- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Simple Guide to Scheduling Recurring Zelle Payments

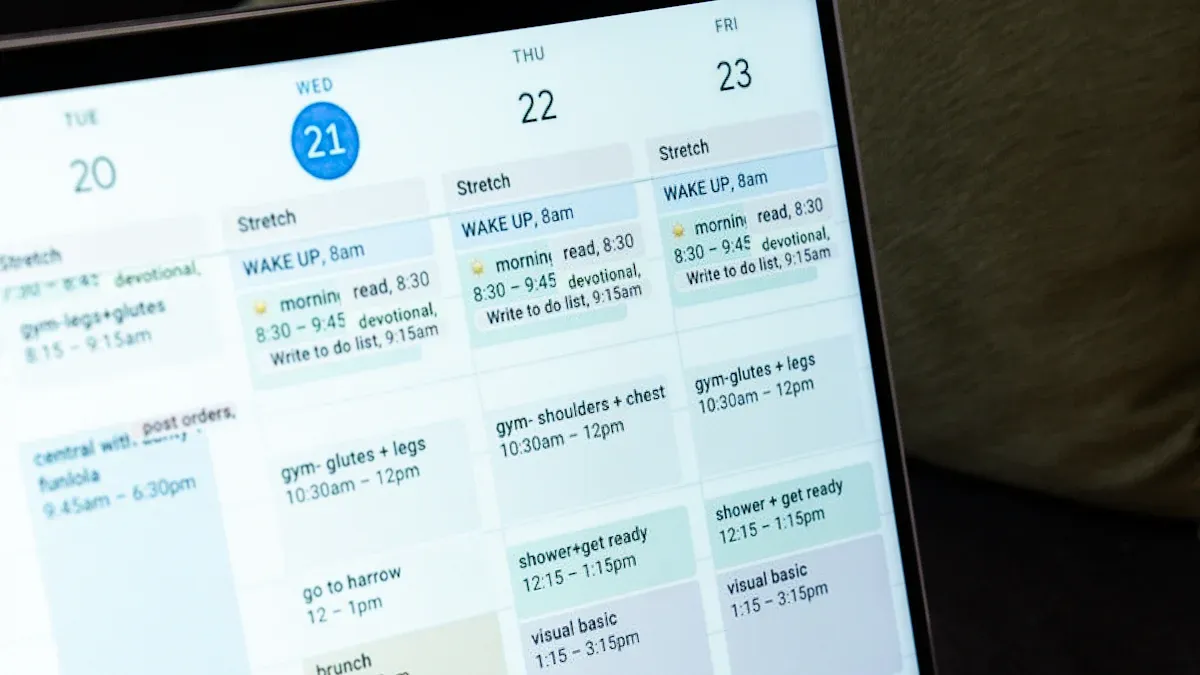

Image Source: pexels

You might wonder if you can schedule recurring Zelle payments for things like rent or subscriptions. The answer depends on your bank, since Zelle itself does not offer this feature everywhere. Many people now rely on Zelle for regular payments, and this number keeps growing each year.

- Rent payments and disbursements are among the fastest-growing uses for Zelle.

- About 51% of Americans use peer-to-peer apps like Zelle and Venmo for regular payments.

Setting up automatic payments with Zelle saves you time and helps you avoid missing due dates. You only enter payment details once, and your payments go out on time without reminders. This makes life easier and helps you stay organized.

Key Takeaways

- Zelle itself does not support automatic recurring payments, but some banks offer this feature through their apps.

- Setting up recurring payments with your bank saves time and helps you avoid missing due dates.

- Always double-check recipient details before sending money to avoid delays or mistakes.

- You can manage, edit, or cancel scheduled payments only through your bank’s app, not the Zelle app.

- If your bank does not support recurring Zelle payments, consider using bank bill pay or other payment apps like PayPal for automatic payments.

Recurring Zelle Payments Overview

Image Source: unsplash

Can You Schedule Recurring Zelle Payments?

