- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Makes Ally Bank a Safe Choice for Online Banking

Image Source: pexels

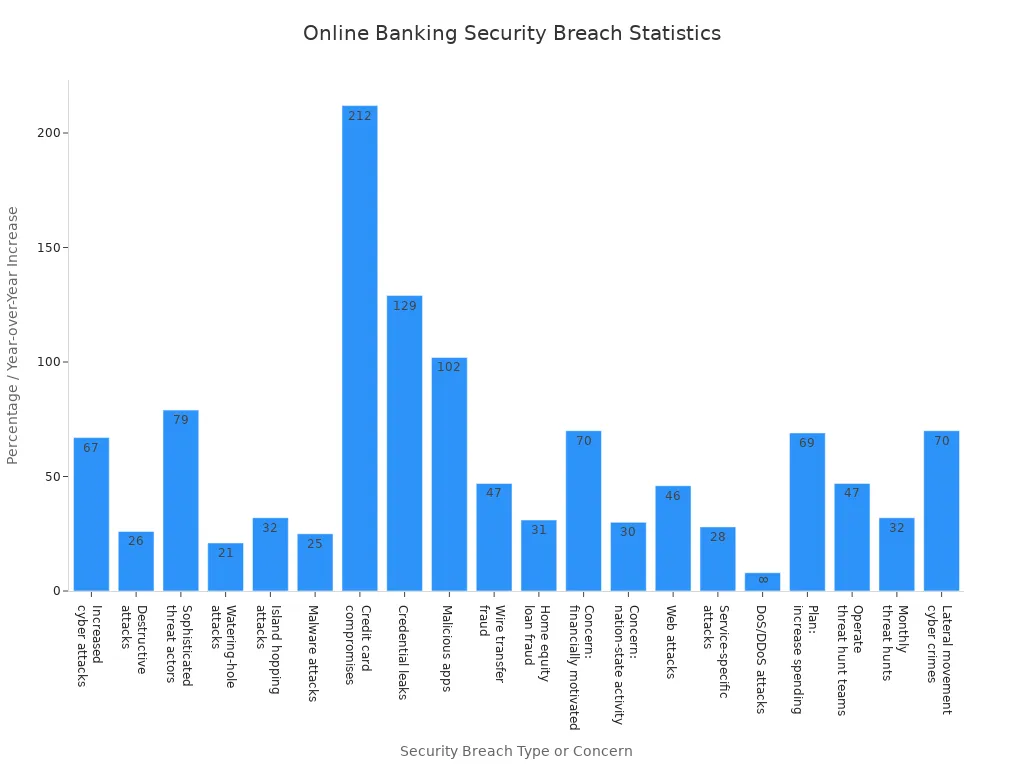

You want a bank that protects your money and financial information. Ally Bank stands out for its commitment to safety. A recent survey shows that 35% of online banking customers rank security as their top concern. Ally Bank uses advanced digital tools to guard your data. The bank also provides FDIC insurance and customer protections for extra peace of mind. The rise in cyber attacks on banks makes ally bank safety even more important.

Ally Bank safety means you can trust your accounts stay secure.

Key Takeaways

- Ally Bank protects your account with multi-factor authentication and strong encryption to keep your information safe from hackers.

- Your deposits are insured by the FDIC up to $250,000 per ownership category, giving you peace of mind about your money.

- The bank monitors accounts 24/7 and offers a zero liability guarantee to protect you from unauthorized transactions.

- Following safety tips like using strong passwords, avoiding scams, and securing your devices helps keep your accounts secure.

- Ally Bank invests in advanced technology and provides customer education to stay ahead of online threats and support your safety.

