- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Send and Receive Money on PayPal Without a Bank Account

Image Source: unsplash

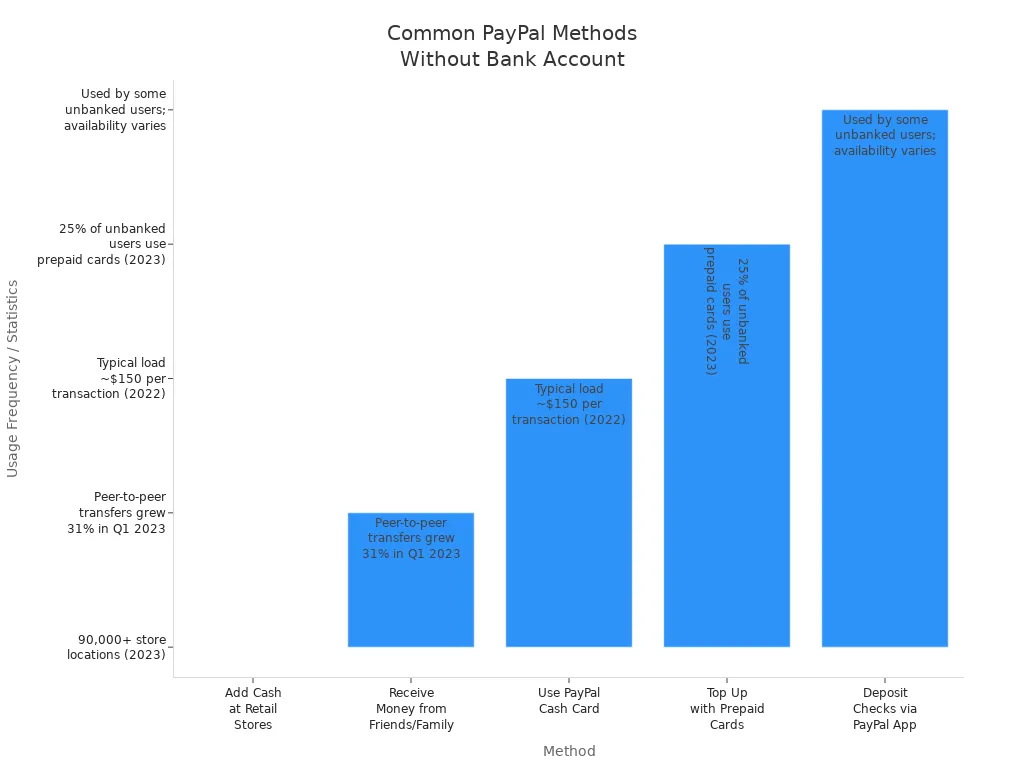

You can use PayPal for a lot of things even without a bank account. You have several easy methods to get started. Many people add cash at retail stores like CVS or Walmart, link a prepaid or gift card, or use the PayPal Cash Card. The chart below shows how often people use these options:

If you want to receive money, PayPal makes it simple. Sending money is also possible when you use PayPal balance or a prepaid card. Withdrawing funds takes a little more work, though, and you might need a PayPal Cash Card or another easy method.

Key Takeaways

- You can create and use a PayPal account without linking a bank or credit card by confirming your email and adding prepaid or gift cards.

- Add money to your PayPal balance using cash at retail stores, prepaid cards, or the PayPal Cash Card to send and receive payments easily.

- Receive money by sharing your email or phone number, and use your PayPal balance to pay online, send money, or create invoices without a bank account.

- Withdraw funds using the PayPal Cash Card, request a mailed check, or transfer to prepaid cards, but watch for fees and withdrawal limits.

- Keep your account safe by confirming your email, using strong passwords, enabling two-factor authentication, and monitoring your transactions regularly.

Use PayPal Without a Bank Account

Image Source: pexels

Create a PayPal Account

You can use PayPal without a bank account, and the process is simple. First, go to the PayPal website and select “Sign Up.” Choose if you want a personal or business account. Enter your name, address, and a valid email address. This email will become your PayPal ID. You do not need to link a bank account or credit card right away. If you want to use PayPal without a credit card, you can skip that step for now.

