- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Are the Hidden Costs of Bank of America Foreign Transactions

Image Source: pexels

Bank of America foreign transaction fees can surprise you. Most cards charge a 3% fee when you make purchases or ATM withdrawals processed outside the United States, even if you pay in U.S. dollars.

- Some cards, like Bank of America Travel Rewards and Premium Rewards, have no foreign transaction fees.

- Others, such as Customized Cash Rewards and BankAmericard, charge the 3% fee.

You may also face extra costs, like ATM operator charges or network fees, which can add up quickly during your foreign travels.

Key Takeaways

- Bank of America charges a 3% foreign transaction fee on purchases and ATM withdrawals made outside the U.S., even if you pay in U.S. dollars.

- Using Bank of America credit cards with no foreign transaction fees, like Travel Rewards or Premium Rewards, can save you up to 3% on international purchases.

- Always pay in the local currency when abroad to avoid extra fees from dynamic currency conversion, which can add hidden costs.

- Use Bank of America’s partner ATMs in the Global ATM Alliance to avoid extra ATM operator fees and reduce withdrawal costs.

- Regularly check your statements and monitor transactions to spot foreign transaction fees and dispute any unexpected charges within 60 days.

Bank of America Foreign Transaction Fee

Image Source: pexels

Fee Overview

You pay a foreign transaction fee when you use your Bank of America card for purchases or ATM withdrawals outside the United States. This fee is usually 3% of the total amount. The fee applies to both credit and debit cards. You might think you can avoid it by paying in U.S. dollars, but if the transaction is processed by a bank or merchant outside the U.S., you still get charged. This includes online purchases from foreign websites or payments processed by international banks.

Many people do not realize that foreign transaction fees can show up in unexpected places. For example, you might buy something online from a company based in another country. Even if you see the price in U.S. dollars, the transaction could be processed abroad, and you will pay the fee. The same thing happens if you withdraw cash from an ATM in another country.

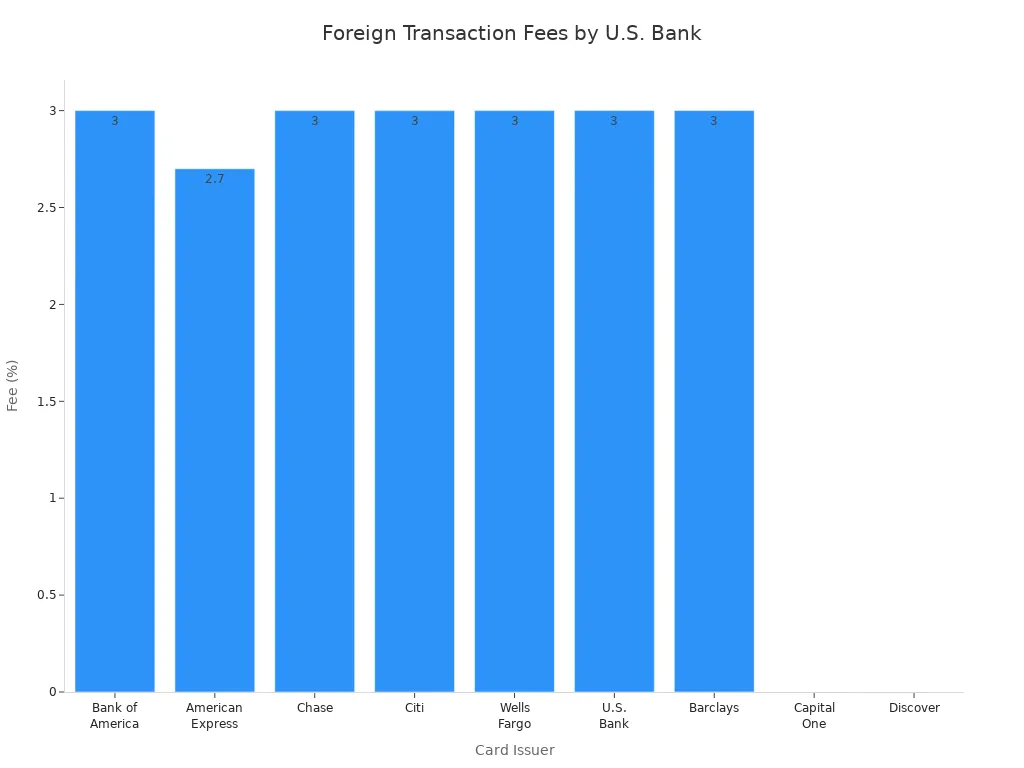

Here is how Bank of America compares to other major U.S. banks:

| Card Issuer | Standard Foreign Transaction Fee |

|---|---|

| Bank of America | 3% |

| American Express | 2.7% |

| Chase | 3% |

| Citi | 3% |

| Wells Fargo | 3% |

| U.S. Bank | 3% |

| Barclays | 3% |

| Capital One | None |

| Discover | None |

Most major banks charge a similar foreign transaction fee. Capital One and Discover do not charge any foreign transaction fees, so they are better for international transactions.

