- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Send a Wire Transfer with Wells Fargo in 2025

Image Source: pexels

You can send a wells fargo wire transfer quickly by choosing your preferred money transfer options—such as online, mobile, or visiting a branch. Gather the recipient’s account details and use the wire transfer service to send funds. Always check wire transfer fees, limits, and processing times before you start. Double-check every detail to prevent mistakes. If you want to learn how to wire money or compare fees, Wells Fargo offers clear guidance for every step.

Key Takeaways

- You can send Wells Fargo wire transfers online, via mobile app, or in-branch, each offering different limits and fees.

- Always double-check recipient details like name, account number, and bank codes to avoid delays or lost money.

- Wire transfer fees are lower online; using online banking or special accounts can help you save money.

- Transfers sent before the daily cutoff time usually process the same day; international transfers take 2-3 business days.

- Use Wells Fargo’s security features and stay alert for scams to keep your account and money safe.

How to Send a Wells Fargo Wire Transfer

Image Source: unsplash

Online and Mobile Steps

You can complete a wells fargo wire transfer using your computer or mobile device. This method gives you flexibility and speed. Follow these steps to send money securely:

- Sign on to Wells Fargo Online or use the Wells Fargo Mobile app.

- Go to the Transfer & Pay section.

- Enroll in Digital Wires if you have not done so before.

- Add your recipient’s details, including their name, address, and bank information.

- Select your funding account and enter the amount you want to send.

- Review all information carefully. Double-check the recipient’s account number and bank codes.

- Submit your wire transfer.

Tip: You need a valid U.S. mobile number or a secure ID device to complete the process. For international wire transfers, you may need to provide extra details such as SWIFT/BIC codes, IBAN, and the purpose of payment.

The daily minimum for a wells fargo wire transfer is $25, and the maximum is $5,000 when using online or mobile banking. If you send your wire before 2:00 PM Pacific Time, Wells Fargo usually processes it the same business day. International wire delivery times depend on the country.

In-Branch Steps

If you prefer face-to-face service, you can visit a Wells Fargo branch to send a wire transfer. This option helps if you need higher limits or want assistance with wells fargo wiring instructions. Here is how you can do it:

- Bring your government-issued photo ID and your Wells Fargo account information.

- Provide the recipient’s full name, address, and bank details.

- Give the teller the recipient’s account number, bank routing number (for U.S. wires), or SWIFT/BIC code (for international wires).

- Specify the amount you want to send and the currency if you send international wires.

- Review all details with the teller before authorizing the transfer.

- Receive a confirmation receipt for your records.

Note: In-branch transfers may allow you to send larger amounts than online transfers. The staff can help you with any questions about how to wire money or about the wells fargo address for wire transfers.

Required Details

To complete a wells fargo wire transfer, you must provide accurate sender and recipient information. Missing or incorrect details can cause delays or rejection of your transfer. Here is what you need:

- Sender Information:

- Your Wells Fargo account number

- Your PIN or secure ID device

- Recipient Information:

- Full name and address (must match their bank statement)

- Bank name and address

- Bank routing number (ABA/RTN) for U.S. wires

- SWIFT/BIC code for international wire instructions

- Recipient’s bank account number or IBAN

- Additional country-specific codes if needed:

- Australia: BSB

- Canada: Canadian Routing Number

- Great Britain: U.K. Sort Code

- India: IFSC Code

- Mexico: CLABE

- New Zealand: New Zealand Clearing Code

Important: Always double-check all information before you send a wells fargo wire transfer. Wells Fargo may delay or reject transfers that look irregular or suspicious. If you are sending international wire transfers, make sure you have all the required codes and the purpose of payment.

The bank’s recent updates mean that if a transfer appears suspicious, Wells Fargo can delay or decline it. New regulations in 2025 may also increase the bank’s responsibility for unauthorized transfers. You should keep your account secure and report any issues right away.

If you want to compare money transfer options, Wells Fargo staff can explain the differences between online, mobile, and in-branch services. They can also help you understand the best way to send international wires and avoid common mistakes.

Wire Transfer Fees

Understanding wire transfer fees helps you plan your money transfers and avoid surprises. Wells Fargo charges different fees for outgoing wire transfers depending on whether you use online banking or visit a branch. You also need to know about fees for receiving money and how to avoid wire transfer fees when possible.

