- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Unlocking Tax-Free Shopping in Italy for International Visitors

Image Source: unsplash

You can enjoy tax-free shopping in Italy if you visit as a non-EU tourist. Just buy goods at stores that offer a VAT refund Italy service and keep the right paperwork. Before you leave Italy, follow the customs process so you can claim your VAT refund Italy. Many shops offer tax-free shopping, and you might save close to 22% of the price, though the actual refund is often a bit less because of fees. This means more money in your pocket as you explore Italy. VAT refund Italy rules make shopping in Italy even more fun for every visitor.

Key Takeaways

- Non-EU tourists can save money by shopping at stores with a “Tax Free” sign and claiming a VAT refund on eligible goods.

- Keep your passport, receipts, and tax refund forms safe and show them to customs before leaving Italy to get your refund.

- You must spend at least $76 USD in one store on the same day to qualify for a VAT refund in Italy.

- Only new, unused goods you take home with you qualify for a refund; services and meals do not.

- Follow the refund steps carefully: get forms at purchase, get customs stamps at departure, and submit forms to receive your money.

VAT Refund Italy

What Is VAT?

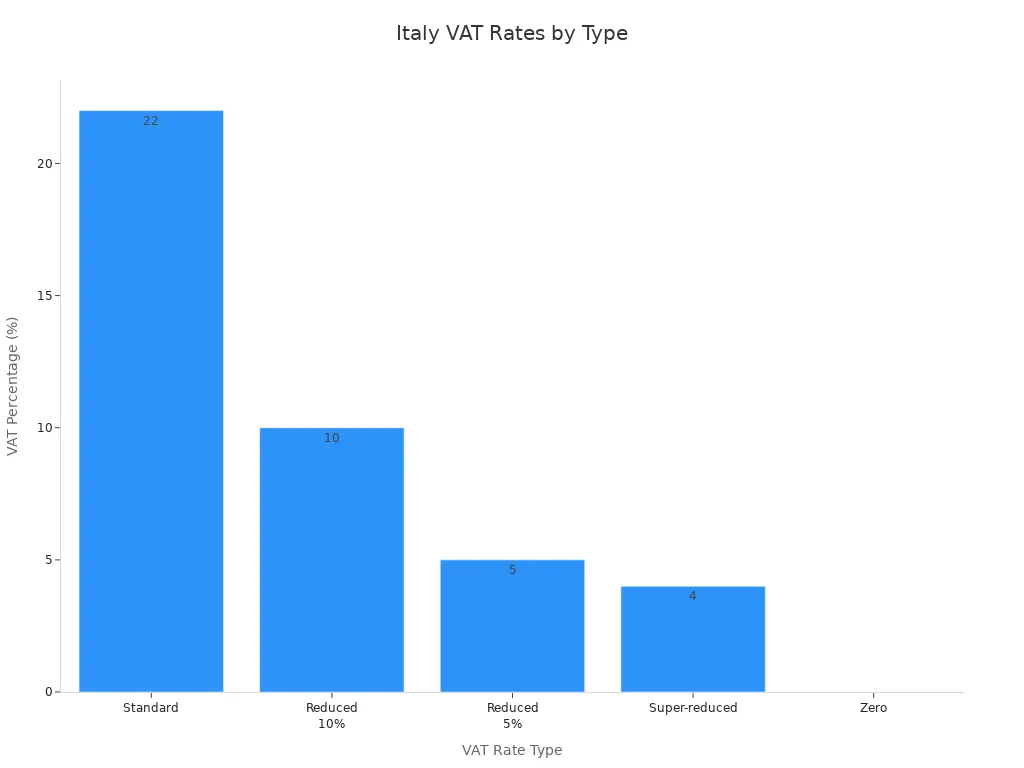

You might wonder what VAT means when you shop in Italy. VAT stands for Value Added Tax. This is a tax that Italy adds to most goods and services you buy. The standard VAT rate in Italy is 22%. This rate is a bit higher than the average in the European Union, which is about 21.8%. Some items in Italy have lower VAT rates, like books or certain foods, but most things you buy in stores use the 22% rate. If you want to see how much is VAT in Italy compared to other countries, check out this chart:

How Tax-Free Shopping Works

When you visit Italy as a tourist, you can enjoy tax-free shopping. This means you can get a VAT refund on many goods you buy. The process of tax-free shopping is simple if you follow the steps. First, you shop at stores that offer a VAT refund Italy service. You ask for a tax refund form at the checkout and show your passport. The store gives you the form and the receipt. You keep these safe until you leave Italy. At the airport, you show your goods, receipts, and forms to customs. They stamp your documents. After that, you can claim your refund at a counter or by mail. The process of tax-free shopping in Italy helps you save money on your purchases.

