- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Bank Does Cash App Use with Plaid in 2025

Image Source: unsplash

Lincoln Savings Bank serves as the main cash app bank you see when you use Plaid to link your account in 2025. Cash App, a financial technology company, does not operate as a bank. Instead, it partners with FDIC-insured banks, including Lincoln Savings Bank for direct deposits and Sutton Bank for issuing the Cash App Card. You often notice Lincoln Savings Bank appear on Plaid because it handles Cash App’s banking services.

Key Takeaways

- Lincoln Savings Bank is the main bank you see when linking Cash App with Plaid in 2025, handling direct deposits and transfers securely.

- Sutton Bank supports Cash App card services but does not appear in Plaid connections, focusing on prepaid card management.

- Plaid acts as a safe bridge between your Cash App and bank accounts, using strong encryption and multi-factor authentication to protect your data.

- Linking your bank to Cash App through Plaid is quick and secure, with options for instant or manual verification to fit your needs.

- You control your linked accounts and can manage or unlink them anytime to keep your financial information safe and up to date.

Cash App Bank

Image Source: unsplash

Lincoln Savings Bank

Lincoln Savings Bank acts as the main cash app bank for users who connect their accounts through Plaid in 2025. When you link your Cash App account to another financial service, you often see Lincoln Savings Bank as the option. This bank is FDIC-insured, which means your funds have protection up to the legal limit. Lincoln Savings Bank supports fast and secure transaction processing, making your experience with Cash App smooth and reliable.

You benefit from several features when Lincoln Savings Bank powers your Cash App account:

- Your money stays safe because of FDIC insurance.

- You can receive direct deposits, such as paychecks, straight into your Cash App account.

- Transactions process quickly, so you do not have to wait long for transfers.

- The bank uses strong security protocols, including TLS 1.3 encryption and multi-factor authentication.

- You authenticate your account through Plaid’s secure portal, which keeps your Cash App credentials separate from your bank login.

The partnership between Cash App and Lincoln Savings Bank gives you a reliable way to manage your money. The system uses a layered setup, with the Cash App interface, Plaid’s API, and Lincoln Savings Bank’s servers working together. This design allows real-time monitoring and fast fund transfers. You can trust that your transactions will complete quickly and accurately.

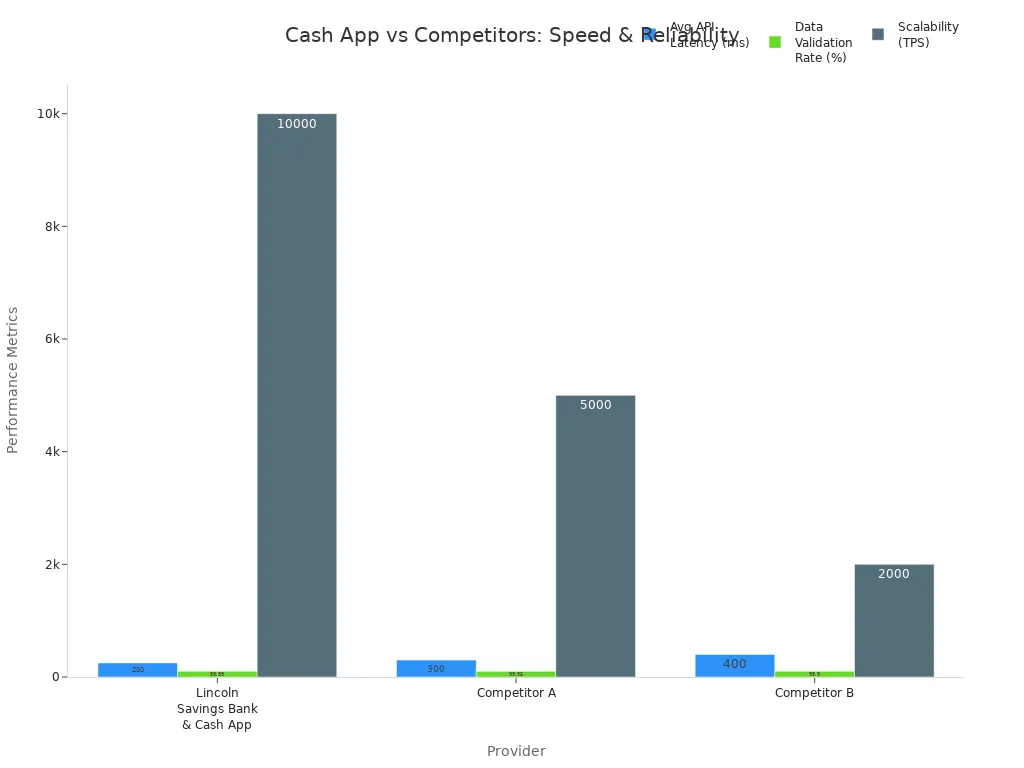

Here is a table that shows how Lincoln Savings Bank compares to other banks in terms of transaction speed and security:

| Feature | Lincoln Savings Bank & Cash App | Competitor A | Competitor B |

|---|---|---|---|

| Average API Latency | 250 ms | 300 ms | 400 ms |

| Data Validation Rate | 99.99% | 99.95% | 99.90% |

| Security Protocols | TLS 1.3 | TLS 1.2 | TLS 1.1 |

| Scalability (Transactions per second) | 10,000+ | 5,000+ | 2,000+ |

You can see that Lincoln Savings Bank and Cash App offer faster processing, higher accuracy, and stronger security than many competitors. This partnership helps you send and receive money with confidence, whether you use peer-to-peer payments or direct deposits.

