- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Transfer Money from PayPal to Cash App Without Hassle

Image Source: unsplash

Many people want to transfer money from a PayPal account to a Cash App account, but you cannot send payment directly between the two. You are not alone if you use both services.

- Over 80% of Gen Z and millennials use PayPal.

- More than half of these also use Cash App, showing a big overlap.

You can transfer money from PayPal to Cash App using a linked bank account, the Cash App Cash Card, or a barcode. This step-by-step guide will help you understand how to transfer money, handle each payment method, and keep your payment safe.

Key Takeaways

- You cannot transfer money directly from PayPal to Cash App, but you can use a linked bank account, Cash App Cash Card, or barcode method to move funds safely.

- Link the same bank account to both PayPal and Cash App to transfer money smoothly; transfer from PayPal to your bank, then add money to Cash App from that bank.

- Always double-check your account and card details, use strong passwords, enable two-factor authentication, and monitor transactions to keep your money safe.

How to Transfer Money from PayPal to Cash App

Image Source: pexels

No Direct Transfer Option

You might wonder if you can transfer money from your PayPal account straight to your Cash App account. Right now, there is no direct way to do this. PayPal and Cash App work as separate platforms. They do not offer a built-in feature for a direct payment transfer between them. If you try to send payment from PayPal to Cash App, you will not find an option in either app. This can feel frustrating, especially when you want to move funds quickly.

Note: Both PayPal and Cash App focus on peer-to-peer payments, but they do not connect directly for transfers.

Main Workarounds

Even though you cannot transfer money from PayPal to Cash App directly, you have several easy workarounds. Many people use these methods every day to move money between accounts. Here are the most common ways to transfer money:

- Use a linked bank account. You can transfer money from PayPal to your bank, then add it to Cash App from the same account.

- Try the Cash App Cash Card. You can link this card to PayPal and use it to move funds.

- Use the barcode method. This lets you load money to Cash App after withdrawing from PayPal.

- Some people use third-party services like Wise or Venmo to help with the transaction.

- You can also ask a trusted person who has both accounts to help with the payment transfer.

- Always check for new features in both apps. Sometimes, updates add new ways to transfer money.

If you follow this step-by-step guide, you will find a method that works for you. Each option helps you transfer money from PayPal to Cash App safely and easily.

Transfer Money Using a Linked Bank Account

Image Source: pexels

Transferring money from your PayPal account to your Cash App account works best when you use a linked bank account. This method is popular because it is reliable and does not require extra cards or third-party services. If you want to know how to transfer money between these platforms, follow this step-by-step guide.

Link Bank Account to PayPal and Cash App

First, you need to link the same bank account to both PayPal and Cash App. This step is important because it lets you move funds smoothly between your accounts. Here is what you need to know before you start:

- The bank account must be from a U.S. bank.

- The name on your bank account must match the name on your PayPal account.

- PayPal lets you link up to 8 bank accounts.

- You cannot link the same bank account to more than 3 PayPal accounts over its lifetime.

- If your bank account has active limitations or a negative balance on PayPal, you cannot link it.

- Bank accounts removed due to declined or stopped payments cannot be relinked until you resolve the issue.

- Online-only or prepaid bank accounts usually do not work with PayPal.

- If you enter the wrong confirmation deposit amount three times, PayPal will disable and remove the bank account.

- Linking the same bank account to a second PayPal account may be possible only if PayPal approves it.

To link your bank account, open the PayPal app and go to “Wallet.” Tap “Link a bank account” and follow the prompts. For Cash App, open the app, tap the “Banking” tab, and select “Link Bank.” Enter your account and routing numbers. Double-check your details to avoid errors.

Tip: Always use the exact name on your bank account for both PayPal and Cash App. This helps prevent failed transactions and delays.

Transfer Money from PayPal to Bank

Once you have linked your bank account, you can transfer money from your PayPal account to your bank. Here is how to transfer money:

- Open PayPal and log in.

