- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Business Credit Card Approval for LLCs Made Easy

Image Source: pexels

Getting a business credit card for your LLC is simple when you know the steps. First, gather your LLC details, personal information, and business address. Next, check your credit score. Compare different business credit card options to find the best fit. Apply online and follow up with the bank. Even if your LLC is new or your credit is less than perfect, you can still get a business credit card. Many banks look for business credit history or enough income, but you can start building credit now. Stay confident and take the first step to get a credit card for LLC.

Key Takeaways

- Use your LLC’s EIN on every credit card application and payment to build business credit and keep finances separate.

- Prepare your LLC details, personal information, and business documents before applying to make the process smooth and increase approval chances.

- Even new LLCs or those with low revenue can get business credit cards by using personal income and choosing cards designed for startups or secured credit.

- Keep your personal credit score strong, pay bills on time, and keep credit use low to improve approval odds and build a good business credit history.

- Use business credit cards responsibly to protect personal assets, track expenses easily, earn rewards, and grow your LLC’s financial strength.

Why Get a Business Credit Card

Separate Finances

You want to keep your business and personal money apart. Using a business credit card helps you do this. When you pay for business expenses with your card, you create a clear record. This makes tax time easier and lowers your risk of an IRS audit. The IRS expects LLCs to keep separate accounts. Mixing your money can put your limited liability protection at risk. You also avoid confusion about which expenses are business and which are personal.

Tip: Keeping your finances separate helps you protect your personal assets and makes your bookkeeping simple.

Build Business Credit

A business credit card lets your LLC build its own credit history. When you pay your bills on time, credit bureaus like Dun & Bradstreet and Experian notice. Over time, your business credit score goes up. This helps you get better loan terms and higher credit limits in the future. Even if you need to give a personal guarantee at first, your business can still build its own credit profile. This keeps your personal credit safer and shows lenders your business is trustworthy.

Rewards and Perks

Business credit cards offer rewards that help your company save money. You can earn cash back, points, or travel rewards on things like office supplies, advertising, and travel. Some cards give you extra perks, such as travel insurance, purchase protection, or free employee cards. Here’s a quick look at common rewards:

| Card Type | Typical Rewards and Perks |

|---|---|

| Cash Back | 1%-5% back, often higher for office supplies or ads |

| Travel Rewards | 2x-5x points on travel, travel insurance, no foreign fees |

| Points-Based | Flexible points for travel, gift cards, or statement credit |

| Employee Management | Spending controls, easy expense tracking |

Higher Limits

Business credit cards usually have higher credit limits than personal cards. This gives you more room to cover big purchases or unexpected costs. For example, while personal cards might offer $2,000 to $10,000, business cards for small businesses often average around $56,100. Your limit can grow as your business grows, giving you more flexibility.

Employee Cards

You can give cards to your employees, making it easy for them to pay for business expenses. You set spending limits and track what each person spends. This cuts down on paperwork and speeds up purchases. Employee cards also help you earn more rewards and keep business spending separate from personal money. Each transaction links to an employee, so you always know who spent what. This makes your accounting and tax prep much easier.

Requirements to Get a Business Credit Card

Image Source: pexels

Getting a business credit card for your LLC is easier when you know what banks and issuers look for. You will need to gather some important details about your business and yourself. Let’s break down the main requirements to get a business credit card and what you should prepare before you apply.

LLC Information

When you apply for a business credit card, issuers want to see that your LLC is real and active. You will need to provide:

- The legal name of your LLC

- The business name you want printed on the card

- Your business address and contact details

- The type of business (LLC, corporation, etc.)

- The number of years your LLC has been in business

- The number of employees you have

Tip: Even if your LLC is brand new, you can still apply for a business credit card. There is no minimum time in business required. Many banks let you apply right after you form your LLC.

Issuers may also ask for documents like your Articles of Organization or business licenses. These help prove your LLC’s legal structure and show that your business is set up correctly.

