- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Australian Credit Cards with the Best Lounge Access Benefits

Image Source: pexels

You probably want the best cards for airport lounge access, right? Some of the best lounge access options in Australia come from cards like American Express Platinum, Citi Prestige, and Qantas Premier Platinum. These offer lounge access through networks like Priority Pass, Qantas Club, Star Alliance, and Mastercard Travel Pass. If you are a frequent flyer or a frequent traveller, you know how much time you spend at the airport. Lounge access gives you a quiet space, snacks, and a better airport experience. Even if you do not travel often, the best lounge access can make your trip smoother. Many best cards include guest passes, so families and business travelers get more value. Picking the best lounge access card helps you enjoy every airport pass, relax in each lounge, and make every travel pass count.

Key Takeaways

- Airport lounge access improves your travel experience by offering quiet spaces, free snacks, Wi-Fi, and comfort during airport waits.

- Top Australian credit cards like American Express Platinum and Citi Prestige offer unlimited lounge visits and guest passes, ideal for frequent travelers.

- Cards with fewer complimentary passes, such as ANZ Frequent Flyer Black and Qantas Premier Platinum, suit occasional flyers who want lounge access without high fees.

- Guest policies vary; some cards allow free guests while others use your passes for guests, so choose a card that fits your travel group.

- Match your credit card choice to your travel habits, spending, and rewards preferences to get the best value from lounge access and perks.

Comparison Table

Best Cards Overview

You want to know which credit cards give you the best lounge access at the airport. The best cards stand out because they offer more lounge networks, more complimentary passes, and better perks. Some cards, like the American Express Platinum, let you visit Priority Pass lounges, American Express Lounges, and Virgin Australia Lounges. You get unlimited entry for yourself and a bonus guest. Citi Prestige also gives you unlimited lounge access and a bonus guest pass. Other cards, like the ANZ Frequent Flyer Black and Qantas Premier Platinum, give you two complimentary lounge passes each year. These passes work well if you only travel a few times a year.

Here’s a quick look at how the top credit cards with lounge access compare:

| Credit Card | Lounge Networks | Complimentary Visits | Guest Policy | Annual Fee (USD) | Standout Perks & Bonus Rewards |

|---|---|---|---|---|---|

| American Express Platinum | Priority Pass, Amex Lounges, Virgin Australia | Unlimited | 1 bonus guest per entry | $1,150 | Bonus rewards, travel insurance, hotel perks |

| Citi Prestige | Priority Pass | Unlimited | 1 bonus guest per entry | $900+ | Bonus rewards, hotel credits, insurance |

| ANZ Frequent Flyer Black | Qantas Club | 2 passes/year | 2nd pass for guest | $280 | Bonus Qantas points, travel insurance |

| Qantas Premier Platinum | Qantas Club | 2 passes/year | 2nd pass for guest | $260 | Bonus Qantas points, insurance |

| HSBC Star Alliance Gold | Star Alliance Lounges | Gold status (varies) | Guest rules by lounge | $330 (1st yr free) | Star Alliance Gold, bonus rewards |

| Bankwest More World | LoungeKey (1,300+ lounges) | 10 passes/year | Passes can be used for guests | $180 | Bonus points, travel insurance |

| CommBank Mastercard Travel Pass | Mastercard Travel Pass | 2 passes/year | Passes can be used for guests | $120 | Bonus rewards, no foreign fees |

Note: Annual fees are shown in USD and may change with exchange rates. Always check the latest rates before you apply.

Key Lounge Access Features

When you look for the best lounge access, you want to know how many complimentary passes you get, which lounge networks you can enter, and if you can bring a bonus guest. The best lounge access cards give you more than just a pass—they give you bonus rewards, travel insurance, and sometimes even hotel perks. Unlimited entry is great if you travel a lot. If you only fly a few times, a card with two or ten complimentary passes might be enough.

