- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Pitch Your Small Business to Attract Investors

Image Source: pexels

If you want to get investors for your small business, you need to show why your business matters. You must explain your value, growth potential, and financial stability in a way that builds trust. Many small business owners face challenges like not preparing enough, pitching too quickly, or forgetting to show passion. Investors want to see your dedication and understand your business. With research and practice, you can learn how to pitch and get investors interested in your business.

Key Takeaways

- Prepare a clear business plan with honest financials and a strong growth plan to build investor trust.

- Find investors by networking at events, using online platforms, and joining incubators or accelerators.

- Show your business growth with real data like revenue, customer numbers, and market demand to prove traction.

- Build a strong team with diverse skills and clear roles to increase investor confidence.

- Choose the right funding option carefully and always get legal and financial advice before accepting money.

How to Find Investors

Finding the right investors can change the future of your small business. You need to know how to find investors who believe in your idea and want to help you grow. Let’s look at some of the best ways to connect with potential investors and open up new investment opportunities.

Networking Strategies

You can start by meeting investors in person. Networking events give you a chance to share your story and learn from others. Some events focus on helping small business owners like you find investors. These events bring together people who want to invest and those who need investment. Here is a table with some of the most effective networking events for small business owners:

| Event Name | Location | Key Features | Why Effective for Small Business Owners Seeking Investors |

|---|---|---|---|

| Startup Grind Tech Summit | Redwood City, CA | 5,000+ entrepreneurs, 400+ VC firms, 175+ sessions, pitch competitions, workshops | Large investor presence, pitch opportunities, strategic business insights |

| Slush | Helsinki, Finland | Founder-focused, curated investor matchmaking, Slush 100 pitch competition | High-energy founder-centric environment, curated investor connections, innovation focus |

| The Vault | Primarily U.S. | Application-based, small-group sessions, mastermind principles, strategic growth coaching | Intimate investor access, personalized scaling strategies, elite entrepreneur network |

| EY Entrepreneur Of The Year™ Awards & Strategic Growth Forum | Global (varies) | Invitation-only, high-growth entrepreneurs, executive-level content, networking with proven investors | Access to seasoned investors and entrepreneurs, strategic insights, exclusive networking |

| National Small Business Conference | New Orleans, LA | 2,000+ attendees, workshops, networking meals, broad business topics including AI and finance | Broad networking opportunities with diverse small business owners and potential investors |

| Forbes Under 30 Summit | N/A | Broad networking, exposure to young entrepreneurs and investors | Opportunity to connect with emerging leaders and investors |

| Global Entrepreneurship Week | Global | Wide range of events focused on entrepreneurship | Broad access to entrepreneurial ecosystem and investor connections |

You can also look for local meetups or business groups. These smaller events help you build relationships with investors who live near you. When you attend these events, focus on talking to people who invest in your industry. This helps you find investors who understand your business and see its value.

Tip: Always prepare a short pitch before you go to a networking event. Practice explaining your business in one minute. This helps you make a strong first impression.

Online Platforms

If you want to know how to find investors without leaving your office, online platforms can help. Many small business owners use these websites to connect with investors from around the world. Some platforms focus on equity crowdfunding, while others help you raise money through rewards or loans.

Here is a table showing some popular online platforms and their features:

| Platform | Success Rate | Acceptance Rate | Key Features and Notes |

|---|---|---|---|

| Republic | 90% of accepted startups meet goal | Accepts ~5% of applicants | Highly selective; offers revenue and profit sharing; fast campaign launch; minimum investment $10 |

| WeFunder | N/A | N/A | Accessible crowdfunding with low minimum investment ($100); broad industry coverage |

| StartEngine | N/A | N/A | Equity crowdfunding; allows trading of shares on platform; top 5 platform by volume |

| SeedInvest | N/A | N/A | Vetted startups only; minimum investment $500; top 5 equity crowdfunding platform |

| Kiva | N/A | N/A | 0% interest loans up to $15,000; no fees; requires strong social network for lender recruitment |

Republic stands out because 90% of accepted startups reach their fundraising goals, but only about 5% of applicants get accepted. Other platforms like WeFunder and StartEngine also offer good investment opportunities for small business owners. If you want to try crowdfunding platforms, Kickstarter and Indiegogo are popular choices. Most small businesses raise between $7,000 and $10,000 on these sites, but some projects can raise much more. Equity crowdfunding sites like AngelList and Gust usually handle bigger funding rounds, often between $500,000 and $5 million. You should choose a platform that matches your business goals and the amount you want to raise.

Incubators and Accelerators

Incubators and accelerators help you grow your business and connect with investors. These programs give you training, office space, and sometimes money to help your small business succeed. Many investors watch these programs to find new investment opportunities.