EIN and Legal Structure

Your EIN, or Employer Identification Number, is a key part of the application. The EIN acts like a Social Security Number for your LLC. It helps banks track your business for tax and credit purposes. You will need to enter your EIN on the application. If you do not have one yet, you can get it from the IRS for free.

Here’s why your EIN and legal structure matter:

- Using an EIN helps keep your business and personal finances separate.

- Most business credit cards for LLCs still require a personal guarantee, so you will also need to provide your Social Security Number.

- Some cards, called EIN-only cards, let you apply without using your SSN. These are usually for larger businesses with strong financials.

- Your LLC’s legal structure affects which cards you can get. Corporations and partnerships with an EIN and steady revenue may qualify for EIN-only cards. Most LLCs, especially new ones, need to use both an EIN and SSN.

| What You Need | Why It Matters |

|---|---|

| EIN | Builds business credit, separates finances, needed for most applications |

| Articles of Organization | Proves your LLC is real and active |

| Business Address | Shows your LLC is operating |

Note: Having an EIN helps your LLC build its own credit history over time. This can lead to better approval odds and higher credit limits in the future.

Personal Credit Check

Most banks check your personal credit when you apply for a business credit card. They want to see if you have a good track record with credit. This is called a personal guarantee. If your LLC cannot pay the bill, you are responsible.

- A good personal credit score (usually 670 or higher) gives you the best chance for approval.

- If your score is between 580 and 669, you may still qualify for basic or secured business credit cards.

- Scores below 580 often need secured cards or credit-building products.

Credit Score Considerations: Your personal credit history matters a lot, especially for new LLCs. Even if your business has no credit history yet, your own score can help you get started.

Some cards let you apply with just your EIN, but these are rare for LLCs without strong revenue. Most of the time, your personal credit will play a big role in the decision.

Business Financials

Banks want to know if your LLC can handle a business credit card. They look at your business’s annual revenue, monthly expenses, and sometimes your business bank account. Here’s what you should have ready:

- Annual business revenue (if you have any)

- Estimated monthly expenses

- Time in business

- Business bank account details (optional, but helpful)

If your LLC is new and has no revenue, you can still apply. Many issuers let you use your personal income or household income to qualify. This means you do not need to wait until your business is making money.

Note: Higher and verifiable business revenue can help you get approved for higher credit limits. If you do not have revenue yet, be honest on your application. You can still get a business credit card and start building your LLC’s credit history.

Checklist: What You’ll Need to Apply

- LLC legal name and business name for the card

- EIN (Employer Identification Number)

- Business address, phone, and email

- Articles of Organization or business license

- Number of years in business and number of employees

- Annual revenue and monthly expenses (estimates are okay)

- Personal information (name, SSN, income, credit score)

Getting these details ready will make your application process smooth. Remember, the requirements to get a business credit card are not as hard as they seem. Even if your LLC is new or your credit is not perfect, you have options. Focus on building your credit history and keeping your EIN and business details up to date. This will help your LLC grow and open more doors for your business in the future.

Easiest Ways to Get a Business Credit Card

Getting a business credit card for your LLC does not have to feel overwhelming. Many banks and card issuers want to work with small businesses, even if your company is brand new or your finances are not perfect. Let’s look at the easiest ways you can get approved, no matter where your LLC stands today.

New LLCs

You might think your LLC needs years of experience before you can get a business credit card. That is not true. Most issuers care more about your personal credit score than how long your LLC has existed. If you have a good personal credit score, you can get approved for a new business credit card even if your LLC just started.

Here are some issuers that often approve new LLCs:

- Chase (Ink Business Preferred® Credit Card)

- Ramp Corporate Card

- U.S. Bank (Business Altitude® Connect Visa Signature® Card)

- Capital One (Spark Classic for Business)

When you apply, you will need to provide your LLC’s legal name, EIN, business address, and your personal information. Most banks will ask for your Social Security number and a personal guarantee. Your EIN helps keep your business and personal finances separate, but your personal credit history is still the main factor for approval.

Tip: The age of your LLC does not matter as much as your personal credit score. Focus on keeping your credit strong and have your EIN ready.

