- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What You Need to Know About the Cost of Living in America

Image Source: pexels

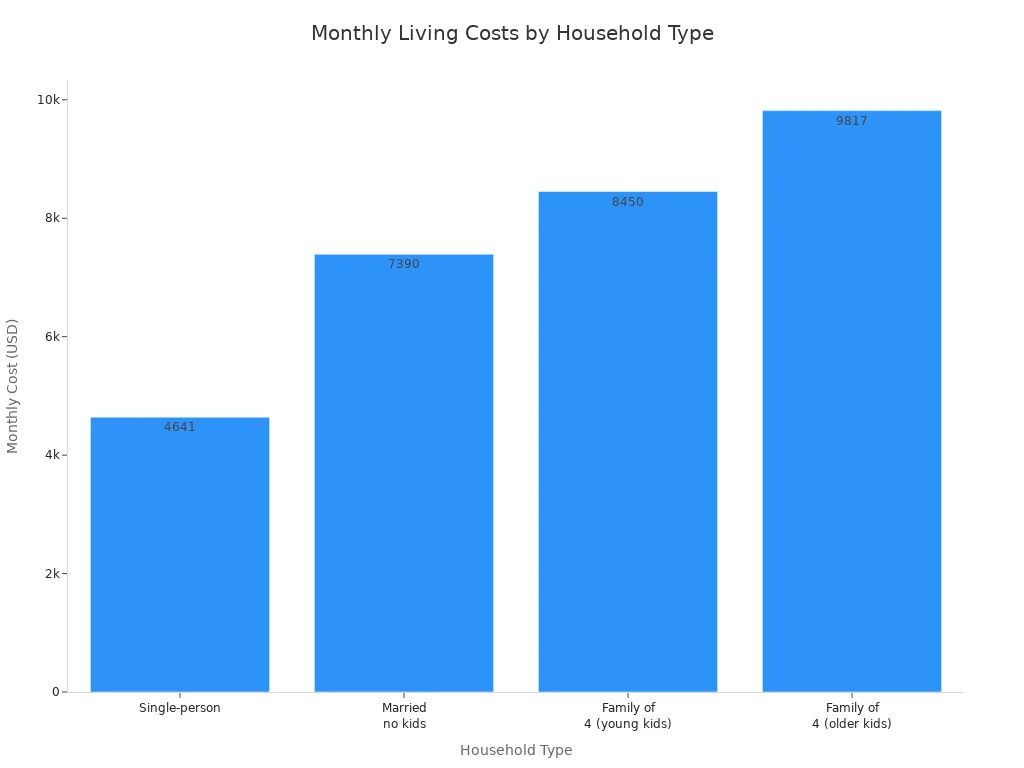

You will notice the cost of living in America varies by household size and lifestyle. On average, a single person spends about $4,641 per month, while a family of four often pays between $8,450 and $9,817 monthly. The average cost of living for most households reaches $6,440 each month, or $77,280 per year.

| Household Type | Monthly Cost (USD) | Yearly Cost (USD) |

|---|---|---|

| Single Person | $4,641 | $55,692 |

| Married, No Kids | $7,390 | $88,680 |

| Family of Four | $8,450 – $9,817 | $101,400 – $117,804 |

Several factors shape the cost of living in the USA. Housing, healthcare, transportation, and food make up the largest living expenses. Government policies, local zoning laws, and your chosen location all play a major role in the typical cost of living in America. You should expect the cost of living to increase with family size and lifestyle choices. The typical cost of living in America often reflects these differences.

Key Takeaways

- Housing, transportation, food, utilities, and healthcare make up most of your living expenses in America.

- The cost of living varies widely by state and city, with coastal and urban areas generally costing more than rural and Midwestern states.

- Using online cost of living calculators helps you plan your budget and compare expenses before moving.

- Tracking your spending and adjusting your budget regularly can help you manage costs and avoid surprises.

- Choosing affordable locations and lifestyle habits like cooking at home and using public transit can lower your monthly expenses.

Average Cost of Living

Image Source: pexels

Monthly and Yearly Averages

You may wonder how much you need each month to cover your basic needs in the United States. The average monthly cost of living for a single person ranges from $4,641 to $4,948. This figure includes all major expenses, such as housing, transportation, healthcare, food, and utilities. If you look at the yearly total, you will spend between $55,692 and $59,376. For families, the cost of living in the USA rises quickly, especially when you add children or choose a larger home.