Tip: Always keep your receipts and forms together. You need them for your VAT refund in Italy.

Savings for Tourists

Tax-free shopping in Italy can lead to big savings. Since the standard VAT rate is 22%, you can get a tax refund on most goods you buy. The actual refund is a bit less because of service fees, but you still save a lot. For example, if you buy a bag for $500 USD, the VAT included is about $90 USD. After fees, you might get back around $75 USD. This makes shopping in Italy more fun and affordable. Many tourists plan their shopping to take advantage of the VAT refund Italy offers. You can use your savings for more travel, food, or gifts. Tax-free shopping in Italy is a great way to stretch your budget and enjoy more of what Italy has to offer.

| VAT Rate | Type | What It Applies To |

|---|---|---|

| 22% | Standard | Most goods and services |

| 10% | Reduced | Some foods, hotels, cultural events |

| 5% | Reduced | Certain foods, social services |

| 4% | Super-reduced | Books, newspapers, some medical equipment |

| 0% | Zero | International transport |

Eligibility for VAT Refund

Who Qualifies

You might wonder who is eligible for tax-free shopping in Italy. If you live outside the European Union, you can claim a tax refund when you shop in Italy. You need to show a non-EU passport or a residence permit from a country outside the EU. When you buy goods, you must present your passport at the store. The store will give you a tax refund form to fill out with your details.

Here are the main requirements for claiming a VAT refund as a tourist in Italy:

- You must live outside the European Union.

- You need to show your non-EU passport or residence permit at the time of purchase.

- You must buy goods at a store that offers tax-free purchases and displays a “Tax Free” sign.

- You must fill out a tax refund form at the store.

- You must export the goods out of the EU within three months of purchase.

- You need to get your tax refund form stamped by customs when you leave the EU.

- The goods must travel with you in your personal luggage and be available for customs inspection.

Note: You cannot claim a tax refund for services, meals, or goods you use in Italy. Only goods you take home with you qualify.

Minimum Purchase Amount

To qualify for a tax refund in Italy, your eligible purchases must reach a certain amount on a single receipt. The minimum purchase amount is $76 USD (about €70.01, but always check the latest exchange rates). If you buy several items at the same store on the same day, you can sometimes combine receipts to meet this minimum. However, you cannot combine receipts from different stores or different days.