Ally Bank Safety Features

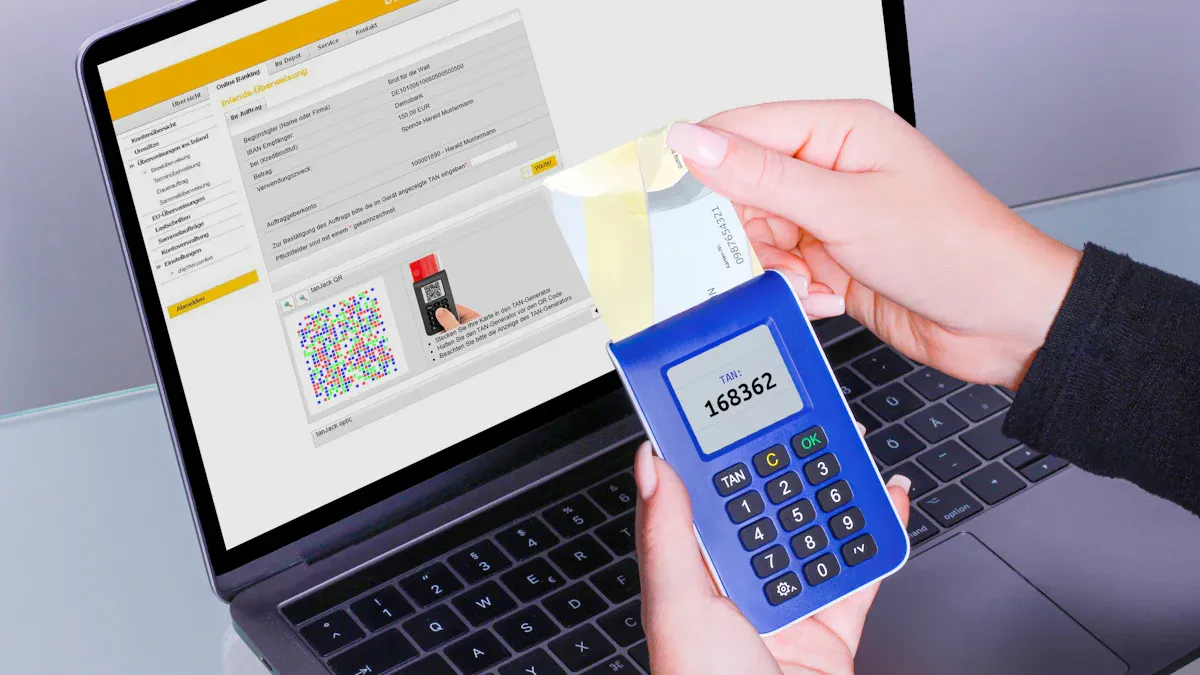

Image Source: unsplash

Multi-Factor Authentication

You want your online bank account to stay safe from hackers. Ally Bank uses multi-factor authentication to protect your account. When you log in, you enter your password or PIN. Then, Ally Bank sends a security code to your registered device. You must enter this code to finish logging in. This process is called two-factor authentication. It adds an extra step, making it much harder for someone else to get into your account.

Ally Bank also uses biometric authentication in its mobile apps. You can use your fingerprint to log in. Some devices allow facial or voice recognition. These features make it easier for you to access your account while keeping it secure.

Studies show that multi-factor authentication greatly reduces identity theft and cyber fraud. By adding more layers of verification, Ally Bank safety increases. Attackers find it much harder to break into your account when you use these extra steps.

Ally Bank reminds you to stay alert for scams. Never share your security codes with anyone. This helps keep your account safe.

Encryption Technology

Ally Bank uses strong encryption to protect your information. When you use Ally Bank’s website or app, Secure Socket Layer (SSL) technology scrambles your data. The bank uses 128-bit encryption. This means your information turns into a secret code as it travels over the internet. Only Ally Bank can read this code.

Here is a quick comparison of encryption strengths:

| Key Size | Estimated Time to Crack |

|---|---|

| 128-bit | Billions of years with current computers |

| 256-bit | Even longer, with more protection against future threats |

128-bit SSL encryption is fast and secure. It protects your banking details from hackers. Many banks use this level of encryption because it balances speed and safety. Ally Bank safety relies on this technology to keep your money and personal information secure.

Firewalls and Monitoring

Ally Bank builds strong barriers around its systems. Firewalls block unwanted traffic and keep out hackers. The bank uses intrusion detection systems to spot suspicious activity. Antivirus and anti-malware programs stop harmful software before it can cause damage.

Ally Bank also uses account monitoring to watch for unusual activity. If the system sees something strange, it alerts you right away. This helps you act fast if someone tries to access your account without permission.

- Firewalls screen all data coming in and out.

- Monitoring systems check for fraud 24/7.

- Security teams respond quickly to threats.

