- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Global Currency Crisis The Weakest Performers of 2025

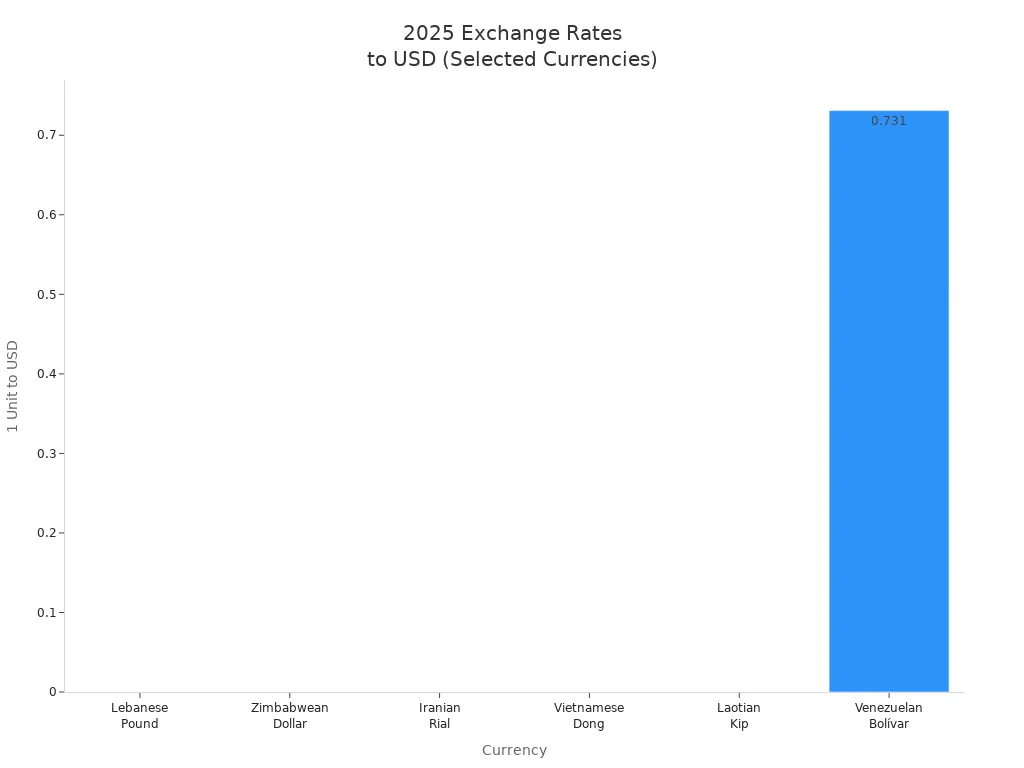

Image Source: unsplash

You might wonder which currencies hold the title of weakest currencies in 2025. The lowest currency in the world right now is the lebanese pound, trading at just 0.000011 USD. Others on this list include the iranian rial, vietnamese dong, laotian kip, zimbabwean dollar, sierra leonean leone, venezuelan bolivar, and São Tomé & Príncipe dobra. These weakest currencies in the world struggle mostly because of inflation, political chaos, or sanctions. Check out the exchange rate table below to see how these currencies compare.

| Currency | Code | Exchange Rate (1 unit to USD) | Exchange Rate (1 USD to unit) | Notes on Economic Context |

|---|---|---|---|---|

| Lebanese Pound | LBP | 0.000011 USD | 89,377 LBP | Financial crisis, political instability, banking collapse |

| Zimbabwean Dollar | ZWL | 0.000015 USD | 67,176 ZWL | Hyperinflation, economic mismanagement |

| Iranian Rial | IRR | 0.000024 USD | 42,068 IRR | Economic sanctions, inflation, political instability |

| Vietnamese Dong | VND | 0.000038 USD | 26,121 VND | Inflation history, currency management to promote exports |

| Laotian Kip | LAK | 0.000046 USD | 21,522 LAK | Landlocked economy, limited industrialization |

| Venezuelan Bolívar | VES | ~0.731 USD | N/A | Hyperinflation, political chaos |

| Sierra Leonean Leone | SLE | N/A | ~22,000 SLE | Depleted reserves, foreign aid dependence |

| São Tomé & Príncipe Dobra | STN | N/A | ~4 STN | Limited exports, foreign aid dependence |

When you see these weak exchange rates, you can imagine how tough life gets for people living in these countries.