You might want to set up recurring Zelle payments for things like a monthly payment to your landlord or to cover a subscription. Many people look for this feature because it saves time and helps keep a payment schedule on track. However, Zelle itself does not let you schedule automatic payments. Each transaction must be started by you. If you want to send money every month, you need to do it manually unless your bank offers a way to automate it.

Here are some important points to know:

- Zelle does not have a built-in option for recurring Zelle payments.

- Some banks let you schedule payments using Zelle through their own apps or websites.

- Zelle does not plan to add recurring payment features soon.

- If you run a business and need recurring payments, you may want to look at other payment platforms that support this.

- Many people want recurring Zelle payments because Zelle sends money quickly, which is helpful for small businesses and anyone who needs fast transfers.

- If you want to repeat a payment, you can go to your payment history in your bank’s app and select a past transaction to repeat it.

Tip: If you need to send the same amount to the same person often, check if your bank lets you repeat a previous payment with just a few taps.

Bank Support

While Zelle does not offer recurring payments on its own, some banks have added this feature to their online or mobile banking. You should always check your bank’s app or website to see if you can set up recurring Zelle payments. The process and options can be different at each bank.

Here is a table showing how some major banks handle recurring Zelle payments:

| Bank Name | Support for Scheduling Recurring Zelle Payments | Eligibility Requirements and Notes |

|---|---|---|

| Bank of America | Yes | - You need a U.S. mobile number or email address (not VOIP or Google Voice).- Must have an eligible deposit account.- You can schedule one-time or recurring payments in the app or online.- You get email notifications for scheduled payments.- Small business accounts need separate enrollment.- Limits apply to how much and how often you can send. |

| Wells Fargo | Yes | - Supports recurring Zelle payments.- You can stop payments with at least 3 business days’ notice.- Details about who can use this are not always clear. |

| Ally Bank | Not confirmed | - Zelle is available, but recurring payment support is not confirmed. |

| Other Banks | Not mentioned | - No clear information about recurring Zelle payments. |

If your bank supports recurring Zelle payments, you can usually set up a payment schedule right in the app. You pick the recipient, choose how often to send money, and confirm the details. Some banks let you stop or change these payments, but you must do it through the bank, not through Zelle.

Note: If you want to cancel or change a recurring Zelle payment, you cannot do this in the Zelle app. You need to use your bank’s app or contact your bank’s customer service. Always check your scheduled payments in your bank’s online bill pay or payment settings.

Banks also follow strict rules to keep your money safe. They may delay or block payments to prevent fraud or meet legal requirements. If you enter the wrong contact info for the recipient, your payment could be delayed or even canceled. Always double-check the details before you set up a recurring Zelle payment.

Setup Guide

Image Source: unsplash

Setting up recurring Zelle payments can save you time and help you stay on top of your bills. If your bank supports this feature, you can set up recurring payments right from your mobile app. Here’s how you can get started:

Add Recipient

First, open your bank’s mobile app and sign in. Go to the section labeled ‘Pay & Transfer’ or something similar. Select Zelle from the list of options. If you haven’t used Zelle before, you’ll need to enroll using your U.S. mobile number or email address. The app will guide you through a quick verification process. Once you’re set up, search for your recipient by entering their mobile number or email. You can also pick someone from your recent contacts list. Make sure you double-check the details so your payment goes to the right person.

Tip: If you send money to the same person often, adding them to your favorites can make future payments even faster.

Choose Frequency

After you add your recipient and enter the payment amount, look for the option to set up recurring payments. Many banking apps start with a default setting for a one-time payment. You’ll usually see a ‘Change’ button or a drop-down list where you can select how often you want the payment to repeat. Common payment frequency options include weekly, bi-weekly, monthly, annually, or even custom intervals. Some apps let you use a calendar to pick the exact date for your payment schedule. You can also set the duration or number of payments if you want the automatic payments to stop after a certain time.

Confirm and Schedule

Once you’ve chosen your payment schedule, review all the details. Make sure the recipient, amount, and payment frequency are correct. Some apps show a summary screen before you confirm. If everything looks good, tap to confirm and schedule your payment. You can manage or modify your scheduled payments later in the ‘Activity’ or ‘Scheduled’ section of your app. Setting up a monthly payment or any other recurring Zelle payments only takes a few minutes, but it can help you avoid late fees and keep your finances organized.

