- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Payoneer Safety in 2025: What the Numbers Reveal

Image Source: pexels

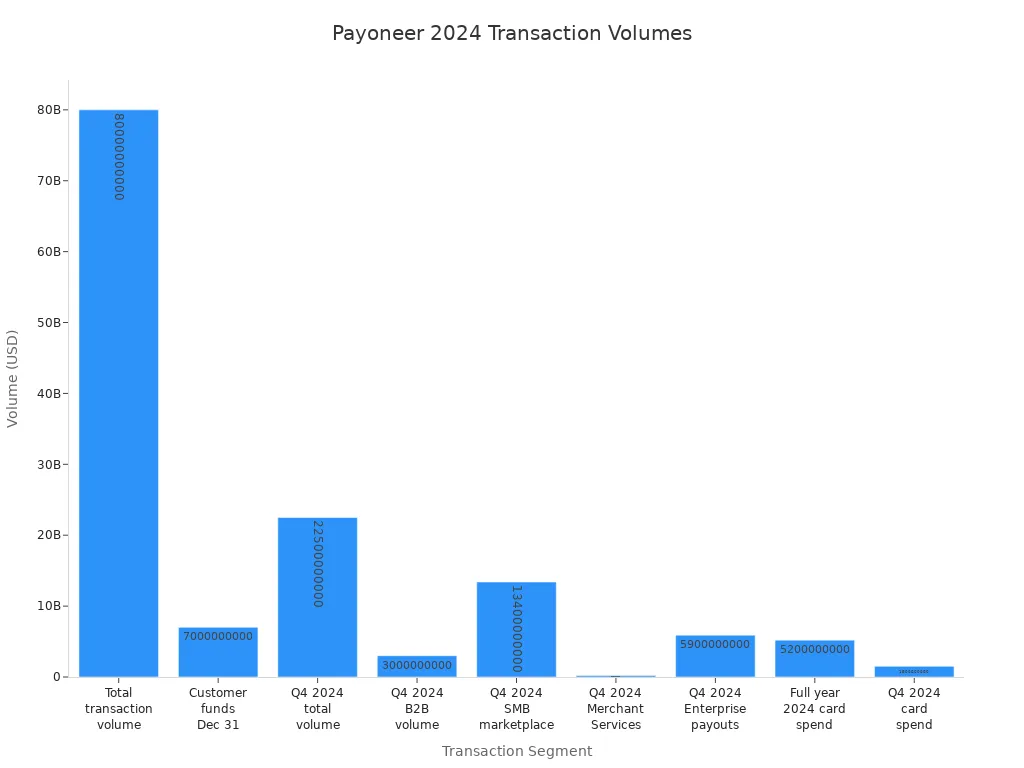

You can trust Payoneer safety in 2025. The online payment platform shows strong growth and stability. Recent numbers highlight this trend:

| Metric | Q1 2025 Value | Year-over-Year Growth |

|---|---|---|

| Transaction volume | $19.7 billion | 7% YoY |

| Active Ideal Customer Profiles (ICPs) | 556,000 | 5% YoY |

| Revenue excluding interest income | $188.6 million | 16% YoY |

Payoneer safety matters to you because you want your funds and data protected. Is payoneer safe? The numbers say yes. Payoneer uses advanced security measures to keep your information secure.

Key Takeaways

- Payoneer uses strong security tools like two-step verification and AI fraud detection to protect your money and data every day.

- Your funds stay safe in separate bank accounts, and Payoneer follows strict rules and regular audits to keep your money protected.

- Watch out for phishing scams and suspicious emails; never share your login details and always report threats to Payoneer support.

- Payoneer offers fast, global payments in many currencies, helping you send and receive money quickly and easily worldwide.

- Keep your account secure by using strong passwords, enabling two-factor authentication, and checking your account activity often.

