- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

4 Smart Ways to Send Money Internationally in 2025

Image Source: unsplash

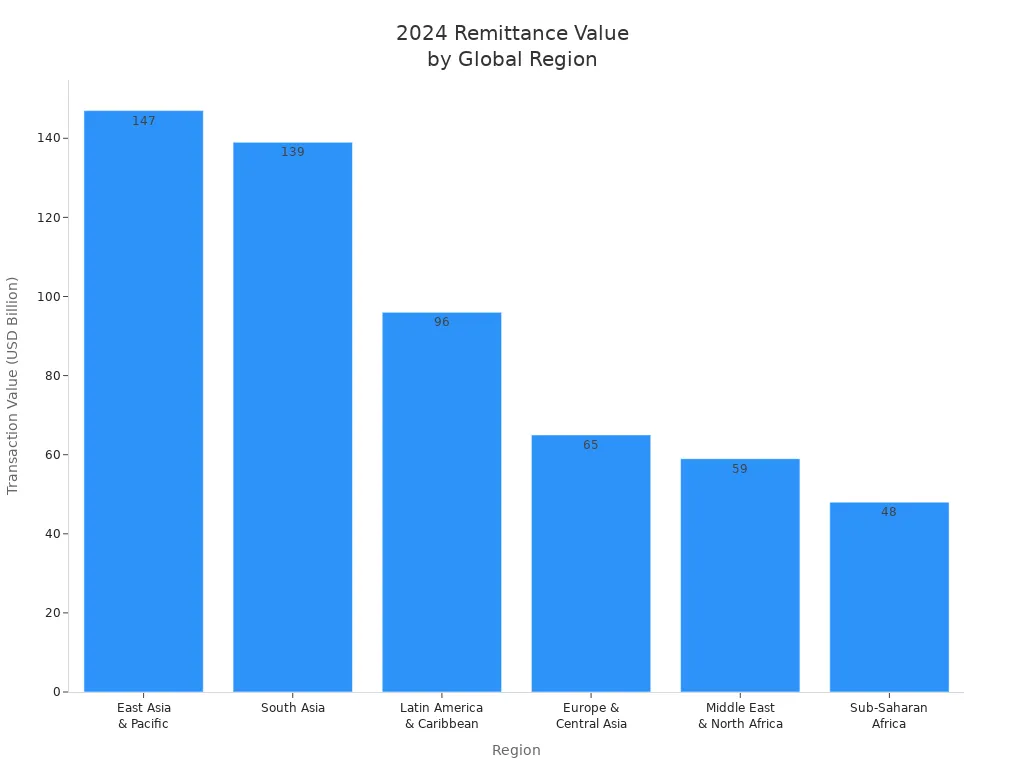

When you are sending money internationally in 2025, you have four smart options: online money transfer services, international wire transfers, cash transfer services, and cryptocurrency. Each method offers a unique combination of cost, speed, security, and convenience. Many people sending money internationally do so to support family with daily expenses, pay tuition, or cover medical bills. The global remittance market reached USD 750 billion in 2023, highlighting how essential sending money internationally has become for millions.

Consider the amount you’re sending, the destination, how quickly the funds need to arrive, and how your recipient will access the money. Each option suits different needs, so keep your personal situation in mind as you explore the best way of sending money internationally.

Key Takeaways

- You can send money internationally using online services, wire transfers, cash transfer services, or cryptocurrency, each with unique benefits.

- Online services offer fast transfers with low fees and convenience, making them great for everyday needs and emergencies.

- International wire transfers provide strong security and suit large payments but may take longer and cost more.

- Cash transfer services let recipients get cash quickly without a bank account, ideal for urgent or small transfers.

- Cryptocurrency moves money almost instantly with low fees but requires both sender and receiver to understand digital wallets.

