- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Deep Dive into Sage Accounting Software Plans and Pricing

Image Source: unsplash

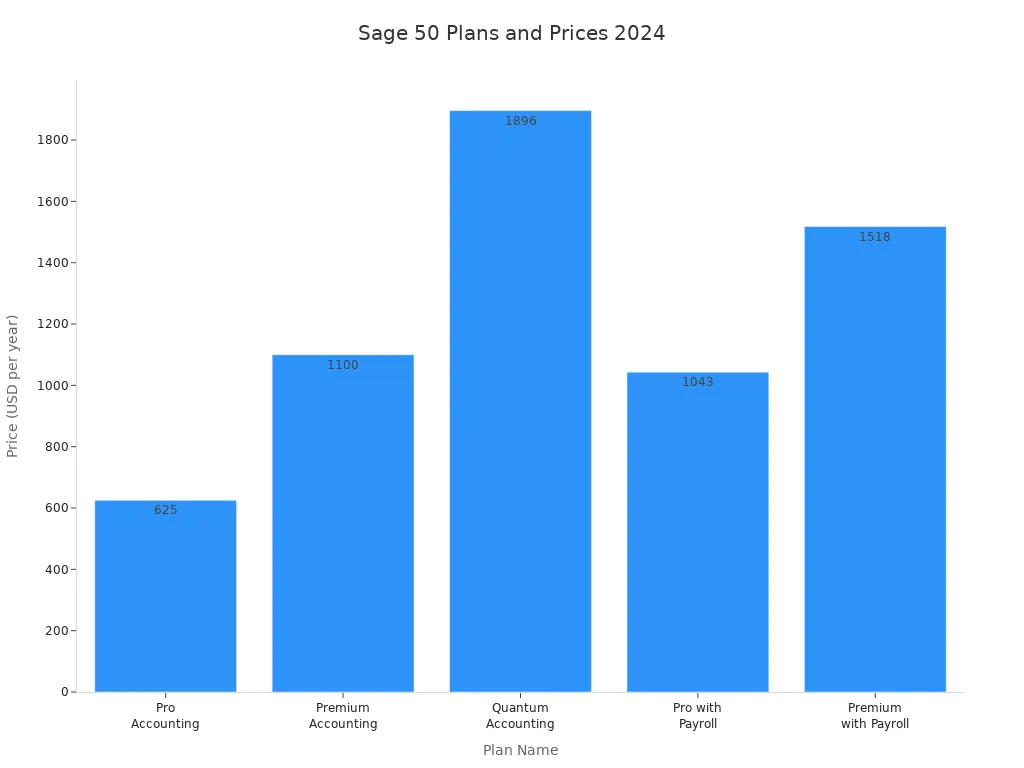

You have several Sage accounting software plans to choose from, each with distinct features and pricing. Sage 50 offers options like Pro Accounting for $625 per year (1 user), Premium Accounting for $1,100 per year (1–5 users), and Quantum Accounting for $1,896 per year (up to 40 users). Bundled payroll versions are available, starting at $1,043 per year. Sage accounting pricing depends on user count and payroll needs. Sage accounting start plans support small businesses, while advanced Sage accounting plan options include inventory, job costing, and reporting. Here is a comparison of Sage accounting plans and their annual pricing:

| Plan Name | User Options | Price (per year) | Description/Notes |

|---|---|---|---|

| Pro Accounting | 1 user | $625 | Simple accounting for solopreneurs and small businesses. |

| Premium Accounting | 1 to 5 users | $1,100 | Advanced accounting with inventory, budgeting, and reporting tools. |

| Quantum Accounting | 1 to 40 users | $1,896 | Full Sage 50 experience with industry-specific functions. |

| Pro with Payroll | 1 user + payroll tiers | $1,043 | Pro plan bundled with payroll for 1–30 employees. |

| Premium with Payroll | 1–5 users + payroll | $1,518 | Premium plan with payroll for 1–30 employees. |

Sage accounting start plans give you essential features, while higher-tier Sage accounting plan options add advanced tools. Sage accounting software serves over 19,000 companies, mainly small and medium-sized businesses. You can select the right Sage accounting plan based on your accounting needs and business size.

Key Takeaways

- Sage offers multiple accounting plans with different prices and features to fit small to large businesses.