Sutton Bank

Sutton Bank also plays an important role as a cash app bank, but its focus is different from Lincoln Savings Bank. Sutton Bank issues the Cash Card, which is a prepaid debit card linked to your Cash App account. You use this card for purchases online and in stores. Sutton Bank provides the banking infrastructure for these card services, making sure you can spend your Cash App balance easily.

In 2025, Sutton Bank continues to support Cash App by powering the Cash Card and related services. You may also find new financial products, such as Buy Now, Pay Later (BNPL) options and fee-free cash advances, available through partnerships with Sutton Bank. These features give you more flexibility and control over your money.

However, when you use Plaid to link your Cash App account, you usually see Lincoln Savings Bank, not Sutton Bank. Sutton Bank does not handle direct deposits or account linking through Plaid. Instead, it focuses on card services and prepaid card management. This division of roles helps Cash App deliver a wide range of financial tools to you.

Here is a summary of the roles each bank plays for Cash App:

| Bank Partner | Role in Cash App Services |

|---|---|

| Sutton Bank | Powers the Cash App card and related card services, including issuing the Cash Card and facilitating card transactions. |

| Lincoln Savings Bank | Powers Cash App’s direct deposit functionality, managing transfers to and from virtual bank accounts provided to users. |

When you link your Cash App account through Plaid, remember that Lincoln Savings Bank is the main cash app bank you will see. Sutton Bank supports your card services, but it does not appear in Plaid integrations.

Cash App on Plaid

How Plaid Works

Plaid acts as a secure bridge between your Cash App account and your external bank accounts. When you use cash app on plaid, you start by entering your online banking credentials. Plaid checks your identity and asks for your consent before moving forward. You do not need to worry about Plaid sharing your account information with Cash App. Plaid only accesses the data needed for linking financial information and encrypts everything for safety.

You will see extra security steps, such as multi-factor authentication or security questions from your bank. These steps help keep your account safe. If you have trouble connecting, Plaid offers manual verification. This method uses small deposits to your bank account, which you confirm later. The process is quick and user-friendly, so you can start using cash app on plaid for transfers and transactions right away.

Note: Plaid never stores your banking credentials. It only uses them to set up the connection and then protects your data with strong encryption.

Here is a simple process you follow when you link your bank account to cash app on plaid:

- Log in to your digital banking platform and go to Transfers.

- Choose to add an external account using Plaid’s Instant Verification.

- Find your bank and complete the verification steps, such as entering a security code.

- If your bank is not listed, use manual verification with small deposits.

Why Lincoln Savings Bank Appears

When you connect cash app on plaid, you may wonder why Lincoln Savings Bank shows up instead of your own bank. Cash App uses Lincoln Savings Bank as its main partner for Plaid connections. Your Cash App account does not have traditional online login details, so Plaid cannot link it automatically. Instead, you must enter the routing and account numbers linked to Lincoln Savings Bank.

Lincoln Savings Bank acts as the middleman for banking services on Cash App. Plaid connects through Lincoln Savings Bank to handle your transactions and share financial data securely. This setup means you see Lincoln Savings Bank during the linking process, not your personal bank. If you want to skip this step, you can link your bank account directly by entering your routing and account numbers, but most users find cash app on plaid easier and faster.

Tip: Always double-check your account information when linking accounts to avoid delays or errors.

Linking Accounts

Image Source: pexels

Steps to Link with Plaid

You can link your bank account to Cash App quickly and securely using Plaid. This process helps you send and receive money without delays. Follow these steps to link your bank account:

- Open your Cash App and go to your profile.

- Tap on ‘Linked Banks’ or ‘Bank Accounts’ in the settings menu.

- Select ‘Add Bank Account’ to start the process.

- Choose to link your bank account instantly with Plaid.

- Find your bank from the list and select it.

- Enter your bank login details to verify your identity.

- If you prefer, you can link your bank account manually by entering your routing and account numbers.

- Tap ‘Verify’ to complete the setup.

Plaid uses strong encryption to protect your account information. Instant verification saves you time and reduces errors. Manual verification may take up to four business days. Always keep your login details secure and update your app for the best experience.

Tip: If your bank is not listed, you can still link your account by entering your routing and account numbers manually.

Managing Connections

You can manage, unlink, or troubleshoot your bank connections in Cash App settings. This gives you control over your linked accounts and helps keep your information safe. To remove a linked bank account, follow these steps:

- Go to the ‘Linked Accounts’ or ‘Bank Accounts’ section in Cash App.