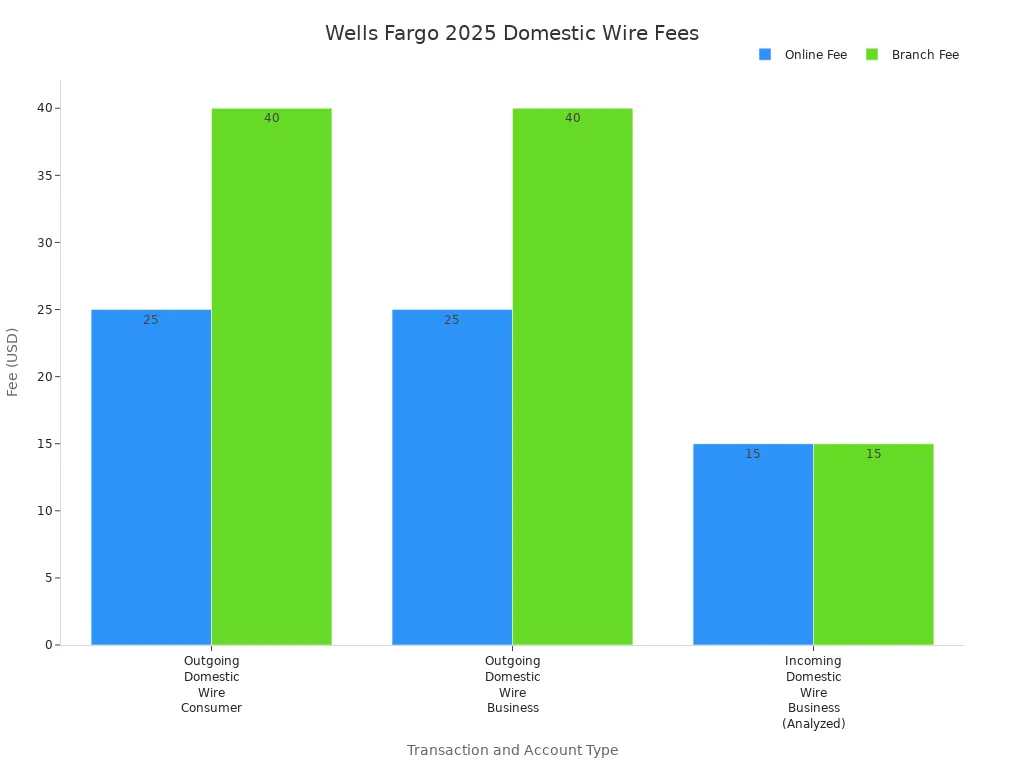

Domestic Wire Transfer Fees

Wells Fargo domestic wire transfers have different charges based on how you send money. You pay less if you use online banking. Here is a table showing the average wire transfer fees for outgoing wire transfers and for receiving money:

| Transaction Type | Account Type | Online Fee | Branch Fee |

|---|---|---|---|

| Outgoing Domestic Wire | Consumer | $25 | $40 |

| Outgoing Domestic Wire | Business | $25 | $40 |

| Incoming Domestic Wire | Consumer | No Fee | No Fee |

| Incoming Domestic Wire | Business (Non-analyzed) | No Fee | No Fee |

| Incoming Domestic Wire | Business (Analyzed) | $15 | $15 |

You can see that outgoing wire transfers cost more at a branch. Most people pay no fee to receive money unless they have a special business account. The average wire transfer fees at Wells Fargo are similar to other major banks.

International Money Transfer Fees

Wells Fargo international money transfers also have different fees. You pay $25 for outgoing wire transfers online and $40 at a branch. These international wire transfer fees are close to what other banks charge. When you send international wire transfers, you may also pay extra charges for currency exchange. Wells Fargo adds a markup to the exchange rate, so you should check the rate before you send money. Sometimes, other banks in the transfer process may also take a fee, which can lower the amount your recipient gets.

How to Reduce Fees

You can avoid wire transfer fees in several ways:

- Use online banking for outgoing wire transfers instead of going to a branch.

- Open a Private Bank Interest Checking account. This account waives all Wells Fargo fees for outgoing wire transfers, both domestic and international.

- Always check if your account type offers any fee waivers.

- Compare average wire transfer fees at different banks before you send money.

