- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Makes Chase Money Market Accounts Different

Image Source: unsplash

You may wonder if chase money market accounts exist at all. Chase does not offer a traditional money market account as a deposit product. Chase provides savings accounts, which are FDIC insured and protect your deposits. A money market account also has FDIC insurance and works like a savings account with some added features. In contrast, chase offers money market funds through JP Morgan, but these funds are not FDIC insured. Money market funds carry investment risks and are not obligations of chase bank or its affiliates, so you could lose your principal.

Key Takeaways

- Chase does not offer a traditional money market account but provides FDIC-insured savings accounts and money market funds through J.P. Morgan.

- Chase savings accounts protect your money up to $250,000 and offer easy access but have lower interest rates and monthly fees.

- Money market funds from J.P. Morgan are investments with higher risk and no FDIC insurance, unlike savings accounts.

- Other banks often offer higher interest rates and more features on money market accounts than Chase.

- Choose Chase if you want strong branch access and security; compare other banks if you want higher rates or check-writing features.

Chase Money Market Accounts

Image Source: unsplash

What Is a Money Market Account?

A money market account is a type of deposit account you can open at many banks or credit unions. This account combines features of both savings and checking accounts. You usually earn a higher interest rate than a regular savings account. You can also write checks or use a debit card for withdrawals, but there are limits on how many times you can take money out each month.

Money market accounts are FDIC insured if you open them at a bank in the United States. This means your money is protected up to $250,000 per depositor, per bank. You can use a money market account to save for emergencies, short-term goals, or to keep extra cash safe while earning some interest.

Here is a quick comparison:

| Feature | Money Market Account | Savings Account | Money Market Fund |

|---|---|---|---|

| FDIC Insured | Yes | Yes | No |

| Check Writing | Yes (limited) | No | No |

| Debit Card Access | Yes (limited) | Sometimes | No |

| Investment Risk | No | No | Yes |

| Offered by Chase Bank | No | Yes | No (but funds via JP Morgan) |

Note: Money market funds are not the same as money market accounts. Funds are investments and can lose value.

Does Chase Offer a Money Market Account?

You might look for chase money market accounts when you want a safe place to earn interest and keep your money liquid. However, chase does not offer a traditional money market account as a deposit product. If you search the chase website or check their product disclosures, you will not find any chase money market account listed. Instead, chase provides savings accounts for deposit customers. These savings accounts are FDIC insured and protect your money up to the legal limit.

Chase also gives you access to money market funds through J.P. Morgan Self-Directed Investing. These funds are not the same as a money market account. Money market funds are mutual funds. They are not FDIC insured and carry investment risks. You can choose from different types of funds, such as Government & Treasury, Prime, and Municipal tax-free funds. These funds are offered through J.P. Morgan Securities LLC, not chase bank itself.

If you want a chase money market account, you will not find one as a deposit product. You can open a savings account with chase bank, or you can invest in a money market fund through J.P. Morgan. Each option has different features and risks. You should think about your needs before you decide.

Tip: Always check if your account is FDIC insured. This protects your money if the bank fails.

You now know that chase money market accounts do not exist as traditional deposit products. You can choose a chase savings account for FDIC insurance, or you can invest in a money market fund for potential higher yields, but with more risk.

Chase Savings and Money Market Fund Options

Chase Savings Accounts

You can open a chase savings account if you want a safe place to keep your money. This account gives you FDIC insurance, so your money stays protected up to $250,000. You can use features like Autosave, mobile banking, and easy transfers between accounts. The chase savings account charges a $5 monthly service fee, but you can avoid this fee by keeping a daily balance of at least $300, setting up automatic transfers of $25 or more, linking to certain checking accounts, or if you are under 18 years old. You pay no fee for using Chase ATMs, but you pay $3 to $5 for non-Chase ATMs. Wire transfer fees range from $0 to $50.

