- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Easily Send Money with Venmo

Image Source: pexels

You can send money on Venmo in just a few taps. Nearly one-third of U.S. adults use Venmo for peer-to-peer payments, often sending around $65 to $75 per transaction. Transfers between users happen instantly.

Venmo keeps things fast and easy, even if you are new and want to know how to send money.

Key Takeaways

- Send money quickly by opening the Venmo app, choosing a recipient, entering the amount, and confirming your payment.

- Set up your Venmo account by creating an account, verifying your identity, and linking a bank or card to start sending money.

- Keep your account safe by setting privacy to private, using strong passwords, enabling two-factor authentication, and only sending money to people you trust.

How to Send Money on Venmo

Image Source: pexels

Sending money with Venmo is quick and simple. If you want to pay someone on Venmo or transfer money from Venmo to a friend, you can follow this step by step guide. Here’s how to send money on Venmo, from opening the app to confirming your payment.

Open the Venmo App

Start by opening the Venmo app on your phone. Log in with your username and password if you are not already signed in. Make sure your app is updated to the latest version to avoid glitches or errors. A stable internet connection helps your transfer go smoothly.

Choose Pay or Request

Once you are in the app, look for the “Pay or Request” button. You will usually find this icon at the top right corner of your screen. Tap pay to begin the process. If you want to receive money on Venmo, you can also use the request option.

Select Recipient

Now you need to choose who you want to pay. Venmo gives you several ways to find the right person:

- Search by username, phone number, or email. Type the information in the search bar.

- Scan a QR code. Tap the scan icon and point your camera at your friend’s Venmo QR code.

- Sync your phone contacts or Facebook friends. Go to Settings, then Friends & Social, and turn on Phone Contacts or Facebook Contacts. This helps you find people you know who use Venmo.

Always double-check the recipient’s details before you send money. This helps you avoid sending money to the wrong person.

Enter Amount and Note

Type in the amount you want to send. You can send money for anything, like splitting a bill or paying for lunch. Venmo lets you add a note or emoji to your payment. This makes your transfer more personal and fun. Many people use notes to explain what the payment is for, like “pizza night” or “movie tickets.” Adding a note or emoji also helps you remember what each payment was for when you look back at your activity feed.

Tip: Adding a note or emoji turns your payment into a social interaction. It makes sending money feel more like chatting with friends.

Pick Payment Method

Venmo gives you several ways to pay someone. You can choose from:

| Payment Method | Fee | Speed/Notes |

|---|---|---|

| Venmo Balance | Free | Instant payment within Venmo |

| Linked Bank Account | Free | Instant payment within Venmo |

| Debit Card | Free | Instant payment within Venmo |

| Credit Card | 3% fee | Instant payment within Venmo |

You can select your payment method before you tap pay. If you use a credit card, Venmo charges a 3% fee. Payments from your Venmo balance, bank account, or debit card are free. Make sure you have enough funds in your chosen account before you send money.

Confirm and Send

Review all the details. Check the recipient, amount, note, and payment method. When you are ready, tap pay to send money instantly. Venmo will show you a confirmation screen. You can track your transfer in the activity tab. If you want to transfer money from Venmo to your bank, you can do that from the main menu. Standard transfers to your bank are free and take 1 to 3 business days. Instant transfers cost 1.5% (minimum $0.25, maximum $10) and usually arrive within 30 minutes.

Note: If your payment does not go through, check your internet connection, make sure your app is updated, and confirm your bank or card details are correct.

Common Mistakes and How to Avoid Them

Here are some common errors people make when they send money on Venmo, along with tips to avoid them:

| Common User Errors on Venmo Sending Money | How to Avoid Them |

|---|---|

| Insufficient funds in linked bank or Venmo balance | Check your balances before you send money |

| Incorrect or outdated bank account or card info | Keep your linked accounts and cards updated |

| Unstable or slow internet connection | Use a stable internet connection |

| Outdated Venmo app version | Update the Venmo app regularly |

| Payment declined by bank or card issuer | Contact your bank or try another payment method |

If you follow these steps, you will know how to send money, how to pay someone, and how to transfer money from Venmo without trouble. Venmo makes it easy to pay someone on Venmo, send money on Venmo, and transfer money from Venmo to your bank.

Venmo Account Setup

Image Source: unsplash

Setting up your venmo account is the first step before you can send or receive money. You need to create your account, verify your identity, and link a bank or card. Let’s walk through each part so you can get started with venmo quickly.

Create Account

You can set up a venmo account in just a few minutes. Here’s what you need to do:

- Download the venmo app and open it on your device.

- Enter your first and last name, email, and create a password. You can also sign up with Facebook to speed things up.

- Accept the User Agreement and Privacy Policy.

- Add a U.S.-based phone number. venmo will send you a 4-digit code by text.

- Enter the code to confirm your phone number.

- Pick a username and profile picture if you want.

You must be at least 18 years old, have a U.S. phone number, and be in the United States to open a venmo account.