- Ask your recipient if they can receive money using a lower-cost method.

If you want to avoid wire transfer fees, always review your account benefits and choose the best way to send or receive money. This helps you save on charges and get the most from your wells fargo domestic wire transfers and wells fargo international money transfers.

Wells Fargo Wire Transfer Limits and Times

Daily Limits

You need to know your wire transfer limits before you send money. Wells Fargo does not set a fixed daily limit for all customers in 2025. Your transaction limits depend on your account type and your transfer history. You can check your specific wire transfer limits by logging into your online banking. If you need to send more than your online limit allows, you can visit a branch. Branch transfers usually allow higher transaction limits, but you will pay a $40 fee for this service.

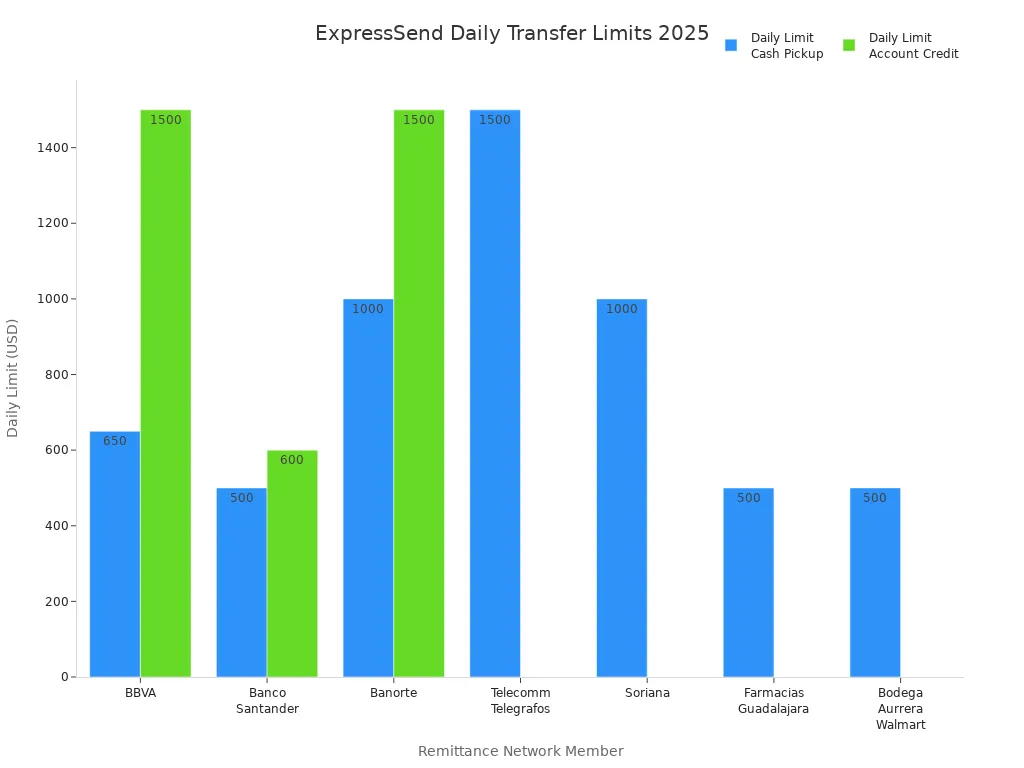

For ExpressSend, Wells Fargo sets clear limits. You can send up to $5,000 per day across all recipients. There is also a 30-day rolling limit of $12,500. These limits may change based on the country or the receiving bank. Here is a table showing some ExpressSend limits for different network members:

| Remittance Network Member | Daily Transfer Limit (USD) | 30-Day Rolling Limit (USD) |

|---|---|---|

| BBVA | $650 (cash pickup), $1,500 (account credit) | $1,300 (cash pickup), $10,000 (account credit) |

| Banco Santander | $500 (cash pickup), $600 (account credit) | $1,500 (cash pickup or account credit) |

| Banorte | $1,000 (cash pickup), $1,500 (account credit) | $10,000 (cash pickup or account credit) |

| Telecomm Telegrafos | $1,500 (cash pickup only) | $12,500 (cash pickup only) |

| Soriana | $1,000 (cash pickup only) | $12,500 (cash pickup only) |

| Farmacias Guadalajara | $500 (cash pickup only) | $10,000 (cash pickup only) |

| Bodega Aurrera Walmart | $500 (cash pickup only) | $10,000 (cash pickup only) |