Payoneer Safety Metrics

Image Source: pexels

Fraud Rates

You want to know how safe your money is with Payoneer. Payoneer uses advanced machine learning and two-step verification to stop fraud before it happens. These tools help keep your account secure. Payoneer’s fraud protection stands strong when compared to other payment platforms like PayPal. Both companies use machine learning and real-time alerts to catch suspicious activity. Payoneer relies on trusted third-party tools, such as RSA Adaptive Authentication and MaxMind, to watch for fraud. This approach gives you a level of protection that matches what you find with top payment services in 2025.

| Feature | Payoneer | Tipalti |

|---|---|---|

| Fraud Detection Technology | Multiple third-party tools (RSA, MaxMind, 41stParameter) | Built-in AI-driven fraud detection |

| AI Integration | Uses external tools | Integrated AI system |

| Fraud Prevention Impact | No public fraud rate stats | Blocked 7,400 payees, saved $4M |

| Screening Against Watchlists | Yes | Yes |

User Complaints

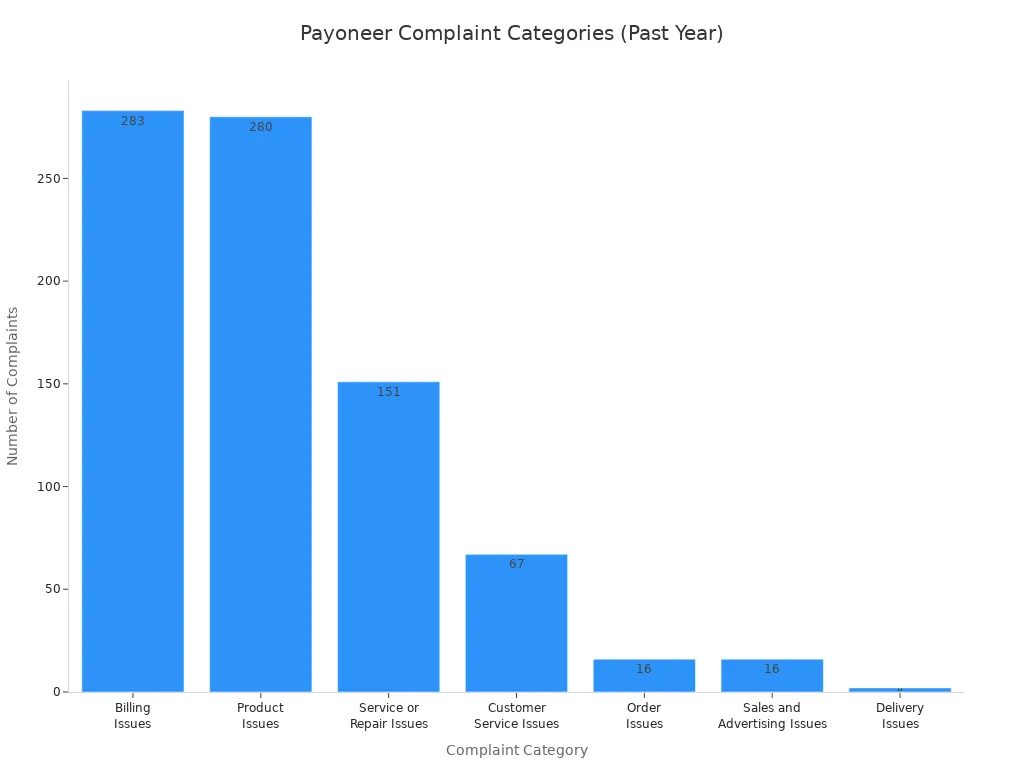

You may wonder how many people have problems with Payoneer. In the past year, Payoneer received 815 complaints. Most complaints involved billing and product issues. Some users also reported problems with customer service, account access, and verification delays. The chart below shows the main complaint categories:

| Complaint Category | Number of Complaints |

|---|---|

| Billing Issues | 283 |

| Product Issues | 280 |

| Service or Repair Issues | 151 |

| Customer Service Issues | 67 |

| Order Issues | 16 |

| Sales and Advertising Issues | 16 |

| Delivery Issues | 2 |

Security Incidents

You want to feel confident about Payoneer safety. In the last 12 months, Payoneer did not report any major security breaches. The company monitors accounts for hacking or unauthorized access. If Payoneer sees risky activity, it may close or limit your account to protect you. Payoneer also advises you not to use VPNs or log in from restricted regions. These steps help keep your funds and data safe. Payoneer meets strict regulatory standards and follows PCI compliance rules, which means your information stays protected.

