- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Complete Guide to PayPal Credit

Image Source: pexels

PayPal Credit gives you a revolving line of credit from Synchrony Bank, which you link to your PayPal account. When you use PayPal Credit, you can pay for items online or in-store and repay the amount over time. PayPal Credit works with your PayPal wallet, so you see it as a payment option when you check out. Many people choose PayPal Credit for its flexible payments and special financing deals. You do not pay an annual fee for PayPal Credit. PayPal Credit now offers a physical card, letting you use PayPal Credit in more places. You decide when to use PayPal Credit or other PayPal options. PayPal Credit lets you manage spending and track payments easily through your PayPal account. Understanding how PayPal Credit works helps you make smart choices. Always review PayPal Credit terms before you spend with PayPal Credit.

Key Takeaways

- PayPal Credit gives you a flexible credit line linked to your PayPal account for online and in-store purchases.

- You can use PayPal Credit to buy now and pay later, with special offers like no interest if paid within six months.

- The new PayPal Credit physical card lets you use your credit line anywhere Mastercard is accepted.

- Always pay on time and keep your balance low to avoid high interest rates and protect your credit score.

- Before applying, check your credit history and understand all terms to use PayPal Credit responsibly and avoid extra fees.

What Is PayPal Credit

Image Source: pexels

PayPal Credit gives you a digital way to borrow money for your purchases. You link this service to your PayPal account. When you use PayPal Credit, you get a revolving credit line from Synchrony Bank. This means you can borrow up to a set limit, pay back what you owe, and then borrow again. You do not pay an annual fee for this service. PayPal Credit now offers a physical card, which lets you use your credit line in more places.

How PayPal Credit Works

You use PayPal Credit much like a traditional credit card. When you make a purchase, you borrow money from your available credit line. You must make at least the minimum payment each month to keep your account in good standing. Interest charges apply if you do not pay your balance in full. PayPal Credit often gives you special offers, such as no interest if you pay off purchases over $149 within six months.

- You can use your credit line again and again, as long as you stay within your limit.

- You see PayPal Credit as a payment option when you check out with PayPal online.

- You can track your spending and payments through your PayPal account.

- Responsible use of PayPal Credit can help your credit score.

Note: PayPal Credit does not charge an annual fee. You get purchase protection on eligible items, which adds a layer of security to your shopping.

PayPal Credit works as a buy now, pay later option. You can split payments over time instead of paying the full amount right away. This flexibility helps you manage your budget, especially for larger purchases.

Where You Can Use PayPal Credit

You can use PayPal Credit in many places. Online, you select PayPal Credit at checkout when you shop at stores that accept PayPal. This includes thousands of websites, from large retailers to small businesses.

Recently, PayPal introduced a physical card for PayPal Credit. This card connects to the Mastercard network. Now, you can use PayPal Credit at almost any store or service that accepts Mastercard. You can also add the card to your mobile wallet for tap-to-pay and faster checkouts in stores.

- The physical card expands PayPal Credit from online-only to in-store use.

- You do not need to search for special merchants. Most places that accept Mastercard will accept your PayPal Credit card.

- You can blend your online and offline shopping experiences with one credit line.

Tip: Always check your available credit before making a purchase. This helps you avoid declined transactions and keeps your account in good standing.

PayPal Credit started as an online-only service. Now, with the new card, you can use it almost anywhere you shop. This change gives you more freedom and flexibility with your spending.

How to Use PayPal Credit

PayPal Credit gives you several ways to pay for goods and services. You can use it online, in stores, or even to send money. Learning how to use PayPal Credit helps you get the most out of your account and manage your spending.

Making Purchases Online

You can use PayPal Credit for online shopping at thousands of websites that accept PayPal. When you reach the checkout page, you will see PayPal as a payment option. If you want to use PayPal Credit, you can select it during the payment process.

- Open your PayPal Wallet.

- Choose PayPal Credit as your payment method.

- Set it as your preferred payment method if you want to use it for most purchases.

- At checkout, select PayPal Credit from the list of available payment options.

If you have not set a preferred payment method, PayPal will show all your available options. You can pick PayPal Credit for that purchase. If you set PayPal Credit as your default, PayPal will use it first when you shop online.

