- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stripe vs PayPal Which Payment Platform Fits Your Business Best

Image Source: unsplash

When you compare stripe vs paypal, you will notice that paypal works best for a small business or someone just starting out who wants a simple payment platform. Stripe gives you more custom options and better scaling for a growing enterprise. In the United States, about 64% of small businesses use paypal, while 56% of newly formed Delaware C-Corps choose stripe. You should think about your business size, technical skills, and international needs before you pick a payment processor. The next table makes stripe vs paypal easy to compare.

Key Takeaways

- PayPal is best for small businesses and startups that want a simple, fast setup with no coding skills needed.

- Stripe suits mid-sized and large businesses that need advanced customization, developer tools, and better control over payments.

- Stripe supports more currencies and offers stronger security features, while PayPal reaches more countries and has stronger brand recognition.

- Stripe charges lower fees for in-person payments and has no monthly fees, but requires technical skills; PayPal has higher fees but offers easy setup and more payment options.

- Many businesses use both Stripe and PayPal together to give customers more payment choices and grow their sales.

Stripe vs PayPal Overview

Image Source: pexels

Key Differences

When you compare stripe vs paypal, you will see that each platform fits different business needs. Stripe works best for businesses that want to grow and need more control over their payment system. You can use stripe if you have a team with technical skills or if you want to build a custom checkout experience. Stripe gives you powerful developer tools and lets you change almost every part of your payment process. This makes stripe a top choice for mid-sized and large businesses.

PayPal, on the other hand, is a favorite for small businesses and startups. You can set up paypal quickly, even if you do not have coding skills. PayPal gives you an all-in-one solution that is easy to use. You can start accepting payments in minutes. PayPal also has strong brand recognition, which helps build trust with your customers. If you want a payment processor that is simple and fast, paypal is a great option.

You should also think about where your customers live. Stripe supports over 135 currencies and works in 47 countries. PayPal reaches more than 200 countries and supports 25 currencies. If you want to sell to customers around the world, paypal gives you a wider reach, but stripe offers more currency options.

When you look at stripe pros and cons, you will notice that stripe gives you more control and better security. Stripe uses Stripe.js, which keeps card data off your servers and lowers your PCI compliance burden. Stripe also lets you move your customer data if you ever want to switch payment service providers. For paypal pros and cons, you get easy setup and strong brand trust, but you have less control over the checkout process and cannot export customer card data if you switch platforms.

Note: Many businesses now want faster payments and more choices. Trends show that real-time payments, pay-by-bank, and even stablecoins are becoming popular. Both stripe and paypal keep adding new features to help you meet these needs.

Quick Comparison Table

Here is a table that shows the main differences between stripe and paypal. Use this table to see which payment processor fits your business best.

| Aspect | Stripe | PayPal |

|---|---|---|

| Business Size Suitability | Best for mid to large businesses; strong developer tools and customization | Best for small to medium businesses or startups; easy to set up and use |

| Setup Process | More complex; needs coding skills and developer access | Simple and fast; minimal coding required |

| Customizability | High; many integrations and developer tools (APIs, SDKs) | Limited; mostly all-in-one solution |

| International Reach | 47 countries; 135+ currencies | 200+ countries; 25 currencies |

| Data Portability | Easy migration of credit card data | Cannot export card data |

| Payment Customization | Flexible API and payment pages | Limited; custom domains cost extra |

| API Quality | Clean, well-documented, industry standard | Improved, but less user-friendly historically |

| Security | Stripe.js keeps card data off your servers | Card data passes through your servers |

| Brand Recognition | Less consumer recognition | Very strong brand trust |

| Setup Complexity | Detailed setup, integrated experience | Quick and simple setup |

| Chargeback Fees | $15 per chargeback | $15 or more per chargeback |

| Payout Schedule | 2-day rolling (US/Australia); 7-day elsewhere | Often within 1 business day outside US/Australia |

| Fee Structure | 2.9% + 30¢ per transaction; extra 1% for international cards/currency | 3.49% + 49¢ typical; 1.5% cross-border fee; extra fees for features |

| Recurring Billing Fees | Free | $10/month optional; $30/month for advanced tools |

| Fraud Protection | Included free via Stripe Radar | Basic free; advanced costs $10/month + per transaction |

