- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Foreigners Need to Know Before Buying Property in Portuga

Image Source: pexels

You can buy property as a foreigner in Portugal without restrictions. The Portuguese real estate market welcomes buyers from around the world. Foreigners buying property in Portugal now represent a significant share of the market, especially in Greater Lisbon. The table below shows how interest from international buyers has grown:

| Year | % Foreign Buyers (Lisbon) | % American Buyers Among Foreigners | US Buyers’ Share | Chinese Buyers’ Share | European Buyers’ Share |

|---|---|---|---|---|---|

| 2016 | N/A | 8% | 2% | 22% | N/A |

| 2023 | 23% | 23% | 15.2% | 7% | 47% |

When buying property, you need to gather documents, get a tax number, and understand the steps involved. Preparation and legal advice help you avoid mistakes. Think about your goals before you start the process of foreigners buying property in Portugal.

Key Takeaways

- Foreigners can buy property in Portugal without restrictions and enjoy the same rights as citizens.

- You must get a Portuguese Tax Identification Number (NIF) and open a local bank account before buying.

- Hiring a lawyer and using licensed real estate agents helps avoid legal problems and scams.

- Prepare all required documents early to speed up the buying process and secure financing.

- Understand taxes, fees, and ongoing costs to budget properly and protect your investment.

Legal Basics for Foreigners

Who Can Buy Property

You can buy property in Portugal no matter where you come from. Portugal does not limit who can purchase real estate based on nationality. Foreigners buying property in portugal face no quotas or special permits. You enjoy the same rights as Portuguese citizens when you buy a home, land, or apartment. You do not need to live in Portugal to own property there. The only main requirement is that you must get a Portuguese Tax Identification Number (NIF) before you start the process.

Here is a quick look at the main legal steps and documents you need:

| Requirement/Step | Description |

|---|---|

| Restrictions on foreigners | No restrictions on foreigners buying property in Portugal. |

| Portuguese Tax ID (NIF) | You must obtain a NIF before purchasing. |

| Promissory Contract (CPCV) | You sign this contract before the final deed, usually with a deposit. |

| Final Deed (Escritura) | You sign this before a Notary to complete the purchase. |

| Legal Assistance | You should hire a lawyer for legal checks. |

| Portuguese Bank Account | You need this to make payments. |

| Valid Identification | You must show a passport or photo ID. |

| Additional Documents | You need a sales contract, energy certificate, stamp tax, and land registry. |

| Residency Implications | Buying property does not give you residency. |

| Property License | The property must have a valid license of use. |

| Tax Representative | Non-EU buyers need a tax representative to get a NIF. |

Restrictions and Rights

Portugal stands out as one of the most open real estate markets in Europe. Foreigners buying property in portugal have the same property ownership rights as citizens. You can buy, sell, and register property in your name. You do not need to live in Portugal to own real estate. If you plan to stay longer than 90 days, you will need a visa or residency permit.

Here is a table comparing your rights with those of Portuguese citizens:

| Aspect | Foreign Buyers (Non-Residents) | Portuguese Citizens |

|---|---|---|

| Right to Purchase Property | Yes, no restrictions based on nationality or residency status | Yes, unrestricted |

| Ownership Rights | Full ownership rights including registering property in their name | Full ownership rights |

| Required Documentation | Portuguese taxpayer number (NIF) required | Portuguese ID and taxpayer number |

| Residency Requirement | No residency required to buy; visa needed if staying >90 days | N/A |

| Financing (Mortgage) | Up to 70% loan-to-value; more documents needed | Higher loan-to-value ratios possible |

| Taxes and Fees | Same taxes and fees as citizens | Same taxes and fees |

| Visa Options Related to Property | Eligible for Golden Visa and other residency visas through investment | N/A |

Tip: Always check that the property has a valid license of use from the local municipality. This protects your investment and avoids legal issues.

Requirements for Foreigners Buying Property in Portugal

Essential Documents

When you start buying property in Portugal, you need to prepare several important papers. These documents help prove your identity, financial status, and ability to complete the purchase. The process of buying property usually takes one to two months. Delays can happen if there are title disputes, mortgage approval issues, or slow paperwork. If you work with experienced real estate agents and lawyers, you can speed up the process and avoid mistakes. Having all the required documents to buy property ready will make your experience much smoother.