When you join an incubator or accelerator, you get to meet mentors and other business owners. You also get a chance to pitch your business to investors at the end of the program. Some well-known programs include Y Combinator, Techstars, and 500 Startups. These programs often focus on certain industries, so you should look for one that matches your business.

Note: Always target investors who have experience in your industry or business model. This increases your chances of finding the right support and investment for your small business.

Learning how to find investors takes time and effort. You need to use different strategies, from networking events to online platforms and business programs. Focus on building real connections with potential investors who understand your business and want to help you grow.

Get Investors for Your Small Business

Building Credibility

If you want to get investors for your small business, you need to build trust from the start. Investors look for founders who show a strong track record and clear business thinking. You can do this by preparing a detailed business plan. Your plan should include:

- An executive summary

- Company description

- Market analysis

- Products and services

- Management and organization

- Sales and marketing plan

- Funding request

- Operations plan

- Financial projections

- Personal financial statement

- Appendices

When you share your business plan, be honest about your challenges. Investors respect founders who know their risks and have a plan to handle them. Show clear financial records and realistic projections. This helps investors see that you are investor-ready and reduces their worries about risk.

Investors also check your character and your track record. They want to know if you have led teams before or started other businesses. Reference checks help them learn about your leadership style and how you handle problems. If you have a strong network and good relationships, this can make you stand out. Investors often see these as signs that you can lead your business to success.

Tip: Keep your records organized and up to date. This shows you pay attention to details and take your business seriously.

Showing Traction

You need to show that your business is growing and has real demand. Investors want proof that your idea works in the real world. You can do this by sharing key metrics that show your business performance. Some of the most important metrics include:

- Revenue (Monthly Recurring Revenue, Annual Recurring Revenue)

- Customer growth and retention rates

- User engagement (daily or monthly active users)

- Churn rate (how many customers leave)

- Customer Lifetime Value (CLV)

- Gross Merchandise Value (GMV)

- Customer Acquisition Cost (CAC) compared to Lifetime Value (LTV)

If you are just starting, you might not have big profits yet. That is okay. Investors look for signs that you have a repeatable process for growth. For example, if you have steady revenue each month or a growing number of users, this shows traction. Even early-stage investors do not always expect high revenue. Sometimes, a couple hundred thousand dollars a year is enough if you can prove there is strong customer interest and product-market fit.

You can also show traction by sharing letters of intent, waitlists, or pilot results. These show that people want what you offer. When you talk to investors, explain your growth rates and how you plan to keep growing. This helps them see your business has a future.

Presenting Your Team

Investors care a lot about your team. They want to see that you have the right people to make your business succeed. Teams with different skills and backgrounds are more likely to get investors than solo founders. If you have a co-founder, you can share the workload and bring different ideas to the table. Most investors prefer teams of two or three people because this balances trust, skills, and decision-making.

Here is what investors look for in a strong team:

- Complementary skills (technical, business, sales, operations)

- Prior industry experience

- Leadership roles (especially founder-CEO experience)

- Agility and resilience

- Clear roles and responsibilities

A team with a track record of high performance gives investors confidence. If you have worked together before or have experience in your industry, mention this. Investors also like to see that you have planned for the future. If you have a plan to train new leaders or fill skill gaps, share it. This shows you are thinking ahead and want your business to last.

Note: Avoid splitting equity equally just to be fair. Instead, base it on each person’s real contribution. This keeps everyone motivated and reduces future conflicts.

When you present your team, highlight your strengths and how you work together. Show that you can handle challenges and adapt when things change. Investors want to know that your team will stick together and push the business forward, even when things get tough.

Funding Options

Image Source: pexels

When you look for funding, you have many options for funding your business. Each choice has its own benefits and risks. Let’s break down the most common ways small businesses get the money they need to grow.