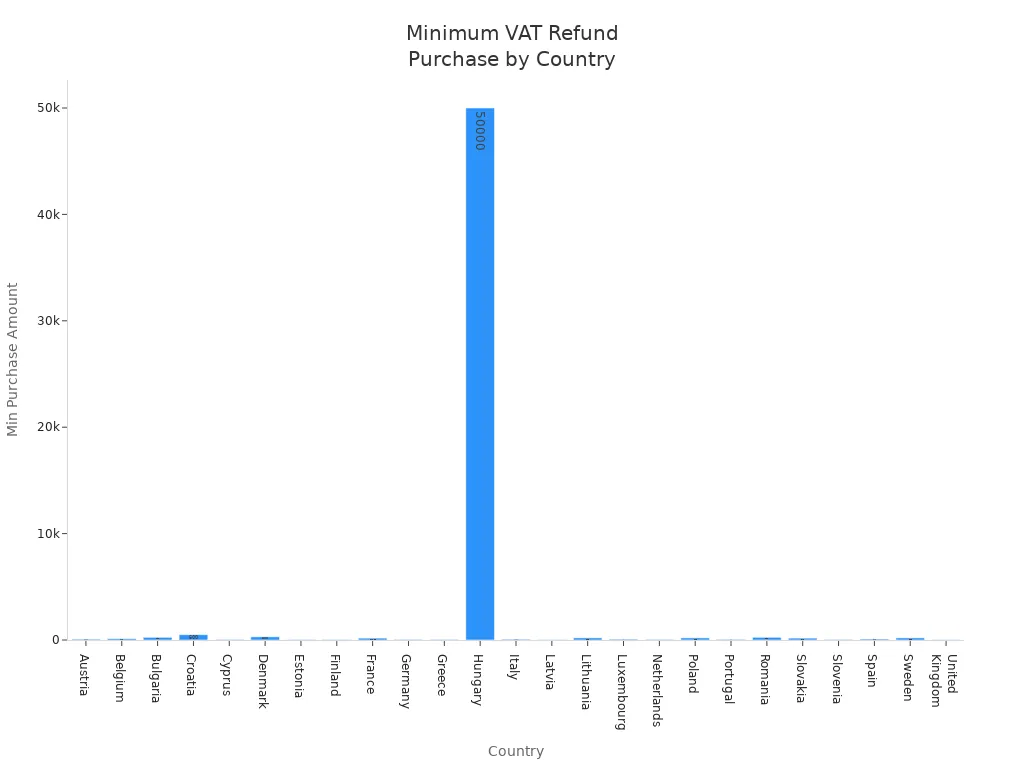

Here is a table showing the minimum purchase amounts for VAT refunds in different countries:

| Country | Minimum Purchase Amount per Receipt (including VAT) |

|---|---|

| Belgium | $135 USD |

| France | $190 USD |

| Germany | $54 USD |

| Italy | $76 USD |

| Spain | $98 USD |

| Austria | $81 USD |

Tip: Always ask the store if you can combine receipts from the same day to reach the minimum. This helps you maximize your tax refund.

Eligible Goods and Exclusions

Not every item you buy in Italy qualifies for a tax refund. You can only get a refund on eligible purchases that you export unused in your personal luggage. Here is what you need to know:

- You can claim a tax refund on new, unused goods like clothes, shoes, leather bags, art, jewelry, and even wine if you carry it with you.

- You cannot get a tax refund for restaurant meals, hotel stays, or services such as tours or classes.

- Food items like cheese or packaged snacks can qualify if you take them home and do not consume them in Italy.

- You must take the goods with you when you leave the EU and show them to customs for validation.

- Goods shipped separately or left behind in Italy do not qualify for a tax refund.

- Purchases made in San Marino or Vatican City are not eligible for Italian VAT refunds.

- Some stores may not participate in the tax refund scheme, so always look for the “Tax Free” sign.

Note: Only eligible purchases that you export unused can get a tax refund. Always keep your receipts and tax refund forms safe until you leave Italy.

If you follow these rules, you can enjoy tax free shopping eligibility and make the most of your trip. Knowing who is eligible for tax-free shopping and understanding the rules helps you save money and avoid disappointment.

VAT Refund Process

Image Source: pexels

Shopping in Italy gets even better when you know how to claim your tax refund. This step-by-step guide to applying for a tax refund will walk you through the process of tax-free shopping, from the moment you pick out your favorite Italian goods to the final step at the airport. If you want to know how do you get a vat refund, just follow these steps.

Shopping at Participating Stores

Start your tax-free shopping adventure by choosing stores that offer a VAT refund. Look for shops with a “Tax Free” sign in the window. These stores know the process and will help you get your tax refund in Rome, Milan, Florence, or any other city in Italy.

When you make a purchase, you need to:

- Bring your passport with you. The store will need it to fill out your tax refund form.

- Make sure your purchase meets the minimum amount required for a VAT refund. In Italy, this is about $76 USD (check the latest exchange rates).

- Ask the cashier for a tax-free form. Not every shop offers this, so always check before you buy.

Tip: Always shop at stores that display the “Tax Free” sign. This makes the process of tax-free shopping much easier.

Requesting Tax-Free Forms

To obtain a VAT refund, you must collect the right paperwork at the time of purchase. Here’s what you need to do:

- Show your passport to the cashier. This proves you live outside the European Union.

- Ask for an invoice that lists:

- The goods you bought.

- Your personal details.

- Your passport number or another document showing you live outside the EU.

- Make sure the store issues the invoice electronically and validates it through the OTELLO system. The invoice should have a special request code from OTELLO.

- Double-check that your name and passport details are correct on the form.

You need these documents to get your tax refund in Rome or any other Italian city. Without them, you cannot claim your refund.

Organizing Receipts and Forms

Keeping your paperwork organized is key to a smooth tax refund process. Here’s a step-by-step guide to applying for a tax refund:

- Keep all receipts, invoices, and tax-free forms together in a safe place.

- Make sure each receipt shows the VAT amount and matches the items you bought.

- Do not use the goods before leaving Italy. Keep them in their original packaging.

- Pack your purchases in your carry-on luggage. Customs may want to see them.

- Before you leave, check that you have:

- Your passport.

- All original receipts and invoices.

- Completed tax-free forms from each store.

Note: If you lose any receipts or forms, you may not be able to claim your tax refund.

Customs Validation

Before you leave Italy, you must visit customs at the airport, port, or border crossing. Customs validation is the most important step in claiming a VAT refund.

