- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Step-by-Step Guide to Sending Remittance

Image Source: unsplash

You can send a remittance by following a clear process and using the right tools. The act of sending money across borders supports millions of families each year. According to the latest World Bank data, people sent a record $818 billion in remittances globally in 2023, with $656 billion reaching low- and middle-income countries. When you send a remittance, you help loved ones meet daily needs or pay for education. Choosing the best method, understanding fees, and keeping your information safe will help you send remittance with confidence.

Key Takeaways

- Sending remittance helps support families by covering daily needs, education, and emergencies across borders.

- Choose the best transfer method by comparing speed, cost, convenience, and security to fit your and your recipient’s needs.

- Gather and double-check all recipient details and transfer information to avoid delays or errors.

- Understand all fees, including hidden costs and exchange rates, to save money and send funds efficiently.

- Stay alert to scams by using trusted providers, verifying requests, and protecting your personal information.

Remittance Basics

Image Source: unsplash

What Is Remittance

You might wonder what remittance means. Remittance refers to money that you send to someone in another country, usually to support family or friends. This type of transfer is personal and not for business or commercial reasons. Many people who move to new countries for work, such as migrants or members of a diaspora, use remittance to help loved ones back home.

Note: Remittance can take different forms. You may send cash, pay for goods, or transfer money through a bank or app. The main goal is to help someone you know.

Major financial organizations like the World Bank and IMF define remittance in several ways. Here is a table that shows the main types:

| Term | Definition |

|---|---|

| Workers’ Remittances | Money sent by migrant workers living in a host country for more than one year to their home country. |

| Compensation of Employees | Income earned by migrants living in a host country for less than one year. |

| Migrants’ Transfers | Net worth moved at the time of migration by people staying more than one year. |

Remittance includes both personal transfers and wages earned abroad. These transfers often use formal channels, but some people still use informal ways, which can make tracking difficult.

Why People Send Remittance

You send remittance for many reasons. Most people want to help their families meet daily needs or improve their lives. Here are some common reasons:

- Support for everyday expenses, such as food, clothing, and bills.

- Help with medical costs, especially during emergencies.

- Payment for education, including school fees and supplies.

- Contributions for housing, like rent or home repairs.

- Gifts for special events, such as weddings or holidays.

- Investment in small businesses or savings for the future.

Remittance plays a big role in the lives of families in low- and middle-income countries. In 2022, families received $626 billion in remittance, which was more than foreign direct investment and official aid. This money helps reduce poverty, improve health, and give children better chances at school. It also helps families recover from disasters and build stronger homes.

