- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Practices for Saving Money on International Card Payments

Image Source: pexels

You want to keep more of your money when traveling abroad, right? Avoiding international transaction fees is one of the smartest ways to do that. Even small fees add up fast—travelers often save hundreds of dollars by skipping extra charges that can reach 3% to 5% on each purchase. If you’re traveling on a budget, every dollar counts. Choosing the right card for foreign travel helps you stick to your budget and makes your trip smoother.

Key Takeaways

- Choose credit or debit cards with no foreign transaction fees to avoid extra charges on purchases abroad.

- Always pay in the local currency to get better exchange rates and avoid costly dynamic currency conversion fees.

- Use ATMs from your bank’s partner network or those that reimburse fees to save on withdrawal costs.

- Notify your bank about your travel plans to prevent card freezes and ensure smooth card use overseas.

- Set up account alerts and monitor exchange rates to catch unusual activity and manage your spending wisely.

International Transaction Fees

Image Source: pexels

Types of Charges

When you use your card abroad, you face several types of international transaction fees. These fees can sneak up on you if you do not pay attention. The most common charges include:

- Foreign transaction fees: Banks and card issuers often charge these fees for purchases made in a foreign currency. Usually, you see a network fee from Visa or Mastercard, which is about 1%, and an issuer fee from your bank, which ranges from 1% to 2%. Together, these fees add up to about 2% to 3% of your purchase.

- Currency conversion fee: When you buy something in another country, your card network converts the price to USD. This process often comes with a 1% fee.

- Dynamic currency conversion fees: Some merchants offer to charge you in your home currency instead of the local one. This service can cost you an extra 3% to 12% on top of your purchase. It usually comes with a worse exchange rate, too.

- ATM fees: If you withdraw cash from an ATM, you might pay extra charges. These fees depend on the ATM operator and your bank. Using ATMs outside your bank’s network can make these costs even higher.

Here’s a quick look at how these fees compare:

| Fee Type | Who Charges It | Typical Cost Range |

|---|---|---|

| Foreign transaction fee | Card issuer or bank | 2% to 3% of transaction amount |

| Currency conversion fee | Card network/processor | About 1% of transaction amount |

| Dynamic currency conversion (DCC) fee | Merchant | 3% to 12% of transaction amount |

Why Fees Matter

You might think a few dollars here and there do not matter, but international transaction fees add up fast. Every time you pay for a meal, a taxi, or a souvenir, you pay a percentage in fees. If you travel for a week and use your card for every purchase, these small charges can turn into a big expense.

Many travelers do not realize that banks and card providers often use exchange rates that are less favorable than the market rate. This means you lose even more money with each transaction. Some merchants also add dynamic currency conversion fees if you choose to pay in your home currency, making things even more expensive.

Understanding international transaction fees helps you avoid surprises on your statement. When you know what to look for, you can pick cards that do not charge a foreign transaction fee, use partner ATMs, and always pay in the local currency. These simple steps help you keep more of your money for the things you enjoy on your trip.

Preparing to Avoid Overseas Card Fees

Choosing Debit and Credit Cards

You want to save money when you travel, so picking the right debit and credit cards matters. Many banks offer cards with zero foreign transaction fees. These no-fee cards help you avoid extra charges every time you pay abroad. Here’s a quick look at some top options:

| Card Name | International Transaction Fees | Acceptance Abroad | Key Benefits and Conditions |

|---|---|---|---|

| Wise Multi-Currency Card | Zero fees, mid-market exchange rates | Widely accepted Mastercard | No margins on exchange rates; low fees; suitable for international use |

| Santander Select World Debit Mastercard | No fees on purchases and ATM withdrawals | Global network with 30,000+ ATMs | ATM surcharge reimbursement; travel protection; Priority Pass; requires $25 minimum deposit; $25k balance to waive monthly fee |

| Schwab Bank Visa Platinum Debit Card | No foreign transaction fees; ATM fees reimbursed | Widely accepted Visa | Unlimited ATM fee rebates worldwide; no monthly fees; daily purchase and withdrawal limits |

