- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Americans can buy a home in Canada step by step

Image Source: pexels

You can buy property in Canada as an American, but you need to know about the current federal ban on foreign buyers. Some exceptions allow you to move forward with buying property even if you are not a resident. Buying property does not give you residency or citizenship. Rules about buying a home in Canada can change by province, and taxes may apply. Americans looking to purchase a home should check both federal and local rules. Understanding financial requirements will help you avoid surprises when buying a house in Canada.

Key Takeaways

- Most foreign buyers, including Americans, face a two-year federal ban on buying residential property in Canada, but exceptions exist for certain cases like buying rural or recreational properties and buying with a Canadian spouse.

- Non-residents must prepare a down payment of at least 35% of the purchase price and open a Canadian bank account to handle payments and mortgages.

- Each Canadian province has its own rules and taxes for foreign buyers, so checking local laws and working with a knowledgeable real estate agent is essential.

- Buying property in Canada does not grant residency or citizenship; immigration requires separate legal processes.

- Hiring professionals like real estate agents, lawyers, and tax advisors who understand cross-border rules helps avoid costly mistakes and ensures a smooth buying experience.

Eligibility to Buy Property

Federal Restrictions for Foreign Buyers

You need to know about the Prohibition on the Purchase of Residential Property by Non-Canadians Act if you are thinking about buying property in Canada. This law started on January 1, 2023, and will last for two years. During this time, most foreign buyers cannot purchase residential property in Canada. The government created this rule to help make homes more affordable for people living in Canada.

However, you will find several important exceptions to this rule. You may still have a path to buying property if you meet certain conditions. Here are some of the main exceptions:

- You can buy property if you inherit it or receive it through divorce or separation.

- You can purchase property for development purposes.

- You can rent property, as renting is not restricted by this Act.

- You can buy recreational properties and vacation homes outside major metropolitan areas.

- Properties outside Census Metropolitan Areas (CMAs) or Census Agglomerations (CAs) are usually exempt. This means you can often buy a cottage or cabin in rural areas.

- If you buy property with a Canadian spouse or common-law partner, you are exempt from the ban.

- Study permit holders can buy one property if they have filed income tax returns for five years, lived in Canada for at least 244 days each year, and the property costs less than $500,000.

- Work permit holders can buy one property if they have worked full-time in Canada for at least three years in the last four years and filed income tax returns for three of those years.

- People with diplomatic or consular status, or those protected under refugee laws, are also exempt.

Note: The rules focus on residential property. You can still buy land in Canada, especially if it is not for residential use. This can give you more options if you want to invest in the Canadian real estate market.

Provincial Rules and Exceptions

Each province in Canada sets its own rules for foreign buyers. Some provinces add extra taxes or restrictions, so you need to check local laws before purchasing property. For example, British Columbia and Ontario charge a Non-Resident Speculation Tax (NRST) on top of other fees. This tax can be as high as 25% of the purchase price in some areas. Other provinces, like Quebec and Alberta, do not have extra taxes for non-resident buyers, but local rules can still affect your plans.

You may find that some provinces limit the amount of land foreign buyers can own. In places like Prince Edward Island, you need government approval to buy large parcels of land. Some provinces also have rules about buying farmland or properties near borders.

The Canadian real estate market changes from province to province. You should always research the area where you want to buy. Local real estate agents can help you understand the rules and avoid surprises. Buying property in Canada can be different from buying in the United States, so you need to pay close attention to both federal and provincial laws.

Tip: Always check with a local real estate professional before making any decisions. They can help you understand the latest rules and taxes for foreign buyers in your chosen area.

Financial Requirements

Down Payment for Non-Residents

When you buy a home in Canada as an American, you need to prepare for a higher downpayment than you might expect in the United States. Most Canadian banks and lenders require non-residents, including Americans, to provide at least 35% of the purchase price as a downpayment. You must pay this amount from your own funds, and you cannot borrow it from another lender. For example, if you want to buy a house that costs $400,000 USD (check the current exchange rate for accuracy), you need to have at least $140,000 USD ready for the downpayment.