- You can choose between desktop software like Sage 50 or cloud options like Sage Business Cloud Accounting based on your needs.

- Advanced plans include features like inventory, job costing, automation, and multi-user access to help your business grow.

- Add-ons like payroll and HR tools can improve your software but may add extra costs, so check all fees before buying.

- Try Sage Business Cloud Accounting free for 30 days to see if it fits your business before committing.

Sage Accounting Software Overview

Image Source: unsplash

Main Products

You can choose from several Sage accounting products, each designed for different business needs. Sage 50 gives you a desktop-based accounting solution with strong reporting and inventory features. Sage Business Cloud Accounting offers cloud-based software that lets you manage your finances from anywhere. Sage Intacct provides advanced financial accounting tools for growing companies that need automation and deep insights. Sage 100 ERP combines accounting with business management software, helping you handle inventory, manufacturing, and distribution tasks.

- Sage 50: Desktop accounting software for small to medium businesses. It supports invoicing, inventory, and payroll.

- Sage Business Cloud Accounting: Cloud-based accounting for small businesses. You can access your data online and automate daily tasks.

- Sage Intacct: Cloud-based financial accounting platform for mid-sized businesses. It offers advanced automation, reporting, and integration.

- Sage 100 ERP: Business management software that includes accounting, inventory, and operations management for larger businesses.

Note: Sage accounting software covers a wide range of business needs, from simple bookkeeping to complex business management.

Plan Comparison

You need to compare Sage accounting plans to find the best fit for your business. Each product line offers different pricing and features. The table below summarizes the main plans and pricing for Sage accounting software:

| Product | Plan/Edition | Users | Pricing (USD/year) | Key Features |

|---|---|---|---|---|

| Sage 50 | Pro, Premium, Quantum | 1–40 | $625–$1,896 | Desktop, inventory, payroll, reporting |

| Sage Business Cloud Accounting | Start, Standard | 1–Unlimited | $10–$25/month | Cloud-based, invoicing, bank feeds, mobile |

| Sage Intacct | Custom | Custom | Custom | Cloud-based, automation, advanced reporting |

| Sage 100 ERP | Custom | Custom | Custom | ERP, accounting, inventory, manufacturing |

Sage accounting pricing varies by product, user count, and features. You can select a plan based on your business size and accounting needs. Sage offers both cloud-based accounting and desktop options, so you can choose what works best for your workflow.

Sage Accounting Pricing Breakdown

Image Source: pexels

Sage 50

Sage 50 gives you a desktop-based accounting solution with three main plans. You can choose Pro Accounting, Premium Accounting, or Quantum Accounting. Each plan fits different business sizes and needs. The pricing structure uses an annual subscription model. You pay once per year for access and support.

| Plan Name | Users | Annual Price (USD) | Key Features |

|---|---|---|---|

| Pro Accounting | 1 | $625 | Basic accounting, invoicing, expense tracking |

| Premium Accounting | 1–5 | $1,100 | Inventory, budgeting, advanced reporting |

| Quantum Accounting | 1–40 | $1,896 | Job costing, workflow management, industry tools |

You can add payroll to any plan. For example, Pro with Payroll starts at $1,043 per year. Premium with Payroll starts at $1,518 per year. Sage 50 limits user capacity to 40. You get basic dashboards and limited customization. The software works best for small to medium businesses that want simple accounting features and lower costs. You can choose Sage 50 if you want a desktop solution with clear annual pricing and easy setup.

Note: Sage 50 uses a license purchase with annual maintenance or subscription. You get support and updates as part of your annual fee.

Sage Business Cloud Accounting

Sage Business Cloud Accounting gives you a cloud-based accounting software option. You can access your data from anywhere. The pricing is simple and uses a monthly subscription model. You can choose between the Start and Standard plans.

| Plan Name | Users | Monthly Price (USD) | Key Features |

|---|---|---|---|

| Start | 1 | $10 | Invoicing, expense tracking, bank feeds |

| Standard | Unlimited | $25 | All Start features, quotes, cash flow, more |

You can invite unlimited users at no extra cost. User roles include full access, read-only, restricted, and custom. Only the business owner can invite users. You do not pay more for adding users. The software supports multiple users working at the same time. You get features like invoicing, bank reconciliation, and mobile access. Sage Business Cloud Accounting works best for small businesses that want flexibility and easy collaboration.