Follow these steps:

- Go to the customs office at your last point of departure from the European Union.

- Show your passport, all tax-free forms, receipts, and the goods you bought.

- Customs officials will check your documents and may ask to see your purchases.

- Get a customs stamp on each tax-free form. This stamp proves you are exporting the goods.

- Without the customs stamp, you cannot obtain a VAT refund.

If you are leaving Italy by cruise ship, check if customs officials are available at your port. Some ports, like Civitavecchia (Rome), may have customs desks, but this is not always guaranteed. Always plan ahead to avoid missing your tax refund in Rome or other cities.

Tip: Customs officials may not always inspect your goods, but you must have them ready just in case.

Submitting for Refund

After customs stamps your forms, you are ready to submit them for your tax refund. You have several options at Italian airports and border crossings:

| Submission Option | Location Details | Additional Notes |

|---|---|---|

| Customs Office | Departures area of Terminal 1 and Terminal 3; Boarding Areas E and A | VAT refund for goods in hold baggage must be requested before check-in |

| VAT Refund Provider Offices | Terminal 3 near check-in counters 196-225; Terminal 1 near check-in counters 111-140; Boarding Area E near ADR Info Point | Providers include Global Blue, Planet, and Tax Refund operators |

| Self-service Kiosks and Mailboxes | Available at the airport for completing the VAT refund procedure | Alternative to in-person offices |

You can submit your stamped forms at a refund provider’s desk, such as Global Blue or Planet. If you prefer, you can use a self-service kiosk or drop your forms in a mailbox at the airport. Some stores may ask you to mail the stamped forms back to them. Refunds can be paid in cash, credited to your credit card, or sent to your bank account.

Note: Always keep a copy or photo of your stamped forms until you receive your refund.

The process of tax-free shopping in Italy may seem long, but it is worth it. You can save a lot of money by following these steps. Now you know how to claim a VAT refund and enjoy more of your trip. If you want to obtain a VAT refund, just remember to keep your documents safe and follow the process at each step.

Receiving Your Refund

Refund Methods

When you finish your shopping in Italy and complete the customs process, you can choose how to get your tax refund. The most common ways are cash or credit card. You can get cash at special refund offices in the airport, like Planet Refund Offices. Sometimes, you can also get your refund by mailing your stamped forms. Bank transfer is not always available in Italy, so most travelers pick cash or credit card.

Here’s a table to help you see your options:

| Refund Method | Refund Limit (USD) | How to Receive Refund |

|---|---|---|

| Pre-validation Cash | $1,080 per week | Visit Planet Refund Office before customs validation |

| Pre-validation Credit Card | $3,240 | Visit Planet Refund Office before customs validation |

| Post-validation Cash | $1,080 per week | Submit validated Tax Free form by mail or dropbox |

Note: Always check the latest exchange rates when you choose your refund method. Some offices may have limits on how much cash you can get.

Processing Times and Fees

You probably want to know how fast you will get your tax refund in Italy. If you pick cash at the airport, you might get your money right away, but sometimes you have to wait in long lines. The process can take a few hours, especially during busy travel times. If you choose a credit card refund, you may need to wait two months or more. Some travelers report waiting even longer. Mailing your forms can take up to seven months for the refund to show up.

Here’s a quick look at the timing:

| Refund Method | Typical Processing Time | Notes |

|---|---|---|

| Immediate Cash (Airport) | Immediate to a few hours | Delays possible due to inspections and lines |

| Credit Card | 2+ months | Refunds can be slow, sometimes over two months |

| Bank Transfer (if offered) | 2 to 7 months | Not always available in Italy |

You will also pay a service fee for each tax refund. This fee comes out of your refund amount. So, when you ask, “how much vat is refunded in italy?”—remember, you will not get the full 22%. The actual refund is usually a bit less after fees.

Tip: Arrive early at the airport if you want a cash refund. Bring all your documents to avoid delays.

Tracking Your Refund

After you submit your forms, you can track your tax refund. Most refund companies, like Planet or Global Blue, let you check your refund status online. You just enter your form number or passport details on their website. If you do not see your refund after a few months, contact the company directly. Always keep copies or photos of your stamped forms until you get your refund.

- Save your receipts and forms until the refund arrives.

- Check your credit card or bank account for the refund.

- Contact the refund company if you have questions.

Note: If you shop in Rome, you can ask about your tax refund in Rome at the airport refund desk. Staff can help you with tracking and questions.