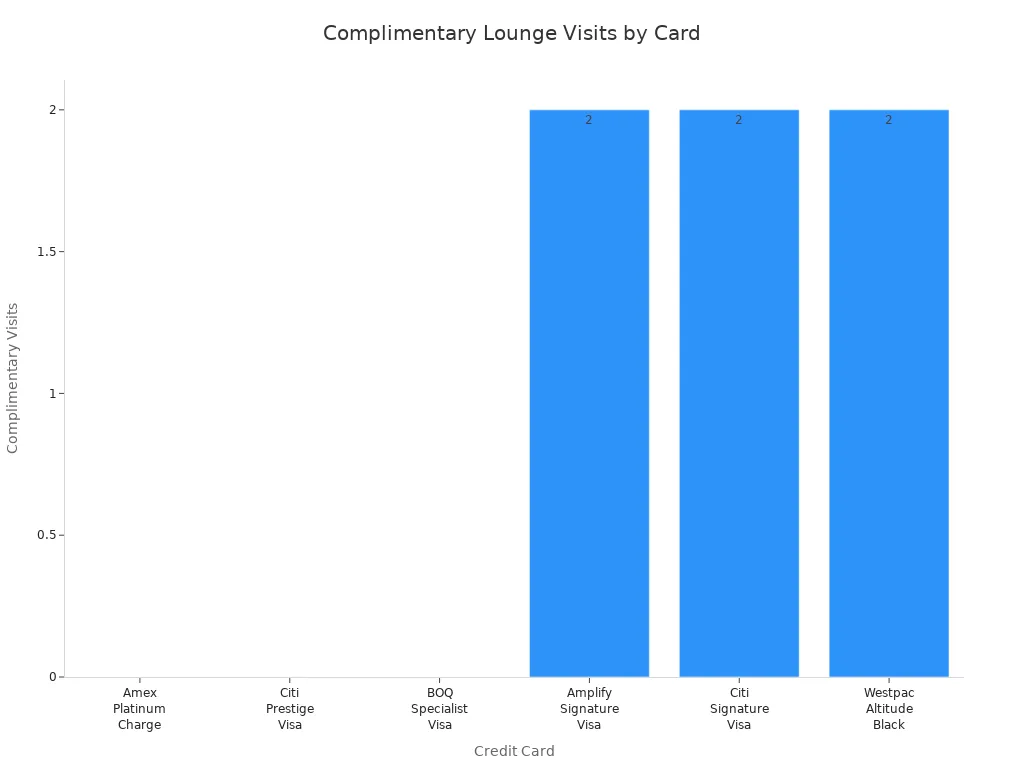

Here’s a chart that shows how many complimentary lounge visits you get with some of the best credit cards:

You can see that American Express Platinum and Citi Prestige offer unlimited lounge entry. Cards like Bankwest More World give you ten passes, which you can use for yourself or share with a bonus guest. Other cards, like ANZ Frequent Flyer Black and Qantas Premier Platinum, give you two complimentary passes each year. These passes are single-entry, so you use one pass each time you enter a lounge.

The best cards also give you bonus rewards on your spending. You can earn points for flights, hotels, and more. Some cards even give you bonus perks like hotel upgrades or travel credits. If you want the best lounge access, look for credit cards with lounge access that match your travel style and give you the most bonus value for your money.

Lounge Access Explained

Image Source: pexels

What Is Airport Lounge Access?

You might wonder what airport lounge access really means. When you have lounge access, you can enter special lounges at the airport. These lounges give you a quiet place to relax, enjoy free food and drinks, use Wi-Fi, and sometimes even take a shower. Many Australian credit cards offer lounge access as a perk. You can get in by showing your eligible card or a digital lounge pass. Some cards give you a set number of passes each year, while others offer unlimited access. Lounge access is worth it if you want to escape the busy airport terminal and enjoy a better travel experience. You can use your lounge pass before your flight, during layovers, or even when you arrive.

