- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How long does it take for an international wire transfer to arrive

Image Source: unsplash

You usually receive an international wire transfer in 1 to 5 business days, but sometimes it may take up to 1 or 2 weeks. The time your money transfer takes depends on many factors. Banks process transfers on their own schedules. If your transfer passes through several banks or uses a less common currency, you may wait longer. Checks for compliance, accuracy in recipient details, time zone differences, and banking holidays can also delay the transfer.

Key Takeaways

- International wire transfers usually take 1 to 5 business days but can take up to 1 or 2 weeks depending on factors like banks involved, currency, and holidays.

- Sending your transfer early in the day and double-checking all recipient details helps avoid delays and ensures your money arrives faster.

- Choosing a fast and reliable service, such as specialist money transfer companies, can speed up your transfer and reduce fees.

- Intermediary banks, currency conversion, and compliance checks add extra time, so fewer banks and major currencies usually mean quicker transfers.

- If your transfer is delayed, track it with your bank, confirm all details, and contact customer service to resolve issues quickly.

International Wire Transfer Timeframes

Image Source: pexels

Typical Duration

When you send an international wire transfer, you usually want to know how long it will take for the money to arrive. Most wire transfers between countries take 1 to 5 business days to clear. This is the standard range for average processing times at major global banks. Some banks can complete a wire transfer on the same day, but this often requires an extra fee and only works for certain countries.

Note: Transfers involving major currencies like USD, Euro, or GBP tend to move faster. If you send money to a country with a strong banking system, you may see the funds arrive in 1 to 2 business days.

Several factors affect the time it takes for an international wire transfer to complete:

- Banking regulations in the sending and receiving countries

- Currency conversion steps

- Time zone differences between banks

- Bank holidays and weekends in either country

- The number of intermediary banks involved

If you send money to a country with a weaker currency or a less developed banking system, the wire transfer may take longer. In rare cases, the process can stretch to 1 or even 2 weeks, especially if there are errors or extra compliance checks.

Fast and Slow Scenarios

You have several options for sending an international wire transfer. The method you choose can change how quickly your money arrives. Here is a comparison of common services:

| Transfer Service | Typical Transfer Time | Factors Affecting Time | Additional Notes |

|---|---|---|---|

| Western Union | 1 to 2 business days | Destination country, banking hours, verification | Uses a global network and advanced technology for faster processing and real-time tracking |

| SWIFT Wire Transfers | 1 to 3 business days | Intermediary banks, currency conversion, banking holidays | Can be as fast as 24 hours between major banks; may take up to a week with delays |

| Other Major Services | Slower than wire transfers | Less commonly used for international transfers | ACH transfers are slower and not widely used for international payments |

If you use a service like Western Union, you may see the funds delivered within one business day. This is possible because Western Union uses a large global network and advanced technology. However, if the destination country has strict banking rules or needs extra verification, the transfer may take longer.

SWIFT wire transfers are common for international payments. These usually take 1 to 3 business days. If you send money between major banks in developed countries, the transfer can finish in less than 24 hours. If your transfer passes through several intermediary banks or involves a less common currency, it may take up to a week.

Tip: If you want to know how international wire transfers work, ask your bank about their process and cutoff times. Some banks in Hong Kong, for example, have later cutoff times, which can help reduce delays.

You may also find that some countries have instant payment systems. For example, the UK, India, and Singapore can process certain wire transfers within minutes or on the same day. SEPA payouts in Europe can also arrive quickly, sometimes within minutes.

On the other hand, transfers to countries with slow banking systems or strict anti-money laundering checks may take much longer. Some countries even have a “slow-to-pay” status, which can delay your wire transfer for up to three weeks or cause it to be canceled.

Here are some key points to remember about how international wire transfers work and what affects their timeframes:

- Transfers in major currencies like USD and Euro are faster.

- Bank holidays and weekends in either country add delays.

- Time zone differences can push processing to the next business day.

- Errors in recipient details, such as incorrect SWIFT codes, often cause delays.

- The more intermediary banks involved, the longer the transfer may take.

If you want your wire transfer to arrive quickly, choose a service with a strong global network, send money in a major currency, and double-check all recipient details.