- Select the bank account you want to remove.

- Tap the option to unlink or disconnect the account.

- Confirm your choice when prompted.

- Complete any extra verification steps, such as entering a security code.

If you have trouble linking or removing your bank account, check the table below for common issues and solutions:

| Common Issue/Error Code | Description | Resolution |

|---|---|---|

| Error 100 | Connection issues with the bank | Check your internet connection and try again |

| Error 101 / INVALID_CREDENTIALS | Incorrect login details | Re-enter your username and password |

| Error 102 | Unsupported account type | Make sure your account type is supported by Plaid |

| Error 103 | Bank security settings blocking access | Contact your bank to adjust settings |

| BANK_NOT_FOUND | Bank not recognized by Plaid | Double-check your bank name |

| ACCOUNT_NOT_FOUND | Account details not found | Recheck your account information |

| TOO_MANY_REQUESTS | Too many attempts | Wait a few minutes before retrying |

| UNAUTHORIZED | Access denied by bank | Verify permissions and authorization |

If problems continue, try clearing your browser cache, switching devices, or contacting Cash App support. You can also use manual entry if Plaid cannot connect your bank account.

Security and Privacy

Is Plaid Safe?

You may wonder if Plaid offers a secure connection when you link your bank account to Cash App. Many users feel uneasy about sharing sensitive information with a third-party service. Plaid understands these concerns and builds its platform with security as a top priority. You control what data you share and can manage your connections at any time.

Plaid uses several advanced tools to keep your data safe:

- Plaid protects your information with advanced encryption technology, including AES-256 for stored data and TLS for data in transit.

- Multi-factor authentication adds an extra layer of security, making it harder for anyone to access your account without your approval.

- Plaid uses tokenization, so your actual login credentials never get shared with Cash App or other apps.

- The system only gives apps read-only access, which means no one can move money or make changes without your permission.

- Continuous monitoring and regular security audits help detect fraud and fix any weaknesses quickly.

- Plaid’s information security team watches for suspicious activity 24/7.

Plaid never sells or shares your data without your permission. You can always review and disconnect linked accounts through the Plaid Portal.

Protecting Your Data

You play an important role in keeping your secure information safe. Plaid and Cash App both follow industry best practices to protect your privacy and prevent fraud. Here are some steps you can take:

- Use strong, unique passwords for your financial accounts.

- Enable two-factor authentication whenever possible.

- Regularly check your account activity for signs of fraud.

- Review which apps have access to your bank account and remove any you do not use.

- Only share the minimum sensitive information needed for each service.

Plaid’s privacy policies give you control over your data. You decide which accounts to link and what information to share. The company follows strict rules for data sharing and only shares information with your consent. Plaid also complies with important security standards like ISO 27001 and ISO 27701.

If you ever feel unsure, you can unlink your bank account from Cash App or Plaid at any time. This helps you stay in control and reduces the risk of fraud. Remember, keeping your data safe is a team effort between you, Cash App, and Plaid.

Lincoln Savings Bank remains the main bank you see when linking accounts with Plaid in 2025. Understanding this connection helps you keep your information secure and troubleshoot issues quickly. Plaid uses strong encryption and acts as a secure bridge, so your data stays protected.

Practical tips for safe linking and management:

- Use Plaid Link to connect accounts securely.

- Collect and store Proof of Authorization for transfers.

- Monitor transfer decisions and handle errors properly.

- Format transaction descriptions clearly.

- Guide users through re-authentication if needed.

Stay informed about updates to partner banks. Always review privacy policies and choose trusted providers for your financial needs.

FAQ

What bank do you see when linking Cash App with Plaid?

You see Lincoln Savings Bank when you link your account with Plaid. This bank handles most banking services for Cash App, including direct deposits and transfers.

Can you use Plaid to link any bank account to Cash App?

Plaid supports many banks, but not all. If your bank does not appear, you can enter your routing and account numbers manually in Cash App.

Is it safe to connect your bank to Cash App using Plaid?

Plaid uses strong encryption and security checks. Your login details stay private. You control which accounts you link and can remove access at any time.

Why does Lincoln Savings Bank appear instead of your own bank?

Lincoln Savings Bank partners with Cash App for Plaid connections. Even if you use another bank, Plaid connects through Lincoln Savings Bank to manage your Cash App transactions.

How do you unlink a bank account from Cash App?

Go to your Cash App settings. Select the linked bank account. Tap to remove or disconnect it. Follow the prompts to confirm and finish the process.

Linking Cash App through Plaid ensures security—but when it comes to international money transfers, high fees and hidden exchange rate losses can still cut into your balance. If you want a faster, more cost-effective solution, BiyaPay is built for you.

With remittance fees as low as 0.5%, real-time exchange rate checks, and support for both fiat and digital currencies, BiyaPay helps you move money globally without surprises. Transfers reach most countries and regions the same day, giving you both speed and transparency.

Make your cross-border transactions as smooth as linking accounts with Plaid. Register today at BiyaPay and keep more of your money in your own hands.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.