants |

You can see that many apps like venmo offer more than just sending money. Some let you invest, budget, or shop. Others focus on business payments or international transfers. If you want a digital wallet service that fits your needs, check which features matter most to you.

Note: Zelle, Cash App, and Apple Cash offer FDIC insurance under certain conditions. Zelle moves money directly between insured bank accounts. Cash App provides FDIC insurance if you use their debit card. Apple Cash offers insurance when you register with their partner bank.

Pros and Cons

Every app has strengths and weaknesses. You want to pick the venmo alternatives that match your needs. Here’s a closer look at the pros and cons of the most popular apps like venmo:

Wise

- Pros:

- Low-cost, fast international payments.

- Uses real exchange rates.

- Supports over 80 countries.

- Cons:

- Not all transfers are instant.

- Needs internet access.

- Best for: Sending money abroad with low fees.

PayPal

- Pros:

- Works worldwide.

- Buyer protection for purchases.

- Links to many banks and cards.

- Cons:

- Higher fees for card payments and international transfers.

- Recipient must have a PayPal account.

- Best for: Online shopping, global payments, and business.

Zelle

- Pros:

- Instant transfers to bank accounts.

- No fees for sending or receiving.

- Built into many bank apps.

- Cons:

- Only works with US bank accounts.

- No credit card funding.

- Best for: Quick payments between US bank accounts.

Cash App

- Pros:

- Fast P2P payments.

- Lets you invest in stocks and Bitcoin.

- Free debit card.

- Cons:

- Limited use outside the US.

- Fees for instant cash out and some ATM withdrawals.

- Best for: Peer-to-peer payments, investing, and spending in the US.

Apple Cash

- Pros:

- Easy to use with iPhone or Apple Watch.

- Send money in Messages.

- Accepted at many US stores.

- Cons:

- Only for Apple users.

- Needs registration for FDIC insurance.

- Best for: Apple device users who want simple payments.

Google Pay

- Pros:

- Works on Android and iOS.

- Tap-to-pay and send money.

- Integrates with Gmail.

- Cons:

- Fees for credit card payments and instant cash outs.

- Limited options for sending money abroad.

- Best for: Android users and those who use Google services.

Meta Pay

- Pros:

- Send money in Facebook Messenger and Instagram.

- No fees for personal transfers with debit cards.

- Cons:

- Limited to social platforms.

- Not for business or international payments.

- Best for: Sending money to friends on social media.

Chime Pay Anyone

- Pros:

- No-fee transfers.

- Works with Chime accounts.

- Cons:

- Lower transfer limits.

- Only for Chime users.

- Best for: Chime account holders who want free payments.

Revolut

- Pros:

- Multi-currency accounts.

- Budgeting and travel tools.

- Currency exchange at good rates.

- Cons:

- Some features need a paid plan.

- Best for: Travelers and those who need multi-currency spending.

Payoneer

- Pros:

- Great for freelancers and businesses.

- Multi-currency payments.

- Local receiving accounts.

- Cons:

- Not ideal for casual users.

- Fees for receiving and withdrawing.

- Best for: Business owners and freelancers working with clients abroad.

WorldRemit

- Pros:

- Send money to over 130 countries.

- Offers cash pickup and mobile money.

- Low, clear fees.

- Cons:

- Fees and limits depend on the country.

- Best for: Sending money to family or friends in other countries.

Bloom

- Pros:

- Financial wellness and budgeting tools.

- P2P payments.

- Cons:

- Newer app, less recognition.

- Best for: Users who want to manage money and budget.

WePay

- Pros:

- Good for platforms and marketplaces.

- Payment processing tools.

- Cons:

- Not for personal use.

- Merchant fees apply.

- Best for: Businesses and online platforms.

Square Payments

- Pros:

- In-person and online payments.

- POS integration.

- Business tools.

- Cons:

- Merchant fees.

- Best for: Small businesses and retailers.

Stripe Pay

- Pros:

- Online payment processing.

- Supports many currencies.