Transfer Speed Factors

Bank Processing and Cutoff Times

When you send a wire transfer, the processing speed depends on when you submit your request. Banks only process transfers during business hours. Each bank sets a cutoff time, which is the latest moment you can send a wire transfer for same-day processing. If you miss this cutoff, your transfer will wait until the next business day. Here are some common cutoff times at major U.S. banks:

- Bank of America: 5 PM EST

- Chase Bank: 4 PM EST

- Citibank US: 5:15 PM EST

- Goldman Sachs: 4 PM EST

- US Bank: 4 PM EST

- Wells Fargo: 5 PM EST

If you send a wire transfer after these times, the bank will process it the next business day. Time zone differences can also cause delays. For example, if you send money from Hong Kong to the U.S. late in the day, you might miss the cutoff in both places. Weekends and bank holidays add more waiting time because banks do not process transfers when they are closed.

Intermediary Banks

Many wire transfers need help from intermediary banks. These banks act as bridges when the sending and receiving banks do not have a direct relationship. Each intermediary bank adds extra steps. They receive, check, and forward your transfer. This process increases the total time and may add extra fees. If your transfer passes through several intermediary banks, each one can slow things down. Sometimes, they ask for more documents or checks, which can delay your transfer even more.

- Each intermediary bank adds processing steps and possible fees.

- More intermediary banks mean longer transfer times.

- The SWIFT network often uses multiple banks, which can slow down the process.

Currency Conversion and Compliance

Wire transfers between countries often need currency conversion. The bank must change your money into the recipient’s currency at the current exchange rate. This step can take extra time, especially if the currencies are not common. The bank may need to wait for the best rate or clear the funds through international networks.

Banks also follow strict rules to prevent fraud and money laundering. They check large or suspicious transfers, especially those over $10,000 USD. These compliance checks can delay your wire transfer. Intermediary banks may also review your transfer for safety. Sometimes, banks cannot tell you about these delays, which can be frustrating.

| Factor | Impact on Wire Transfer Time |

|---|---|

| Currency Conversion | Adds extra processing and settlement time |

| Compliance Checks | Delays due to verification and reporting |

| Intermediary Banks | More steps and possible extra documentation |

If you want your wire transfer to arrive quickly, plan ahead. Send your transfer early in the day, avoid weekends and holidays, and check if your bank uses intermediary banks.

Required Information

Sender and Recipient Details

When you send a wire transfer, you must provide specific information about yourself and the person receiving the money. Banks need these details to process your request and make sure the funds reach the right account. If you miss any part, your wire transfer may not go through.

Here is a list of the most common details you need to give:

- Your full name and address

- Your phone number

- Recipient’s full name as shown on their bank account

- Recipient’s address and phone number

- Name and address of the recipient’s bank

- Recipient’s bank account number and account type

- Bank’s IBAN (International Bank Account Number), if required

- Bank’s BIC or SWIFT code

- Amount you want to send (in USD or another currency)

- Purpose of the transfer

- Reference or message for the recipient (optional)

Some banks, like those in Hong Kong, may ask for extra details. For example, if you send money to a Chase account, you need the bank’s full name, branch address, and the correct SWIFT code (such as CHASUS33). Always check with your bank to see if they need more information for your wire transfer.

Importance of Accuracy

You must double-check every detail before you send a wire transfer. Even a small mistake, like a wrong account number or SWIFT code, can cause big problems. Missing or incorrect information often leads to delays, rejected transfers, or even lost money.

Providing complete and accurate recipient information—including full name, address, IBAN, and SWIFT code—helps prevent delays or rejection of international wire transfers. Some countries also require you to state the reason for the transfer to follow their rules.

- Delays or rejection of your wire transfer

- Money sent to the wrong account, which is hard to recover

- Extra fees from intermediary banks

- Damaged trust between you and the recipient

- Legal problems if you send money to someone involved in illegal activities

You can avoid these issues by checking all details before you submit your wire transfer. This step helps your money arrive safely and on time.

Wire Transfer Delays

Image Source: pexels

Common Causes

You may wonder why international wire transfers might be delayed. Many reasons can slow down a wire transfer. Some of the most common causes include:

- Errors in recipient details, such as misspelled names or incorrect SWIFT codes, often cause delays or even rejection.