Is Payoneer Safe?

Security Features

You want to know if your money and data stay protected when you use Payoneer. Payoneer safety starts with strong security features. The platform uses two-step verification every time you log in or make important changes. This means you need both your password and a code sent to your phone or email. Two-step verification makes it much harder for someone else to access your account, even if they know your password.

Payoneer also uses password encryption. When you create a password, Payoneer stores it in a way that no one can read, not even Payoneer staff. End-to-end encryption protects your data as it moves between your device and Payoneer’s servers. This keeps your information safe from hackers during secure international transactions.

You get real-time alerts for any suspicious activity. Payoneer’s fraud detection systems use artificial intelligence to spot unusual behavior. If something looks wrong, you receive a warning and Payoneer may freeze your account to protect you. These steps show that Payoneer safety is not just a promise but a daily practice.

Compliance Measures

You may ask, is Payoneer safe when it comes to following the rules? Payoneer works hard to meet strict international standards. The company follows regulations set by groups like the Financial Action Task Force (FATF) and the Financial Stability Board. These organizations require Payoneer to collect full information about who sends and receives money. This helps stop illegal activities and keeps your transactions transparent.

Payoneer faced a fine in 2023 for not meeting anti-money laundering (AML) rules. Since then, Payoneer has improved its systems. The company now uses advanced AI and machine learning to watch for suspicious payments in real time. Payoneer also works with regulators and industry partners to close any gaps in compliance. You benefit from these efforts because they help keep your money safe.

Payoneer complies with PCI DSS, a global security standard for payment companies. This means Payoneer must pass regular audits and use strong security controls. PCI DSS compliance lowers the risk of data breaches and unauthorized access. When you use Payoneer, you trust a platform that takes your safety seriously.

Tip: Using a PCI DSS compliant service like Payoneer shifts some security responsibility to the provider. This reduces your risk and helps protect your reputation.

Safeguarded Funds

You want to know what happens to your money if something goes wrong with Payoneer. Payoneer safety includes strict rules for safeguarding your funds. The company keeps your money in segregated accounts at major banks like Barclays and Citibank. These accounts stay separate from Payoneer’s own business funds. This means your money is not used for company expenses or loans.

If Payoneer or its card partners face financial trouble, your funds remain protected. For example, when Wirecard, a card issuer, had problems, the UK Financial Conduct Authority (FCA) froze card activity to protect users. Payoneer made sure you could still withdraw your money or keep it safe in your account. Even though prepaid cards are not covered by the Financial Services Compensation Scheme, funds held in trust at regulated banks stay protected from creditors.

Payoneer follows rules set by the FCA and other regulators. Regular audits by firms like PwC check that Payoneer keeps your money safe and separate. You can feel confident that Payoneer safety measures protect your funds, even in rare cases of company insolvency.

Note: Payoneer’s safeguarding practices mean your money stays liquid and available. You can always access your funds or move them to your bank account.

Risks to Users

Phishing Threats

You face real risks from phishing scams when you use online payment platforms. In the past year, many Payoneer users in Argentina reported that hackers emptied their accounts. These users shared their stories on Reddit, X, and Discord. Here are some details:

- Several users lost all their savings, including one who lost two years of work.

- Some victims lost about $1,000 USD each.

- Many received suspicious SMS messages with verification codes on the nights their accounts were hacked.

- Most affected users used the Movistar cellphone provider. A security expert linked the breach to a third-party SMS gateway.

- Payoneer confirmed that a limited number of customers clicked on phishing links, which led to stolen credentials.

- Victims experienced delays in getting help, with some waiting up to a week for answers.

You should always check the sender before clicking any link or entering your login details.