Verify Identity

venmo asks you to verify your identity to keep your account safe and unlock all features. You will need to provide your legal name, date of birth, address, and the last four digits of your Social Security Number. venmo may also ask for a photo ID, like a driver’s license or passport. You can find the identity verification option in the app under Settings. This step helps prevent fraud and lets you use your venmo account for higher payment limits.

Link Bank or Card

To send money, you must link a payment source to your venmo account. You can add a bank account, debit card, or credit card. venmo accepts most major cards, including Visa, Mastercard, Discover, and American Express. Some prepaid cards work too. You can link your bank by logging in through the app or by entering your account details manually. venmo recommends verifying your bank before sending money. Remember, credit card payments have a 3% fee, and some banks may charge extra fees.

| Common Setup Issue | How to Fix It |

|---|---|

| App not working | Update the app or reinstall it |

| Can’t verify phone/email | Double-check your info and try again |

| Payment declined | Make sure your bank or card info is correct |

| Account locked | Contact venmo support for help |

If you follow these steps, your venmo account will be ready to use. You need a linked bank account, debit, or credit card to send money.

Venmo Payment Methods

Venmo gives you several ways to pay friends, family, or businesses. You can use your Venmo balance, a linked bank account, or a debit or credit card. Each option works a little differently, so you can pick what fits your needs best.

Venmo Balance

If you have money in your Venmo balance, you can use it to send payments right away. To add money, open the Venmo app and go to the Me tab. Tap “Add Money,” pick your bank or debit card, enter the amount, and confirm. Transfers from a bank usually take three to five business days, while debit card transfers are often instant. You do not need to keep money in your Venmo balance to pay someone. If your balance is too low, Venmo will use your linked payment method to cover the rest.

Bank Account

You can link a bank account to Venmo for sending money. Go to Settings, tap Payment Methods, and choose Add bank or card. You can enter your bank details or log in with your online banking info. Venmo lets you pick between instant or manual verification. When you send money, you can choose your bank account as the payment source. If you want to move money back to your bank, tap Manage Balance and select Transfer to Bank.

Debit or Credit Card

Venmo also lets you add a debit or credit card. In the app, go to Payment Methods and tap Add bank or card. Enter your card details or scan your card with your phone. Debit card payments are free and instant. Credit card payments have a 3% fee. You can set a backup payment method in the app, so Venmo always knows where to pull funds if your balance is low.

Tip: You can manage all your payment sources in the Venmo app. Go to the Me tab, tap the settings gear, and select Backup Payment to review or update your options.

Send Money Limits and Fees

When you send money with Venmo, you need to know about payment limits and possible fees. These limits help keep your account safe and prevent fraud. Fees can affect how much money you actually send or receive.

Payment Limits

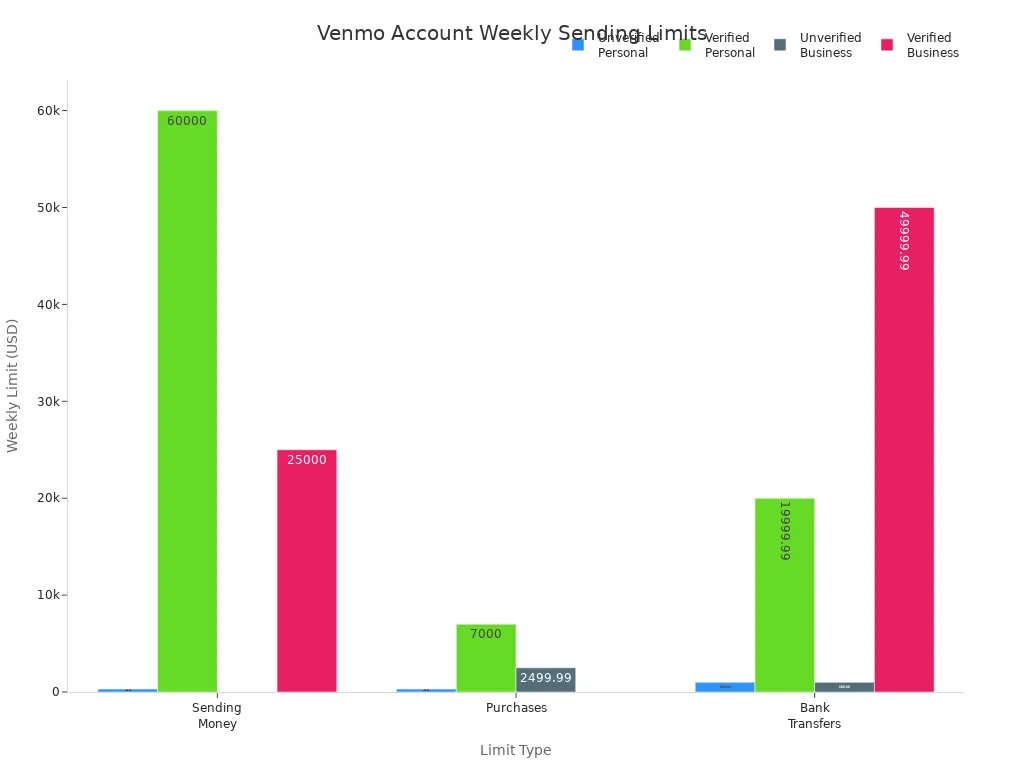

Venmo sets different limits based on your account status. If you verify your identity, you can send much more each week. Here is a table that shows the main limits for personal accounts:

| Account Type | Daily Sending Limit | Weekly Sending Limit (Person-to-Person) |

|---|---|---|

| Unverified Account | $299.99 | $299.99 |

| Verified Account | $4,999.99 | $4,999.99 |

If you use Venmo for business, your weekly sending limit can go up to $25,000 after verification. Verification means you provide your legal name, date of birth, and Social Security number. This step helps you unlock higher limits and more features.