When you review stripe pros and cons, you see that stripe gives you more flexibility, better security, and lower recurring billing costs. Stripe does require more technical skill to set up. For paypal pros and cons, you get fast setup, strong brand trust, and wide international reach, but you have less control and may pay more for advanced features.

Stripe vs paypal is a common question for business owners. You should think about your business size, your technical resources, and where your customers live. Many startups and established companies now look for payment service providers that offer real-time payments and new options like pay-by-bank. Stripe and paypal both keep up with these trends, but your choice depends on what matters most to you.

Fees and Pricing

Stripe Fees

When you use Stripe for payment processing, you pay clear service fees based on each transaction. Stripe does not charge monthly fees for small or medium-sized businesses. You only pay for what you use. The payment processing rates depend on the type of transaction. For online payments, Stripe charges 2.9% plus $0.30 per transaction. If you accept in-person payments, the rate drops to 2.7% plus $0.05 per transaction. Stripe adds a 1% fee for international cards and another 1% for currency conversion. You can also use ACH direct debits for 0.8% per transaction, capped at $5. Stripe charges $15 for chargebacks. If you use recurring billing or invoicing, Stripe adds a small percentage to each transaction. You do not need to worry about a monthly service fee or hidden costs.

| Fee Type | Fee Description | Fee Amount / Rate |

|---|---|---|

| Online Payments | Standard transaction fee | 2.9% + $0.30 per transaction |

| In-Person Payments | Lower rate for physical transactions | 2.7% + $0.05 per transaction |

| International Cards | Extra fee for international card payments | +1% |

| Currency Conversion | Extra fee for currency conversion | +1% |

| ACH Direct Debits | Bank debits | 0.8% (max $5) |

| ACH Credit Payments | Flat fee | $1 per transaction |

| Wire Transfers | Fee per wire transfer | $8 per transaction |

| Chargebacks | Disputed charges | $15 per dispute |

| Recurring Billing | Subscription payments | 0.5%–0.8% of transaction amount |

| Invoicing | Paid invoice amount | 0.4%–0.5% |

| Monthly Fees | None | None |

Stripe gives you a transparent view of your payment processing fees. You can plan your costs based on your sales volume and service needs.