Account Freezes

Payoneer sometimes freezes or closes accounts to protect users or follow regulations. You may find your account under review if Payoneer detects risky activity or needs to check compliance. This can lead to temporary holds or even permanent closure. Users have reported frustration with slow responses and lack of clear explanations. Some people waited days for refunds or answers. These actions can disrupt your business or personal finances.

Buying Accounts Risks

You might see offers to buy verified Payoneer accounts online. This practice is risky and against Payoneer’s rules. If you buy an account, Payoneer can close it without warning. You could lose access to your funds. Using someone else’s account also puts your personal data at risk. Always use your own verified account to stay safe.

Regulatory Issues

Payoneer follows strict rules as a licensed money transmitter and Money Services Business (MSB) in the United States. The company reviews accounts for compliance and risk management. Here is a summary of recent actions:

| Aspect | Details |

|---|---|

| Account Closures | Payoneer closed accounts for risk or compliance reasons, often without giving details. |

| Account Reviews | Regular reviews sometimes led to holds or permanent closures. |

| Refund Issues | Some users faced delays with refunds, especially when wire transfers failed. |

| Customer Grievances | Users complained about slow responses and unclear reasons for actions. |

| Regulatory Actions | No formal government actions against Payoneer or its users in 2024-2025. |

Some users also feel unhappy with Payoneer’s fees and business practices. You should review all terms and costs before using the service.

Benefits of Payoneer

Global Access

You can reach clients and partners almost anywhere with Payoneer. The platform supports payments in over 200 countries and 150 currencies. This wide reach helps you manage business across borders with ease. You can send and receive money in USD, EUR, GBP, JPY, AUD, CAD, HKD, SGD, AED, and MXN, among others. The table below shows some of the countries and currencies you can use:

| Country/Region | Currency(s) Supported | Notes on Transfer Methods |

|---|---|---|

| United States | USD | Local ACH transfer, Fedwire via SWIFT |

| Eurozone | EUR | SEPA Credit Transfer, SWIFT |

| United Kingdom | GBP | BACS, CHAPS, FPS, SWIFT |

| Japan | JPY | Zengin local transfer |

| Australia | AUD | BECS, HVCS, NPP |

| Canada | CAD | EFT |

| Hong Kong | HKD, USD | Autopay, RTGS/CHATS, FPS, SWIFT |

| Singapore | SGD, USD | GIRO/ACH, FAST, MEPS, SWIFT |

| United Arab Emirates | AED | RTGS, IPI |

| Mexico | MXN | SPEI |

You can also use flexible payment options like bank transfers, credit cards, and even receive direct payments from platforms such as Amazon or Upwork. Payoneer gives you access to working capital financing and mass payout services, making it a strong choice for global payment solutions.

Fast Transactions

You want your money to move quickly. Payoneer processes most transfers within 1 to 2 business days. This speed matches other leading platforms, such as Square and Tipalti. For example, Payoneer transfers usually take 1 to 5 business days, while PayPal transfers often complete in 1 to 3 business days. You can withdraw funds directly to your local bank account in your own currency, which saves you time and extra fees. Payoneer also offers a prepaid Mastercard, so you can spend or withdraw your money worldwide.

Tip: Using Payoneer for seamless international transactions can help you avoid high conversion fees and delays that often come with traditional banks.

