- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Order and Activate Your Cash App Card in 2025

Image Source: unsplash

Getting your cash app card in 2025 feels simple and quick. You just open your cash app account, tap the card tab, and follow the steps to order. You need to verify your identity with your name, date of birth, and the last four digits of your SSN. After you order, you can use a virtual cash app card to spend your cash app balance right away while you wait for the real card.

- Over 19 million people in the United States use a cash app card for daily expenses, and most are young adults.

Key Takeaways

- Order your Cash App Card easily by setting up your account, verifying your identity, and following the app prompts.

- Activate your card quickly using the QR code or by entering card details manually in the app.

- Use your virtual card right away for online shopping while waiting for the physical card to arrive.

- Add your Cash App Card to Apple Pay or Google Pay for convenient contactless payments in stores.

- If you face issues, update the app, double-check your info, and contact Cash App support for help.

Order Cash App Card

Image Source: unsplash

Access Card Tab

You can start your journey to get a cash app card right from your phone. First, download the Cash App from the App Store or Google Play Store. Open the app and set up your cash app account by entering your phone number or email. Link your debit card or bank account. Next, create your unique $Cashtag username. Once you finish these steps, you are ready to access the Card tab.

To find the Card tab, look at the bottom of your Cash App home screen. Tap the icon that looks like a credit card. This is where you can start your order for a free cash app card. The app will guide you through the process with easy prompts.

Tip: Make sure your app is updated to the latest version. This helps avoid technical issues during the order process.

Step-by-step guide to order your card:

- Download and open Cash App.

- Set up your account with your phone number or email.

- Link your bank account or debit card.

- Create your $Cashtag.

- Tap the Card tab on the home screen.

- Follow the prompts to order your cash app card.

Verify Identity

Before you can get your cash app debit card, you need to verify your identity. The app will ask for your full legal name, date of birth, and the last four digits of your Social Security Number. Sometimes, the app may need more information. If that happens, you might have to upload a clear photo of a government-issued ID, like a driver’s license or state ID. The app will show you how to take and submit these photos.

Note: If you are between 13 and 17 years old, you can only order a cash app card with a sponsored account. Your parent or guardian must approve and supervise your account.

Here are some common reasons people have trouble with verification:

- Missing or incomplete personal information

- Mistyped details, like your name or birthdate

- Blurry or unclear photos of your ID

- Using expired or fake documents

- Not responding to extra requests from the app

- Technical errors or a weak internet connection

To avoid problems, double-check your information and use clear photos. Make sure your details match your official documents.

Delivery Time

After you finish your order and pass verification, your cash app visa debit card will be on its way. Most people receive their card within 10 business days. The shipping time does not change based on where you live in the United States.

Note: You need a physical mailing address to receive your card. Cash App does not ship to P.O. Boxes.

While you wait for your card, you can use your virtual cash app card for online shopping or add it to your mobile wallet for in-store purchases.

Activate Cash App Card

Image Source: unsplash

Once your cash app card arrives, you need to activate it before you can use it for purchases or ATM withdrawals. You can activate your cash app card right in the app. You have two easy options: scanning the QR code or entering your card details manually. Both methods keep your information secure and only take a few minutes.

QR Code Method

The fastest way to activate your cash app card is by using the QR code that comes with your physical card. You do not need to type in any numbers. Just follow these steps:

- Open the Cash App on your phone.

- Tap the card icon at the bottom of your home screen.

- Select “Activate Cash Card.”

- Use your phone’s camera to scan the QR code that came with your card.

After you scan the code, your card becomes active. You can now use your cash app card at any store or ATM that accepts Visa. If you run into trouble with the QR code, you can always switch to the manual entry method.

Tip: Make sure your phone’s camera lens is clean and the QR code is not damaged. Good lighting helps the app scan the code quickly.

Common QR Code Activation Issues

Sometimes, things do not go as planned. Here are some problems you might see when you try to activate your cash app card with the QR code:

- The QR code is blurry or damaged, so the app cannot read it.

- Your internet connection is weak or unstable.

- You have not finished verifying your account.

- You typed in the wrong card details or CVV number.

- Your account is locked because of suspicious activity.

- The Cash App is not working right and needs a restart or update.

If you see any of these issues, try again in a different spot with better lighting or a stronger signal. You can also restart the app or your phone. If the QR code still does not work, use the manual entry method.

Manual Entry

If you cannot scan the QR code, you can activate your cash app card by entering the card details yourself. This method works well if the QR code is missing or damaged. Here is how you do it:

- Sign in to your Cash App account.

- Tap the Cash Card icon at the bottom of the screen.

- Select “Activate Cash Card.”

- Choose “Use CVV Instead.”

- Enter your cash app card’s CVV number and expiration date.

Once you finish these steps, you can use your cash app debit card for shopping, online payments, or ATM withdrawals.