Low or No Revenue

Many new LLCs do not have steady revenue yet. You might worry this will stop you from getting a business credit card. The good news is, many issuers let you use your personal income or household income on the application. You can also estimate your business revenue if you do not have exact numbers.

If your LLC has low or no revenue, consider these steps:

- Gather your LLC’s EIN, business address, and Articles of Organization.

- Use your personal income if your business has not made money yet.

- Look for cards that accept new businesses and startups.

Some cards, like the Ramp Corporate Card, focus on startups and may not require a long business history. Other options include secured business credit cards, which require a deposit but help you build credit history for your LLC. These cards report to business credit bureaus, so your EIN gets linked to your payments and spending.

Note: Even if your LLC has no revenue, you can still apply for a business credit card. Be honest about your numbers and use your EIN on every application.

Less-Than-Perfect Credit

If your personal credit score is not great, you still have options. Many business credit cards require a personal guarantee, so your credit history matters. However, some cards are designed for fair or rebuilding credit.

Here are some choices for LLCs with less-than-perfect credit:

- Capital One Spark Classic for Business (for fair credit)

- Revenued Business Card (no hard credit check)

- Secured business credit cards (require a security deposit)

Secured cards work well if you want to build or repair your credit history. You put down a deposit, and the card issuer reports your payments to business credit bureaus. This helps your LLC build a positive credit history tied to your EIN. Over time, you can qualify for better cards with higher limits and more rewards.

Tip: Always use your EIN when applying for business credit cards. This helps your LLC build its own credit profile, even if you start with a secured card.

Quick Comparison Table

| Card Type | Who Can Apply | EIN Required | Personal Guarantee | Good For |

|---|---|---|---|---|

| Standard Business Credit Card | New LLCs, good credit | Yes | Yes | Building credit, rewards |

| Secured Business Credit Card | Low credit, new LLCs | Yes | Yes | Rebuilding credit |

| Startup-Focused Card | Startups, low revenue | Yes | Sometimes | No/low revenue, new LLCs |

| EIN-Only Card | Established LLCs, strong revenue | Yes | No (rare) | High revenue, strong credit |

Most business credit cards require both your EIN and a personal guarantee. EIN-only cards are rare and usually for larger, established LLCs with strong revenue and credit history.

Note: If you get denied, do not give up. Try a secured card or a card for fair credit. Use your EIN every time. Each payment helps your LLC build a stronger credit history.

Business Card Options for LLCs

Choosing the right business card options can help your LLC grow faster. You want a card that matches your needs, whether you want easy approval, to use only your EIN, or to build credit with a deposit. Let’s look at the main types you can pick from.

Simple Approval Cards

If your LLC is new or your credit is average, you can still get a business credit card. Many banks and fintech companies offer cards with simple approval. You just need your LLC’s legal name, EIN, business address, and some personal details. Most cards ask for a personal guarantee, so your credit score matters. Some cards also check your business cash flow.

Here are some popular business card options for LLCs:

| Card Name | Annual Fee | Rewards | Features | Approval Needs |

|---|---|---|---|---|

| Chase Ink Business Cash | $0 | 5% cash back on office supplies | Employee cards, fraud alerts | Lower credit scores accepted |

| Capital One Spark 1% Classic | $0 | 1% cash back | Spending limits, no foreign fees | Low to average credit scores |

| American Express Blue Business Cash | $0 | 2% cash back on first $50k | Purchase protection | Good credit score |

You can apply online using your EIN and personal info. These cards help you manage expenses and earn rewards.

Tip: Always compare rewards, fees, and extra benefits before you choose. Some cards offer better perks for travel, while others give more cash back.