- Tap “Transfer Money” in your Wallet.

- Choose “Transfer to your bank.”

- Select the linked bank account.

- Enter the amount you want to transfer.

- Pick either “Standard” or “Instant” transfer.

Standard transfers are free and usually take 1 to 3 business days. Sometimes, it can take up to 5 business days, depending on your bank’s processing time. Instant transfers complete within minutes or up to 30 minutes, but PayPal charges a fee of about 1.5% to 1.75% of the transfer amount.

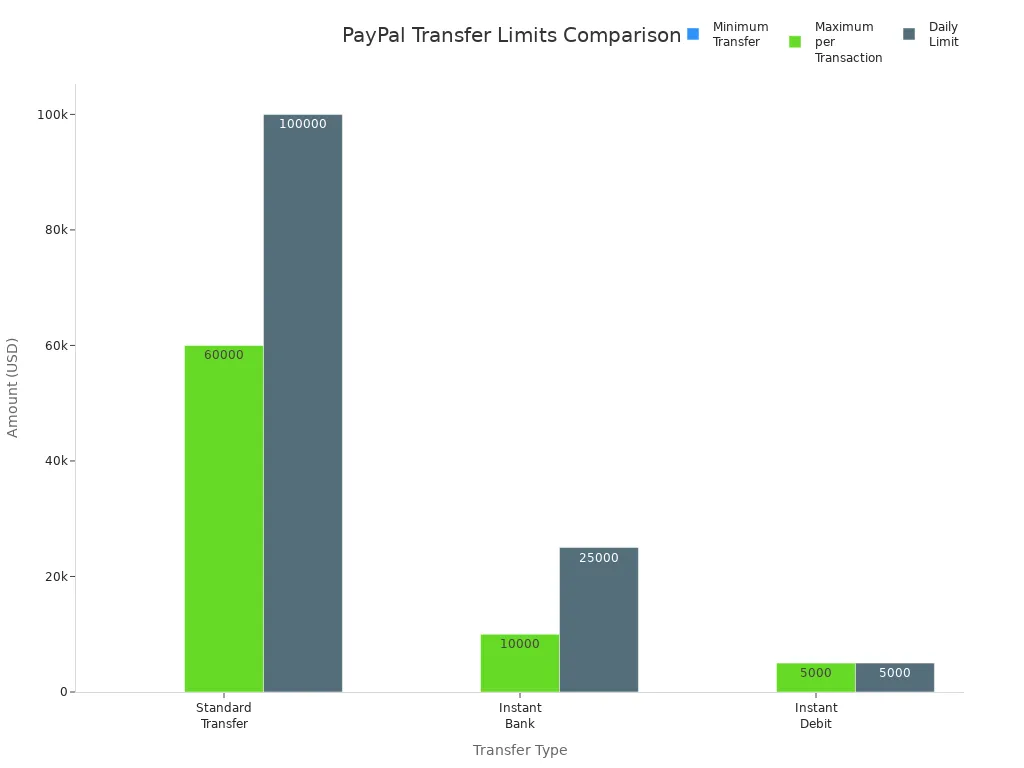

Here is a table showing the minimum and maximum transfer limits for PayPal:

| Transfer Type | Minimum Transfer Amount | Maximum Transfer Amount per Transaction | Daily Limit | Weekly Limit | Monthly Limit |

|---|---|---|---|---|---|

| Standard Transfer | $0.01 | $60,000 (verified account) | $100,000 | N/A | N/A |

| Instant Transfer (Bank Account) | $1 | $10,000 | $25,000 | N/A | N/A |

| Instant Transfer (Debit Card) | $1 | $5,000 | $5,000 | $5,000 | $15,000 |

Note: Transfers started after 7:00 PM ET or on weekends and holidays may take longer. Always check your bank’s processing times.