Main Lounge Networks

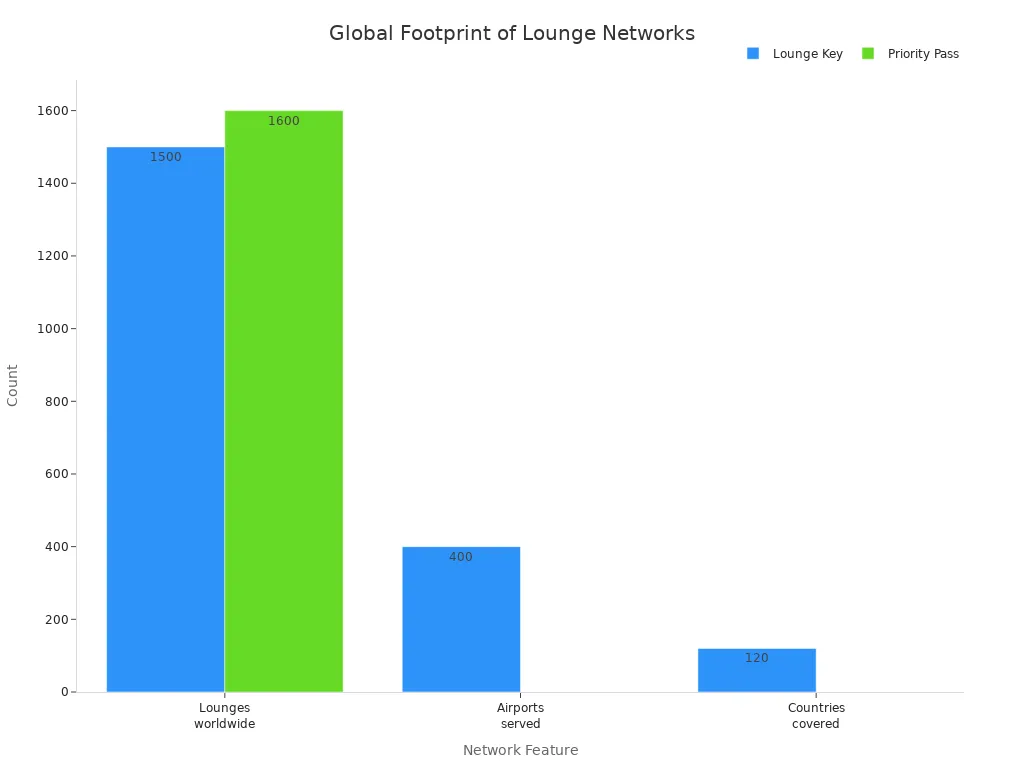

You have several lounge networks to choose from with Australian credit cards. The most popular ones are Priority Pass, Lounge Key, Qantas Club, Virgin Australia Lounge, Star Alliance, Mastercard Travel Pass, and the American Express Global Lounge Collection. Each network has its own rules for access and guest policies. Some networks, like Priority Pass, let you visit over 1,600 lounges worldwide. Others, like Lounge Key, offer about 1,500 lounges in more than 120 countries. The American Express Global Lounge Collection gives you access to over 1,400 lounges, including Centurion Lounges and Escape Lounges.

Here’s a quick table to help you compare two of the biggest networks:

| Feature | Lounge Key | Priority Pass |

|---|---|---|

| Network size | ~1,500 lounges in 400+ airports, 120+ countries | 1,600+ lounges worldwide |

| Access method | Only via eligible credit cards | Via eligible credit cards or direct membership |

| Annual fees | Included with card | $99 - $469 USD depending on plan |

| Per-visit fees | May have limited free visits; fees vary | Fees per visit may apply |

| Services and amenities | Food, drinks, spa discounts, partner offers | Spa, gaming, workspaces, meet & assist |

| Guest policy | Guests allowed with fees | Guests allowed with fees |

You can see that Priority Pass lounges and Lounge Key both have a huge global footprint. With the right card, you can enjoy priority pass experiences almost anywhere you travel.

Why It Matters

Lounge access is worth it for many reasons. If you travel often, you save money on food and drinks at the airport. You also get a comfortable seat, free Wi-Fi, and a quiet place to work or rest. Frequent travelers love unlimited lounge access and the chance to use their lounge pass at different airports. Business travelers use lounges to work, hold meetings, or just relax between flights. Families enjoy lounges because kids often get in free or at a discount, and some lounges have play areas. Occasional travelers can use their lounge pass for a special treat, even if they only fly once or twice a year. Sharing a lounge pass with a guest makes travel easier for everyone. Lounge access is worth it if you want to make every airport visit more enjoyable and stress-free. With so many priority pass experiences and networks, you can always find a lounge that fits your needs.

Card Reviews

Image Source: pexels

American Express Platinum

You want a card that gives you the best lounge access and premium perks. The American Express Platinum card stands out among credit cards with lounge access. You get a strong welcome bonus and a wide range of rewards. Here’s a quick look at the main features:

| Feature | Details |

|---|---|

| Annual Fee | $465 USD (approximate, check current exchange rates) |

| Welcome Offer | Up to 175,000 Membership Rewards points after spending $5,300 USD in the first 6 months |

| Bonus Value | Valued up to $2,350 USD based on points valuation |

When you hold this card, you unlock entry to more than 1,400 airport lounges worldwide. You get unlimited complimentary entry to Priority Pass lounges, Centurion Lounges, Plaza Premium, and more. You also receive 10 complimentary Delta Sky Club visits per year. Guest policies vary, but you can often bring one guest for free or pay a small fee for extra guests. After you spend $53,000 USD in a year, you unlock even more guest access.

