- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is Wise Safe for Large Transfers and Everyday Use

Image Source: pexels

You might wonder, is wise safe? When you send money or use Wise for everyday payments, safety matters most. Wise follows strict rules set by regulators like the Financial Conduct Authority and the National Bank of Belgium. You can see some of Wise’s main protections below:

| Aspect | Details |

|---|---|

| Main Regulatory Bodies | FCA (UK), NBB (Europe), FinCEN, CFPB, OCC (US partner bank) |

| Fund Protection | Money held with top banks, always separate from Wise’s own funds |

| FDIC Insurance | Not by default; available if you opt-in with a program bank |

Is wise safe? For large transfers or daily use, Wise uses two-factor authentication and anti-fraud checks. When you send money, you want to trust the process. Is wise safe? Wise’s strong controls help protect you when sending money or when you need to send money for daily needs.

Key Takeaways

- Wise follows strict global regulations and keeps your money separate from its own funds to protect your transfers.

- Strong security features like two-step verification, encryption, and fraud monitoring keep your account and money safe.

- Wise supports large transfers up to $1,000,000 with strict verification to prevent fraud and comply with laws.

- You can use Wise daily with a Multi-Currency Card for easy spending and fast international payments.

- Always double-check recipient details, stay alert for scams, and prepare your documents to ensure smooth and safe transfers.

Is Wise Safe?

Wise’s Safety Credentials

You want to know, is wise safe? Wise takes many steps to protect your money and information. The company follows strict rules from regulators in the United Kingdom, Europe, the United States, and other regions. Wise has a dedicated compliance team that works to stop financial crime and keep your transfers secure. This team uses advanced tools, including machine learning, to spot suspicious activity and prevent fraud. If they see something unusual, they may freeze an account to investigate, but your money stays protected during this process.

Wise also works closely with local regulators and banking partners. The company builds strong compliance systems to meet the rules in each country. Wise focuses on verifying your identity, fighting money laundering, stopping fraud, and managing risks in real time. In fact, about one-third of Wise’s global workforce works on fighting financial crime and making sure the platform follows over 65 regulatory licenses worldwide.

Wise’s safety credentials include several independent audits and certifications. These show that Wise takes your security seriously:

- Wise is audited by independent IT and finance experts.

- The company holds SOC 1 type 2 and SOC 2 type 2 certifications.

- Wise has PCI DSS certification, which protects payment card data.

- Wise holds ISO 27001 certification for information security.

- The company follows GDPR rules to protect your personal data.

- Wise runs regular security scans, tests, and audits to keep your data and money safe.

Wise faced some challenges in the past. For example, the National Bank of Belgium found that Wise needed to improve its anti-money laundering controls. Wise responded by creating a plan to fix these issues, contacting affected customers, and freezing accounts if needed. The company worked closely with regulators to improve its systems and make the platform safer for everyone.

User Trust and Reputation

You might still ask, is wise safe? Many people trust Wise for their money transfer needs. Wise serves over 16 million customers worldwide. The company has earned a strong reputation for safety and reliability in the money transfer service industry.

Let’s look at how users rate Wise compared to other services:

| Service | Trustpilot Rating | Number of Reviews |

|---|---|---|

| Wise | 4.2 / 5 | 196,462 |

| Ria Money Transfer | 4.4 / 5 | 13,000+ |

Wise holds a 4.3 out of 5 rating on Trustpilot, based on over 203,000 reviews. Most users rate Wise as “Excellent,” with more than 155,400 five-star ratings. This high score shows that many people feel confident using Wise for both large and everyday transfers.

However, some users have concerns. Common complaints include scams, delays, and customer service issues. Wise warns you about scams like investment scams, job scams, and impersonation scams. The company gives clear instructions on what they will never ask you to do, such as paying deposits to unfreeze money or downloading software for payments. Wise encourages you to stay alert and get a second opinion if something feels wrong.

Other complaints involve delays in getting money back, slow replacement of debit cards, and problems when accounts are closed. Some users feel frustrated by security checks and verification steps, even though these are important for keeping your money safe. Wise tries to balance strong security with a smooth experience, but sometimes these checks can cause inconvenience.

Note: Wise takes user feedback seriously and works to improve its services. The company continues to update its systems and customer support to address these concerns.

Overall, Wise’s strong safety credentials, independent certifications, and high user ratings show that you can trust the platform for your money transfer needs. Still, you should always stay alert and follow Wise’s safety tips to protect yourself from scams.

