- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to safely send money with routing and account number

Image Source: pexels

You might wonder if it’s safe to send money using a routing and account number. The answer is yes, as long as you pay close attention to the details. Always double-check the routing and account number before you send money. A small mistake can send your funds to the wrong place. When sending money, protect your information and never share it with strangers. Stay alert to keep your money safe.

Key Takeaways

- Always double-check the routing and account numbers before sending money to avoid mistakes and delays.

- Keep your bank details private and share them only with trusted people or companies.

- Use secure networks and banking apps with strong security features to protect your information.

- Verify recipient details by confirming their information through trusted contacts before transferring funds.

- Act quickly if you notice suspicious activity or enter wrong payment details to protect your money.

Send Money Safely

Image Source: unsplash

Safety Basics

When you send money, you want to make sure your payment goes to the right person. Always double-check the recipient’s name, routing number, and account number before you confirm any transfer. Many banks use encryption and two-factor authentication to keep your information safe. You should use these features whenever possible.

Tip: Set up email or text alerts with your bank. These notifications help you spot suspicious payment activity right away.

Here are some simple steps to securely transfer money:

- Treat your routing and account numbers like private information. Never write them down where others can see.

- Only share your bank details with people or companies you trust.

- Use secure networks when sending payments online. Avoid public Wi-Fi for bank transfers.

- Monitor your accounts often. If you see a payment you do not recognize, contact your bank immediately.

- Store your bank statements in a safe place. Electronic statements can reduce the risk of theft.

When you send money, remember that a wire transfer works much like cash. Once you send it, you usually cannot get it back. Take your time and never rush when sending payments in the US or anywhere else.

Common Risks

You face several risks when you transfer funds using routing and account numbers. If someone gets both numbers, they can create fake checks, make unauthorized online payments, or even set up fraudulent ACH debits. Scammers may use social engineering to trick you into sharing your details. Sometimes, they pretend to be your bank or a trusted company.

Recent reports show a rise in payment fraud using new technology. Criminals use AI and automation to steal information or change payment details in real time. Account takeover fraud is also growing. In these cases, someone gains access to your bank account and changes your login details to steal your money.

Note: If you share your bank account number and routing number along with other personal information, the risk of fraud increases. Always limit what you share.

Banks in the US have protections for unauthorized transactions. If you report a problem within 60 days, your bank can often reverse the payment. Still, you need to act fast. Keep an eye on your accounts and never ignore strange activity. By following these steps, you can make bank-to-bank transfers and other payments with more confidence.

Routing and Account Number Explained

Image Source: unsplash

What Is a Routing Number

You see a routing number every time you look at the bottom left corner of a check. This nine-digit code tells you which bank or credit union holds your account. The American Bankers Association created the routing number system in 1910 to help process checks. Today, banks use it for electronic payments, wire transfers, and ACH transfers. The ABA, along with Accuity, assigns and manages these codes for all banks in the United States. When you use a routing and account number to send money, the routing number acts like a virtual address for your bank.

What Is an Account Number

Your account number is different from your routing number. While the routing number points to the bank, the account number points to your specific bank account. Each account number is unique, even if you have more than one account at the same bank. This number helps the bank know exactly where to put your money during a transfer. If you want to see the difference at a glance, check out this table:

| Aspect | Account Number | Routing Number |

|---|---|---|

| Uniqueness | Unique to each individual bank account | Unique to each financial institution |

| Identification Purpose | Identifies the specific bank account for transactions | Identifies the bank or financial institution involved |

| Consistency Across Bank | Different for each account, even for the same person | Same for all accounts within the bank (may vary by region or transaction type) |

Why They Matter for Transfers

You need both the routing and account number to make sure your money goes to the right place. Here’s why these numbers matter for every transfer:

- The routing number tells the payment system which bank should receive the money.

- The account number shows which bank account inside that bank should get the funds.

- The routing and account number work together to guide electronic payments, like ACH transfers, wire transfers, direct deposits, and bill payments.

- Without both numbers, your transfer could get delayed, lost, or sent to the wrong person.

- These numbers help banks process your transfer quickly and safely.

Tip: Always double-check the routing and account number before you send money. A small mistake can cause big problems.

When you understand how the routing and account number work, you can send money with more confidence. You lower your risk of errors and make sure your transfer reaches the right bank account every time.

