- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Everything you need to know to wire money with Walmart

Image Source: pexels

You can wire money with Walmart in just a few steps. First, choose a service that fits your needs. Next, pick if you want to visit a store or use the website. Then, give the recipient’s details, pay, and share the pickup info. Walmart partners with services like Western Union, making it easy to send money to almost anywhere. With over 4,600 Walmart locations in the United States offering these services, you can wire money quickly and reach friends or family worldwide. The process stays simple and fast whether you send money in person or online.

Key Takeaways

- Walmart lets you send money quickly either in-store or online using trusted partners like Ria and MoneyGram.

- You need a valid photo ID and the recipient’s full details to send money safely and avoid delays.

- Fees are clear and often lower than banks, with fast transfers usually completed in about 10 minutes.

- Walmart uses strong security measures to protect your money and helps you avoid scams.

- If you want more speed or no fees, consider digital apps, but Walmart is great for cash pickups and wide coverage.

Wire Money Options

When you want to wire money, Walmart gives you a few ways to do it. You can visit a Walmart Money Center in person or use their online tools. Walmart works with MoneyGram and Ria to help you send money almost anywhere. These partners let you transfer money to friends or family in the United States, Puerto Rico, Mexico, and over 200 other countries.

In-Store

If you like face-to-face service, head to your local Walmart Money Center. You can find these centers in most Walmart stores. The staff will help you send money using Walmart2Walmart or Walmart2World. Walmart2Walmart lets you send money between Walmart stores in the United States, Puerto Rico, and Mexico. This service uses Ria Money Transfer, which has a huge network. If you want to send money outside these areas, choose Walmart2World. This service uses MoneyGram and covers more than 200 countries. You can start your transfer at the Walmart Money Center counter or at a self-service kiosk.

Tip: Bring your photo ID and the recipient’s details to the Walmart Money Center. This makes the process faster.

Online

You can also wire money without leaving home. Use the Walmart Money Center online or the Walmart app. Both options let you send money with Walmart2Walmart or Walmart2World. The online process is simple. You enter the recipient’s information, choose how they will get the money, and pay with your debit card. Walmart2World gives you more choices for delivery, like cash pickup, bank deposit, or even mobile wallet delivery in some countries. The Walmart Money Center website shows you all your options and helps you track your transfer.

Here’s a quick look at the differences:

| Feature | Walmart2Walmart | Walmart2World |

|---|---|---|

| Where you can send | US, Puerto Rico, Mexico | 200+ countries and territories |

| How to start | In-store, online, Walmart2Walmart app | In-store, online, Walmart app |

| Delivery options | Pickup at Walmart Money Center | Cash pickup, bank deposit, mobile wallet |

| Service provider | Ria Money Transfer | MoneyGram |

No matter which way you choose, the Walmart Money Center makes it easy to send money quickly and safely.

How to Wire Money

Image Source: unsplash

Steps

You can wire money at the walmart money center or online. Both ways are simple, but each has its own steps. Here’s how you can send money with confidence:

In-Store at the Walmart Money Center

- Walk into your nearest walmart money center. You can find one in most Walmart stores.

- Bring a valid photo ID, like your driver’s license or a government-issued card. The staff will check your ID to make sure you are who you say you are.

- Tell the staff you want to send money. Pick a provider, such as Ria, MoneyGram, or Western Union.

- Give the recipient’s full name and where they will pick up the money. You can choose cash pickup at a walmart money center, a mobile wallet, or a direct bank deposit.

- Decide how much you want to send and how the recipient will get the funds.

- Pay the amount you want to transfer, plus any fees. You can use cash or a debit card at the walmart money center.

- Get a receipt with a tracking number. This number helps you and the recipient track the transfer.

- Let your recipient know the money is on its way. In many cases, they can pick it up at a walmart money center in about ten minutes.

Tip: Always double-check the recipient’s details before you pay. This helps avoid delays or mistakes.

Online or with the Walmart App

- Go to the walmart money center website or open the Walmart app.

- Register for an account if you do not have one. You will need to enter your full name and home address, just like it appears on your photo ID.

- Log in and choose to send money. Enter the recipient’s name, country, and state or province.

- Pick how the recipient will get the money. Most people choose cash pickup at a walmart money center, but you can also select bank deposit or mobile wallet if available.

- Enter the amount you want to send. Review the transfer fee and total cost.

- Choose your payment method. You can use a debit card, credit card, or sometimes a bank account.

- Confirm your identity if asked. You may need to provide extra information, like your Social Security Number or a mobile number for verification.

