- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Easy Ways to Identify Your ACH Routing Number Online

Image Source: pexels

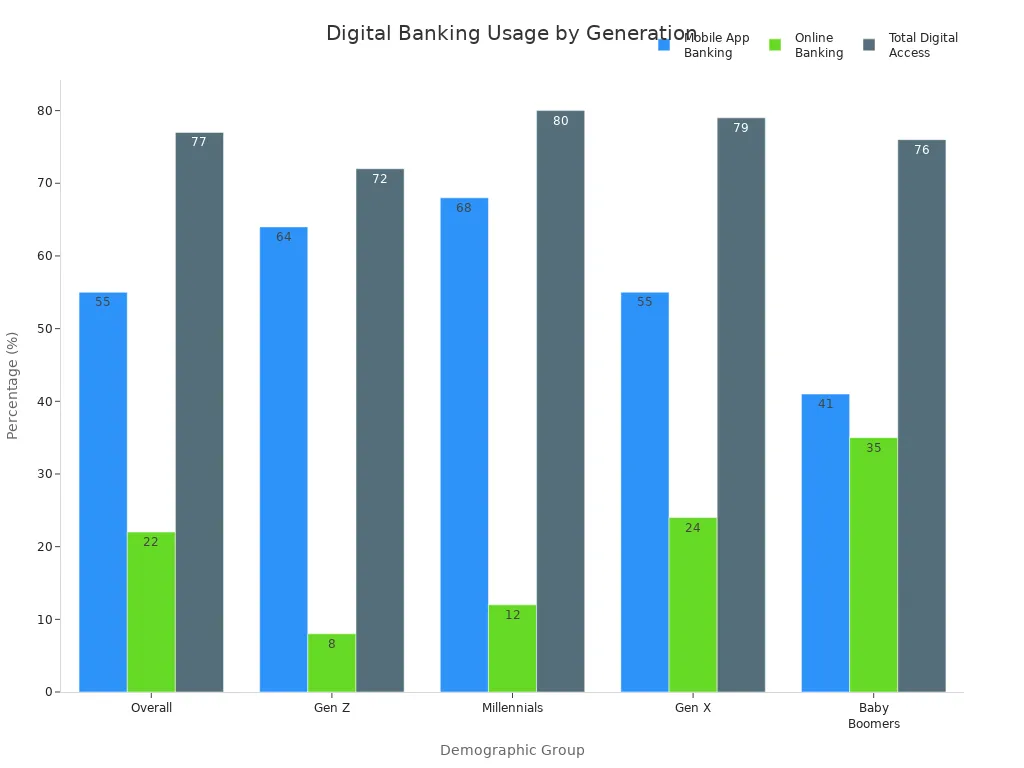

You can easily find your ACH routing number online by logging into your bank’s digital platforms, such as mobile apps or official websites. The ACH routing number is a unique nine-digit code that helps banks process electronic payments quickly and securely. Most people no longer need a checkbook to access this number. According to the 2024 Preferred Banking Methods report, 77% of U.S. bank customers use mobile or online banking to view account details, including the routing number.

Key Takeaways

- Your ACH routing number is a unique nine-digit code used to process electronic payments safely and quickly.

- You can find your routing number easily by logging into your bank’s official website or mobile app under account details.

- Always double-check your routing number before making payments to avoid delays or errors.

- Banks may use different routing numbers for ACH transfers, wire transfers, and checks, so use the correct one for your transaction.

- Protect your banking information by using secure websites, strong passwords, and monitoring your account regularly.

What Is an ACH Routing Number?

ACH Routing Number Meaning

You may wonder what an ACH routing number is and why it matters. The ACH routing number is a unique nine-digit code that helps banks and credit unions in the United States identify each other during electronic transactions. According to the Federal Reserve and NACHA, this number acts like a virtual street address for your bank. It tells the digital payment system exactly where to pull money from and where to send it. Every financial institution that wants to work with the Federal Reserve receives its own routing number. When you use online banking or set up payments, you often need to enter this number along with your account number.

Why You Need It

You use a routing number for many important tasks. The electronic ach routing number lets you move money safely and quickly between accounts. Here are some common ways you might use it:

- Setting up direct deposits for your paycheck or government benefits.

- Automating bill payments so you never miss a due date.

- Receiving payments from customers or other businesses.

You can also see more details in the table below:

| Common Uses of ACH Routing Numbers | Description |

|---|---|

| Direct Deposits | Employers and government agencies use routing numbers to deposit salaries and benefits directly into bank accounts, providing a fast and secure payment method. |

| Bill Payments | Routing numbers help you pay utilities, mortgages, and other bills automatically, so you avoid late fees. |

| Tax Refunds | Tax authorities use routing numbers to send refunds straight to your bank account. |

| Transfers Between Accounts | Routing numbers allow you to move money between your own accounts or send funds to others. |

| Authorizing Online Payments | Routing numbers are needed for one-time or recurring online payments, including payment apps and autopay. |

Tip: Always double-check your routing number before entering it online. Using the wrong number can cause your payment to fail or go to the wrong place. Banks use security tools to protect your information, but you should still be careful.