EIN-Only Cards

Some LLCs want to keep personal credit separate. EIN-only cards let you apply using just your business details. You do not need to give your Social Security Number or a personal guarantee. These cards work best for LLCs with strong business finances.

| Card Name | EIN-Only Allowed | Requirements |

|---|---|---|

| Brex Corporate Card | Yes | LLC, partnership, or corporation; no personal guarantee |

| Ramp Corporate Card | Yes | LLC with $75,000+ in business bank account |

| Stripe Corporate Card | Yes (invite only) | Active Stripe user; based on payment history |

| AtoB Fleet Fuel Card | Yes | LLC with large fleet; monthly fees apply |

You must have an EIN, a business bank account, and good revenue. These cards often give you real-time spending controls and no preset limits.

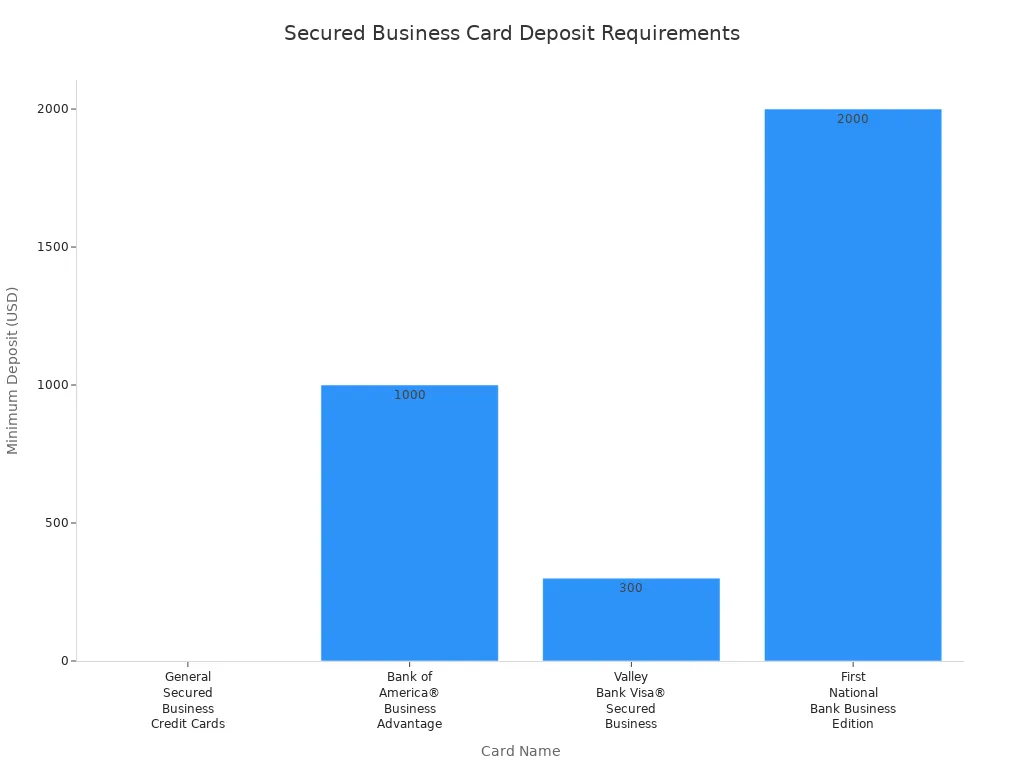

Secured Business Cards

If your LLC has low credit or no credit, secured business cards can help. You pay a deposit, which becomes your credit limit. Use your EIN when you apply. Make payments on time to build your LLC’s credit.

| Card Name | Minimum Deposit | How It Works |

|---|---|---|

| Bank of America Business Advantage Secured | $1,000 | Deposit equals limit; helps build credit |

| Valley Bank Visa Secured | $300 | Up to $5,000 limit; 0% intro APR |

| First National Bank Business Edition Secured | $2,000 | Designed for credit building |

Secured cards report to business credit bureaus using your EIN. Over time, your LLC can move up to unsecured cards with better rewards.

Note: Always use your EIN on every application. This helps your LLC build a strong credit profile.