In Canada, permanent residents can sometimes pay a lower downpayment, as little as 5% to 20%. As a non-resident, you do not qualify for these lower rates. You must show proof that your downpayment comes from your own savings or investments. Canadian banks will not accept borrowed money for this purpose.

Note: Saving for a downpayment can take many years. Some buyers report that it took them over a decade to save enough. Plan ahead and start saving early if you want to buy property in Canada.

Mortgage Options in Canada

You have several mortgage options when buying property in Canada, but the process is different from what you may know in the United States. Many major Canadian banks, such as RBC, CIBC, TD Canada Trust, and BMO, offer mortgages to Americans. However, you should expect stricter requirements:

- Canadian lenders usually require a higher downpayment, often at least 35%.

- Most banks do not use your U.S. credit score. Instead, you must provide proof of income, tax returns, and bank statements.

- Mortgage terms in Canada are shorter. Fixed-rate terms usually last from 1 to 5 years, not 15 to 30 years like in the U.S.

- Fixed-rate mortgages are common. Variable rates are available, but adjustable-rate mortgages are rare.

- You must pass a mortgage stress test. This means you need to show you can afford payments at a higher interest rate than the one offered.

- If your downpayment is less than 20%, you must buy mortgage insurance. This insurance is usually paid as a lump sum added to your loan.

- Canadian banks may ask for alternative ways to check your credit, since they do not use U.S. credit scores.

- Opening a Canadian bank account helps you make mortgage payments and handle other transactions in Canadian dollars.

You may face other financial challenges. The Canadian housing market has high prices and limited supply. Mortgage and condo fees can be much higher than rent. Many buyers find it hard to decide if buying is better than renting. You also need to think about cross-border tax planning. Without good advice, you could face double taxation or legal problems. It is smart to talk to a financial advisor who understands both U.S. and Canadian tax laws.

Opening a Canadian Bank Account

You need a Canadian bank account to buy property and make mortgage payments. Opening an account as an American is possible, but you must bring the right documents. Most banks require you to visit in person, but some offer virtual account options. Always contact the bank before you go to confirm what you need.

Here is what you usually need to open a Canadian bank account:

- Valid, unexpired passport or driver’s license

- Immigration papers, such as a work or study permit, temporary residence permit, or confirmation of permanent residence

- Proof of address, such as a lease agreement, utility bill, or official letter showing a Canadian address

- Social Insurance Number (SIN) if your account earns interest (not needed for non-interest accounts)

- Some banks may accept a NEXUS card or other government-issued ID

Tip: Bring both proof of identity and proof of address. Examples include a passport and a utility bill. If you do not have a Canadian address yet, ask the bank what other documents they accept.

A Canadian bank account makes it easier to transfer your downpayment, pay your mortgage, and handle other costs in Canadian dollars. This step is important for a smooth buying process.

Finding and Buying Property in Canada

Image Source: unsplash

How to Buy Property in Canada

You need to follow clear steps when you want to buy property in Canada. Start by arranging your financing. You can contact Canadian banks or prepare to pay cash. Next, get a non-resident Tax Number from the Canada Revenue Agency. This number helps you handle tax matters. You should talk to a tax professional who knows about cross-border deals. A Canadian real estate agent and a property lawyer will guide you through the process. You must also prepare for currency exchange changes and legal fees because all transactions use Canadian dollars. If you want to know how to buy property in Canada, these steps will help you avoid mistakes and delays.

Tip: Always keep your documents ready. This includes your passport, proof of funds, and your tax number.

Choosing a Location

You have many choices when you look for the best city to buy property in Canada. Each city and province offers something different. Some places are popular with Americans because of price, lifestyle, or investment value. Here are some top picks:

- Kelowna, British Columbia: Good for retirees and remote workers. Many choose it for vacation homes.

- Moncton, New Brunswick: Affordable and growing. It is great for long-term rentals.

