- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Step-by-Step Guide to Sending Money from Zelle to PayPal

Image Source: unsplash

If you want to send money from Zelle to PayPal, you might wonder if it works with just a few taps. You cannot send money directly between Zelle and PayPal since these two apps do not connect to each other. Most people in the United States use PayPal for money transfers, with about 85% choosing it over other options. Zelle is also popular and connects with many banks, but you still need to use a bank account as a bridge. You will move your funds from Zelle to your bank account, then add them to PayPal. This way, you can send money safely and easily.

Key Takeaways

- You cannot send money directly from Zelle to PayPal because they do not connect. You must use your bank account as a middle step.

- Link the same U.S. bank account to both Zelle and PayPal to move money safely between them.

- Send money with Zelle to your bank account first, then add those funds to your PayPal balance through your linked bank.

- Zelle transfers money almost instantly with no fees, while PayPal takes 3 to 5 business days for standard transfers and may charge fees for instant transfers.

- Always protect your accounts by using strong passwords, two-factor authentication, and avoiding third-party apps that promise shortcuts.

Can You Send Money from Zelle to PayPal?

Image Source: pexels

You might wonder if you can send money directly from Zelle to PayPal. The answer is no. These two platforms do not connect, so you cannot directly send money between them. Zelle and PayPal work in different ways, and each has its own rules for moving money. Let’s break down why this happens and what limits you need to know.

Direct Transfer Limits

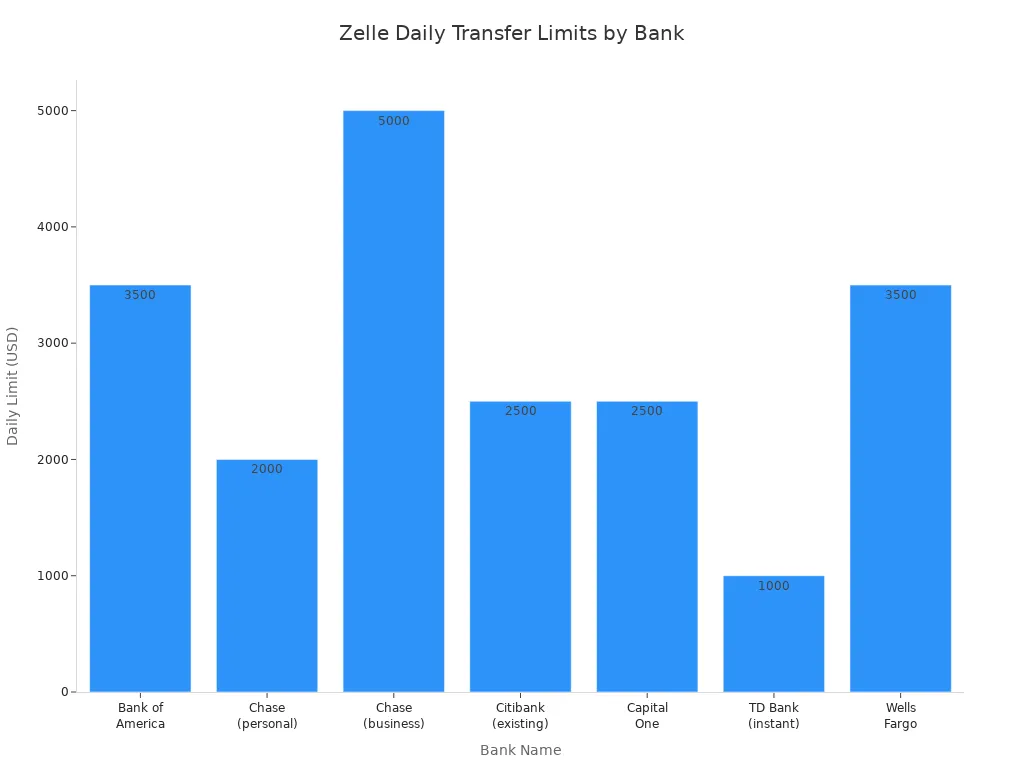

Zelle and PayPal both set limits on how much money you can send. These limits help keep your transactions safe and follow banking rules. Zelle’s limits depend on your bank. Some banks let you send up to $3,500 per day, while others set lower amounts. If you use Zelle without a bank partner, you can only send up to $500 per week. PayPal, on the other hand, lets you send up to $60,000 per transaction if your account is verified.