Equity and Debt

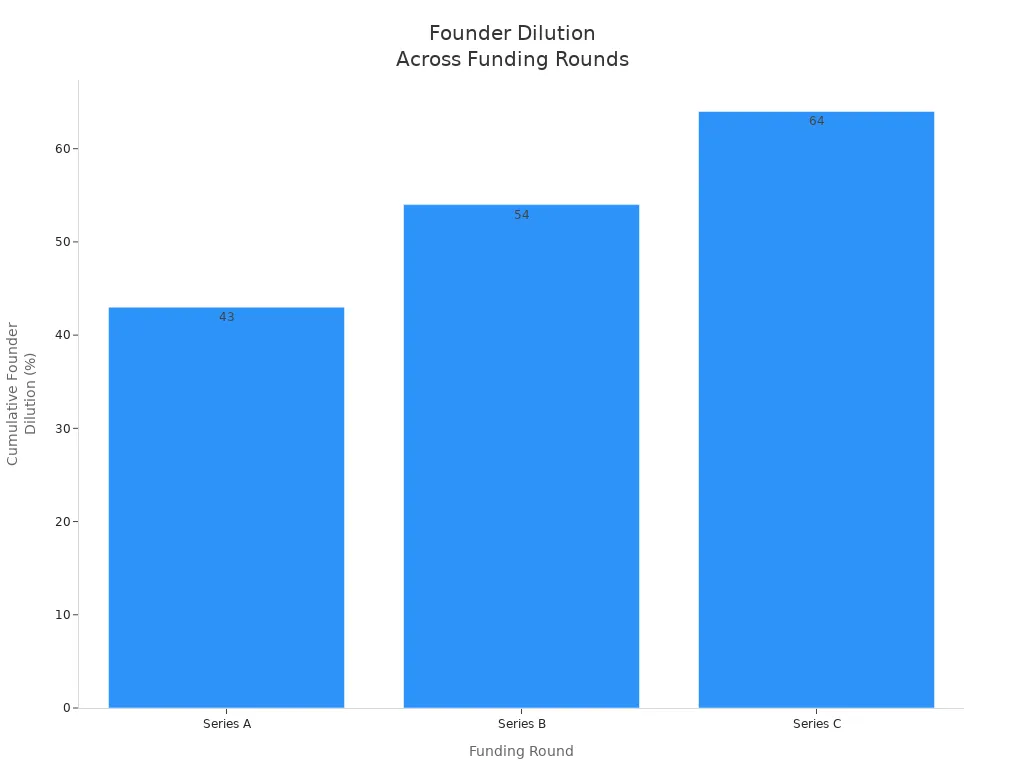

You can raise money by selling part of your business. This is called equity funding. Investors give you cash, and you give them a share of your company. Over time, you may give up more ownership as you raise more money. For example, after three rounds of equity funding, founders often own less than 40% of their business.

Convertible debt is another option. You borrow money now, but instead of paying it back in cash, the loan turns into shares later. The amount of ownership you give up depends on the deal you make.

You can also use loans. Small business loans come from banks, online lenders, or government programs. Here’s a quick look at average rates and terms:

| Loan Type | Average Interest Rate Range (APR) | Average Loan Term |

|---|---|---|

| Bank Business Loan | 7.31% to 7.61% | 1 to 10 years |

| Online Business Loan | 9.00% to 75.00% | Varies |

| SBA Loans | 11.00% to 16.00% | Up to 25 years |

| Business Lines of Credit | 6.47% to 7.92% | 12 to 24 months |

| SBA Microloans | 8% to 13% | Up to 6 years |

Loans mean you keep full ownership, but you must pay back the money with interest. Always read the terms and ask a financial advisor before you sign anything.

Crowdfunding

Crowdfunding lets you raise money from many people online. You can use platforms like Kickstarter, Indiegogo, or equity crowdfunding sites such as AngelList, Gust, and StartEngine. Most small businesses raise about $7,000 to $8,150 per crowdfunding campaign. However, only about 22% of crowdfunding campaigns reach their goals. Crowdfunding works best if you have a strong story and can market your business well.

Equity crowdfunding is different from regular crowdfunding. With equity crowdfunding, you offer shares of your business to investors online. This can help you raise bigger amounts, but you give up some ownership. You must follow legal rules, so talk to a lawyer before you start.

Friends and Family

Many business owners turn to friends and family for funding. This group provides up to 25% of initial funding for small businesses. Sometimes, they give loans. Other times, they invest for a share of your business. Treat these deals like any other funding opportunities. Write down the terms and keep things professional. This helps avoid problems later.

Tip: No matter which funding option you choose, always get legal and financial advice. This protects you and your business.

Business Plan and Pitch

Image Source: pexels

A winning business plan and a strong pitch can help you stand out when you talk to investors. You want to show that you understand your business, your market, and your numbers. Let’s break down what you need for a comprehensive business plan and a pitch that gets attention.

Executive Summary

Start your business plan with an executive summary. This is like your elevator pitch in written form. Investors often read this first, so make it count. Here’s what you should include:

- State the problem your business solves and why it matters.

- Describe your solution and what makes it special.

- Explain the value your business brings, including results and financial impact.

- End with why your work is important and how it will make a difference.

Keep your summary short and clear. Avoid jargon. Make sure it can stand alone. Tell your story in a way that shows your passion and what makes your business unique. Share your goals, your team’s strengths, and what you want from investors. Always proofread before you share.