Key Takeaways

- Weak currencies lose value fast due to high inflation, political problems, or sanctions, making daily life harder for people.

- Countries with unstable governments, heavy debt, or reliance on few exports often face weak currencies and economic challenges.

- Exchange rates show currency strength; needing many units to buy one US dollar signals a weak currency.

- Weak currencies raise prices, reduce savings value, and create uncertainty for businesses and families.

- Strong leadership, stable politics, and smart economic policies help countries recover and keep their currencies stable.

What Is a Weak Currency?

Image Source: unsplash

When you hear people talk about a weak currency, they usually mean a type of money that loses value quickly compared to others, like the US dollar or the euro. You might notice this when you travel or shop online and see how much more of one currency you need to buy the same thing. But what really makes a currency weak? Let’s break it down.

Key Features of a Weak Currency

You can spot a weak currency by looking at a few key signs. Here’s what you should watch for:

- High inflation rates that make prices rise fast and reduce what your money can buy.

- Lots of public debt, which means the country owes a lot compared to what it earns.

- Weak economic fundamentals, so investors don’t want to hold or use that currency.

- Frequent changes in value, making it hard for people and businesses to plan.

- Speculative attacks, where traders bet against the currency, causing its value to drop even more.

A strong or stable currency, on the other hand, usually has low inflation, manageable debt, and a healthy economy. This attracts investors and helps keep the currency’s value steady. When you see a country with these features, you can expect more stability in its money.

Note: Weak currencies often face sudden drops in value, forcing governments to use their reserves or raise interest rates to try to keep things under control.

How Exchange Rates Show Weakness

Exchange rates tell you how much one currency is worth compared to another. If you see that you need a huge amount of one currency to get just one US dollar, that’s a sign of weakness. For example, if 1 USD equals 89,000 Lebanese pounds, you know the Lebanese pound is struggling.

Central banks sometimes try to help by changing interest rates or using their reserves, but if the economy is weak or inflation is high, these moves might not work for long. Exchange rates move up or down based on things like inflation, interest rates, and how strong the economy is. When a country’s economy slows down or its government spends too much, its currency often loses value. This makes exchange rates a clear signal of a currency’s strength or weakness.

Causes of the Weakest Currencies

Inflation and Economic Instability

You might notice that high inflation rates often go hand in hand with a weak economy. When prices rise quickly, your money buys less each day. This makes people lose trust in their currency. In many countries, once currency depreciation passes a certain point, inflation gets even worse. For example, a study in Kenya found that when the exchange rate drops by more than 0.51% in a month, inflation jumps much higher. Central banks try to control this by changing interest rates, but it does not always work. If you live in a place with rapid depreciation, you probably see prices change every week. This cycle makes your country more vulnerable to shocks and can lead to economic turmoil.

Political and Structural Issues

Political problems can make currencies even more vulnerable. When leaders fight or change rules often, investors get nervous. They might pull their money out, which causes currency weakening. You can see this in many places where political instability leads to less economic growth. For example, research shows that when governments face protests or lose control, the economy shrinks. This drop in output makes the currency lose value. Sometimes, outside groups like the IMF ask countries to make big changes. These changes can cause hardship and protests, which only add to the problem. If you live in a country with weak banks or lots of debt, your currency is at risk.

Political fights and sudden rule changes can scare investors and make your currency even more vulnerable.