- Double-check all the details, then finish the transfer.

- Share the confirmation or tracking number with your recipient.

Note: If you send money to the same person often, use the “Send Again” feature in your account. This saves time and keeps things simple.

Requirements

Before you start, make sure you meet all the requirements for using the walmart money center to send money. Here’s what you need:

- Age and Residency

- You must be at least 18 years old.

- You need to be a legal permanent resident of one of the 50 US states or Washington, DC. Vermont, Puerto Rico, and other US territories are not eligible.

- Identification

- Bring a valid photo ID, such as a driver’s license or a government-issued card.

- For online transfers, you may need to provide your Social Security Number and verify your mobile number.

- Recipient Details

- You need the recipient’s full name as it appears on their ID.

- Know the country and city where they will pick up the money.

- Payment Methods

- At the walmart money center, you can pay with:

- Cash

- Debit card

- Online, you can use:

- Debit card

- Credit card

- Bank account (if available)

- Walmart does not accept Apple Pay or Google Pay for money transfers.

- At the walmart money center, you can pay with:

- Account Registration

- For online or app transfers, you must register for a walmart money center account.

- You need an email address and access to a mobile phone for verification.

Note: If you use the walmart money center often, keep your ID and recipient details handy. This makes it faster to send money next time.

You can wire money at the walmart money center or online, and both ways let you transfer money quickly and safely. Just follow these steps, bring the right documents, and you’ll be ready to send money whenever you need.

How Much Does It Cost to Wire Money

When you want to know how much does it cost to wire money with Walmart, you will find that the fees are clear and often lower than other places. Walmart keeps things simple, so you do not have to guess about the price.

Domestic Fees

If you send money within the United States using Walmart2Walmart, you pay a flat fee based on how much you send. Here is a quick look at the fees:

| Amount Sent (USD) | Fee (USD) |

|---|---|

| Up to $50 | $4 |

| $51 - $1,000 | $8 |

| $1,001 - $2,500 | $16 |

You can see that these fees are much lower than what banks charge for wire transfers, which can cost $15 to $30. Other services like Ria also charge between $0.99 and $9, but Walmart2Walmart usually stays on the lower end. You get a good deal and a simple fee structure.

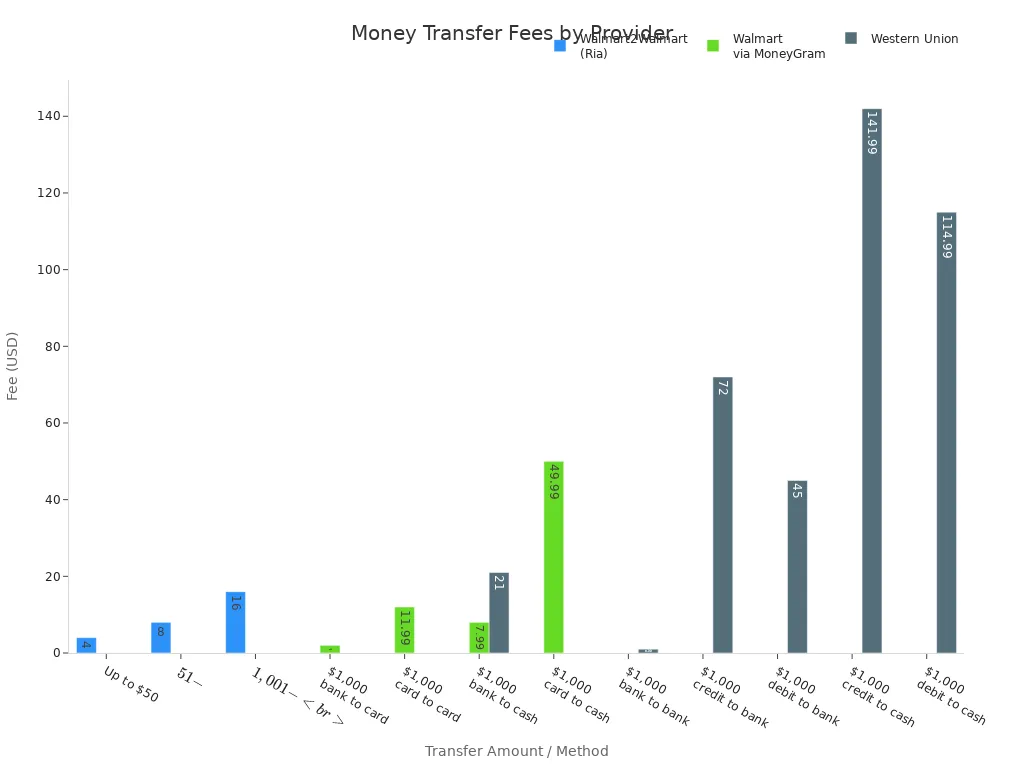

International Fees

Walmart2World lets you send money to over 200 countries. The fees are flat and do not change based on where your recipient lives. Here is what you pay:

| Amount Sent (USD) | Fee (USD) |

|---|---|

| Up to $60 | $4 |

| $61 - $1,000 | $8 |

| $1,001 - $2,500 | $16 |

| $5,000 | $50 |

Note: The exchange rate can affect how much your recipient gets. MoneyGram sets the rate, so always check before you send.

You can also compare Walmart’s fees to other services. Some providers charge much more, especially if you use a credit card or want cash pickup.

Transfer Times

Walmart makes sending money fast. Most transfers within the United States take about 10 minutes. International transfers can be just as quick if you use a debit or credit card. Bank transfers may take up to 4 business days. Here is a quick guide:

| Transfer Type | Typical Time |

|---|---|

| Walmart2Walmart (US) | About 10 minutes |

| Walmart2World (International) | Minutes to 4 business days |

| Debit/Credit Card Funding | Usually minutes |

| Bank Transfer Funding | 3-4 business days |

Tip: If you need your money to arrive fast, use a debit or credit card for payment.

Safety and Limits

Security

You want your money to stay safe when you send it. Walmart and its partners use strong security steps to protect your transfers. After a settlement with the Federal Trade Commission, Walmart put strict anti-fraud rules in place. Employees now get special training to spot scams and help you avoid them. Walmart uses systems that watch for suspicious activity and flag any transfers that look risky. If a transfer seems linked to fraud, Walmart will not process it. The company also blocks transfers for telemarketers or sellers who try to use the service for fake goods or donations. These steps help keep your money and information secure.

Tip: Always check that you are dealing with real Walmart staff and official channels before sending money.

Limits

Walmart sets clear limits on how much you can send. This helps prevent fraud and keeps your transfers safe. Here is a quick table to show you the main limits:

| Transfer Limit Type | Amount |

|---|---|

| Minimum Transfer Amount | $1 |

| Maximum Transfer Amount | $2,500 per txn |

| Daily Transfer Limit | $2,500 per day |

| 30-Day Transfer Limit | $6,000 per 30 days |

You need a valid photo ID and the transfer reference number to pick up money. There are no set limits for how much you can receive, but you must show your ID each time.

Scams

Scammers often target money transfers. You need to stay alert. Here are some common tricks they use:

- Phishing scams: Someone pretends to be a Walmart worker and asks for your personal or bank details.

- Gift card scams: A scammer tells you to buy Walmart gift cards and send them the codes.

- Giveaway scams: You get a message saying you won a prize or job from Walmart, but it is fake.

- Email scams: Fake emails with Walmart logos try to steal your information.

- Delivery scams: Texts claim to be from Walmart or a delivery service and ask you to click a link.

You can protect yourself by following these steps:

- Never send money to people you do not know or trust.

- Always check if a message or call really comes from Walmart.

- If you think you shared your details with a scammer, call your bank right away.

- Change your Walmart+ password and remove saved payment info if you suspect fraud.

- Report any scam to Walmart and the Federal Trade Commission.

- Place a fraud alert or freeze on your credit report if your personal info is at risk.

- File a police report to help with the investigation.

Note: From 2013 to 2018, scammers used Walmart’s money transfer services to steal millions from people. Walmart now works hard to stop this, but you should always stay careful.

Receiving Money

Image Source: pexels

Pickup

You can pick up money at any Walmart Money Center or Customer Service desk. When you arrive, go straight to the counter and let the staff know you are there to collect a money transfer. The process is quick. The staff will ask for your details and check their system for your transfer. If you want cash, you can get it right away. Some providers also let you choose other ways to receive money. You might pick up cash, have the funds sent to your bank account, or even get the money in a mobile wallet. In some cases, you can use home delivery or ATM payout, depending on the provider and the country.

Tip: Always check which payout options are available before you go to the store. Not every Walmart or provider supports all methods.