Add Money to Cash App

After your money arrives in your bank account, you can add it to Cash App. This step is simple and does not require you to visit a bank branch. Here is how you can add to Cash App:

- Open Cash App and tap the “Banking” tab.

- Tap “Add Cash.”

- Enter the amount you want to add.

- Confirm the transfer using your linked bank account.

You can also set up direct deposit by entering your account and routing numbers in Cash App. This lets you receive payments like paychecks or tax returns straight into your Cash App balance.

Tip: Make sure you have enough funds in your bank account before you try to add money to Cash App. Insufficient funds often cause delays or failed transfers.

Common Issues and How to Avoid Them

Many users face delays or errors when they transfer via a bank account. Here are some common problems and how you can avoid them:

- Incorrect bank account or card details often cause failed transfers.

- Account restrictions on PayPal or Cash App can block transfers.

- Insufficient funds in your bank account will stop the payment.

- Technical issues, like network outages or server overloads, may delay your transfer.

- Bank processing times vary by account type and can affect how fast you receive your money.

- Delays are more common on weekends, holidays, or for large transfers.

- Verification checks may hold your transfer if there is unusual activity.

If you run into problems, double-check your account details and make sure your accounts are in good standing. Contact customer support if you cannot resolve the issue.

Using a linked bank account is a safe and effective way to transfer money from PayPal to Cash App. This method works well for most users and keeps your payment transfer secure.

Send Money to Cash App with Cash Card

If you want a fast and flexible way to move money between your PayPal account and your Cash App account, the Cash App Cash Card can help. This method lets you use your Cash Card as a debit card linked to PayPal. You can send money to Cash App without waiting for long bank transfers. Many people like this option because it feels like using a regular debit card, but it connects directly to your Cash App balance.

What Is the Cash App Cash Card

The Cash App Cash Card is a prepaid debit card that works just like a Visa card. You can use it in stores, online, or at ATMs. The card pulls money straight from your Cash App balance, so you do not need to worry about overdrafts or hidden fees. You can even customize the card with colors, emojis, or your own drawings. Here is a quick look at what the Cash Card offers:

| Feature/Aspect | Description |

|---|---|

| Card Type | Prepaid debit card issued by Sutton Bank, Member FDIC, functioning as a Visa debit card |

| Usage | Can be used anywhere Visa is accepted, in stores and online |

| Customization | Users can customize card design with colors, emojis, stamps, and drawings |

| Fees | No hidden fees, no monthly fees, no minimum balance requirements |

| Security Features | 24/7 fraud monitoring, real-time transaction alerts, ability to lock/unlock the card |

| Activation | Activated via the app using a QR code |

| Spending Mechanism | Purchases deduct money directly from the user’s Cash App balance |

| Additional Features | Instant discounts, round ups for saving/investing spare change, ATM withdrawals, direct deposit |

| Negative Balance | Card cannot cause a negative balance |

| Overdraft Coverage | Available under certain conditions |

| Ordering | Can be ordered directly in the app; available for users 18+ or sponsored accounts for 13-17 year olds |

| Delivery Time | Card arrives within approximately 10 business days |

You can order your Cash Card right in the Cash App. If you are between 13 and 17 years old, you need a parent or guardian to invite you through the Cash App Family feature. Here is how you can get your own Cash Card:

- Teens aged 13 to 17 can get a Cash App Cash Card only if invited by an eligible parent or guardian.

- The parent or guardian sends an invitation through the Cash App Family feature.

- The teen accepts the invitation and creates a sponsored account.

- The teen can then order a customizable Cash App Card within the app.

- The sponsoring adult supervises the teen’s account, setting limits and allowances.

- For more details, check the Sponsored Accounts section in the Cash App Terms of Service.

The Cash Card gives you more control over your money and makes it easy to transfer money between apps.

Link Cash Card to PayPal

You can link your Cash App Cash Card to your PayPal account just like any other debit card. This step lets you use your Cash Card as a payment method in PayPal. Here is a step-by-step guide to help you link your card:

- Open your PayPal account and go to the Wallet section.

