- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

10 Countries Where Americans Can Enjoy Retirement Abroad

Image Source: unsplash

You might notice more u.s. retirees deciding to retire outside the us these days. Many choose retiring abroad because they want to stretch their savings and enjoy a better quality of life. Lower cost of living often means you can afford more with your retirement income. Some people look for countries with better healthcare or a relaxed lifestyle. Others want to escape harsh winters or find new adventures. When you think about retiring abroad, you open the door to new places, lower costs, and a fresh start. U.s. retirees often find that the best countries offer a mix of safety, comfort, and opportunity for social connections. Considering the cost of living and healthcare, retiring abroad can make your retirement both affordable and exciting. If you want to retire outside the us, you have many great options to explore.

Key Takeaways

- Retiring abroad can stretch your savings and offer a better quality of life with lower living costs and new experiences.

- Top countries for American retirees balance affordable living, good healthcare, easy visa rules, and friendly expat communities.

- Important factors to consider include cost of living, healthcare quality, visa requirements, safety, climate, and social life.

- Countries like Mexico, Portugal, and Costa Rica offer low costs and large expat communities, while Switzerland and New Zealand provide top healthcare and safety.

- Planning your finances, health insurance, and cultural adjustment before moving helps ensure a smooth and happy retirement abroad.

Quick List

Best Countries Overview

Here are the 10 best countries for Americans to retire abroad. You will find these retirement spots popular with U.S. retirees because they offer a mix of low living costs, good healthcare, and friendly expat communities. If you want to retire outside the US, these countries can help you stretch your savings and enjoy a new lifestyle.

- Switzerland

- New Zealand

- Portugal

- Mexico

- Costa Rica

- Panama

- Spain

- Malaysia

- Thailand

- Belize

You might notice that these best countries for Americans to retire abroad show up in many rankings. Experts use factors like cost of living, healthcare quality, visa rules, safety, and lifestyle when they pick the best countries for Americans to retire. Trusted sources like Bankrate and Reader’s Digest rely on data from the U.S. Census, health organizations, and financial experts to make sure these retirement spots meet your needs.

Tip: When you compare the best countries to retire, look at living costs, healthcare, and how easy it is to get a retirement visa. These details can make a big difference in your retirement experience.

Why These Countries

You will see that each of these best countries for Americans to retire offers something special. Some, like Mexico and Costa Rica, have low living costs and large expat communities. Others, like Switzerland and Spain, give you top-notch healthcare and a safe environment. If you want warm weather, Panama and Thailand stand out. Portugal and Malaysia offer a relaxed lifestyle and affordable housing. Belize gives you English-speaking locals and easy visa options.

Most of these best expat retirement countries have programs that make it simple for U.S. retirees to retire outside the US. You can find places where your Social Security income goes further, thanks to low living costs and tax agreements. If you want to enjoy new cultures, great food, and friendly neighbors, these best places to retire abroad are worth a closer look.

Criteria

How We Chose

When you look for the best countries for Americans to retire, you want more than just a pretty view. You want a place that feels like home and helps you enjoy your retirement. Here’s how we picked the top spots:

- We searched for countries with unique attractions and a lifestyle that fits retirees.

- We checked if you can get a retirement visa easily. Simple retirement visa requirements make moving less stressful.

- We looked at the cost of living. You want affordable living, so your savings last longer.

- We made sure each country has a strong healthcare system. Access to high-quality healthcare matters as you age.

- We picked places with rich culture and a relaxed pace. You want to enjoy your days and meet new friends in a retired expat community.

- We checked for good weather. Many retirees want a mild or warm climate.

- We focused on countries that offer tax-free retirement or have tax rules that help you keep more of your money.

These best countries for Americans to retire promise beautiful settings, better climates, and a lower cost of living. They help make your dream of expat retirement a reality.