What to Bring

You need to bring a few things to pick up your money. The most important is a state-issued photo ID, like a driver’s license or passport. The staff will use this to confirm your identity. You also need the confirmation or tracking number from the sender. This number helps the staff find your transfer in their system. If you use a barcode for pickup, make sure you have it ready on your phone or printed out. Here is a quick checklist:

- State-issued photo ID (driver’s license, passport, or government ID)

- Confirmation or tracking number

- Pickup barcode (if you received one)

If you forget any of these, you may not be able to get your money.

Time Limits

You have 48 hours from the time your cash pickup barcode is created to collect your money at Walmart. The barcode will show the exact date and time it expires. Make sure you visit the Money Center or Customer Service desk before the barcode runs out. If you miss the deadline, you can log in to your account and generate a new barcode. If you do not pick up the money at all, Walmart will return the funds to the sender or the original payment method. This refund usually happens within 30 days after the transaction is marked as unclaimed or rejected. Always check your pickup details and act quickly so you do not miss out on your money.

Alternatives

When to Use

You have many choices when it comes to sending money. Sometimes, Walmart is not the best fit for your needs. Here are some other money transfer services and when you might want to use them:

- Ria Money Transfer and Western Union: These are classic options. You can send money in person or online. They work well if you want a trusted name and do not mind paying a fee.

- Gerald Instant Cash Advance App: This app gives you instant, fee-free cash advances. You do not need someone to send you money. It works best if you need cash fast, especially if you work gigs or have an irregular income.

- Gerald’s Buy Now, Pay Later (BNPL) Feature: This lets you buy what you need now and pay later. You can also get a cash advance with no fees. It is great if you want more control over your money.

- Lydia, Airtm, Payconiq: These digital apps offer free international transfers, digital wallets, and strong security. They are perfect if you want to send money worldwide or use new payment tools.

You might pick these alternatives if you want faster access to funds, want to avoid fees, or need 24/7 digital service. Some apps also help you manage your money better with extra features.

Pros and Cons

Let’s see how these options stack up against Walmart. Here is a quick comparison:

| Aspect | Walmart Money Transfer Services | Gerald BNPL + Cash Advance |

|---|---|---|

| Fees | Fees depend on amount and speed; can be high for some transfers | No fees for cash advances or transfers after BNPL purchase |

| Transfer Times | Usually fast, but depends on the partner | Instant once you make a BNPL purchase |

| Coverage Areas | Wide network in the US and worldwide | Works with supported banks and stores |

| Accessibility | In-store or online; ID needed | App-based; no need to visit a store |

| Limits | Daily and monthly limits apply | Limits depend on your BNPL activity |

Tip: If you want to avoid lines and paperwork, try a digital app. If you need to send cash to someone who does not use apps, Walmart or Western Union might be better.

Each service has its strengths. Walmart covers many places and works well for in-person cash pickups. Digital apps like Gerald, Lydia, or Airtm give you more speed and flexibility, especially if you want to skip fees or manage your money on your phone.

Wiring money with Walmart stays simple when you follow a few steps. You choose how to send money, either in-store or online, and share the right details. Always check the latest fees and limits before you send money.

- Stay alert for scams, as fraud has been a problem in the past.

- Use Walmart’s MoneyCenter website or customer service for up-to-date info.

- Watch for new features, like instant payments and expanded card options.

For the safest experience, keep your records and ask questions if you need help.

FAQ

How long does it take for my recipient to get the money?

Most transfers arrive in about 10 minutes. If you use a bank account for payment, it can take up to 4 business days. Always check the estimated delivery time before you send.

Can I cancel a Walmart money transfer?

You can cancel a transfer if the recipient has not picked up the money. Visit the Walmart Money Center website or call customer service. You will need your tracking number and photo ID.

What should I do if I entered the wrong recipient information?

Contact Walmart customer service right away. If the money has not been picked up, you can correct the details or cancel the transfer. Always double-check names and locations before you send.

Are there any hidden fees when sending money with Walmart?

Walmart shows you all fees before you pay. You will see the transfer fee and the exchange rate if you send money internationally. There are no hidden charges.

Walmart money transfers are convenient for quick domestic or international cash pickups, but fees and exchange rates can add up—especially if you send money often. With BiyaPay, you get a smarter alternative: remittance fees as low as 0.5%, transparent costs, and access to multi-currency exchange across both fiat and digital assets. Unlike traditional services, BiyaPay supports same-day remittance with same-day arrival and coverage across most countries and regions worldwide. You can always check the latest costs with our real-time exchange rate tool before sending.

Take control of your transfers today—register with BiyaPay and experience faster, cheaper, and more reliable cross-border payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.