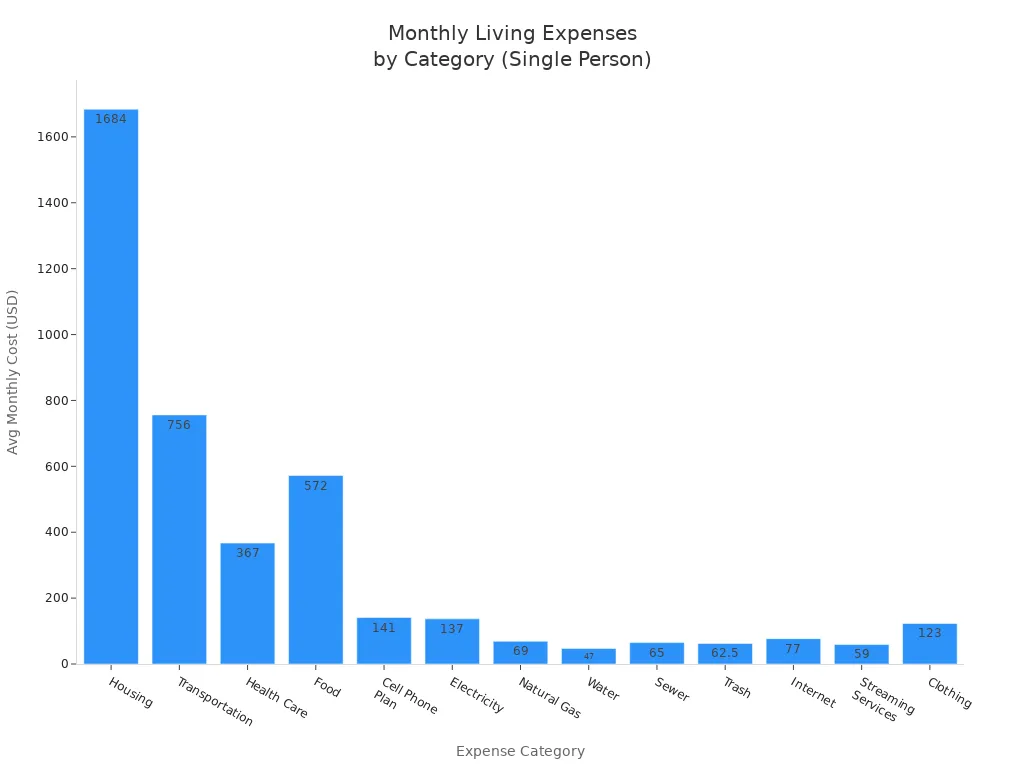

Here is a breakdown of average monthly expenses for a single person:

| Expense Category | Average Monthly Cost (Single Person, 2023-2024) |

|---|---|

| Total Monthly Expenses | $4,641 to $4,948 |

| Housing | $1,684 |

| Transportation | $756 |

| Health Care | $367 |

| Food | $572 |

| Cell Phone Plan | $141 |

| Electricity | $137 |

| Natural Gas | $69 |

| Water | $47 |

| Sewer | $65 |

| Trash | $62.50 |

| Internet | $77 |

| Streaming Services | $59 |

| Clothing | $123 |

You can see these numbers in the cost of living chart below, which shows how each category contributes to your total monthly cost of living.

The average monthly costs for families are higher, but the main categories remain the same. The typical cost of living in America depends on your household size and lifestyle choices.

Main Influencing Factors

Several factors shape the cost of living in the USA. Where you live matters most. Cities like New York or San Francisco have much higher housing costs than smaller towns or rural areas. Housing is the largest part of your monthly cost of living. In some cities, rent can be double or even triple the national average.

Transportation also affects your budget. If you live in a city with good public transit, you may spend less on cars and fuel. In car-dependent areas, you will pay more for gas, insurance, and parking. Healthcare costs change by state and city. Some places have higher insurance premiums or medical fees.

Food prices depend on local supply and demand. Eating out often or buying specialty foods will increase your average monthly expenses. Utilities, such as electricity and water, can cost more in regions with extreme weather. Taxes, including income and property taxes, also impact your overall cost of living.

Your lifestyle choices play a big role. If you prefer to dine out, travel, or live in a trendy neighborhood, your average monthly costs will rise. Using a cost of living chart or calculator helps you compare expenses in different locations. Always consider your income, job market, and personal needs when planning your budget.

Cost of Living in the USA: Key Expenses

Housing Cost in the USA

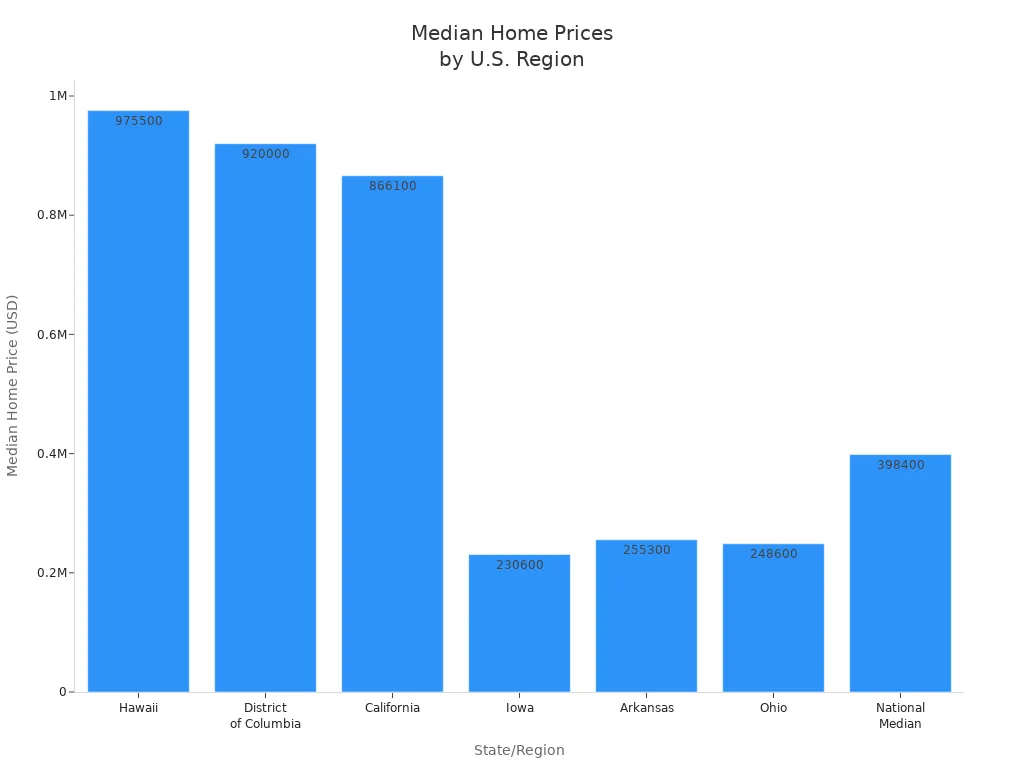

Housing is the largest part of your cost of living. On average, you spend about 34.9% of your monthly budget on housing. The housing cost in the usa changes a lot depending on where you live. If you look at the national median home price, it is about $398,400 in early 2025. Some states are much more expensive. For example, Hawaii has a median home price of around $975,500, and California is close behind at $866,100. In more affordable states like Iowa or Ohio, the median home price is about $230,600 to $248,600.