Regulation & Protection

Regulatory Authorities

When you use Wise for a money transfer, you want to know that strong rules protect your funds. Wise operates under strict regulation in every major market. The company holds licenses from top financial authorities. Here is a table showing who supervises Wise in different regions:

| Market | Regulatory Authority / License Holder | License / Registration Details |

|---|---|---|

| United Kingdom | UK Financial Conduct Authority (FCA) | Wise Payments Limited authorized as Electronic Money Institution (EMI), Reg. No. 900507; Wise Assets Limited authorized for investment activities, Reg. No. 839689 |

| United States | Financial Crimes Enforcement Network (FinCEN) | Wise US Inc. registered and licensed as money transmitter in multiple states; supervised by state regulatory authorities; partner bank Community Federal Savings Bank supervised by Office of the Comptroller of Currency |

| Australia | Australian Securities and Investments Commission (ASIC) and Australian Prudential Regulation Authority (APRA) | Wise Australia Pty Ltd holds Australian Financial Services Licence (AFSL 513764) and ADI license (PPF licence); Wise Australia Investments Pty Ltd holds AFSL 545411; both are reporting entities with AUSTRAC |

| European Economic Area | National Bank of Belgium | Wise Europe SA authorized as Payment Institution with passporting rights across the EEA, registered in Belgium (Reg. No. 0713629988) |

These authorities check that Wise follows the law and keeps your money transfer safe. Wise must meet high standards for every transfer you make.

Fund Segregation

Wise protects your money by keeping it separate from company funds. This practice is called fund segregation. Here is how Wise does this for every money transfer:

- Wise holds your money in special accounts at leading banks, such as JPMorgan Chase Bank, N.A.

- The company invests some funds in low-risk assets like money market funds managed by BlackRock and State Street.

- Wise never mixes your money with its own. This means if Wise faces financial trouble, your money stays safe.

- Wise does not lend out your money. Your funds remain available for transfer at any time.

- Daily checks and records help Wise track every customer’s money.

- Regulators like the FCA and the National Bank of Belgium watch over these practices.

- External auditors, such as PwC, review Wise’s fund segregation each year.

- In some regions, you get extra protection from compensation schemes. For example, the UK Financial Services Compensation Scheme covers up to $108,000 (using current exchange rates), and the Estonian Guarantee Fund covers up to $21,600.

If Wise ever becomes insolvent, your money transfer should remain protected. Wise’s careful fund segregation means your money is not used to pay company debts.

FDIC Insurance Status

Wise is not a bank, so it does not offer FDIC insurance by default. In the United States, FDIC insurance protects deposits up to $250,000 per person at insured banks. If you use Wise’s interest feature, your USD balance goes into an account at an FDIC-insured partner bank. This gives you FDIC protection up to the limit. If you do not use this feature, your funds with Wise are not covered by FDIC insurance.

Wise still keeps your money safe by holding it in secure partner banks and investing in low-risk assets. In regions without FDIC insurance, Wise uses strong banks and safe investments to protect your funds. Wise’s approach means your money transfer remains secure, even if deposit insurance does not apply.

Security Features

Image Source: unsplash

Encryption & Data Security

When you use Wise for a money transfer, your information stays protected by strong encryption. Wise uses SSL/TLS protocols to keep your data safe as it moves between your device and their servers. This secure tunnel uses AES encryption with a key length of 128-bit or higher. Your username and password are encrypted during login, and session ID cookies help identify you while you stay logged in. All communication between you and Wise remains encrypted at every step. These security measures match what top financial technology companies use to protect sensitive data. Wise also limits employee access to your information based on job roles, which helps prevent unauthorized access.

- Wise uses SSL/TLS protocols for all data in transit.

- AES encryption with 128-bit or higher key length protects your information.

- Usernames, passwords, and session cookies are always encrypted.

- Employee access is restricted by job role.

Two-Step Verification

Wise adds another layer of protection with two-step verification. This feature helps keep your account safe, especially when you send a money transfer or manage your balance. You enter your password and then confirm your identity with a code sent to your phone or email. This process makes it much harder for anyone else to access your account, even if they know your password. Wise enforces two-factor authentication for all users, which matches industry best practices for secure transfers.

Tip: Always enable two-step verification on your Wise account. This step gives you extra security for every transfer.

Fraud Prevention

Wise works hard to stop fraud and keep your money safe. The company uses automated systems to check every money transfer for signs of risk. Wise verifies your identity and uses machine learning to spot suspicious activity. If Wise finds something unusual, it may block or reject the transfer to protect you. Over 1,000 anti-fraud specialists work around the clock, running about 7 million checks each day. Wise also uses biometrics, real-time notifications, and instant card freezing to help you control your account. The company shares data with law enforcement and fraud prevention agencies when needed, always following strict legal rules. You can ask for a manual review if Wise blocks a transfer or account.