- Developer-friendly.

- Cons:

- Not for personal payments.

- Merchant fees.

- Best for: Online businesses and developers.

Tip: If you want FDIC insurance, use apps like venmo that connect to insured bank accounts. Zelle, Cash App (with debit card), and Apple Cash (with registration) offer this protection. Always move your balance to your bank account for extra safety.

You have many venmo alternatives to choose from. Some apps like venmo focus on fast, free payments. Others help you send money around the world or manage your business. Pick the digital wallet service that fits your lifestyle, device, and where you want your money to go.

Choosing the Right Option

Personal Needs

When you pick a money app, your personal habits matter most. You want something that fits your personal style and makes life easier. Some people care about speed. Others want to save on fees. Many apps focus on personal convenience, so you can send or receive money fast. Here are some ways apps meet personal needs:

- Some apps offer instant transfers for people who need money right away.

- Many apps keep fees low or even free, which helps your personal budget.

- Security features like encryption and biometric logins protect your personal information.

- If you travel or have family abroad, global access and multi-currency support help your personal finances.

- Apps with easy interfaces make personal use simple, even for beginners.

- Good customer support solves personal problems quickly.

You might like PayPal for its global reach and personal flexibility. Zelle works well for personal transfers between U.S. bank accounts. If you want to manage your personal spending, apps like MiFinity eWallet or Revolut offer tools for personal budgeting. Always match the app to your personal habits and digital payment needs.

Device Compatibility

Your personal device choice shapes your experience. Some people use iPhones, while others prefer Android. Many apps work on both, but some only support one. If you want to use your personal computer, look for web access. Here’s a quick table to show device compatibility:

| App | iOS | Android | Web |

|---|---|---|---|

| Google Pay | ✔ | ✔ | ✔ |

| Square | ✔ | ✔ | ✔ |

| Cash App | ✔ | ✔ | |

| Apple Cash | ✔ | ||

| Chime Pay | ✔ | ✔ | |

| Revolut | ✔ | ✔ | |

| Wise | ✔ | ✔ | ✔ |

| Skrill | ✔ | ✔ | ✔ |

| Remitly | ✔ | ✔ | ✔ |

| WorldRemit | ✔ | ✔ | ✔ |

Apps that work on all your personal devices make life easier. You can send money from your phone or computer, depending on your personal routine. Broad compatibility means you never miss a transfer, no matter which personal device you use.