What Matters Most

You want to know what really counts when picking the best countries for Americans to retire. Here’s a table to help you see the most important factors:

| Factor | Description |

|---|---|

| Cost of Living | Housing, utilities, groceries, transportation, and healthcare system costs. |

| Climate and Weather | Warm, sunny, or seasonal climates that support your health and lifestyle. |

| Healthcare and Medical | Access to a strong healthcare system and affordable care. |

| Retirement Visa Requirements | How easy it is to get a retirement visa and stay long-term. |

| Safety and Security | Low crime rates and good emergency services. |

| Lifestyle and Recreation | Hobbies, clubs, and social activities in the retired expat community. |

| Tax-Free Retirement | Tax rules that help you keep more of your retirement income. |

| Community and Support | Friendly expats and support services for retirees. |

You will notice that lower living costs, a good healthcare system, and easy retirement visa requirements show up again and again. Many expats look for tax-free retirement options and a strong retired expat community. You want a place where you can enjoy a high quality of life without worrying about costs. The best countries for Americans to retire offer all these things, making your retirement both fun and stress-free.

Best Countries for Americans to Retire Abroad

Image Source: unsplash

Switzerland

Switzerland stands out as one of the best countries for Americans to retire abroad if you want a safe, clean, and scenic place to live. You will find beautiful lakes, mountains, and charming towns. The country offers a high standard of living, but you should know that the cost of living is much higher than in the United States.

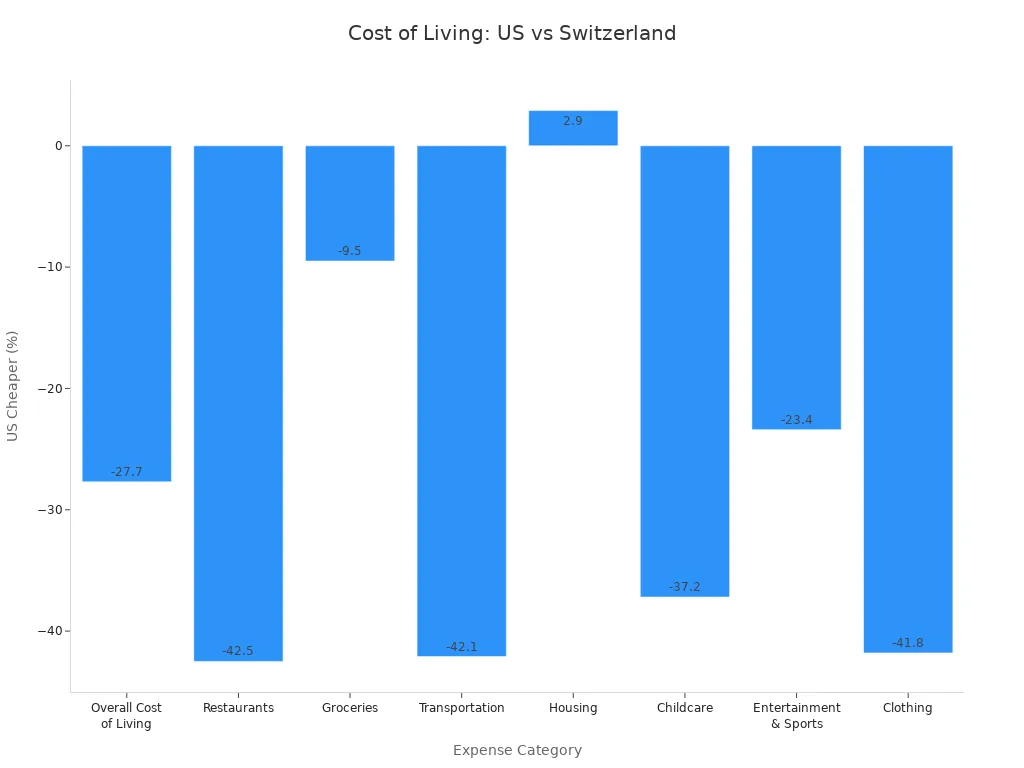

| Expense Category | Cost Difference (US vs Switzerland) | Notes on Cost Impact for Retirees |

|---|---|---|

| Overall Cost of Living | United States is 27.7% cheaper | General cost of living, relevant for retirees |

| Restaurants | 42.5% less in US | Food expenses lower in US |

| Groceries | 9.5% less in US | Food staples generally cheaper, some exceptions |

| Transportation | 42.1% less in US | Lower transport costs benefit retirees |

| Housing | 2.9% more in US | Slightly higher housing costs in US, but small difference |

| Entertainment & Sports | 23.4% less in US | Leisure costs lower in US |

| Clothing | 41.8% less in US | Clothing costs lower in US |

You will notice that living costs in Switzerland are much higher than in the US, especially for food, transportation, and entertainment. Housing costs are similar, but you will pay more for most daily expenses. If you want to retire outside the US and choose Switzerland, you need a strong retirement income.