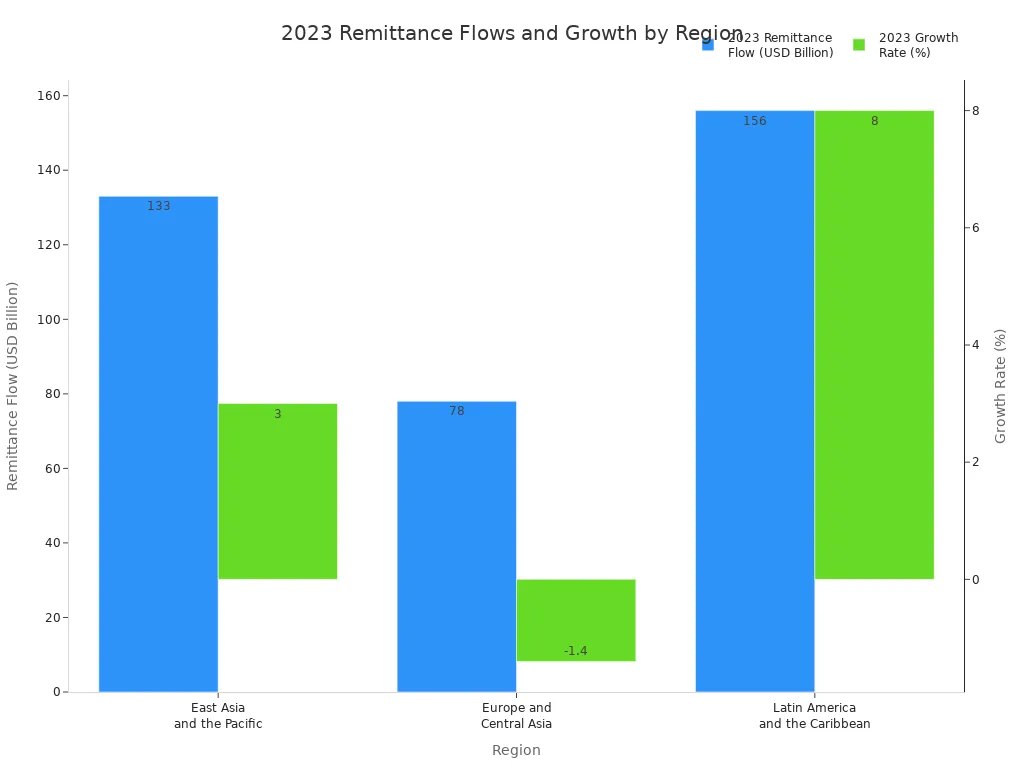

At the national level, remittance can make up a large part of a country’s income. In some places, it is over 15% of the total economy. The chart below shows how remittance flows differ by region:

Remittance helps countries stay stable during tough times, such as global crises. It also supports local businesses and helps families plan for the future.

Choose Method

When you want to send money to another country, you have several options. Each method has its own strengths and weaknesses. You should think about what works best for you and your recipient before you start a transfer.

Bank Transfers

Bank transfers let you send money from your account to someone else’s bank account overseas. Many people trust this method because banks follow strict rules and use secure networks. You can start a transfer online or by visiting a branch. Bank transfers work well for large amounts and offer strong security. However, you may face higher fees, sometimes averaging 7.34% of the amount sent. Transfers can take 1 to 5 business days to reach the recipient. Banks often add extra costs through exchange rate markups and hidden fees. You may also need to provide detailed information, such as SWIFT or IBAN codes, to complete the transfer.

Money Transfer Services

Money transfer services give you more ways to send funds. These services include online platforms, physical locations, and even cash pickup points. Many people choose money transfer services because they offer faster delivery, sometimes within minutes. You can send money even if your recipient does not have a bank account. Some services allow you to pay with cash, debit cards, or credit cards. Fees and exchange rates vary, so you should compare options before making a transfer. Money transfer services often provide tracking tools, so you can see when your transfer arrives.