- Peterborough, Ontario: Close to Toronto. Many families and students move here.

- Lethbridge, Alberta: Offers low prices and a strong economy.

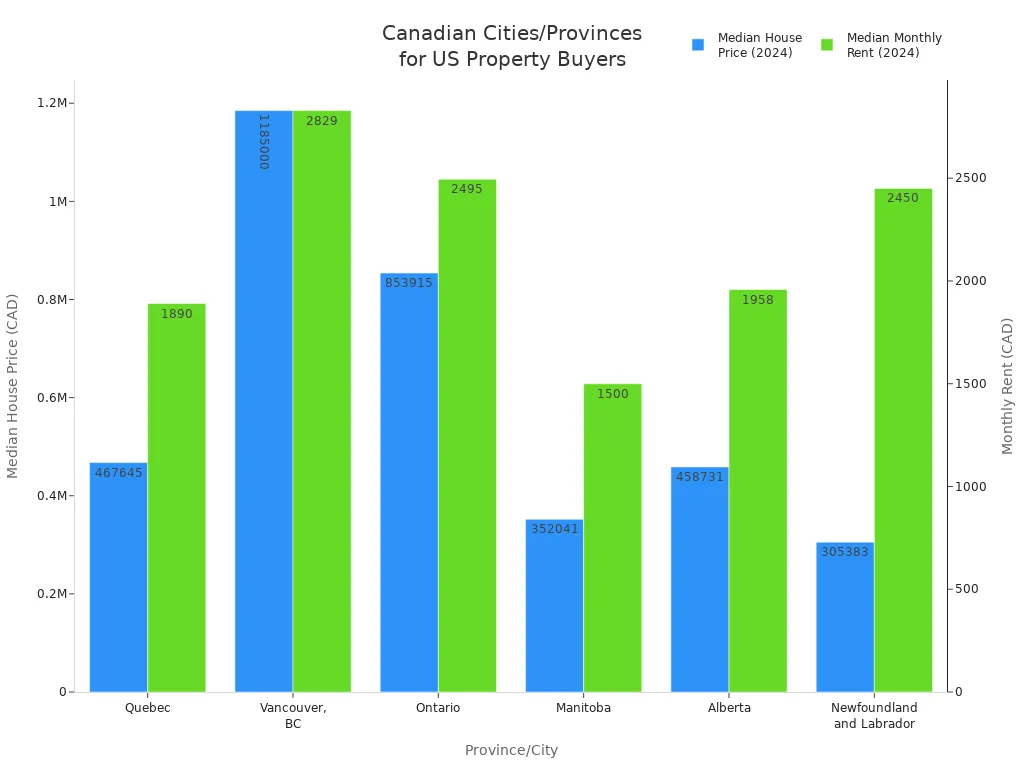

You can also compare popular cities and provinces using this table:

| Province/City | Median House Price (2024) | Median Monthly Rent (2024) | Popular Areas for Investment | Key Appeal Factors |

|---|---|---|---|---|

| Quebec | $467,645 | $1,890 | Montreal, Quebec City | Affordable prices, steady appreciation, quality of life |

| Vancouver, BC | $1,185,000 | $2,829 | Downtown, Kitsilano, Mount Pleasant | Scenic beauty, strong demand, limited land |

| Ontario | $853,915 | $2,495 | Toronto, Ottawa | Dynamic market, economic growth, population growth |

| Manitoba | $352,041 | $1,500 | Winnipeg, St. Boniface, Brandon | Affordability, stable market, emerging tech sector |

| Alberta | $458,731 | $1,958 | Calgary, Edmonton, Canmore, Banff | Diverse properties, vacation spots, affordability |

| Newfoundland and Labrador | $305,383 | $2,450 | St. John’s, Mount Pearl, Corner Brook | Affordable coastal living, peaceful lifestyle |

If you want to find real estate in Canada, think about your budget, lifestyle, and long-term plans. The best city to buy property in Canada depends on your needs. Some buyers want city life, while others prefer quiet towns.

