- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Which free business checking account is right for your business

Image Source: unsplash

You want the best free business checking account for your needs. If you care about earning interest, Bluevine offers one of the top high-yield options. For freelancers, Found stands out with built-in tax tools. If you run an international business, Mercury makes global payments simple. Small businesses often look for free business checking with no monthly fees, unlimited transactions, rewards, and easy integration with bookkeeping tools. Matching these features to your daily needs helps you find the right business checking account fast.

Key Takeaways

- Choose a free business checking account that matches your daily banking needs, like transaction volume and cash deposits.

- Look for accounts with no monthly fees, unlimited transactions, and useful features like mobile banking and integration with payment tools.

- Consider your business type: freelancers benefit from tax tools, international businesses need low-fee global transfers, and high-yield accounts help grow your funds.

- Always check for hidden fees, FDIC insurance, and customer support to avoid surprises and keep your money safe.

- Use the provided checklist to ensure the account fits your business and helps you manage money easily and securely.

Best Free Business Checking Account

Image Source: unsplash

Quick Overview

If you want the best free business checking account, you should look at nbkc Bank. Many financial experts recommend nbkc Bank because it gives you great value. You do not have to worry about no monthly fees or minimum balance requirements. You get a lot of services for free that other banks usually charge for. For example, you can make as many transactions as you need without extra costs. You also get free incoming wire transfers, no overdraft fees, and access to over 90,000 ATMs. This makes nbkc Bank a strong choice if you want a business checking account that saves you money and gives you flexibility.

Who It’s Best For

You should choose nbkc Bank if you want a business checking account with no monthly fees and no hidden charges. This account works well for small business owners, freelancers, and anyone who wants to avoid paying for basic banking. If you make a lot of transactions each month, you will like the unlimited transactions feature. If you use online banking or need to connect your account to payment services, nbkc Bank makes it easy. You also get mobile deposits and tools for contactless payments. If you want a simple, low-cost way to manage your business money, this account is a top pick.

Key Features

Here are some features that make nbkc Bank stand out:

- No monthly fees or minimum balance requirements

- Unlimited transactions with no extra charges

- Free incoming wire transfers

- No overdraft, stop payment, or returned transaction fees

- Access to a huge ATM network (over 90,000 ATMs)

- Mobile check deposits and easy online banking

- Integration with payment services like Autobooks for contactless payments

Other top free business checking accounts also offer strong features. For example, Bluevine gives you a high interest rate up to 3.7% APY and unlimited transactions. Rho offers zero ACH fees, no monthly fees, and FDIC insurance up to $75 million. Mercury is great for startups and tech businesses, with free ACH and wire transfers, virtual cards, and high-yield treasury services.

Tip: If you want to earn interest, Bluevine and Kabbage both offer APY between 1.10% and 1.20% for balances up to $100,000. Here is a quick comparison:

| Business Checking Account | APY (%) | Deposit Range | Key Features |

|---|---|---|---|

| Kabbage Checking Account | 1.10 | Up to $100,000 | No monthly fees, no minimum deposit, unlimited transactions |

| Bluevine Business Checking Account | 1.20 | $0 to $100,000 | No fees, no minimum deposit, unlimited transactions, online |

You can see that both accounts give you a good APY and let you make as many transactions as you need.

Here is a table showing unique benefits of some top accounts:

| Account | Unique Benefits |

|---|---|

| Rho | No monthly fees, unlimited ACH and wire transfers, FDIC insurance up to $75 million, 24/7 support |

| Bluevine | No monthly fees, up to 3.7% APY, unlimited transactions, accounting software integration, sub-accounts |

| Mercury | Free checking and savings, free ACH and wire transfers, virtual cards, high-yield treasury services |

These features help you save money, manage your business better, and grow your funds.