Mobile Apps

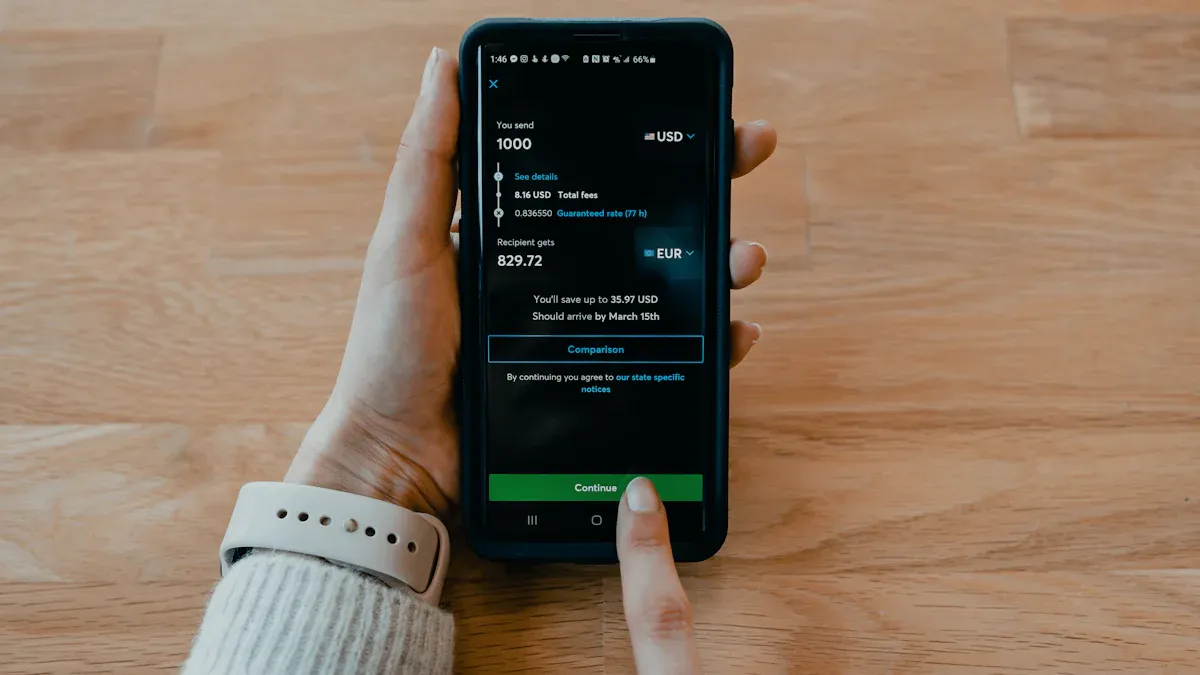

Money transfer apps make sending money easy and quick. You can use your phone to start a transfer at any time. Many apps support transfers to over 150 countries and offer different payout options, such as bank deposits, mobile wallets, or cash pickups. Money transfer apps usually have lower fees and faster speeds than banks. They use strong security features like encryption and two-factor authentication. You can track your transfer and get help from customer support if you need it.

What to Consider

You should look at several factors before you choose a transfer method:

- Speed: Some transfers arrive in minutes, while others take days.

- Cost: Check for fees, exchange rate markups, and hidden charges.

- Convenience: Think about how easy it is to start a transfer and how your recipient will get the money.

- Recipient Access: Make sure your recipient can receive the funds, even without a bank account.

- Security: Pick a method that protects your information and your money.

Tip: Always compare money transfer services, apps, and banks to find the best deal for your needs.

Prepare to Send

Required Info

Before you send money, you need to gather some important information. This step helps you avoid mistakes and delays. When you start a remittance transaction, you must give the provider certain details. Here is what you usually need:

- Your recipient’s information, such as their full name and how they will receive the money.

- The amount you want to send, stated in USD. You should check the current exchange rate to see how much your recipient will get.

- The funding source for your transfer. This could be your bank account, debit card, or cash.

- Your request to send the remittance. You can make this request in person, online, or by phone.

- The provider will confirm your details and give you a summary of fees and the total cost before you pay.

- You may need to show identification, especially if you use a bank or a money transfer service.

Note: Always double-check the information you provide. Even a small mistake can cause problems with your transfer.

Recipient Details

You must enter your recipient’s details correctly to make sure the money arrives safely. The exact information depends on how your recipient will get the funds. Most providers ask for the following:

- Recipient’s full name (as shown on their ID)

- Bank account number (if sending to a bank)

- Bank codes, such as SWIFT, IBAN, or IFSC, depending on the country and bank

- Cash pickup ID or reference number (if your recipient will collect cash)

Check these details with your recipient before you send money. A wrong account number or name can delay the transfer or cause it to fail. Some countries use special codes for banks, so ask your provider if you are unsure. Always keep a copy of the information you use for your records.

Send Remittance

Step-by-Step Process

You can complete a remittance by following a clear process. Each step helps you make sure your transfer is safe and reaches your recipient quickly. Here is a typical process you will follow when sending remittances through a bank or money transfer service:

- Provide Recipient Details and Amount

Start by giving the service provider your recipient’s full name, the amount you want to transfer, and how your recipient will receive the funds. You may choose a bank deposit, cash pickup, or mobile wallet. - Verify Your Identity

The provider will ask you to show a government-issued ID. This can be a National ID, Passport, or Driving Licence. Make sure your ID is clear and shows your name, date of birth, and other important details. If you use a National ID, both sides must be visible. For a Passport, all corners must show. Some providers may also ask for proof of address, such as a utility bill or bank statement, especially if you are sending money from certain countries. - Review and Confirm Transaction Details

The provider will check your information and confirm your identity. You will see a summary of your transfer, including the exchange rate and any fees. Take time to review these details. - Transfer Funds

After you confirm, the provider will move the funds from your account. The money will go through secure banking networks. The provider will convert the amount from your currency to your recipient’s currency using the current exchange rate. - Recipient Receives Funds

Your recipient will get the money either in their bank account, as cash at a pickup location, or in a mobile wallet. The time it takes depends on the method you choose. Some transfers arrive in minutes, while others may take a few days.

