- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Do You Need a SWIFT Code for International Transfers in 2025

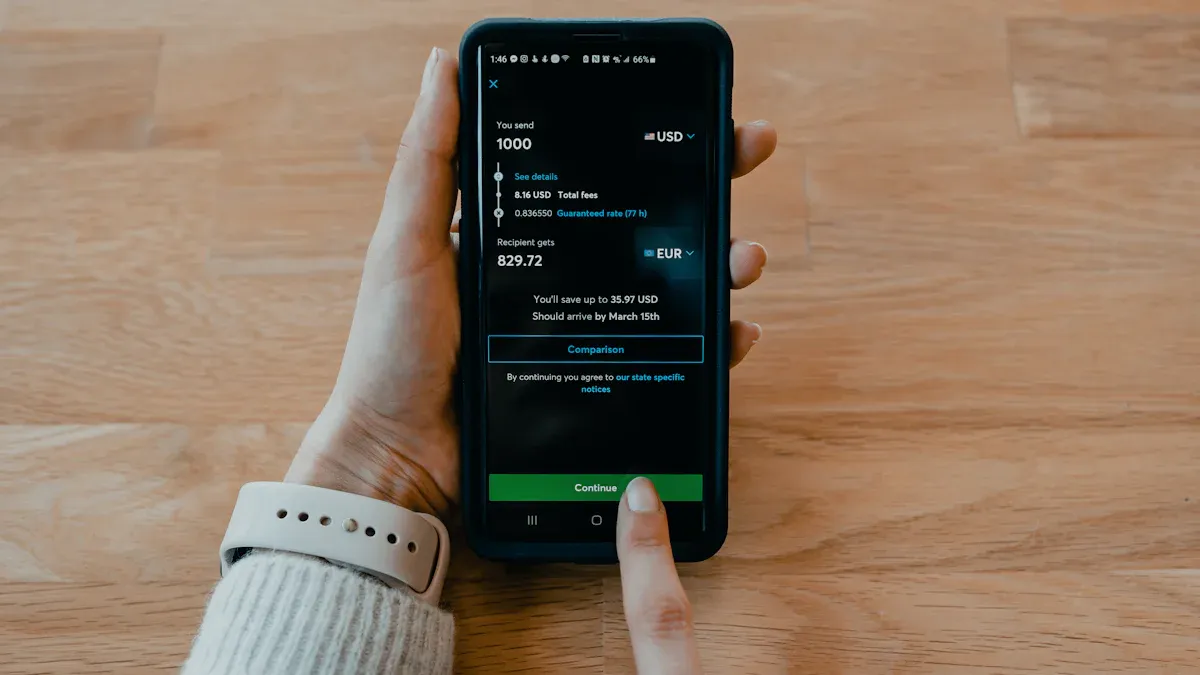

Image Source: unsplash

You still need a SWIFT code for international wire transfers in 2025. SWIFT has started moving to the ISO 20022 standard, which means banks now use richer data formats to make transfers safer and more accurate. If you want to send a non-USD transfer, you must complete a new reverification process that includes updating your ID and bank details. Using the correct SWIFT code helps prevent transfer delays or errors. Always check your bank’s instructions before making an international transfer to ensure your wire goes through smoothly.

Key Takeaways

- You need a SWIFT code for most international wire transfers in 2025 to ensure your money reaches the right bank safely and quickly.

- Always double-check the SWIFT code and provide all required details like account number and bank address to avoid delays or lost funds.

- Some countries have new rules for SWIFT codes, so check your bank’s instructions and stay updated on changes before sending or receiving money.

- IBAN codes identify specific bank accounts and often work with SWIFT codes to make international transfers accurate and faster.

- You can find your bank’s SWIFT code on bank statements, online banking, or the official bank website—always verify it before making a transfer.

SWIFT Code for International Wire Transfer

Image Source: unsplash

What Is a SWIFT Code

You need to understand what a SWIFT code is before you send or receive an international wire transfer. According to the Society for Worldwide Interbank Financial Telecommunication (SWIFT), a SWIFT code is a standardized format that banks and financial institutions use for cross-border financial transactions. This code identifies the bank, branch, and country where an account is registered. SWIFT owns and manages the Bank Identifier Code (BIC) system. You may also hear people call it a BIC code, SWIFT ID, or ISO 9362 code.