Here’s a table that shows some Zelle daily and monthly limits at different banks, along with PayPal’s maximum:

| Bank Name | Zelle Daily Transfer Limit (USD) | Zelle Monthly Transfer Limit (USD) |

|---|---|---|

| Bank of America | 3,500 | 20,000 |

| Capital One | 3,000 | Not disclosed |

| Chase | 500 - 10,000 per transaction | Not disclosed |

| Citibank | 2,500 (for accounts >30 days) | 15,000 (for accounts >30 days) |

| Discover Bank | 600 | Not disclosed |

| Quontic Bank | 500 per transaction, 1,000 daily | Not disclosed |

| TD Bank | 1,000 (instant), 2,500 (scheduled) | 5,000 (instant), 10,000 (scheduled) |

| Truist Bank | 2,000 | 10,000 |

| USAA Federal Savings | 1,000 | 10,000 |

| Wells Fargo | 3,500 | 20,000 |

| PayPal | Up to 60,000 per transaction |

Zelle checks your transfer amount every time you try to send money. If you go over your limit, Zelle will tell you how much you can send. You cannot ask Zelle to raise your limit. PayPal also has its own checks, but the limit is much higher if your account is verified.

Note: You cannot send money directly from Zelle to PayPal because these two services do not share accounts or balances. Zelle puts money straight into your bank account, while PayPal keeps your funds in your PayPal balance or linked bank account.

Why a Bank Account Is Needed

You need a bank account to move money between Zelle and PayPal. Both platforms require you to link a U.S. bank account before you can send or receive money. Here’s why:

- Zelle sends money straight to your linked bank account. It does not hold a balance for you.

- You must have a U.S. checking or savings account to use Zelle. Some prepaid cards work, but only if they come from a bank in the Zelle network.

- PayPal also needs a U.S. bank account. The name on your bank account must match your PayPal account.

- PayPal does not allow all types of accounts. Online-only or some prepaid accounts may not work.

These rules help keep your money safe and follow U.S. banking laws. Banks use strong security to protect your funds from fraud or theft. When you use a bank account as a bridge, you lower the risk of losing money. Both Zelle and PayPal rely on banks to make sure your transfers are secure and follow the rules.

Tip: Always double-check that your bank account is linked to both Zelle and PayPal. This step makes it easy to send money from Zelle to PayPal by moving funds through your bank.

The main reason you cannot directly send money from Zelle to PayPal is that they are separate companies. Zelle does not hold your money; it just moves it to your bank. PayPal keeps your money in your PayPal account or your bank. Because of these differences, you must use your bank account as the middle step when you want to send money from Zelle to PayPal.

Zelle to PayPal: Step-by-Step

Image Source: unsplash

Moving your money from Zelle to PayPal takes a few steps. You cannot connect your Zelle account and your PayPal account directly, but you can use your bank account as a bridge. Here’s how you can send money from Zelle to PayPal without any confusion.

Link Bank Account to Both Platforms

First, you need to make sure your bank account is linked to both Zelle and PayPal. This step is important because it lets you move money between the two services.

- Open your Zelle app or use your bank’s mobile app to enroll. Enter your U.S. mobile number or email address. Zelle will connect this information to your bank account.

- For PayPal, log in and go to the Wallet section. Add your bank account by entering your account and routing numbers. PayPal will send two small deposits to your bank account. Check your bank statement and enter the exact amounts in PayPal to confirm you own the account.

- If you want, you can try linking your PayPal debit card to Zelle. Some people do this by entering their card details in the Zelle app, but it does not always work.

- Once you finish these steps, you have linked the same bank account to both Zelle and PayPal. Now you are ready to send money between them.

Note: Zelle only works with U.S. bank accounts. PayPal needs your bank account name to match your PayPal account name. This helps keep your money safe.

Receive Zelle Funds in Bank Account

After you link your accounts, you can receive money through Zelle. The process is quick and simple.