Tip: Always check if the seller supports PayPal Credit before you start shopping. Some stores may not offer this option.

PayPal Credit gives you flexibility. You can buy now and pay later. You can also track your purchases and payments in your PayPal account. This helps you stay organized and avoid missing payments.

Using PayPal Credit In-Store

PayPal Credit is not just for online shopping. You can use it in stores with the PayPal Credit physical card. This card is available to eligible PayPal Credit customers in the United States. The card connects to the Mastercard network, so you can use it at most places that accept Mastercard.

- The PayPal Credit card lets you pay in stores and on the go.

- You can add the card to your mobile wallet for tap-to-pay convenience.

- The card works at millions of locations that accept Mastercard.

- PayPal will notify you when you are eligible for the card.

When you use the PayPal Credit card, you draw from your PayPal Credit line. You can use it for groceries, clothes, or other everyday purchases. The card gives you more ways to use PayPal Credit outside of online shopping.

Note: The rollout of the PayPal Credit card is happening in phases. You may need to wait for an invitation from PayPal before you can get the card.

PayPal Credit in stores gives you more control over your spending. You can use one credit line for both online and offline purchases. You can also track all your transactions in your PayPal account.

Sending Money with PayPal Credit

You can use PayPal Credit to send money to friends or family. When you send money through PayPal, you can choose PayPal Credit as your payment source. This lets you borrow from your credit line instead of using your bank account or debit card.

To send money with PayPal Credit:

- Log in to your PayPal account.

- Click “Send & Request.”

- Enter the recipient’s email or mobile number.

- Enter the amount you want to send.

- Select PayPal Credit as your payment method.

- Review and confirm your payment.

PayPal Credit makes sending money easy. You can help someone in need or split a bill without using cash. You can also pay over time, which gives you more flexibility.

Note: PayPal may charge a fee when you use PayPal Credit to send money. Always review the terms before you complete the transaction.

PayPal Credit offers security for your payments. You get purchase protection on eligible items. You can also monitor your account for any unusual activity. If you see something wrong, you can contact PayPal for help.

PayPal Credit gives you many ways to pay and manage your money. You can shop online, pay in stores, or send money to others. You can also track your spending and payments in your PayPal account. Learning how to use PayPal Credit helps you make smart choices and stay in control of your finances.

PayPal Credit Pros and Cons

Benefits of PayPal Credit

PayPal Credit gives you several advantages when you shop or manage your money. Many users and experts highlight these benefits:

- You can check out quickly online with your PayPal account. You do not need to enter your credit card details every time you shop.

- PayPal Credit helps protect your personal and financial information. When you use PayPal, your details stay hidden from sellers, which lowers the risk of fraud.

- You may get special offers like “No Payments + No Interest” on certain purchases. This feature lets you buy now and pay later without extra cost if you pay off the balance during the offer period.

- PayPal Credit works well for people who pay bills on time and keep a budget. If you use it responsibly, you can avoid debt and manage your spending.

- You can track all your PayPal Credit activity in your PayPal account. This makes it easy to see what you spend and when you need to pay.

- PayPal Credit does not charge an annual fee. You only pay interest if you carry a balance past the promotional period.

Tip: PayPal Credit is best for people who want a simple way to shop online, value security, and can pay off their balances each month. If you ask who is paypal credit best for, it suits users who want flexibility and can manage payments on time.

Drawbacks and Risks

PayPal Credit also comes with some risks and downsides. You should know these before you decide to use it:

- If you miss payments or default, your credit score can drop. This can make it harder to get loans or open new accounts.

- PayPal Credit charges high interest rates if you do not pay off your balance during the promotional period. This can make your purchases much more expensive.

- Late fees apply if you do not pay on time. If you keep missing payments, PayPal may send your account to collections.

- PayPal Credit uses hard credit checks and reports your payment history to credit bureaus. This can help or hurt your credit, depending on how you use it.

- Online threats like phishing and malware can target your PayPal account. Weak passwords or using public WiFi can put your account at risk.

- PayPal Credit does not offer rewards or cash back. Some users may prefer traditional credit cards for these features.

Note: If you wonder who is paypal credit best for, it may not suit people who struggle with debt or want rewards. Always review your spending and pay on time to avoid extra costs.