Tip: You can switch between monthly and annual billing. Annual plans may offer discounts, so check with Sage for current offers.

Sage Intacct

Sage Intacct targets growing businesses that need advanced accounting features. The pricing model uses an annual subscription. You get a base package with core financial management. You can add modules for extra features.

| Pricing Component | Details |

|---|---|

| Base Package | Core Financial Management, first legal entity |

| Annual Subscription | Starts at $9,000 for 2 users and 2 entities |

| Add-on Modules | $3,000–$10,000+ per year (Payroll, HR, Planning, Inventory, etc.) |

| Implementation Cost | 100%–150% of annual subscription (depends on complexity) |

| Included in Subscription | 24/7 support, upgrades, 15GB storage, security |

You pay more as you add users or modules. Sage Intacct does not limit transactions. You get advanced dashboards, customizable workflows, and deep reporting. The software fits mid-sized to large businesses that need automation and scalability. You should expect higher costs compared to other Sage accounting plans, but you get more features and support.

Note: Sage Intacct uses a predictable subscription model. You get automatic upgrades and hosting included in your fee.

Sage 100 ERP

Sage 100 ERP gives you a full business management solution. The pricing structure uses modular plans and fees. You can choose the Starter, Small Business, Standard, or Enterprise editions. Each edition fits different transaction volumes and user needs.

| Plan Name | Monthly Transactions | Record Limit | Worker Users | Starting Price (USD) | Key Features Summary |

|---|---|---|---|---|---|

| Starter Edition | 250 | 10,000 | 2 | $450/mo | Basic ecommerce, CRM, core accounting |

| Small Business Edition | 500 | 10,000 | 5 | Request Pricing | CRM, content, help, more features |

| Standard Edition | 1,000 | Unlimited | 15 | Request Pricing | All standard features, more users and records |

| Enterprise Edition | 5,000 | Unlimited | 30 | Request Pricing | All features plus 5 optional bundles |

You can add optional bundles for advanced order entry, merchandising, and multi-store support. Sage 100 ERP supports both on-premises and cloud deployment. You get advanced inventory, project management, and business intelligence features. The software fits businesses that want to scale and customize their accounting software. You need to contact Sage for a custom quote if you want more than the Starter Edition.

Note: Sage 100 ERP offers Essentials, Advanced, and Complete versions. You can select the right plan based on your operational needs and growth plans.

Features by Plan

When you compare Sage accounting software plans, you need to look at the features that matter most for your business. Each Sage product offers a unique set of tools. Some features come standard in every plan, while others are only available in higher tiers. Understanding these differences helps you choose the right solution for your needs and budget.

Core Features

You get essential tools in every Sage accounting plan. These sage core features help you manage daily business tasks and keep your finances organized. Here are the key features you can expect in the entry-level plans for each product:

| Product | Key Features |

|---|---|

| Sage 50 | Invoicing, expense tracking, bank reconciliation, accounts payable/receivable, basic reports |

| Sage Business Cloud Accounting | Online invoicing, bank feeds, expense management, cash flow tracking, mobile access |

| Sage Intacct | General ledger, accounts payable/receivable, cash management, basic financial reporting |

| Sage 100 ERP | Core accounting, order entry, purchasing, inventory control, basic dashboards |

- You can create and send invoices.

- You can track expenses and manage bills.

- You can connect your bank accounts for easy reconciliation.

- You can access basic financial reporting tools.

- You can manage customers and vendors.

Note: These core features support your daily bookkeeping and help you stay compliant with accounting standards.

Advanced Features

If your business needs more than the basics, Sage offers advanced features in higher-tier plans. These tools help you automate processes, analyze data, and scale your operations. The advanced features vary by product and plan, so you should review them before making a decision.

| Product | Advanced Features |

|---|---|

| Sage 50 | Inventory management, job costing, departmental accounting, multi-user access, advanced reporting |

| Sage Business Cloud Accounting | Quotes and estimates, cash flow forecasting, unlimited users, multi-currency support |

| Sage Intacct | Automation, customizable workflows, multi-entity consolidation, comprehensive reporting, integrations |

| Sage 100 ERP | Manufacturing, project management, advanced inventory, business intelligence, custom modules |

- You can manage inventory and track stock levels.

- You can set up job costing for projects.

- You can automate recurring transactions.

