- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Making an ACH payment explained in easy steps

Image Source: unsplash

You can make an ach payment easily by logging into your online banking or mobile app. First, choose the option to send money or pay bills. Next, enter the recipient’s bank account and routing number. Select the payment type and amount, then review the details. Confirm to complete the process. Many people use ach payment methods for large transactions. In 2018, ACH payments made up over 66% of the total value of all noncash payments in the United States. You only need a few details to get started, and each step is simple.

Key Takeaways

- ACH payments let you send money safely and affordably using your bank’s online or mobile app.

- There are two types: ACH debit pulls money from your account, and ACH credit pushes money to others.

- You need the recipient’s name, bank account number, and routing number to make an ACH payment.

- ACH transfers usually take 1 to 3 business days and cost less than wire transfers or credit cards.

- Always double-check payment details and keep records to avoid errors and protect your money.

What is an ACH Payment?

ACH Payment Basics

You may wonder what an ACH payment is and why so many people and businesses use it. According to the National Automated Clearing House Association (NACHA), an ACH payment is an electronic financial transaction that moves through the ACH Network. This network connects all U.S. bank and credit union accounts. It processes transactions like ach direct deposit for paychecks, bill payments, and business-to-business transfers. The ACH Network is known for its safety, efficiency, and ability to handle both credit and debit payments. You can trust this system to deliver funds accurately and on time.

ACH payments stand out from other electronic payment methods for several reasons:

- ACH payments are processed in batches, not one by one.

- They usually settle in 1 to 3 business days, but you can choose a same-day option for a higher fee.

- ACH payments cost less than wire transfers or card payments.

- You can use ACH for recurring transactions, such as subscriptions or ach direct deposit.

- NACHA regulates ACH payments, which means you get extra security and fraud protection.

Here is a table to help you compare ACH payments with other electronic funds transfer (EFT) types:

| Feature | ACH Payments | Other EFT Types |

|---|---|---|

| Processing Method | Batch processing | Individual or varied processing methods |

| Settlement Speed | 1-3 business days; same-day available | Minutes to hours; some real-time options |

| Cost | Lower cost; little or no fee | Higher cost; $15 to $50+ |

| Geographic Reach | U.S.-based; limited international | Domestic and international |

| Volume Capacity | Good for high-volume transactions | Good for high-value or variable volume |

How ACH Payments Work

When you make an ach payment, you start by giving payment instructions to your bank. Your bank, called the Originating Depository Financial Institution (ODFI), collects your payment with others and sends them as a batch to an ACH Operator, such as the Federal Reserve or The Clearing House. The ACH Operator sorts these payments and sends each one to the right Receiving Depository Financial Institution (RDFI), which is the recipient’s bank. The RDFI then puts the money into the receiver’s account.

The steps look like this:

- You or a business (the Originator) starts the ach payment by sending instructions to the bank.

- The bank (ODFI) groups payments and sends them to the ACH Operator.

- The ACH Operator sorts and routes each payment to the correct recipient bank (RDFI).

- The recipient bank adds the funds to the receiver’s account.

- Settlement usually happens in one to two business days, depending on the type of payment.

You can use ach payments for many things, such as payroll, automatic bill payments, and business transactions. The automated clearing house system makes these payments secure, reliable, and easy to use.

Types of ACH Payments

ACH Debit vs. Credit

You will find two main types of ach payments: ach debit payment and ach credit payment. Each type moves money in a different direction. The table below shows how they work:

| Type of ACH Payment | Transaction Direction | Description |

|---|---|---|

| ACH Debit Transfer | Pulls money from another account into your own account | The payee starts the transaction with your permission. This method works well for recurring payments. Funds move from your account to the payee. |

| ACH Credit Transfer | Pushes money from your account to the recipient’s account | You start the transaction. This method is common for payroll deposits or sending money to others. Funds move from your account to the recipient. |

When you use ach debit payment, you allow a company or person to pull money from your account. This method is popular for bills, subscriptions, and other regular payments. On the other hand, ach credit payment lets you push money to someone else. You control when the payment leaves your account.

When to Use Each

You may wonder which type of ach payments fits your needs. Here are some tips to help you decide:

- Use ach credit payment when you want to control the timing of your payment. This method works well for payroll, vendor payments, or sending money to friends and family.

- Choose ach credit payment if you want extra security. You do not need to share your bank details with the recipient.

- Pick ach debit payment for recurring bills, such as utilities, insurance, or memberships. The payee will pull the funds on a set schedule, so you never miss a payment.

- Businesses often use ach debit payment for steady cash flow and less paperwork. This method helps them collect payments on time.