Online Services for Sending Money Internationally

Image Source: pexels

How It Works

When you use an online money transfer service, you can send funds to over 70 countries right from your phone or computer. Payment platforms like Wise, PayPal, Xoom, and OFX let you create an account, enter the recipient’s details, and choose how much you want to transfer. Wise uses the mid-market exchange rate and charges a low, clear fee. PayPal adds a currency conversion fee and a surcharge, and your recipient usually needs a PayPal account. OFX is great for large transfers, with no maximum limit and a minimum of $1,000 USD. These payment platforms process your transfer by moving money locally in both the sending and receiving countries, which helps avoid extra costs and delays.

Here’s a quick look at some leading services:

| Service | Exchange Rate Policy | Fee Structure | Transaction Highlights |

|---|---|---|---|

| Wise | Mid-market rate, no markup | Low, transparent fee (from 0.33%) | Local payout, no recipient account needed |

| OFX | Small markup | No transfer fee, possible bank fees | Best for large transfers, $1,000 USD minimum |

| PayPal | 4% conversion fee | 5% surcharge | Recipient needs PayPal account |

Pros

- You can send money anytime, anywhere, using your phone or computer.

- Most payment platforms offer lower transfer fees than banks, saving you money.

- Transfers are fast, often arriving within minutes or hours.

- You get real-time updates and notifications.

- Many services use strong security features to protect your money.

Cons

- Some services have hidden transfer fees or less favorable exchange rates.

- Security risks exist, like phishing or hacking, especially if you use weak passwords or public Wi-Fi.

- Technical issues, such as app outages or slow internet, can delay your transfer.

- You may not get personal help if you have a problem, since support is often automated.

- New users might find payment platforms confusing at first.

Best For

Online money transfer services work best when you want speed, low transfer fees, and convenience. If you need to send money for family support, pay for school, or handle emergencies, these platforms are a smart choice. They are also great for both small and large transfers, and for people who want to avoid the high costs of banks. If your recipient has a bank account or a digital wallet, you can use these services for sending money internationally with confidence.

International Wire Transfer

How It Works

You might choose an international wire transfer when you want to move money directly from your bank account to someone else’s bank account in another country. Here’s how the process usually works:

- You give your bank the recipient’s name, account number, and bank details, like the IBAN or SWIFT code.

- Your bank checks your account balance and verifies the transfer details.

- The bank sends your money through a network such as SWIFT.

- Sometimes, the money passes through other banks before reaching the recipient’s bank.

- The recipient’s bank gets the instructions and puts the money into their account.

- Both you and the recipient get notified when the transfer is complete.

- The banks settle the funds between themselves.

International wire transfer fees can be high, and the process usually takes 1 to 5 business days. The time depends on the destination, the number of banks involved, and the time zones.

Pros

- You can send large amounts of money securely.

- Banks use strong security measures, like multi-factor authentication and encrypted channels, to protect your transfer.

- This method works well for business payments or when you need to send money to someone’s bank account.

- You get confirmation when the transfer is complete.

Cons

- International wire transfer fees can reach $50 or more, and you might pay extra for currency conversion or intermediary banks.

- Transfer fees are often higher than online services.

- The process can be slow, sometimes taking several days.

- You may get less money on the other end because of less favorable exchange rates and hidden costs.

- Filling out the transfer form can be tricky, and mistakes can cause delays.

Tip: Always double-check the recipient’s banking details to avoid errors and extra fees.

Best For

International wire transfer is best when you need to send large sums, like paying for property or business deals. It’s also a good choice if you want strong security and need to send money directly to a bank account. If you are sending money internationally to a trusted recipient and need to move a high-value payment, this method gives you peace of mind.

Cash Transfer Services

How It Works

Cash transfer services like Western Union and MoneyGram make it easy for you to send money to almost any country. You can use their website, app, or visit an agent location. Here’s how you send money with a money transfer service like MoneyGram:

- Create or log into your account online or in the app.

- Choose the country and amount you want to send.

- Enter your recipient’s full legal name.