Here is a table showing the main required documents to buy property in Portugal:

| Required Documents to Buy Property | Description |

|---|---|

| Valid Passport | Confirms your identity and legality of the transaction |

| Portuguese Tax Identification Number (NIF) | Needed for all financial transactions in Portugal |

| Proof of Address | Recent utility bill or rental agreement from your home country |

| Recent Tax Returns | Shows your financial and tax status |

| Financial Documents (if mortgage) | Payslips, bank statements, or credit report |

If you plan to get a mortgage, you must also show proof of income and other financial records. You may need extra documents if the property has special features or if you buy through a company. Always check with your lawyer or agent to make sure you have everything you need.

Note: Having your documents ready before you start searching for property will help you avoid delays and make the process of buying property much easier.

Getting a NIF Number

You must get a Portuguese Tax Identification Number, called a NIF, before you can buy property. The NIF is required for all financial transactions in Portugal, including opening a bank account, signing contracts, and paying taxes. If you are a non-EU citizen, you need a tax representative in Portugal to help you get your NIF.

Here is how you can get your NIF number:

- Visit a local Portuguese tax office (Finanças) with your passport or national ID and proof of address from your home country, such as a bank statement.

- At the tax office, take a ticket from the electronic queue and wait for your turn.

- Present your documents to the staff and request a NIF.

- After registration, you will receive a password and login details for the tax office portal.

- If you cannot visit in person, you can appoint a representative to apply for your NIF remotely. You will need to send a copy of your passport, proof of address, and a signed power of attorney.

- Pay a fee, usually between $95 and $130 USD (exchange rates may vary).

- Your representative will get your NIF and act as your tax representative for one year.

- You will receive your NIF and instructions to access your tax office account online.

You need your NIF before you can move forward with buying property. Without it, you cannot sign contracts or open a bank account.

Tip: Start the process of getting your NIF early. This step is required for almost every part of buying property in Portugal.

Opening a Bank Account

Opening a Portuguese bank account is highly recommended when buying property. A local account makes it easier to pay deposits, handle taxes, and manage ongoing expenses. Most banks in Portugal require you to visit a branch in person, but some digital banks allow you to open an account online.

Here are the steps to open a bank account in Portugal:

- Research different banks and compare their fees, services, and branch locations.

- Make sure you have your NIF number, as it is required to open an account.

- Gather your documents: valid passport, proof of address (such as a lease agreement or utility bill), proof of income or employment (like pay slips or a work contract), and your NIF.

- Visit a local bank branch. You may need to make a minimum deposit, usually around $270 USD (check current exchange rates).

- If you prefer, you can use digital banks like N26 or Revolut, which let you open an account online.

Note: Requirements may vary between banks. Some may ask for extra documents or information. Having a Portuguese bank account will make the process of buying property and paying ongoing costs much easier.

Buying Property Process

Image Source: pexels

Property Search

You start the buying process by searching for the right property. Many foreigners use local real estate agencies because these agents know the market well and can guide you through each step. You can also look for properties online. Popular websites include Idealista, Imovirtual, RE/MAX, Century 21, ERA, Casa Sopo, and Rightmove. These sites let you browse listings from anywhere in the world.

- Local real estate agencies help you understand the neighborhoods and prices.

- Online property websites allow you to compare many options quickly.

- Estate agents in Portugal must register and hold a license, which helps protect you as a buyer.

You do not have to use an agent, but it often makes the buying property experience easier, especially if you do not speak Portuguese or know the local laws.

Tip: Always check that your agent is licensed. This ensures you get reliable help during the buying process.

Making an Offer

Once you find a property you like, you move to the next step in the buying process: making an offer. You can negotiate the price and terms with the seller. Sometimes, you may sign an offer to purchase agreement, but this is not required by law. This agreement can include details such as your name, the seller’s name, the property address, the price, deposit amount, deadlines, and any penalties for breaking the agreement.

Here is a table showing the main steps and details when making an offer:

| Step/Aspect | Description |

|---|---|

| Negotiation | You discuss price, deadlines, and conditions with the seller. |

| Reservation Form | Optional. You may pay a deposit to reserve the property. If the sale fails, you may get your deposit back. |

| Promissory Agreement (CPCV) | Strongly recommended. Sets price, deadlines, payment terms, and conditions. |

| Identification Requirements | You must provide your full name, address, marital status, and ID or passport details. |

| Down Payment | Usually 5%-20% of the price. Paid directly to the seller. |

| Money Laundering Compliance | You must declare where your funds come from. This follows Portuguese and EU laws. |

| Legal Advice | It is best to have a lawyer or notary check all agreements. |

| Timeframe | Usually 60-90 days from promissory agreement to final deed. |

| Taxpayer Number (NIF) | Not needed at the offer stage, but required for the final deed. |

You usually pay the rest of the purchase price at the final deed signing, often using a certified bank cheque. After the deed, you must register the property and notify the tax office. Notary and land registry fees are your responsibility.