Note: Not all banks offer the same features, so your options for automatic payments may vary. Always check your bank’s app for the latest tools.

Manage Payments

View Scheduled Payments

You want to keep track of your upcoming payments. Most banking apps make this easy. Open your bank’s app and look for the ‘Activity’ or ‘Scheduled’ tab. This is where you can see all your upcoming and past payments. For example, in the Truist banking app, you can find your scheduled and recurring Zelle payments in the Pending section of the Zelle activity page. This section lists your next payment in any recurring series. You can also see if you have set up more than one payment.

If you use U.S. Bank, you can view your Zelle activity by going to ‘Transfer & pay,’ then ‘Send & request money with Zelle,’ and finally ‘Activity.’ Here, you will see transactions from the last 90 days. If you need to check older payments, you can search up to 18 months back. This helps you stay organized and makes sure you never miss a payment.

Tip: Always check the Pending or Scheduled section before making changes. This helps you avoid sending duplicate payments.

Edit or Cancel

Sometimes you need to change or stop a payment. Most banks let you do this if the payment is still pending. Here’s how you can manage your recurring Zelle payments:

- Go to the ‘Activity’ tab in your banking app.

- Tap the ‘Pending’ section to see your scheduled or recurring payments.

- Find the payment you want to change.

- If the payment has not been sent yet, select ‘Edit Payment’ to change the amount or date, or choose ‘Cancel This Payment’ to stop it.

- If you use online banking, you might need to go to the ‘Move Money’ tab, select ‘Zelle,’ and then find your payment in the ‘Pending’ section.

- Remember, you can only cancel a payment if the recipient has not enrolled with Zelle. Once the money leaves your account, you cannot get it back.

Note: Always double-check the recipient’s details before you send money. If you send it to the wrong person, you may not be able to cancel the payment.

Managing your payments keeps you in control. You can avoid mistakes and make sure your money goes where you want.

Limitations

Bank Compatibility

Not every bank lets you set up recurring Zelle payments. Zelle itself does not have a built-in recurring payment feature. You need to use your bank’s app or website to schedule these payments. Some banks only allow one-time transfers, and others may limit recurring payments to personal accounts, not business ones. You should always check your bank’s website or app to see what options you have.

Here’s a quick look at some common limitations:

| Limitation Aspect | Details |

|---|---|

| Native Recurring Feature | Zelle does not offer recurring payments directly; you must use your bank’s tools. |

| Bank Support | Some banks do not support recurring Zelle payments, especially for business accounts. |

| Payment Limits | Each bank sets its own limits. For example, Bank of America may cap daily payments at $15,000. |

| Fees | Zelle does not charge fees, but your bank might. |

| Payment Schedule Options | Frequency options like weekly or monthly depend on your bank’s app. |

| Compatibility Check | Always check your bank’s compatibility and features before setting up recurring payments. |

You should also know that Zelle is meant for sending money to people you trust. Some banks may not let you use recurring payments for business purposes.

Payment Timing

Zelle payments usually move fast, but timing can still trip you up. When you send money, it often shows up right away. However, Zelle uses the ACH network, which only processes payments on business days. If you schedule a payment on a weekend or holiday, your bank will hold it until the next business day. Sometimes, it can take 1–3 business days for the payment to clear. If you want your payment to arrive on time, try to schedule it for a regular business day.

Note: Once your recipient enrolls with Zelle, you cannot cancel the payment. Always double-check the date and details before you hit send.

Security Tips

You want your money to stay safe. Zelle uses encryption to protect your information. Your bank will ask you to verify your identity when you set up recurring payments. This might mean entering a code or using your fingerprint. Banks also watch for suspicious activity and may block payments if something looks wrong.

Here are some tips to keep your account secure:

- Use strong, unique passwords for your banking app.

- Turn on two-factor authentication if your bank offers it.

- Keep your phone and computer updated with the latest security software.

- Watch out for phishing emails or texts. Never share your login details.

- Check your account activity often. If you see anything strange, contact your bank right away.