Switzerland’s healthcare system ranks among the best in the world. You get access to high-quality healthcare, modern hospitals, and skilled doctors. Expats must buy private health insurance within three months of arrival. The system is efficient and supports multiple languages, making it easier for you to get care. Healthcare costs are high, but you receive excellent service and quick access to specialists.

Retirement visa requirements in Switzerland are strict. You need to show proof of high income and enough savings. The process can be complex, and you may need legal help. Safety is a big plus here. Switzerland has low crime rates and a stable environment. The retired expat community is smaller than in other countries, but you will find support in larger cities like Zurich and Geneva.

If you value safety, a strong healthcare system, and beautiful scenery, Switzerland is one of the best countries for Americans to retire. Just be ready for higher living costs and strict retirement visa requirements.

New Zealand

New Zealand is another top choice if you want to retire outside the US. The country offers stunning landscapes, friendly people, and a peaceful lifestyle. You will find a relaxed pace of life and a welcoming retired expat community.

The cost of living in New Zealand is higher than in many US cities. Housing and food can be expensive, so you need to plan your retirement budget carefully. Healthcare is subsidized for residents, but you may need private insurance for full coverage. The healthcare system is modern and provides high-quality care.

When it comes to retirement visa requirements, New Zealand has several options:

- Active Investor Plus Visa: Invest between $5 million and $15 million over 4-5 years. Minimal physical presence needed.

- Parent Retirement Resident Visa: If you have an adult child living in New Zealand, you need an annual income of $60,000, a $1 million investment over four years, and $500,000 in settlement funds.

- Temporary Retirement Visitor Visa: For those 66 or older, you need a $750,000 investment for two years, $500,000 for living costs, and $60,000 annual income. This visa is renewable but does not allow dependent children.

- Parent and Grandparent Visitor Visa: Multiple entries for up to 6 months at a time, with sponsorship by a New Zealand resident child or grandchild.

You must show proof of funds and may need legal help for the paperwork. Dual citizenship is allowed, so you can keep your US passport.

New Zealand is one of the safest countries in the world. It ranks fourth on the Global Peace Index and has low crime rates. People often leave their doors unlocked, and the community is very trusting. Natural risks like earthquakes exist, but the government has strong safety measures.

You will find a friendly retired expat community, especially in cities like Auckland and Wellington. The expat lifestyle is easy to enjoy with outdoor activities, clubs, and social events. If you want a peaceful, safe, and scenic place to retire, New Zealand is one of the best countries for Americans to retire abroad.

Portugal

Portugal is one of the best countries for Americans to retire abroad if you want affordable living, a mild climate, and a welcoming retired expat community. The country offers beautiful beaches, historic towns, and a relaxed lifestyle.

| Expense Category | Approximate Monthly Cost (USD) |

|---|---|

| Rent (furnished apartment) | $700 (single, 1-bedroom) to $1,100 (couple, 2-bedroom) |

| Utilities | $75 (single) to $150 (couple) |

| Internet/Phone/TV | $35 (single) to $70 (couple) |

| Private Health Insurance | $75 (single) to $150 (couple) |

| Transportation | $300 (both) |

| Groceries | $250 (single) to $500 (couple) |

| Household Help (weekly) | $125 (both) |

| Entertainment | $150 (single) to $300 (couple) |

| Miscellaneous | $300 (both) |

| Total Monthly Cost | Approximately $2,000 (single) to $3,000 (couple) |

You can live comfortably in Portugal for about $2,000 to $3,000 per month, depending on your lifestyle. Living costs are lower than in the US, making it easier to stretch your retirement savings.