Note: Verification is a legal requirement. Most providers complete this step in minutes, but sometimes it can take up to 48 hours. If your documents do not match or are unclear, you may need to submit them again or contact customer service.

Confirm Details

Before you finish sending remittances, you should always double-check the information. This step helps you avoid mistakes and extra costs. Use this checklist to confirm your transfer:

- Check the Exchange Rate

Look at the exchange rate the provider uses for your remittance. Even small changes can affect how much your recipient gets. - Review All Fees

Make sure you understand every fee. Some providers charge a flat fee, while others add a percentage or use a less favorable exchange rate. - Verify Recipient Details and Amount

Confirm your recipient’s name, account number, and the amount you are sending. Errors in these details can delay the transfer or cause it to fail.

Tip: Always keep a copy of your transfer receipt. This document will help you track your remittance and solve any problems if they come up.

You can use the table below to help you remember what to check before you send your remittance:

| What to Check | Why It Matters |

|---|---|

| Exchange Rate | Affects the final amount received |

| Fees | Impacts total cost of sending money |

| Recipient Information | Ensures funds reach the right person |

| Transfer Amount | Confirms you are sending the right sum |

By following these steps, you make sure your remittance process is smooth and secure. You also reduce the risk of errors when sending money to your loved ones.

Remittance Fees

Types of Fees

When you send money abroad, you pay several types of remittance fees. These fees can change based on the method you choose, the provider, and the country where your recipient lives. You may see both flat fees and percentage-based fees. For example, some banks charge a fixed fee, such as $20 per transfer, while others take a percentage, like 2% of the amount you send. If you send smaller amounts, the percentage-based fee can be much higher, sometimes reaching 10% or more for transfers under $200.

You also need to watch for exchange rate margins. Providers often offer a rate that is less favorable than the market rate, which acts as an extra fee. Some banks, including those in Hong Kong, may charge your recipient a receiving fee. Intermediary banks that help process the transfer can add their own charges. Sometimes, you may face hidden fees, such as service charges or compliance costs, that are not clear at first.

Here is a table to help you understand the main types of fees:

| Fee Type | Description |

|---|---|

| Flat Fee | Fixed charge per transfer, e.g., $20 |

| Percentage-Based Fee | Fee based on a percent of the amount sent |

| Exchange Rate Margin | Extra cost from a less favorable exchange rate |

| Receiving Fee | Fee charged to the recipient by their bank |

| Intermediary Fee | Fee from banks that process the transfer |

| Hidden/Service Fees | Additional or undisclosed charges |

Save on Costs

You can lower your costs by understanding how remittance fees work. Start by comparing different providers. Online money transfer services and mobile apps often have lower fees than traditional banks. Look for providers that show all fees and exchange rates upfront. This transparency helps you avoid hidden charges.

Try to send larger amounts less often. Fixed fees have less impact when you send more money at once. Avoid unnecessary currency conversions, as each conversion can add to your total cost. Timing your transfer when exchange rates are better can also help you save.

Tip: Always check the total cost, including all fees and the exchange rate, before you send money. Providers like Wise use mid-market rates and show all charges clearly.

If you want to save even more, use digital platforms and avoid exclusive deals with one provider. More competition in the market often leads to lower fees for everyone.

Track and Confirm

Image Source: unsplash

Tracking Options

After you send a remittance, you want to know when your recipient gets the money. Most banks, money transfer services, and mobile apps give you ways to track your transfer. You can use these options to stay updated:

- Online Tracking: Many services let you track your remittance on their website or app. You enter your transaction number to see the status.

- Email or SMS Alerts: Some providers send you updates by email or text message. These alerts tell you when the money is sent and when your recipient receives it.

- Customer Support: If you cannot find tracking information online, you can call or chat with customer support. They can check the status for you.

- Receipts and Reference Numbers: Always keep your receipt and any reference numbers. You may need these if you have questions later.

Tip: Tracking helps you feel confident that your money is safe and on its way. If you use a Hong Kong bank, you can often track your transfer through their secure online banking system.

If Issues Arise

Sometimes, a remittance does not arrive as expected. You should act quickly if this happens. First, check for common problems like processing delays or missing information. Make sure you gave the correct recipient details and that your payment went through.