Processing Times

You might wonder how long does a wire transfer take with Wells Fargo. The transfer time depends on where you send the money. If you send funds to another Wells Fargo customer, the estimated transfer time is up to 24 hours. Transfers to other banks or international recipients usually take 2 to 3 business days. The table below shows typical transfer times:

| Transfer Type | Typical Processing Time |

|---|---|

| To another Wells Fargo customer | Up to 24 hours (within 1 business day) |

| To non-Wells Fargo recipients | 2-3 business days |

| Overall wire transfer processing | 1-3 business days |

You should also pay attention to the cut-off time for wire transfers. If you send your transfer before the daily cut-off time, Wells Fargo processes it the same business day. Transfers sent after the cut-off time will process on the next business day.

Common Delays

Several factors can affect your transfer time. Here are the most common reasons for delays:

- Sending a transfer outside banking hours, on weekends, or holidays means it will process the next business day.

- Missing the cut-off time can delay your transfer until the following day.

- Verification and fraud checks may hold your transfer for review.

- Incorrect or incomplete recipient information can cause processing delays.

- Intermediary banks in international transfers add extra time.

- Currency conversion steps may slow down the process.

- Regulatory and compliance checks, such as anti-money laundering rules, can add time.

- Technical issues at either bank may cause delays.

- The recipient’s bank may take longer to credit the funds.

- Transfers to less common destinations may need extra routing or manual handling.

Note: Always double-check all recipient details and send your transfer early in the day to avoid delays. Knowing your wire transfer limits and the estimated transfer time helps you plan better.

Security and Mistakes to Avoid

Image Source: unsplash

Protecting Your Account

You want to keep your money safe when you send a wire transfer. Wells Fargo uses many security tools to protect your account. The table below shows some of the main security measures you can use:

| Security Measure | Description |

|---|---|

| 24/7 Fraud Monitoring | Wells Fargo watches for unusual activity and contacts you if they see something suspicious. |

| Encryption & Browser Requirements | Your online sessions use encryption. You should use updated browsers and keep your software current. |

| Automatic Sign Off | The system logs you out after a period of inactivity to stop others from using your account. |

| Unique Username & Strong Password | You must create a strong password and a unique username. Passwords are encrypted for extra safety. |

| Advanced Access | Some actions need extra codes or two-step verification. Codes go to your updated contact information. |

| Security Options | You can turn on two-step verification or use face or fingerprint sign-in for more protection. |

Tip: Always set up account alerts. These alerts help you spot any suspicious activity quickly.

Common Errors

Many people make mistakes when sending wire transfers. Some errors can cause delays or even loss of money. Here are the most frequent mistakes and how you can avoid them:

- Using the wrong routing number or SWIFT code

- Misspelling the recipient’s name, city, or country

- Leaving out the bank address or using the wrong account number

- Sending money in a currency the recipient’s bank does not accept

- Missing required information for intermediary banks

To prevent these mistakes:

- Double-check all details before you send the transfer

- Never share your password or account information with anyone

- Watch out for urgent requests to send money, especially from unknown contacts

- Use account alerts to track your transfers

- Contact Wells Fargo right away if you think you made a mistake

Wire transfers are hard to reverse once the money leaves your account. If you enter the wrong information, you may not get your money back. Wells Fargo tries to help if you report the problem quickly, but you are responsible for any losses from incorrect details.