User Trust Data

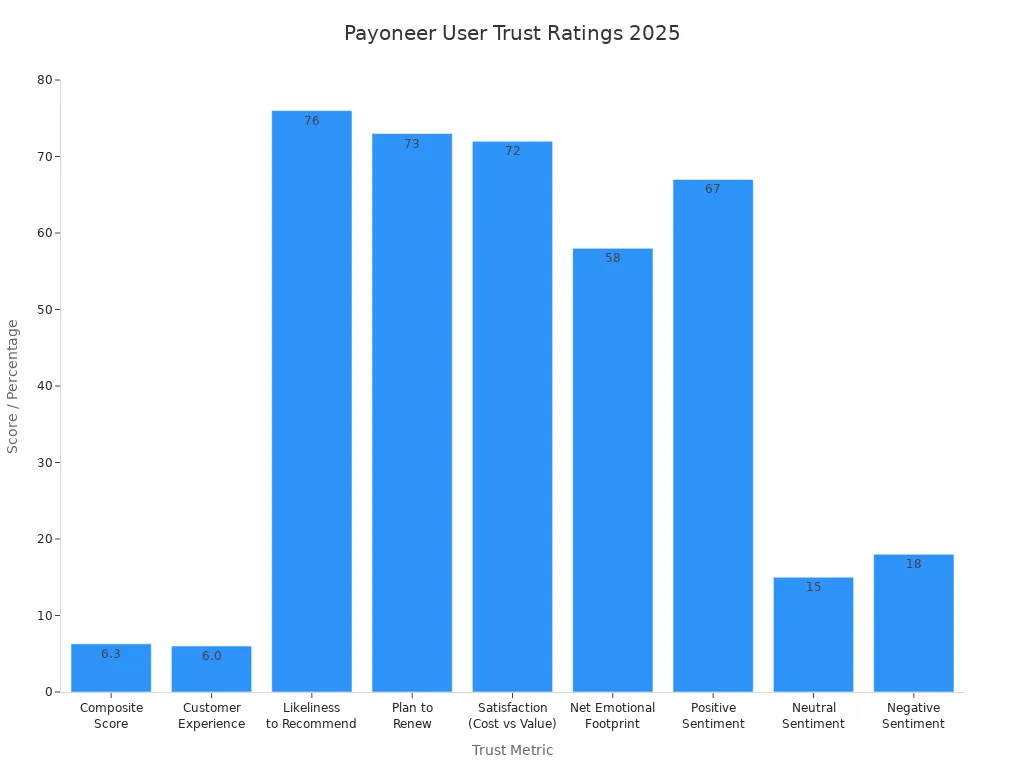

You want to know if others trust Payoneer. In 2025, users give Payoneer a composite trust score of 6.3 out of 10. About 76% of users say they would recommend Payoneer to others. The satisfaction score for cost versus value stands at 72. Most users feel positive about their experience, with 67% showing positive sentiment. Some users mention slow customer service, but most agree that Payoneer is reliable for global payments.

You can feel confident using Payoneer for your business or freelance work. The platform’s broad network, strong security, and user-friendly features make it a trusted choice for handling payments worldwide.

Verified Payoneer Account

Verification Process

You need to complete a few steps to get a verified payoneer account. The process checks your identity and helps keep your account secure. You must submit documents that prove who you are and where you live. The table below shows what you need for each account type:

| Account Type | Required Documents |

|---|---|

| Individual/Sole Proprietor | - Government-issued ID (national ID, driver’s license, passport)- Proof of address (utility bill, bank or credit card statement not older than 3 months, matching your name and address)- Bank verification document (bank statement or screenshot with bank name, full account number, full name, issued within 3 months) |

| Registered Company | - Certificate of Registration or Incorporation- Tax documents (such as IRS EIN)- Business license- Proof of company activity- Proof of company address (utility bill, company verification document, or bank statement under company name and address, no older than 3 months) |

You must upload clear and recent documents. Payoneer reviews your information in the Verification Center. The requirements may change based on your country. Make sure your documents are not password protected.

Security Advantages

A verified payoneer account gives you extra protection. You get mandatory 3D Secure purchase verification for card transactions. This means you receive a one-time code by email or SMS to confirm each purchase. If you use a card from Payoneer Europe Limited, you also need a personal security passcode. This is a permanent 6-digit code unique to your account. Entering the wrong code several times will block your card to stop fraud.

You can view or change your passcode in your security settings. The 3D Secure process is required for all users, so you cannot skip it. This helps stop unauthorized transactions. You should also keep your profile updated, use strong passwords, and enable two-factor authentication. Checking your account activity often helps you spot problems early. Avoid public Wi-Fi and shared devices to lower your risk. These steps make your verified payoneer account much safer than an unverified one.