Note: Always get legal advice before signing any documents. This protects you from mistakes during the buying property process.

Promissory Contract

The promissory contract, called Contrato de Promessa de Compra e Venda (CPCV), is a key part of buying property in Portugal. You and the seller sign this contract after agreeing on the main terms. The CPCV is not required by law, but most buyers use it because it gives both sides security.

Here are the main elements included in a promissory contract:

- Deposit (Sinal): You pay a deposit, usually about 10% of the price. This shows your commitment. If you break the contract, you lose the deposit. If the seller breaks the contract, they must return your deposit and may pay double.

- Conditions and Obligations: The contract lists what each side must do. This can include getting a mortgage, finishing inspections, or fixing problems before the sale.

- Penalties: The contract explains what happens if someone does not follow the rules. Penalties protect both you and the seller.

- Completion Date: The contract sets the date for the final deed. This is when you become the legal owner.

- Payment Details: The contract explains how you pay the deposit and the rest of the price. In Portugal, banks usually handle these payments.

Tip: The promissory contract is a strong legal document. Always have a lawyer review it before you sign.

Due Diligence

Before you finish buying property, you must complete due diligence. This step helps you avoid problems and protects your investment. You should always ask a lawyer to check the property’s legal status. The lawyer will make sure the title is clear, there are no debts, and the property has all the right licenses.

Follow these steps for due diligence:

- Ask your lawyer to check the property’s title and confirm there are no debts or legal issues.

- Hire a surveyor or inspector to look at the building’s condition. This is very important for older homes.

- Make sure any changes or additions to the property have the correct permits and follow local rules.

These steps help you avoid buying property with hidden problems. You want to be sure the property is legal and safe before you move forward.

Note: Skipping due diligence can lead to costly mistakes. Always complete this step before signing the final deed.

Final Deed

The last step in the buying process is signing the final deed, called Escritura Pública de Compra e Venda. You usually sign this at a notary’s office. The buyer, seller, and notary or lawyer must all be present. If you cannot attend, you can give power of attorney to someone you trust.

Here is what happens during the final deed signing:

- You, the seller, and the notary or lawyer meet at the agreed location.

- The notary or lawyer reads the deed aloud. This makes sure everyone understands the terms.

- Both you and the seller agree to the terms and sign the deed.

- You pay the rest of the purchase price, often with a certified bank cheque.

- The seller gives you the keys to the property.

- The notary or lawyer registers the deed with the Land Registry and Tax Authority. This step makes you the legal owner.

After you finish these steps, you have completed the buying property process in Portugal. You now own the property and can move in or start using it as you wish.

Tip: Keep all documents from the buying process in a safe place. You may need them for taxes or future sales.