Sanctions and External Pressures

Sanctions from other countries can hit currencies hard. When a country faces trade bans or loses access to the U.S. dollar, its currency often drops fast. The global financial system relies on the dollar, so losing access makes it tough to pay for imports or borrow money. This pressure can lead to rapid depreciation and more economic turmoil. Sanctions also raise prices for things like oil and food, which hurts people in vulnerable countries even more. When you see a country under sanctions, you can expect its currency to struggle. The effects often spill over to other countries, making the whole region less stable.

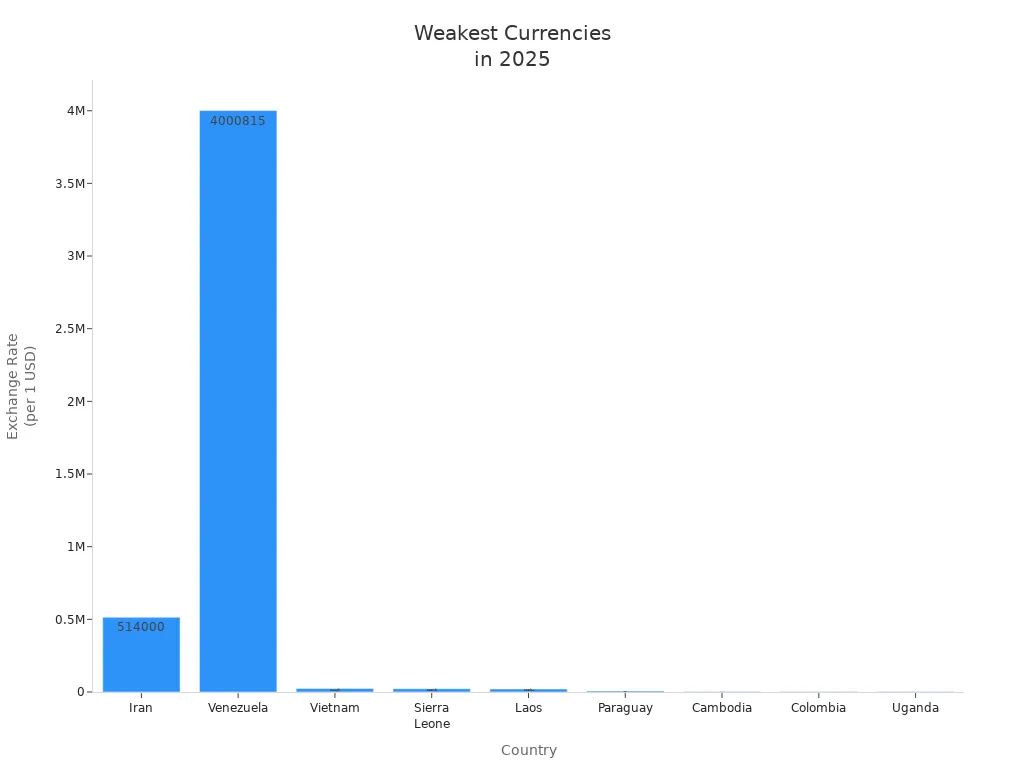

Weakest Currencies in the World 2025

You might wonder which currencies have the lowest value in 2025. Let’s look at the ranked list of the weakest currencies in the world, their exchange rates, and the main reasons behind their struggles. This table gives you a quick overview:

| Rank | Country | Currency Name | Currency Code | Exchange Rate (1 USD to local currency) | Main Reason for Weakness |

|---|---|---|---|---|---|

| 1 | Lebanon | Lebanese Pound | LBP | 89,500 LBP | Hyperinflation, political crisis |

| 2 | Iran | Iranian Rial | IRR | 514,000 IRR | Sanctions, inflation, mismanagement |

| 3 | Vietnam | Vietnamese Dong | VND | 26,092 VND | Export dependence, policy-driven devaluation |

| 4 | Laos | Laotian Kip | LAK | 21,748 LAK | Trade deficit, low reserves |

| 5 | Sierra Leone | Sierra Leonean Leone | SLL | 22,563 SLL | Structural weakness, inflation |

| 6 | Zimbabwe | Zimbabwean Dollar | ZWL | N/A | Hyperinflation, currency instability |

| 7 | Venezuela | Venezuelan Bolivar | VES | 123.72 VES | Oil crisis, hyperinflation |

| 8 | São Tomé & Príncipe | Dobra | STN | 21.65 STN | Limited resources, inflation |

Let’s break down each currency and see why it ranks among the lowest currency in the world.