Application Steps

Pre-Application Checklist

Before you start the application process, make sure you have everything ready. This helps you move through each step quickly and boosts your chances of approval. Here’s a simple checklist:

- Your LLC’s legal name and EIN

- Business address and contact details

- Articles of Organization

- Business checking account information

- DUNS number (if you have one)

- Estimated annual revenue and monthly expenses

- Personal information, including your Social Security Number

- List of vendors or suppliers you work with

Tip: Keep your EIN and business details up to date. This makes your business credit card application smoother.

Online Application Process

Most banks and card issuers let you apply online. The application process usually takes less than 20 minutes. You fill in your LLC’s legal name, EIN, and business address. You also enter your personal information and income. Some forms ask for your business checking account details. Double-check all entries before you submit.

After you send your credit card application, you may get an instant decision. Sometimes, the bank will ask for extra documents, like your Articles of Organization or proof of EIN. Upload these quickly to keep the application process moving.

Tips for Approval

You want to get a business credit card on your first try. Here are some steps that help:

- Legally set up your LLC and get your EIN.

- Open a business checking account to show you keep business and personal money separate.

- Get a DUNS number to help track your business credit.

- Build credit by paying vendors and bills on time.

- Use your EIN on every application process.

- Keep your credit utilization low, under 30%.

- Review your business credit reports for errors.

- Update your business info with credit bureaus.

- Communicate with creditors if you face payment issues.

Note: Responsible use of your business credit card helps you build a strong credit profile for your LLC.

After You Apply

Once you finish the application process, watch your email for updates. If approved, activate your business credit card right away. Add your EIN to all business accounts and start using the card for business expenses. If you get denied, review your credit card application and check your EIN and business details for mistakes. Try a secured card or work on building your credit, then apply again.

Overcoming Roadblocks

Every LLC faces challenges when trying to get a business credit card. You might run into problems with your EIN, credit history, or even the application process itself. Let’s look at the most common roadblocks and how you can move past them.

No Business Credit

If your LLC has no business credit, you are not alone. Many new businesses start this way. Lenders want to see that your company can handle credit, but you need a chance to prove it. Here are some steps you can take:

- Apply for cards that do not need a personal credit check, like the Nav Prime Card. This card uses your EIN and business bank account.

- Try a secured business credit card. You put down a deposit, and the card reports to business credit bureaus using your EIN.

- Use your EIN on every application. This helps your LLC build a credit profile.

- Include household income on your application if allowed.

- Start with a lower credit limit and pay on time. Over time, your EIN will show a positive payment history.

Tip: Always keep your business and personal finances separate. Use your EIN for all business credit card payments.

Low Personal Credit

A low personal credit score can make things tough, but you still have options. Many issuers check your personal credit during the application process, even if you use your EIN. Here’s what you can do:

- Look for secured business credit cards that accept lower scores. These cards use your EIN and a deposit.

- Add yourself as an authorized user on another card to help your credit.

- Make all payments on time and keep your balances low.

- Dispute any errors on your credit report to improve your score.

- Use your EIN on every application to help your LLC build its own credit.

Low Revenue

Some banks want to see steady business revenue, but not all cards require high numbers. Many issuers let you use your household income or personal income if your LLC is new. Here are some tips:

- Choose cards that accept low or no revenue, like secured cards or startup-focused cards.

- Use your EIN and business bank account for the application process.

- Keep good records of your business expenses and income.

- Start with a lower credit limit and ask for increases after you show a good payment history.

| Card Type | Revenue Needed | EIN Used | Good For |

|---|---|---|---|

| Secured Business Card | Low/None | Yes | Building credit |

| Startup-Focused Card | Low/None | Yes | New LLCs, low revenue |

| EIN-Only Card | High | Yes | Established LLCs |

Application Denied

If your application gets denied, don’t worry. Many LLCs face this at first. Here’s what you can do next:

- Review your credit reports for mistakes and fix them.

- Call the card issuer and ask for reconsideration. Explain your situation and provide more details about your EIN and business.

- Try a secured business credit card or a card for fair credit.

- Use your EIN on every new application to help your LLC build credit.

- Lower your existing debts and keep making payments on time.