Portugal’s healthcare system is a mix of public and private care. As an expat, you can register for the public system (SNS) and pay small fees for services. Private healthcare is also available and affordable. Health insurance is recommended to cover extra costs. The healthcare system is high quality, and you get good care for a low price.

Retirement visa requirements are straightforward. Portugal offers a D7 visa for retirees with a steady income. You need to show proof of income and health insurance. The process is simple, and many Americans have moved to Portugal using this visa.

Safety is another big plus. Portugal is one of the safest countries in Europe. The retired expat community is large, especially in Lisbon, Porto, and the Algarve. You will find English speaking locals and many clubs and activities for retirees. If you want affordable living, a strong healthcare system, and a friendly retired expat community, Portugal is one of the best countries for Americans to retire.

Mexico

Mexico is one of the best countries for Americans to retire abroad if you want to stay close to the US, enjoy warm weather, and save on living costs. You will find many retirement spots with large retired expat communities and a welcoming culture.

Popular cities for retirees include San Miguel de Allende, Playa del Carmen, Mazatlán, Merida, Lake Chapala, Puerto Vallarta, and Cozumel. Each city offers something different, from beach living to colonial charm. You can choose based on your lifestyle and budget.

Living costs in Mexico are much lower than in the US. You can rent a nice apartment, eat out, and enjoy entertainment for a fraction of US prices. Healthcare system options are good, with private hospitals and clinics in larger towns. Healthcare costs are much lower than in the US, and you can get affordable healthcare and insurance.

Retirement visa requirements are simple. Americans can stay for six months on a tourist visa. For longer stays, you can apply for a temporary or permanent resident visa. The process is easy, and many expats use local services to help with paperwork.

Mexico is safe in most retirement spots, especially in towns popular with expats. You should use common sense and avoid risky areas. The retired expat community is huge, with about 700,000 US expats living in Mexico. You will find clubs, social events, and support networks in most towns.

If you want to retire outside the US and enjoy a low cost of living, a strong healthcare system, and a large retired expat community, Mexico is one of the best countries for Americans to retire.

Costa Rica

Costa Rica is a favorite among u.s. retirees who want to enjoy nature, a warm climate, and a relaxed lifestyle. The country offers beautiful beaches, rainforests, and friendly locals. You will find many retirement spots with active retired expat communities.

The cost of living in Costa Rica is lower than in the US. You can rent a home, buy fresh food, and enjoy entertainment for less. Living costs are affordable, and you can live well on a modest retirement income.

Costa Rica’s healthcare system is strong. The public system (CAJA) covers most medical needs for residents, and private care is also available. Healthcare costs are much lower than in the US. For example, a dental cleaning costs about $30, and a root canal is around $300. Even surgeries are much cheaper than in the US. Many retirees use both public and private healthcare for the best care.

Retirement visa requirements are easy to meet. The Pensionado visa only asks for a $1,000 monthly pension income. You can include your spouse and children under 25. The visa lasts two years and is renewable. After three years, you can apply for permanent residency. The process is simple, and many u.s. retirees find it easy to qualify.

Costa Rica is safe, with a stable government and low crime rates in most areas. The retired expat community is large, and you will find clubs, activities, and support networks. If you want affordable living, a strong healthcare system, and easy retirement visa requirements, Costa Rica is one of the best countries for Americans to retire abroad.

Best Places to Retire Abroad Comparison

Table Overview

When you look at the best places to retire abroad, you want to see how each country stacks up. The table below gives you a quick way to compare the cost of living, healthcare system, and visa rules. You can spot which countries have lower living costs and which ones offer better healthcare.

| Country | Cost of Living (Monthly Budget) | Healthcare Quality & Accessibility | Visa Requirements Summary |

|---|---|---|---|

| Ecuador | Very low ($1,200–$1,500) | Universal healthcare; efficient | Proof of $1,350/month income, health insurance |

| Philippines | Very low ($1,200–$2,000) | Affordable, easy access | Special retirement visa, expat-friendly |

| Colombia | Affordable ($1,500–$2,500) | Modern, well-regarded | Pension visa, $2,000/month income |

| Panama | Moderate (under $3,000) | High-quality public/private | Pensionado visa, flexible residency |

| Uruguay | Higher (around $3,000) | Universal plus private plans | Pensionado visa, $1,500/month income |

| Greece | Moderate-high (€1,500–€2,500) | Public/private options | Financially Independent Person Permit, Golden Visa |

| Portugal | Moderate | Well-regarded public/private | D7 visa, passive income, 183 days/year stay |

| Mexico | Moderate (lower than U.S.) | Accessible healthcare | Proof of income or savings for residency |