| Revolut Debit Card | No fees on spending in 150+ currencies (with limits) | Widely accepted Mastercard/Visa | Fee-free currency exchange weekdays; limits on free withdrawals and currency exchange; multiple plans available |

| HSBC Premier Debit World Mastercard | No foreign transaction fees on purchases | Widely accepted Mastercard | Requires high deposit or monthly deposits to waive $50 fee; global support and wealth products |

| Betterment Visa Debit Card | ATM and foreign transaction fees reimbursed | Visa and Mastercard acceptance | No minimums or monthly fees; daily spending and withdrawal limits; cashback and FDIC insured |

| Citibank Citi Priority Package | No foreign exchange fees on purchases and ATM withdrawals | Widely accepted Mastercard | Travel benefits; $30 monthly fee waived with $30k balance; higher purchase and withdrawal limits |

Some banks join global partnerships, like the Global ATM Alliance, to help you avoid overseas card fees. Here’s how these partnerships work:

- You can use ATMs from member banks, such as Bank of America, Barclay’s, and Deutsche Bank, without paying extra ATM fees.

- Some banks, like Charles Schwab, reimburse all ATM fees worldwide, so you never worry about extra charges.

- Always check if your bank’s partnership covers the country you plan to visit.

When you choose a credit card with no foreign transaction fee, you keep more money for your trip. Look for cards that work well worldwide and offer extra perks, like travel protection or ATM fee rebates.

Notifying Your Bank

Before you leave, let your bank know about your travel plans. This step helps you avoid problems with your cards while you are away. If your bank sees a purchase in another country, it might freeze your card to stop fraud. By sharing your travel dates and locations, you help your bank recognize your purchases as real.

| Benefit | Explanation |

|---|---|

| Prevent card freezing | Notifying your bank before travel helps avoid your cards being frozen due to suspicious activity detected by fraud systems while abroad. |

| Uninterrupted card usage | Informing the bank allows continued use of credit and debit cards overseas without interruption. |

| Reduced ATM fees | Some large banks have overseas ATM partnerships that reduce withdrawal fees, which you can take advantage of by notifying them. |

| Avoid account freezes | Banks may freeze checking accounts if suspicious foreign withdrawals occur; notifying them helps prevent this. |

| Provide travel details | Sharing travel locations and dates helps banks recognize legitimate transactions and avoid fraud alerts. |

Some banks, like Chase, use advanced fraud detection and may not always need a travel notice. Still, updating your contact information is smart. This way, your bank can reach you if they spot something unusual.

Setting Up Digital Wallets

Digital wallets add a layer of security when you travel. They use tokenization, which means your real card number never gets shared during a purchase. You can set up PIN codes or use your fingerprint or face to unlock your wallet. This makes it hard for anyone else to use your cards if your phone gets lost or stolen.

Digital wallets also let you pay without touching a card reader, which keeps your card details safe. They use encryption and real-time monitoring to spot fraud quickly. Still, not every store accepts digital wallets, especially in places with limited internet or contactless payment options. Always carry your physical cards as a backup. When you use both a digital wallet and a credit card with no foreign transaction fee, you get the best mix of security and savings.

Money Tips for Spending Abroad

Pay in Local Currency

When you travel, you often get a choice at checkout: pay in your home currency or the local currency. Always pick the local currency. This simple step saves you money. If you choose your home currency, the merchant or ATM provider uses their own exchange rate. These rates are usually much worse than what your card issuer offers. You also pay extra hidden fees. Wise explains that paying in local currency helps you avoid these inflated rates and hidden charges. Their card uses the mid-market exchange rate and low, clear fees, so you keep more of your money.

NatWest found that travelers lose over $21 million each year by picking their home currency instead of the local one. Sometimes, you pay up to 13% more for things like hotels. Hazel Harper from NatWest says paying in your home currency can make your trip much more expensive. If you want to stick to your budget, always pay in the local currency. This is one of the best money tips for traveling abroad.

Tip: If a card reader asks, “Pay in USD or local currency?” always pick local currency. You will avoid extra fees and get a better exchange rate.