You can also see how these limits compare in this chart:

Venmo uses a rolling 7-day period for these limits. That means your limit resets based on your activity over the last week, not on a set day.

Tip: If you need to send more money, make sure you complete the verification process in the app.

Fees Overview

Most payments on Venmo are free if you use your balance, bank account, or debit card. If you use a credit card, Venmo charges a 3% fee for each payment. Some credit card companies may also charge extra fees or higher interest rates, so check with your card provider before you pay.

Here is a quick look at the main fees:

| Fee Type | Fee Description | Fee Amount/Rate |

|---|---|---|

| Sending money with credit card | Fee for using a credit card to send money | 3% of the transaction amount |

| Instant transfer | Move money to your bank in minutes | 1.75% (min $0.25, max $25) |

| Standard transfer | Move money to your bank in 1-3 business days | Free |

Always review the fee details before you send money or transfer funds. This helps you avoid surprises and keeps your payments on track.

How to Use Venmo Safely

Keeping your money and information safe is important when you use Venmo. You can take a few simple steps to protect your account and keep your payments private. Here’s how to use Venmo with confidence.

Privacy Settings

Venmo lets you control who can see your transactions. Many people do not realize that payments can be visible to friends or even strangers by default. You can change this anytime. Here’s a quick look at your options:

| Privacy Setting | Visibility Description |

|---|---|

| Public | Anyone on the internet may be able to see the transaction. |

| Friends only | The transaction is shared with your Venmo friends and the other participant’s Venmo friends. |

| Private | The transaction is only visible in your personal transactions feed and to the other participant. |

To make all future payments private, go to the “Me” tab, tap the settings gear, select “Privacy,” and choose “Private.” You can also make past payments private and hide your friends list. This helps keep your financial activity away from prying eyes.

Tip: Setting your transactions to Private is the best way to keep your Venmo payments personal.

Account Security

You can add extra protection to your Venmo account. Set up a PIN or use Face ID or fingerprint unlock if your phone supports it. Always use a strong password that is hard to guess. Venmo also lets you turn on two-factor authentication. This means you will get a code by text or app when you log in, making it harder for someone else to get into your account.

| Security Feature | Description |

|---|---|

| PIN and Biometric Login | Add a PIN or use Face ID/fingerprint to unlock the app. |

| Two-Factor Authentication | Get a code by text or app for extra login security. |

| Strong Password | Use a unique password with letters, numbers, and symbols. |

| Fraud Monitoring | Venmo watches for strange activity and can freeze your account if needed. |

Remember to transfer large amounts to your bank. Venmo does not have FDIC insurance for your balance.

Avoiding Scams

Scams can happen on any payment app. You might get fake emails, calls, or messages that look like they are from Venmo. Some scammers pretend to be friends or ask for money for fake prizes or sales. Here are some ways to spot and avoid scams:

- Never send money to someone you do not know.

- Do not click on strange links or give out your password or codes.

- Double-check requests from friends, especially if they seem odd.

- Only buy from trusted Venmo business accounts.

- Mark payments as purchases if you buy goods or services.

If you think you got scammed, change your password, check your account activity, and contact Venmo support right away.

Stay alert and use these tips to keep your Venmo account safe.

You can send money with Venmo in just a few taps. For a smooth experience, follow these steps and keep your account safe:

- Never share your login info or password.

- Set your privacy to private.

- Only send money to people you trust.

Venmo also lets you split bills, use a debit card, and pay at many stores.

FAQ

How do you receive money on Venmo?

You just share your username or QR code. When someone sends you money, it appears in your Venmo balance. That’s how to receive money.

How do you transfer money from Venmo to your bank?

Open the app, tap “Manage Balance,” then choose “Transfer to Bank.” Enter the amount and select your bank. That’s how to transfer money from Venmo.

Can you use Venmo outside the United States?

Venmo only works if you sign up and use it in the United States. You cannot send or receive money on Venmo from other countries.

Venmo makes local transfers simple, but when it comes to sending money abroad, its limitations and fees can become frustrating. That’s where BiyaPay comes in. With BiyaPay, you can send funds globally with remittance fees as low as 0.5%, enjoy same-day delivery to most countries, and convert seamlessly between multiple fiat and digital currencies. Before you transfer, you can always check our real-time exchange rate calculator to see exactly how much your recipient will receive.

For a payment solution that goes beyond borders, sign up with BiyaPay today and experience fast, transparent, and secure international transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.