Main Fees

You do not have to pay monthly fees with nbkc Bank. There are no fees for overdrafts, stop payments, or returned transactions. You also get free incoming wire transfers. If you use an ATM in the network, you pay nothing. If you use an out-of-network ATM, you may pay a small fee, but nbkc Bank refunds up to $12 per month for those charges. Other top accounts like Bluevine and Rho also have no monthly fees and let you make unlimited transactions without extra costs. This means you can focus on your business and not worry about surprise charges.

Free Business Checking Accounts Comparison

Comparison Table

Choosing the right business checking account can feel overwhelming. You want to see the differences at a glance. Here’s a table that compares the top free business checking accounts. You can quickly spot which one fits your business best.

| Bank | APY (Interest) | Monthly Fees | Cash Deposit Support & Fees | Rewards & Bonuses | Best Use Case |

|---|---|---|---|---|---|

| Bluevine | 1.5% (Standard, up to $250K)2.7% (Plus)3.7% (Premier, up to $3M) | $0 (Standard)$30 (Plus, waivable)$95 (Premier, waivable) | Cash deposits accepted with fees ($1 + 0.5% at Allpoint+ ATMs, $4.95 at Green Dot) | $300 sign-up bonus; no cashback rewards | High-yield, growing balances |

| Novo | None | $0 | No direct cash deposits; $4.95 at Green Dot | 30-day free trial + 40% off Lili Smart fee | Digital tools, integrations |

| Found | None | $0 (core)$19.99 (Plus) | No direct cash deposits; money orders at retail with fees | No cashback or sign-up bonuses | Freelancers, tax tools |

| Grasshopper | 1.0% (<$25K)1.8% ($25K-$250K)1.0% (>$250K) | $0 | No cash deposits accepted | Unlimited 1% cashback on online and signature debit card purchases | Rewards, online businesses |

| Mercury | None | $0 | No cash deposits accepted | 1.5% cashback on corporate card purchases; no wire fees | Startups, international |

Note: Some accounts limit cash deposits or charge fees for them. If you handle a lot of cash, check these details before you choose.

Key Features to Compare

When you compare free business checking accounts, you want to look at more than just the name or the promise of no monthly fees. Here are the most important features you should check:

- Deposit Requirements

Some banks ask for a minimum opening deposit. Others let you start with any amount. You want an account that matches your cash flow. - Transaction Limits

Many accounts offer unlimited transactions. Some set a cap and charge you if you go over. If your business moves money often, unlimited transactions save you money and stress. - Additional Fees

Watch out for extra charges. These can include overdraft fees, wire transfer fees, or ATM fees. Some banks refund ATM fees up to a certain amount each month. - Account Features

Look for online and mobile banking, bill pay, check deposit, and customer support. Some accounts offer special tools for freelancers, like tax tracking or invoice management. - FDIC Insurance

Make sure your money is safe. FDIC insurance protects your deposits up to $250,000.

Let’s break down which account works best for different needs:

- High-Yield Savings:

If you want to earn interest, Bluevine stands out. You can get up to 3.7% APY with their Premier account. Grasshopper also pays interest, but at a lower rate. - Freelancers and Gig Workers:

Found is built for you. It has no monthly fees for the core account and offers built-in tax tools. Novo and Bluevine also work well for freelancers, with no minimum balance and unlimited transactions. - International and Tech Businesses:

Mercury is a top pick. You get no monthly fees, unlimited transactions, and free wire transfers. Mercury also gives you a 1.5% cashback corporate card, which helps if you spend a lot online or overseas. - Rewards and Cashback:

Grasshopper gives you unlimited 1% cashback on online and signature debit card purchases. Mercury offers 1.5% cashback on its corporate card. If you want rewards, these two accounts lead the pack. - Digital Banking and Integrations:

Novo shines here. You get easy connections to tools like Wise, Stripe, and QuickBooks. If you run your business online, Novo makes it simple.

Tip: If you want a business checking account with no monthly fees and unlimited transactions, Bluevine, Novo, Mercury, and Found all deliver. If you need to deposit cash, Bluevine is your best bet, but watch the fees.

