- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tips to Minimize Your Western Union Fees When Sending Money

Image Source: pexels

You can lower your western union fees by paying close attention to how you transfer money. Western Union charges can add up quickly, especially when you factor in both the transfer fee and the exchange rate markup. For example, sending $1,000 USD to Mexico could cost you around $85 in total fees. Understanding each fee, including hidden ones, helps you make smarter choices and keep more money in your recipient’s pocket.

Key Takeaways

- Western Union fees include transfer charges, exchange rate markups, and sometimes hidden costs like intermediary bank fees.

- Paying with a bank account online usually costs less than using credit cards or cash pickups.

- Always check the total cost, including fees and exchange rates, before sending money to avoid surprises.

- Send larger amounts less often and choose off-peak times to reduce fees and get better exchange rates.

- Consider alternative services like Wise or Vance for lower, more transparent fees and better exchange rates.

Understanding Western Union Fees

Western Union fees can seem confusing at first, but you can break them down into a few main parts. These money transfer fees change based on where you send money, how much you send, and the method you choose. Knowing each type of fee helps you avoid surprises and keep your costs low.

Types of Transfer Fees

You will see several types of transfer fees when you use Western Union.

- Sending fees: These depend on your location, the destination, and your payment method.

- Receiving fees: Sometimes, the recipient’s bank may charge a fee, especially for bank transfers.

- Intermediary bank fees: If a third-party bank helps with the transfer, you might pay extra.

- Additional fees: These include cancellation fees, correspondent bank fees, and differences between online and in-person transfers.

Western Union calculates these money transfer fees using fixed or percentage rates. The amount you send, the currencies involved, and your chosen payment and delivery methods all affect the final transfer fee.

Exchange Rate Markups

Western Union does not use the mid-market exchange rate. Instead, it adds a margin to the rate you see. This margin acts as a hidden fee and can change based on the currency and market conditions. You may not notice this cost right away, but it can make your money transfer more expensive. Always check the exchange rate before you send money.

Payment Method Costs

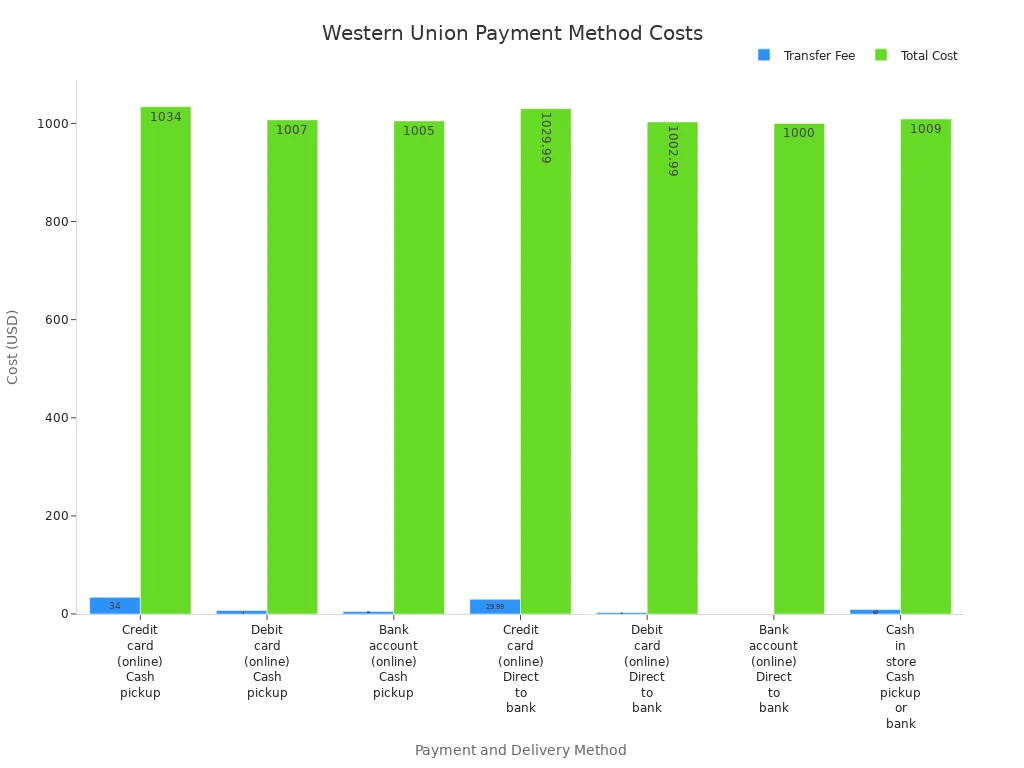

The way you pay for your transfer changes the money transfer fees. Here is a table showing typical costs for sending $1,000 USD to Canada:

| Payment Method | Delivery Method | Transfer Fee (USD) | Total Cost (USD) | Recipient Receives (CAD) |

|---|---|---|---|---|

| Credit card (online) | Cash pickup | 34 | 1,034 | 1,199.80 |

| Debit card (online) | Cash pickup | 7 | 1,007 | 1,199.80 |

| Bank account (online) | Cash pickup | 5 | 1,005 | 1,199.80 |

| Credit card (online) | Direct to bank | 29.99 | 1,029.99 | 1,317.00 |

| Debit card (online) | Direct to bank | 2.99 | 1,002.99 | 1,317.00 |

| Bank account (online) | Direct to bank | 0 | 1,000 | 1,317.00 |

| Cash in store | Cash pickup or bank | 9 | 1,009 | 1,130.20 |

You can see that credit card payments cost the most. Bank account transfers online are usually the cheapest, sometimes with no transfer fee at all.

Hidden Charges

Some fees and charges are not easy to spot.

- Exchange rate markups add to your total cost.

- Non-sterling transaction fees may apply if your bank or card company converts currency, often up to 3%.

- Intermediary bank fees can appear if a third-party bank helps with your money transfer.

- Additional fees include cancellation fees and differences between online and in-person transfers.

Western Union fees are often higher and less transparent than some other money transfer services. Always use the company’s online estimator to check all money transfer fees before you send money.

How Much Does Western Union Charge?

When you send money with Western Union, you might wonder how much does western union charge for each transfer. The answer depends on where you send money, how much you send, and the method you choose. Money transfer fees can change often, so you should always check before you send.

Domestic vs. International Money Transfer Fees

Western Union charges different money transfer fees for sending money within the same country and for sending money internationally. Here is a table to help you compare:

| Transfer Type | Outgoing Wire Transfer Fees |

|---|---|

| Domestic Transfers | $20 to $35 |

| International Transfers | $35 to $50 |

You may pay extra if an intermediary bank is involved or if you use a less common payment method. International transfer fees are usually higher because of exchange rates and extra steps in the process.