Lowest Currency in the World: Lebanese Pound (LBP)

You see the lebanese pound at the very bottom of the list in 2025. The exchange rate against the U.S. dollar is about 89,500 LBP for 1 USD, making it the lowest currency in the world. Years of corruption, political gridlock, and mismanagement have crushed Lebanon’s economy. The 2019 banking crisis froze people’s savings. The 2020 Beirut port explosion destroyed trust and infrastructure. The government kept printing money, which led to hyperinflation. Most people now use U.S. dollars for daily life because the lebanese pound has lost almost all value. You can’t rely on banks, and many businesses only accept cash in foreign currency.

The lebanese pound’s collapse shows how quickly a currency can lose value when trust disappears.

Iranian Rial (IRR)

The iranian rial is another currency with one of the lowest values in 2025. The exchange rate is about 514,000 IRR for 1 USD. Sanctions have cut Iran off from global markets. The country faces high inflation and a shrinking economy. The government uses a dual exchange rate system, which confuses prices and makes things worse. Oil revenues have dropped, and political instability scares away investors. You see prices rise every week, and many families struggle to afford basic goods.

Vietnamese Dong (VND)

The vietnamese dong has a low value, with an exchange rate of about 26,092 VND for 1 USD in 2025. Vietnam’s economy depends on exports, especially to the U.S. When global demand drops or trade tensions rise, the currency weakens. The State Bank of Vietnam lets the dong fall to help exports stay competitive. This policy makes imports more expensive and pushes up inflation. Many people in Vietnam turn to gold to protect their savings when the vietnamese dong loses value.

Laotian Kip (LAK)

The laotian kip is also among the weakest currencies. The exchange rate is about 21,748 LAK for 1 USD. Laos relies on natural resources and agriculture, which makes its economy unstable when prices change. The country runs a trade deficit, especially with Thailand, and has low foreign currency reserves. Banks often run out of dollars or Thai baht, so people use exchange shops with higher rates. The laotian kip keeps losing value because the country cannot earn enough from exports.

Zimbabwean Dollar (ZWL)

The zimbabwean dollar has a long history of hyperinflation. In 2008, prices doubled almost every day, and people stopped trusting the currency. Zimbabwe switched to using foreign money, mostly U.S. dollars. In 2024, the government tried to fix things by launching a new gold-backed currency called the ZiG. Still, inflation and instability continue. The exchange rate changes often, and many people still prefer to use U.S. dollars for safety.

Sierra Leonean Leone (SLL)

The sierra leonean leone trades at about 22,563 SLL for 1 USD in 2025. The country’s economy depends on agriculture and raw materials. After a long civil war, Sierra Leone struggled to rebuild. Corruption, weak infrastructure, and poor investment keep the currency weak. The government tried to fix things by removing zeros from the currency, but inflation and debt remain big problems. You see prices rise and jobs stay scarce.

Venezuelan Bolivar (VEF)

The Venezuelan bolivar is another example of a currency in crisis. The exchange rate is about 123.72 VES for 1 USD in July 2025. Venezuela’s economy depends on oil, but production has dropped sharply. Inflation is extremely high, and salaries are very low. The government lost a major oil partner, which made things worse. The bolivar keeps losing value, and most people struggle to buy basic goods.

São Tomé & Príncipe Dobra (STN)

The dobra from São Tomé & Príncipe is one of the weakest currencies in Africa. The exchange rate is about 21.65 STN for 1 USD in 2025. The country has limited resources and faces high inflation. Poverty and poor fiscal management make it hard to build trust in the currency. Even after redenomination, the dobra remains weak because the economy is small and depends on a few exports.