Tip: Only send money to people you know and trust. If someone asks for payment to a bank account number instead of an email or mobile number, that may not be a Zelle transaction. Always confirm before you send.

Alternatives to Recurring Zelle Payments

Bank Bill Pay

If your bank does not let you schedule recurring Zelle payments, you still have good options. Many banks offer a bill pay service in their online or mobile banking. You can use this feature to set up automatic payments for things like rent, utilities, or subscriptions. Bill pay lets you send money directly to a person or business using their routing and account number. Some banks, like Bank of America, even mail a paper check if the recipient cannot accept electronic payments.

You get more control with bill pay. You can pick the payment date, set up recurring payments, and cancel or change them before they go out. This flexibility helps you avoid late fees and keeps your payments on track. However, bill pay can be slower than Zelle. Sometimes, it takes up to a week for the payment to reach the recipient, especially if the bank sends a check.

Note: Bill pay works well for regular bills, but it may not be as fast as Zelle for urgent payments.

Here is a quick comparison:

| Feature | Zelle | Bank Bill Pay |

|---|---|---|

| Speed | Near-instant | 1–7 days |

| Recurring Payments | Not supported | Supported |

| Control | Limited | High |

| Cancel/Change | Not possible | Possible |

Other Payment Apps

You can also try other payment apps if you need recurring payments. PayPal stands out because it supports automatic recurring payments and subscriptions. You can set up regular transfers, send invoices, and even manage subscriptions for your business. PayPal offers strong security, professional tools, and works with many currencies.

Other apps, like Venmo, Cash App, and Apple Cash, let you send and receive money easily. However, these apps do not support automatic recurring payments. Both you and the recipient must use the same app. Some services, such as Cozy.co (now part of Apartments.com), help with scheduled rent payments and tracking, but they may have delays similar to bank transfers.

Here is a look at some payment app fees:

| Payment App | Monthly Fee | Transaction Fee(s) |

|---|---|---|

| PayPal | None | 2.9% + $0.30 per transaction |

| Venmo | None | 1.75% for instant transfers |

| Cash App | None | 1.5% for instant transfers |

Tip: Always check the fees and features before you choose a payment app. Pick the one that fits your needs best.

You now know that Zelle itself does not offer recurring payments, but some banks do. Here’s what you should remember:

- Your bank may let you schedule recurring Zelle payments by entering the recipient, amount, and schedule.

- Automatic payments save time and help you pay on time.

- Always send money to people you trust and double-check their details.

- If you need help, use your bank’s app or contact customer support for questions or changes.

Check your bank’s features and explore other payment options if you need more flexibility.

FAQ

Can you set up recurring Zelle payments with every bank?

No, you cannot. Only some banks offer recurring Zelle payments. You should check your bank’s app or website for this feature. If you use a Hong Kong bank, look for details in their online banking section.

What happens if you schedule a Zelle payment on a holiday?

Your bank will process the payment on the next business day. Zelle does not send money on weekends or holidays. Always plan your payments ahead to avoid late fees.

Can you cancel a recurring Zelle payment after scheduling it?

Yes, you can. Go to your bank’s app, find the scheduled payment, and select “Cancel.” You cannot cancel a payment after the money leaves your account. Always double-check before confirming.

Are there fees for scheduling recurring Zelle payments?

Most banks do not charge fees for Zelle payments. You should check your bank’s fee schedule to be sure. For example, some Hong Kong banks may have different policies. Always review the latest fee details in USD.

While Zelle offers fast and secure money transfers, scheduling recurring payments can be tricky since it doesn’t support this feature natively. Some banks, however, allow you to set up recurring Zelle payments through their apps. But if you’re looking for a more flexible and cost-effective solution, consider BiyaPay. With BiyaPay, you can make transfers with a low fee of just 0.5%, and enjoy a seamless experience with real-time exchange rate checks through our converter.

BiyaPay supports global remittances, with coverage across most countries and regions. You can easily exchange multiple fiat currencies and digital currencies, making it a versatile tool for managing cross-border payments. Start today with BiyaPay to take control of your payments with greater flexibility and lower costs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.