Here’s a quick guide to get started:

- Visit the PayPal website and click “Sign Up.”

- Fill in your personal details and create a password.

- Use a real email address so you can receive important messages.

- Skip the bank account and credit card steps if you want to use PayPal without a credit card.

You can add money to PayPal later using other methods, like cash at retail stores or prepaid cards.

Confirm Your Email

After you sign up, PayPal will send you an email. You need to open this email and click the link to confirm your address. Confirming your email is important because it lets you receive payments and use PayPal features. If you do not confirm your email, you cannot access your funds or get notifications.

Tip: Confirming your email also helps protect your account and raises your transaction limits. It makes your PayPal account more secure and trusted by others.

Add Prepaid or Gift Card

If you want to use PayPal without a credit card or bank account, you can add a prepaid or gift card. PayPal accepts cards with Visa, Mastercard, American Express, or Discover logos. You can even use virtual prepaid Mastercards from providers like Rewarble. These cards work for online shopping and can be added to mobile wallets.

To add a prepaid or gift card:

- Log in to PayPal and go to “Wallet.”

- Click “Link a debit or credit card.”

- Enter your prepaid or gift card details.

- Make sure the name and address on the card match your PayPal account.

You can add up to three gift cards if your account is verified. Some cards may need to be registered online with a billing address. If you want to top up with prepaid cards, just make sure the card has enough balance. Remember, store-specific gift cards do not work with PayPal.

Here’s a table showing some common limitations:

| Limitation | What It Means |

|---|---|

| Card Network Requirement | Only cards with Visa, Mastercard, Amex, or Discover logos are accepted. |

| Billing Address Needed | Register your card with a billing address before adding to PayPal. |

| Number of Cards | You can add up to three gift cards if verified. |

| No Recurring Payments | Prepaid cards may not work for subscriptions or recurring charges. |

| No Partial Payments | PayPal does not split payments between gift cards and other methods. |

You can add money to PayPal using these cards or by visiting retail stores. This makes it easy to use PayPal without a credit card or bank account.

Receive Money Without a Bank Account

Image Source: pexels

Accept Payments

You can receive money on PayPal without a bank account, and it is easier than you might think. All you need to do is share your email address or phone number with the person who wants to send you money. When someone sends you money, PayPal will notify you right away. If you do not have a PayPal account yet, you will need to create one to claim your funds. Once you confirm your email, you can access your money.

You can also use the PayPal app to accept payments in person. Just show your personal QR code, and the sender can scan it to pay you. This works well for friend-to-friend transfers, small business sales, or even splitting a bill at a restaurant. You do not need to link a bank account to accept payments. You can use PayPal without a card or bank account for most types of payments, including friend-to-friend transfers, online sales, or even donations.

Tip: Always make sure your email is confirmed. If you skip this step, you will not be able to use your PayPal balance or get notifications about new payments.

Use PayPal Balance

Once you receive money, it goes straight into your PayPal balance. You can use this balance to pay for things online, send money to friends, or even create invoices. You do not need a bank account to use your PayPal balance. Many people use PayPal without a credit card or bank account and still enjoy all the main features.

Here are some things you can do with your PayPal balance:

- Send money to others, including friend-to-friend transfers.

- Shop online at stores that accept PayPal.

- Create and send invoices for work or sales.

- Organize fundraising by creating Money Pools.

- Donate to charities through the PayPal Giving Fund.

You can use PayPal without a card for most of these actions. If you want to use PayPal without a credit card, just keep your balance topped up with payments from others or by adding cash at retail stores.

Withdraw Funds

Withdrawing your money from PayPal without a bank account takes a little planning, but you have several options. The most popular way is to use the PayPal Cash Card. This card links directly to your PayPal balance. You can use it to withdraw cash at ATMs, pay in stores, or shop online. You do not need a bank account to get the PayPal Cash Card. Just apply through your PayPal account, and you will receive the card in about a week.