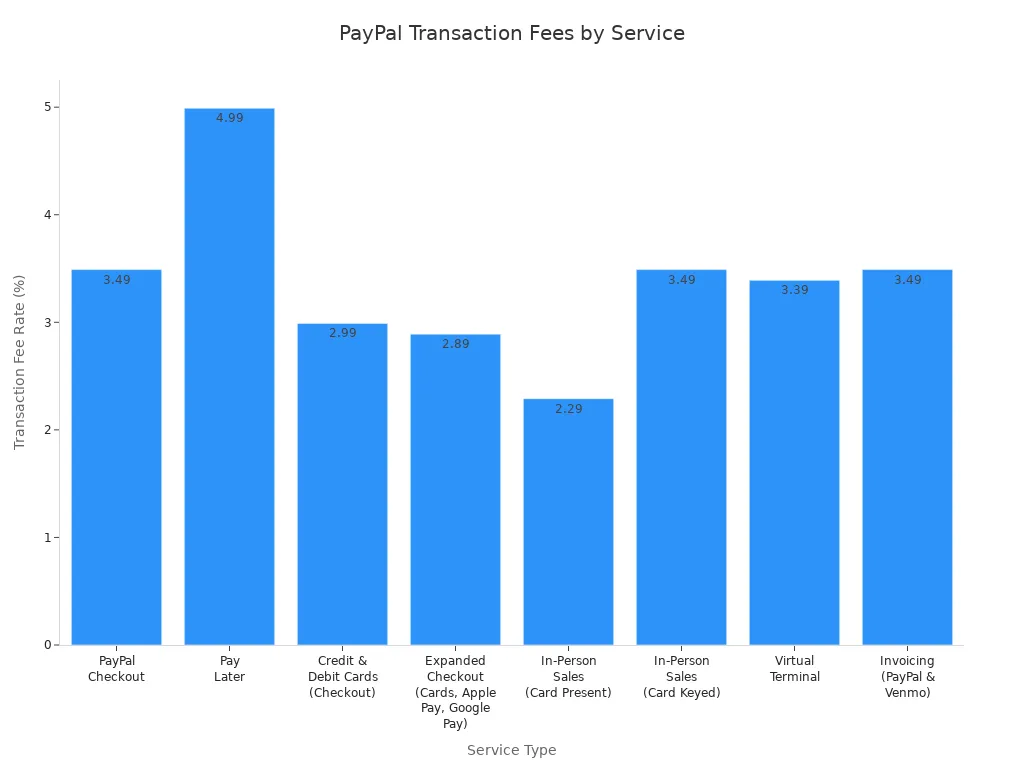

PayPal Fees

PayPal uses a different structure for payment processing. You pay service fees for each transaction, and some services have higher rates. For PayPal Checkout, you pay 3.49% plus $0.49 per transaction. If you offer Pay Later, the fee rises to 4.99% plus $0.49. Card payments through PayPal cost 2.99% plus $0.49. Expanded checkout options, like Apple Pay or Google Pay, cost 2.89% plus $0.29. In-person sales have lower rates, starting at 2.29% plus $0.09. PayPal charges $30 per month for its virtual terminal. Invoicing through PayPal costs 3.49% plus $0.49 per transaction. You may also pay for hardware if you need a card reader or terminal.

| Service Type | Transaction Fee Rate | Fixed Fee per Transaction | Monthly Fee |

|---|---|---|---|

| PayPal Checkout | 3.49% | $0.49 | N/A |

| Pay Later | 4.99% | $0.49 | N/A |

| Credit & Debit Cards | 2.99% | $0.49 | N/A |

| Expanded Checkout | 2.89% | $0.29 | N/A |

| In-Person Sales | 2.29%–3.49% | $0.09 | N/A |

| Virtual Terminal | 3.39% | $0.29 | $30 |

| Invoicing | 3.49% | $0.49 | N/A |

PayPal sometimes offers merchant account discounts for high-volume sellers. You can also apply for micropayment rates if you process many small transactions. These options help you lower your payment processing rates.

Cost Comparison

You need to compare payment processing fees and service fees to find the best fit for your business. Stripe offers lower rates for in-person sales and does not charge monthly fees. PayPal charges higher transaction fees for online sales and some extra services. Both Stripe and PayPal let you open a merchant account without a monthly fee for basic services. Stripe gives you more predictable payment processing rates, while PayPal offers more options for discounts if you qualify. If you process many small payments, PayPal’s micropayment rates may help you save money. Stripe works well for businesses that want simple, transparent fees and no monthly costs. PayPal fits businesses that want flexible payment processing and may benefit from special merchant account rates.

Tip: Always review your monthly sales and payment processing needs. This helps you choose the platform with the lowest payment processing fees for your business.

Setup and Ease of Use

Getting Started

You want a payment platform that lets you start quickly. Stripe and PayPal both allow you to open an account online. PayPal guides you through a simple sign-up process. You can connect your bank account, verify your email, and begin accepting payments in just a few steps. Many small business owners choose PayPal because you do not need coding skills to get started.