- Wise uses machine learning and AI to monitor transfers.

- Over 1,000 specialists work 24/7 to prevent fraud.

- Real-time alerts and instant card freezing help you react quickly.

- Wise follows global regulations and works with law enforcement to stop fraud.

With these security features, Wise helps you make secure transfers and protects your money transfer every step of the way.

Wise Money Transfer Safety

Image Source: unsplash

Large Transfer Limits

When you use Wise for a money transfer, you can send large amounts, but Wise sets certain limits to keep your funds secure. Wise allows you to transfer up to $1,000,000 USD per transaction in many countries. If you need to send money above this amount, you may need to split your transfer or contact Wise support for help. These limits help Wise manage risk and follow financial regulations. For international money transfers, Wise uses different payment methods, such as bank transfers and wire transfers, to move your money quickly and safely. You can use CHAPS payments for same-day large transfers or Faster Payments for smaller amounts. Wise’s money transfer service supports both personal and business users who need to transfer money internationally or handle large payments.

Verification & Risk Controls

Wise uses strict verification steps to protect you when sending money, especially for large transfers. You must upload a government-issued ID, such as a passport or driver’s license, and proof of address, like a recent bank statement. Wise reviews these documents, usually within one or two business days. Only verified accounts can send large money transfers and access all Wise features. For very large transfers, Wise may ask for extra documents, such as proof of the source of funds, shareholder lists, or invoices. These checks help Wise follow anti-money laundering rules and reduce the risk of fraud. Sometimes, Wise may freeze your account during verification, which can take over two weeks. Even though this can feel inconvenient, these steps protect you and make sure your money transfer is safe.

Wise also monitors every transfer for suspicious activity. In the past, Wise had some weaknesses in its risk controls, such as slow alert escalation and weak monitoring. Wise now works to improve these controls by using better transaction monitoring and stronger compliance checks. These improvements help Wise spot and stop risky money transfers before they happen.

Best Practices

You can take steps to make your money transfer even safer. Here are some best practices:

- Always verify your identity before you send money to avoid delays.

- Double-check all recipient bank details, including account number and SWIFT/BIC code.

- Use regulated money transfer services like Wise that offer two-factor authentication and data encryption.

- Never rush when sending money or transfer money internationally to unknown parties.

- Prepare all needed documents, such as photo ID and proof of address, before starting your transfer.

- For large international money transfers, use support teams and choose the right payment method, such as CHAPS for same-day transfers.

alert for scams and never send money if something feels wrong.

Note: Following these best practices helps you protect your money and ensures your international money transfers go smoothly. Wise gives you tools and support to make safe and secure transfers, whether you are sending money for business or personal reasons, or moving money overseas.

Everyday Use with Wise

Daily Transactions

You can use Wise for daily spending, shopping, and paying bills. Wise gives you a Multi-Currency Card that works in many countries. When you use this card, you pay in local currency at the real exchange rate. You can make a money transfer or pay for goods and services without hidden fees. Wise sends instant notifications for every transaction, so you always know when you spend or receive money. If you need to send money to friends or family, you can do it quickly through the Wise app. Wise supports international money transfers, making it easy to pay for things abroad or while traveling. You can also use Wise for sending money to pay for subscriptions or online purchases.

Account Limitations

Wise sets some limits to help keep your account safe. These limits affect how much you can spend, withdraw, or transfer each day or month. Here are some common account limitations you might face:

- Wise cards have spending and withdrawal limits that depend on your country and the type of transaction.

- Limits include single transaction caps, daily limits, and monthly limits. For example, US cardholders have different limits for ATM withdrawals, online purchases, and chip payments.

- Limits reset daily at midnight and monthly on the first day of each month.

- You cannot deposit cash into your Wise account. You must add money online using a bank transfer, debit card, or other supported methods.

- ATM withdrawals have monthly caps. If you reach your limit, you must wait until the next period to withdraw more.

- Wise charges fees for currency conversions, money transfer, and sending money.

- Sometimes, Wise may freeze your account if it detects suspicious activity. This can interrupt your ability to send money or use your card until Wise completes a review.

You can check your current limits in the Cards tab on the Wise app or website. If you move to a new country, Wise updates your card limits automatically.