Working with Real Estate Agents

You should work with a real estate agent who knows the Canadian real estate market. Agents help you find real estate in Canada that matches your goals. They explain how to buy property in Canada and guide you through each step. Agents also know about local rules and can help you avoid common mistakes. When buying property, a good agent will show you listings, arrange viewings, and help with offers. You can ask them about the best city to buy property in Canada for your situation. If you want to start buying real estate in Canada, a trusted agent is your best partner.

Note: Choose an agent who has experience with Americans purchasing property. This makes the process smoother and helps you understand the Canadian real estate system.

Making an Offer

Offer Process

You start the offer process by making sure your finances are ready. Contact Canadian banks to get a mortgage or prepare to pay cash. Open a Canadian bank account if you have not done so. Next, get a non-resident Tax Number from the Canada Revenue Agency. This number helps you meet tax rules. You should talk to a tax professional about your tax responsibilities in both the United States and Canada. Some provinces charge extra taxes, like the Non-Resident Speculation Tax, so you need to know about these costs.

Work with a Canadian real estate agent to find the right property. Hire a real estate lawyer to review your offer and make sure you follow all laws. Prepare for extra costs, such as land transfer taxes, legal fees, and inspection fees. You may also need to think about currency exchange rates, since all payments use Canadian dollars.

Here is a simple list of steps:

- Arrange your financing and open a Canadian bank account.

- Get your non-resident Tax Number.

- Consult a tax professional about cross-border taxes.

- Work with a real estate agent and a lawyer.

- Prepare for extra costs and currency changes.

Tip: Always check if the property is in an area where foreign buyers can purchase. Some cities have restrictions.

Due Diligence and Inspections

You need to do careful research before you buy. Start by looking at the local market and the neighborhood. Check the property’s history and the seller’s background. Review all reports about the property’s condition and any seller disclosures. Look at environmental and energy assessments. Make sure the property has all the right permits and follows local codes.

- Visit the property with your advisors to check for maintenance or structural problems.

- Hire professionals to inspect the building, systems, and look for hazards like mold or flood damage.

- Review financial documents, such as tax bills and any debts on the property.

- Make a list of repairs or improvements you may need.

Note: Always conduct a full home inspection before you buy. This step helps you avoid costly surprises.

Legal Representation

You need a lawyer to protect your interests during the purchase. A lawyer will review your offer, check the title, and make sure the contract follows Canadian law. Your lawyer will also help you understand any restrictions on foreign buyers and make sure you meet all legal requirements. If you buy with a Canadian partner, your lawyer can explain how this affects your ownership. A real estate lawyer knows the rules for property transfers and can help you avoid legal problems. You should always choose a lawyer who has experience with cross-border real estate deals.

Tip: Ask your lawyer to explain every document before you sign. This helps you understand your rights and responsibilities.

Closing the Purchase

Closing Steps

You reach the final stage when you close on your Canadian property. Your lawyer will review the purchase agreement and confirm that all conditions are met. You will sign the final documents, pay the remaining balance, and cover closing costs. The lawyer will register the property in your name with the local land registry office. You will receive the keys once the funds clear and the title transfers. This process usually takes a few days after both parties sign the paperwork.

Tip: Always double-check the closing date and make sure you have enough time to transfer funds and complete all steps.

Required Documents

You need to prepare several documents for closing. These documents help prove your identity, show your source of funds, and confirm your right to buy property in Canada. Here is a list of common documents:

- Valid passport or government-issued photo ID

- Proof of Canadian bank account

- Purchase and sale agreement

- Proof of down payment and source of funds

- Mortgage approval letter (if using financing)

- Non-resident Tax Number from the Canada Revenue Agency

- Proof of payment for closing costs and taxes

Your lawyer or real estate agent may ask for extra documents based on your situation. Always keep copies of everything for your records.