Stripe asks for more information during setup. You need to provide business details, banking information, and sometimes extra documents. Stripe’s dashboard gives you many options, but you may feel overwhelmed if you are new to payment processing. If you want to add Stripe to your website, you often need to use code or work with a developer. Stripe works best for you if you have technical skills or a team that can handle integrations.

Tip: If you want the fastest setup, PayPal is the better choice. Stripe gives you more control, but you may spend more time on the initial setup.

User Experience

Your daily experience with Stripe or PayPal depends on how you use the platform. PayPal’s dashboard is simple. You can send invoices, track payments, and withdraw funds with just a few clicks. Many users like PayPal because it feels familiar and easy to use.

Stripe’s interface shows you a lot of data. You see charts, payment details, and many settings. Some users say Stripe is not so user-friendly. New users often find it complicated because of the volume of data displayed. Setting up integrations with Stripe requires technical knowledge and can be time-consuming for beginners.

- Stripe’s interface is described as “not so user-friendly.”

- New users find it complicated due to the volume of data displayed.

- Setting up integrations requires technical knowledge and can be time-consuming for beginners.

You should choose PayPal if you want a simple, ready-to-use platform. Stripe fits you if you want more features and do not mind a learning curve. Both platforms let you manage payments, but your comfort with technology will shape your experience.

Customization and Integrations

Stripe Customization

You can shape your payment experience with stripe. Stripe gives you a powerful set of tools for integration. You can build a customizable checkout that matches your brand. Stripe offers APIs and SDKs that let you control every part of the payment flow. You can add features like saved cards, one-click payments, and custom fields. Stripe supports integrated checkout pages that work on any device. You can also use pre-built solutions if you want a faster setup.

Stripe lets you connect with hundreds of third-party apps. You can link stripe to accounting software, e-commerce platforms, and business management tools. Stripe’s integration options help you automate tasks and track sales. You can also use stripe to handle subscriptions and recurring payments. Stripe’s customizable checkout gives you the freedom to design a unique payment page. You can test changes in a sandbox before going live. Stripe’s developer tools make integration smooth for your team.

Note: Stripe’s flexibility works best if you have technical skills or a developer on your team. You can create a payment system that grows with your business.

PayPal Integrations

PayPal makes integration easy for many business types. You can connect PayPal to popular e-commerce platforms like WooCommerce, BigCommerce, and Shopware. This helps you set up an integrated checkout quickly. PayPal supports multiple payment methods, including direct card payments and PayPal accounts. You can offer a customizable checkout that builds trust with your customers.

PayPal’s integration options go beyond e-commerce. You can link PayPal to accounting systems, billing tools, and business management software. PayPal also supports recurring payments for subscriptions. You can use PayPal for in-person sales with POS and QR code solutions. PayPal’s platform independence means you can use it with many content management systems or as a standalone solution.

Here is a table showing some common PayPal integration categories:

| Integration Category | Description | Example Platforms / Partners |

|---|---|---|

| E-commerce Platforms | Website design and payment processing | WooCommerce, BigCommerce, Shopware |

| Accounting Systems | Billing, invoicing, inventory, taxes | Accounting software partners |

| Recurring Payments | Subscriptions and repeat billing | Recurring payments partners |

| In-person Payments | POS and QR code solutions | POS payment partners |

PayPal’s integration options help you manage shipping, track orders, and handle returns. You can also support international transactions and multi-language stores. PayPal’s broad compatibility makes it a strong choice for many businesses.

Payment Types and International Support

Supported Payments

You want your business to accept as many payment methods as possible. Stripe and PayPal both support a wide range of options for online payments. Stripe lets you accept credit cards, debit cards, Apple Pay, Google Pay, and even bank transfers. You can also use Stripe for recurring billing, which helps if you run a subscription-based ecommerce business. Stripe works well for e-commerce stores that want to offer flexible online payments.