Fee Ranges by Amount and Method

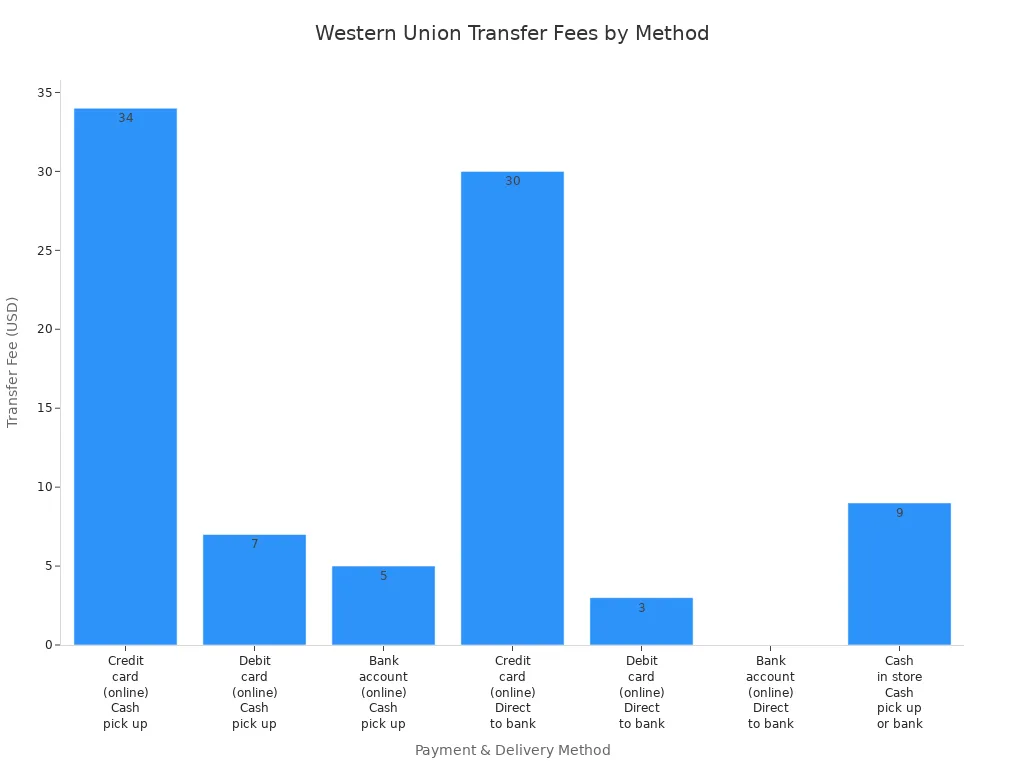

The way you pay and the amount you send can change your money transfer fees. For example, sending $1,000 to Canada can cost more if you use a credit card or choose cash pickup. Here is a breakdown:

| Payment Method | Delivery Method | Approximate Transfer Fee (USD) | Notes on Cost and Recipient Amount |

|---|---|---|---|

| Credit card (online) | Cash pick up | Around 34 | Highest fee; recipient gets less |

| Debit card (online) | Cash pick up | Around 7 | Lower fee than credit card |

| Bank account (online) | Cash pick up | Around 5 | Lowest fee among cash pickup options |

| Credit card (online) | Direct to bank account | Around 30 | High fee but better exchange rate |

| Debit card (online) | Direct to bank account | Around 3 | Lower fee and better recipient amount |

| Bank account (online) | Direct to bank account | 0 | No transfer fee; best for cost savings |

| Cash in store | Cash pick up or bank | Around 9 | Fixed fee; less favorable exchange rate |

You can see that online bank transfers to a bank account have the lowest money transfer fees. Using a credit card or choosing cash pickup will cost you more.

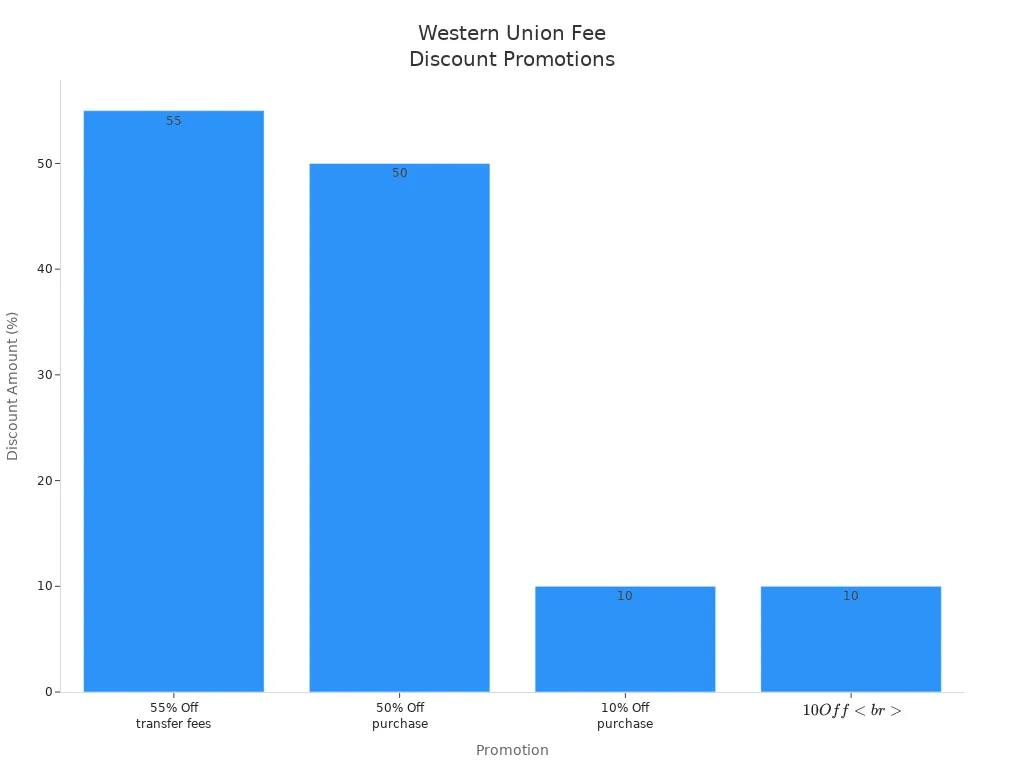

Promotions and First-Time Offers

Western Union often runs promotions to help you save on money transfer fees. You can take advantage of these offers to lower your costs:

- First transfer free when you sign up and send money online.

- Referral program gives you and your friend a $20 Amazon e-gift card after a qualifying transfer.

- My WU rewards program lets you earn points for discounts and cashback.

- Using the Western Union app can unlock special discounts.

- Email alerts notify you about promo codes and sales.

| Promotion Type | Description | Validity/Notes |

|---|---|---|

| Free First Transfer | First transfer free for new users | Valid until October 15, 2025 |

| Percentage Discounts | Discounts like 10%, 50%, and 55% off transfer fees | Some offers expire; check availability |

| Referral Bonus | $20 Amazon gift cards for both referrer and referee after $100+ transfer | Up to 25 referrals for max $500 credit |

| My WU Rewards Program | Earn points on transactions for fee discounts | Ongoing program |

| Promo Codes | Apply during checkout to reduce fees | Available on promo sites |

| App-based Discounts | Special offers when using the Western Union app | Ongoing |

Tip: Always check for new promotions before sending money internationally. These offers can help you save a lot on international money transfers.

Money transfer fees can change based on your location, the channel you use, and current promotions. Always use the Western Union fee estimator to see how much does western union charge before you send money.

Ways to Reduce Money Transfer Fees

Image Source: pexels

Compare Payment Methods

You can save money when you transfer money by comparing different payment methods. Each method comes with its own fees and exchange rates. For example, paying with a credit card often costs more than using a bank account. If you use a credit card, you might pay extra fees and get a less favorable exchange rate. Bank transfers usually have lower fees and better rates.

- You should always check both the transfer fee and the exchange rate before you send money.

- Wise uses the mid-market exchange rate and charges low, transparent fees. Western Union and PayPal often add a margin to the exchange rate, which increases your total cost.

- PayPal may charge about 5% plus a 3-4% margin on the exchange rate.

- Wise uses local bank accounts to reduce international fees, which can make fund transfers cheaper than Western Union, depending on the destination.

Tip: Comparing payment methods and providers helps you find the best deal. Do not just look at the upfront fee. Check the exchange rate and any hidden costs.

Financial experts recommend these steps to lower your costs:

- Compare multiple money transfer providers for the best fees and exchange rates.

- Avoid using credit cards for payments to reduce extra fees.

- Choose services that use the mid-market exchange rate to avoid costly markups.

- Focus on transparency and select services with minimal hidden costs.

Choose Cost-Effective Delivery Options

The way you deliver money to your recipient affects the total cost. Some delivery options are more affordable than others. Mobile wallets and money transfer apps often have minimal or no transaction fees. These electronic methods are secure and easy to use. They work best when you fund the transfer with a bank account.

- Mobile wallet transfers and money transfer apps offer near-instant transfers with low or no fees.

- These options are more cost-effective, especially for frequent senders.

- You need internet access for mobile wallets, and they may not be available in every country.

- Money transfer apps are widely accessible on smartphones and often have advanced security features.

Western Union’s fees change based on the delivery method. Credit and debit card payments usually cost more than bank transfers. If you choose to transfer to a bank account, you often pay the lowest fees. Electronic delivery methods funded by bank transfers are the most economical for frequent users.

Note: Always compare the total cost, including both the fee and the exchange rate, before you choose a delivery option.