Tips for Tourists

Image Source: unsplash

Maximizing Your VAT Refund in Italy

You want to get the most out of tax free shopping in Italy. Here are some smart steps you can follow to make sure you receive the highest possible tax refund:

- Buy only new, unused items and keep them in their original packaging.

- Shop at stores that show “tax-free” or “VAT-free” signs and tell the staff you plan to claim a tax refund.

- Carry your passport and airline ticket when you shop to prove you are a tourist leaving Europe soon.

- Fill out the VAT refund paperwork at the store and check that the shop works with trusted refund companies like Global Blue or Planet.

- Keep all receipts, forms, and your purchased goods together for customs inspection.

- Show your items and documents to customs before you leave Italy. Make sure your goods are easy to reach and not packed in checked bags.

- If you do not get your refund right away, mail your stamped forms to the refund agency within the deadline.

- Use VAT refund counters at big airports for in-person help, but remember there may be a fee.

- If you visit more than one EU country, claim your VAT refund in the last country you leave.

Tip: Always double-check your paperwork and keep everything organized. This makes claiming a VAT refund as a tourist much easier.

Avoiding Common Mistakes

Many tourists miss out on their tax refund because of simple errors. You can avoid these common mistakes:

- Forgetting that only new, unused items qualify for a tax refund.

- Not following the refund instructions, which are sometimes in another language.

- Missing the customs stamp on your forms and receipts.

- Losing or misplacing your tax refund paperwork.

- Mailing forms incorrectly or too late, which can lead to lost refunds.

- Not knowing that refund companies may charge you if paperwork is missing or late.

- Getting confused by the process and missing steps, which can cause you to lose your refund.

Note: Stay organized and ask for help if you do not understand the process. This helps you avoid problems with tax-free shopping in Italy.

Using Refund Services

You might wonder if using a third-party VAT refund service is a good idea. Here is a quick look at the pros and cons:

| Aspect | Advantages | Disadvantages |

|---|---|---|

| System Stability | More stable, less risk if one system fails | |

| Cost | Lower costs for businesses, which may help shoppers | |

| Business Opportunities | More companies can offer refund services | |

| Fraud Risk | Higher risk of fraud due to less frequent checks | |

| Audit Frequency | Refund platforms checked less often, so mistakes may go unnoticed | |

| Oversight | Harder to spot errors or fraud with many companies involved |

Although Italy uses a central system for VAT refunds, you will often deal with third-party companies like Global Blue or Planet. These services can make the process faster and easier, but you should watch out for extra fees and always check that your paperwork is complete. If you want to know how to claim a VAT refund, using these services at the airport can save you time, but you must stay alert to avoid mistakes.

You can unlock big savings with vat refund italy if you follow a few simple steps. Here’s a quick recap:

- Shop at stores with the “Tax-Free” sign and keep your passport handy.

- Fill out the refund form and keep all receipts.

- Present your goods, forms, and passport to customs before you leave.

- Submit your stamped paperwork for your refund.

When you prepare your documents and know the process, vat refund in italy becomes easy and rewarding. With the right information, you can enjoy more shopping and keep more money in your pocket.

FAQ

Can you get a VAT refund if you shop online in Italy?

No, you cannot claim a VAT refund for online purchases shipped to your home. You must buy goods in person at a store in Italy and export them yourself to qualify for a refund.

What happens if you forget to get your customs stamp?

You will not receive your VAT refund without the customs stamp. Customs must validate your forms before you leave the European Union. Always visit the customs desk before departure.

How much time do you have to claim your VAT refund after shopping?

You must export your goods and get your forms stamped within three months of purchase. Some refund companies require you to submit your paperwork within a set deadline. Always check the instructions on your tax-free form.

Which banks can you use to receive your VAT refund?

You can choose a refund to your credit card or sometimes to a bank account. Many travelers use Hong Kong banks for international transfers. Always confirm with the refund company if your preferred bank is accepted.

Tax-free shopping in Italy can save you up to 22% on purchases—but what about when you need to send or receive money internationally? High bank fees and poor exchange rates often eat into those savings.

That’s where BiyaPay makes the difference:

- Remittance fees as low as 0.5%, always clear and transparent

- Real-time exchange rates, so you know exactly what your recipient will get

- Same-day transfers available to most countries and regions

- Support for multiple fiat and digital currencies

- Global coverage across 200+ countries and regions

Make your international transfers as rewarding as your shopping in Italy. Sign up today with BiyaPay and keep more of your money where it belongs—with you.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.