- Pick how your recipient will get the money—cash pickup, bank deposit, or mobile wallet.

- Pay with your bank account, credit card, debit card, or cash at an agent.

- Double-check the details and send the transfer.

- Share the reference number with your recipient for pickup.

If you go to a physical location, bring your photo ID and pay in cash. Your recipient can pick up the money at one of hundreds of thousands of agent locations worldwide, often within minutes.

Note: You and your recipient can track the transfer online using a unique tracking number.

Pros

- You can send money to over 200 countries, even if your recipient does not have a bank account.

- Cash pickup is fast—sometimes instant or within a few hours.

- Many agent locations are open late or on weekends, making it easy for your recipient to collect cash.

- You can pay in different ways, including cash, card, or bank transfer.

- Security features like encryption and fraud prevention help protect your money.

| Provider | Countries Covered | Agent Locations / Cash Pickup Availability |

|---|---|---|

| Western Union | Almost any | 500,000+ agent locations worldwide |

| Ria Money Transfer | 190+ | Banks, retail stores, supermarkets, convenience shops |

| Remitly | 100+ | Multiple payout options including cash pickup |

Cons

- Fees can be high, especially if you pay by credit card or send to certain countries.

- Exchange rates may not match the mid-market rate, so your recipient might get less money.

- Transfer limits apply, especially for unverified accounts (for example, $3,000 USD for MoneyGram).

- Risks include fraud, scams, and money laundering if you do not use trusted providers.

- Some countries or rural areas may have fewer agent locations, making pickup harder.

Tip: Always use a trusted provider and keep your transfer receipt until your recipient gets the money.

Best For

Cash transfer services work best when your recipient needs cash fast and does not have a bank account. If you are sending money internationally to family or friends in places with limited banking, this is a great choice. These services are also helpful for small, urgent transfers or when you want your recipient to collect cash right away.

Cryptocurrency for International Money Transfer

Image Source: pexels

How It Works

You can send money across borders using cryptocurrency by moving digital coins like Bitcoin, Ethereum, or stablecoins from your wallet to your recipient’s wallet. This process happens on a blockchain, which is a public digital ledger. You do not need banks or middlemen. You just need internet access and a crypto wallet. When you start a transfer, the blockchain records it almost instantly. Most transfers finish in minutes, even if you send money to someone on the other side of the world.

Here’s a quick comparison of crypto and traditional transfers:

| Aspect | Traditional Wire Transfers | Cryptocurrency Transfers |

|---|---|---|

| Intermediaries | Multiple banks | Peer-to-peer on blockchain |

| Processing Time | 3-5 business days | Minutes |

| Fees | High (around 6%) | Low (often under 1%) |

| Accessibility | Needs bank account | Needs internet and crypto wallet |

| Security Model | Bank security | Blockchain security, user-managed |

| Recipient Requirements | Bank account | Crypto wallet, ability to convert to local currency |

Pros

- You can send money almost instantly, 24/7, no matter where you or your recipient live.

- Fees are much lower than banks, often less than $1 USD per transfer.

- Blockchain technology keeps your transfer secure and transparent. Anyone can check the transaction on the public ledger.

- You do not need a bank account, which helps people in areas with limited banking.

- Stablecoins, like USDC or Tether, help avoid big price swings, making transfers more predictable.

| Benefit | Explanation |

|---|---|

| Faster speeds | Transfers settle in minutes, not days. |

| Lower fees | Most transfers cost just a few cents or dollars. |

| Greater access | Anyone with internet and a wallet can use it. |

| Security | Blockchain and cryptography protect your money. |

| Transparency | Public ledger lets you track every transfer. |

Cons

- You and your recipient need to understand how crypto wallets work. Mistakes can lead to lost funds.

- Crypto prices can change quickly. If you use coins like Bitcoin, the value might drop before your recipient cashes out.

- Some countries have unclear rules about crypto. This can make it hard to use or cash out your money.