How to Transfer Funds

Step-by-Step Process

You want to send money safely and quickly. Here’s a simple guide to help you transfer funds using a routing and account number. Most major banks, like Bank of America and U.S. Bank, follow similar steps for a payment to a bank account:

- Log in to your online or mobile banking app.

- Find the “Pay & Transfer” or “Transfer money” section.

- Choose to add a new recipient or external account.

- Enter the recipient’s full name, address, routing and account number, and account type (checking or savings).

- Some banks may ask for your debit card number and PIN for extra security.

- Accept any service agreements if it’s your first time making this kind of payment.

- Verify your identity. You might get a text message with a code or need to enter your ATM card details.

- Wait for the bank to confirm the recipient’s information. This can be instant or take a couple of days if trial deposits are used.

- Once the recipient is added, select your account to send money from and the recipient’s account to send money to.

- Enter the amount, date, and any notes for the transfer.

- Review all details. Look for scam warnings or reminders from your bank.

- Confirm the transfer.

- Watch for a confirmation message or email. You can check the status in your transfer activity.

Note: If you schedule a future transfer, you can usually edit or cancel it before the date.

Banks use secure networks and may use services that instantly check if the routing and account number are valid. This helps prevent mistakes and keeps your payment safe.

Information Needed

Before you start, gather all the details you need for a successful bank transfer. Missing or incorrect information can delay your payment or send it to the wrong place. Here’s what you should have ready:

- Recipient’s full name

- Recipient’s address

- Recipient’s phone number

- Recipient’s bank name

- Routing and account number for the recipient’s bank account

- Account type (checking or savings)

- Your own full name and phone number (some banks require this)

- Amount to send and the date for the transfer

Banks need both the routing and account number to process your payment. The routing number tells the system which bank will receive the money. The account number points to the exact bank account for the transfer. If you leave out either number, the payment will not go through.

Tip: Double-check the numbers. Even a small mistake can cause delays, extra fees, or failed payments.

Verify Recipient Details

Verifying recipient details is the most important step before you send money. Many people make mistakes by entering the wrong routing or account number, or by skipping the verification step. Here’s how you can avoid common errors and scams:

- Always confirm the recipient’s information by calling them on a trusted phone number. Never rely only on email, since scammers can fake messages.

- Check the routing and account number twice. Compare them with official documents or bank statements.

- If you get new payment instructions, be careful. Scammers often send fake updates. Call the recipient to confirm any changes.

- Use secure networks for your transfer. Avoid public Wi-Fi, which can expose your payment details.

- Watch for urgent or unexpected requests to transfer funds. These can be signs of a scam.

- Some banks use extra tools to check if the routing and account number are real. They may ask for a code sent to your phone or use special software to check the numbers.

- If you notice any errors or suspicious activity, contact your bank right away. Quick action can help stop fraud.

Alert: Entering the wrong routing or account number can send your payment to the wrong bank or cause delays. Banks may return the money, but you could wait one to two weeks and pay extra fees.

Mistakes happen when people confuse routing numbers with other codes, skip verification, or use outdated information. Take your time and review every detail before you confirm the transfer. This helps your payment reach the right bank account and keeps your money safe.

Transfer Methods Compared

ACH vs. Wire Transfer

You have a few choices when you want to send a payment from your bank account. ACH transfers and wire transfers are two of the most common ways to move money. Both methods use routing and account numbers, but they work differently. Here’s a quick look at how they compare:

| Aspect | ACH Transfers | Wire Transfers |

|---|---|---|

| Process | Batch-processed; takes 1-3 business days; some same-day options | Sent one at a time; usually arrives same day in the U.S., 1-2 days for other countries |

| Reversibility | Can reverse or recall within a limited time | Usually cannot reverse once sent |

| Usage | Good for payroll, bill pay, and regular payments | Best for large, urgent, or international payments |

| Security | Secure, with possible reversals | Secure, but permanent—double-check details |

| Cost | Low fees, often less than $3 | Higher fees, $25-$50 per transfer |

| Speed | 1-3 business days (some same-day) | Same day or next day |

ACH transfers work well for regular payments, like paying bills or sending money to friends. Wire transfers move money faster, but you pay more for the speed. If you need to send a bank-to-bank transfer quickly, wire transfers are the way to go. Just remember, once you send a wire, you usually cannot get it back.