When you look at these weakest currencies, you see how inflation, political problems, and economic shocks can quickly destroy a currency’s value. If you live in one of these countries, you know how hard it is to plan for the future when your money loses value every day.

Why These Are the Weakest Currencies

Lebanese Pound: Hyperinflation and Political Crisis

You have seen the lebanese pound lose over 90% of its value since the crisis began. Hyperinflation hit hard, with prices for bread and fuel rising by hundreds of percent in just months. Banks restricted access to savings, so you might have struggled to get your money. Many people switched to using US dollars or stablecoins for daily life. The Central Bank tried to boost reserves by converting lebanese pound into US dollars, but this did not fix the deep economic collapse. Political fights and regional conflicts made things worse, leading to more poverty and shortages of basic goods.

Iranian Rial: Sanctions and Economic Isolation

You notice the iranian rial keeps falling because of strict international sanctions. These sanctions cut off access to global markets and financial systems. Iran cannot export oil easily, which makes up most of its government revenue. The collapse of international agreements in 2025 led to a sharp drop in the rial’s value and pushed inflation to 35%. Many families now face poverty, and the country struggles to get medicine and supplies.

Vietnamese Dong: Structural Economic Challenges

The vietnamese dong faces pressure from several directions:

- Global demand dropped as U.S. trade policies shifted, so export orders fell.

- Manufacturing slowed, and more businesses closed than opened.

- Investors and business owners feel cautious, so they invest less and hire fewer workers.

- Banking risks grew, with more bad loans and a gap between official and unofficial exchange rates.

- People started buying gold to protect their savings as the dong lost value.

- Inflation stayed moderate, but the currency still weakened due to these challenges.

Laotian Kip: Fiscal Deficits and Instability

You see the laotian kip struggle because the government borrowed too much and could not collect enough taxes. Laos owes a lot to foreign lenders, especially China, and must pay high interest rates. The kip lost about half its value since 2022, making it harder to pay back loans. Inflation stayed high, and people’s incomes dropped. Even after some debt relief, the country still faces big risks. Without better tax collection and spending controls, the kip will likely stay weak.

Zimbabwean Dollar: Chronic Inflation

Zimbabwe’s currency troubles come from years of economic mismanagement. Failed land reforms and sanctions hurt the economy. Hyperinflation peaked in 2008, and people lost trust in the local money. In 2024, Zimbabwe introduced a gold-backed dollar called ZiG to fight inflation. The government raised interest rates and controlled the money supply. These steps helped slow inflation, but prices still rise fast. The Zimbabwean dollar remains unstable, and many people prefer to use US dollars.

Sierra Leonean Leone: Structural Weaknesses

The sierra leonean leone keeps losing value because of several problems:

- Political instability scares away investors.

- The country cannot export enough goods to bring in US dollars.

- Sierra Leone relies on imports, which increases demand for foreign currency.

- Mining and farming have not stabilized the economy.

- Low investment and ongoing inflation make things worse. You might notice food prices going up and public workers struggling with low pay.

Venezuelan Bolivar: Economic Collapse

Venezuela’s bolivar has collapsed due to a mix of problems:

- The Central Bank cut the supply of US dollars, so people turned to the black market.

- Oil exports dropped after the loss of key partners, making it hard to get foreign currency.

- Inflation soared to nearly 200%, and wages did not keep up.

- The gap between official and black market rates grew wider, showing a lack of trust in the bolivar.

- Many people now struggle to buy basic goods, and the economy faces deep recession.

São Tomé & Príncipe Dobra: Limited Economic Base

You see the dobra stay weak because São Tomé & Príncipe has a small economy and depends on imports. The country does not export much, so it cannot earn enough US dollars. Low reserves and heavy reliance on foreign aid make the currency fragile. Without more exports or economic growth, the dobra will likely remain one of the weakest currencies.