Costs and Taxes

Purchase Taxes

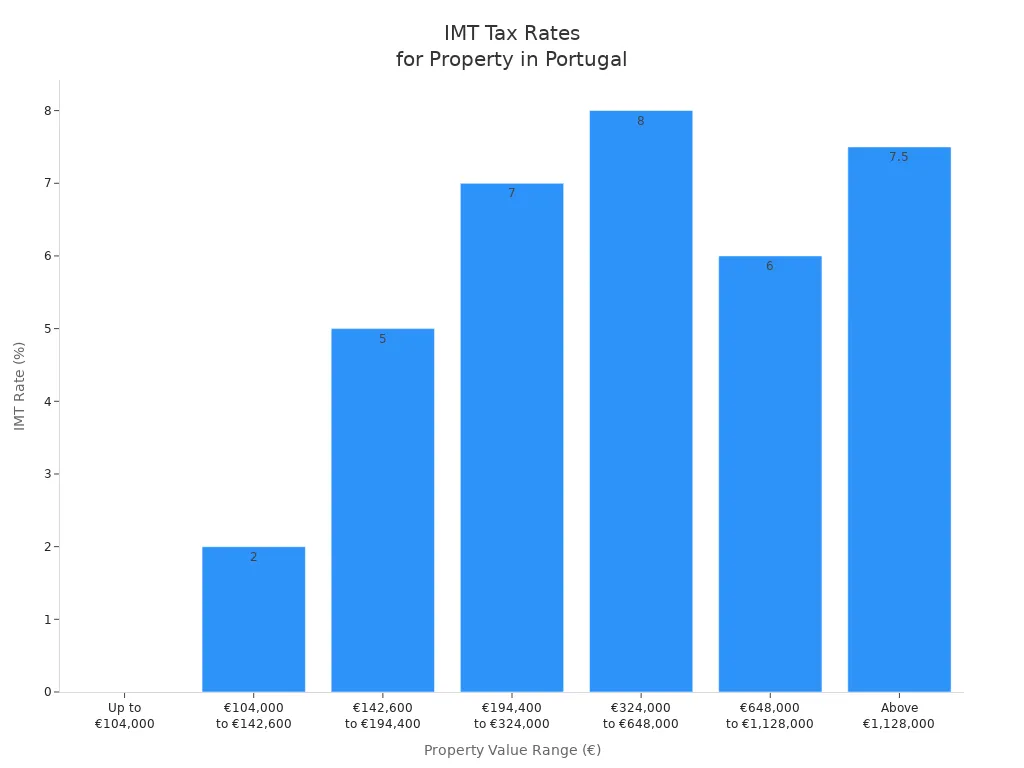

When you buy property in Portugal, you must pay two main property taxes in portugal: the Property Transfer Tax (IMT) and Stamp Duty. IMT rates depend on the property’s value, its location, and whether you plan to live there. For example, if you buy a primary residence, properties valued up to about $112,000 USD (check current exchange rates) are exempt from IMT. As the property value increases, the tax rate rises. The highest rate can reach 7.5% for properties above about $1,220,000 USD.

Stamp Duty is another important part of property taxes in portugal. You pay this tax at a flat rate of 0.8% on the higher value between the purchase price and the taxable value. For example, if you buy a property for $165,000 USD and the taxable value is $110,000 USD, you pay 0.8% of $165,000 USD, which is $1,320 USD.

Here is a summary table of IMT rates for primary residences:

| Property Value Range (USD) | IMT Rate (%) | Notes |

|---|---|---|

| Up to ~112,000 | 0 | Exempt |

| ~112,000 to ~153,800 | 2 | |

| ~153,800 to ~209,600 | 5 | |

| ~209,600 to ~349,000 | 7 | |

| ~349,000 to ~698,000 | 8 | |

| ~698,000 to ~1,220,000 | 6 | |

| Above ~1,220,000 | 7.5 |

Note: Always check the latest exchange rates when converting from EUR to USD.

Notary and Legal Fees

You must also include notary and legal fees in your property purchase costs. Notary fees usually range from $110 to $330 USD per transaction. These fees cover the official signing and registration of your property. Legal fees often range from 1% to 2% of the purchase price, with a minimum charge of about $1,100 USD. Lawyers help you check the property’s legal status and protect your interests. While legal help is optional, most buyers find it very helpful.

| Fee Type | Typical Cost (USD) | Notes |

|---|---|---|

| Notary Fees | $110 to $330 | Required for legal transfer |

| Legal Fees | 1% to 2% of purchase price | Minimum about $1,100; depends on transaction complexity |

Tip: Always ask for a detailed quote from your lawyer and notary before you begin.

Ongoing Expenses

After you buy your property, you will have ongoing expenses. The main recurring tax is the Municipal Property Tax (IMI). The local government sets this tax, and the rate usually ranges from 0.3% to 0.45% of the property’s taxable value each year. You must also pay for utilities, insurance, and maintenance. If you rent out your property, you may owe income tax on your rental earnings.

- IMI (Municipal Property Tax): 0.3% to 0.45% of taxable value per year

- Utilities: Water, electricity, gas, and internet

- Insurance: Home insurance is recommended

- Maintenance: Repairs and upkeep

Note: Budget for these ongoing costs to avoid surprises after your purchase.

Financing Options

Mortgages for Foreigners

You can find many mortgage options when buying property in Portugal as a foreigner. Portuguese banks often offer loans to non-residents if you meet their requirements. Most mortgages have variable interest rates, but some banks allow a fixed rate for the first year. The average loan term is 25 to 30 years for non-residents. Banks usually ask for a larger down payment from foreigners to reduce their risk.