PayPal also supports many payment methods. You can accept PayPal balances, credit cards, debit cards, and even payments from customers who do not have a PayPal account. PayPal makes it easy for e-commerce businesses to add a checkout button to their site. This helps you reach more customers who prefer different online payments. If you want to offer multiple payment methods, both Stripe and PayPal give you strong options.

Note: Stripe gives you more control over the checkout experience. You can customize the payment page to match your brand. PayPal offers a familiar checkout process that many customers trust.

Global Reach

If you plan to grow your ecommerce business, you need to know where you can accept online payments. Stripe and PayPal have different levels of international support. Stripe lets you accept payments in 39 countries. PayPal supports businesses in more than 200 countries. This means PayPal gives you a much wider reach for your e-commerce store.

Here is a table that shows the number of countries each platform supports:

| Platform | Number of Countries Supported |

|---|---|

| Stripe | 39 |

| PayPal | More than 200 |

You should think about your target market. If you want to sell products worldwide, PayPal may fit your needs better. Stripe works well if you focus on countries where it operates and need advanced features for online payments. Both platforms support many currencies, so you can serve customers in different regions. For e-commerce and ecommerce businesses, having access to global online payments helps you grow faster.

Security and Compliance

Image Source: pexels

Fraud Protection

You want a trusted payment processor that keeps your business and customers safe. Stripe and PayPal both use strong security tools to fight fraud. When you use PayPal, you get several layers of protection:

- PayPal uses encryption and tokenization to keep customer data safe during payments.

- The Address Verification System checks if the billing address matches the card issuer’s records. This helps spot suspicious activity.

- PayPal’s fraud scoring system looks at transaction amount, location, and customer history. It assigns a risk score to each payment.

- Real-time monitoring helps PayPal catch strange patterns before fraud happens.

- PayPal offers chargeback protection. If a customer disputes a charge, PayPal investigates and helps protect you from losing money.

- You can set up fraud management filters in your PayPal account. These filters let you control transaction limits and rules.

- PayPal also suggests using two-factor authentication, strong passwords, and regular updates to your account information.

- Best practices include checking customer identity, verifying addresses, and watching for odd activities. You should always follow PCI DSS security standards.

- You can connect PayPal with tools like Chargeflow to automate dispute management and improve your response to fraud.

Stripe also gives you advanced fraud protection. Stripe Radar uses machine learning to spot and block risky payments. You can set custom rules and review flagged transactions. Stripe’s tools help you act fast and keep your business safe.

Note: Both Stripe and PayPal want you to feel secure. They update their systems often to stay ahead of new threats.

Data Security

You trust a payment processor with your customers’ sensitive data. Stripe and PayPal both work hard to meet strict security standards. They help you follow PCI DSS rules, which protect cardholder data.

- Stripe and PayPal offer SDKs and hosted payment tools. These keep sensitive card data away from your website and lower your compliance risks.

- Their tools stop you from storing or logging payment information. This makes PCI DSS compliance easier for your business.

- Security is more than just tools. You should use strong code reviews, threat modeling, and secure deployment pipelines. These steps help prevent mistakes and insider threats.

- Stripe and PayPal recommend separation of duties. No single person should control both development and deployment. This limits risks but does not remove them all.

- You should review code carefully, check for vulnerabilities, and use strict controls in your deployment process.

When you choose a trusted payment processor like Stripe or PayPal, you get a partner that values security. Their layered approach helps protect your business and your customers. You can focus on growth, knowing your payment data stays safe.

Customer Support

Support Options

You want reliable help when you run into problems with your payment platform. Stripe gives you 24/7 support through email, live chat, and phone. If you use Stripe’s premium or enterprise plans, you get even faster responses and a dedicated customer success manager. Standard users may wait longer, but you can speed up the process by giving clear details about your issue. Stripe’s live chat and phone support often respond in about three minutes.

PayPal offers several ways to get help. You can call their support center, use live chat, send text messages, or visit their online community. Phone support is available from 8 a.m. to 8 p.m. Central Time, Monday through Friday. Other channels may be open outside these hours. PayPal’s response times can vary, and phone support is not available around the clock.