- Click on ‘Link a debit or credit card’.

- Follow the on-screen instructions to add your Cash Card.

- Enter your Cash Card details: card number, expiration date, and your name.

- Confirm the card is added. You can now use it for PayPal payments.

If you use the PayPal app, tap ‘Accounts’, scroll to ‘Linked bank and cards’, tap ‘Add new’, and link your card manually. Make sure your Cash Card is activated before you try to link it. Unverified PayPal accounts can link up to four cards, while verified accounts can link up to 24 cards. If you have trouble, update your Cash App to the latest version and check that your Cash Card is ready to use.

Tip: Always double-check your card details before linking. This helps prevent failed transactions and saves time.

Transfer Money to Cash Card

Once you have linked your Cash App Cash Card to your PayPal account, you can transfer money quickly. You can use your Cash Card as a debit card to receive funds from PayPal. Here is how to transfer money:

- Log into your PayPal account.

- Go to the Summary section and select ‘Transfer Money’.

- Choose ‘Withdraw from PayPal to your card’ if available, or transfer to your linked bank account first.

- Enter the amount you want to transfer and confirm the transaction.

If PayPal does not allow direct transfers to your Cash Card, you can move money from PayPal to your linked bank account, then add it to your Cash App balance using the ‘Add Cash’ feature. Open Cash App, tap the ‘Banking’ tab, select ‘Add Cash’, enter the amount, and confirm with your PIN or Touch ID.

Note: Some PayPal accounts may not support instant transfers to prepaid cards. If you see an error, try transferring to your bank account first, then add the money to Cash App.

Fees and Troubleshooting Tips

PayPal charges a fee for instant transfers to debit cards, usually around 1.5% to 1.75% of the amount. Standard transfers to your bank account are free but take longer. The Cash App does not charge fees for adding money from your bank, but ATM withdrawals may have fees unless you meet certain deposit requirements.

If you run into problems, check these common issues:

- Your Cash Card is not activated or has expired.

- Your PayPal account is not verified.

- The card details entered do not match your Cash Card.

- Your Cash App balance is too low for the payment.

- There are technical issues with either app.

If you have trouble with your payment transfer, contact PayPal or Cash App support for help. Always keep your apps updated and monitor your transaction history for any unexpected activity.

Using the Cash App Cash Card gives you a simple way to send money to Cash App from your PayPal account. This method works well if you want to avoid waiting for bank transfers and need a fast payment option.

How to Transfer Money Using Barcode

If you want a different way to move money between your PayPal account and Cash App, the barcode method can help. This option lets you use cash and barcodes at stores to transfer funds. You do not need to wait for long bank transfers or link extra cards.

Use PayPal Card to Withdraw Funds

You can start by getting your money out of PayPal. If you have a PayPal Debit MasterCard, you can withdraw cash at most ATMs. Here is how you do it:

- Log in to your PayPal account.

- Enter the amount you want to withdraw.

- Pick your PayPal Debit MasterCard as the destination.

- Confirm the transfer to move the money to your card.

- Go to an ATM and use your card to get cash. The daily limit is $400.

If you do not have a PayPal card, you can use the PayPal app’s “Add cash at a store” feature. Open the app, select this feature, and choose a store like Walmart or CVS. The app will give you a barcode. Show this barcode to the cashier and pay the amount you want to add to your PayPal balance. The money will show up in about 15 minutes.

Load Money to Cash App with Barcode

Now you can add your cash to Cash App. Here is how to transfer money using a barcode:

- Open Cash App and tap the Banking tab.

- Select ‘Paper Money’ to find nearby stores.

- Tap ‘Show Barcode’ to get your unique barcode.

- Go to a store like 7-Eleven or CVS.

- Tell the cashier you want to add cash to your Cash App.

- Let the cashier scan your barcode.

- Hand over your cash (between $5 and $500 per deposit).