You can see that some countries, like Ecuador and the Philippines, have very low living costs. Others, like Uruguay and Greece, cost more each month. The healthcare system in most of these countries is strong, so you get good care for less money.

Key Differences

You might wonder what really sets these best places to retire abroad apart. The biggest difference is the cost of living. If you want to save money, Ecuador, the Philippines, and Colombia stand out. Panama and Mexico also offer lower living costs compared to the United States. Uruguay and Greece cost more, but you get access to a strong healthcare system and more European perks.

Visa rules also matter. Some countries, like Panama and Mexico, make it easy for you to get a retirement visa. Others, like Greece, ask for more proof of income or property investment. Portugal’s D7 visa is popular because you only need passive income and a place to stay.

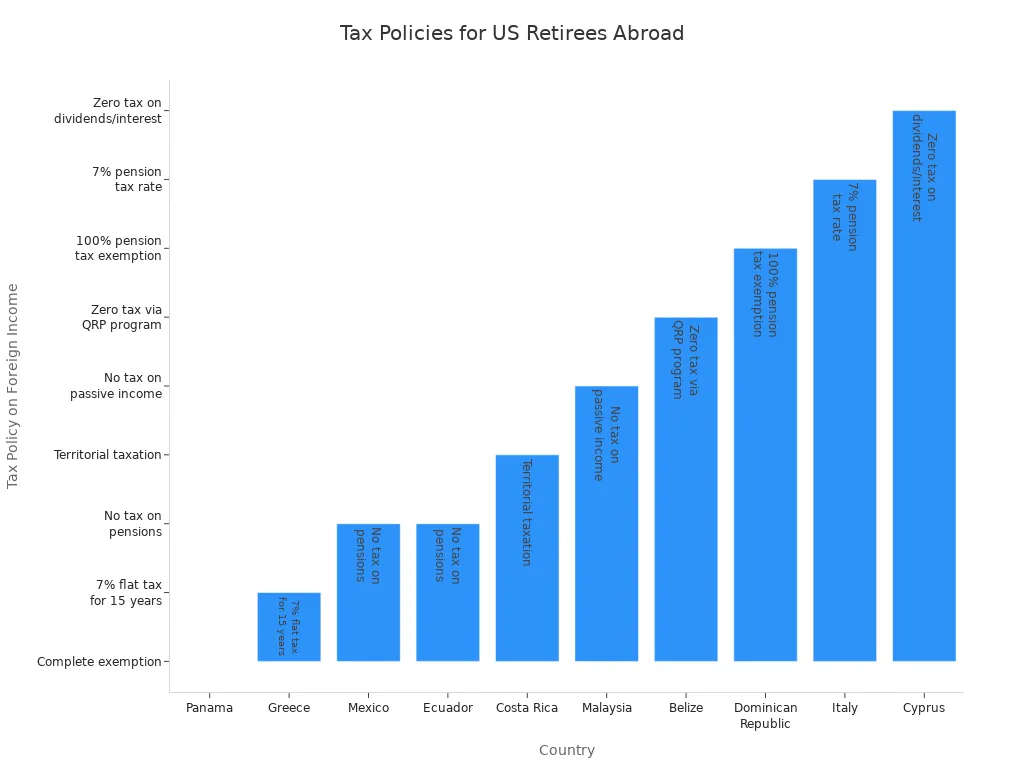

Taxes can make a big difference in your budget. Many of the best places to retire abroad do not tax your foreign pension or Social Security. For example, Panama, Mexico, Ecuador, and Belize let you keep more of your money. Some countries, like Greece and Italy, offer special flat tax rates for retirees.

Note: Even if you move, you still need to file a U.S. tax return. You can use tax credits and treaties to avoid paying taxes twice, but you should plan ahead.