- If someone sends you money with Zelle and you already enrolled your email or mobile number, the money will show up in your bank account within minutes.

- If you have not enrolled yet, you will get a payment notification. Follow the link in the message.

- Choose your bank and finish the enrollment using the same email or mobile number the sender used.

- Once you enroll, the money will go straight into your bank account.

Most of the time, you will see the funds almost right away. If you do not see the money after a few minutes, check that you used the correct email or mobile number. Sometimes, if you enroll late, it can take 1 to 3 business days for the money to arrive. If you wait more than three days, double-check your enrollment and contact details.

Tip: Zelle does not hold your money. It always sends funds directly to your bank account. If you do not enroll within 14 days, the money goes back to the sender.

Add Money to PayPal from Bank

Now that your money is in your bank account, you can add it to PayPal. This step lets you finish sending money to PayPal and use your balance for shopping or payments.

- Log in to your PayPal account and go to the Wallet section.

- Click on Transfer money, then choose Add money to your balance.

- Pick your linked bank account as the source.

- Enter the amount you want to move and confirm the transfer.

PayPal will start moving the money from your bank account. Usually, it takes 3 to 5 business days for the funds to show up in your PayPal balance. There are no fees for this service. If you need the money faster, PayPal offers instant transfers for some accounts, but these may have extra fees and lower limits.

Note: PayPal may place a hold on your funds for up to 21 days for security reasons. This is rare, but it can happen if you are new to PayPal or if they need to check the transaction.

You have now completed the process to send money from Zelle to PayPal. Using PayPal with Zelle is safe when you follow these steps. You always use your bank account as the middle step, so you never risk losing your money. This method works for anyone who wants to move funds between these two popular services.

Transfer Times & Fees

Zelle Transfer Speed

When you use Zelle, you usually see your money move almost instantly. Most transfers arrive within minutes. This makes Zelle a great choice if you want an instant transfer. However, sometimes things slow down. Here are a few reasons why your instant transfer might take longer:

- Your bank may need extra time for security checks, especially if it spots something unusual.

- If you send money late at night or on weekends, your bank might wait until the next business day to finish the transfer.

- Some banks have their own rules and may hold large or strange transfers for review.

- Both you and the person you send money to must use the same instant payment service for the fastest results.

- If you try to send more than your daily limit, Zelle may delay or block the transfer.

Note: Zelle does not charge transfer fees for sending or receiving money. Still, check with your bank to make sure it does not add any extra charges.

PayPal Processing Time

After your money lands in your bank account, you can move it to PayPal. If you pick a standard transfer, PayPal usually takes 3 to 5 business days to add the money to your balance. This happens because PayPal uses the ACH system, which is not instant. If you need your money right away, PayPal offers an instant transfer option. You can use a linked Visa or Mastercard debit card for this. The instant transfer finishes in seconds, but you may pay a small fee.

Here’s a quick look at how PayPal compares to other services:

| Service | Transfer Type | Processing Time / Speed |

|---|---|---|

| PayPal | Bank withdrawals | 3-5 days |

| PayPal | Instant transfer | Seconds |

| Venmo | Peer-to-peer payments | Instant |

| Samsung Wallet | Online payments | Fast and secure, swift |

| Western Union | Cash pickup | Minutes |

Tip: If you want your money fast, always choose the instant transfer option. Just remember, instant transfers may come with extra transfer fees.

Possible Fees

You probably want to know about transfer fees. Zelle does not charge you for sending or receiving money. Almost all users pay nothing for Zelle transfers. Still, a few banks might add their own fees, so it’s smart to ask your bank first.

PayPal does not charge you to add money from your bank account or to move money to your bank with a standard transfer. If you use the instant transfer feature, PayPal charges a small fee. This fee is usually a percentage of the amount you send. If you receive money for business, PayPal takes a cut—often around 3.49% plus $0.49 per transaction. Currency conversion also adds a fee, usually between 3.00% and 4.00%. You never pay a monthly fee just to have a PayPal account.

Always check the latest transfer fees before you send money. Fees can change, and knowing them helps you avoid surprises.