Market Opportunity

Investors want to know if your business can grow. In your comprehensive business plan, show the size of your market and how fast it is growing. Use numbers to back up your claims. For example, talk about your total addressable market (TAM) and trends you see. Show how your business stands out from the competition. Use charts or tables to make your points clear.

- Explain who your customers are.

- Show how you plan to reach them.

- Highlight what makes your business different.

A winning business plan always includes a go-to-market strategy. This tells investors how you will get customers and grow your business.

Financial Projections

Your financial projections show investors how you plan to use funding and what results you expect. Most investors want to see three years of projections. Include your income statement, balance sheet, and cash flow. Make sure your numbers are realistic. Do not overestimate profits or ignore costs. Link your financial statements together so they make sense.

Common mistakes to avoid:

| Mistake | Why It’s a Problem |

|---|---|

| Unrealistic profits | Investors lose trust if numbers seem too good to be true. |

| Underestimating costs | Real expenses are often higher than you think. |

| Missing funding request | Always state how much funding you need and how you will use it. |

Be clear about your funding request. Tell investors how much you want, what you will give in return, and how the money will help your business grow. A comprehensive business plan with solid financials gives you the best chance to secure funding.

What Investors Look For

When you pitch your business, you want to know what investors care about most. They look for signs that your business can grow, make money, and give them a fair deal. Let’s break down the main things investors check before they decide to give you funding.

Market Need

Investors want to see that your business solves a real problem. They look for proof that people want your product or service. Here are some things they check:

- Demand for what you offer

- Size of your market (how many people might buy)

- Economic factors like income levels and jobs in your area

- Where your customers live and how far your business can reach

- How many other options people have (market saturation)

- Prices of other products like yours

- Who your competitors are and what makes you different

You can show this with surveys, focus groups, or interviews. Investors also like to see data from market research and business statistics. If you can explain your competitive advantage, you stand out.

Revenue Potential

You need to show investors that your business can make money and grow fast. They want to see strong revenue growth, especially in the first year.

Many investors expect you to reach $1 million in yearly revenue within 12 months. They look for month-over-month growth rates of 15% to 25% at the start. After you hit $1 million, a 5% to 10% monthly growth rate is healthy. Year-over-year, doubling or tripling your revenue is a good sign. Investors also check if you keep your customers and sell to them again.

If you can show this kind of growth potential, you make your business more attractive for investment.

Ownership and Terms

Investors want a fair share of your business for their money. Most early-stage investors ask for 10% to 20% ownership. This range is common for angel investors and even friends and family who help with funding. You should avoid giving away more than 25% in the early rounds.

Here are some common terms you might see in a funding agreement:

- How much money the investor will give

- When the investment happens

- What your business is worth before and after funding

- What kind of shares the investor gets

- Rights to vote on big decisions

- Plans for stock options

- What happens if the business closes or has problems

You should always read these terms carefully. If you use crowdfunding, the terms may be different, but you still need to know what you are offering.

You can boost your small business by following a few proven steps.

- Build a clear business plan with strong financials and a roadmap for growth.

- Target investors who fit your goals and add value.

- Network at events and use referrals to find investors.

- Prepare your pitch, practice often, and always seek feedback.

Stay curious, keep learning, and start reaching out to investors today. Your next big opportunity could be just one pitch away.

FAQ

How much money should you ask for from investors?

You should ask for the amount you need to reach your next big goal. Show investors how you will use every dollar. Always explain your plan and link your funding request to your business growth.

What documents do you need before pitching?

You need a business plan, financial statements, and a pitch deck. Bring proof of traction, like sales reports or customer lists. Keep your documents organized and ready to share.

How long should your investor pitch last?

Aim for 10 to 15 minutes. Practice your pitch so you can explain your business clearly and answer questions. Short, focused pitches work best.

Can you pitch to investors if your business is not profitable yet?

Yes, you can. Many investors look for growth potential, not just profits. Show your traction, customer interest, and a clear path to making money.

Tip: Investors want to see your plan for reaching profitability, even if you are not there yet.

Securing investors is only the first step—earning their long-term trust requires demonstrating strong financial management and efficient global fund transfers. Many small businesses lose ground with high transfer fees and non-transparent exchange rates, which weakens profitability and investor confidence.

With BiyaPay, you benefit from:

- Remittance fees as low as 0.5% to cut funding costs

- Transparent real-time exchange rates

- Support for multiple fiat and digital currency conversions

- Coverage across most countries and regions worldwide

- Same-day transfers for faster settlement

Whether receiving investor funds or paying overseas partners, BiyaPay helps you build a reliable, global financial backbone. Sign up today with BiyaPay and empower your business growth with smarter cross-border payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.