PayPal Credit Terms

Understanding PayPal Credit terms helps you avoid surprises and manage your account wisely. You should know how interest rates, fees, and credit limits affect your PayPal Credit balance and overall costs.

Interest Rates and Fees

PayPal Credit charges a variable purchase APR. As of March 1, 2025, the rate is 30.39%. This rate is higher than the average credit card APR in the United States, which usually stays around 20%. If you miss payments or carry a balance, you may face a penalty APR of 34.99%. These rates can change with the Prime Rate.

You need to watch out for PayPal Credit fees. Late payment fees and returned payment fees can add up quickly. If you do not pay at least the minimum amount by the due date, you will pay a late fee. These extra charges increase your PayPal Credit costs and make it harder to pay off your balance.

Note: PayPal Credit terms and conditions explain all fees and rates. Always review them before using your account.

Special Financing Offers

PayPal Credit financing often includes special deals. One popular offer is no interest if you pay off a purchase of $149 or more within six months. If you do not pay the full amount in this period, PayPal charges interest from the purchase date at the regular APR. This feature can help you manage big purchases, but you must plan your payments to avoid extra PayPal Credit costs.

You should always read the details of each offer. Some purchases may not qualify for special financing. Missing a payment can also cancel the offer and trigger interest charges.

Credit Limits and Payments

PayPal sets your credit limit based on your credit history and other factors. Your credit limit controls how much you can spend with PayPal Credit. You can use your available limit for online shopping, in-store purchases, or sending money.

To keep your account in good standing, you must make at least the minimum monthly payment. Here is how PayPal calculates this payment:

- The minimum payment is usually the greater of a flat fee or 1-2% of your outstanding balance.

- PayPal adds any interest charges and late fees from previous cycles.

- Paying only the minimum does not cover all interest, so your balance may grow.

- Grace periods let you pay the full balance to avoid interest.

If you pay late, you risk extra fees and a lower credit score. Keeping track of your credit limit and payments helps you avoid problems with your PayPal Credit account.

Tip: Always pay more than the minimum to reduce your PayPal Credit balance faster and lower your total costs.

Apply for PayPal Credit

Image Source: pexels

Eligibility Requirements

Before you apply for PayPal Credit, you need to meet certain requirements. You must have a PayPal account in good standing. You must be at least 18 years old and live in the United States. PayPal Credit checks your credit history and score. Most users with a fair credit score and some credit history can qualify. The credit requirements include a review of your PayPal transaction history and how long you have used your account. PayPal also looks at your income and other personal details. If you have had a bankruptcy that included PayPal Credit or Bill Me Later, you may not meet the requirements.

How to Apply for PayPal Credit

You can apply for PayPal Credit directly through your PayPal account. The application process is simple and quick. Here is how to apply for PayPal Credit:

- Create a PayPal account if you do not have one.

- Start the Pay Monthly installment loan application on the PayPal platform.

- Enter your personal information, such as your US address, phone number, date of birth, Social Security Number (SSN) or Individual Tax Identification Number (ITIN), and annual income after taxes.

- Submit your application for review.

- PayPal checks your information, credit score, transaction history, and account age.

- The application process does not affect your credit score, but using PayPal Credit may impact it later.

- If you do not get approved, check your PayPal message center for details and consider other payment options.

You should make sure all your information is correct before you submit your application. If you face system issues or get a rejection, you can contact PayPal Credit customer service for help.

What Happens After You Apply

After you apply for PayPal Credit, PayPal reviews your application. You may get an instant decision. If approved, you receive a credit limit based on your credit requirements and account history. Most users see their new credit line in their PayPal account right away. If you do not get approved, PayPal will send you a message with the reason.

Common reasons for rejection include system glitches, past bankruptcies, or not meeting credit requirements. The table below shows some issues and ways to improve your chances:

| Reason for Rejection or Issue | Supporting User Experience | Suggested Improvement |

|---|---|---|

| System glitches preventing application access | Blocked from applying, received a generic message. Customer service resolved the issue. | Contact PayPal Credit customer service. |

| Prior bankruptcy involving PayPal Credit or Bill Me Later | Automatic ineligibility after bankruptcy. | Avoid applying if you had a recent bankruptcy with PayPal Credit. |

| Credit history factors (credit score and account age) | Approved with a credit score in the 600s and 1 year of history. | Maintain a fair credit score and some credit history. |

| Using different PayPal accounts or emails | Considered applying with a different account after rejection. | Try a different PayPal account or email if rejected. |

PayPal Credit reports your account to major credit bureaus. Your credit utilization, payment history, and account age can affect your credit score. High balances may lower your score, while low balances and on-time payments can help it. Closing your PayPal Credit account may also impact your score by reducing your available credit.