Avoid Dynamic Currency Conversion

Dynamic currency conversion, or DCC, sounds helpful, but it costs you more. Merchants and ATMs may offer to convert your purchase into your home currency right away. This service adds big markups and commissions on top of the usual 1% fee from card companies. Here’s what happens with DCC:

- DCC providers add unlimited commissions and markups, making your purchase more expensive.

- Third-party companies, not your card issuer, set the exchange rate. Their rates are much worse.

- You may not realize you can say no to DCC. Many travelers accept it by mistake.

- Merchants and DCC providers make extra profit from these markups.

- Sometimes, the system guesses your home currency wrong, causing even more conversions and fees.

- Visa says merchants must tell you about DCC, but often you do not get a real choice.

If you want tips to avoid charges, always decline DCC. Let your card issuer handle the conversion. You will pay less and avoid surprise fees. This is one of the most important money tips for anyone using cards abroad.

Use Partner ATMs

When you need cash, use ATMs that belong to your bank’s partner network. These ATMs help you avoid high withdrawal fees and bad exchange rates. The Allpoint Network, for example, has over 55,000 ATMs worldwide. If your bank or card provider works with Allpoint, you can withdraw cash from ATMs in places like the United Kingdom, Canada, Australia, and Mexico without paying extra fees. Always check if your bank is part of a global ATM network before you travel.

Note: Using non-partner ATMs can cost you more. You may face higher withdrawal fees, poor exchange rates, and even security risks like card skimming. Stick to bank-run ATMs in safe locations, especially during bank hours.

Limit Cash Withdrawals

Every time you withdraw cash from ATMs abroad, you may pay a flat fee (usually $1 to $5) or a percentage (about 1-3%). U.S. banks often charge around $4 per withdrawal, plus a 3% foreign transaction fee. Some foreign ATMs add their own surcharges. To save money, limit how often you take out cash. Make fewer, larger withdrawals instead of many small ones. This reduces the total fees you pay.

Here are some tips to avoid charges when you need cash:

- Check your bank’s withdrawal fees before you travel.

- Know your daily withdrawal limits to avoid declined transactions.

- Avoid independent ATMs, like Travelex or Euronet. They charge higher fees and may use dynamic currency conversion tricks.

- Use bank-run ATMs during business hours for better security.

- Do not carry too much cash for safety.

If you use debit-card cash withdrawals, plan ahead. This helps you avoid extra fees and keeps your budget on track.