Here is a table that compares the support options for Stripe and PayPal:

| Support Aspect | Stripe | PayPal |

|---|---|---|

| Support Availability | 24/7 support | Phone: 8 a.m. to 8 p.m. Central Time, Monday-Friday; other channels may be available outside these hours |

| Support Channels | Email, live chat, phone | Call center, live chat, text support, online community, resolution center |

| Average Response Time | Approx. 3 minutes for live chat and phone | Not explicitly stated; phone support limited to business hours |

Tip: If you need help at any time of day, Stripe’s 24/7 support can give you peace of mind. PayPal offers more types of support channels, but you may have to wait if you need phone help outside business hours.

Resources

Both Stripe and PayPal give you many resources to help you learn and solve problems on your own. Stripe’s documentation covers topics like payment methods, subscription management, and payment handling. You can find guides on accepting payments with Apple Pay, Google Pay, Klarna, and more. Stripe also explains how to refund payments, manage failed transactions, and extend trial periods for subscriptions.

PayPal provides step-by-step guides and articles for business users. You can learn how to accept payments without a PayPal account, sell online courses with installment payments, and create PayPal buttons that work with tools like Zapier. PayPal’s resources help you set up your business and automate tasks.

Here is a table showing some topics you can find in their resources:

| Category | Examples / Topics Covered |

|---|---|

| Payment Methods Accepted | iDEAL, Bancontact, SOFORT, Przelewy24, Klarna, Afterpay/Clearpay, Apple Pay, Google Pay, Boleto |

| Subscription Management | Extending user subscription trial periods |

| Payment Handling | Refunding payments via Stripe or PayPal dashboard, managing failed payments and customer emails |

You can also find these helpful features in PayPal’s resources:

- Accept payments without a PayPal account

- Sell online courses with installment payments

- Create PayPal buttons that connect with Zapier for automatic user enrollment

Note: Stripe and PayPal both offer strong self-service resources. You can solve many problems by searching their help centers or reading their guides. This saves you time and helps you run your business smoothly.

Best Payment Platform by Business Type

Small Businesses

If you run a small business, you want a payment platform that is easy to set up and manage. PayPal stands out for its simplicity. You can create a merchant account in minutes and start accepting payments right away. You do not need technical skills or a developer to get started. PayPal’s strong brand recognition helps build trust with your customers. Many people already have PayPal accounts, so they feel comfortable using it for purchases.

Stripe also works for small businesses, especially if you plan to grow or want more control over your payment process. Stripe gives you more customization options, but you may need some technical help to set it up. If you want to keep things simple and focus on running your business, PayPal is often the better choice. You can always add Stripe later as your needs change.

Tip: If you want fast setup and a familiar checkout experience for your customers, choose PayPal. If you want to invest in a flexible system that can grow with your business, consider Stripe.

E-commerce

E-commerce businesses need payment platforms that offer flexibility, low fees, and a wide range of features. Both Stripe and PayPal make it easy to set up an account, require no contracts, and let you cancel anytime. Many startups and small e-commerce businesses prefer PayPal because it is simple and quick to launch. You can add a PayPal button to your site and start selling within hours.

Stripe is the top choice for established e-commerce companies that want more control and lower fees. Stripe supports a wide variety of payment options, so you can tailor your checkout to your customers’ needs. You get access to advanced tools like subscription billing, invoicing, gift cards, tax calculation, identity verification, fraud prevention, and inventory management. These features make Stripe an all-in-one solution for growing e-commerce businesses.

- Reasons e-commerce businesses choose Stripe or PayPal:

- Both platforms are easy to set up and cancel.

- PayPal is preferred for simplicity.

- Stripe is favored for flexibility and customization.

- Stripe offers lower fees.

- Stripe supports more payment options.

- Stripe provides extra tools for billing, fraud prevention, and inventory.