Another option is to request a paper check. PayPal can mail a check to your registered address for a small fee, usually $1.50 per check in the United States. This method takes about 5–10 business days for delivery. If you prefer, you can also transfer your PayPal balance to a prepaid debit card or use third-party services like Venmo to access your funds.

Here is a table showing common withdrawal methods, fees, and limits:

| Withdrawal Method | Fees and Limitations |

|---|---|

| PayPal Cash Card ATM Withdrawals | Fees vary by ATM; daily withdrawal limit around $400 USD |

| Check by Mail | $1.50 per check in the U.S.; delivery in 5–10 business days |

| Third-Party Prepaid Cards | Fees depend on the card provider; may have daily or per-transaction limits |

| Over-the-Counter Withdrawals | $3 per transaction |

| ATM Withdrawals (MoneyPass) | Free |

| ATM Withdrawals (outside MoneyPass) | $2.50 per withdrawal |

Note: You cannot always withdraw your PayPal balance as cash unless you have a PayPal Cash Card or a linked prepaid card. Some withdrawal methods have daily or per-transaction limits, especially if your account is not verified.

If you want to use PayPal without a bank account, the PayPal Cash Card is usually the easiest way to get your money. You can also request a check or use a prepaid card, but each method has its own fees and limits. Always check the latest fees and limits before you withdraw.

Send Money Through PayPal

Sending money through PayPal is easy, even if you do not have a bank account. You have several ways to send money, including using your PayPal balance, adding cash at retail stores, or paying with a prepaid card. You can even send money without a PayPal account by using the guest checkout option. Let’s look at each method step by step.

Use PayPal Balance

If you have money in your PayPal balance, you can send it to anyone with just a few taps. You do not need a bank account for this. Here’s how you can send money through PayPal using your balance:

- Log in to your PayPal account.

- Tap the “Send & Request” button or the “Send” button in the app.

- Enter the recipient’s email address, name, or mobile number.

- Type in the amount you want to send and choose the currency.

- Add a note if you want.

- Pick the payment type, like Friends and Family or Goods and Services.

- Select PayPal balance as your payment method.

- Review the details and confirm to send the money.

You can use your balance for paying for goods and services, sending money to friends, or even making donations. If you want to know how to pay with PayPal, this is the most direct way when you already have funds in your account.

Tip: You need to accept money into your PayPal account first. Make sure you complete any required steps, like confirming your identity, before you send money through PayPal without a bank account.

Add Cash at Retail Stores

You can deposit cash into your PayPal account at many retail stores. This is helpful if you want to send money through PayPal but do not have a bank account or card. The process is simple and quick. Here’s a table to show you how to load cash at stores and what to expect:

| Step-by-step process |

|---|

| 1. Log into the PayPal app. |

| 2. Tap the More button on the home screen. |

| 3. Select Add cash, choose the retailer, and generate a barcode. |

| 4. Show the barcode to the store clerk and hand over the cash to add it to your PayPal account. |

| Aspect | Details |

|---|---|

| How to add cash | Generate a barcode in the PayPal app and show it to the cashier at stores like CVS, Walmart, Dollar General, and Family Dollar. |

| Fees | $3.95 service fee per transaction. |

| Limits | Add between $20 and $500 per transaction. Daily limit is $500. Monthly limit is $4,000. |

| Processing time | Funds usually appear in your PayPal balance within minutes. |

| Supported stores | Over 90,000 locations nationwide. |

| Barcode validity | Barcodes are valid for only 1 hour. |

You can deposit cash at these stores and use your PayPal balance to send money right away. This method works well if you want to send money through PayPal without a bank account. Many people use this option when they do not have access to traditional banking.

Note: If you have a PayPal Cash Card, you can also swipe it at the register to add funds. This makes it even easier to manage your money.

Use Prepaid Card

You can also send money through PayPal by linking a prepaid card. This is a good choice if you do not want to use a bank account or credit card. Here’s how you can send money with a prepaid card:

- Link your prepaid card to your PayPal account.

- Go to the “Send & Request” section.

- Choose the person you want to send money to by entering their email or phone number.

- Enter the amount you want to send.