A SWIFT code consists of 8 to 11 alphanumeric characters. The structure includes a four-letter bank code, a two-letter country code, a two-character location code, and an optional three-character branch code. For example, if you want to send money to a bank in Hong Kong, you will need the unique SWIFT code for that specific bank branch. This code helps banks quickly and securely identify each other during international wire transfers.

SWIFT currently connects about 11,000 member financial institutions worldwide. This global network allows you to send and receive money across borders with confidence. When you use the correct SWIFT code for international wire transfer, you make sure your funds reach the right place.

SWIFT Code Used For

You use a SWIFT code for international wire transfer to make sure your money goes to the correct bank and branch. The SWIFT code used for these transfers acts like an address for banks. It tells the system exactly where to send your funds. This process helps avoid mistakes and speeds up cross-border payments.

Note: Always double-check the SWIFT code before you start a transfer. Using the wrong code can cause delays, extra fees, or even send your money to the wrong bank.

Here are some reasons why SWIFT codes are essential for accurate and secure international wire transfers:

- SWIFT codes uniquely identify banks and their branches worldwide. This ensures your transfer reaches the correct destination.

- The SWIFT network uses secure messaging formats and encryption. This protects your information and helps detect any unusual activity.

- Banks use end-to-end encryption, multi-factor authentication, and real-time monitoring. These features prevent unauthorized transactions.

- SWIFT codes support compliance with anti-money laundering (AML) and know your customer (KYC) rules. This adds another layer of security.

- Fraud detection tools in the SWIFT network help keep your cross-border payments safe.

If you enter the wrong SWIFT code, you might face several problems:

- Typing mistakes or incorrect formatting can cause your transfer to be rejected.

- Missing or incorrect branch codes may lead to routing issues.

- Incomplete recipient details can delay your transfer or send funds to the wrong place.

These errors can result in rejected transfers, delays, extra fees, or lost funds. To avoid these issues, always verify the SWIFT/BIC codes using the recipient bank’s official website or by contacting the bank directly.

When you use the correct SWIFT code for international wire transfer, you help ensure your money arrives safely and quickly. SWIFT codes play a key role in making cross-border payments secure and reliable for everyone.

When You Need a SWIFT Code

Sending International Wire Transfers

You need a SWIFT code when you send an international wire transfer. The SWIFT code acts as a unique address for the recipient’s bank. This code helps banks identify each other and route your money transfer correctly. If you leave out the SWIFT code, your transfer may not reach the right bank or could get delayed.

Double-checking the SWIFT code before you send money helps you avoid mistakes. Errors or missing codes can cause delays, misdirected funds, or failed transactions. SWIFT codes guide your funds to the correct bank quickly and securely.

When you send international wire payments, most banks ask for the SWIFT code of the recipient’s bank. Some banks, especially in the United States, may not have their own SWIFT codes. In these cases, they use intermediary banks to process the transfer. This can make the process slower and more complex.

Here is what can happen if you omit the SWIFT code when sending payments internationally:

- The sending bank may refuse or delay your transfer.

- Overseas banks often require a SWIFT code as part of their policy.

- Some banks use intermediary banks, which increases processing time and complexity.

- Incorrect or missing SWIFT codes can lead to misdirected funds, failed transactions, or longer processing times.

- The SWIFT code ensures your funds reach the correct bank securely and promptly.

If you want your international money transfer to go smoothly, always include the correct SWIFT code needed for the recipient’s bank. This step helps you avoid extra fees, delays, or lost funds.

Receiving International Wire Transfers

When you receive international wire payments, you must give the sender the correct SWIFT code for your bank. This code helps the sender’s bank find your bank and deliver the funds to your account. If you do not provide the right SWIFT code, your transfer may get delayed or even returned.

You also need to give more information than just the SWIFT code. Banks need several details to complete an international wire transfer. If you leave out important information, your transfer may get frozen or delayed until you provide the missing details.

Here is a list of information you should give to someone sending you an international bank transfer:

- Your full name and address

- Your bank’s name and address

- Your account number or IBAN (if required)

- The SWIFT code for your bank

- The transfer amount and currency

- The reason for the transfer (sometimes required)

- Any reference or note to include with the transfer

A real example shows why this is important. A user reported that their bank received a payment with only the SWIFT code and address. The sender forgot to include the account number. The transfer was frozen until the sender sent another SWIFT message with the correct account number. This shows that you must provide all required details, not just the SWIFT code.