If you want a simple solution for your e-commerce store, PayPal works well. If you want to scale your ecommerce business and need advanced features, Stripe is the better fit.

Freelancers

Freelancers need payment platforms that make invoicing and getting paid easy. Both Stripe and PayPal offer solutions, but each has unique strengths. The table below compares how Stripe and PayPal support freelancers:

| Feature/Aspect | Stripe Benefits | PayPal Benefits |

|---|---|---|

| Payment Processing | On-site payment processing keeps clients on your website, seamless branding | Off-site processing via PayPal window, may disrupt client experience |

| Fees | Standard 2.9% + $0.30 per transaction; no extra fees for fraud protection, American Express, or recurring billing | Same base fee; additional fees for American Express (3.5%), chargebacks ($20), monthly fees for fraud protection and recurring billing |

| Micropayments | No discounts for micropayments; can be expensive for very small transactions | Micropayment fee structure (5% + fixed fee) helps for transactions under $10 |

| Payment Methods Accepted | Accepts ApplePay and American Express with no extra charge | Does not accept ApplePay; charges extra for American Express |

| Data Portability | Allows export of customer payment data when switching providers | Limited data portability; recurring payment data cannot be transferred |

| Setup and Integration | More complex setup; may require professional help | Easy to set up; integrated into many billing software solutions |

| Fund Access Speed | Funds issued on a 2-day rolling cycle | Funds can be transferred to external accounts as quickly as one business day |

| Customer Trust and Recognition | Less widely known; some clients prefer PayPal | Widely recognized and trusted by clients |

| Additional Features | No extra fees for refunds; no monthly fees for fraud protection or recurring billing | Offers business financing options, PayPal credit, and customer financing |

| Use Strategy | Often used alongside PayPal depending on client preference and transaction size | Often preferred by clients; freelancers benefit from having both options |

Stripe gives you a seamless, branded payment experience and no extra fees for fraud protection or recurring billing. PayPal is easier to set up and is trusted by many clients. If you handle many small payments, PayPal’s micropayment fee structure can save you money. Many freelancers use both Stripe and PayPal to give clients more choices and to manage fees.

Global Businesses

If you run a global business, you need a payment platform that supports many countries and currencies. Stripe and PayPal both offer international solutions, but they have different strengths. The table below shows how each platform supports global businesses:

| Feature | Stripe | PayPal |

|---|---|---|

| Global Availability | Operates in 46+ countries | Available in 200+ countries |

| Currency Support | Supports 135+ currencies | Supports 25 currencies |

| Localized Payment Methods | Yes, supports local payment options | Limited local payment methods |

| Checkout Experience | Embedded on-site checkout, no redirection | Often redirects customers to PayPal site |

| Developer Tools | Extensive APIs and SDKs for customization | Basic APIs, less developer-friendly |

| Fraud Protection | Advanced machine learning-based fraud detection (Radar) | Standard fraud protection |

| Brand Recognition | Less recognized by general consumers | High brand recognition, trusted by customers |

| Setup Complexity | Requires development resources for integration | Simple setup, ready-to-use plugins |

| Recurring Payments | Advanced subscription management features | Basic recurring billing |

| Payout Speed | 2-day rolling basis (varies by country) | Instant transfers available (with fees) |

Stripe is best if you want to support many currencies, offer local payment methods, and create a seamless checkout experience. You get advanced fraud protection and powerful developer tools. PayPal is better if you want to reach customers in more countries and benefit from strong brand trust. PayPal’s simple setup and instant transfers help you move quickly in new markets.

Note: Stripe fits global businesses that need advanced features and broad currency support. PayPal works well for businesses that want the widest reach and a trusted name.

Brand Trust and User Perception

Customer Confidence

You want your customers to feel safe when they pay online. Trust plays a big role in their decision to complete a purchase. Both Stripe and PayPal have strong reputations for security and reliability. When you display their trust seals or payment logos during checkout, you help reassure your customers that their financial information stays protected.