- Remember, ach debit payment gives the payee control over when the money leaves your account. You must trust the payee with your bank information.

Tip: Always review your bank statements after setting up ach payments. This habit helps you spot errors or unauthorized transactions quickly.

You can use ach payments for many purposes. Both types offer speed, security, and lower costs compared to checks or wire transfers. Choose the method that matches your payment needs and comfort level.

Information Needed for ACH Payments

Image Source: pexels

Bank and Recipient Details

To make an ACH payment, you need to gather some important information. You must know the recipient’s full name and their bank account number. The bank account number tells the bank where to send the money. You also need the recipient’s ABA routing number. This number helps the banks communicate and process the payment safely. Sometimes, you may need the recipient’s address or the address of their bank. Many banks ask for a voided check to verify the bank account details.

Here is a quick checklist of what you need:

- Recipient’s full name

- Recipient’s bank account number

- Recipient’s ABA routing number

- Recipient’s address (sometimes)

- Recipient’s bank address (sometimes)

If you are making a business payment, you may need extra details. These can include the company name, a transaction code, and a unique identification number for each payment. The bank uses these details to make sure the ACH payment goes to the right bank account.

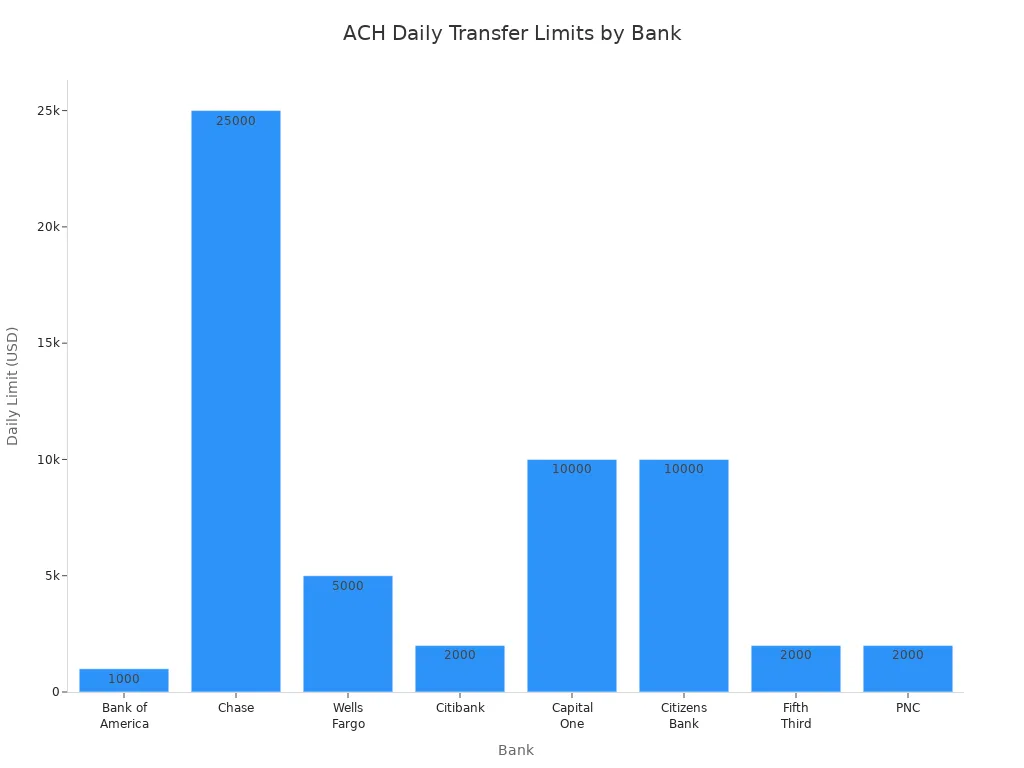

ACH transfer limits can change based on your bank and account type. Some banks set a $1,000 limit for personal accounts, while others allow up to $25,000 per day for premium accounts. The chart below shows how limits can differ:

You can sometimes raise your limit by adding security features to your bank account, such as one-time passcodes.

Authorization Requirements

Before you send an ACH payment, you must give permission. This step is called authorization. Federal rules say you must clearly agree to let money move from your bank account. If you sign a form, the bank may check your signature to make sure it is valid. The Consumer Financial Protection Bureau says your loan documents must explain how to stop or cancel an ACH authorization.

You must verify your identity when you set up an ACH payment. The bank checks your information to keep your bank account safe. If you want to stop a recurring payment, you can contact your bank or the company that receives the money. Federal law protects you from being forced to use ACH payments for loans. You always have a choice.