| Account Type | Monthly Service Fee | Fee Waiver Conditions | ATM Fees (Chase) | ATM Fees (Non-Chase) | Minimum Balance Requirement |

|---|---|---|---|---|---|

| Chase Savings℠ | $5 | $300 daily balance, $25 Autosave, linked accounts, or owner <18 | $0 | $3 (US/territories), $5 (outside US) | $300 daily balance |

| Chase Premier Savings℠ | $25 | $15,000 daily balance or linked to Premier Plus/Sapphire Checking | N/A | N/A | $15,000 daily balance |

Note: The chase savings account does not allow check writing or debit card purchases like a money market account.

Chase Money Market Fund via JP Morgan

If you want to invest for higher potential yields, you can choose a money market fund through JP Morgan. The JPMorgan Prime Money Market Fund (VMVXX) has a minimum initial investment of $1,000 and an expense ratio of 0.48%. This fund is not FDIC insured. You can lose money because it is an investment, not a deposit. You access this fund through J.P. Morgan Self-Directed Investing, not directly through chase bank branches. You cannot write checks or use a debit card with this fund.

| Fund Name | Expense Ratio | Minimum Initial Investment |

|---|---|---|

| JPMorgan Prime Money Market Fund (VMVXX) | 0.48% | $1,000 |

Tip: Always check if your investment fits your risk tolerance before choosing a money market fund.

Key Differences

You may wonder how these options compare to a traditional money market account. A chase money market account does not exist as a deposit product. A money market account at other banks usually gives you check writing, debit card access, and FDIC insurance. The chase savings account gives you FDIC insurance and easy access to your money, but you cannot write checks. The money market fund from JP Morgan offers investment potential, but you take on risk and lose FDIC protection.

- Chase savings account: Safe, insured, easy to use, but limited features.

- Money market fund: Higher yield possible, but riskier and not insured.

- Money market account: Combines safety, check writing, and higher interest, but chase does not offer this product.

Remember: Choose the account that matches your needs for safety, access, and earning potential.

Chase Money Market Account Rates

Image Source: pexels

How Chase Rates Compare

When you look at chase savings accounts, you will notice that the rates are lower than many other banks. The current chase interest rates for savings accounts are 0.01% APY. If you open a Chase Premier Savings account, you might earn up to 0.02% APY, but only if you meet certain requirements. These requirements include linking a qualifying checking account and making a set number of transactions each month. Most people will see the standard 0.01% rate.

| Account Type | APY Range | Monthly Fee | Fee Waiver Conditions |

|---|---|---|---|

| Chase Savings | 0.01% | $5 | Waived if balance ≥ $300, automatic transfers, linked accounts, or under 18 |

| Chase Premier Savings | 0.01%–0.02% | $25 | Waived if balance ≥ $15,000 or linked to Premier Plus/Sapphire Checking |

You will not find a chase money market account rate because chase does not offer this product. If you want a money market account rate, you need to look at other banks. Many banks offer higher rates on money market accounts than chase savings accounts. Some online banks offer rates above 4.00% APY. Chase interest rates stay much lower, so you may want to compare before you decide.

Chase does offer money market funds through JP Morgan, but these do not have a fixed rate like a deposit account. The rates for these funds change daily and depend on the market. You will not see a guaranteed money market account rate with these funds.

Fees and Minimums

Chase charges monthly fees for both savings accounts. The standard chase savings account has a $5 monthly fee. You can avoid this fee by keeping a $300 daily balance, setting up automatic transfers, linking certain accounts, or if you are under 18. The Chase Premier Savings account has a $25 monthly fee, which you can avoid by keeping a $15,000 daily balance or linking to a qualifying checking account.