- Scams and hacks happen. You must keep your wallet and passwords safe.

Tip: Use stablecoins for less risk, and always double-check wallet addresses before sending.

Best For

Cryptocurrency works best for you if you want a fast, low-cost international money transfer and your recipient has a crypto wallet. It helps people in places with weak banking systems or where banks charge high fees. Stablecoins are great if you want to avoid price swings. Crypto is also popular for tech-savvy users and businesses that need to move money across borders quickly.

Comparison of Ways to Send Money Internationally

Choosing the right way to send money can feel tricky. Let’s break down the main differences between online services, international wire transfer, cash transfer services, and cryptocurrency. This will help you see which method fits your needs best.

Fees & Exchange Rates

You want to keep more of your money, so looking at transfer fees and exchange rates is important. Online services like Wise usually have low, clear fees (about 0.57%) and use the mid-market rate. Xoom and OFX may charge higher fees or mark up the exchange rate. Cash transfer services, such as Western Union and MoneyGram, often have higher fees and less favorable rates. International wire transfer can cost even more, with wire transfer fees sometimes reaching $50 or more. Banks may also add extra charges for currency conversion.

| Method | Typical Transfer Fees | Exchange Rate Practice |

|---|---|---|

| Online Services | Low to moderate (0.5%-2%) | Mid-market or small markup |

| International Wire Transfer | High ($30-$50+) | Bank-set, often less favorable |

| Cash Transfer Services | High, varies by country | Often less favorable |

| Cryptocurrency | Low (often under $1) | Market-driven, can be volatile |

Note: Always check both the transfer fees and the exchange rate before you send money.

Speed

Speed matters, especially in emergencies. Online services like Xoom can deliver money within minutes. Wise and MoneyGram usually take 1-2 business days. International wire transfer often takes 1-3 business days, but delays can happen if banks need more time. Cryptocurrency transfers can be almost instant, but your recipient needs to know how to use a crypto wallet.

| Method | Average Speed |

|---|---|

| Online Services | Minutes to 2 days |

| International Wire Transfer | 1-3 business days |

| Cash Transfer Services | Minutes to next business day |

| Cryptocurrency | Minutes |

Security

You want your money to arrive safely. International wire transfer is one of the safest ways to send money. Banks use strong encryption and control the process. Still, mistakes like sending to the wrong account can’t be reversed. Cash transfer services and online platforms also use security tools, but scams and fraud can happen. Cryptocurrency uses blockchain for security, but you must protect your wallet and passwords.

- International wire transfer offers strong security with bank controls.

- Online and cash services use encryption and fraud checks.

- Cryptocurrency is secure if you use it correctly, but mistakes are hard to fix.

Always double-check recipient details and use trusted providers to stay safe.

Accessibility

You want your recipient to get the money easily. Online services and mobile apps work well in many countries, even where banks are hard to find. Cash transfer services let people pick up cash at thousands of locations. International wire transfer needs a bank account, which can be a problem in some places. Cryptocurrency works anywhere with internet, but your recipient must have a crypto wallet and know how to use it.

Mobile money and digital platforms make it easier for people in developing countries to receive funds. Many people now use mobile wallets instead of banks.

| Method | Accessibility Highlights |

|---|---|

| Online Services | Bank account or mobile wallet needed |

| International Wire Transfer | Bank account required |

| Cash Transfer Services | Cash pickup, wide coverage |

| Cryptocurrency | Internet and wallet needed |

Choosing the Best International Money Transfer Method

Key Factors

When you want to send money across borders, you need to think about a few important things. Each method, like an international wire transfer, has its own strengths and weaknesses. Here are some key points you should look at before making your choice:

- Ease of use: Some ways, like an international wire transfer, need more paperwork or technical knowledge. Others, like online services, are simple and quick.

- Transfer speed: You might need your money to arrive fast. An international wire transfer can take a few days, while cryptocurrency or cash transfer services can be much quicker.