Holding Balances

Wise lets you hold balances in multiple currencies. Your money stays safe because Wise keeps your funds in top-tier banks and secure assets, separate from its own money. Wise does not offer FDIC insurance, but it safeguards your funds by keeping them apart from company accounts. If someone uses your Wise balance without permission, Wise may compensate you for damages if you report the issue within 30 days and help with the investigation. You must not have caused the problem by breaking Wise’s rules or being careless. Wise reviews each case and pays compensation in your Wise balance or cash if you qualify. You can protect your balance by freezing or blocking your card in the app and by reporting any unauthorized use right away. Wise’s approach helps you feel confident when using your balance for money transfer, sending money, or international money transfers.

User Experiences

Positive Feedback

Many users trust wise for sending money and making payments. You can find thousands of positive reviews online. People often praise the platform for its clear fees, fast transfers, and easy-to-use app. Wise gives you real-time notifications for every transaction, which helps you track your money. Customers also like the ability to hold and convert balances in different currencies. Wise’s focus on transparency and security makes many users feel confident when moving large amounts or handling daily spending.

Complaints & Issues

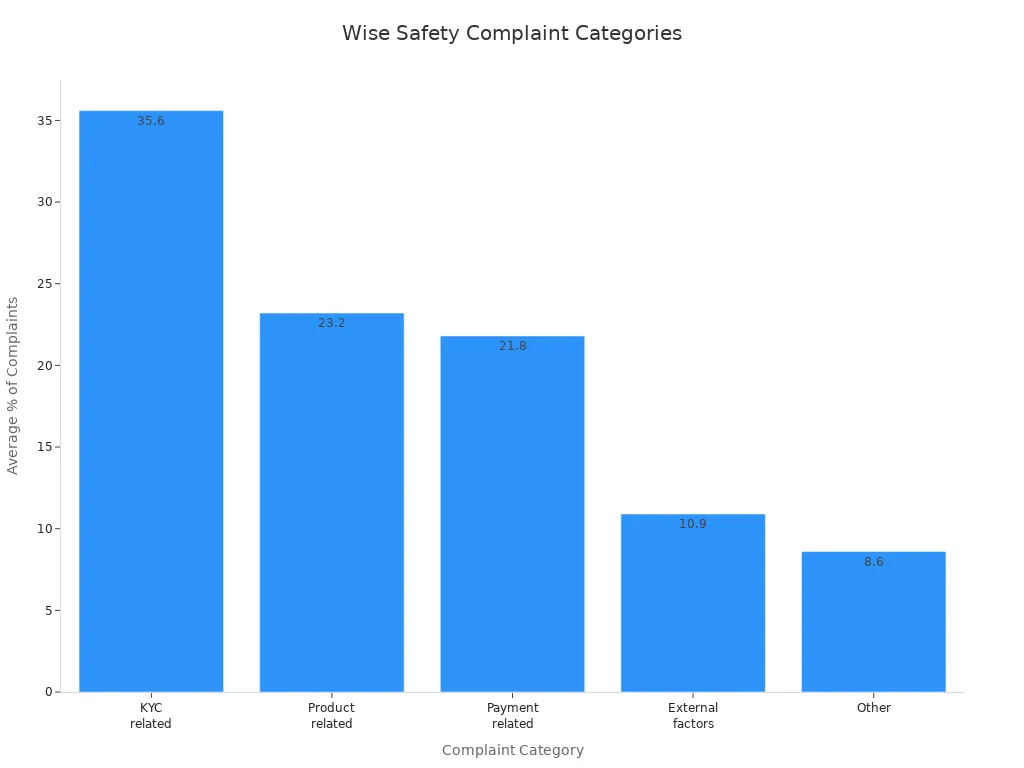

Some users report problems when using wise, especially with account verification and payment delays. The most common complaints relate to KYC (Know Your Customer) checks, which make up about 35.6% of all issues. Other complaints involve product features, payment processing, and problems caused by partner banks.

| Complaint Category | Quarter Average % |

|---|---|

| KYC related | 35.6% |

| Product related | 23.2% |

| Payment related | 21.8% |

| External factors | 10.9% |

| Other | 8.6% |

Wise explains that these checks are required by law to keep your money safe. Sometimes, you may experience delays or account freezes during these checks. Wise works to improve these processes and updates you during any delay. If you have a complaint, you can contact their support team. Wise aims to resolve most issues quickly and fairly.

Customer Support

Wise encourages you to reach out to their support team if you face any problems. The company has a clear policy to protect both customers and staff. Wise does not allow abusive or threatening behavior toward its staff. If you do not get a final response within 15 working days, you can escalate your complaint. Wise guides you through the process and, if needed, helps you contact an independent dispute body. This approach helps ensure your concerns are handled with care and transparency.