| State | Median Home Price (USD) |

|---|---|

| Hawaii | $975,500 |

| District of Columbia | $920,000 |

| California | $866,100 |

| Iowa | $230,600 |

| Arkansas | $255,300 |

| Ohio | $248,600 |

| National Median | $398,400 |

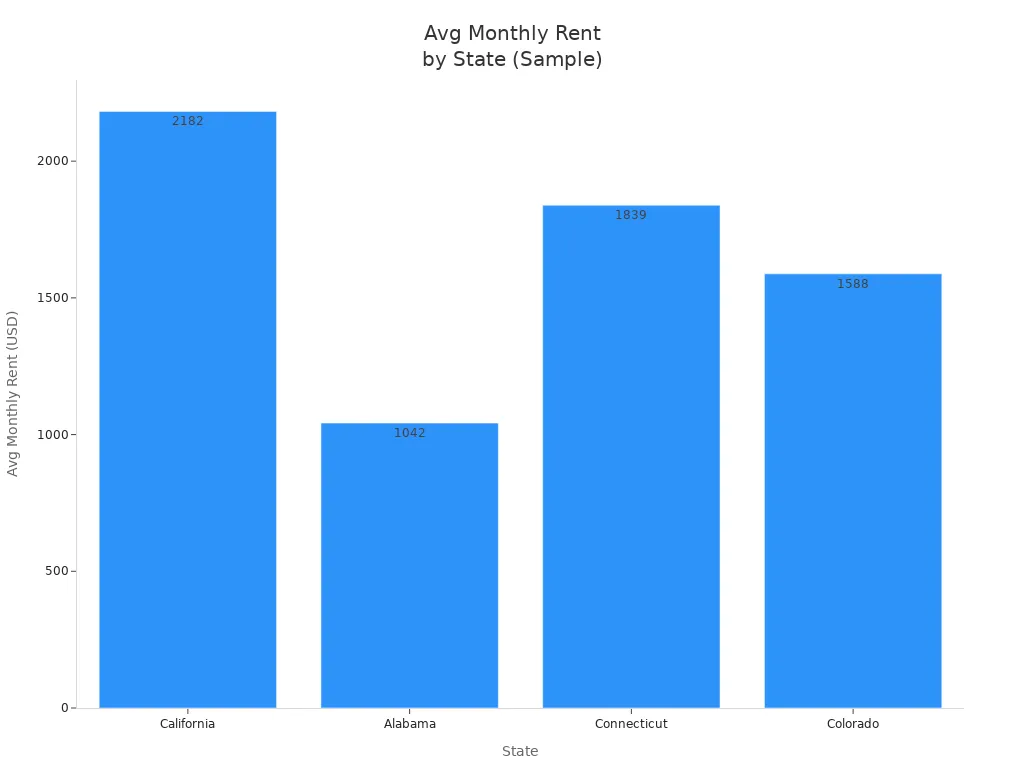

If you rent, the average rent for a one-bedroom apartment also depends on your state. In California, the average rent is about $2,182 per month. In Alabama, you pay around $1,042. Connecticut and Colorado have average rents of $1,839 and $1,588. The housing cost in the usa is highest in coastal and urban areas.

| State | Average Rent (USD, 1-Bedroom) |

|---|---|

| California | $2,182 |

| Alabama | $1,042 |

| Connecticut | $1,839 |

| Colorado | $1,588 |

You should expect to pay more for rent for a one-bedroom apartment in big cities. In smaller towns, the average rent is lower. Housing costs take up the biggest share of your budget, so always check local prices before you move.