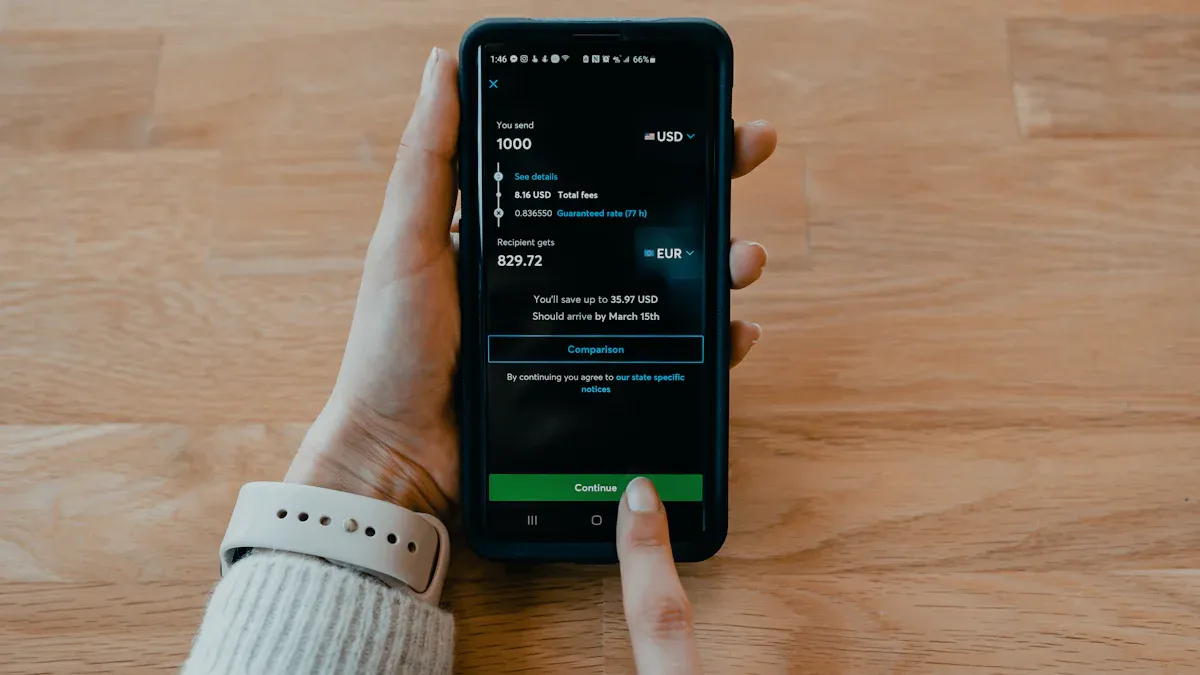

If you want to receive money or send smaller amounts, you can use Zelle. Zelle lets you send and receive money within minutes in the United States with no fees. For international transfers, Wells Fargo recommends services like Xe, which offer lower fees and fast delivery.

You can send a Wells Fargo wire transfer with confidence when you follow the right steps. Before you confirm, make sure you:

- Double-check the recipient’s name, address, bank, and account details.

- Start your transfer before the daily cutoff time to avoid delays.

- Ask about all fees so you know the total cost.

- Stay alert for scams and never send money to unknown contacts.

- Watch your account for any unexpected activity.

If you need help, Wells Fargo offers several resources:

- Call customer service at 1-800-956-4442 for questions about transfers or fees.

- Use online banking help and FAQs for step-by-step guidance.

- Schedule an appointment or use the contact form for more support.

Always review your transfer details and fees to avoid mistakes. Wells Fargo support can answer your questions and help you resolve any issues.

FAQ

How do you track your Wells Fargo wire transfer?

You can track your wire transfer by signing in to Wells Fargo Online or the mobile app. Go to the transfer history section. You will see the status of your transfer. If you need help, call Wells Fargo customer service.

What should you do if you entered the wrong recipient information?

Contact Wells Fargo right away. Call customer service at 1-800-956-4442. The bank may try to stop or recall the transfer. You must act quickly because wire transfers process fast and may not be reversible.

Can you cancel a Wells Fargo wire transfer after sending it?

You can request a cancellation if the transfer has not finished processing. Call Wells Fargo as soon as possible. If the money already left your account, the bank may not recover it. Always double-check details before sending.

What is the exchange rate for international wire transfers?

Wells Fargo sets its own exchange rate for international wires. The rate includes a markup over the market rate. You can check the current rate before sending money. Here is an example:

| Market Rate (USD/EUR) | Wells Fargo Rate (USD/EUR) |

|---|---|

| 1.10 | 1.07 |

Compared to Wells Fargo’s high fees and complex wire process, you can manage international transfers faster and more cost-effectively with BiyaPay.

With transparent real-time exchange rates, you always know the exact conversion value, while enjoying remittance fees as low as 0.5%. BiyaPay supports multiple fiat and digital currency conversions, covers most countries and regions worldwide, and enables same-day transfers for urgent payments.

Whether sending funds abroad or receiving payments from global partners, BiyaPay gives you speed, transparency, and reliability. Start today with BiyaPay and simplify your cross-border transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.