- You can generate comprehensive reporting for deeper insights.

- You can add unlimited users or manage multiple business entities.

- You can integrate with other business tools for a seamless workflow.

Tip: Advanced features help you save time and reduce errors as your business grows. You get more control over your data and can make better decisions with detailed reports.

When you review Sage accounting pricing and features, you see that each plan builds on the last. Entry-level plans focus on core features, while premium plans add advanced tools for growing businesses. You should match your choice to your current needs and future goals.

Add-Ons and Extra Costs

Popular Add-Ons

You can enhance your Sage accounting software with a range of add-ons. These tools help you manage payroll, automate data entry, and process payments more efficiently. Many businesses choose add-ons to unlock extra features that support growth and streamline operations. Here is a table showing some of the most popular Sage add-ons and what they offer:

| Add-on Name | Description | Associated Cost |

|---|---|---|

| Payroll | Manage payroll, direct deposit, paycards, tax forms, and track employee time | Not specified; call for pricing |

| eFile | Unlimited eFiling for federal/state forms, HR forms, and alerts | Not specified; call for pricing |

| Sage HR | HR compliance, automated HR tasks, secure document storage, instant pay slips | Not specified |

| Direct Deposit | Secure employee payments, reduce lost paychecks | Not specified |

| Checks and Forms | Compatible checks with fraud monitoring | Not specified |

| Data Entry (AutoEntry) | Automate invoice, receipt, and bill data entry | Not specified |

| Invoice Payments | Accept payments via Stripe and PayPal, automatic record updates | Not specified |

| Payment Processing Solutions | Real-time payment consolidation and reconciliation | Not specified |

Note: You need to contact Sage directly for the most up-to-date pricing on these add-ons. Costs may vary based on your plan and business needs.

Hidden Fees

When you select a Sage accounting plan, you should watch for extra costs that may not appear in the base pricing. Some hidden fees can affect your total cost of ownership. Here are common extra charges you might encounter:

- Multi-user licenses for Sage 50 often require additional fees.

- Microsoft 365 integration with Sage 50 may add to your expenses.

- Sage Intacct can include costs for implementation, training, extra modules, data migration, and premium support.

- You may face overage charges, renewal price increases, or early termination fees with Sage Intacct.

- Sage Business Cloud Accounting limits expense receipt data capture. If you exceed your plan’s limit, you pay $0.20 per extra capture.

- Payroll and HR add-ons are not included in the base Sage Accounting software.

- Sage does not offer discounts for annual payments, but you may qualify for free months or special rates if you are a new user or a non-profit.

Tip: To avoid unexpected costs, review your contract and ask Sage about all possible fees before you subscribe. Always check which features are included in your plan and which require add-ons.

Discounts and Free Trials

Promotions

You can find several discount offers for Sage accounting software plans. Many third-party sites, such as Honey, list up to 30 deals and promo codes for Sage products. These deals cover Sage accounting, HR management, ERP, and business management software. Honey can automatically apply coupons when you check out on supported browsers. You should always check the Sage website or trusted resellers for the latest promotions, as offers may change.

Here is a summary of recent discount ranges for Sage 50 plans:

| Sage Accounting Plan | MSRP Range (USD) | Discount Amount (USD) | Discounted Price Range (USD) |

|---|---|---|---|

| Sage 50 Pro Accounting 2024 | $625.00 – $1,638.00 | Up to $328.00 | $500.00 – $1,310.00 |

| Sage 50 Premium Accounting 2024 | $1,100.00 – $3,536.00 | Up to $707.00 | $880.00 – $2,829.00 |

| Sage 50 Quantum Accounting 2024 | $1,896.00 – $10,247.00 | Up to $2,049.00 | $1,517.00 – $8,198.00 |

Note: Unlimited support often comes with most purchases. Some resellers offer special unadvertised discounts if you contact them directly. Always confirm the legitimacy of the reseller before making a purchase.

Free Trial Info

You can try Sage accounting software before you commit to a subscription. Sage Business Cloud Accounting offers a free 30-day trial. You do not need to provide payment details to start the trial. During the trial, you can access all features of the Standard plan. This helps you test invoicing, bank feeds, and reporting tools in a real business environment.

Sage Intacct and Sage 100 ERP do not offer public free trials. Instead, you can request a personalized demo or guided walkthrough from the Sage sales team. This gives you a chance to see advanced features and ask questions about your business needs.