Extra Ways to Cut International Transaction Charges

Online Payment Platforms

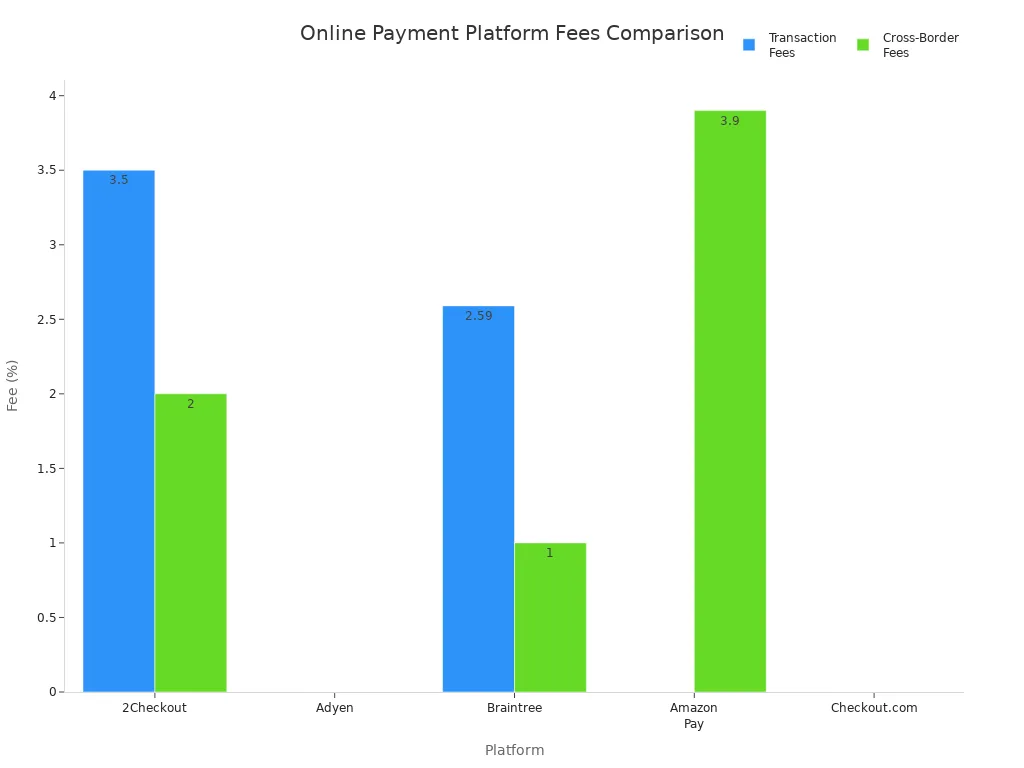

You can save money by using online payment platforms when you pay for things abroad. These platforms often have lower fees than banks or traditional card networks. They also support many currencies and countries, making them a smart choice for travelers. Here’s a quick look at some popular options:

| Platform | Transaction Fees | Cross-Border Fees | Currency & Country Support | Key Features & Notes |

|---|---|---|---|---|

| 2Checkout | 3.5% + $0.35 (2Sell plan) | 2% (some countries) | 200 countries, 100+ currencies | No monthly fees, supports 45+ local payment methods |

| Adyen | $0.13 + variable | Varies by method | PCI compliant | Strong fraud protection, easy integration |

| Braintree | 2.59% + $0.49 (cards) | 1% for non-US cards | 45+ countries, 130+ currencies | Recurring billing, supports digital wallets |

| Amazon Pay | $0.30 + 3.9% cross-border | 3.9% cross-border fee | 18 countries, 12 currencies | Easy for Amazon sellers, fraud protection |

| Checkout.com | Quote-based flat rate | N/A | 45+ countries, 150+ currencies | Zero setup fees, unified API |

You can see that 2Checkout, Adyen, and Braintree offer competitive fees and support many countries. If you want to cut international transaction charges, consider these payment methods for online shopping or booking travel.

Prepaid Forex and Foreign Currency Cards

Prepaid forex cards and foreign currency cards help you avoid high credit-card charges. These cards usually offer better exchange rates and lower conversion fees than regular credit cards. You load money onto the card before your trip, so you control your spending and avoid interest charges. Here’s how they compare:

| Fee Type | Prepaid Forex Card | Credit Card | Debit Card (Wise example) |

|---|---|---|---|

| Currency Conversion Fees | Lower, better rates | Higher, may add DCC | Mid-market rates, transparent |

| Initial/Setup Fees | Possible | Usually none, annual fees | N/A |

| Inactivity Fees | Possible | None | N/A |

| Interest Charges | None | Possible | N/A |

| ATM Withdrawal Fees | Varies | Often higher abroad | Limited free withdrawals |

Prepaid cards may have setup or inactivity fees, but you do not pay interest. Credit cards are easy to use, but they can cost more because of extra fees. Debit cards like Wise use fair exchange rates and show you all fees upfront. If you are traveling on a budget, prepaid cards can help you manage costs.

Memorize Your PIN

Knowing your card PIN is important for safe travel. Many international ATMs and stores require a PIN. If you forget it, you might not get cash or finish a purchase. Here are some tips:

- Memorize your numeric PIN. Some ATMs do not have letter keypads.

- Cover the keypad when you enter your PIN to keep it private.

- Use ATMs in safe, well-lit places, especially during the day.

- Do not write your PIN down or keep it with your card.

- Set your PIN before you travel to avoid problems with fraud alerts or account freezes.

Memorizing your PIN keeps your money safe and gives you easy access to cash when you need it. This simple habit helps you avoid trouble and keeps your trip stress-free.

Smart Habits for Card Security

Image Source: pexels

Monitor Exchange Rates

When you travel, exchange rates can change quickly. These changes affect how much you pay for things with your card. If the local currency gets stronger against the USD, you might pay more than you expected. Credit card companies use rates set by payment networks or banks, and these rates shift all the time. You may find it hard to predict the exact cost of your purchases. Sometimes, you even see a higher bill if the rate changes between when you buy something and when your bank processes the payment.