Here is a table that shows the main features of mortgages for foreigners in Portugal:

| Aspect | Details |

|---|---|

| Mortgage Types | Variable interest rates, sometimes fixed for up to 1 year; 25-30 year terms |

| Loan-to-Value (LTV) Ratios | Up to 90% for main homes, 80% for other uses; foreigners often get 70% LTV or less |

| Eligibility Criteria | No visa needed; banks check your income, debts, job, and credit history |

| Required Documentation | Passport, NIF, proof of address, property documents, pay slips, tax returns, bank statements |

| EU/EEA vs Non-EU Citizens | EU/EEA: Passport or ID card, EU address; Non-EU: Passport, visa, tax representative, non-EU address, fee applies |

| Additional Costs | Fees for deed registration, appraisal, IMT (up to 10%), stamp duty, legal fees |

| Bank Willingness | Most banks in Portugal will lend to foreigners if you meet their conditions |

| Residency and Tax Status | Living and paying taxes in Portugal can lower your down payment |

Note: You should prepare all your documents before applying for a mortgage. This helps speed up the process.

Down Payments

You need to plan for a down payment when buying property in Portugal. The amount depends on your residency status and the bank’s rules.

- Portuguese residents usually pay 10-20% of the property’s value as a down payment.

- Foreign buyers without residency often need to pay 25-35%, with 30% being common.

- Banks ask for higher down payments from foreigners to protect themselves.

- If you have high income, special skills, or European citizenship, you may qualify for a lower down payment.

- The down payment is the main difference between residents and non-residents when getting a mortgage.

Tip: A larger down payment can help you get better loan terms and lower your monthly payments.

Residency and Golden Visa

Golden Visa Requirements

Many foreign investors have looked to the golden visa portugal program as a way to gain residency. Before late 2023, you could get a golden visa portugal by buying property. The minimum investment depended on the type and location of the property. Here are the main requirements that applied:

- Buy property worth at least $305,000 USD in low-density areas.

- Invest $380,000 USD in a property that needs renovation.

- Purchase other real estate for at least $545,000 USD.

- Select your property and prepare all documents.

- Get a Portuguese tax number.

- Pay reservation fees and prepare for the deal.

- Pay stamp duty (0.8% of the property value) and property transfer tax (IMT), which ranges from 0% to 6.5%.

- Register the property with the Tax Office and Land Registry.

- Keep your investment for at least five years and meet the physical presence rule.

As of late 2023, Portugal changed the rules. You can no longer get a golden visa by buying property. Now, you must choose other options, such as investing $545,000 USD in a fund, donating $272,000 USD to cultural projects, investing $545,000 USD in research, or starting a business that creates jobs. You must keep your investment for five years and spend at least 14 days in Portugal every two years.

Note: Always check the latest rules before you start your application. The requirements can change.

Property and Residency

Buying property in Portugal no longer gives you the right to a golden visa. You can still buy property as a foreign investor, but you must use other ways to get residency. If you want to live in Portugal, you can apply for a D7 visa or other residency permits. These options often require proof of income or savings. Owning property can help your application, but it is not enough by itself.

If you plan to stay long-term, you should talk to a lawyer or visa expert. They can help you choose the best path for your situation. Many foreign investors still buy property in Portugal for lifestyle or investment reasons, even without the golden visa link.

Risks and Pitfalls

Legal Checks

You need to perform careful legal checks before you buy property in Portugal. A real estate lawyer helps you avoid costly mistakes. The lawyer reviews all important documents, such as the sales contract, title deed, Promissory Contract (CPCV), and Public Deed (Escritura). The lawyer also checks the Portuguese land registry to confirm the seller owns the property and has the right to sell it. This process ensures the property has a clear title and no hidden debts or disputes. The lawyer checks that the property follows local zoning and environmental rules. You can see the main legal checks in the table below:

| Legal Check / Service | Description |

|---|---|

| Verify legal ownership and rights to sell | Confirm the seller has legitimate ownership and authority to sell the property |

| Examine property legitimacy | Check for existing mortgages, outstanding taxes, or ownership disputes |

| Access Portuguese land registry | Verify property ownership and account history to ensure clear title |

| Review legal documents | Analyze sales contracts, title deeds, CPCV, and Escritura |

| Ensure compliance with urban planning and environmental laws | Confirm property adheres to local regulations and zoning requirements |

| Provide legal representation | Assist in dispute resolution and protect buyer interests |

| Navigate local regulations and tax obligations | Guide through property registration, taxes, and inheritance law |

| Draft and review contracts | Prepare and scrutinize all necessary legal documents |

Note: Always hire a qualified lawyer to guide you through these checks.