Note: Always review your bank account statements after setting up ACH payments. This habit helps you spot mistakes or unauthorized payments quickly.

How to Make an ACH Payment

Image Source: unsplash

Online and Mobile Banking Steps

You can make an ACH transfer using your bank’s online platform or mobile app. Most banks in the United States and Hong Kong offer these services. The process is simple and secure. You only need a few details to get started. Here is a step-by-step guide to help you complete an ACH transfer:

- Log in to your online banking account or open your bank’s mobile app.

- Find the section for transfers, payments, or bill pay.

- Choose the option to make an ACH transfer or ACH direct payment.

- Enter the recipient’s bank account number and routing number. Some banks may ask for the recipient’s name and address.

- Select the payment type. You can choose between a one-time payment or a recurring ACH direct payment.

- Enter the amount you want to send.

- Review all the details. Double-check the recipient’s information and the payment amount.

- Confirm the ACH payment. Your bank will process the transaction.

Mobile banking apps make ACH payments even easier. You can snap a picture of an invoice or use your phone to enter payment details. The app will guide you through each step. You can also set up notifications to track your ACH transfer status.

Tip: Always keep your banking app updated. This helps protect your information and ensures you have the latest features for ACH payments.

Some banks also allow you to make an ACH transfer by phone. You can call your bank’s customer service line and provide the necessary details. The bank representative will help you complete the ACH payment.

Scheduling and Confirming Payments

You can schedule ACH payments in advance. This feature helps you pay bills on time and avoid late fees. When you set up an ACH transfer, look for the option to choose a future date. Many banks let you set up recurring payments for regular bills, such as rent or utilities.

- Set up a one-time or recurring ACH transfer by selecting the payment date.

- Use your bank’s online calendar to pick the best day for your payment.

- Automate your payments to save time and reduce the risk of missing a due date.

After you schedule an ACH payment, you should confirm that the transaction was successful. Most banks send a confirmation email or notification. You can also check your transaction history in your online banking account or mobile app. Compare your ACH transfer records with your bank statements to make sure every payment went through.

- Monitor your ACH payments using your bank’s real-time tracking tools.

- Keep a record of each ACH transfer for your files.

- If you notice any errors or missing payments, contact your bank right away.

Note: Regularly reviewing your ACH transfer history helps you spot mistakes and prevent fraud.

Business ACH Payments

Businesses often use ACH payments to pay vendors, suppliers, or employees. The process has a few extra steps to ensure security and accuracy. Here is how you can set up ACH payments for your business:

- Choose an ACH payment processor. Compare fees and features from different banks or payment operators.

- Complete the required paperwork. Your bank will explain how ACH payments work and what you need to do.

- Collect and verify your vendor’s or employee’s bank account information. You need the account number, routing number, bank name, account type, and the name on the account.

- Get a signed ACH authorization form from each vendor or employee. This can be done electronically.

- Set up your ACH transfer service with your bank. You may need to sign agreements and learn about limits and fees.

- Create payment templates and approval workflows. This helps you manage recurring ACH payments and keeps your process secure.

- Log in to your bank’s ACH portal. Enter or select the payment details, schedule the payment, and submit the transaction.

- Monitor and reconcile your ACH payments. Confirm that each payment cleared and record it in your accounting system.

If you use an invoice management system, you can upload invoices by email, drag and drop, or take a picture with your mobile app. Check if your vendor is set up for ACH payments. If not, invite them to join your payment network. Review and approve each invoice before making an ACH transfer. Once approved, pay the invoice with a single click.

Tip: Update your vendor contracts to include ACH payment schedules and authorization details. This ensures everyone agrees on payment timing and terms.

ACH payments help businesses save time and reduce paperwork. You can automate payroll, pay vendors, and keep accurate records. Always follow your bank’s security guidelines to protect your business and your partners.

ACH Transfer Times and Costs

Processing Times

When you start an ach transfer, you want to know how long it will take for the money to reach the other account. Most ach transfers in the United States take about three business days to complete. The process begins when you submit your payment request to your bank. On the first day, your bank debits your account and sends the ach transfer file to the network. The next day, the receiving bank processes the payment and credits the recipient’s account. By the third day, your bank confirms the ach transfer and notifies you.

Here is a simple breakdown of the ach transfer timeline:

- You submit the ach transfer request (Day 0).

- Your bank processes and sends the ach transfer to the network (Day 1).

- The recipient’s bank receives and credits the ach transfer (Day 2).

- Your bank confirms the ach transfer and communicates with you (Day 3).