You enjoy extra perks like Gold elite status with Hilton and Marriott, statement credits for airline fees, and CLEAR+ membership credits. You earn 5x rewards points on flights and hotels booked through Amex Travel. This card is perfect for frequent flyers who want the best lounge access, unlimited entry, and premium travel rewards. If you travel often, you will love the bonus value and the comfort of lounge entry at almost any airport.

Tip: The American Express Platinum card is a top choice for frequent travelers who want unlimited lounge access, premium rewards, and extra perks like hotel status and travel insurance.

Citi Prestige

The Citi Prestige card is another strong option if you want premium lounge access and bonus rewards. You get a welcome bonus of 50,000 miles after spending $1,400 USD in the first two months. The annual fee is about $400 USD (check the latest exchange rates).

With this card, you receive unlimited complimentary Priority Pass Select membership. This gives you entry to over 1,300 lounges worldwide. You can bring two guests or your immediate family for free. If you bring more than two guests, you pay a fee of $27 per person. Starting July 2025, you will have a cap of 12 complimentary lounge visits per year, including guests. Each entry counts toward your annual limit.

You also get bonus rewards on travel and dining, plus travel insurance and hotel credits. The Citi Prestige card works best for frequent flyers who want easy lounge entry and strong rewards. If you travel with family or friends, the guest policy gives you flexibility. The unlimited entry (until the new cap starts) makes it a great choice for those who fly often.

ANZ Frequent Flyer Black

If you want a card that focuses on Qantas lounge access and flyer rewards, the ANZ Frequent Flyer Black card is a solid pick. You pay an annual fee of $280 USD. The welcome offer changes, but you often see bonus Qantas Points for new cardholders.

You get two complimentary Qantas Club lounge invitations each year. These passes give you entry to more than 30 Qantas lounges in Australia and over 600 partner lounges worldwide. You can use one pass for yourself and the other for a guest, or save both for two trips. The card also gives you uncapped Qantas Points earning, travel insurance, and a 24/7 concierge.

This card is best for occasional flyers who want a taste of lounge access and bonus rewards without a high annual fee. If you only travel a few times a year, the complimentary passes and flyer perks make this card a good value.

Qantas Premier Platinum

The Qantas Premier Platinum card is designed for Qantas flyers who want bonus points and lounge access. Here’s a summary of the main features:

| Feature | Details |

|---|---|

| Welcome Offer | Up to 90,000 bonus Qantas Points: 50,000 after spending $3,300 USD in 3 months, plus 40,000 more if you have not earned Qantas Points on a credit card in the last 12–24 months |

| Annual Fee | $215 USD for the first year, then $245 USD ongoing |

You receive two complimentary Qantas Club lounge passes each year. These passes give you entry to Qantas Club, Qantas Domestic Business, and Qantas International Business lounges. You can bring one guest with you, as long as they travel on the same flight. You also get access to over 600 partner lounges, including oneworld and Emirates lounges, when flying on eligible flights.

The Qantas Premier Platinum card is a great fit for Qantas loyalists and occasional flyers. You get bonus points, travel insurance, and lounge entry for yourself and a guest. The annual fee is lower than most premium credit cards, making it a good value for the perks you receive.

HSBC Star Alliance Gold

The HSBC Star Alliance Gold card is unique among credit cards. You pay no annual fee for the first year, then $295 USD after that. When you spend $2,600 USD in the first 90 days, you fast-track to Star Alliance Gold status. This gives you lounge access across all Star Alliance member airlines.

You can choose your preferred frequent flyer program, such as Air Canada Aeroplan, Singapore Airlines KrisFlyer, or United MileagePlus. Lounge entry includes you and a guest, depending on the program rules. You also get priority check-in, baggage handling, and bonus points that you can transfer to seven different frequent flyer programs.

This card is perfect for frequent flyers who want flexibility and global lounge access. You also get 0% interest for six months on airfares booked with Star Alliance airlines, plus travel insurance and other perks. If you want the best lounge access with a focus on Star Alliance, this card is a top pick.

Bankwest More World

The Bankwest More World Mastercard gives you a balance of lounge access and bonus rewards. The annual fee is $180 USD. You receive 10 complimentary lounge visits each year through the Mastercard Travel Pass program. These visits give you entry to over 1,300 airport lounges worldwide.