Ally Bank safety means you get secure login, transaction protection, and constant support. The bank’s digital security team works around the clock to keep your accounts safe. If you ever have a question or notice something odd, Ally Bank offers 24/7 customer support to help you.

FDIC Insurance and Account Protection

FDIC Coverage Limits

You want to know your money is safe at Ally Bank. The Federal Deposit Insurance Corporation (FDIC) protects your deposits if the bank fails. At Ally Bank, FDIC insurance covers up to $250,000 per depositor, per ownership category. This protection applies to all FDIC-insured banks in the United States.

- Each account ownership category—such as single, joint, retirement, trust, or business—has its own $250,000 insurance limit.

- If you have a single account and a joint account, each gets separate coverage.

- Covered accounts include checking, savings, money market accounts, certificates of deposit (CDs), IRAs, cashier’s checks, and money orders.

- Investment products like stocks, bonds, mutual funds, and annuities do not have FDIC insurance.

You can increase your total insured amount by using different ownership categories. For example, a joint account with two owners is insured up to $500,000 ($250,000 per owner). Ally Bank gives you the same FDIC protection as any traditional bank, so your financial information and funds stay secure.

FDIC insurance means you do not lose your insured deposits, even if the bank closes. You can trust Ally Bank to keep your money protected.

Zero Liability Guarantee

Ally Bank wants you to feel confident when you bank online. If someone makes an unauthorized transaction on your account, you are not responsible for the loss if you report it within 60 days. This is called a zero liability guarantee.

- You should check your account activity often.

- If you see a transaction you did not make, contact Ally Bank right away.

- The bank will investigate and return your money if the transaction was unauthorized.

This guarantee helps protect your financial information from fraud. Ally Bank uses privacy protection measures and fraud monitoring to spot suspicious activity. The bank’s systems work around the clock to keep your accounts safe.

Always report any strange activity as soon as possible. Quick action helps Ally Bank protect your money and your identity.

Fraud and Identity Protection

Ally Bank takes fraud and identity protection seriously. The bank offers several services to help you if you suspect fraud or identity theft.

- You can call the 24/7 fraud hotline at 1-833-226-1520 to report suspicious activity.

- Place a fraud alert on your credit report by contacting one of the three major credit bureaus. The bureau you contact will notify the others.

- Consider a credit freeze for extra security. You need to contact all three credit bureaus to set this up.

- If you think someone used your Social Security number, call the Social Security Administration Fraud hotline.

- Order and review your credit reports often to check for errors or new accounts you did not open.

- If you find a fraudulent account, contact the company to close it and keep all records.

- Report identity theft to the Federal Trade Commission (FTC) to help law enforcement.

- File a police report to support your case with creditors.

Ally Bank also teaches you how to avoid scams. Do not open suspicious emails or click on strange links. If you get a text or phone call that seems odd, verify it by calling Ally Bank directly. The bank never asks for your password. Use strong, unique passwords for each account and never share your login details. Keep your software updated and avoid public Wi-Fi when accessing your accounts.

For investment accounts, Ally Invest provides extra protection through the Securities Investor Protection Corporation (SIPC). SIPC covers up to $500,000 for securities and cash in your investment account, including a $250,000 limit for cash.

Ally Bank’s fraud monitoring and customer education help you stay safe. The bank’s team works to protect your financial information and guide you through any issues.

Online Banking Safety Tips

Image Source: pexels

Strong Passwords

You protect your account by creating strong passwords. Cybersecurity experts recommend several best practices for password creation:

- Use a mix of uppercase and lowercase letters, numbers, and symbols.

- Avoid personal information like names or birthdays.

- Make your password at least 12 characters long.

- Do not reuse passwords across different accounts.

- Change your password regularly, especially after suspicious activity.

- Consider using a password manager to keep track of unique passwords.

A strong password might look like this: Mys0ng$Title!2024. This approach makes it hard for hackers to guess your password. Studies show that about 30% of users have experienced breaches due to weak or reused passwords. You lower your risk by following these steps.

Tip: Never share your password with anyone. Use two-factor authentication for extra security.

Avoiding Scams

Scammers use many tricks to steal your information. Common scams include phishing emails, fake texts, and phone calls pretending to be from Ally Bank. Some scams use personal details to seem more real. Others offer fake rewards or ask you to download harmful files.

- Watch for emails or texts asking for your login details.

- Do not click on suspicious links.