Tip: Use the free trial period to explore the software’s interface and features. Make sure the plan fits your workflow before you subscribe.

Sage Accounting Software vs Competitors

Comparison Table

When you compare sage to other leading options, you see clear differences in features and target users. The table below shows how Sage Intacct, QuickBooks Online, and Xero stack up in an accounting software review.

| Feature / Aspect | Sage Intacct | QuickBooks Online | Xero |

|---|---|---|---|

| Target Business Size | Larger enterprises, complex needs | Small to medium businesses | Small to medium businesses |

| Business Variables Tracking | Over 13 categories | 2 categories | 2 categories |

| Invoicing | Approval hierarchies, strong controls | Integrated payment links | Third-party integrations |

| Accounts Payable Management | Approval hierarchies, Amex integration | Bill.com, QB payments | Bill.com integration |

| Bank Transaction Reconciliation | Less customizable rules | Basic categorization | Customizable rule-based categorization |

| Sales Tax Management | Avalara partnership | Basic management | Avalara, GST/VAT simplification |

| Reporting | Highly customizable, extensive | Detailed, slightly better than Xero | Improved templates, less detail |

| Security and Uptime | Robust, >99.5% uptime | Robust, >99.5% uptime | Robust, >99.5% uptime |

| Integrations | Fewer, comprehensive | Many integrations | Over 500 apps, leads in integrations |

| Customer Support | VAR or IAP | Extensive support | Customer-centric, adaptable support |

| Pricing | Suited for complex needs and scalability | Cost-effective for small/medium business | Cost-effective for small/medium business |

Note: Sage Intacct targets larger businesses that need advanced controls. QuickBooks Online and Xero focus on small to medium businesses with simpler needs.

Strengths and Weaknesses

You should look at both strengths and weaknesses in any accounting software review. Sage stands out in some areas but may not fit every business.

Strengths of Sage:

- You get advanced reporting and automation, especially with Sage Intacct.

- Sage supports complex business management software needs, such as multi-entity and departmental tracking.

- Approval hierarchies and integration with partners like Avalara help you manage compliance.

- Sage offers robust uptime and security for your data.

Weaknesses of Sage:

- You may find fewer third-party integrations compared to Xero.

- Sage Intacct pricing fits larger businesses, so small businesses may prefer QuickBooks Online or Xero for lower costs.

- Bank reconciliation rules in Sage are less customizable than in Xero.

- You may need to contact a value-added reseller for support, which can slow down response times.

When you choose sage, you get strong tools for growth and control. If you want more integrations or a lower price, QuickBooks Online and Xero may fit better. Always match your choice to your business goals and workflow.

Pros and Cons

Advantages

You gain many benefits when you choose Sage accounting software for your business. Sage offers plans that fit your budget and let you upgrade as your company grows. You can manage your finances in one place and generate reports that help you make better decisions. Sage automates invoicing and payments, which speeds up your cash flow and reduces manual work. You also simplify tax filing and payroll processing, making it easier to stay accurate and compliant.

- Sage connects with popular business tools, including payment processors and e-commerce platforms, to streamline your workflow.

- You get strong security and automatic cloud backups, so your financial data stays safe.

- You can access your accounts from anywhere using mobile devices, which supports real-time collaboration.

- Sage saves you time by automating repetitive accounting tasks and improving accuracy.

- The software supports detailed job cost tracking and project revenue identification.

- You can manage quotes, track inventory, and handle online invoicing with secure payment options.

- Sage offers both desktop and cloud solutions, so you can pick what works best for your business.

- Many users praise Sage for its user-friendly interface, robust features, and excellent customer support.

- Sage Intacct and Sage 50 scale with your business as it grows in size and complexity.

Sage stands out for its value, advanced features, and high customer satisfaction, especially for small and medium-sized businesses.

Drawbacks

You should also consider some limitations before you decide. Many users report concerns about the overall cost of Sage accounting software. The price can increase as you add users, modules, or advanced features. Some users mention that Sage uses a pay-as-you-go model for customer service, which may lead to extra charges if you need frequent support.

- You may find that certain reports or features require an additional payment or subscription.

- Some users have experienced situations where they had to pay for a month and then cancel just to access a specific report.