Patterns Among the Weakest Currencies

Regional Trends

When you look at the weakest currencies in 2025, you start to see some clear patterns by region. Some areas face more trouble than others. Here’s what stands out:

- In the Middle East, countries like Lebanon and Iran struggle with chronic inflation. Sanctions and political instability make these places vulnerable. Governments often print more money, which leads to rapid depreciation and hyperinflation.

- Sub-Saharan Africa has several vulnerable currencies. Sierra Leone and Guinea depend on exporting things like diamonds and gold. Political instability and corruption make it hard to keep stability. These countries often see their exchange rates drop fast.

- Southeast Asia shows a different story. Vietnam and Laos have low-value currencies, but you notice more stability here. These countries manage their economies better, with diversified exports and careful fiscal policies. Even if their currencies are weak, they avoid rapid depreciation.

- Other regions, like Central Asia and South America, also have weak currencies. For example, the Uzbekistani Som and Paraguayan Guarani face problems from commodity dependence and political challenges.

You can see that political instability, reliance on a few exports, and outside pressures shape these regional trends. Countries with more stable governments and diverse economies tend to avoid the worst currency problems.

Common Causes

If you compare the weakest currencies, you find many share the same problems. The table below shows what makes these currencies so vulnerable:

| Currency | Key Causes of Weakness |

|---|---|

| Lebanese Pound (LBP) | Excessive money printing, hyperinflation, weak growth |

| Iranian Rial (IRR) | Economic sanctions, political instability |

| Vietnamese Dong (VND) | Economic transition, export dependence |

| Sierra Leonean Leone (SLL) | Economic challenges, political instability |

| Laotian Kip (LAK) | Long-term low valuation, fiscal deficits |

| Indonesian Rupiah (IDR) | Declining reserves, commodity reliance |

| Uzbekistani Som (UZS) | Low growth, high inflation |

| Guinean Franc (GNF) | Corruption, political unrest |

| Paraguayan Guarani (PYG) | Economic collapse, high inflation, corruption |

| Malagasy Ariary (MGA) | Natural disasters, political instability |

You notice that hyperinflation, weak governance, and political instability show up again and again. Many of these countries depend on just a few exports. When prices fall or disasters hit, their economies become vulnerable. Weak economic growth and corruption also make it hard to build stability. When you see these patterns, you understand why some currencies keep losing value while others hold steady.

Impact of Weak Currencies Globally

Image Source: pexels

Economic Effects

When you see a weak currency, you notice changes in the world economy. Countries with falling currencies often face higher import prices. This makes it harder for them to buy goods from other places. You might see global trade slow down because companies worry about price swings. According to J.P. Morgan economists, weak currencies in 2025 mix with trade shocks and tariff changes. These problems create more ups and downs in global markets. Investors sometimes move their money to safer places, which can hurt growth in countries with unstable money. Still, some emerging markets may attract new investments if their currencies start to recover against the U.S. dollar. Even with these chances, you see more uncertainty and slower global growth.

Impact on Individuals and Businesses

If you live in a country with a weak currency, you feel the effects every day. The cost of living goes up fast. Groceries, gas, and even school supplies can double in price in just a few months. Businesses struggle to plan for the future. They pay more for imported materials and often pass those costs to you. Some companies may close or lay off workers because they cannot keep up with rising expenses. You might see your savings lose value, making it harder to buy what you need. People sometimes turn to foreign money or gold to protect their earnings.

When your money loses value, you have to make tough choices about spending and saving.

Weak Currency vs. Instability

A weak currency does not always mean a country will fall apart, but it often signals deeper problems. You might notice that places with political fights or poor leadership see their money drop the fastest. Currency devaluation can lead to protests or unrest if people cannot afford basic goods. Sometimes, governments try to fix things by changing leaders or making new rules. If they do not act fast, the situation can get worse. You see that stability and trust are key for any country hoping to rebuild its currency and improve living conditions.