Processing only happens on business days. If you start an ach transfer on a weekend or holiday, the process will take longer. Some banks have cut-off times. If you miss the cut-off, your ach transfer will start the next business day. You can choose faster options like same-day ach transfer, but these may cost more.

Many factors can affect how fast your ach transfer completes. The table below shows what can speed up or slow down your ach transfer:

| Factor | Impact on ACH Transfer Speed |

|---|---|

| Transaction Type | Debits often process faster than credits. |

| Banking Hours | Transfers outside banking hours wait until the next business day. |

| Weekends and Holidays | Processing pauses, causing delays. |

| Cut-off Times | Missing the cut-off delays the ach transfer by a day. |

| Batch Processing | Banks process ach transfers in batches, not instantly. |

| Verification & Security | Extra checks for new or large ach transfers can add time. |

| Risk Management Holds | Suspicious or first-time ach transfers may be held for review. |

| Accuracy of Account Info | Incorrect details cause delays. |

| Expedited Services | Same-day ach transfer speeds up the process. |

| Intermediaries & Compliance | More banks and checks can slow down the ach transfer. |

Note: To speed up your ach transfer, always double-check account details and start your transfer during banking hours.

Fees and Charges

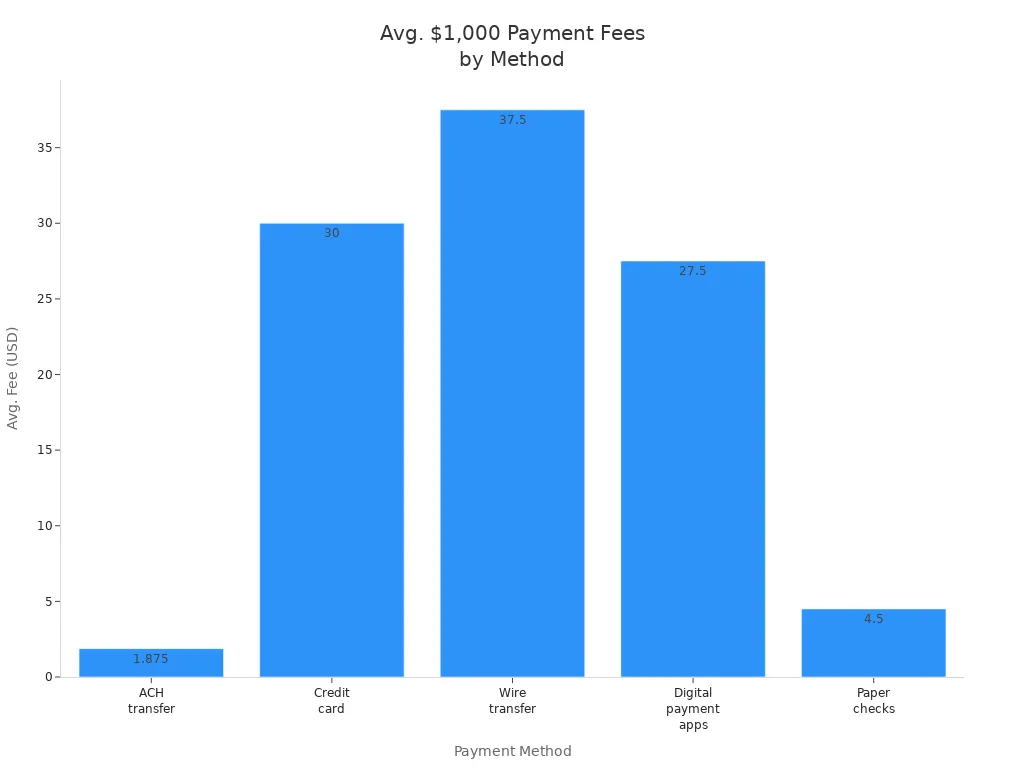

You may wonder how much an ach transfer costs. Most banks and payment processors charge a small fee for each ach transfer. The fee is usually much lower than what you pay for a wire transfer or credit card payment. The table below compares typical fees for different payment methods:

| Payment Method | Typical Fee Structure | Avg. Cost for $1,000 Payment | Processing Time |

|---|---|---|---|

| ACH transfer | Flat fee $0.20–$1.50 | $0.75–$3 | 1–3 business days |

| Credit card | 2.5%–3.5% + $0.10–$0.30 | $25–$35 | Instant |

| Wire transfer | Flat fee $25–$50 | $25–$50 | Same day |

| Digital payment apps | 2.5%–3% for businesses | $25–$30 | Instant to 1–3 days |

| Paper checks | $3–$6+ total cost | $3–$6+ | 5–7 business days |

For most ach transfers, you pay a flat fee between $0.20 and $1.50. Some banks may charge a small percentage, usually 0.5% to 1.5%. If your ach transfer fails, you may pay a return fee of $2 to $5. Same-day ach transfer services cost more, often $1 to $10 per transfer. Businesses may pay monthly fees or batch fees if they send many ach transfers.