You can see that free business checking accounts come with different strengths. Some focus on high-yield interest, others on rewards, and some on digital tools. Think about how your business handles transactions, what features you use most, and whether you need to deposit cash. This way, you can pick the free business checking account that fits your business best.

Small Business Accounts

Who Should Choose This

You should consider a small business checking account if you want to keep your business costs low and manage your money easily. Many small business owners look for accounts with no monthly fees. If you want to avoid paying for every transaction, this type of account is a smart choice. You might run a shop, a service company, or even an online business. If you make a lot of transactions each month, you need an account that does not limit you. You also want to handle your banking from your phone or computer. If you value support, some banks offer business advisors to help you grow.

Top Features

Small business owners often want three main things from a free business checking account:

- No fees. You want to avoid monthly maintenance fees, transaction fees, wire transfer fees, and ATM fees. This helps you keep more of your profits.

- Mobile banking. You need to manage your money on the go. Online platforms and mobile apps make this easy and save you time.

- Overdraft coverage. Mistakes happen. Overdraft protection keeps your business running smoothly if you spend a little too much.

Other helpful features include:

- No minimum balance requirements

- Free online banking and mobile deposits

- Access to business advisors for financial guidance

Many accounts also offer unlimited transactions, so you never have to worry about extra charges as your business grows.

Considerations

When you choose a small business account, think about what matters most to you. Many business owners switch from paid accounts because of high fees, poor customer service, or limited access to business products like loans and credit cards. You might want to save money, get better support, or find more useful features. Look for an account that fits your daily needs. Make sure you can deposit cash if you need to. Check if the bank offers perks or sign-up bonuses. Always read the fee schedule so you do not get surprised later. A good account should help you focus on your business, not on banking problems.

Freelancer and Gig Worker Options

Who Should Choose This

If you work for yourself, pick up gigs, or run a small side business, you need a checking account that fits your style. You want something simple, fast, and flexible. Many freelancers and startups choose accounts that help them track income, manage taxes, and get paid easily. You might not have a business license or a company name. That’s okay—some banks let you open an account with just your personal details. If you want to keep your business and personal money separate, these accounts make it easy.

Here’s a quick look at the most popular free business checking accounts for freelancers and gig workers:

| Bank Name | Why Popular Among Freelancers and Gig Workers |

|---|---|

| Found | Best for tax tools, automatic tax savings, and no business proof needed. |

| Bluevine | High interest rate, no monthly fees, and easy cash deposits. |

| Novo | Great digital tools and integrations for online work. |

| Chase | Accepts credit card payments, good for client work. |

| Lili | Simple finances, savings sub-accounts for taxes and expenses. |

| Axos | Unlimited ATM reimbursements, handy for frequent cash withdrawals. |

| Wave Money | Built-in accounting features for easy bookkeeping. |

| North One | Savings sub-accounts help you set aside money for taxes or expenses. |

| NBKC | Basic, fee-free account with no monthly fees or minimum balance. |

Top Features

You want features that make your life easier. Here are the top things to look for in a free business checking account if you are a freelancer or gig worker:

- No monthly fees so you keep more of your earnings.

- Mobile banking lets you manage money anywhere.

- Built-in tax tools help you save for taxes and track expenses.

- Integration with accounting software saves time and reduces mistakes.

- Invoicing tools make it easy to bill clients and look professional.

- High APY helps your money grow while you work.

- ATM access with fee refunds gives you cash when you need it.

- Unlimited transactions mean you never worry about hitting a limit.

Tip: Seeing all your income and expenses in one place helps you understand your business health. Many accounts also offer branded debit cards, which can make you look more professional to clients.

Considerations

Before you pick an account, think about how you get paid and what tools you use. If you need to accept credit card payments, look for accounts like Chase or Novo. If you want help with taxes, Found and Lili stand out. Some accounts do not support cash deposits, so check if that matters to you. You may want an account that connects with your favorite apps or offers rewards for using your card. Always read the fine print on fees, even if the account advertises no monthly fees. The right account should make your transactions smooth and help you focus on your work, not your banking.