- Fees and exchange rates: Always check the total cost. An international wire transfer often has higher fees and less favorable exchange rates than online services.

- Security: You want your money to be safe. An international wire transfer is usually very secure, but you should still double-check all details.

- Documentation: Banks, especially in Hong Kong, may ask for extra documents for an international wire transfer. This can slow things down.

- Customer support: If you send a large amount, you want good help. An international wire transfer usually comes with strong support from your bank.

- Purpose of transfer: Some transfers, like gifts or business payments, may have special fees or rules.

- Country and amount: Rules and limits change by country. An international wire transfer may have higher limits, but also more checks.

Here’s a table to help you compare:

| Factor | Why It Matters |

|---|---|

| Exchange Rates | Affects how much your recipient gets. |

| Fees | Can add up, especially with an international wire transfer. |

| Speed | Some methods are instant, others take days. |

| Security | An international wire transfer is very secure, but always check details. |

| Ease of Use | Some methods are easier to use than others. |

| Documentation | Banks may need ID or extra forms for an international wire transfer. |

| Customer Support | Good support helps if you have questions or problems. |

| Country & Amount | Rules and limits can change your options. |

Quick Checklist

You can use this checklist to pick the best way to send money:

- Do you need to send a large amount? An international wire transfer might be best.

- Does your recipient have a bank account? If yes, an international wire transfer or online service works well.

- Is speed important? If you need fast delivery, cash transfer or crypto may be better than an international wire transfer.

- Are you worried about security? An international wire transfer offers strong protection.

- Do you want low fees? Compare all costs, since an international wire transfer can be expensive.

- Does your bank in Hong Kong require extra documents? Be ready for paperwork with an international wire transfer.

- Will you need help? Choose a method with good customer support, like an international wire transfer.

- Are there country rules or limits? Check if an international wire transfer is allowed and what the limits are.

Tip: Always compare at least two providers before you decide. Look at the total cost, speed, and how easy it is for your recipient to get the money.

You have four smart ways to send money internationally: online services, international wire transfers, cash transfer services, and cryptocurrency. Each method has its strengths, like speed, security, or flexibility. Before you choose, check the comparison table and use the checklist.

- Always double-check recipient details.

- Watch out for hidden fees and exchange rate changes.

- Pick the method that matches your needs and your recipient’s access.

If you compare your options and stay alert to common mistakes, you can send money safely and cost-effectively.

FAQ

What is the cheapest way to send money internationally?

Online money transfer services like Wise often give you the lowest fees and best exchange rates. Always compare the total cost, including both fees and exchange rates, before you send money.

How fast can my recipient get the money?

Some online services and cash transfer providers deliver funds within minutes. International wire transfers usually take 1–3 business days. Cryptocurrency can move money almost instantly if your recipient has a crypto wallet.

Can I send money to someone without a bank account?

Yes, you can. Cash transfer services like Western Union let your recipient pick up cash at agent locations. Cryptocurrency also works if your recipient has a crypto wallet.

Are international money transfers safe?

Most services use strong security tools to protect your money. Always double-check recipient details and use trusted providers. If you use a Hong Kong bank, you get extra security and support.

Tip: Keep your receipts and tracking numbers until your recipient confirms they received the money.

When exploring the best way to send money internationally, one challenge remains clear: traditional methods often come with high fees, hidden costs, or long delays. That’s where BiyaPay steps in. With BiyaPay, you gain access to real-time exchange rate checks through our converter, ensuring full transparency before you hit “send.” Even better, transfer fees are as low as 0.5%, so more of your money reaches your loved ones or business partners.

Whether you’re covering tuition, family expenses, or medical bills, BiyaPay supports both fiat and digital currency exchanges, covering most countries and regions worldwide. Funds can arrive the same day, and registration takes just minutes. If you’re ready to experience faster, safer, and more affordable transfers, start today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.