Tip: Keep your PayPal Credit balance low and pay on time to help your credit score.

Alternatives to PayPal Credit

Credit Cards vs. PayPal Credit

You may wonder if you should use a credit card or PayPal Credit for your purchases. Both options let you buy now and pay later, but they work in different ways. Credit cards often give you rewards, cash back, or travel points. Many cards also offer lower interest rates than PayPal Credit. You can use credit cards almost everywhere, both online and in stores.

PayPal Credit links directly to your PayPal account. You can use it for online shopping, in-store purchases with the PayPal Credit card, or even for sending money. You do not pay an annual fee for PayPal Credit. You can also use special offers like six months of no interest on purchases over $99. However, if you do not pay off your balance in time, you may face high interest rates.

Credit cards usually require a hard credit check. PayPal Credit also checks your credit, but you can use PayPal Pay in 4 with only a soft check. This makes it easier for some people to qualify for PayPal Pay in 4. You should compare the interest rates, fees, and rewards before you choose between a credit card and PayPal Credit.

Other Buy Now, Pay Later Options

You have many choices besides PayPal Credit when you want to split your payments. Services like Affirm, Klarna, Afterpay, Apple Pay Later, and Gerald all offer buy now, pay later plans. Each service has its own rules for payments, interest, and fees.

The table below shows how these options compare:

| Service | Repayment Terms | Interest Rates | Credit Checks | Purchase Limits | Late Fees |

|---|---|---|---|---|---|

| Affirm | “Pay in 4” or monthly installments | No interest on Pay in 4; 0%-36% APR on monthly plans | Soft credit check; may report payment history | Up to $20,000 | None |

| Klarna | “Pay in 4”, “Pay in 30 days”, monthly financing | No interest on Pay in 4 and 30 days; variable APR on monthly plans | Soft for Pay in 4; hard for monthly financing | No predefined limit; automated approval per purchase | Up to $7 late fee after 10 days (max 25% of installment) |

| Afterpay | Four interest-free payments or monthly installments | None on 4 payments; varies on monthly installments | Soft credit check | Starting around $500, increases over time | Capped at 25% of order or $68 max |

| Apple Pay Later | Four interest-free payments over six weeks | None | Soft credit check | Up to $1,000 | None |

| PayPal Credit | Reusable credit line; promotional financing or Pay Monthly | None for Pay in 4; 9.99%-35.99% APR for Pay Monthly | Soft for Pay in 4; hard for Pay Monthly | $30-$1,500 for Pay in 4; $199-$10,000 for Pay Monthly | None |

Some services, like Gerald, focus on helping you pay for household bills and offer cash advances with no fees. Gerald encourages you to use buy now, pay later for essentials before you get a cash advance. This approach helps you manage your budget and avoid extra debt.