Use Online Transfers When Possible

Online transfers usually cost less than in-person or agent-based transfers. If you use Western Union’s website or app, you often get lower fees and better exchange rates. For example, sending money online from your bank account to the recipient’s bank account can sometimes have zero transfer fees. In-person transfers may have fixed fees, such as $9, and less favorable exchange rates. This means your recipient gets less money.

| Transfer Corridor | % of Remittances Sent Online | Average Transfer Amount Online vs Agent | Fee Impact on Transfer Method |

|---|---|---|---|

| US to India | Over 80% | Online amounts 50-200% higher | Online transfers generally have lower fees and FX markups compared to agent locations |

| USA to Mexico | Less than 40% | Smaller amounts sent via agents ($200-300) | Agent location transfers have higher fees and FX markups due to agent commissions and operational costs |

You can see that online senders tend to send larger amounts less often and pay lower fees. Agent location transfers often have higher fees, especially for small amounts. Card funding methods are usually more expensive than bank-funded online transfers.

Tip: Use online money transfer options whenever possible. They are usually cheaper and more transparent than in-person services.

Common mistakes that lead to higher fees include:

- Choosing the wrong transfer method without comparing costs.

- Forgetting to check exchange rates.

- Failing to consider all fees, including hidden ones.

- Not verifying recipient information, which can cause delays and extra charges.

- Ignoring transfer times and paying for rush services.

- Using insecure payment methods, which can lead to fraud or loss.

You can avoid these mistakes by planning ahead, double-checking all details, and choosing the most cost-effective way to transfer money.

Monitor Exchange Rates

Image Source: unsplash

Impact on International Money Transfer Fees

Exchange rates change many times each day. These changes can make a big difference in how much you pay or how much your recipient gets. If you send money when the rate is low, you might pay more in international money transfer fees. If you wait for a better rate, you can save money and send more to your loved ones.

- Exchange rates move up and down because of supply and demand. Economic news, interest rates, inflation, and political events all play a part.

- When inflation rises, a currency often loses value. This can lower the exchange rate and increase your costs.

- Higher interest rates can make a currency stronger, which may help you get a better deal.

- Political problems can make a currency weaker, so you might pay more in international money transfer fees.

- Western Union updates its rates often. If you do not check the rate before sending, you might miss a chance to save money.

Tip: Always check the exchange rate before you send money. Even a small change can affect the total cost of your transfer.

Tools for Tracking Rates

You have many ways to track exchange rates and plan your transfers. Western Union offers a currency converter on its website. You can use this tool to see the current rate for your transfer. The Western Union app also lets you track your money in real time by entering your Money Transfer Control Number (MTCN). These features help you know when to send money for the best value.

Other online currency converters can show you trends and help you decide when to send. By watching the rates, you can choose the right time and avoid paying more than you need to.

- Use Western Union’s currency converter to check rates before you send.

- Track your transfer status and rate changes with the Western Union app or website.

- Try other online tools to compare rates and spot the best time to send money.

Note: Planning your transfer and watching exchange rates can help you keep more money in your recipient’s pocket.

Optimize Transfer Timing and Limits

Send Larger Amounts Less Often

You can save money by adjusting how often you send funds. Many people send small amounts several times each month. This habit can increase your total fees because each transfer comes with its own charge. If you combine payments and send a larger amount less often, you reduce the number of transactions and pay fewer fees overall.

- Sending smaller amounts frequently leads to higher total fees, especially when banks or services charge a flat fee per transfer.

- Sending larger amounts less often helps you cut down on the number of transactions, which lowers your total costs.

- You can sometimes negotiate better terms with your provider when you transfer a larger sum.

- Batching several payments into one transfer makes it easier to keep track of your money and schedule payments.

Timing also plays a big role in how much you pay. Fees and exchange rates change based on when you send money. Transfers made at the end or beginning of the month often cost more because demand is higher. You may also see less favorable exchange rates during these busy times. If you send money during off-peak periods, such as mid-month or on weekends, you might get lower fees and better rates. Banks and transfer outlets sometimes raise fees during busy periods to manage demand. Try to avoid weekends and holidays in the recipient’s country to speed up processing and avoid delays.

Tip: Plan your transfers for less busy days, like Mondays or mid-month, to get better rates and lower fees.

Take Advantage of Account Verification

Account verification can help you increase your transfer limits with Western Union. When you want to send more than $3,000 in the United States, Western Union asks you to verify your identity. After you complete this step, you can send up to $50,000 in a single transfer. This higher limit makes it easier to send larger amounts less often, which can help you save on total fees. However, account verification does not change the fee structure itself. The fees still depend on the amount you send, your payment method, the countries involved, and the current exchange rates. Always check your transfer details before sending money to make sure you get the best deal.