Food and Groceries

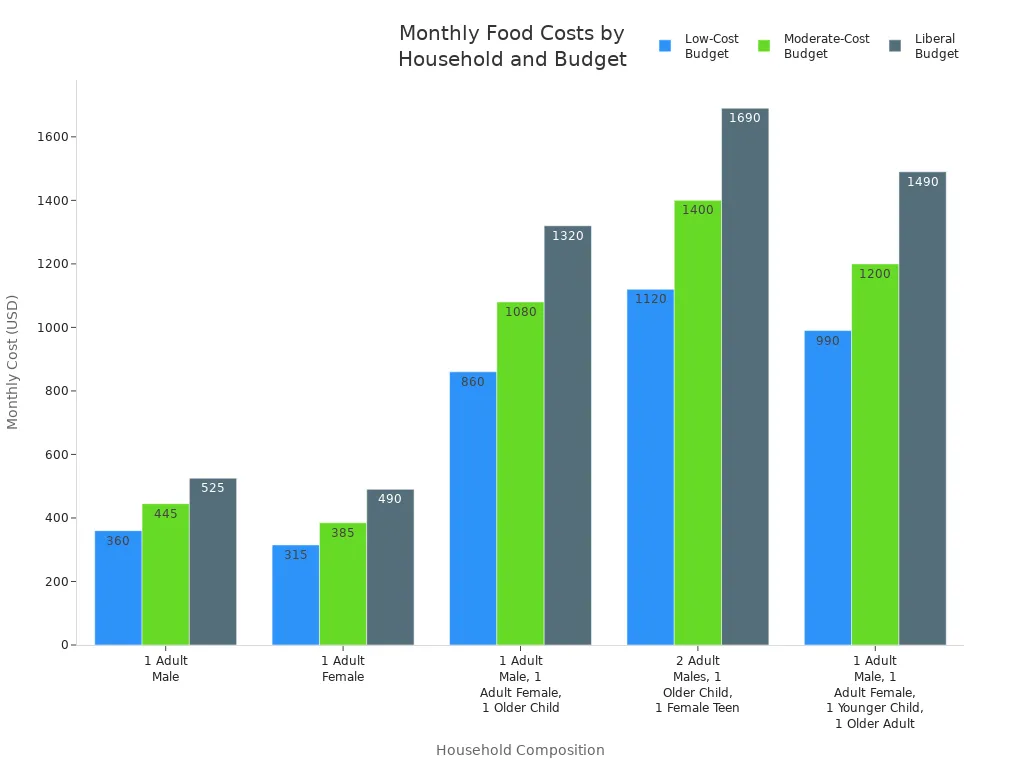

Food cost in usa is another key part of your budget. Your monthly grocery bill depends on your family size and eating habits. For a single adult male, you spend about $445 per month on groceries. A single adult female spends around $385. If you have a family of four, your monthly food cost in usa is about $1,360 on a moderate budget.

| Household Composition | Low-Cost Budget | Moderate-Cost Budget | Liberal Budget |

|---|---|---|---|

| 1 Adult Male | $360 | $445 | $525 |

| 1 Adult Female | $315 | $385 | $490 |

| Family of Four (2 adults, 2 children) | $1,076 | $1,360 | $1,603 |

Your actual spending may be higher if you eat out often or buy specialty foods. The average cost of living for food and entertainment costs can rise quickly in large cities or if you have special dietary needs.

Transportation

Transportation costs in the usa are the second largest part of your budget after housing. On average, you spend about $13,174 per year on transportation, which is about 16% of your household expenses. Most of this money goes to owning and running a car. You pay for gas, insurance, maintenance, and car payments. If you use public transit, your costs are usually lower, but many cities do not have good public transportation.

| Aspect | Data / Description |

|---|---|

| Average annual transportation cost per household | $12,295 to $13,174 |

| Share of household expenditures | 16% |

| Main contributors | Vehicle purchase, fuel, insurance, maintenance (93%) |

| Public transit spending | Lower than private vehicle costs |

Low-income households spend up to 38% of their income on transportation costs in the usa, while high-income households spend about 10%. If you live in a rural area, you travel more and spend a bigger share of your income on transportation. Rural households often spend about 60% of their income on housing and transportation together. If you do not own a car, your transportation costs drop, but many rural areas have limited options.

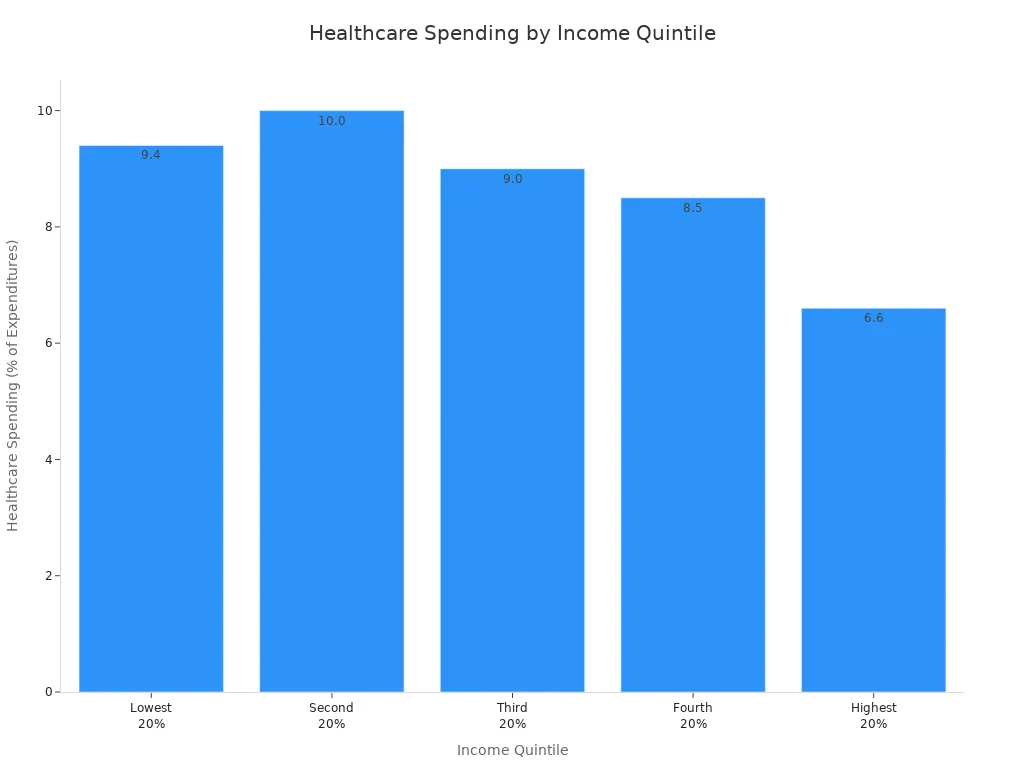

Healthcare

Healthcare costs are a major part of your cost of living. The average household spends about 9% of its budget on healthcare. If you have employer health insurance, your median out-of-pocket spending is about $800 per year, but some families pay much more. The average monthly health insurance premium is about $477 for a family, but this number changes by state. For example, you pay $346 per month in Maryland and $950 in Vermont.

| Income Quintile | Healthcare Spending (% of Total Household Expenditures) |

|---|---|

| Lowest 20% | 9.4% |

| Second 20% | 10.0% |

| Third 20% | 9.0% |

| Fourth 20% | 8.5% |

| Highest 20% | 6.6% |

Healthcare costs depend on your age, health, and where you live. If you have chronic health problems or live in a state with high premiums, you pay more. Medicare households spend a higher share of their budget on healthcare costs than non-Medicare households.