Note: Always double-check the numbers you enter. Even a small mistake can stop you from activating your card.

Security Measures During Activation

Cash App takes your safety seriously when you activate your cash app card. The app uses encryption and fraud detection to protect your data. You must verify your identity before you can activate your cash app card. If the app sees anything suspicious, it may lock your account and ask for extra steps to keep your money safe. You can also control your privacy settings and decide who can send you requests. If you ever have trouble, Cash App support is ready to help.

Alert: Never share your card details or QR code with anyone. Only enter your information in the official Cash App.

Use Cash App Card

Virtual Card Access

You do not have to wait for your physical card to start using it. As soon as you order your cash app card, you get instant access to a virtual version. This means you can use your cash app balance for online shopping or payments right away. To find your virtual card, open your cash app account, tap the Cash Card tab, and select “Show Card Info.” You will see your card number, expiration date, and CVV. You can use these details just like a regular debit card for online purchases. You can also send money, pay for services, or transfer funds to your bank while you wait for your physical card.

Tip: The virtual card works anywhere that accepts Visa for online payments.

Add to Mobile Wallet

You can add your cash app card to Apple Pay or Google Pay in just a few steps. This lets you pay in stores with your phone, even before your physical card arrives. Here is how you do it:

- Open Apple Wallet or Google Pay on your phone.

- Go to your Cash Card details in the Cash App.

- Follow the prompts to add your card.

- At checkout, look for the contactless symbol.

- Unlock your phone and hold it near the payment terminal.

- Approve the payment with Face ID, Touch ID, or your passcode.

Note: You need a cash app card (virtual or physical) to link it to your mobile wallet.

In-Store and Online Use

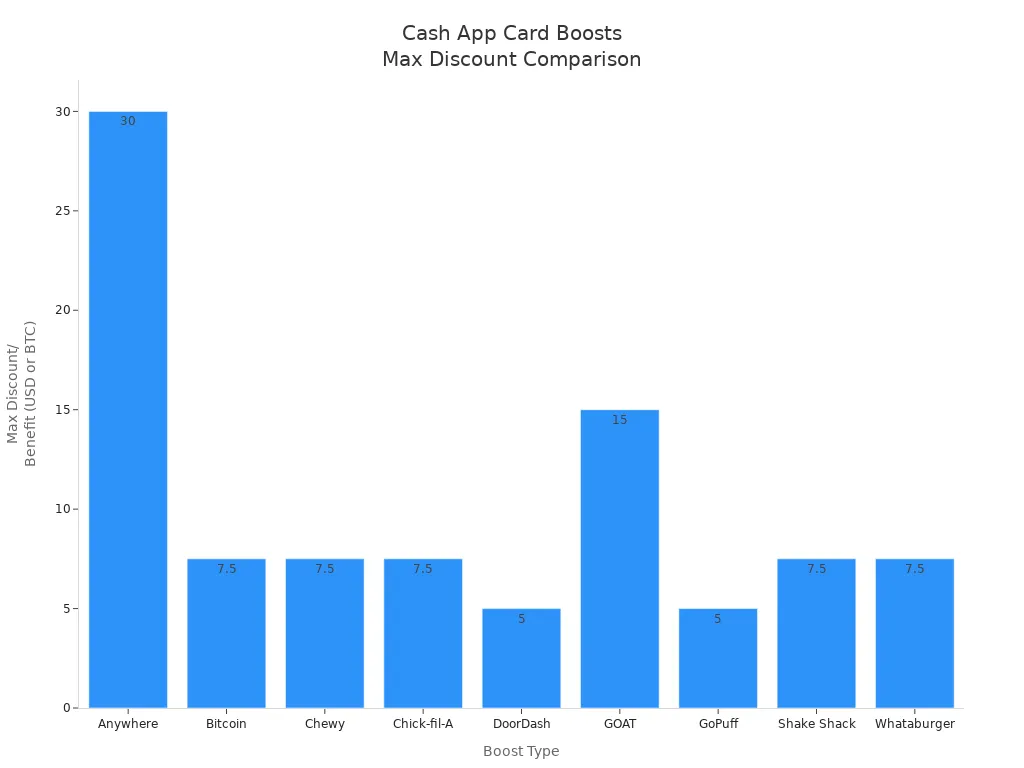

You can use your cash app card for both in-store and online purchases. The card works anywhere Visa is accepted, with no hidden fees. You can also enjoy instant discounts through Boosts. Boosts give you cash back or percentage savings at places like restaurants, grocery stores, and online shops. You can only use one Boost at a time, but you can switch them whenever you want.