If you use the wrong ach routing number, your payment might not reach the right account. This can lead to delays, errors, or even lost money. Make sure you use the correct routing number every time you set up a new payment or transfer.

Finding Your ACH Routing Number Online

Image Source: pexels

Find My Routing Number in Online Banking

You can find your routing number quickly by using your bank’s online banking platform. Most major banks in the United States display this information in your account details. If you want to find your routing number, follow these steps:

- Log into your bank’s online banking platform with your username and password.

- Go to the section labeled “Accounts” or “Account Summary.”

- Select the specific account you want to view.

- Look for a link or tab called “Account Details,” “Account Information,” or “Account Numbers.”

- Find terms such as “Routing number,” “Electronic ABA routing number,” “ACH routing number,” or “Routing/Transit number.”

- Write down the nine-digit number shown. This is your ACH routing number.

- If you cannot find your routing number, check your bank’s FAQ or help section. Some banks, like Chase, Bank of America, and Wells Fargo, list routing numbers by state or region.

- If you still cannot find your routing number, contact your bank for help.

Note: Routing numbers may vary depending on the type of transaction. Always make sure you use the correct number for ACH payments.

Find the Routing Number in Mobile App

Many banks also let you find your routing number using their mobile app. The process is similar to online banking, but the layout may look different. To find your routing number in a mobile app, try these steps:

- Open your bank’s mobile app and log in.

- Tap on the account you want to view.

- Look for a menu or button labeled “Account Details,” “Account Info,” or something similar.

- Scroll until you see the section for “Routing number,” “ACH routing number,” or “Routing/Transit number.”

- Write down the nine-digit number displayed.

If you have trouble, use the app’s search feature or help section. Some banks provide a direct link to “find my routing number” in the app menu. If you still cannot find your routing number, call your bank’s customer service for guidance.

Tip: Mobile apps often update their design. If you do not see the option right away, check for updates or look for a help icon.

Tips for Navigating Digital Platforms

If you are new to online banking or do not have a checkbook, you can still find your routing number with a few simple tips:

- Always use your bank’s official website or app. Look for “https” in the web address and a padlock icon to make sure the site is secure.

- Create a strong, unique password for your online banking account. Change it regularly.

- Enable two-factor authentication if your bank offers it. This adds an extra layer of security.

- Never share your login details with anyone.

- If you cannot find your routing number online, contact your bank directly. Ask for the “electronic ACH routing number” and specify the state where you opened your account.

- Remember that routing numbers can change based on the type of transfer. Double-check that you are using the correct number for ACH transactions.

- Keep your device’s antivirus and firewall software up to date to protect your information.

- Regularly monitor your account for any unauthorized transactions.

Note: Banks use strong security tools like encryption, firewalls, and secure authentication to protect your information when you access your routing number online. These measures help keep your data safe from fraud and errors.

Finding your ACH routing number online is simple and safe if you follow these steps and tips. You do not need a checkbook to access this important information. With a few clicks, you can find your routing number and use it for direct deposits, bill payments, and more.

Find the Routing Number on Bank Website

Image Source: unsplash

Where to Look on the Website

You can often find the routing number by searching your bank’s official website. Banks usually display this information in several easy-to-find places:

- FAQs section: Many banks answer common questions about how to find the routing number here.

- Contact or customer service pages: These sections often provide details for different types of transactions.

- Account details area in online banking: After logging in, you may see the routing number listed with your account information.

If you cannot find the routing number online, you should call your bank’s customer service. They can help you get the correct number. Some banks, especially larger ones, may have more than one routing number. Always check the website for the most accurate information.

Regional Differences

Banks in the United States assign routing numbers based on regions. The first two digits of a routing number show which Federal Reserve district the bank belongs to. This means that your routing number can change depending on where you opened your account. The table below shows how these numbers connect to different regions:

| Prefix (First Two Digits) | Federal Reserve District |

|---|---|

| 01 | Boston |

| 02 | New York |

| 03 | Philadelphia |

| 04 | Cleveland |

| 05 | Richmond |

| 06 | Atlanta |

| 07 | Chicago |

| 08 | St. Louis |

| 09 | Minneapolis |

| 10 | Kansas City |

| 11 | Dallas |

| 12 | San Francisco |

If you look at a list of u.s. bank routing numbers, you will notice these patterns. Always use the routing number that matches your account’s location.

Confirming the Correct Number

You should always confirm the accuracy of any u.s. bank routing number you find online. Banks recommend these steps:

- Remove any non-numeric characters and check the number using a validation method like the Luhn Algorithm.

- Call your bank directly to verify the routing number and your account number.

- Use online validation tools that check for errors and confirm the routing number quickly.

These steps help you avoid mistakes and keep your money safe. If you need to find the routing number for a specific transaction, double-check that you are using the right one. Some banks use different routing numbers for ACH transfers, wire transfers, and paper checks.

Tip: Always use the routing number listed for ACH payments if you want to set up direct deposits or pay bills online.