- Select your linked prepaid card as the payment source.

- Review and confirm the payment.

Prepaid cards with Visa, Mastercard, American Express, or Discover logos usually work. You can use this method for paying for goods and services, sending money to friends, or even making purchases online. If you have a PayPal Cash Card, you can use it as a prepaid card for both spending and adding funds.

Tip: Some prepaid cards may have their own limits or fees. Always check with your card provider before sending large amounts.

Send Money Without a PayPal Account (Pay as a Guest)

You do not always need a PayPal account to send money. The guest checkout option lets you pay as a guest. Here’s how it works:

- You receive an invoice or payment request by email.

- Click the “Pay now” button in the email.

- Enter your credit or debit card details on the PayPal payment page.

- Review the payment details and confirm.

- You get a receipt by email after the payment goes through.

This pay as a guest feature is helpful if you want to send money through PayPal without a PayPal account. Some people use this when they do not want to sign up or link their bank account. Merchants must enable guest checkout in their PayPal settings for this to work. You may see higher fees when you pay as a guest compared to using your PayPal balance.

Note: Not all payments support guest checkout. Some types, like subscriptions, require a PayPal account. Always check if the pay as a guest option is available before you try to send money.

You can send money through PayPal in many ways, even without a bank account. Whether you use your balance, deposit cash, or pay as a guest, you have flexible options to fit your needs.

Fees, Limits, and Safety

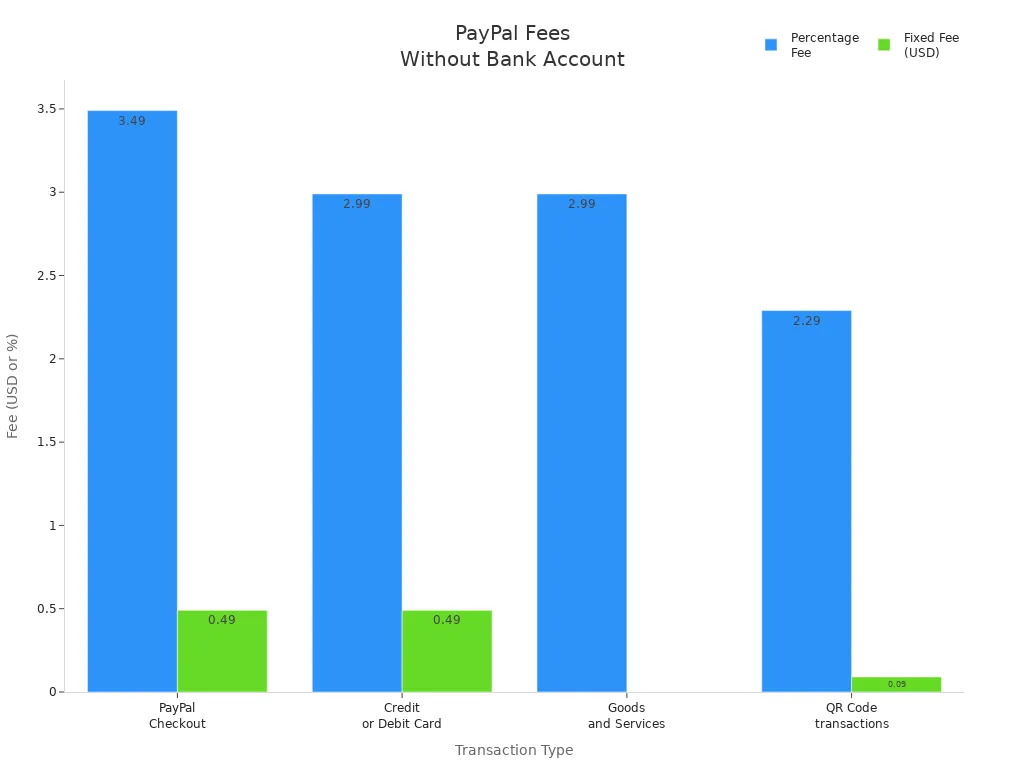

Transaction Fees

When you use PayPal without a bank account, you might notice some extra fees. These fees depend on how you send or receive money. If you use a credit or debit card, or pay as a guest, you pay more than if you use your PayPal balance. Here’s a table to help you see the main fees:

| Transaction Type | Percentage Fee | Fixed Fee (USD) |

|---|---|---|

| PayPal Checkout/Guest Checkout | 3.49% | $0.49 |

| Credit or Debit Card | 2.99% | $0.49 |

| Send/Receive Money for Goods and Services | 2.99% | No fixed fee |

| QR Code transactions | 2.29% | $0.09 |

You also pay $1.50 if you want a check mailed to you, or $0.25 for a transfer to a debit card. There is no fee to open a PayPal account. If you use your PayPal balance or a linked bank account, you can avoid some of these fees. Sending money to friends and family in the US with your balance is free, but using a card costs extra.

Account Limits

If you do not link a bank account, PayPal sets lower limits on your account. You can only send or withdraw up to $500 before you need to verify your identity. Verified users with a linked bank account can send much more—up to $100,000 per day or $60,000 per transaction. Here’s a quick look:

| Account Status | Transaction Limits and Restrictions |

|---|---|

| Unverified (no linked bank account) | - Sending money limited by total amount allowed before verification- Maximum withdrawal limit: $500- Lower transaction limits compared to verified accounts |

| Verified (linked bank account, debit or credit card) | - No overall sending limits- Single transaction limit up to $60,000- Daily sending limit up to $100,000- Higher instant transfer limits |

If you want to keep your limits higher, you should verify your account. This helps you use more PayPal features.

Security Tips

PayPal works hard to keep your money safe, but you should also protect yourself. Here are some easy ways to stay secure when paying online without sharing your details:

- Use a strong, unique password for your PayPal account.

- Turn on two-factor authentication for extra protection.

- Never share your login details with anyone.

- Watch out for phishing emails or fake websites. Always check the sender before clicking links.

- Avoid using public Wi-Fi when logging into PayPal.

- Keep your phone and computer software up to date.

- Only send money to people you trust or verified sellers.

- Check your account often for any strange activity.

- Use a VPN if you want more privacy online.

PayPal uses encryption and fraud monitoring to protect your transactions. If you ever notice something odd, report it right away.

You have many ways to use PayPal without a bank account. You can pay in stores by scanning QR codes, use the One Touch feature for quick payments, or add prepaid cards for more options. Check your transaction history often and turn on notifications to keep your account safe. Always confirm your email to avoid access problems. Review the fees and limits for each method so you can choose what works best for you.

FAQ

Can you use PayPal without linking any bank account?

Yes, you can use PayPal without linking a bank account. You can add money with prepaid cards, gift cards, or cash at retail stores. You can also receive payments and spend your PayPal balance online.

How do you withdraw PayPal funds without a bank account?

You can withdraw money using a PayPal Cash Card at ATMs, request a check by mail, or transfer funds to a prepaid debit card. Each method has its own fees and limits. Always check the latest withdrawal options in your PayPal account.

Are there limits on how much you can send or receive?

Yes, PayPal sets limits if you do not verify your account. You can send or withdraw up to $500 before you need to confirm your identity. Verified users get higher limits. Check your account settings for your current limits.

Can you use a Hong Kong bank card with PayPal?

You can link a Hong Kong bank card to PayPal if it has a Visa, Mastercard, American Express, or Discover logo. PayPal accepts these cards for sending and receiving money. Make sure your card supports international transactions in USD.

Frustrated by PayPal’s 2.99%-3.49% fees and restrictive $500 limits without a bank account? BiyaPay offers a seamless solution with transfer fees as low as 0.5%. With “Send Today, Arrive Today,” your funds reach recipients promptly, avoiding PayPal’s costly checkout fees or slow check withdrawals. Freely convert multiple fiat and digital currencies using real-time exchange rates for full transparency. BiyaPay’s regulated platform ensures secure transactions, ideal for cross-border payments to Mexico, Germany, and beyond, even without a bank account. Sign up with BiyaPay today to save and simplify your payments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.