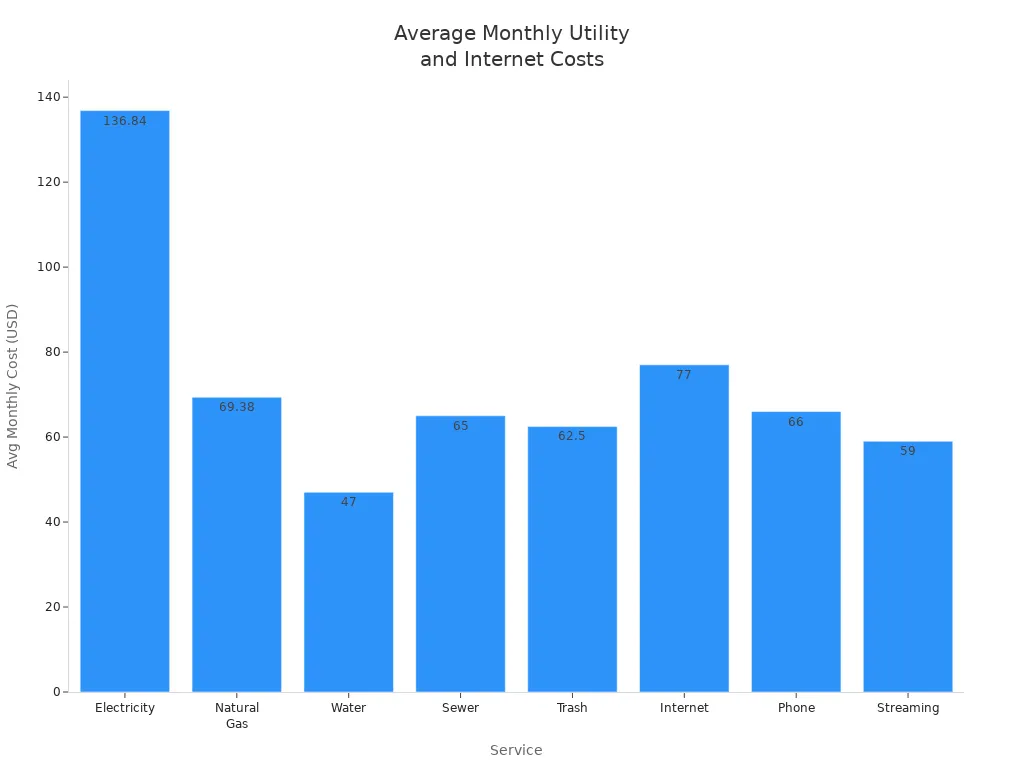

Utilities and Internet

Utilities cost in usa includes electricity, gas, water, sewer, trash, internet, and phone. The average monthly utility bill is about $583. Electricity costs about $137 per month, natural gas is $69, water is $47, and sewer is $65. Internet service averages $77 per month.

| Service | Average Monthly Cost (USD) |

|---|---|

| Electricity | $136.84 |

| Natural Gas | $69.38 |

| Water | $47 |

| Sewer | $65 |

| Trash | $62.50 |

| Internet | $77 |

| Phone | $66 |

| Streaming | $59 |

| Total | $583 |

Utilities cost in usa changes by state. For example, Idaho has the lowest average utility bill at $495 per month, while Connecticut has the highest at $794. States with cold winters or high electricity rates usually have higher bills. Internet and cable costs are higher in some states, such as Alaska and New Mexico.

Miscellaneous

Miscellaneous expenses in usa cover things like gifts, subscriptions, clothing, and personal care. These costs do not fit into other categories, but they add up. You might spend $100 to $200 per month on miscellaneous expenses in usa, depending on your lifestyle.

| Miscellaneous Expense Category | Average Monthly Cost Range (USD) |

|---|---|

| Entertainment | $15 to $100+ per event or ticket |

| Clothing | $10 to $150+ per item |

| Personal Care | $3 to $50+ per item |

Tip: To manage these costs, review your past spending, list all your miscellaneous expenses, estimate each cost, add a 10% buffer, and divide by 12 to set a monthly budget.

These expenses are predictable but may not happen every month. Planning for them helps you avoid surprises in your budget.