If you want to receive international money transfers without problems, always check with your bank for the exact information needed. Giving the correct SWIFT code and other details helps you get your funds quickly.

Exceptions and Recent Changes

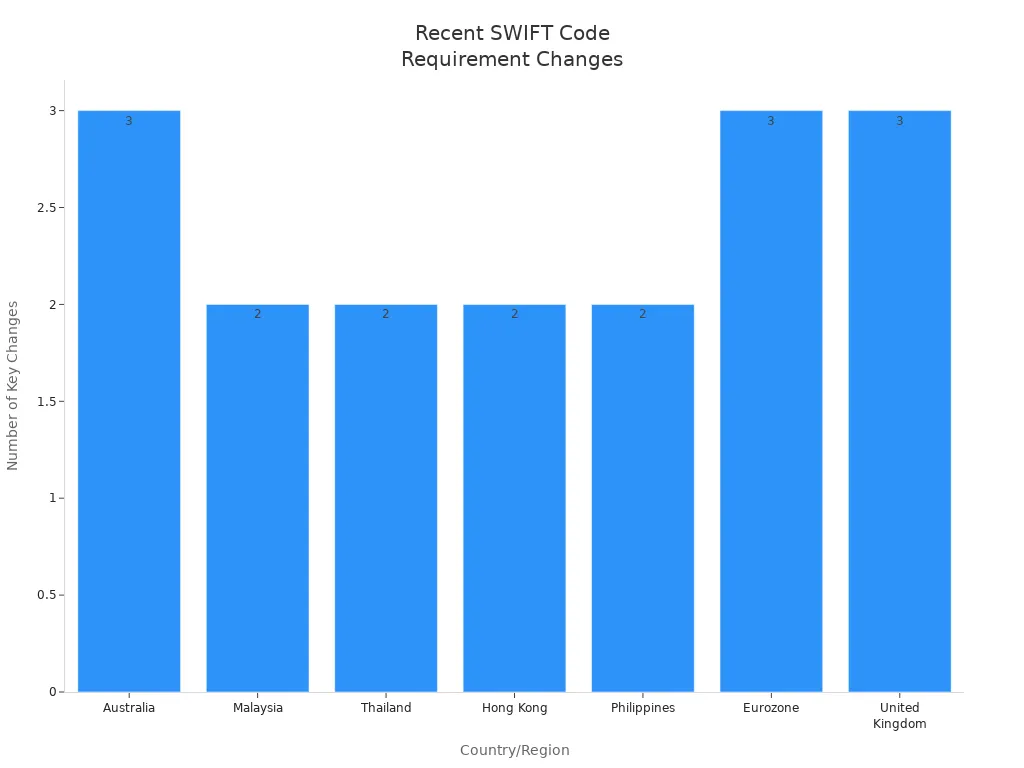

Some countries and regions have made changes to SWIFT code requirements for international transfers. These changes may affect how you send or receive money. For example, some places now require longer beneficiary names or extra information for certain types of payments.

Here is a table showing recent exceptions and changes to SWIFT code requirements in different countries and regions:

| Country/Region | Key Recent Exceptions or Changes to SWIFT Code Requirements and Payment Instructions |

|---|---|

| Australia | Beneficiary name field extended from 70 to 140 characters; BSB code mandatory in MX instructions; co-existence of MT and MX messages until 2024. |

| Malaysia | Beneficiary name field extended to 140 characters; recommendation to avoid special characters outside SWIFT FIN X set. |

| Thailand | Beneficiary name field extended to 140 characters; recommendation to avoid special characters outside SWIFT FIN X set. |

| Hong Kong | Beneficiary name field extended to 140 characters; recommendation to avoid special characters outside SWIFT FIN X set. |

| Philippines | Beneficiary name field extended to 140 characters; regulatory requirement for offshore PHP payments to include Date of Incorporation and industry-specific code word. |

| Eurozone | TARGET2 no longer accepts unpublished 11-digit BICs; payments with such BICs are converted to valid 8-digit BICs; clients encouraged to publish 11-digit BICs. |

| United Kingdom | From May 1, 2025, CHAPS payments require inclusion of LEI for financial institution payments and Purpose Codes for property-related transactions; no immediate rejection if missing but tightening expected by November 2027. |

You should always check the latest rules for the country where you are sending or receiving money. Some banks in Hong Kong and other regions may have new requirements for SWIFT codes or extra details for international wire payments. These changes help make cross-border payments safer and more accurate.