Alternatives to Western Union Fees

Compare with Other Money Transfer Services

You have many choices when sending money abroad. Services like Wise and Vance often give you lower fees and more transparent pricing than Western Union. Wise uses local bank systems instead of traditional SWIFT transfers. This method helps you avoid extra intermediary fees. Wise also charges a low upfront fee and uses the real mid-market exchange rate without any markup. Vance offers a flat $3 transfer fee, no hidden charges, and uses Google exchange rates with no markup. These features make both Wise and Vance more cost-effective and easier to understand than Western Union.

Here is a quick comparison of popular services:

| Service | Key Features & Fees Summary |

|---|---|

| Vance | Flat $3 transfer fee, no hidden charges, Google exchange rates, supports USD, EUR, AED, INR |

| Wise | Real mid-market exchange rates, low transparent fees, multi-currency accounts available |

| WorldRemit | Mobile-first app, sends to 130+ countries, multiple payout methods, competitive fees |

| Remitly | Express (faster, higher fee) and economy (slower, lower fee) options, transparent fees, first-time discounts |

| MoneyGram | Fast transfers, 24/7 support, broad reach, fees higher than Vance and Wise |

Note: Western Union often charges up to $10 per transaction and adds a markup to the exchange rate. You may find Vance and Wise more affordable and transparent.

When to Switch Providers

You should think about switching providers if you want to save money and get more value from your transfers. Western Union fees change based on payment method, speed, and location. For example, sending $200 in cash can cost $13.50, but sending the same amount online may have no fee. Western Union also adds a margin to the exchange rate, which increases your total cost.

You may want to switch if:

- You want lower and more predictable fees.

- You prefer transparent pricing with no hidden costs.

- You send money to bank accounts or digital wallets, not just for cash pickup.

- You want to avoid high exchange rate markups.

- You value fast transfers and clear communication.

Wise and Vance both use the mid-market exchange rate and show you all fees upfront. Wise’s fees start at about 0.43%, which is usually lower than Western Union. Vance completes many transfers within minutes, sometimes faster than Western Union for bank or wallet transfers. If you care about cost, speed, and transparency, comparing these services can help you keep more of your money.

You can keep more of your money by following a few smart steps:

- Compare providers and choose digital-first services with transparent fees and exchange rates.

- Track exchange rates often, since Western Union’s rates and fees change daily.

- Understand all fee components, including transfer fees, FX markups, and extra charges for faster transfers or credit card payments.

Staying informed and checking your options before sending money helps you avoid hidden costs. Use these tips each time you transfer funds to get the best value.

FAQ

How can you check Western Union fees before sending money?

You can use the Western Union online fee estimator. Enter the amount, destination, and payment method. The tool shows the exact transfer fee and exchange rate. Always check this before you send money to avoid surprises.

Does Western Union charge extra for using a credit card?

Yes. Western Union charges higher fees for credit card payments. Your card provider may also add cash advance fees. You save money by using a bank account or debit card instead.

Can you cancel a Western Union transfer and get a refund?

You can cancel a transfer if the recipient has not picked up the money. Log in to your account, find the transfer, and select “Cancel.” Western Union refunds your money, but you may not get back the full fee.

Why does the recipient sometimes get less money than expected?

Exchange rate markups and hidden fees can reduce the final amount. Always check the exchange rate and total cost before you send money. Use the online estimator to see exactly how much your recipient will get.

Are there limits on how much you can send with Western Union?

Yes. Western Union sets limits based on your location, payment method, and account verification. Verified users in the United States can send up to $50,000 per transfer. Check your account for your specific limit.

Many senders using Western Union face not only transfer fees but also hidden FX markups and intermediary charges, leaving recipients with less than expected. With BiyaPay, you stay in control: check real-time exchange rates anytime, and enjoy remittance fees as low as 0.5%. BiyaPay supports multiple fiat and digital currency conversions, covers most countries and regions worldwide, and enables same-day transfers—without costly surprises.

Send money smarter and safer. Start today with BiyaPay and experience transparent, low-cost global transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.