- Customers see these logos and feel more confident about entering their payment details.

- Many people trust fintech companies like Stripe and PayPal more than traditional banks. This trust is especially strong among Millennials and Gen Z.

- PayPal and Stripe both rank high on trust surveys in the United States, with younger shoppers showing a clear preference for these payment platforms.

You can also rely on their security standards. Stripe follows strict rules like PCI DSS to keep payments secure. PayPal invests in customer education, teaching users how to spot scams and protect their accounts. Both companies use advanced security protocols, which helps build their reputations as trustworthy payment providers.

Showing trusted payment options at checkout can increase your customers’ confidence and encourage them to finish their purchases.

Checkout Experience

The checkout experience shapes how your customers feel about your business. A smooth and familiar process can boost your sales. When you offer PayPal at checkout, you make it easy for customers who already have PayPal accounts. Studies show that adding PayPal can increase conversion rates by up to 47% for digital products in some markets.

Stripe also helps you improve the checkout process. You can add digital wallets and local payment methods, which makes it easier for customers to pay in the way they prefer. Stripe’s research shows that offering more than one payment method at checkout can raise conversion rates by an average of 7.4%. The right mix of payment options depends on your customers and what you sell.

- Adding PayPal or Stripe at checkout gives your customers more choices.

- Displaying multiple payment methods can help reduce cart abandonment.

- Tailoring your checkout to your audience’s preferences leads to higher sales.

Tip: Review your checkout page regularly. Make sure you show trusted payment logos and offer the payment methods your customers want. This simple step can make a big difference in your business results.

Choosing between stripe and paypal depends on your business goals. Stripe works best if you want advanced billing, many payment types, and strong integrations. Paypal fits you if you need fast setup, broad country coverage, and strong brand trust. Review this table to help you decide:

| Factor | Stripe | PayPal |

|---|---|---|

| Payment Options | Wide variety | Multiple, easy to use |

| Currency Support | 135+ currencies | 25 currencies |

| Customization | Advanced | Limited |

| Payout Speed | 2-day rolling | Often faster |

| Brand Recognition | Growing | Very strong |

| Security Compliance | Strong | Strong |

| Fees | Transparent, lower for some | Higher for some features |

Weigh your needs for fees, security, and support. Some businesses use both stripe and paypal to reach more customers. Review your needs and try the platform that matches your goals.

FAQ

Can you use both Stripe and PayPal on your website?

Yes, you can use both Stripe and PayPal together. Many businesses offer both options at checkout. This gives your customers more ways to pay and can help increase your sales.

Which platform pays out faster, Stripe or PayPal?

PayPal usually pays out within one business day. Stripe uses a two-day rolling payout in the United States and Australia. In other countries, Stripe may take up to seven days. Always check your account for the latest payout schedule.

Do Stripe and PayPal support recurring payments?

Both Stripe and PayPal support recurring payments. Stripe offers advanced tools for subscriptions and billing. PayPal provides basic recurring billing. You can choose the platform that matches your business needs.

What currencies do Stripe and PayPal support?

| Platform | Number of Currencies Supported |

|---|---|

| Stripe | 135+ |

| PayPal | 25 |

Stripe supports over 135 currencies. PayPal supports 25 currencies. Stripe gives you more options if you sell worldwide.

When comparing Stripe and PayPal, it’s clear that each has strengths, but neither fully removes the friction of high international fees, slow settlement, and limited flexibility. That’s where BiyaPay comes in.

With remittance fees as low as 0.5%, support for most countries and regions worldwide, and real-time exchange rate monitoring, BiyaPay empowers businesses to manage global payments with clarity and control. The platform also supports multi-currency conversions between fiat and digital assets and same-day settlement, ensuring your money moves as fast as your business.

For a payment partner that scales globally without slowing you down, register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.