When you compare the best places to retire abroad, think about your budget, the healthcare system, and how easy it is to get a visa. Each country has its own mix of costs, benefits, and lifestyle. You can find a place that fits your needs and helps you enjoy retirement.

Essential Considerations

Image Source: pexels

Taxes & Finances

When you think about retiring abroad, you need to plan your finances carefully. You still have to file a U.S. tax return, even if you live overseas. Some countries offer tax-free retirement, but you should check if you might face double taxation. Talking to an international tax advisor helps you avoid surprises. Social Security benefits can follow you, but you must understand the rules for reporting and eligibility. Managing your pension plans, keeping track of living costs, and knowing the cost of living in your new country will help you build a solid financial plan. Many expats keep a U.S. bank account and open a local account for daily expenses. Renting before buying property gives you flexibility and helps you test if the area fits your lifestyle.

Healthcare Abroad

Healthcare is a big part of retirement planning. Medicare does not cover you outside the U.S., so you need private health insurance. Look for a plan that covers medical evacuation and dental care. Research the healthcare system in your new country. Some places have high-quality care for lower costs, but others may lack certain services. Check if you need to pay out of pocket or if you can join the public system. Good healthcare helps you enjoy your retirement years with peace of mind.

Language & Culture

Moving to a new country means learning new customs and sometimes a new language. Language barriers can make daily life and healthcare harder. Culture shock happens when you face unfamiliar social norms. You might miss familiar foods or find that some amenities are not available. Try to learn basic phrases and stay open to new experiences. Joining local classes or groups helps you adjust faster.

Social Life

Building a social life is important for your happiness. Many expats feel lonely at first. You can join clubs, volunteer, or attend community events to meet people. Some places have large expat communities, which makes it easier to find friends. Staying in touch with family and friends back home also helps you feel connected. Be patient as you build your new support network.

Moving Steps

Getting ready for retirement abroad takes planning. Here are some steps to help you prepare:

- Research the cost of living and healthcare in your chosen country.

- Understand retirement visa requirements and residency rules.

- Rent before you buy property to see if the area suits you.

- Set up your finances, including bank accounts and budgeting for living costs.

- Get the right health insurance.

- Prepare for cultural and language changes.

- Seek advice from professionals who know about expat retirement.

Tip: Take your time and visit your chosen country before making a final move. This helps you avoid costly mistakes and makes your transition smoother.

You have many great places to explore if you want to live abroad. Each country offers something special, from friendly people to beautiful scenery. Think about what matters most to you. Make a list of your top choices. Visit a few countries if you can. Talk to other expats or experts for advice.

You can find a place that fits your dreams. Enjoy the adventure and make the most of this new chapter.

FAQ

What documents do you need to retire abroad?

You usually need a valid passport, proof of income, health insurance, and a background check. Some countries ask for extra paperwork. Always check the official government website for the latest requirements.

Can you use Medicare in another country?

No, Medicare does not cover you outside the United States. You need to buy private health insurance or join the local healthcare system in your new country.

How do you receive Social Security while living abroad?

You can get your Social Security payments in most countries. The U.S. government can deposit your money into a local or Hong Kong bank account. Check the Social Security Administration’s website for details.

What happens if you want to move back to the U.S.?

You can return to the United States at any time. You may need to reapply for health insurance and update your address with Social Security. Plan ahead to make your move smooth.

Retiring abroad opens doors to new lifestyles, but one challenge many expats face is managing cross-border finances. High bank fees, unclear exchange rates, and delays can quickly eat into your retirement income. With BiyaPay, you can simplify your financial life overseas. Our platform supports seamless conversion between multiple fiat and digital currencies, provides real-time exchange rate checks, and ensures transparent costs with transfer fees as low as 0.5%.

Whether you’re covering monthly rent in Portugal, medical bills in Costa Rica, or supporting family back home, BiyaPay enables fast and secure international transfers, with same-day delivery supported across most countries and regions. Registration is quick, so you can focus on enjoying your retirement instead of worrying about hidden charges. Start today with BiyaPay and make your overseas retirement both affordable and stress-free.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.