If you still have concerns, follow these steps:

- Record the remittance issue as soon as you notice the delay.

- Contact your provider’s customer support. Give them your transaction number and all details.

- Ask if there are any holds or extra steps needed to release the funds.

- Keep your receipts and any forms related to the transfer.

- If you used a bank, ask if they need to check with intermediary banks or if there are extra fees.

- If you sent the remittance through a service, request a trace or investigation.

- Follow up until you get a clear answer or your recipient receives the money.

Note: Providers may take up to seven business days to resolve some issues. Always keep your records for at least two years in case you need to check them later.

By tracking your remittance and knowing what to do if problems arise, you help protect your money and make sure your loved ones get the support they need.

Safety Tips

Avoid Scams

You need to stay alert when sending remittance. Scammers often target both senders and recipients. They use many tricks to steal your money or personal information. Here are some of the most common scams you might face:

- Phishing Emails and Messages

Scammers send fake emails or texts that look like they come from banks or remittance services. These messages ask you to click links or share your login details. - Impersonation Scams

Fraudsters pretend to be your relatives or remittance agents. They may claim there is an emergency and ask you to send money quickly. - Fake Job and Lottery Offers

You may get messages about winning a lottery or getting a job. These scams ask for upfront fees or personal information. - Overpayment and Refund Scams

Scammers may send you extra money by mistake and then ask for a refund. Later, they reverse the original payment, leaving you with a loss. - Social Engineering

Some fraudsters call you and pretend to be from customer support. They try to get your account details or passwords.

Tip: Always check the sender’s identity. Never share your passwords or PINs with anyone, even if they claim to be from a trusted company.

Best Practices

You can protect your money by following simple safety steps. Financial authorities recommend these best practices for secure remittance transactions:

- Use only trusted banks, retailers, or money transfer services. Look for companies that are licensed and listed in public registries.

- Verify all recipient details before you send money. Double-check names, account numbers, and codes.

- Keep records of every transaction. Save receipts and confirmation numbers for tracking and dispute resolution.

- Stay cautious if you get urgent or unexpected requests for money. Take time to confirm with your recipient before sending funds.

- Complete all identity verification steps. This helps keep your transfer legal and secure.

- Make sure you understand the purpose of your transfer. Some providers may ask for this information to follow regulations.

Note: Hong Kong banks and other reputable providers use strong security features. Choose services that offer clear information about fees and exchange rates in USD.

By following these tips, you help keep your remittance safe and make sure your loved ones receive the support they need.

You can send remittance smoothly by following a few key steps. Start by double-checking your recipient’s details and understanding all fees and limits. Choose a secure method that fits your needs and always use trusted channels. Stay alert for scams and monitor your transfer status. If you need more help, organizations like the World Bank and the International Fund for Agricultural Development offer useful guidance. With careful preparation, you can support your loved ones with confidence.

FAQ

How long does it take for a remittance to arrive?

Transfer times depend on your chosen method. Bank transfers may take 1 to 5 business days. Money transfer services and mobile apps can deliver funds within minutes. Always check with your provider for exact timing.

What information do I need to send a remittance?

You need your recipient’s full name, bank account number or pickup details, and the amount in USD. Some providers also require identification, such as a passport or Hong Kong ID card.

Can I cancel or change a remittance after sending?

You can sometimes cancel or change a remittance if the provider has not processed it. Contact customer support immediately. Some services may charge a fee for changes or cancellations.

Are there limits on how much money I can send?

Yes, most providers set daily or monthly limits. For example, some Hong Kong banks may allow up to $10,000 USD per transfer. Check your provider’s policy before sending large amounts.

Sending remittance can be a smooth process when you choose the right provider, but hidden fees and lengthy transfer times can make the process more complicated. To make sure your transfers are cost-effective and fast, consider using BiyaPay. With BiyaPay, you can enjoy transfers with fees as low as 0.5%, and you can send money to most countries worldwide with ease.

Additionally, BiyaPay offers real-time exchange rate checks via our converter, helping you ensure the best exchange rates before sending funds. Whether you’re supporting family or paying for services, BiyaPay makes international money transfers simple, fast, and affordable. Start today with BiyaPay and enjoy better control over your remittance payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.