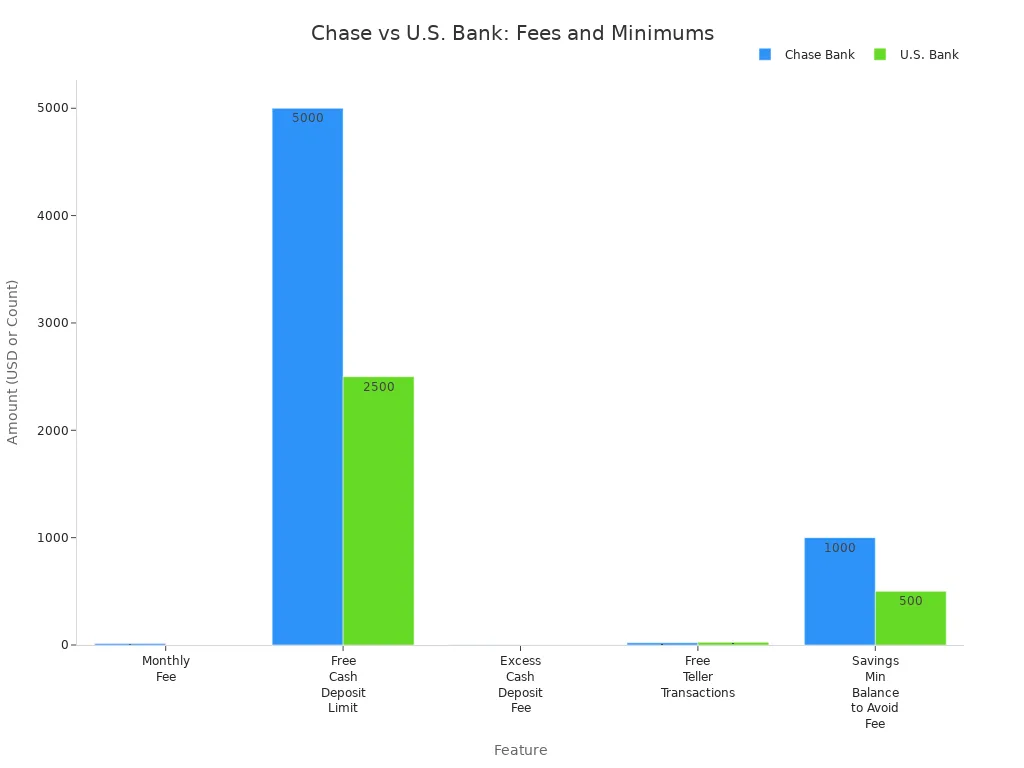

When you compare chase fees and minimums to other banks, you will see that chase often has higher fees. The chart below shows how chase compares to U.S. Bank for business accounts:

Chase offers more ways to waive fees, but you need to keep higher balances. U.S. Bank has lower minimums and fees, which may help if you want to save money. Chase gives you more branch access across the country, which can be helpful if you travel or move often.

Note: Chase does not limit the number of withdrawals from savings accounts right now. This makes it easier for you to access your money when you need it.

If you want a higher money market account rate, you may need to look at other banks or online options. Chase rates are lower, but you get strong branch access and flexible fee waivers.

Pros and Cons of Chase

Advantages

You may find several benefits when you choose chase for your savings or investment needs. Chase offers a large network of branches and ATMs across the United States. You can visit a branch or use online banking to manage your accounts. This makes it easy to access your money when you need it.

- You get FDIC insurance on chase savings accounts. This protects your money up to $250,000 per depositor.

- Chase bank provides strong customer support. You can reach out by phone, online chat, or in person.

- You can link your chase checking and savings accounts for easy transfers.

- Chase offers digital tools like mobile banking, account alerts, and automatic savings features.

- You can invest in money market funds through J.P. Morgan if you want more options.

Note: Chase gives you many ways to waive monthly fees if you meet certain requirements.

Drawbacks

You should also consider the downsides before you open an account with chase. The interest rates on chase savings accounts are much lower than those at many online banks. You may earn only 0.01% APY, which is less than what some money market accounts offer elsewhere.