You can use your 10 complimentary visits for yourself or share them with guests. For example, you could bring two guests five times each, or use all 10 for yourself. You must register your card and generate a QR code before each lounge entry. After you use your 10 complimentary visits, you pay a fee for extra entry.

You also earn bonus points on your spending and get travel insurance. The Bankwest More World card is a smart choice for occasional flyers or families who want flexible lounge access and rewards without a high annual fee. The guest policy makes it easy to share the experience.

CommBank Mastercard Travel Pass

The CommBank Mastercard Travel Pass card is a practical option for travelers who want lounge access and strong travel insurance. The annual fee is $120 USD. You get two complimentary lounge visits each year through the Mastercard Airport Experience program. This gives you entry to over 1,300 lounges worldwide.

You can use your complimentary visits for yourself or for guests. The card also comes with international travel insurance, which covers you, your spouse, and your children on trips from Australia. You must spend at least $330 USD on travel and activate the insurance before you go. Coverage includes travel delays, lost luggage, and rental vehicle excess.

You also get access to Priceless.com offers for discounts and experiences around the world. The CommBank Mastercard Travel Pass card is best for occasional flyers who want basic lounge entry, bonus rewards, and strong travel perks at a low annual fee.

Note: Always check the latest exchange rates and card terms before you apply. Lounge access, entry rules, and bonus offers can change.

Choosing the Best Card

Matching Lounge Access to Travel Habits

Finding the best credit card for lounge access starts with looking at your travel habits. Do you fly often or just a few times a year? Your answer helps you decide if you need unlimited lounge access or just a couple of passes. Here are some things you should think about:

- Your frequent flyer status can change which lounges you can enter. For example, Oneworld Emerald or Sapphire status gives you more lounge benefits.

- The class of your ticket matters. Business or first-class tickets often come with extra lounge access.

- Some lounges have special rules. You might need a certain status or ticket type to get in.

- Premium lounges and priority services depend on your status level.

You should also look at your spending patterns and what you want from your card. If you love earning points or miles, check the rewards program. If you want cash back, see if the card offers it. Matching these features to your travel style helps you get the most out of your lounge access.

Guest Policies and Family Access

Guest policies can make a big difference, especially if you travel with family or friends. Some cards let you bring a guest for free, while others charge a fee. A few cards even let you use your passes for guests. If you travel with kids, check if the lounge allows children and if there are any age limits. You want a card that fits your group’s needs, so everyone can enjoy the airport lounge together.