How the Fee Is Charged

Bank of America charges the foreign transaction fee automatically. When you make a purchase or withdraw cash in another country, the fee appears as a separate line on your statement. The fee is a percentage of the total transaction amount. For example, if you buy something for $100, you pay an extra $3 as the fee.

You also pay the fee if you use your card at an ATM in another country. Sometimes, you pay more than one fee. The ATM operator may charge you a separate fee, and the network (like Visa or Mastercard) may add another charge. The Bank of America fee is on top of these other charges.

You might not notice the fee right away. It often appears after the transaction clears. If you use a Mastercard, you pay the Mastercard foreign transaction fee, which is included in the total fee charged by Bank of America.

Here are some common situations where you might pay foreign transaction fees without realizing it:

- You use your Bank of America debit card at an ATM in another country.

- You buy something online from a foreign website, even if the price is in U.S. dollars.

- You pay for a hotel or restaurant in another country, and the payment is processed by a foreign bank.

- You use a credit card that does not waive foreign transaction fees for international purchases.

Examples

You can calculate foreign transaction fees easily. Here are some examples to help you understand how much you might pay:

| Transaction Amount (USD) | 3% Foreign Transaction Fee (USD) | Total Charged (USD) |

|---|---|---|

| $50 | $1.50 | $51.50 |

| $100 | $3.00 | $103.00 |

| $250 | $7.50 | $257.50 |

| $1,000 | $30.00 | $1,030.00 |

Suppose you travel to Hong Kong and use your Bank of America card to withdraw $200 from an ATM. You pay a $6 foreign transaction fee. If the ATM operator charges $5, your total cost is $211. If you use a Mastercard, the Mastercard foreign transaction fee is included in the 3% total.

Tip: Always check your statement after international transactions. Look for any foreign transaction fees or extra charges. This helps you spot unexpected costs and plan better for your next trip.

Other Foreign Transaction Fees

Currency Conversion

When you use your Bank of America card outside the United States, you face more than just foreign transaction fees. Currency conversion is a big part of the total cost. Bank of America usually charges about 3% for foreign currency transactions. This 3% is a common rate for foreign transaction fees, but the bank does not always show you the exact markup. The exchange rate you get is set by Bank of America. The bank can add a hidden markup to the rate, which means you get less value for your money. For example, if you send $1,000 to Europe, you might get 838.01 euros with Bank of America, while a service using the mid-market rate gives you 855.63 euros. The difference comes from the hidden markup in the exchange rate. This means you pay more in foreign transaction fees than you might expect.

Bank of America also profits from currency conversion during international wire transfers. The bank sets the exchange rate and can include extra profit, fees, or markups. You do not always see these costs, but they increase the total amount you pay in foreign transaction fees.

Dynamic Currency Conversion

Dynamic currency conversion (DCC) is another way you can pay more in foreign transaction fees. When you shop or withdraw cash abroad, a merchant or ATM may offer to convert the price to U.S. dollars right away. This sounds easy, but it often costs you more. Merchants use their own exchange rates, which include extra markups and commissions. These markups can be as high as 3% or more. If you accept DCC, you pay these extra foreign transaction fees on top of the regular 3% fee from Bank of America. Sometimes, you end up paying both the DCC markup and the bank’s foreign transaction fees. For example, if you buy something for 850 euros, you could pay nearly 6% in combined foreign transaction fees. Paying in local currency and letting Bank of America handle the conversion usually gives you a better rate and lower foreign transaction fees.

Visa rules say merchants must tell you that DCC is optional, but many still push you to accept it. Always choose to pay in the local currency to avoid extra foreign transaction fees.

ATM Fees

When you use an ATM outside the United States, you pay more than just foreign transaction fees. Bank of America charges a $5 flat fee for each withdrawal at a foreign ATM. You also pay a 3% foreign transaction fee on the amount you take out. For example, if you withdraw $200, you pay $5 plus $6 in foreign transaction fees. Some ATM operators add their own fees, which can make the total cost even higher. Compared to the $2.50 fee for using an out-of-network ATM in the United States, the $5 fee for foreign ATMs is much higher. Other banks, like Connexus Credit Union or LendingClub, may charge less for foreign transaction fees, but Bank of America’s fees are among the highest.

Tip: Always check for extra ATM fees before you withdraw cash abroad. Use partner ATMs when possible to lower your foreign transaction fees.

