- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use the Bank of America App for Wire Transfers

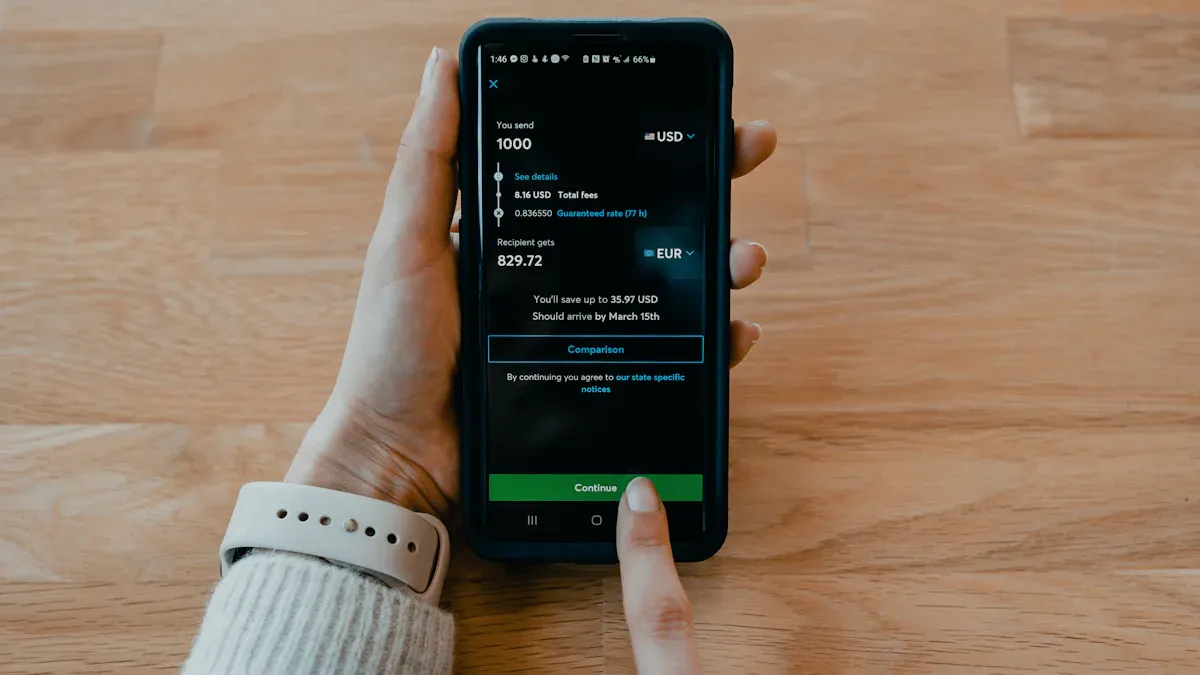

Image Source: unsplash

You can easily send money using the Bank of America wire transfer feature right from your phone. The app lets you complete a bank of america wire transfer at any time, whether you need to move funds within the U.S. or to another country. Mobile banking keeps your information safe with special security steps, like one-time codes sent by text and even USB security keys for extra protection. With these tools, you stay in control and your bank of america wire transfer stays secure. The whole process feels quick and simple, even if you have never used the app before.

Key Takeaways

- Enroll in the Bank of America app’s wire transfer service by following simple steps to keep your account secure and ready for transfers.

- Always double-check recipient details like name, account number, and bank codes to avoid delays or sending money to the wrong place.

- Use the app’s ‘Pay & Transfer’ section to add recipients, enter transfer details, and review fees before sending money.

- Be aware of wire transfer fees and daily limits; domestic transfers cost about $30, and international fees vary with limits up to $100,000 daily.

- Track your transfers easily in the app and contact Bank of America support if you face delays or issues to keep your money safe.

Bank of America Wire Transfer Basics

Image Source: unsplash

What You Need

Before you start a bank of america wire transfer, you need to gather some important details. This helps make sure your money goes to the right place. The app supports both domestic wire transfers and international wire transfers. Here’s what you should have ready:

- Recipient’s full name and address

- Bank account number

- Routing number for domestic wire transfers

- SWIFT/BIC code or IBAN for international wire transfers

- Account type (checking or savings)

- Currency for international wire transfers

- Recipient bank’s address

Tip: Double-check all information before you send a wire transfer. Even a small mistake can delay your transfer or send money to the wrong account.

You can use the app to send both domestic and international wire transfers. For international wire transfers, you may need extra details like the recipient’s bank SWIFT code. If you want to receive an international wire transfer, give the sender Bank of America’s SWIFT code (BOFAUS3N for USD or BOFAUS6S for foreign currency) and your routing number.

Enrollment Steps

If this is your first time using the app for a bank of america wire transfer, you need to enroll in the service. The process is simple and keeps your account secure. Here’s how you do it:

- Log in to the Bank of America app.

- Go to ‘Pay & Transfer’ and tap ‘Wire’.

- Choose the account you want to send money from.

- Tap ‘Start a wire’ to begin.

- If you are sending to a new person, tap ‘Add new recipient’ and enter their details.

- Review and accept the Service Agreement.

- Add your U.S. mobile number if you are not already enrolled in Secured Transfer.

- Enter the authorization code sent to your phone.

- Add your ATM or debit card details and PIN.

- Wait for confirmation that you are enrolled.

- Once enrolled, you can add recipients and send wire transfers anytime.