If you want to avoid problems with your international transfers, stay updated on SWIFT code changes and always follow your bank’s instructions. This will help you send and receive money without delays or errors.

Alternatives to SWIFT Codes

Image Source: unsplash

IBAN and Other Identifiers

You may notice that not every international money transfer uses a SWIFT code alone. Many banks now ask for IBAN codes when you send or receive funds across borders. An IBAN code helps identify your exact bank account. It starts with a two-letter country code, then a two-digit check number, and includes your bank code, sort code, and account number. IBAN codes can be up to 34 characters long. For example, a bank transfer to a UK account uses an IBAN that begins with “GB,” followed by numbers and letters that point to your bank and account.

A SWIFT code, also called a BIC, points to the bank itself. The IBAN code points to your specific account. When you use both together, you help banks process international money transfers quickly and accurately. Most countries in Europe require IBAN codes for all cross-border payments. The table below shows where IBAN codes are mandatory:

| Region/Countries | IBAN Requirement for Cross-Border Payments | Notes |

|---|---|---|

| European Economic Area (EEA) | Mandatory | IBAN is required for all cross-border payments under SEPA regulations since 2014/2016. |

| Euro-using countries | Mandatory | IBAN replaced domestic numbering schemes fully by end of 2012. |

| Switzerland | Mandatory (national and cross-border) | IBAN used for all credit transfers since 2006. |

| Middle East, North Africa, Caribbean | IBAN implemented but not always mandatory | Usage varies by bank. |

| United States | Not used | Uses routing numbers and SWIFT codes. |

| Canada | Not used | Uses routing numbers and SWIFT codes. |

Tip: Always check if your recipient’s country needs IBAN codes for international money transfers. This helps avoid delays or rejected payments.

Regional and Fintech Solutions

You have more choices than ever for sending international money transfers. Some regions use payment systems that do not rely on SWIFT codes. For example, the ASEAN regional payment connectivity (RPC) initiative and Project Nexus connect banks in places like Hong Kong, Singapore, and Thailand. These systems let you make real-time transfers and currency conversions without using SWIFT codes. You can pay with QR codes and enjoy lower fees.

Fintech companies also offer new ways to send money. Here are some popular options:

- Airwallex lets you open local bank accounts and manage expenses for your business.

- Nium gives you a platform to send payments to over 190 countries.

- Wise Platform helps you transfer money at real exchange rates and spend in local currencies.

- Cryptocurrency gateways allow you to pay or get paid in digital currencies.

These platforms often make international money transfers faster and cheaper. They do not always need SWIFT or BIC codes. Fintech solutions have also pushed banks to improve their services. SWIFT now offers faster tracking and better transparency because of this competition.

Note: Always compare fees and exchange rates (in USD) before you choose a platform for your next bank transfer.

How to Find SWIFT Codes

Bank Statements and Online Banking

You can find a swift code quickly by checking your bank statements or using your online banking account. Many banks, including those in Hong Kong, display the swift code in sections related to international transfers or account details. If you have received an international transfer before, your bank statement may already show the swift code used for your account.

Here is a simple way to find a swift code using online banking:

- Log into your online banking account or mobile app.

- Go to the section for international transfers or account details.

- Look for the swift code listed with your account information.

- If you do not see it, check your recent bank statements for any past international transfers.

- If you still cannot find it, contact your bank’s customer service for help.

Tip: Always double-check the swift code before you use it for a transfer. A small mistake can cause delays or send your money to the wrong place.

Official Bank Websites

You can also find a swift code by visiting your bank’s official website. Most banks have a section for international wire transfers or frequently asked questions (FAQs) where they list their swift codes. Hong Kong banks often provide a branch locator tool that helps you find the correct code for your specific branch.

Follow these steps to verify a swift code on an official bank website:

- Visit your bank’s official website.

- Navigate to the international banking or contact information section.

- Use the search box to look for “swift code” or “BIC code.”