Avoiding Scams

You may face scams when buying property in Portugal. Some common scams target foreign buyers who are not familiar with the market. Here are the main risks and how you can avoid them:

- Overpaying for properties. Compare prices with similar homes in the area to avoid paying too much.

- Buying in poor locations. Research the neighborhood and check for access to services and future development plans.

- Failing to verify legal documents. Always check for hidden debts, mortgages, or missing permits.

- Hidden charges and unfair contract terms. Have a Portuguese lawyer review all contracts for hidden fees or abusive clauses.

- Ignoring financing conditions and total costs. Understand all bank terms, taxes, and fees before you commit.

- Neglecting property condition. Arrange a technical inspection to check for structural or maintenance issues.

Tip: Careful research and professional advice help you avoid most scams.

Professional Help

You should work with trusted professionals during your property purchase. Each expert plays a key role in protecting your interests and making the process smooth. The table below shows the main types of professional help and their typical costs:

| Professional Assistance | Description | Typical Costs (USD) |

|---|---|---|

| Notary | Reviews documents, witnesses contract signing, and registers ownership | Included in legal fees; required for contract validity |

| Mortgage Banks | Provide loans, evaluate property, and set terms | Mortgage rates average 3.3%; down payments 20-50%; property evaluation fee about $370 |

| Real Estate Agents / Buyer’s Agents | Help find property, provide market knowledge, and guide you | Commission-based; varies by agent |

Note: Choose professionals with experience helping foreign buyers. This gives you peace of mind and helps you avoid costly errors.

Portuguese Real Estate Market Tips

Image Source: pexels

Choosing a Location

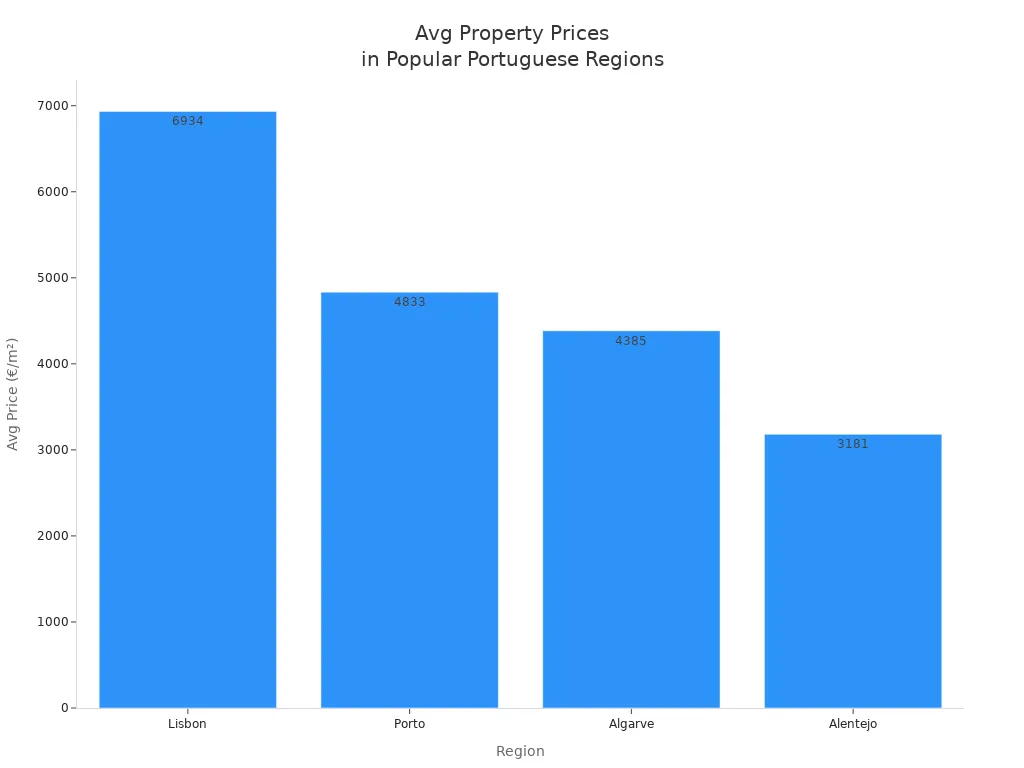

When you start buying property in Portugal, you need to choose the right region for your needs. The portuguese real estate market offers many options. Each area has its own lifestyle, price range, and investment potential. The table below shows popular regions and what makes them attractive:

| Region | Lifestyle & Appeal | Average Price (USD/m²) | Notes |

|---|---|---|---|

| Lisbon | Historic charm, modern life, family-friendly | ~$7,500 | High demand, luxury market |

| Porto | Riverside, beaches, young professionals | ~$5,200 | Growing rental market |

| Algarve | Beaches, golf, sunny weather, retirees | ~$4,700 | Strong rental yields |

| Cascais | Coastal luxury, golf, culture | N/A | Attracts affluent buyers |

| Silver Coast | Quiet, affordable, scenic | N/A | Emerging interest |

| Alentejo | Countryside, vineyards, peaceful | ~$3,400 | Affordable homes |

You should think about climate, lifestyle, safety, and access to schools or healthcare. Many buyers look for strong property investment potential and stable property prices in portugal.

Using Agents

Real estate agents play a key role in the portuguese real estate market. You can use agents to find listings, arrange viewings, and handle paperwork. Agents know the local market and can help you avoid common mistakes when buying property. Always check that your agent is licensed. Good agents explain the process and answer your questions. They also help you compare property prices in portugal and spot good deals.

Tip: Choose agents with experience helping foreign buyers. This makes buying property much easier.

Language and After-Sale Steps

You may face language barriers when buying property. All contracts and legal documents use Portuguese. Many people speak English, but you should never rely only on verbal agreements. Hire a lawyer who understands portuguese real estate market laws. Use professional translation for all documents. This protects you from legal problems.

After you buy, you must:

- Notify the tax office about your new property.

- Register or transfer utilities like water, electricity, and gas.

- Keep all documents, such as the deed and proof of payment, for your records.

These steps help you avoid issues and enjoy your new home in Portugal.

When buying property in Portugal, you benefit from a strong market, high rental returns, and no residency requirement. You should prepare by gathering documents, getting a NIF, and opening a bank account. Professional help from agents and lawyers makes buying property safer and easier.

- Property prices have risen, and popular regions offer unique investment opportunities.

- Taxes like IMI and IMT apply when buying property.

- Legal checks and due diligence protect your investment.

To start buying property, follow these steps:

- Get your NIF and open a bank account.

- Secure financing and set your budget.

- Begin your property search with local experts.

- Hire a lawyer for legal checks and contract review.

Careful planning and expert support help you avoid mistakes and enjoy your new property in Portugal.

FAQ

Can you buy property in Portugal without living there?

Yes, you can buy property in Portugal even if you do not live there. You do not need residency. You only need a Portuguese Tax Identification Number (NIF) and the required documents.

Do you need a lawyer to buy property in Portugal?

You do not have to hire a lawyer, but you should. A lawyer checks legal documents, protects your interests, and helps you avoid mistakes. This step gives you peace of mind.

What taxes do you pay when buying property in Portugal?

You pay Property Transfer Tax (IMT) and Stamp Duty. IMT rates depend on the property’s value. Stamp Duty is 0.8% of the purchase price. You also pay annual Municipal Property Tax (IMI).

Can you get a mortgage as a foreigner in Portugal?

Yes, you can apply for a mortgage as a foreigner. Portuguese banks offer loans to non-residents. You usually need a higher down payment and extra documents, such as proof of income and a valid passport.

When buying property in Portugal, managing your cross-border payments is just as important as legal and tax preparation. Traditional bank transfers often come with high international fees, hidden exchange markups, and slow settlement, all of which can increase your investment costs. With BiyaPay, you get a smarter alternative: remittance fees as low as 0.5%, seamless multi-currency conversions between fiat and digital assets, and coverage across most countries and regions worldwide.

By using real-time exchange rate tracking, you always know you’re getting a transparent and competitive deal. Even better, BiyaPay supports same-day settlement, ensuring your deposits and property payments arrive securely and on time. Join BiyaPay today to make your Portugal property investment smoother and more cost-efficient.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.