Note: Each time you use your EIN and pay on time, you help your LLC grow stronger. Keep trying, and you will see results.

Responsible Card Use

Image Source: pexels

Build Credit

You want your LLC to grow stronger. Using your business credit card the right way helps you build a solid credit history. Start by making sure your LLC is set up with an ein. Open a business checking account and keep it separate from your personal money. Register your business with credit bureaus using your ein. When you apply for a business credit card, always use your ein on the application.

Here are some steps you can follow to build credit:

- Use your ein for every business credit card application.

- Make all payments on time or early. Set up autopay or reminders so you never miss a due date.

- Keep your credit card balance low. Try to use less than 30% of your limit.

- Check your business credit reports every month. Look for mistakes and fix them fast.

- Move to unsecured cards as your credit grows. This gives you more flexibility and higher limits.

Tip: Paying your bills on time with your ein helps your LLC look reliable to lenders.

Manage Expenses

A business credit card makes it easy to track what your LLC spends. Always use your ein when you pay for business costs. This keeps your records clean and helps you see where your money goes. You can set spending limits for employee cards and review each purchase.

Try these tips to manage expenses:

- Use your ein for all business purchases.

- Review your statements every month.

- Separate business and personal expenses by using your ein on every transaction.

- Set alerts for large or unusual charges.

A table can help you see how to organize your spending:

| Expense Type | Pay With EIN? | Track Monthly? |

|---|---|---|

| Office Supplies | Yes | Yes |

| Travel | Yes | Yes |

| Meals | Yes | Yes |

| Personal Items | No | No |

Avoid Pitfalls

You want to avoid common mistakes that can hurt your LLC’s credit. Never mix personal and business spending. Always use your ein for business credit cards. Do not max out your card. High balances can lower your credit score. Watch out for late payments. Even one missed payment with your ein can damage your business credit.

Here are some pitfalls to watch for:

- Using your business card for personal expenses

- Forgetting to use your ein on applications or payments

- Missing payment deadlines

- Ignoring your business credit reports

Note: Your ein is your LLC’s key to building credit. Use it wisely and check your progress often.

Getting a business credit card for your llc is easier than you think. Start by setting up your ein, gather your business details, and choose the right card. Use your ein on every application and payment. When you use your ein for all business spending, you keep your llc safe and organized. Here are some long-term benefits you get when you use your ein and business credit card responsibly:

- Build business credit for better financing and higher limits

- Keep personal and business expenses separate, making taxes simple

- Protect your personal assets

- Boost your purchasing power without using cash right away

- Earn rewards you can reinvest in your llc

- Manage cash flow with short-term financing

Take the first step today. Use your ein to help your llc grow stronger and reach new goals.

FAQ

Can I get a business credit card for my LLC if it is brand new?

Yes, you can. Many issuers approve new LLCs. You just need your EIN, business details, and personal information. Your personal credit score matters most. Some cards even accept startups with no revenue.

Do I need a good personal credit score to qualify?

A higher score helps, but you still have options with fair or low credit. Secured business cards and some startup-focused cards accept lower scores. Always check the card’s requirements before you apply.

Can I apply for a business credit card using only my EIN?

Most issuers require your Social Security Number and a personal guarantee. Some cards, like those from Brex or Ramp, may allow EIN-only applications. These usually need strong business revenue and a good financial history.

What should I do if my application gets denied?

Check your credit reports for mistakes.

Try a secured business card or one for fair credit.

Call the issuer and ask for reconsideration.

Keep building your business credit by paying bills on time.

Even if your LLC is just starting out, access to reliable financial tools makes all the difference. Beyond credit cards, you also need global payment solutions that are cost-efficient and transparent.

With BiyaPay, you can simplify international transfers and keep expenses predictable:

- Remittance fees as low as 0.5%

- Quick access to real-time exchange rates

- Support for multiple fiat and digital currency conversions

- Coverage in most countries and regions worldwide

- Same-day transfers available in many cases

Equip your LLC with the right payment partner. Get started today with BiyaPay and strengthen your business financial foundation.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.