Weighing Fees and Benefits

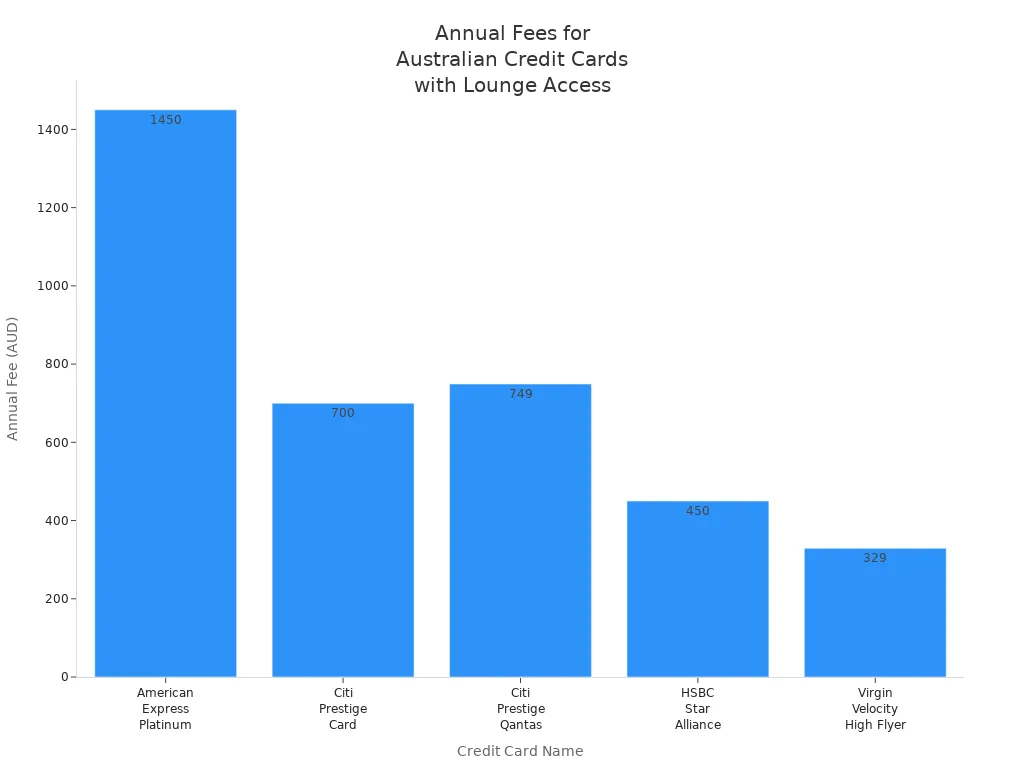

Annual fees for cards with lounge access can be high, but the value can make up for it. Take a look at this table to compare some popular cards:

| Credit Card Name | Annual Fee (USD) | Lounge Access Details | Included Benefits and Value Considerations |

|---|---|---|---|

| American Express Platinum | $1,150 | Unlimited access to 1,400+ lounges worldwide | Premium lounges, high fee, lots of perks |

| Citi Prestige | $900+ | Unlimited access to 1,200+ Priority Pass lounges | Guest access, travel insurance, hotel credits |

| HSBC Star Alliance Gold | $330 (1st yr free) | Unlimited Star Alliance lounges | Lower fee, global access, bonus points |

| Virgin Velocity High Flyer | $220 | Two lounge passes per year | Passes valued at $130, fee partly offset by perks |

Credit cards with lounge access usually cost more than standard cards. The average annual fee is about $437, while regular cards average $135. If you use the lounges, travel insurance, and rewards points, you can get good value. Some cards even waive the fee for the first year or if you spend enough.

When you compare cards, look at more than just lounge access. Check for travel insurance, no foreign transaction fees, and strong rewards programs. Some cards, like the Qantas American Express Ultimate or ANZ Frequent Flyer Black, offer a mix of lounge access, insurance, and points. Picking the right card means you get the most value every time you visit an airport lounge.

You have many great choices for lounge access in Australia. Some cards give you unlimited visits and guest perks, while others keep fees low and offer a few passes each year. Think about how often you travel, who comes with you, and what rewards matter most.

Always check the latest terms, guest rules, and eligibility before you apply.

For current offers and application links, sites like The Points Guy keep you updated. Compare your options, read the fine print, and pick the card that fits your travel style and budget best.

FAQ

What is airport lounge access and why does it matter?

Airport lounge access lets you enter special lounges at the airport. You get perks like snacks, Wi-Fi, and comfy seats. If you travel often, lounge entry makes your trip smoother. Even if you fly just once, lounge benefits can make waiting much better.

Are lounge access credit cards worth it for occasional travelers?

Yes, lounge access credit cards can be worth it even if you do not travel a lot. You get complimentary lounge passes, bonus rewards, and sometimes travel insurance. The best cards give you lounge entry for you and a guest, so you enjoy every airport visit.

How do guest policies work with lounge access?

Guest policies depend on the card. Some best credit cards let you bring a guest for free. Others use your complimentary visits for guests. Always check the rules before you travel. If you fly with family, look for lounge access credit cards with flexible guest perks.

What is the difference between Priority Pass lounges and other lounge networks?

Priority Pass lounges are part of a global network. You can use your lounge pass at over 1,600 locations. Other networks, like Qantas Club or Star Alliance, have their own lounges. The best lounge access cards may offer entry to several networks for more options.

How do I choose the best credit card for lounge access?

Think about how often you travel, which airports you use, and if you want to bring guests. Compare annual fees, bonus rewards, and lounge benefits. The best credit cards for lounge access match your travel style and give you the most value for your visits.

Many premium credit cards in Australia offer lounge access but also come with high annual fees and hidden foreign transaction costs. If your goal is seamless international spending or transfers, BiyaPay provides a more flexible alternative. With BiyaPay, you can send money to most countries and regions worldwide, enjoy remittance fees as low as 0.5%, and convert freely between multiple fiat and digital currencies—all without the overhead of a luxury card.

Unlike credit cards that only reward frequent flyers, BiyaPay gives every user fast and secure access to funds, including same-day arrival service. Check our real-time exchange rate tool before each transfer to avoid hidden costs. Start today with BiyaPay and take control of your cross-border payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.