- Check that the code matches the correct format and does not have extra spaces or wrong characters.

- If you cannot find the code online, contact the bank directly by phone, live chat, or email.

- Always cross-check the swift code with the recipient or your bank before sending money.

- Keep a record of the swift code and your transaction details for future reference.

Note: If you enter the wrong swift code, contact your bank right away. They may help you cancel or reverse the transfer if possible.

By following these steps, you can find a swift code safely and avoid common mistakes. This helps your international transfers go through without problems.

SWIFT Codes vs IBAN

Key Differences

You may wonder how SWIFT codes and IBANs differ. Each serves a unique purpose in international banking. Here is a clear breakdown:

-

IBAN (International Bank Account Number):

- Length: 15 to 34 alphanumeric characters.

- Structure: Starts with a two-letter country code, followed by check digits, a bank identifier, and your account number.

- Purpose: Identifies your specific bank account for international payments.

- Usage: Common in Europe, the Middle East, and some other regions. Not used in the United States or Canada.

-

SWIFT Code (also called BIC):

- Length: 8 to 11 alphanumeric characters.

- Structure: Includes a four-letter bank code, two-letter country code, two-character location code, and an optional three-character branch code.

- Purpose: Identifies the bank or financial institution involved in the transfer.

- Usage: Used globally, including Hong Kong, the United States, and over 200 countries.

IBANs point to your exact account, while SWIFT codes direct the payment to the right bank.

When Each Is Needed

You often need both a SWIFT code and an IBAN for international wire transfers. The SWIFT code routes your payment to the correct bank. The IBAN ensures the money lands in the right account. Using both reduces errors and speeds up processing.

| Code Type | Purpose | Geographic Usage | When Both Are Required |

|---|---|---|---|

| IBAN | Identifies the recipient’s bank account | Mainly Europe, Middle East, some other regions | When sending money to countries that use IBANs, especially from Hong Kong or the United States |

| SWIFT | Identifies the recipient’s bank | Global | Needed with IBAN to route funds and credit the right account |

If you use only one identifier when both are required, you risk delays, misdirected funds, or failed transfers. For example, if you send money from Hong Kong to a bank in France, you must provide both the SWIFT code and the IBAN. The SWIFT code gets your payment to the right bank, and the IBAN makes sure it reaches the correct account. Always check with your bank before sending money to avoid costly mistakes.

You still need SWIFT codes for international wire transfers in 2025. SWIFT continues to modernize, offering real-time tracking and better security for your transfer. You use SWIFT codes to make sure your money reaches the right bank. Fintech solutions and IBANs offer alternatives, but SWIFT remains the global standard. Always confirm transfer requirements with your bank and double-check SWIFT codes using trusted tools like Convera or Wise. This helps you avoid errors and delays when sending a wire.

FAQ

Do you always need a SWIFT code for international transfers in 2025?

You need a SWIFT code for most international wire transfers. Some fintech platforms or regional payment systems may not require one. Always check your bank’s requirements before sending money.

Can you use an IBAN instead of a SWIFT code?

You cannot use an IBAN instead of a SWIFT code. The IBAN identifies your account. The SWIFT code identifies your bank. Many transfers need both. For example, sending money from Hong Kong to Europe often requires both codes.

What happens if you enter the wrong SWIFT code?

If you enter the wrong SWIFT code, your transfer may get delayed, rejected, or sent to the wrong bank. You might pay extra fees. Contact your bank immediately if you notice a mistake.

How much does an international wire transfer cost in 2025?

Transfer fees vary by bank and platform. For example, a Hong Kong bank may charge $20–$50 USD per transfer. Fintech services may offer lower fees. Always compare costs and check the latest USD exchange rates before sending money.

Frustrated by high fees, delays, or errors in international wire transfers? BiyaPay streamlines your cross-border payments with transfer fees as low as 0.5%. Enjoy “Send Today, Arrive Today” for instant transfers to most countries worldwide, bypassing the complexities of SWIFT codes and IBANs. With real-time exchange rates, you can freely convert multiple fiat and digital currencies with full transparency. BiyaPay’s secure, regulated platform ensures your funds are safe, making it ideal for global businesses or frequent travelers. Sign up with BiyaPay today to experience fast, affordable, and reliable international transfers!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.