Cost of Living by State

Image Source: pexels

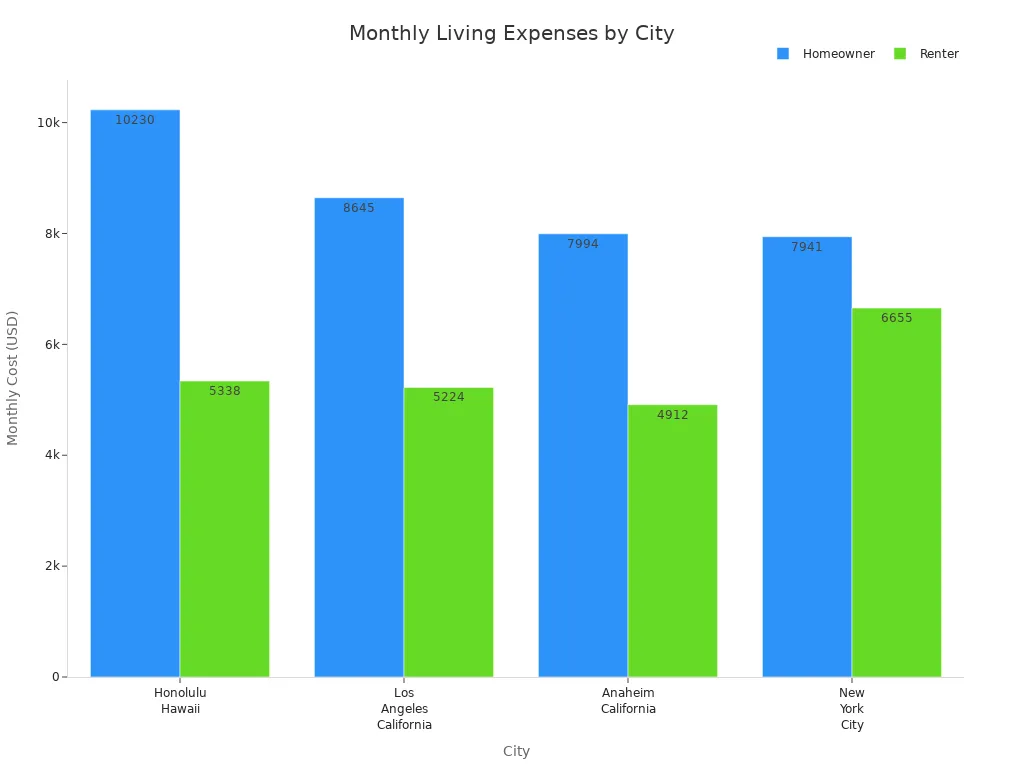

Most Expensive States

You will notice that the cost of living by state can change a lot, especially in the most expensive cities. States like Hawaii, Massachusetts, and California have the highest average annual costs. Housing is the main reason for these high prices. In Hawaii, you pay about $55,491 per year, while California and New York also have high costs due to expensive housing, food, and transportation.

| Rank | State | Average Annual Cost of Living (USD) |

|---|---|---|

| 1 | Hawaii | $55,491 |

| 2 | Massachusetts | $53,860 |

| 3 | California | $53,171 |

| 4 | New York | $49,623 |

| 5 | New Jersey | $49,511 |

If you look at the most expensive cities, you see even higher monthly costs. For example, living in Honolulu, Hawaii, as a homeowner costs about $10,230 per month. In Los Angeles, California, the monthly cost is $8,645 for homeowners. Renters in New York City pay around $6,655 each month.

| City | State | Monthly Cost (Homeowner) | Monthly Cost (Renter) |

|---|---|---|---|

| Honolulu | Hawaii | $10,230 | $5,338 |

| Los Angeles | California | $8,645 | $5,224 |

| New York City | New York | $7,941 | $6,655 |

Housing, taxes, and transportation drive up the cost of living per state in these areas. You will find that coastal states and urban centers have the highest costs.

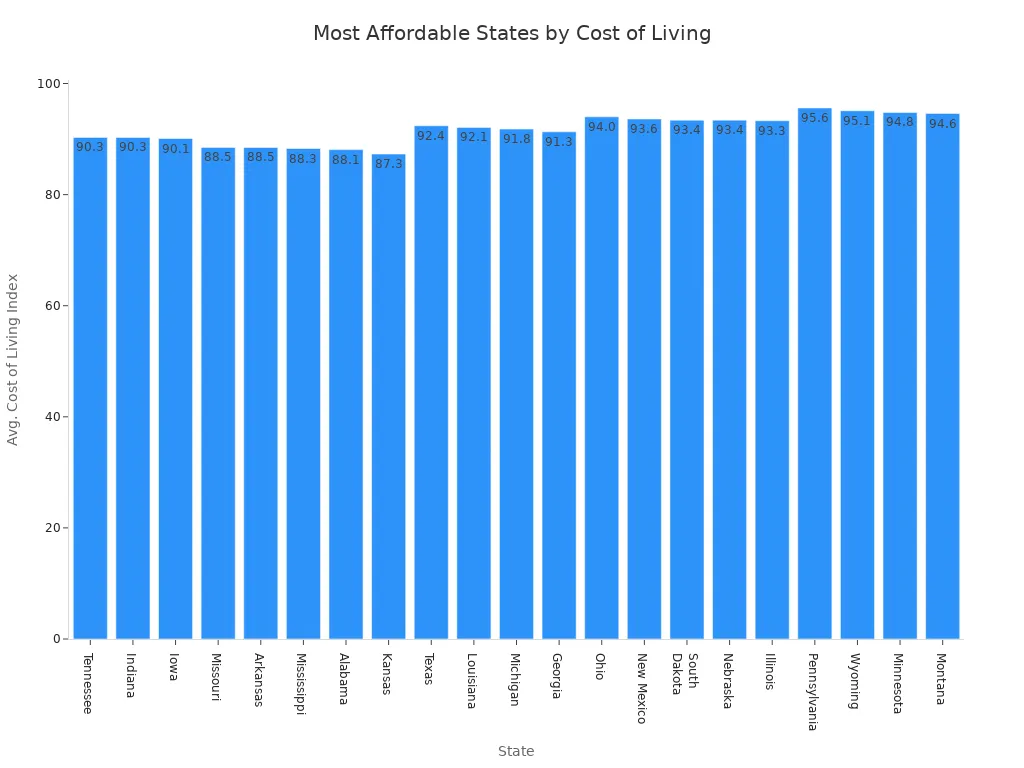

Most Affordable States

You can find affordable places to live by looking at the cost of living by state in the Midwest and South. States like Arkansas, Mississippi, and Indiana have much lower costs. For example, Arkansas has a cost of living index of 88.5, which is about 11.5% below the national average. Housing, groceries, and transportation are all cheaper in these states.