Transferring Funds

You must transfer the purchase funds to your Canadian lawyer’s trust account before closing. Americans use several methods to send money to Canada. Each method has pros and cons. The table below compares the most common options:

| Method | Pros | Cons |

|---|---|---|

| International Bank Transfer | Secure, familiar, can be done online or in person | Higher fees, slower (up to 5 days), exchange rate markups |

| International Money Transfer Services | Faster, cheaper, better exchange rates, online convenience | Need to create and verify accounts, variable fees and times |

Many buyers use banks because they feel secure, but banks often charge higher fees and offer less favorable exchange rates. Money transfer services like Wise or brokers can move funds faster and at lower cost. Some banks, such as RBC Bank, offer cross-border services that let you send up to $25,000 USD instantly between the U.S. and Canada with no fees. This option can save you time and money during closing.

Note: Always check transfer limits, fees, and exchange rates before sending large sums. Ask your lawyer for the correct trust account details to avoid mistakes.

Costs and Taxes

Property Transfer Tax

When you buy a home in Canada, you need to plan for property transfer tax. This tax is a key part of your property purchase costs. Each province sets its own rules and rates. Some provinces use a tiered system, while others charge a flat fee or registration cost. The table below shows how much you might pay in different provinces:

| Province | Tax Structure / Average Rate Description |

|---|---|

| British Columbia | Tiered rates: 1% on first $200K, 2% on $200K-$2M, 3% above $2M; extra 2% on portion above $3M for residential properties. |

| Alberta | No traditional land transfer tax; charges registration fees: $50 plus $5 per $5,000 of property value. |

| Quebec | Tiered: 0.5% up to ~$61.5K, 1% up to ~$307.8K, 1.5% above; municipalities add up to 3%, Montreal has higher tiers. |

| Ontario | Tiered: 0.5% up to $55K, 1% on $55K-$250K, 1.5% on $250K-$400K, 2% above $400K, 2.5% above $2M; municipal taxes may apply. |

| Manitoba | Tiered: 0% up to $30K, 0.5% on $30K-$90K, 1% on $90K-$150K, 1.5% on $150K-$200K, 2% above $200K; plus registration fees. |

| Nova Scotia | Deed Transfer Tax varies by municipality, ranges from $0 to $3,000 on $200K property. |

| New Brunswick | Flat 1% on assessed or purchase price, whichever is greater. |

| Prince Edward Island | Flat 1% on purchase price or assessed value, whichever is greater. |

You should check the latest rates in your chosen province. Some cities, like Toronto or Montreal, add extra municipal taxes. These taxes can increase your total property purchase costs.