- The flexibility of service can feel limited, especially if you want to customize your plan or access support on your terms.

Always review your contract and ask about all possible fees before you subscribe. This helps you avoid surprises and ensures Sage fits your business needs.

Value for Money

Best Fit Users

You get the most value from sage when your business has specific needs. Sage Intacct works best for larger companies that need advanced features. You benefit from tools like advanced reporting, industry-specific solutions, and multi-entity support. Sage Intacct also offers strong project management. The modular pricing lets you pay only for what you use, which helps you control costs. If your business expects to grow or needs complex financial management, Sage Intacct justifies its higher price.

You may also find benefits of sage accounting software if you run a small business and want a simple solution. Sage Business Cloud Accounting gives you easy access and automation. Sage 50 fits small to medium businesses that want desktop software with strong reporting.

- Larger businesses with complex accounting needs

- Companies needing advanced financial reporting and project management

- Businesses that want modular pricing and customization

- Small businesses seeking reliable small-business accounting software with essential features

Sage helps you scale as your business grows. You can start with a basic plan and add features as you need them.

When to Look Elsewhere

You should consider other options if sage does not meet your business needs. Some businesses need features or pricing that sage does not offer. If you have a tight budget, you may want a more cost-effective solution. If your team needs a very user-friendly interface or a fast learning curve, other software may work better.

You may also need to look elsewhere if you want more flexible subscription options or better support for rapid growth. Some companies need advanced ERP features that go beyond what sage provides. If you need strong bank reconciliation, tax management, or online payment processing, check if sage covers these needs.

- Your business needs industry-specific features not available in sage

- You want lower pricing or more flexible plans

- You require easier onboarding for your team

- You expect rapid growth and need advanced ERP capabilities

- You need better support for expense tracking or project accounting

Popular alternatives include QuickBooks Online, Xero, Zoho Books, and Pie. Each offers different strengths for various business sizes and budgets.

You benefit most from Sage accounting software if your business needs advanced reporting, multi-entity management, or industry-specific features. When choosing among plans, consider your company’s size, growth projections, and team expertise.

- Evaluate if you need simple tools or advanced capabilities.

- Check compatibility with your current systems and support resources.

- Compare add-ons, discounts, and alternatives like QuickBooks or Xero to maximize value.

| Factor | Impact on Your Decision |

|---|---|

| Add-ons | Enhance features and may unlock better pricing |

| Discounts | Lower costs through promotions or negotiation |

| Competitors | Help you assess if Sage offers the best fit for your needs |

Start with a free trial or request a demo to see which plan aligns with your goals.

FAQ

What is the difference between Sage 50 and Sage Business Cloud Accounting?

Sage 50 gives you a desktop-based solution with advanced inventory and reporting. Sage Business Cloud Accounting lets you manage your finances online. You can access your data from anywhere with the cloud version. Choose based on your workflow and access needs.

Can you upgrade your Sage plan as your business grows?

Yes, you can upgrade your Sage plan at any time. Sage allows you to add users, features, or modules as your business expands. Contact Sage support or your account manager to discuss the best upgrade options for your needs.

Does Sage offer support if you have technical issues?

Sage provides customer support with most plans. You can reach out by phone, email, or live chat. Some advanced plans include priority support. Always check your plan details to see what support options you receive.

Are there any hidden fees with Sage accounting software?

You may encounter extra charges for add-ons, additional users, or premium support. Review your contract and ask Sage about all possible fees before you subscribe. This helps you avoid surprises and manage your budget effectively.

Can you try Sage accounting software before buying?

You can start a free 30-day trial with Sage Business Cloud Accounting. No payment details are required. For Sage Intacct and Sage 100 ERP, you can request a demo. This lets you explore features and see if the software fits your needs.

If you’re considering the right accounting software for your business, Sage offers multiple plans that can be tailored to suit your needs. However, one challenge with accounting software is often the cost and hidden fees. With BiyaPay, you can streamline your international transactions, paying as low as 0.5% in fees while ensuring your funds arrive quickly and securely. Whether you’re making payments for your business or managing payroll for employees, BiyaPay is designed to fit seamlessly into your financial operations.

Real-time exchange rate checks are available through our converter, ensuring transparency in every transaction. As your business grows, the scalability and affordability of BiyaPay make it a smart choice. Register today and start making more efficient transfers with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.