- Bank-specific restrictions, like country bans or transaction limits, can stop or slow your transfer.

- Technical errors, such as system glitches or SWIFT network issues, may hold up your money.

- Holidays and weekends mean banks do not process transfers, so your wire transfer waits until the next business day.

- Missing the bank’s cutoff time can push your transfer to the next day.

- Intermediary banks add extra steps, which can increase the time it takes for your funds to arrive.

- Currency conversion and local regulations in the destination country can slow down the process.

- Compliance checks, including anti-money laundering reviews, may hold your transfer for extra verification.

- Recipient bank rules and manual processing at smaller banks can also cause delays.

Recent rules require banks to review wire transfers more closely. These checks can take several hours, days, or even weeks in rare cases. You may not always know when a review is happening, which can make the wait feel longer.

What to Do If Delayed

If your wire transfer takes longer than expected, you can take steps to solve the problem:

- Check all recipient details, including SWIFT/BIC codes and account numbers, to make sure they are correct.

- Track your wire transfer using the confirmation or tracking number from your bank.

- Contact your bank’s customer service for updates on your transfer status.

- Ask if your transfer needs extra documents or verification.

- Confirm that you sent the wire transfer before the bank’s cutoff time.

- Make sure you have enough funds in your account to cover the transfer and any fees.

- Avoid sending transfers on weekends or holidays, as banks do not process them on these days.

- If your transfer is urgent, ask about expedited or same-day options.

- If delays continue, consider using a faster service, such as Wise, for future transfers.

You can avoid many delays by double-checking your information and sending your wire transfer early in the day. Knowing why international wire transfers might be delayed helps you plan better and avoid frustration.

Tips for Faster Transfers

Sending Early

You can speed up your wire transfer by sending it early in the day and early in the week. Banks process transfers only during business hours. If you send a wire transfer late in the day, your bank may wait until the next business day to start the process. Time zone differences also matter. For example, if you send money from the U.S. to China during U.S. business hours, Chinese banks may not open until many hours later. If you send a wire transfer on a Friday, the recipient may not get the funds until Monday or Tuesday.

Sending your wire transfer early helps you avoid delays from weekends, public holidays, and time zone gaps.

Here are some reasons to send your wire transfer early:

- Banks process transfers only on working days.

- Transfers sent late in the day or before holidays may face delays.

- Time zone differences can push your transfer to the next business day.

- Intermediary banks can add 0.5 to 2 days to the process.

Double-Checking Details

You should always double-check all information before sending a wire transfer. Even a small mistake, like a wrong account number or a misspelled name, can cause delays or failed transfers. Many wire transfers fail because of incorrect or incomplete details. Double-checking helps you avoid these problems.

- Incorrect account numbers often cause payment returns.

- Typos can lead to failed transactions.

- Confirming details with the recipient helps ensure accuracy.

- Errors can make it hard to recover your money.

Always review the recipient’s account number, routing number, and name before you send your wire transfer.

Choosing the Right Service

The service you choose affects how fast your wire transfer arrives and how much you pay. Specialist money transfer companies often process transfers faster than banks. Some services can deliver funds in 24 hours or even instantly. Traditional banks may take 1 to 3 business days and often charge higher fees.

| Service Type | Typical Transfer Speed | Notes |

|---|---|---|

| Specialist Money Transfer Companies | As fast as 24 hours or near-instant | Faster due to fewer intermediaries. Examples: Wise, Currencies Direct, TorFX |

| Standard Transfers (Banks) | 1-3 business days | Slower because of intermediary banks and processing delays |

| Instant Transfers | Near-instant | Some specialist services and cryptocurrency transfers |

| Same-Day Transfers | Same day | Available from many providers |

Specialist providers like Wise use transparent fees and mid-market exchange rates. They often avoid hidden costs and deliver faster results. Banks may charge $15 to $65 per wire transfer and add extra fees for currency conversion. Choosing the right service can save you time and money.

You can expect most international wire transfers to arrive within 1 to 5 business days. Several factors influence the speed, such as the number of intermediary banks, time zone differences, and compliance checks.

- Always verify recipient details, including SWIFT and IBAN codes, to prevent delays.