| State | Cost of Living Index | Housing | Transportation | Utilities | Notes |

|---|---|---|---|---|---|

| Arkansas | 88.5 | 74.9 | 88.2 | 90.7 | Low housing and grocery costs |

| Indiana | 90.3 | 77.8 | 94.8 | 90.4 | Affordable housing, low income tax |

| Mississippi | 88.3 | 75.2 | 89.7 | 90.7 | Low housing, groceries, and transportation |

| Missouri | 88.5 | 77.7 | 84.0 | 98.5 | Lowest transportation costs |

| Alabama | 88.1 | 69.4 | 91.2 | 100.7 | Low health care and home prices |

In these states, the cost of living per state is often 10-15% below the national average. You will pay less for rent, groceries, and transportation. This makes these states attractive if you want to save money or need a lower budget.

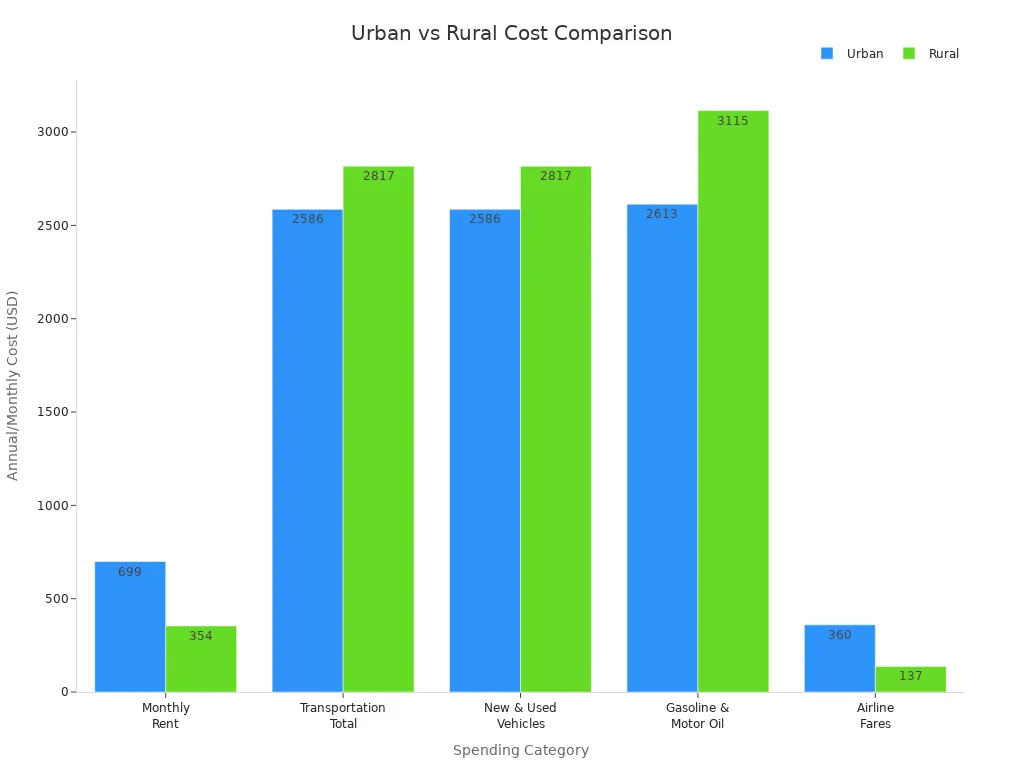

City vs. Rural Costs

The cost of living by state also depends on whether you live in a city or a rural area. Cities have higher housing costs because of demand and limited space. For example, urban rent averages $699 per month, while rural rent is about $354. Food and dining out cost more in cities, but you may save on transportation if you use public transit.

| Category | Urban Cost (USD) | Rural Cost (USD) | Notes |

|---|---|---|---|

| Monthly Rent | $699 | $354 | Urban rent nearly double |

| Transportation | $2,586 | $2,817 | Rural areas spend more on cars |

| Gasoline | $2,613 | $3,115 | Rural households spend more |

You will find that rural areas offer lower housing and food costs, but you may spend more on transportation because you need a car. City living can be more expensive overall, but public transit and higher wages can help balance the cost of living comparison. Always use a cost of living chart to compare your options before you move.

Estimating Your Cost of Living

Online Calculators and Tools

You can estimate your expenses more accurately by using cost of living calculators. These tools help you compare costs in different cities and states. They also break down your spending into categories like housing, food, and transportation. Here are some of the most reliable cost of living calculators available:

| Calculator Name | Provider | Key Features | Coverage/Scope | Reliability Basis |

|---|---|---|---|---|

| Family Budget Calculator | Economic Policy Institute | Estimates community-specific costs for 10 family types; monthly and annual budgets; detailed data | All U.S. counties and metro areas | Backed by reputable economic research institute |

| Living Expenses Calculator | New York Life | Itemizes monthly expenses across many categories including housing, utilities, debts, insurance | Personal monthly expenses | Provided by a major financial services company |

| Budget Calculator | Calculator.net | Offers budget templates and links to related calculators (tax, retirement, income, etc.) | Personal budgeting and financial planning | Widely used free online tool with comprehensive features |

You should try several cost of living calculators to see which one fits your needs best. These calculators give you a clear picture of your monthly and yearly expenses.