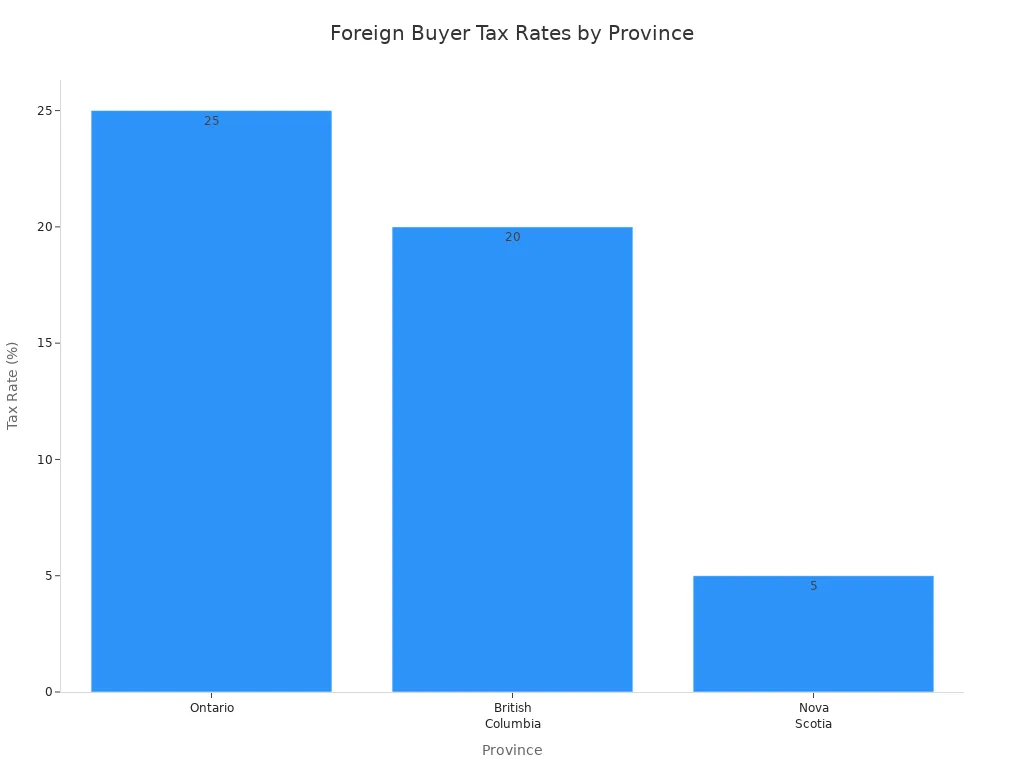

Foreign Buyer Taxes

Some provinces charge extra taxes for foreign buyers. These taxes can make a big difference in your budget. The table below shows the main provinces with these taxes and their current rates:

| Province | Foreign Buyer Tax Name | Current Rate |

|---|---|---|

| Ontario | Non-Resident Speculation Tax (NRST) | 25% |

| British Columbia | Additional Property Transfer Tax | 20% |

| Nova Scotia | Non-resident Deed Transfer Tax | 5% |

If you buy in Ontario, British Columbia, or Nova Scotia, you must pay this tax on top of other property purchase costs. These rules apply to most foreign buyers, including Americans. Always ask your real estate agent about the latest tax rates before you buy.

Ongoing Costs

Owning property in Canada comes with regular expenses. You will pay annual property taxes, which vary by city and province. If you do not live nearby, you may need to hire a property manager. This helps keep your home safe and well-maintained. Renting out your property means you must file income tax returns in Canada. The Canada Revenue Agency requires a 25% withholding tax on gross rental income for foreign buyers. You also need to report this income on your U.S. tax return. If you sell your property, both Canada and the U.S. will tax your capital gains. You may face extra costs if you use your home for short-term rentals, as some cities have special rules. Always plan for these ongoing costs to avoid surprises.

Residency and Immigration

Image Source: unsplash

Buying Property and Residency

You might wonder if buying a home in Canada helps you become a resident or citizen. The answer is no. Canada does not offer residency or citizenship just because you own property. You need to follow immigration programs if you want to live in Canada long-term. Here are some important facts:

- Buying property in Canada does not give you residency or citizenship.

- Canada does not have a citizenship-by-investment program.

- You cannot get permanent residency by real estate investment alone.

- Most foreign investors cannot buy residential properties in major cities, except for some recreational or rural properties.

- If you want to move to Canada, you must apply through business immigration programs, such as the Start-Up Visa or Provincial Nominee Programs. These require you to invest in and manage a Canadian business.

- To become a citizen, you must first get permanent residency and live in Canada for at least three years.

- If you break the rules about foreign property ownership, you could face fines or be forced to sell your property.

Note: The Prohibition on the Purchase of Residential Property by Non-Canadians Act does not connect to immigration status. It aims to keep housing affordable for Canadians.

Visitor Rules

Owning property in Canada does not give you special travel rights. You must follow the same visitor rules as other Americans. Here is what you need to know:

- U.S. citizens do not need a visitor visa or an Electronic Travel Authorization (eTA) to visit Canada for up to six months.

- You must show a valid U.S. passport at the border.

- Canadian border officers decide if you can enter. They check your travel documents and ask about your plans.

- You must prove you have ties to the United States, such as a job, home, or family.

- You need to show you have enough money for your stay and that you plan to leave Canada after your visit.