Find My Routing Number on Statements

Accessing Electronic Statements

You can easily access your bank statements online if you use digital banking. Most banks, including many in Hong Kong, offer electronic statements through their websites or mobile apps. To get started, log in to your online banking account. Look for a section labeled “Statements,” “e-Statements,” or “Documents.” You may need to select the account you want to view. Choose the month or date range for the statement you need. Download the statement as a PDF or view it directly in your browser.

If you have trouble finding your statements, check the help section on your bank’s website. Some banks also send email notifications when your new statement is ready. You can sign up for these alerts to stay updated. Electronic statements are secure and easy to store. You can print them if you need a paper copy.

Tip: Always use a secure internet connection when you access your electronic statements. Avoid public Wi-Fi to protect your personal information.

Identifying the Number

Once you open your electronic statement, you can find important account details at the top or bottom of the first page. Look for a section that lists your account number, bank branch, and other details. The routing number on my monthly statement usually appears near your account number or in a summary box. Some banks label it as “Routing Number,” “ACH Routing Number,” or “Bank Code.”

To make sure you have the correct number, compare it with the information on your bank’s website. If you want to find my routing number for a specific transaction, use the number listed on your statement for ACH payments. If you see more than one number, check the labels carefully. When in doubt, contact your bank’s customer service for help.

Note: Always double-check the routing number before using it for direct deposits or bill payments. Using the wrong number can delay your transaction.

ACH vs. Wire Routing Number

Key Differences

You may notice that banks use different routing numbers for different types of transfers. ACH routing numbers and wire routing numbers both have nine digits, but they serve different purposes. The routing number on a check helps identify your bank for paper transactions. ACH routing numbers work with electronic payments, such as direct deposits and bill payments. Wire routing numbers are used for sending money quickly from one bank to another, often for urgent payments.

Banks in the United States sometimes assign separate routing numbers for ACH and wire transfers. You should always check with your bank to find out which number to use. For example, if you want to set up a direct deposit, you need the ACH routing number. If you plan to send money by wire, you need the wire routing number. Some banks even use different numbers for each state or region.

The American Bankers Association (ABA) manages these numbers. ACH routing numbers may start with digits between 61 and 72, while other ABA routing numbers usually start with numbers between 00 and 12. For international transfers, banks use a SWIFT code instead of a routing number.

Note: Always confirm the correct routing number for your transaction type. Using the wrong number can cause delays or failed payments.

Avoiding Mistakes

Many people make mistakes when using routing numbers. Here are some common errors you should avoid:

- Typing the wrong routing number or using outdated information.

- Mixing up ACH routing numbers with wire routing numbers.

- Not checking the routing number with your bank’s website or official documents.

- Believing that all U.S. routing numbers work for international payments.

- Forgetting to update routing numbers after a bank merger.

- Accepting bank details without verifying them.

These mistakes can lead to payment delays, rejected transactions, or even lost money. If you use the wrong routing number, your payment might go to the wrong account or get returned. Criminals can also use stolen routing and account numbers to make fake checks or steal money. You should always monitor your bank account for any unusual activity.

- Using the wrong routing number can cause:

- Payment delays and funds sent to the wrong account.

- Stress and inconvenience from waiting for your money.

- Extra time needed to fix the mistake, sometimes involving your employer or bank.

- Risks of fraud or identity theft if your information is stolen.

Tip: Always double-check your routing number before making a payment. Use your bank’s official website, your statement, or the routing number on a check to confirm the details.

You can find your ACH routing number online with just a few steps. Always double-check the number before you use it for payments. To verify your routing number, follow these steps:

- Log in to your bank’s online platform or use micro-deposit verification.

- Enter your routing and account numbers carefully.

- Confirm any micro-deposits sent to your account.

If you have trouble, banks offer online guides, FAQs, and customer service to help you. Many banks also provide resources that explain routing numbers and their role in electronic payments.

FAQ

How do I know if I have the correct ACH routing number?

You can check your bank’s official website or your online banking account. Compare the number with your electronic statement. If you feel unsure, call your bank’s customer service for confirmation.

Can I use the same routing number for all types of transfers?

No. Banks often use different routing numbers for ACH transfers, wire transfers, and paper checks. Always check which number you need for your specific transaction.

Where can I find the routing number for my Hong Kong bank account?

Hong Kong banks use a bank code and branch code instead of a U.S. routing number. You can find these codes in your online banking account or on your bank’s website.

What should I do if I enter the wrong routing number?

Contact your bank right away. The bank can help you stop or trace the payment. Always double-check your routing number before sending money.

Is it safe to share my routing number online?

Sharing your routing number is usually safe for payments or deposits. Never share your full account number and routing number together unless you trust the recipient. Always use secure websites and apps.

Struggling to find your ACH routing number or worried about transfer errors? BiyaPay simplifies your payment process with a secure, user-friendly platform. With transfer fees as low as 0.5%, you can send money to most countries worldwide and enjoy “Send Today, Arrive Today” for instant transfers. Freely convert multiple fiat and digital currencies using real-time exchange rates for complete transparency. Skip the hassle of routing numbers and high fees—BiyaPay’s regulated platform ensures safe, fast global payments. Sign up with BiyaPay now to manage your funds effortlessly across borders!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.