Budgeting Tips

Managing your money well starts with a good plan. You can use these steps to keep your spending under control:

- Track your spending to see where your money goes each month.

- Categorize your expenses into needs, wants, and values.

- Spend only on what matches your personal values.

- Review your subscriptions and services to cut unnecessary costs.

- Avoid impulse purchases by focusing on your financial goals.

- Save on interest by refinancing loans or making extra payments.

- Build an emergency fund for unexpected expenses.

- Adjust your budget regularly to match changes in your life.

Tip: If you feel overwhelmed, seek help from a financial expert. You can also use cost of living calculators to review your budget and spot areas for improvement.

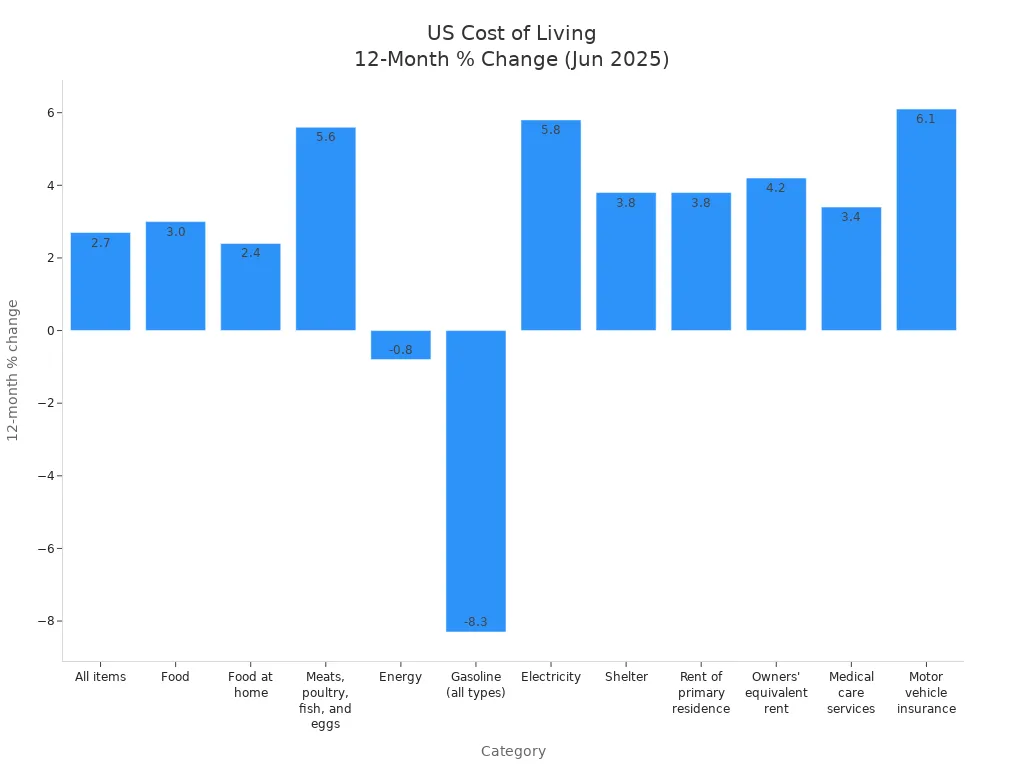

Resources for Updates

The cost of living changes often. You need to stay updated to manage your budget well. The Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) website gives you the latest data on price changes for housing, food, energy, and more. The Social Security Administration (SSA) also uses this data to set the cost of living adjustment for benefits.

You can check these sites each month to see how prices change. Major categories like housing and food often change every year, but the CPI updates monthly. This helps you adjust your budget quickly when prices rise or fall. Cost of living calculators often use this data, so you get the most accurate results.

You need to understand that the cost of living in America changes by location and lifestyle. Housing, transportation, food, utilities, and healthcare make up most of your expenses. When you plan a move or create a budget, research your new city, compare costs, and use online calculators.

- Start your financial planning early.

- Include all possible expenses, such as moving costs and utility setup fees.

- Adjust your budget as prices change.

Review your spending often. Careful planning helps you feel confident and ready for your next step.

FAQ

How can you lower your cost of living in America?

You can save money by choosing a less expensive city or state, using public transportation, cooking at home, and sharing housing. Review your monthly bills and cut unnecessary expenses. Compare prices before making big purchases.

What is the biggest expense for most people in the USA?

Housing takes up the largest part of your budget. On average, you spend about 34.9% of your income on rent or mortgage payments. Always check local housing prices before you move.

Do healthcare costs vary by state?

Yes, healthcare costs change from state to state. Some states have higher insurance premiums and medical fees. You should compare health plans and check average costs in your area before choosing coverage.

Are there free tools to help you estimate your cost of living?

You can use online calculators like the Economic Policy Institute’s Family Budget Calculator or Calculator.net’s Budget Calculator. These tools help you estimate your monthly and yearly expenses based on your location and lifestyle.

Living in America comes with high costs for housing, healthcare, and transportation. For many international families, sending money abroad through traditional banks only adds pressure — with remittance fees that climb far above 0.5%, slow settlement, and hidden exchange markups. BiyaPay solves these pain points by offering remittance fees as low as 0.5%, seamless multi-currency conversion between fiat and digital assets, coverage across most countries and regions worldwide, and same-day settlement.

With real-time exchange rate tracking, you always know you’re getting the best deal and can plan your expenses more effectively. Whether you support family overseas, pay tuition, or manage investments, BiyaPay helps you save both money and time. Start today by registering with BiyaPay and make international transfers as effortless as local ones.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.