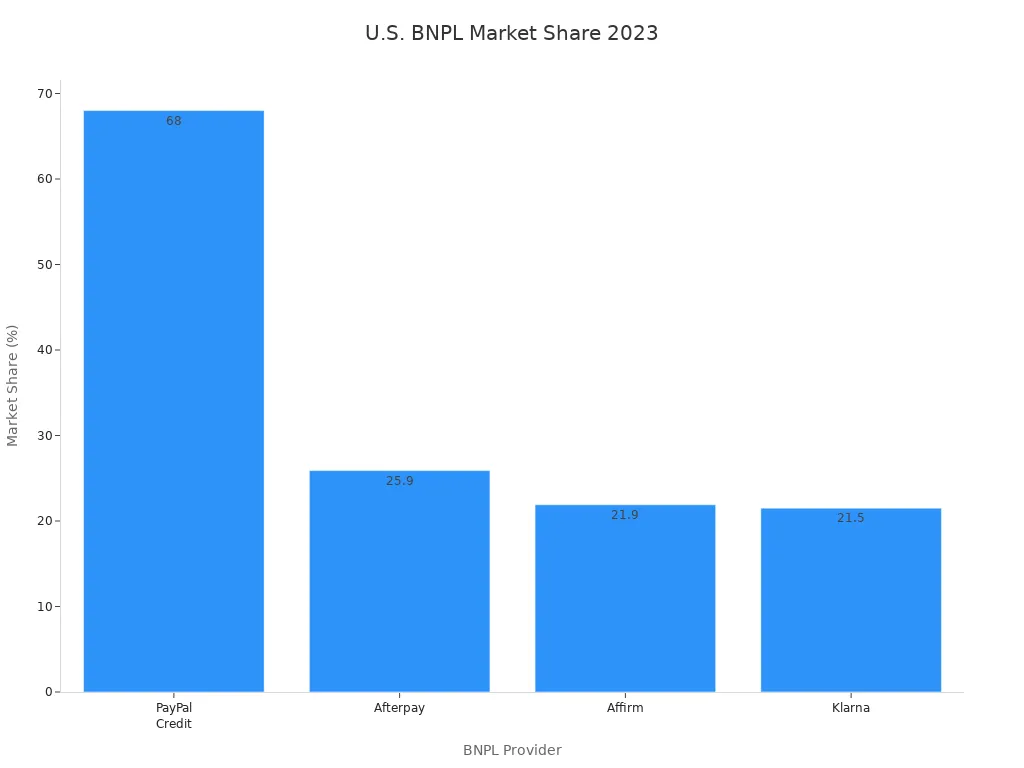

PayPal Credit leads the market in the United States. In 2023, 68% of surveyed buy now, pay later users chose PayPal’s BNPL option. Afterpay, Affirm, and Klarna each had less than 26% of users. You can see this in the chart below:

You can also use PayPal Pay in 4 for smaller purchases. This lets you split your payment into four interest-free parts. PayPal Pay in 4 uses a soft credit check, so it is easier to qualify. You can use PayPal Pay in 4 at many stores that accept PayPal.

Note: Always read the terms before you choose a buy now, pay later service. Check the interest rates, fees, and payment schedule. This helps you avoid surprises and manage your money better.

PayPal Credit gives you a revolving credit line that links to your PayPal account. You can use PayPal Credit for purchases anywhere PayPal is accepted, both online and in stores. Before you apply, review these important points:

- PayPal Credit offers no annual or application fees, but late payments can lead to fees between $25 and $40.

- You must pay off purchases over $99 within six months to avoid high interest charges.

- PayPal Credit does not provide rewards or help build credit history.

- You get zero fraud liability and easy account management through PayPal.

You should compare PayPal Credit with other payment options. Always check your ability to repay balances and understand all terms. Responsible use of PayPal Credit helps you manage spending and avoid extra costs.

FAQ

What credit score do you need for PayPal Credit?

You usually need a fair credit score, often around 640 or higher. PayPal and Synchrony Bank check your credit history. If you have a good payment record and some credit history, you have a better chance of approval.

Can you use PayPal Credit to withdraw cash?

You cannot use PayPal Credit to get cash from ATMs or as a cash advance. PayPal Credit works only for purchases, bill payments, and sending money through PayPal.

Does PayPal Credit affect your credit score?

Yes, PayPal Credit can impact your credit score. When you apply, Synchrony Bank checks your credit. Your payment history and credit usage with PayPal Credit also appear on your credit report.

What happens if you miss a PayPal Credit payment?

If you miss a payment, you may pay a late fee of up to $40. Your credit score can drop. PayPal Credit may also charge interest on your balance. Always pay on time to avoid extra costs.

While PayPal Credit helps you manage flexible payments, you may also need a reliable solution for cross-border transfers. BiyaPay enables fast and secure remittances to most countries and regions worldwide, with remittance fees as low as 0.5%, and full support for multi-fiat and crypto currency conversions. With BiyaPay, you can register quickly and track your money with confidence.

Whether for online shopping or international payments, BiyaPay’s same-day arrival service and real-time exchange rate check help you save costs and avoid hidden charges. Start today with BiyaPay to enjoy a secure, fast, and low-cost global transfer experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.