Wise vs. Banks & Alternatives

Safety Comparison

When you compare Wise with banks and other money transfer options, you see some clear differences in safety and service. Wise operates under strict rules from global regulators, including the FCA in the UK and FinCEN in the US. You get strong protection because Wise keeps your money in separate accounts at top banks. This means your funds stay safe even if Wise faces problems.

You also benefit from security features like two-step verification, real-time alerts, and 3D Secure for card payments. These tools help stop unauthorized access and keep your money transfer safe. Wise uses advanced technology to monitor every transfer and follows international standards such as PCI DSS and ISO 27001.

Here is how Wise compares to banks and other services:

| Feature | Wise | Hong Kong Banks | Other Transfer Services |

|---|---|---|---|

| Regulatory Oversight | FCA, FinCEN, NBB, ASIC | HKMA, SFC | Varies |

| Fund Segregation | Yes | Yes | Sometimes |

| Two-Step Verification | Yes | Sometimes | Varies |

| Transparent Pricing | Yes | No | Sometimes |

| Speed of International Money Transfers | Fast | Slower | Varies |

| International Currency Exchange | Real rate | Markup | Markup or real rate |

| Customer Service | Digital only | In-person and digital | Varies |

Wise stands out for its transparent pricing and fast international money transfers. You avoid hidden fees and get the real exchange rate. However, Wise does not offer credit, interest-bearing accounts, or in-person service. Banks like those in Hong Kong may provide more services, but often charge higher fees and take longer for international currency exchange.

Note: Wise is safer than some alternatives because of its strong licenses, fund protection, and security features. Still, you may face delays if your money transfer triggers compliance checks.

When to Use Wise

You should use Wise when you need to send money across borders quickly and at a low cost. Wise works best for people who want efficient international money transfers, transparent pricing, and easy online access. If you are a traveler, remote worker, or small business owner moving money overseas, Wise gives you a simple way to manage different currencies.

Wise is a good choice if you value:

- Fast and secure money transfer for international payments.

- Low fees and real exchange rates for international currency exchange.

- Easy-to-use app and website for tracking your transfers.

- Strong security with two-factor authentication and real-time alerts.

You may want to choose a bank or another service if you need:

- Credit products or loans.

- Interest-bearing accounts.

- In-person customer support.

- Immediate help with compliance holds or account issues.

Wise is not a full-service bank. You cannot get all banking services, and some features depend on your region. For most people who want to save money and time on international money transfers, Wise offers a safe and reliable solution.

You can trust this service for both large transfers and everyday payments when you follow safe practices. Wise uses strong security, clear fees, and strict rules from global regulators. To protect your money, always double-check recipient details, use secure internet connections, and watch for scams.

- Check for urgent or suspicious requests before sending funds.

- Monitor your account for unusual activity.

- Confirm transfer details with the recipient’s bank if needed.

Choose this platform for fast, low-cost international transfers, but review your needs and risk tolerance before each transaction.

FAQ

How safe is Wise for sending large amounts?

You can trust Wise for large transfers. Wise uses strong security, follows strict rules, and keeps your money in separate accounts. Regulators in the United Kingdom, Europe, and the United States oversee Wise’s operations.

Does Wise offer FDIC insurance for my balance?

Wise does not offer FDIC insurance by default. If you use the Wise interest feature, your USD balance goes into an FDIC-insured partner bank. You get protection up to $250,000 per person.

What should I do if Wise freezes my account?

You should contact Wise support right away. Wise may freeze accounts for security checks or to follow regulations. Prepare your ID and any documents they request. Wise will guide you through the next steps.

Can I use Wise for everyday spending?

Yes, you can use Wise for daily payments, shopping, and bills. Wise gives you a Multi-Currency Card. You pay in local currency at the real exchange rate. Wise sends instant notifications for every transaction.

How does Wise protect against fraud?

Wise uses two-step verification, real-time alerts, and machine learning to spot fraud. Over 1,000 specialists check transfers every day. Wise blocks suspicious activity and works with law enforcement when needed.

Wise can be a helpful tool for everyday spending, but when you need to move larger amounts internationally, safety and cost-efficiency matter even more. That’s where BiyaPay gives you the advantage.

With remittance fees as low as 0.5%, BiyaPay helps you transfer money securely across most countries and regions worldwide. You’ll also benefit from real-time exchange rate monitoring, so you always know exactly what you pay. Unlike many services, BiyaPay supports multi-currency conversions between fiat and digital assets, offers same-day settlement, and makes registration quick and simple.

Whether you’re sending funds to family abroad or managing international business payments, BiyaPay keeps your money moving safely and affordably. Start today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.