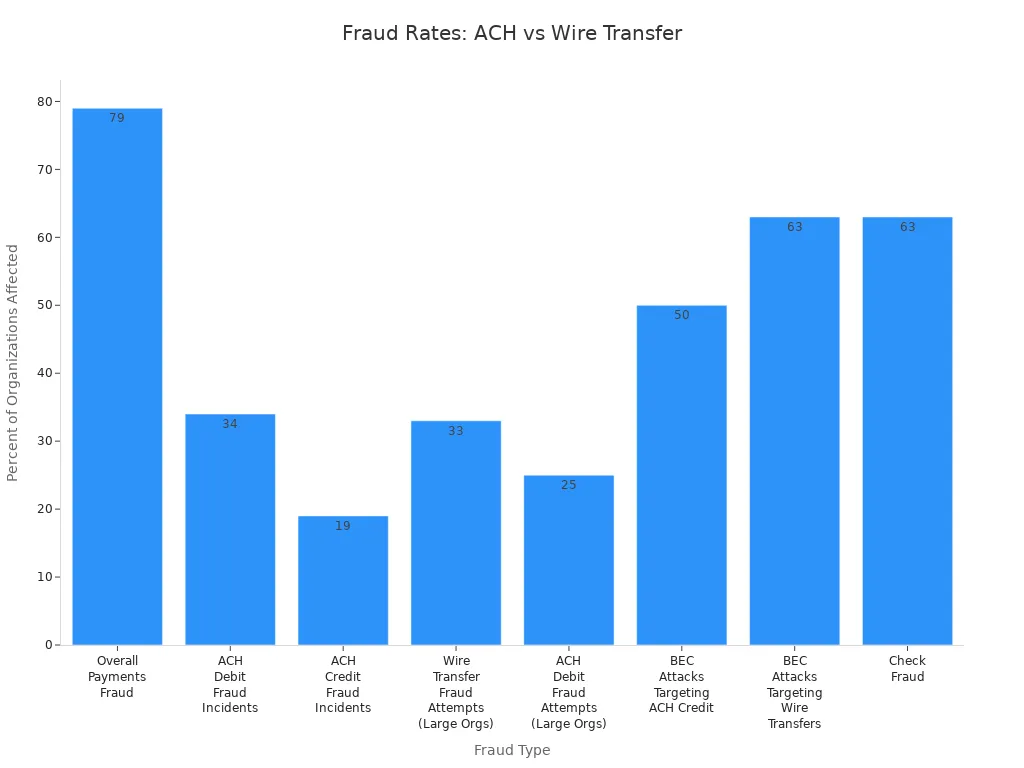

Wire transfers and ACH transfers both have strong security, but wire transfers see more fraud attempts, especially with business email compromise scams. Always double-check payment details before you send a bank transfer.

Digital Banking Apps

Money transfer apps like Zelle, PayPal, and Venmo make sending payments easy. You can use these apps to move money between your own accounts or send payments to others. Most apps let you link your bank account using your routing and account number. Here’s how these apps keep your payments safe:

- They use SSL encryption to protect your data.

- Multi-factor authentication keeps your account secure.

- Device registration and automatic logouts help prevent unauthorized access.

- No account data is stored on your phone.

- You get alerts for large payments or password changes.

To send a payment, you log in, pick the transfer option, enter the amount, and confirm. You can also add external accounts using routing and account numbers. Zelle, PayPal, and Venmo all support quick payments, but each app has its own rules and fees. Zelle is great for instant bank-to-bank transfers between friends. PayPal and Venmo work well for both personal and business payments.

Some digital services, like Wise, Wells Fargo, and HSBC, let you send international payments using routing and account numbers. You may need extra details, such as SWIFT or IBAN codes, for these transfers.

Fees and Speed

You want to know how much a payment will cost and how fast it will arrive. Here’s a table to help you compare:

| Payment Method | Average Fee Range | Typical Transfer Speed |

|---|---|---|

| ACH Transfer | $0.20 to $3 per transaction | 1 to 3 business days |

| Wire Transfer | $25 to $50 per transfer | Same day (within hours) |

| Digital Payment Apps | 2.5% to 3% fee for businesses | Instant to 1-3 days |

ACH transfers are the cheapest way to send a payment, but they take longer. Wire transfers cost more, but your payment arrives fast. Money transfer apps like Zelle, PayPal, and Venmo offer instant payments, but business payments may have higher fees. If you need to send money overseas, some banks and apps let you use routing and account numbers, but you may need extra codes and pay extra fees.