- Confirm the deposit in your app and ask for a receipt.

You will pay a $1 fee for each deposit. Funds usually appear in your Cash App balance right away.

Here is a quick look at possible fees:

| Transaction Type | Percentage Fee | Fixed Fee (USD) |

|---|---|---|

| QR Code transactions | 2.29% | $0.09 |

| Cash App Paper Money | N/A | $1.00 |

You need to bring cash for this method. Make sure you check store hours and limits before you go. This barcode method gives you a simple way to transfer funds between PayPal and Cash App without linking accounts.

Transfer Times, Fees, and Safety

How Long Transfers Take

When you transfer money between PayPal and Cash App, you can pick either instant transfer or standard transfer. Instant transfer moves your funds in up to 30 minutes, but you pay a fee. Standard transfer takes one to five business days and is free. Here’s a quick look:

| Transfer Type | Transfer Time | Fee Structure | Technology Used | Notes |

|---|---|---|---|---|

| Instant Transfer | Up to 30 minutes | ~1.50% fee (min $0.25, max $15) | Real Time Payment (RTP) | Fast, but you pay a fee. Works on both PayPal and Cash App. |

| Standard Transfer | 1-5 business days | Free | Automated Clearing House (ACH) | Slower, but no fee. May take longer on weekends or holidays. |

Both PayPal and Cash App give you these options. Instant transfer is great if you need your payment right away. Standard transfer works well if you want to save on fees.

Fees to Expect

You might wonder about the costs when you use peer-to-peer transfers. Instant transfer usually charges about 1.5% of the amount, with a minimum of $0.25 and a maximum of $15 per transaction. Standard transfers are free. Cash App may charge $1 for adding cash at a store. ATM withdrawals can have extra fees unless you meet deposit requirements.

Tip: To save money, use standard transfer when you do not need your payment transfer quickly. Always check for any extra fees before you finish your transaction.

Safety Tips

Keeping your money safe matters when you use PayPal and Cash App. Here are some important tips:

- Use strong, unique passwords for each account.

- Turn on two-factor authentication for extra security.

- Double-check all payment details before you send money.

- Only send money to people you trust.

- Avoid using public Wi-Fi for payment transfers.

- Keep your apps and phone updated.

- Watch your account activity for any strange transactions.

- Stay alert for phishing scams or fake messages.

- Never share your login details with anyone.

- Report anything suspicious to PayPal or Cash App support right away.

You should also look out for scams like fake contests, quick-cash offers, or fake product listings. Always verify who you are sending money to, especially with peer-to-peer apps. If you lose your phone, secure your accounts as soon as possible.

Most people find linking a bank account to both PayPal and cash app works best. Always double-check your details and follow safety tips. You can move money to your cash app account easily if you follow these steps. Got questions or tips? Share your experience in the comments!

FAQ

Can you transfer money directly from PayPal to cash app?

You cannot send money straight from PayPal to cash app. You need to use a linked bank account, a cash app cash card, or the barcode method.

Why does my cash app transfer not show up after moving money from PayPal?

Sometimes, your cash app transfer takes extra time. Bank processing, app updates, or account verification can slow things down. Check your cash app balance and transaction history.

Are there any limits when adding money to cash app from PayPal?

Yes, cash app has daily and weekly limits for adding money. PayPal also sets transfer limits. Always check both apps before you start your transfer.

Tired of complicated PayPal-to-Cash App transfers and 1.5%-1.75% fees? BiyaPay simplifies payments with transfer fees as low as 0.5%. With “Send Today, Arrive Today,” your funds reach recipients promptly, bypassing slow bank transfers or store visits. Freely convert multiple fiat and digital currencies using real-time exchange rates for full transparency. BiyaPay’s regulated platform ensures secure transactions, ideal for domestic or cross-border payments to Hong Kong, Mexico, and beyond. Sign up with BiyaPay today to transfer money hassle-free!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.