International and Tech Business Solutions

Who Should Choose This

You should look at international and tech business checking accounts if your company works with clients or partners in other countries. These accounts also fit you if you run a tech startup, manage remote teams, or need to send and receive payments across borders. Many tech founders and global entrepreneurs want banking that works everywhere, not just in one country. If you need to pay vendors in different currencies or want to connect your bank with software tools, these accounts make your life easier.

Top Features

International and tech businesses need more than just basic banking. You want features that help you move money, manage teams, and keep everything running smoothly. Here are some top features to look for:

- Multi-currency support lets you hold and send money in different currencies, like USD, EUR, or GBP.

- Low or no fees for international transfers save you money on cross-border payments.

- Integration with accounting and business software, such as QuickBooks, Xero, or Stripe, helps you track your finances.

- Customizable account permissions let you control who can access your business funds.

- Physical and virtual cards give your team flexibility and security.

- Free or low-cost wire transfers make it easy to pay partners worldwide.

- No minimum balance requirements help startups and small tech firms manage cash flow.

- Digital banking platforms with 24/7 support and API access let you automate tasks and get help anytime.

- ATM fee refunds worldwide are useful if you or your team travel often.

- Competitive exchange rates help you avoid hidden costs when sending money abroad.

Here’s a table showing how top accounts support international and tech businesses:

| Account | International Transactions Support | Tech Business Features | Notable Perks | Monthly Fee |

|---|---|---|---|---|

| Brex | Fee-free international transfers | Third-party integrations, startup perks | Startup rewards | Free |

| Mercury | Free USD wire transfers worldwide | API access, team management, software integration | Business-friendly tools | Free |

| Novo | Refunds all ATM fees worldwide | Integrations with ecommerce and tech platforms | ATM fee refunds | Free |

| Relay | Supports foreign owners, high limits | Multiple accounts, QuickBooks/Xero integration | Scalable for teams | Higher fee |

Note: Mercury stands out for API access and automation, while Novo and Relay offer strong software integrations and global support.

Considerations

You need to watch for a few common limits with free business checking accounts for international use. Some banks ask for a minimum opening deposit, which can tie up your cash. Others require you to keep a certain balance or charge fees if you drop below it. You might see fees for wire transfers or currency exchanges, which add up if you send money often. Some accounts cap the number of free transactions each month. Not every account supports international payments, so check this before you sign up. Also, make sure your funds are protected with FDIC or NCUA insurance. Always read the fee schedule and check if the account fits your business needs before you decide.

Rewards and High-Yield Accounts

Image Source: unsplash

Who Should Choose This

You should look at rewards and high-yield business checking accounts if you want your money to work harder for you. These accounts fit you if you keep higher balances or use your business debit or credit card often. If you want to earn cash back, bonus points, or higher interest on your business funds, these accounts make sense. Many business owners who pay vendors, buy supplies, or travel for work find rewards helpful. You might also want these accounts if you want perks like waived fees or discounts on loans.

Top Features

Rewards and high-yield accounts give you more than just a safe place for your money. You can earn bonus rewards on business spending, get higher APY on your balance, and enjoy extra perks. Here’s a quick look at how some rewards programs work:

| Tier Name | Required 3-Month Combined Average Daily Balance | Bonus Rewards on Eligible Business Credit Cards |

|---|---|---|

| Gold | $20,000 to less than $50,000 | 25% bonus rewards |

| Platinum | $50,000 to less than $100,000 | 50% bonus rewards |

| Platinum Honors | $100,000 or more | 75% bonus rewards |

You can also get waived fees, interest rate discounts on loans, and cash back on payroll service fees if you keep qualifying balances. Some banks, like Bank of America, offer these perks for free if you have an eligible business checking account.