- Verify any message by contacting Ally Bank directly.

Ally Bank helps you learn about these scams through articles, guides, and a Security Badge program. You can test your knowledge and stay updated on the latest threats.

Secure Devices

You keep your online banking safe by securing your devices. Install antivirus and anti-malware software. Use firewalls to block unwanted traffic. Always update your device’s software to fix security gaps. Avoid public Wi-Fi when accessing your bank account. Set up multi-factor authentication and use secure browsers.

Ally Bank offers free antivirus software for up to three devices. The bank also uses session timeouts and monitors for fake apps or websites.

Account Alerts

Account alerts help you spot suspicious activity fast. Ally Bank sends automatic alerts by email or text if it detects unusual transactions. You can also set up alerts for low balances, large withdrawals, or new account activity. These alerts arrive 24/7 and help you respond quickly to possible fraud.

You can lock your debit card through the app or website if you notice anything strange. Setting up credit report alerts adds another layer of protection.

By following these online banking safety tips, you take an active role in protecting your money and personal information.

Ally Bank’s Commitment

Security Updates

You want your bank to stay ahead of new threats. Ally Bank invests in advanced technology to protect your information. The bank created Ally.ai, a special platform that uses artificial intelligence to keep your personal data safe. Before any information goes to large language models, Ally.ai hides your personal details. This process, called PII masking, helps protect your privacy during customer service calls. Over 700 customer care associates use this tool to help you while keeping your data secure. Ally Bank even shared this technology with others to help improve safety across the industry.

The bank also uses Salt Security’s API Protection Platform. This system watches over the digital connections that power online banking. It uses big data and machine learning to spot and stop attacks in real time. The platform gives the bank instant updates about possible risks. You benefit from these tools because they help keep your accounts and information safe every day.

Ally Bank’s focus on new technology means you get strong protection as online threats change.

Customer Education

You play a key role in keeping your accounts safe. Ally Bank gives you many resources to help you learn about online banking safety. The bank’s “Additional Resources” page links to trusted sites, such as OnGuard Online and the FTC’s Scam Alerts. These sites teach you how to spot scams, protect your identity, and use public Wi-Fi safely.

Ally Bank also supports programs for children and young adults. These programs cover topics like cyberbullying, social media safety, and mobile security. You can find tips on handling suspicious messages, creating strong passwords, and using secure devices. The bank offers a security guarantee and free security software to help you bank safely.

When you use these resources, you gain the knowledge to protect yourself and your money.

You can count on Ally Bank for strong online banking security. The bank uses multi-factor authentication, encryption, and 24/7 monitoring to protect your money. FDIC insurance and zero liability policies add extra layers of safety. You play a key role by following safety tips and staying alert. When you and Ally Bank work together, your accounts stay secure. Choose Ally Bank and bank online with confidence.

FAQ

How does Ally Bank protect your online account?

Ally Bank uses multi-factor authentication, strong encryption, and 24/7 monitoring. You get alerts for unusual activity. The bank’s security team responds quickly to threats. You can lock your card if you notice anything strange.

What should you do if you spot suspicious activity?

Check your account often. If you see something odd, contact Ally Bank right away. Use the 24/7 fraud hotline. Report the issue within 60 days to stay protected by the zero liability guarantee.

Are your deposits at Ally Bank insured?

Yes. The FDIC insures your deposits up to $250,000 per depositor, per ownership category. This insurance covers checking, savings, and CDs. Investment accounts at Ally Invest have SIPC protection up to $500,000.

Can you use Ally Bank safely on your phone?

Yes. Download the official Ally Bank app. Use biometric login, such as fingerprint or face recognition. Keep your device updated. Avoid public Wi-Fi when accessing your account. Set up alerts for extra security.

Ally Bank shows that strong security, FDIC insurance, and advanced technology are essential for safe online banking. But when your money needs to cross borders, traditional banks often bring high fees, slow transfers, and complex SWIFT/IBAN processes.

With BiyaPay, you get a faster, smarter alternative:

- Remittance fees as low as 0.5%

- Convenient real-time exchange rate checks

- Support for fiat and digital currency conversions

- Coverage across most countries and regions worldwide

- Many transfers arrive the same day

Take control of your international money transfers. Register now at BiyaPay and move funds with confidence.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.