- Owning property in Canada does not give you any special entry privileges or exemptions.

Tip: Always carry proof of your ties to the United States and your travel plans when you visit your Canadian property. This helps border officers see that you plan to return home.

Avoiding Pitfalls

Common Mistakes

You can avoid many problems if you know what to watch for when buying property in Canada. Many Americans make the same mistakes during this process. Here are some of the most common issues:

- You might forget to check all property details and restrictions before you buy. This can make it hard to sell the property later.

- You may underestimate how hard it is to get financing. Canadian banks often ask for a larger down payment, sometimes 20-35% or more. They may not accept your U.S. credit history.

- You could ignore foreign buyer restrictions, like the Prohibition on the Purchase of Residential Property by Non-Canadians Act. This law limits where you can buy until at least 2027.

- Some buyers do not open a Canadian bank account. This step makes payments easier and can help you save on exchange fees.

- You might forget about extra taxes. These include Property Transfer Tax, Foreign Buyer Taxes (which can be 20-25% in some provinces), and yearly property taxes.

- Many people overlook legal fees. Some provinces require you to pay for a real estate lawyer.

- You may not understand Canadian mortgage rules, such as stress tests and mortgage insurance.

- Some buyers do not keep good records of transactions and exchange rates. This can cause problems with taxes later.

- You might not report rental income or foreign bank accounts, which can lead to IRS penalties.

- Ignoring currency exchange rate changes can increase your taxable gains.

Tip: Always double-check the rules in your chosen province and keep detailed records of every step.

Working with Professionals

You should work with experts who know both U.S. and Canadian real estate rules. A real estate agent with cross-border experience can help you find the right property and avoid local restrictions. A tax advisor can explain how to report your income and avoid double taxation. You need a lawyer to review contracts, check property titles, and make sure you follow all legal steps. These professionals help you understand complex rules, manage taxes, and protect your investment.

Note: Professional advice can save you money and prevent legal trouble. Always ask questions if you do not understand something.

Buying a home in Canada as an American involves several important steps. You need to check both federal and provincial rules, including taxes like the Property Transfer Tax and Foreign Buyers Tax.

- Prepare a down payment of at least 35% and open a Canadian bank account.

- Plan for extra costs such as legal fees, inspections, and exchange rate changes.

- Remember, owning property does not give you residency.

Always work with real estate and tax professionals who understand cross-border rules. Stay updated by checking official Canadian government websites and local real estate boards.

FAQ

Can you buy property in Canada as an American if you do not live there?

Yes, you can buy property in Canada even if you do not live there. You must follow federal and provincial rules. Some areas have restrictions or extra taxes for foreign buyers. Always check the latest laws before you start.

How much money do you need for a down payment as a non-resident?

You usually need at least 35% of the purchase price as a down payment. For example, if a home costs $400,000 USD (check the current exchange rate), you need $140,000 USD. Canadian banks require proof that these funds are yours.

Do you need a Canadian bank account to buy a home in Canada?

You need a Canadian bank account to pay your down payment and handle other costs. Most banks ask you to visit in person with your passport and proof of address. Some banks offer virtual account opening options.

What taxes will you pay when buying property in Canada as an American?

You may pay property transfer tax, foreign buyer tax, and annual property taxes. The rates depend on the province. For example, Ontario charges a 25% Non-Resident Speculation Tax. Always check the latest rates and use the current USD to CAD exchange rate.

Buying property in Canada as an American is not just about meeting legal requirements—it also means moving large sums of money across borders. Using traditional banks can lead to high wire fees and unfavorable exchange rates. With BiyaPay, you enjoy remittance fees as low as 0.5%, transparent pricing, and support for both fiat and digital currency conversions. Transfers are processed with same-day remittance and same-day arrival, covering most countries and regions worldwide. Before you transfer funds for your down payment or closing costs, you can always verify costs using our real-time exchange rate tool.

Make your cross-border property purchase smoother and more cost-effective—register today with BiyaPay and experience fast, affordable, and secure international transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.