Tip: Always check your bank’s fee schedule before you start an ach transfer. Some banks waive fees for personal accounts, but businesses may pay more.

If you want to learn how to do an ach transfer, ask your bank for details about their fees and processing times. This helps you plan your payments and avoid surprises.

Best Practices for ACH Payments

Double-Check Details

You should always double-check every detail before you submit an ACH payment. Enter the recipient’s full name, account number, and routing number carefully. Even a small mistake can delay your payment or cause it to go to the wrong person. The bank that starts your payment watches for errors and may reverse the transaction if it finds a problem. To avoid this, follow these steps:

- Enter all banking information with care.

- Review each detail before you submit the payment.

- Complete any extra verification steps your bank requires.

- Double-check account and routing numbers to prevent delays or misdirected funds.

Taking a few extra seconds to review your information can save you from costly errors.

Keep Records

You should keep clear records of every ACH payment you make. Good records help you track your money and solve problems quickly. For personal payments, save any signed forms or digital authorizations for at least two years after you stop the payment. For business payments, use a name that the receiver will recognize. Check your accounts every day to spot any unauthorized or incorrect payments. If you get a notice to change information, update your records within six banking days or before your next payment. Train your team to watch for red flags and use secure systems to store sensitive data.

Tips for keeping records:

- Save all authorizations and confirmations.

- Reconcile your accounts daily.

- Update payment details when you receive new information.

- Use secure methods to store and share account data.

Avoid Common Errors

Many people make the same mistakes with ACH payments. The table below shows common errors and how you can avoid them:

| Common ACH Payment Errors | How to Avoid Them |

|---|---|

| Incorrect bank account information | Always verify and double-check details before sending a payment. |

| Insufficient funds | Make sure you have enough money in your account before you pay. |

| Closed or frozen accounts | Update account information often and check for changes. |

| Invalid routing numbers | Use validation tools to confirm routing numbers are correct. |

| File formatting errors | Use software to check files meet ACH standards before sending. |

You can also protect yourself by using multi-factor authentication, encrypting sensitive data, and following your bank’s security rules. If you report unauthorized payments quickly, U.S. law limits your liability and helps you recover your money. Always stay alert and follow these best practices to keep your ACH payments safe and accurate.

You can see that ACH payments offer a simple and reliable way to move money. When you use ACH, you benefit from lower fees, faster processing than checks, and strong security measures.

- ACH payments help you save money, reduce errors, and protect your information.

- They are widely used for payroll, bill payments, and business transactions.

If you follow the steps in this guide and double-check your details, you can make ACH payments with confidence. Anyone can use ACH to manage payments efficiently and securely.

FAQ

What is the difference between an ACH transfer and a wire transfer?

ACH transfers use batch processing and usually take 1–3 business days. Wire transfers move money faster, often within hours, but cost more. ACH transfers cost about $0.75–$3. Wire transfers can cost $25–$50 per transaction.

Can you make ACH payments with Hong Kong banks?

Many Hong Kong banks offer ACH payment services for U.S. dollar accounts. You can use online banking to set up ACH transfers. Always check your bank’s website for specific instructions and fees.

Is there a limit on how much you can send with ACH?

Yes, banks set daily and monthly limits for ACH transfers. Limits depend on your account type. For example, some banks allow up to $25,000 per day. Check your bank’s policy for exact amounts.

What should you do if an ACH payment fails?

If your ACH payment fails, check your account balance and recipient details. Contact your bank for help. The bank can explain the reason and guide you to fix the issue. Always keep records of your payment attempts.

While ACH payments are popular in the U.S., they are limited to domestic transfers, capped by daily limits, and usually take 1–3 business days to settle.

With BiyaPay, you enjoy transparent real-time exchange rates, ultra-low fees with remittance charges as low as 0.5%, and the ability to convert between multiple fiat and digital currencies. BiyaPay covers most countries and regions worldwide, enabling same-day transfers in many cases.

Whether you’re a business paying suppliers or an individual sending money abroad, BiyaPay makes cross-border payments faster, safer, and more cost-effective. Start today with BiyaPay and take your transfers beyond ACH.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.