Credit Cards Without Foreign Transaction Fees

Image Source: unsplash

Bank of America Options

You can avoid extra charges by choosing credit cards with no foreign transaction fees. Bank of America offers several options for travelers. The Bank of America Travel Rewards credit card stands out as a popular choice. This card gives you 0% foreign transaction fees on purchases made outside the United States. The Premium Rewards credit card also offers no foreign transaction fees. If you use a credit card that doesn’t charge foreign transaction fees, you save up to 3% on every purchase you make abroad. These savings add up quickly, especially if you use your credit card while traveling often.

Here is a list of Bank of America credit cards with no foreign transaction fees:

- Travel Rewards credit card

- Premium Rewards credit card

- Premium Rewards Elite credit card

If you want a bank account with no foreign transaction fees, you should look at the Preferred Rewards program. This program gives you more ways to save when you travel.

How to Qualify

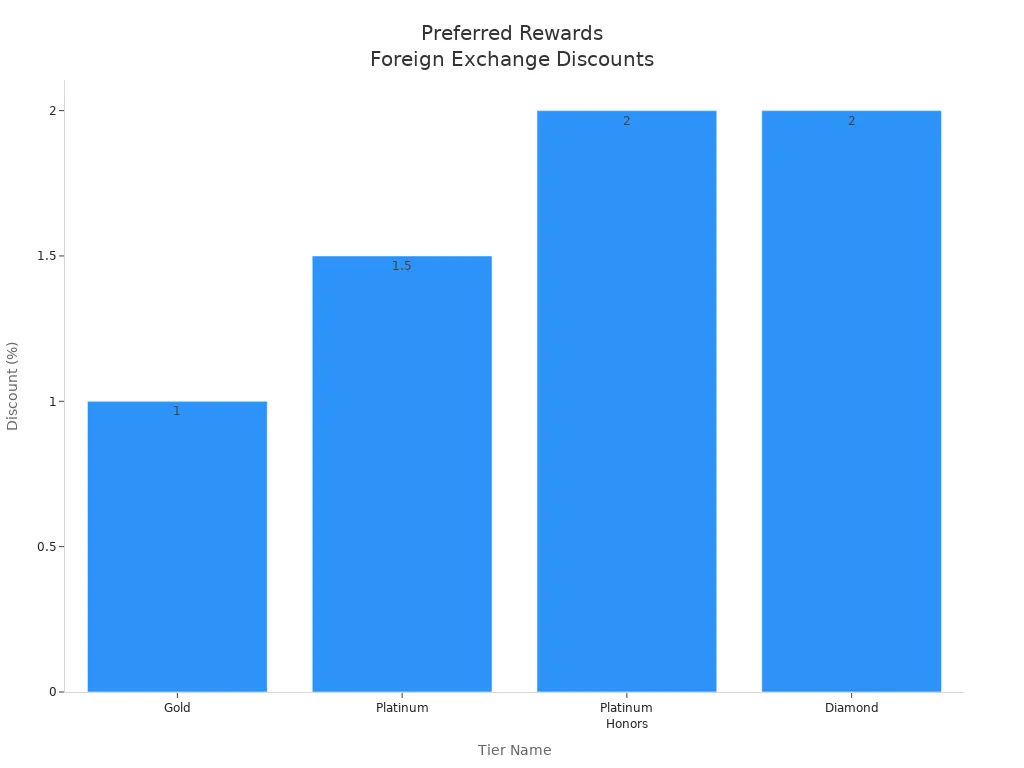

You can join the Preferred Rewards program if you have an active checking account and keep a combined balance in your Bank of America and Merrill accounts. The higher your balance, the more benefits you get. The table below shows the different tiers and what you receive:

| Tier Name | Required Combined Balance (Bank of America + Merrill) | Foreign Currency Exchange Discount | International Transaction Fee Waiver |

|---|---|---|---|

| Gold | $20,000 - $49,999 | 1% discount | No waiver |

| Platinum | $50,000 - $99,999 | 1.5% discount | No waiver |

| Platinum Honors | $100,000 - $999,999 | 2% discount | No waiver |

| Diamond | $1,000,000+ | 2% discount | Unlimited waiver of international transaction fees and ATM fees |

You must keep the required balance for at least three months or have it at account opening. Benefits start within 30 days after you enroll. Only the Diamond tier gives you unlimited waivers for international transaction fees and ATM fees. If you travel often, reaching this tier can help you save the most.

Note: Using a credit card while traveling that has no foreign transaction fees helps you avoid extra costs. Credit card holders who use these cards can save up to 3% on every purchase compared to those who pay foreign transaction fees.