- Send your transfer early and choose the right payment method for faster results.

Taking these steps helps you avoid common issues and ensures your money reaches its destination quickly.

FAQ

How can you track your international wire transfer?

You can track your transfer using the reference or tracking number your bank provides. Contact your bank’s customer service or use their online banking platform to check the status.

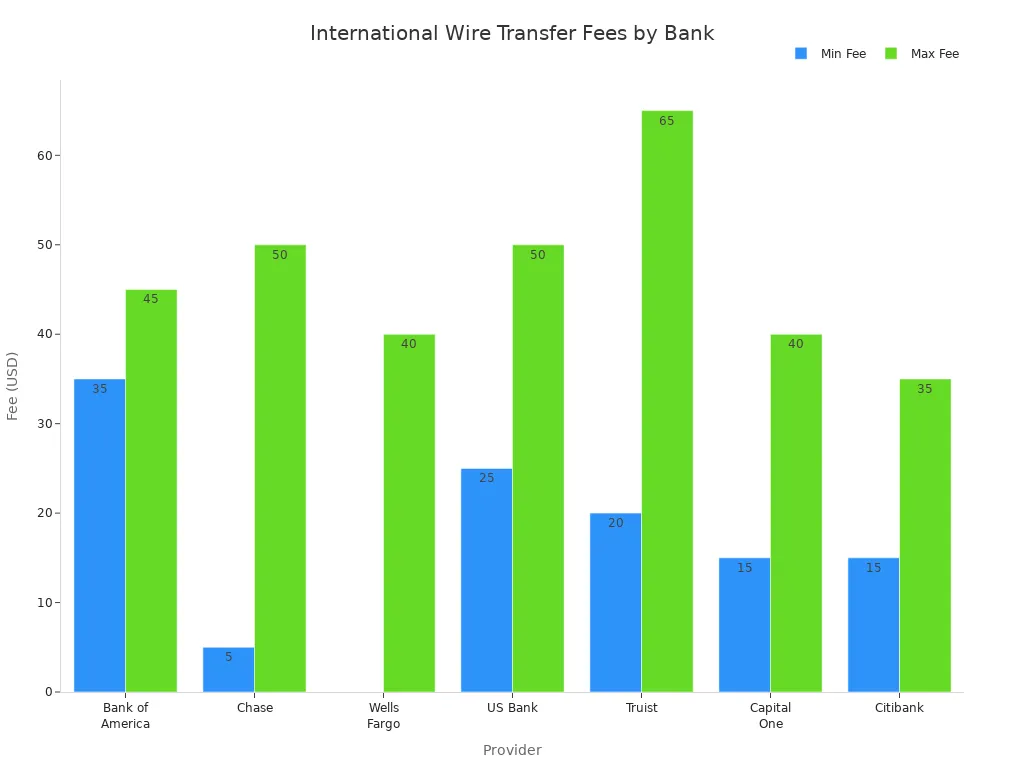

What fees should you expect for an international wire transfer?

Fees vary by bank and service. Here is a quick comparison:

| Service Type | Typical Fee (USD) |

|---|---|

| Hong Kong Banks | $20–$50 |

| Major U.S. Banks | $15–$65 |

| Specialist Services | $0–$15 |

Always check with your provider for exact costs.

Can you cancel an international wire transfer after sending it?

You can request a cancellation if the funds have not reached the recipient’s bank. Contact your bank immediately. If the transfer has already cleared, you may not recover your money.

What should you do if your wire transfer does not arrive?

First, confirm all recipient details. Then, contact your bank with your tracking number. Ask if there are any compliance checks or missing documents. Your bank can help trace the transfer and provide updates.

Traditional international wire transfers often take 1–5 business days or even longer, especially when multiple intermediary banks, currency conversions, and compliance checks are involved. With BiyaPay, you can avoid unnecessary delays and hidden costs. Our platform offers remittance fees as low as 0.5%, supports multi-currency and digital asset conversions, and enables same-day transfers to most countries and regions worldwide. Before sending money, use our real-time exchange rate calculator to ensure transparent costs and maximize your value.

Don’t let outdated banking systems slow you down—register with BiyaPay today and experience faster, safer, and more affordable international transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.