Security & Alternatives

Safe Transfer Tips

When you move money between zelle, your bank, and paypal, you want to keep your funds safe. Scams and mistakes can happen fast, so you need to stay alert. Here are some tips to help you protect yourself when using money transfer apps:

- Always use a secure, password-protected network. Avoid public Wi-Fi for banking or transfers. If you must use public Wi-Fi, try a VPN.

- Double-check the recipient’s phone number or email before you send money. Sending to the wrong person is a common mistake, especially with zelle.

- Only send money to people you trust. Treat zelle like cash—once you send it, you usually cannot get it back.

- Set up strong, unique passwords for your accounts. Do not reuse passwords across different money transfer apps.

- Turn on two-factor authentication or use an authentication app for extra security.

- Enable transaction alerts so you know right away if something changes in your account.

- Watch out for phishing scams. Never click on suspicious links or share your login details.

- Keep your apps updated. Updates fix security problems and help keep your money safe.

- If you lose your phone, act fast. Remotely lock it and remove payment access.

If you ever get scammed, contact your bank right away. Change your passwords and secure your accounts as soon as possible.

Third-Party Services Warning

You might see ads for third-party services that promise to move money between zelle and paypal without a bank account. These offers can look tempting, but they often come with big risks. Here’s what you need to know:

- Scammers sometimes pretend to be banks or payment companies. They may ask for your personal or banking information to steal your money.

- Some fraudsters offer fake jobs or products. After you send money, you never get what you paid for.

- If someone sends you money “by accident” and asks you to send it back, do not do it. This is a common scam.

- Many money transfer apps, including paypal and zelle, do not offer the same fraud protection as banks. Once you send money, it is hard to get it back.

- Third-party services may hold your money, delay transfers for days, or even freeze your account. Customer support can be slow or unhelpful.

- These apps are not always federally insured. If something goes wrong, you could lose your funds.

Always use trusted money transfer apps and official bank channels. Never share your verification codes or lend your phone to strangers. If something feels off, contact your bank or the app’s support team right away.

You can move your money from Zelle to PayPal by following three simple steps:

- Link the same bank account to both Zelle and PayPal.

- Use Zelle to send funds to your bank account.

- Add those funds to PayPal using your linked bank account or debit card.

Using a bank account is the safest way. Always check for possible fees and how long each transfer might take. Here’s a quick comparison:

| Service | Speed | Fees (USD) |

|---|---|---|

| Zelle | Minutes | $0 |

| PayPal | 3-5 days | Varies by method |

Stay away from third-party apps that promise shortcuts. If you run into problems, reach out to PayPal’s Help Center or call Zelle support at 1-844-428-8542.

FAQ

Can you send money from Zelle to PayPal without a bank account?

No, you cannot. Both Zelle and PayPal need a linked U.S. bank account. You must use your bank account as a bridge to move money between these two services.

How long does it take to move money from Zelle to PayPal?

Zelle usually sends money to your bank account within minutes. PayPal takes 3 to 5 business days to add money from your bank. If you use instant transfer, PayPal moves funds in seconds but charges a fee.

Are there any fees for transferring money from Zelle to PayPal?

You pay no fees to send or receive money with Zelle. PayPal does not charge for standard transfers from your bank. Instant transfers cost a small fee. Here’s a quick look:

| Service | Standard Fee | Instant Transfer Fee |

|---|---|---|

| Zelle | $0 | Not available |

| PayPal | $0 | Varies (see PayPal) |

Is it safe to use third-party apps to transfer money between Zelle and PayPal?

You should avoid third-party apps for these transfers. Many are risky and may steal your money or information. Always use official apps and your bank for safe transfers.

While moving money between Zelle and PayPal requires a bank as a bridge and can take days, BiyaPay gives you a faster, simpler path. With remittance fees as low as 0.5%, coverage in most countries and regions worldwide, and even real-time exchange rate monitoring, you always know your exact cost.

BiyaPay also supports multi-currency conversions between fiat and digital assets, plus same-day settlement, so your funds arrive without delays.

Why wait 3–5 business days? Start today with BiyaPay and make global transfers seamless.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.