Minimizing Hidden Costs

Using Partner ATMs

You can avoid foreign transaction fees and extra ATM charges by using Bank of America’s partner ATMs when you travel. Bank of America is part of the Global ATM Alliance, which includes banks in many countries such as Hong Kong. When you use a partner ATM, you do not pay the usual ATM operator fee. This helps you save money each time you withdraw cash. However, a 3% transaction fee on non-USD withdrawals may still apply. Sometimes, you can ask Bank of America to refund this fee. Always look for partner ATMs before you travel. This simple step helps you avoid foreign transaction fees and keeps more money in your pocket.

- Bank of America customers can use partner ATMs in the Global ATM Alliance to avoid ATM operator fees.

- Some partner banks in China, Turkey, and Ukraine also waive ATM fees for Bank of America customers.

- You still pay a 3% transaction fee on non-USD withdrawals, but you can often request a refund from Bank of America.

Choosing Local Currency

When you make purchases abroad, always choose to pay in the local currency. If you select U.S. dollars, merchants may use dynamic currency conversion. This process often adds extra fees and uses a poor exchange rate. Paying in local currency lets the card network, such as Visa or Mastercard, set the exchange rate. These rates are usually better than those offered by merchants. You avoid foreign transaction fees that come from dynamic currency conversion. Vendors in places like Hong Kong or China may also give you better prices if you pay in their currency. This choice helps you avoid hidden costs and get the most value from your money.

Tip: Always check the payment screen and select the local currency to avoid extra fees.

Monitoring Fees

You should monitor your account to avoid foreign transaction fees and spot any unexpected charges. Use the Bank of America mobile app or online banking to check your transactions often. Set up alerts to get notified about new charges. If you see a fee you do not expect, contact the merchant first. If the issue is not resolved, you can dispute the charge with Bank of America. You have 60 days from the statement date to dispute a transaction. The bank will not charge interest or fees on the disputed amount during the review. Keeping track of your spending helps you avoid foreign transaction fees and manage your money better when you use a credit card while traveling.

Note: Reviewing your statements regularly helps you catch errors and avoid paying unnecessary fees. Cards with no foreign transaction fees make this process even easier.

You face several types of foreign transaction fees with Bank of America, including low account balance fees, paper statement fees, and foreign transaction fees on purchases and ATM withdrawals. The table below shows the most common fees:

| Fee Type | Description | Fee Amount |

|---|---|---|

| Foreign Transaction Fee | Charged on purchases made abroad, including online purchases. | 3% of purchase amount |

| Foreign ATM Fee | Charged when using non-partner ATMs abroad. | 3% plus $5 usage fee |

| Dynamic Currency Conversion Fee | Extra fee for converting currency at point of sale or ATM. | Around 1% |

Choosing the right credit card and using partner ATMs helps you avoid extra foreign transaction fees. You can also reduce foreign transaction fees by planning ahead and following this checklist:

- Bring at least two valid cards.

- Use chip-enabled cards and digital wallets.

- Order foreign currency before your trip.

- Locate partner ATMs to avoid extra fees.

- Prepare and memorize your PIN.

Review your statements often and check the Bank of America Foreign Exchange Rate FAQ page for updates. Bank of America updates its exchange rates daily, so staying informed helps you avoid unexpected foreign transaction fees.

FAQ

What is the Bank of America foreign transaction fee?

You pay a 3% fee on each purchase or ATM withdrawal processed outside the United States. This fee applies even if you pay in U.S. dollars. Always check your statement for these charges.

Can you avoid ATM fees when traveling?

You can avoid some ATM fees by using Bank of America’s partner ATMs, such as those in the Global ATM Alliance. You still pay a 3% transaction fee on non-USD withdrawals, but you skip the ATM operator fee.

Should you pay in local currency or U.S. dollars abroad?

You should always choose to pay in the local currency. This helps you avoid extra costs from dynamic currency conversion. Merchants often use poor exchange rates when you pay in U.S. dollars.

Which Bank of America credit cards have no foreign transaction fees?

Here is a quick list:

| Credit Card Name | Foreign Transaction Fee |

|---|---|

| Travel Rewards | None |

| Premium Rewards | None |

| Premium Rewards Elite | None |

You save money with these cards when you travel.

How do you dispute a foreign transaction fee?

You can contact Bank of America through online banking or the mobile app. Explain the fee and provide details. The bank will review your request. You have 60 days from the statement date to dispute a charge.

Bank of America’s 3% foreign transaction fees and hidden exchange rate markups can quietly eat into your spending when traveling or sending money abroad. With BiyaPay, you get a smarter alternative: remittance fees as low as 0.5%, seamless multi-currency conversions between fiat and digital assets, and coverage across most countries and regions worldwide. With real-time exchange rate monitoring, you always know you’re getting a transparent deal.

Even better, BiyaPay supports same-day settlement, ensuring your money moves as quickly as you do. Skip the hidden charges and join BiyaPay today for hassle-free global transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.