| Boost Type | Discount/Benefit | Usage Restrictions |

|---|---|---|

| Anywhere | $30 off one purchase | Minimum $30 purchase, requires $300+ paycheck deposits |

| Bitcoin | Earn 3% Bitcoin on 3 purchases | Min $1.50 purchase, max $7.50 BTC earned |

| Chewy | 5% off one order | Min $1 purchase, max $7.50 discount |

| Chick-fil-A | 5% off one order | Min $1.50 purchase, max $7.50 discount |

| DoorDash | 10% off | Min $2 purchase, max $5 discount |

| GOAT | 5% off one purchase | Min $5 purchase, max $15 discount |

| GoPuff | 10% off one order | Min $5 purchase, max $5 discount |

| Shake Shack | 15% off one order | Min $1 purchase, max $7.50 discount |

| Whataburger | 5% off one purchase | Min $1.50 purchase, max $7.50 discount |

You can use your cash app balance for purchases, instant discounts, and even peer-to-business payments. Many users love the no-fee banking, early paycheck access, and the ability to earn rewards. Your cash app card gives you flexibility and savings every day.

Troubleshooting

Activation Issues

Sometimes, you might run into problems when you try to activate your Cash App Card. Maybe the QR code does not scan, or the app will not accept your card details. Here are some common issues and what you can do:

- The QR code looks blurry or damaged. Try cleaning your camera lens and making sure you have good lighting.

- The app says your information does not match. Double-check your name, date of birth, and Social Security Number.

- You have not finished verifying your identity. Go back and complete any missing steps in the app.

- The app will not load or keeps crashing. Restart your phone and make sure your app is updated.

- You see an error message about suspicious activity. Contact Cash App support for help.

Tip: Always use the latest version of Cash App. Updates fix bugs and make activation smoother.

Lost or Delayed Card

If your Cash App Card gets lost, delayed, or does not arrive, you can take action right away. Follow these steps to stay safe and get a new card:

- Open Cash App on your phone.

- Go to the Cash Card tab.

- Tap ‘Replace Card’ or ‘Order New Card.’

- Check your mailing address and pick any card designs you want.

- The new card usually arrives in 10 to 14 business days.

- Turn off your lost card in the app to stop anyone from using it.

- If you need your card fast or it is taking too long, reach out to Cash App support for help.

- Keep your app updated to avoid problems.

- Watch your email for shipping updates.

Note: Always disable your lost card as soon as possible. This keeps your money safe.

Contact Support

If you still need help, Cash App offers several ways to reach support:

- Use the in-app support feature. Open Cash App, tap your profile, then tap Support, and pick your issue.

- Call Cash App at 1-800-969-1940. You will need your Cash App ID and may need to verify your identity.

- Visit the official website at cash.app/help for FAQs and support forms.

- Email support at support@cash.app.

- Message @CashSupport on Twitter. They usually reply within a couple of hours.

Tip: Always check that you are using official Cash App contact details. Scammers sometimes pretend to be support. Have your card details and any problem info ready to speed up the process.

You can order your Cash App Card by opening your cash app account, verifying your details, and waiting for the card to arrive.

- Activate your card in the app by scanning the QR code or entering the card details.

- Use your card for purchases or ATM withdrawals with your cash app balance.

- Enjoy instant payments, real-time alerts, and mobile wallet convenience.

- Keep your account safe with strong passwords and two-factor authentication.

If you ever have trouble, reach out to Cash App support for quick help.

FAQ

How much does it cost to order a Cash App Card?

You can order your Cash App Card for free. Cash App does not charge you any fee for the card or for standard shipping. If you see any extra charges, check your order details in the app.

Can I use my Cash App Card outside the United States?

No, you cannot use your Cash App Card outside the United States. The card only works with merchants and ATMs in the United States. You cannot use it for international purchases or withdrawals.

What should I do if I forget my Cash App Card PIN?

If you forget your PIN, you can reset it in the app.

Go to the Cash Card tab, tap “Reset PIN,” and follow the prompts. You will need to verify your identity before setting a new PIN.

Can I withdraw cash from ATMs with my Cash App Card?

Yes, you can use your Cash App Card at any ATM that accepts Visa.

- Cash App charges a $2.50 fee per withdrawal.

- Some ATMs may add their own fee.

- You can check your balance in the app before you withdraw.

How do I check my Cash App Card balance?

You can check your balance anytime in the Cash App.

Open the app, look at the home screen, and your balance appears at the top. You do not need to call or visit a bank to see your balance.

Cash App Card is handy for spending in the U.S., but it does not work internationally and includes extra ATM fees. For those needing cross-border transfers or multi-currency support, a broader and more cost-effective solution is key.

With BiyaPay, you get:

- Remittance fees as low as 0.5%

- Transparent real-time exchange rates

- Support for multiple fiat and digital currency conversions

- Coverage across most countries and regions worldwide

- Same-day transfers for many transactions

Whether it’s tuition abroad, family support, or global business payments, BiyaPay makes your transfers smoother and smarter. Sign up now with BiyaPay and unlock a better way to move money globally.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.