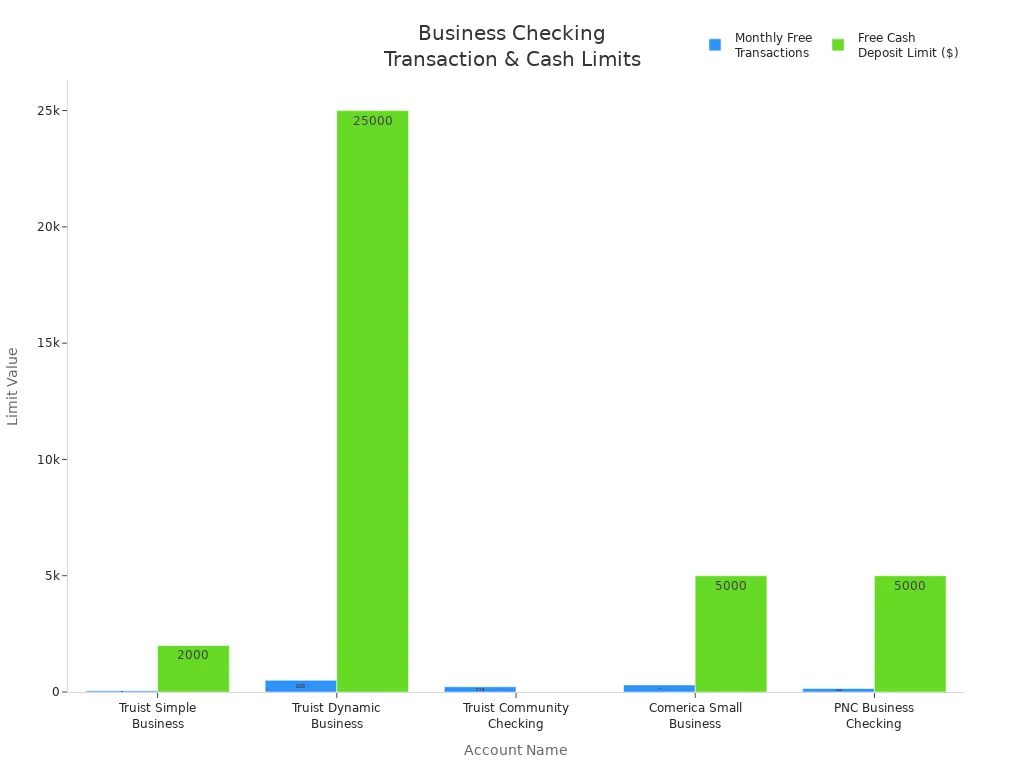

If you want to earn interest, high-yield business checking accounts offer tiered APY rates. For example, you can earn up to 0.80% APY if you keep a balance between $15,000 and $24,999.99 and use your debit card at least 10 times a month. Here’s a chart that shows how APY changes with your balance:

Considerations

Before you open a rewards or high-yield account, check the requirements. Many accounts ask you to keep a minimum balance or make a certain number of debit card purchases each month. Some require you to enroll in eStatements or open your account during a special offer period. You may need to avoid having another business checking account at the same bank in the past year. Here’s a table with common requirements:

| Requirement | Details |

|---|---|

| Minimum Balance | $5,000 to $100,000, depending on the rewards tier |

| Debit Card Swipes | 10 to 12 per month, signature-based |

| Enrollment | Must sign up for eStatements |

| Account Opening Period | Some offers only valid during certain months |

| Transaction Activity | 5 to 10 qualifying transactions within a set period |

| Existing Customer Restrictions | No recent business account at the same bank |

You should also check if the account has no monthly fees or if you need to meet certain conditions to avoid them. Always read the fine print so you do not miss out on rewards or pay unexpected charges.