Summary Table: Weakest Currencies 2025

You have seen how the weakest currencies in the world struggle for many reasons. Now, let’s look at a clear table that shows you the main facts. This table lists each country, its currency code, the current exchange rate to USD, and the main reason for its weakness. You can use this table to compare and spot trends.

| Country | Currency Code | Exchange Rate (1 USD to unit) | Main Cause of Weakness |

|---|---|---|---|

| Lebanon | LBP | 89,500 LBP | Hyperinflation, political crisis |

| Iran | IRR | 514,000 IRR | Sanctions, inflation |

| Vietnam | VND | 26,092 VND | Export dependence, policy choices |

| Laos | LAK | 21,748 LAK | Trade deficit, low reserves |

| Sierra Leone | SLL | 22,563 SLL | Structural weakness, inflation |

| Zimbabwe | ZWL | N/A | Hyperinflation, currency instability |

| Venezuela | VES | 123.72 VES | Oil crisis, hyperinflation |

| São Tomé & Príncipe | STN | 21.65 STN | Limited resources, inflation |

You can see that the exchange rate for each of these currencies is much higher than what you find in stronger economies. When you need tens of thousands of units to get just one USD, you know the currency is weak.

Let’s talk about what you notice in this table. Many of the weakest currencies in the world come from regions with political problems or heavy reliance on just one or two exports. For example, Lebanon and Iran both face political instability and sanctions. In Africa, countries like Sierra Leone and Zimbabwe struggle with inflation and weak economic systems. Southeast Asia shows up too, with Vietnam and Laos both having low exchange rates because of export dependence and trade issues.

You might spot a pattern here. Most of these countries have high inflation, unstable governments, or depend on a single resource. When you see a country with a high exchange rate to USD, you can guess it faces one or more of these problems. This table helps you understand why some currencies stay strong while others keep falling.

You have seen how weak currencies in 2025 often come from countries with inflation, political problems, or sanctions. These issues affect you and people around the world. Prices rise, savings lose value, and planning gets tough.

Stay alert to currency trends.

You can check exchange rates, use trusted banks like those in Hong Kong, and keep some savings in stable currencies. Will more countries face currency trouble next year? Only time will tell.

FAQ

What makes a currency weak?

You see a currency as weak when it loses value quickly compared to others, like the US dollar. High inflation, unstable politics, or poor economic choices often cause this. People in these countries need more money to buy the same things.

How does a weak currency affect your daily life?

You pay more for food, gas, and other goods. Your savings lose value fast. Many people switch to using US dollars or gold to protect their money. Planning for the future gets harder when prices change every week.

Can a weak currency recover?

Yes, a weak currency can recover if the government fixes its economy. Leaders must control inflation, build trust, and attract investors. Sometimes, countries get help from groups like the IMF. Recovery takes time and strong decisions.

Why do some countries have weak currencies while others stay strong?

Countries with stable governments, low inflation, and strong exports usually have stronger currencies. If a country faces political fights, high debt, or relies on one export, its currency often becomes weak. Good leadership and smart policies help keep money strong.

Should you worry if your country’s currency is weak?

You should pay attention. A weak currency can make life harder. Watch exchange rates and try to save in stable currencies, like the US dollar. Using trusted banks in places like Hong Kong can help protect your savings.

Struggling with high fees or delays when transferring to countries with weak currencies like the Lebanese Pound or Iranian Rial? BiyaPay offers a secure, low-cost way to send money globally, with transfer fees as low as 0.5%. With “Send Today, Arrive Today,” your funds reach most countries instantly, even those with volatile currencies. Freely convert between multiple fiat and digital currencies using real-time exchange rates for full transparency. BiyaPay’s regulated platform ensures your money is safe, making it perfect for businesses or individuals dealing with regions like Lebanon or Vietnam. Sign up with BiyaPay today for fast, affordable, and secure global transfers!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.