To stay ahead, use apps that track real-time exchange rates. The Wise app sends you alerts when rates move, so you know the best time to spend or exchange money. Other popular apps include Xe Currency Converter, Currency Converter Plus, and Easy Currency Converter. These apps give you live updates, offline access, and easy-to-read charts. Here’s a quick look at some top choices:

| App Name | Key Features | Platforms |

|---|---|---|

| Wise | Real-time alerts, mid-market rates | iOS, Android |

| Xe Currency Converter | Live updates, user-friendly | iOS, Android |

| Currency Converter Plus | Instant conversion, offline mode | iOS, Android |

If you want to save money, always check the rate before you pay. This habit helps you avoid hidden markups and keeps your spending on track, especially when you are traveling on a budget.

Set Up Account Alerts

Account alerts help you spot problems fast. When you use your card abroad, you want to know right away if something looks wrong. Most banks let you set up alerts for foreign transactions, large purchases, or unusual activity. You get these alerts by text, email, or push notification.

- You receive real-time alerts for every transaction in a foreign currency.

- Alerts show up on your phone or email, so you can check them quickly.

- Special alerts warn you about unusual activity, like spending in a new country.

- You can choose which alerts you want, making it easy to watch your account.

- If you see a charge you do not recognize, you can act fast to stop fraud.

Setting up alerts gives you peace of mind. You stay in control of your money and can travel with less worry.

Handle Leftover Cash

After your trip, you might have some foreign cash left. You have several smart options for handling it:

- Spend your leftover currency before you leave, such as at the airport or on last-minute gifts.

- Save it for your next trip, so you have cash ready for taxis or tips.

- Exchange it at services like Travelex or Leftover Currency, which accept both notes and coins.

- Donate your spare change at airport bins or through programs like UNICEF’s Change for Good.

- Give coins to friends or teachers, or use them for crafts and souvenirs.

If you use a no-foreign-fee credit card during your trip, you can avoid ending up with too much leftover cash. Try to use cash only for small purchases or places that do not take cards. This way, you keep your money safe and make the most of every dollar.

You can save a lot of money on your next trip by planning ahead and using smart card habits. When you choose cards with no foreign transaction fees, let your bank know your travel plans, and pay in local currency, you avoid extra charges.

- Prepare all documents early and research payment options before you go.

- Use multi-currency cards and decline home currency payments to cut fees.

- Pick ATMs from trusted banks and take out larger amounts to reduce withdrawal costs.

These steps help you keep more cash in your pocket, especially if you are traveling on a budget.

FAQ

What should you do if your card gets lost or stolen abroad?

Call your bank right away. Ask them to block your card. Use your backup card or digital wallet for payments. Some banks, like HSBC Hong Kong, offer emergency card replacement. Always keep your bank’s contact number handy.

Can you use your card everywhere when you travel?

Most places accept cards, but some small shops or markets only take cash. Always carry a little cash for these spots. Check if your card works in the country you visit. Some cards work better in certain regions.

How can you avoid ATM skimming scams?

Use ATMs inside banks or busy areas. Cover the keypad when you enter your PIN. Check for anything strange on the machine. If something looks off, find another ATM. Stay alert to keep your money safe.

Is it better to use a credit card or a debit card abroad?

Credit cards often give you more protection against fraud. Debit cards help you stick to your budget. Some cards, like the Wise card, offer good exchange rates. Pick the one that fits your needs, especially if you are traveling on a budget.

What should you do if your card payment is declined overseas?

Try another card or use cash. Sometimes banks block payments for security. Contact your bank to fix the problem. Make sure you told your bank about your travel plans before your trip.

Hidden international card fees can quietly eat into your travel budget. Why lose 3%–5% on every payment when a smarter solution exists?

With BiyaPay, you avoid unnecessary charges and gain more control over your spending:

- Remittance fees as low as 0.5%

- Instant access to real-time exchange rates

- Support for multiple fiat and digital currency conversions

- Coverage in most countries and regions worldwide

- Many transfers arrive the same day

Keep more of your money for what matters most on your journey. Start now with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.