Safety Tips

Image Source: pexels

Best Practices

You can keep your account secure by following a few simple steps. Use a strong, unique password for your Payoneer account. Do not use the same password for other websites. Change your password every few months. A password manager can help you remember your passwords. Enable two-factor authentication (2FA) with SMS or an authenticator app. This adds another layer of protection. Always check your account activity and transaction history. If you see something unusual, contact Payoneer support right away.

Tip: Log out after each session, especially if you use a shared or public device.

Here is a quick checklist for advice to be safe on payoneer:

- Use strong, unique passwords.

- Enable two-factor authentication.

- Monitor your account activity often.

- Avoid public Wi-Fi or shared devices.

- Keep your personal information updated.

Avoiding Scams

Scammers often try to trick you with fake emails or job offers. You should never share your login details or verification codes with anyone. If you get an email asking for your Payoneer password or personal information, do not reply. Report the email to Payoneer. Watch out for job offers that require you to create a Payoneer account. These are often scams. Always check payment requests or invoices that seem unusual. If something does not look right, verify it with the sender using official channels.

- Ignore and report phishing emails that ask for your login or confidential information.

- Be careful with job offers that ask you to open a Payoneer account.

- Double-check payment requests or invoices before sending money.

Advice to be safe on payoneer: Never click on suspicious links or download attachments from unknown sources.

Payoneer Guidance

Payoneer provides resources to help you stay safe. You can find security tips and updates on the official Payoneer website. The support team can answer your questions about account safety. If you think your account has been compromised, contact Payoneer support immediately. They can help you secure your account and recover access. Always use the official Payoneer app or website to log in. Do not trust third-party sites or unofficial apps.

| Situation | What You Should Do |

|---|---|

| Suspicious email received | Report to Payoneer support |

| Unusual account activity noticed | Change password, contact support |

| Trouble with verification | Update documents in your profile |

Following these steps gives you the best advice to be safe on payoneer. Stay alert and use the tools Payoneer offers to protect your funds and information.

You can feel confident using payoneer in 2025. The platform uses multi-factor authentication, AI-driven fraud detection, and regular security audits. Payoneer follows strict rules like PCI DSS and GDPR. You see strong protections, but you should stay alert for phishing and account freezes. The table below shows the main safety trends:

| Safety Trend | What It Means for You |

|---|---|

| Biometrics and MFA | Easier and safer logins |

| AI Fraud Detection | Faster response to threats |

| Regulatory Compliance | Stronger data and fund protection |

You get a secure experience today, and payoneer keeps working on new ways to protect you.

FAQ

How safe is Payoneer for holding large amounts of money?

You can trust Payoneer to keep your funds secure. Payoneer uses segregated accounts at major banks, such as Barclays and Citibank. Regular audits and strict rules protect your money, even if Payoneer faces financial trouble.

What should you do if you receive a suspicious email about your Payoneer account?

You should never click on links or download attachments from unknown emails. Report the email to Payoneer support. Change your password right away if you think your account is at risk.

How long does Payoneer take to resolve account freezes?

Payoneer usually reviews and resolves account freezes within 3 to 7 business days. You can speed up the process by providing all requested documents quickly. Contact support for updates if you do not hear back.

What are the main fees you might pay when using Payoneer?

| Service | Typical Fee (USD) |

|---|---|

| Receiving payments | Free or up to 1% |

| Withdrawing to bank | $1.50–$2.00 per transfer |

| Currency conversion | Up to 2% above rate |

You should always check the latest fee schedule before making transactions.

Payoneer offers strong security and global reach, but many users still face challenges such as account freezes, higher fees, and long wait times. If you want a smoother alternative for cross-border payments, consider BiyaPay.

With BiyaPay, you benefit from:

- Remittance fees as low as 0.5%

- Same-day transfers to most destinations

- Multiple fiat and digital currencies supported for seamless conversion

- Coverage in the majority of countries and regions worldwide

You can also calculate exactly what your recipient will get with our real-time exchange rate tool before sending money.

For a faster, more transparent, and cost-effective way to move money globally, sign up today at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.