Tip: Always check the fees and transfer times before you send a payment. Choose the method that fits your needs and budget.

Avoiding Scams When You Send Money to Friends

Double-Check Details

You want your payment to reach the right person every time. Before you send money to friends, take a few simple steps to avoid mistakes and fraud.

- Double-check the recipient’s bank account number and routing number. Look at each digit closely.

- Confirm the recipient’s name, address, and bank details. Ask your friend to send these details in writing so you have proof.

- If you are unsure, call the recipient’s bank to confirm the information, especially for a first-time transfer.

- Review your bank statements often. This helps you spot any unauthorized or unusual payment quickly.

Tip: Taking a few extra minutes to verify details can save you from losing money or facing delays.

Use Secure Networks

When you send a payment online, always use a secure network. Public Wi-Fi at coffee shops or airports may seem convenient, but these networks are not safe for financial transactions. Hackers can steal your information if you use unsecured connections.

- Use your home Wi-Fi or a trusted private network for online banking.

- If you must use public Wi-Fi, connect through a Virtual Private Network (VPN) to encrypt your data.

- Choose payment platforms that use strong encryption and security features.

- Keep your account details private and never share them over email or text.

Note: If you notice anything strange, like a payment you did not make, report it to your bank or payment provider right away.

Spotting Scams

Scammers use many tricks to steal your money during a transfer. They may ask for urgent payments or pretend to be someone you know. Stay alert by watching for these warning signs:

- You get a sudden request to send money, especially if the person claims it is an emergency.

- Someone pressures you to pay with wire transfers, gift cards, or asks for your bank details.

- The message or call comes from an unknown number or email.

- You are asked to pay for products or services using peer-to-peer payment apps without verifying the seller.

- The person asks for remote access to your computer or wants you to wire money internationally.

If you feel unsure, stop and check. Contact your friend using a trusted phone number. Never use contact details from a suspicious message. For extra safety, send a small test payment first to confirm the recipient.

If you think you have been targeted by a scam, report it to the Consumer Financial Protection Bureau (CFPB) or USA.gov. These official sites help you recover lost funds and protect others from fraud.

Sending money with routing and account numbers can be safe if you stay careful. Always double-check every digit and protect your banking details. Here are some key tips to remember:

- Double-check routing and account numbers to avoid mistakes.

- Protect your account info and use strong passwords.

- Watch out for phishing scams and never share details with strangers.

- Use secure banking apps with encryption and biometric checks.

- Confirm details with your bank, like HSBC or Bank of China (Hong Kong), before sending money.

If you ever feel unsure, reach out to your bank or a trusted provider for help. Stay alert and use secure transfer methods to keep your money safe.

FAQ

Can you send money with just a routing and account number?

Yes, you can. Most banks let you transfer funds using only the routing and account number. Always double-check both numbers before you send money. This helps you avoid sending funds to the wrong account.

How long does a bank transfer take?

Transfer speed depends on the method. ACH transfers usually take 1–3 business days. Wire transfers often arrive the same day. Some digital apps move money instantly. Always check with your bank for exact timing.

What should you do if you enter the wrong account number?

Contact your bank right away. Quick action gives you the best chance to recover your money. Some banks may reverse the payment, but you might wait several days and pay extra fees.

Are there limits on how much money you can send?

Yes, most banks set daily or monthly limits for transfers. Limits depend on your account type and the transfer method. For example, some banks in Hong Kong may cap online transfers at $10,000 USD per day. Always check your bank’s policy.

Worried about high wire transfer fees or sending money to the wrong account? BiyaPay simplifies safe transfers with fees as low as 0.5%. With “Send Today, Arrive Today,” your funds reach recipients promptly, avoiding costly $25-$50 wire transfer fees from banks like Chase. Freely convert multiple fiat and digital currencies using real-time exchange rates for full transparency. BiyaPay’s regulated platform ensures secure transactions with robust encryption, perfect for domestic or international transfers to Mexico, Germany, and beyond. Sign up with BiyaPay today to transfer funds safely and save!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.