How to Choose Free Business Checking

Match Features to Needs

Choosing the right free business checking account starts with knowing what your business needs every day. Think about how you handle money. Do you need to deposit cash often? Do you want to earn interest or need easy online banking? Here’s a simple way to match features to your needs:

- List your daily banking habits. Do you make lots of transactions or just a few each month?

- Pick a bank that offers features you use, like online banking, mobile deposits, or cash management tools.

- Check if the account has low or no fees, high transaction limits, and perks like interest earnings.

- Gather your business documents, such as your business name, tax ID, and address.

- Keep your business and personal money separate. This helps with taxes and keeps your records clear.

- Use banking tools like payroll, merchant services, and mobile apps to save time.

- Make sure the account can grow with your business and supports your future plans.

Tip: Talk to a business banker if you have special needs or want help picking the best account.

Common Mistakes

Many business owners make mistakes when picking a free business checking account. Watch out for these common problems:

- Picking an account without checking for hidden fees, like overdraft or ATM charges.

- Using a PO Box or mailbox service as your business address. Banks want a real address with proof, like a lease or utility bill.

- Not checking if the account works with your favorite business tools or software.

- Missing out on good customer support, which can slow you down when you need help.

- Forgetting to set up user permissions, which can lead to security risks.

- Not keeping track of transactions, making taxes and bookkeeping harder.

Note: Always read the fine print and ask questions before you open your account.

Quick Checklist

Here’s a quick checklist to help you choose the best free business checking account:

- Is the bank FDIC insured?

- Does the account offer unlimited free transactions?

- Are there fees for cash deposits or minimum balances?

- Can you get both paper and electronic statements for free?

- Does the account let customers pay your business directly?

- Do you have all the needed documents (business name, tax ID, address, photo ID)?

- Does the account work with your accounting or invoicing software?

- Can you access good customer support when you need it?

- Does the account offer mobile and online banking that fits your needs?

If you check off these boxes, you’re on your way to finding the right free business checking account for your business.

You can find the best free business checking account by matching your business needs with key features. Look for low fees, mobile banking, and integration with payment platforms. Use the comparison table below to spot accounts that fit your style:

| Account Name | Key Benefit/Feature |

|---|---|

| Bluevine Business Checking | Earning interest |

| Found Business Banking Account | Bookkeeping and tax tools |

| Grasshopper Business Checking | Unlimited cash back |

| Wise Business | International transfers with low fees |

Check your needs, compare options, and follow the checklist. This approach helps you open an account that supports your business goals.

FAQ

What documents do you need to open a free business checking account?

You usually need your business name, tax ID, address, and a photo ID. Some banks may ask for your business license or proof of address. Always check the bank’s website for a full list before you apply.

Can you open a business checking account online?

Yes, you can open most free business checking accounts online. Many banks let you fill out the application on their website. You upload your documents and get approved quickly. Some banks may ask you to visit a branch for final steps.

Do free business checking accounts have hidden fees?

Most free accounts do not charge monthly fees. You may still pay for things like wire transfers, out-of-network ATM use, or cash deposits. Always read the fee schedule before you open your account.

Can you deposit cash into a free business checking account?

Some banks let you deposit cash at ATMs or partner locations. Others do not support cash deposits. If you handle cash often, check the bank’s policy and any fees before you choose an account.

Are your funds safe in a free business checking account?

Yes, your money stays safe if the bank has FDIC insurance. This protects up to $250,000 per account. Always check for FDIC coverage before you open your account.

Finding the right free business checking account is a good first step — but to truly run your business globally with speed and low cost, you need more than just a bank. BiyaPay is designed for modern entrepreneurs and international teams:

- Remittance fees as low as 0.5%, far cheaper than banks or transfer services

- Real-time exchange rate check with no hidden markups

- Support for both fiat and digital currencies, with seamless conversion

- Worldwide coverage across most countries and regions

- Same-day transfers, so your cash flow never stalls

Don’t let traditional accounts limit your growth. Register with BiyaPay today and unlock a smarter global payment solution for your business.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.