International Transfers

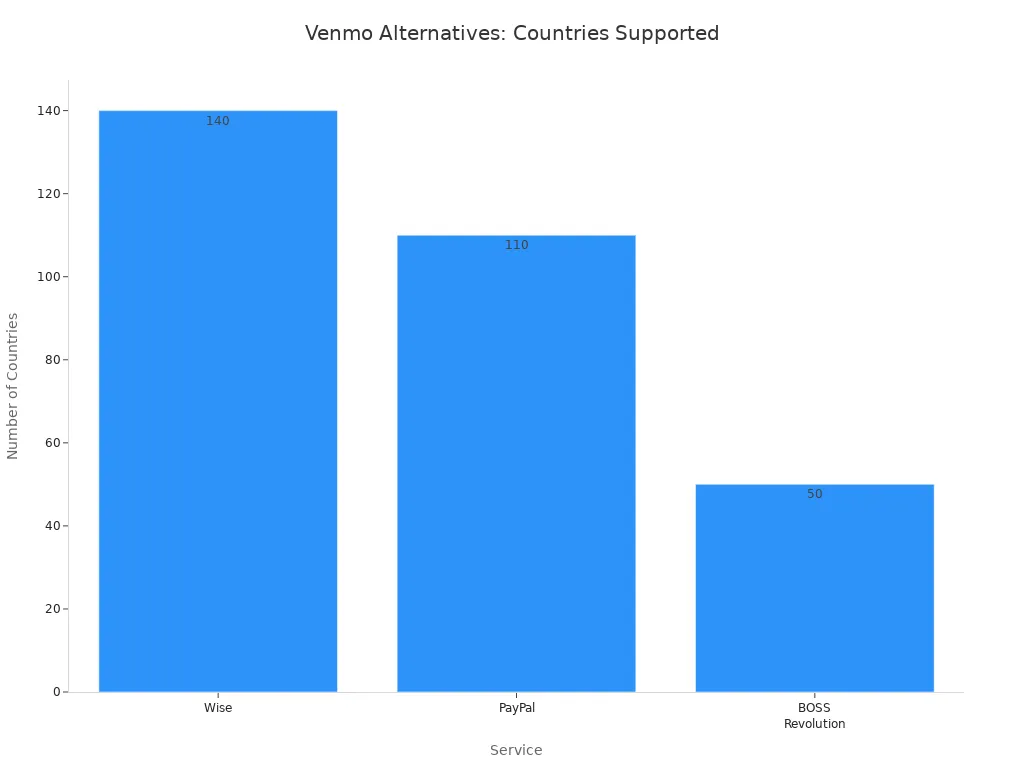

If your personal life includes friends or family in other countries, you need an app that supports global transfers. Some apps cover more countries than others. Wise lets you send money to over 140 countries with low fees and real exchange rates. PayPal works in over 110 countries but charges higher fees. Remitly and WorldRemit also offer wide coverage and flexible delivery options. Here’s a chart comparing country support:

When you compare apps, check if they fit your personal needs for sending money abroad. Look at fees, exchange rates, and how fast your personal transfer arrives. Wise stands out for personal savings, while PayPal offers personal convenience but at a higher cost.

Privacy and Security

Your personal safety comes first. Money apps use strong security to protect your personal data. Most use encrypted connections and two-factor authentication. You should always turn on these features for your personal account. The Consumer Financial Protection Bureau now requires apps to follow strict rules for personal data and fraud protection. Many apps use biometric logins, fraud detection, and regular audits to keep your personal information safe.

- Always use two-factor authentication for your personal account.

- Only send money to personal contacts you trust.

- Set personal transaction limits to reduce risk.

- Choose apps with clear privacy policies for your personal data.

Some apps collect more personal data than you expect. Read their privacy policies to see how they use your personal information. Apps like Apple Pay and Google Pay use device security to protect your personal details. If you want extra peace of mind, pick an app with strong personal privacy controls and transparent data practices.

You have many strong alternatives if you want to send money without Venmo. Apps like venmo, such as Cash App, Zelle, PayPal, and Wise, each offer unique features. Some focus on low fees, while others shine with fast transfers or extra tools like investing. You should think about what matters most—fees, security, privacy, or customer support. Experts and users both look for easy use, strong security, and helpful features. Try a few venmo alternatives to see which one fits your needs best.

FAQ

What is the safest way to send money without Venmo?

You can use apps like Zelle, Wise, or PayPal. These apps use strong encryption and two-factor authentication. Always check for security features before you send money. Move your balance to your bank account for extra safety.

Can I send money internationally with these apps?

Yes, you can. Wise, PayPal, and WorldRemit let you send money to many countries. Wise uses real exchange rates, so you save money. Always check the latest USD exchange rates before you send funds.

Are there any free options for sending money?

You have some free choices. Zelle and Chime Pay Anyone offer no-fee transfers if both you and the recipient use supported banks. Always check the app’s fee policy before you send money.

How fast will my money arrive?

Transfer speed depends on the app. Zelle and Cash App often send money instantly. Wise and PayPal may take a few minutes or hours, especially for international transfers. Check the app for exact timing.

If you’re comparing Venmo alternatives, why limit yourself to domestic transfers with hidden fees and slow delivery? BiyaPay helps you go further — offering support for both fiat and digital currency conversion, low remittance fees starting at just 0.5%, and real-time exchange rate checks so you always know exactly what you’re paying. With coverage across most countries worldwide and the assurance of same-day transfers, BiyaPay is designed for people and businesses that need speed, transparency, and global reach.

Start your smarter transfer journey today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.