- Chase charges monthly fees on savings accounts. You must keep a minimum balance or meet other conditions to avoid these fees.

- Chase does not offer a traditional money market account as a deposit product.

- Money market funds from J.P. Morgan are not FDIC insured. You could lose money if the market changes.

- Some features, like check writing, are not available with chase savings accounts.

If you want higher rates or more features, you may want to compare chase bank with other banks before you decide.

Opening an Account with Chase

Requirements

When you want to open a savings account or invest in a money market fund with chase, you need to prepare some important documents. Chase asks for identification and information to keep your account safe and follow the law. Here is a checklist to help you get ready:

- A government-issued ID, such as a driver’s license or passport.

- Your Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

- Your date of birth. You must be at least 18 years old to open an account by yourself.

- Proof of address, like a utility bill or credit card statement with your name and address.

- Contact details, including your name, address, phone number, and email.

- Bank account information for your first deposit. You can use your checking account and routing numbers, or online services like Zelle or PayPal.

Tip: If you are not a U.S. citizen, chase may ask for extra documents. You might need a Green Card, Employment Authorization Card, or a passport from your home country.

Chase usually requires two forms of ID. At least one must be government-issued. For non-U.S. citizens, you may need to show more proof of address or other documents.

Steps

You can open a chase savings account or start investing in a money market fund by following these steps:

- Visit the chase website or go to a local branch.

- Choose the type of account you want: savings or investment.

- Fill out the application form with your personal information.

- Show your identification and proof of address.

- Enter your SSN or ITIN.

- Fund your new account. You can transfer money from another bank or use online payment services.

- Review your details and submit your application.

If you want to invest in a money market fund, you need to open a J.P. Morgan Self-Directed Investing account. After you open your account, transfer at least $1,000 to start investing. Keep your funds in the account for at least 90 days if you want to qualify for any bonuses.

Note: Chase staff can help you if you have questions during the process. You can also use chase online banking to track your application.

Chase does not offer a traditional money market account, but you can choose between savings accounts or money market funds. You benefit from Chase’s strong branch network, FDIC insurance, and secure banking. However, Chase rates remain much lower than those at online banks, and monthly fees can be hard to avoid.

| Aspect | Pros | Cons |

|---|---|---|

| Chase Savings | FDIC insured, easy access | Low rates, monthly fees |

| Money Market Fund | Investment potential | Not FDIC insured, principal risk |

You may prefer Chase if you value in-person service and security. If you want higher rates or more features, compare options at online banks or credit unions before choosing a money market account.

FAQ

Does Chase offer a traditional money market account?

No, you cannot open a traditional money market account at Chase. You can choose a Chase savings account or invest in a money market fund through J.P. Morgan. Both options have different features and risks.

Are Chase savings accounts FDIC insured?

Yes, Chase savings accounts have FDIC insurance. Your deposits stay protected up to $250,000 per depositor, per bank. This insurance covers you if the bank fails.

What is the main difference between a money market account and a money market fund?

A money market account is a deposit product with FDIC insurance. A money market fund is an investment. You can lose money in a fund, and it does not have FDIC protection.

How do Chase savings account rates compare to other banks?

Chase savings account rates are lower than many online banks. You may earn only 0.01% APY. Some online banks offer rates above 4.00% APY. You can check current rates using USD exchange rates.

Chase savings accounts and money market funds may leave you with tiny yields (0.01% APY), monthly fees, and limited flexibility. If what you really need is efficient money movement across borders, BiyaPay is built for you:

- Remittance fees as low as 0.5%, far below banks and transfer providers

- Real-time exchange rate check with no hidden markups

- Support for both fiat and digital currencies with easy conversion

- Worldwide coverage, enabling smooth payments in most countries

- Same-day transfers, so your funds arrive fast and reliably

Don’t settle for low returns and high fees. Register with BiyaPay today and unlock a smarter way to manage your money globally.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.