Note: For transfers over $1,000, Bank of America recommends using SafePass for extra security. You can track your wire transfer status in the app under the Activity screen.

How to Wire Money in the App

Image Source: unsplash

Accessing Pay & Transfer

You start your wire transfer by logging in to the Bank of America app. Once you see your main dashboard, look for the ‘Transfer | Zelle®’ option. Tap this to enter the ‘Pay & Transfer’ section. This is where you can make transfer choices, including sending a bank of america wire transfer. The app keeps things simple, so you do not have to search through many menus.

Tip: If you use mobile banking often, you will find the ‘Pay & Transfer’ button near the bottom of your screen. This makes it easy to reach every time you want to send money or check your transfer history.

Adding a Recipient

Before you make transfer to someone new, you need to add their details. Tap ‘Wire’ and then select ‘Add new recipient.’ The app will ask for the recipient’s name, address, account number, and bank information. If you plan to send a wire transfer outside the U.S., you will also need the recipient’s bank SWIFT code or IBAN, and the bank’s address.

Take your time when you enter these details. Double-check everything before you save. A small mistake can cause delays or send your money to the wrong place.

Note: You only need to add a recipient once. After that, you can select them from your saved list for future transfers.

Entering Transfer Details

Now you are ready to make transfer. Choose the account you want to send money from. Pick the recipient from your list. Enter the amount you want to send. If you are sending a bank of america wire transfer to another country, select the right currency. The app will show you the current exchange rate in USD, so you know exactly how much the recipient will get.

You can add a note or message for the recipient if you want. Review all the details on the screen. Make sure the amount, recipient, and bank information are correct.

Callout: The app will show you any fees before you finish the wire transfer. Always check these so you know the total cost.

Confirming and Sending

When you feel ready, tap ‘Review.’ The app will show you a summary of your wire transfer. Look over everything one more time. If all the details look good, tap ‘Send.’ The app may ask for a one-time code sent to your phone or for your SafePass code. This step keeps your transfer secure.

After you send money, you will see a confirmation screen. The app will also send you a notification or email. You can track your transfer in the app under the ‘Activity’ or ‘Transfer History’ section.

Tip: If you ever wonder how to wire money again, just follow these steps. The process stays the same each time, so you will get faster with practice.

Wire Transfer Fees and Limits

Domestic vs. International Fees

When you send money using the Bank of America app, you pay a fee. The fee depends on where you send the money. For domestic wire transfers, the fee is usually if you send money out. If you receive money, the fee can be $0 to $15. Some customers, like Preferred Rewards members, get free incoming wires. Diamond members may not have to pay for outgoing wires.

Here’s a quick look at the fees:

| Type of Transfer | Outgoing Fee | Incoming Fee |

|---|---|---|

| Domestic Wire Transfer | $30 | $0–$15 |

| International Wire Transfer | Varies | Varies |

Note: The app does not show all fee details. You can check the Online Banking Service Agreement for more information.

Transfer Limits

You have wire transfer limits when you use the app. These limits help keep your account safe. The daily limit for domestic wire transfers is $100,000. For international wire transfers, the daily limit is $50,000. If you use the online option, the limit is $50,000 for domestic and $10,000 for international. If you need to send more, you can visit a branch or call customer service.

| Transfer Type | Daily Limit (USD) |

|---|---|

| Domestic (App) | $100,000 |

| International (App) | $50,000 |

| Online (International) | $10,000 |

Tip: If you want to raise your wire transfer limits, reach out to Bank of America support.

Processing Times

Bank of America processes most wire transfers on the same business day if you send them before the cutoff time. International wire transfers may take longer because they go through other banks. You can track your transfer in the app. If you have questions about timing, the app has guides and links to help you.

The app gives you step-by-step help for sending money, but it does not list every fee or limit. Always double-check the details before you send.

Security and Troubleshooting

Keeping Transfers Secure

You want your money to stay safe. The Bank of America app gives you strong security tools. When you log in, you use secure passwords and sometimes a one-time code sent to your phone. The app also lets you set up travel notices and activate your card right from your phone. If the bank sees something strange, they will contact you to check for fraud. You can see which companies have access to your data in the Security Center tab. This helps you spot anything that looks wrong. If you report a problem within 60 days, you will not be held responsible for any fraud. These steps help you trust the app when you send money.

Tip: Always double-check the recipient’s details before you send money. Make sure you use the right account number and bank code.

Common Issues

Sometimes, things do not go as planned. Here are some problems you might face:

- Transfers may not send or could be delayed.

- You might have trouble logging in or not get your security code.

- The app could have outages that stop transfers.

- Errors can happen if you enter the wrong recipient details or bank codes.

- Transfers started after the bank’s cutoff time may not process until the next business day.

Wire transfer delays often happen because of mistakes in the recipient’s information or sending money too late in the day. Once you send a wire transfer, you usually cannot cancel it. Always check every detail before you hit send.

Tracking Transfers

You can track your transfer right in the app. Go to the ‘Activity’ or ‘Transfer History’ section to see the status. If your transfer is delayed or not received, try these steps:

- Check all recipient details for mistakes.

- Look for any bank rules or limits that could block your transfer.

- Keep records of your transfer and any messages from the bank.

- Let the bank know ahead of time if you plan to send a large amount.

- Remember that weekends and holidays can slow things down.

- If you think the app is not working, contact Bank of America support.

- Use the app’s tracking features to watch your transfer in real time.

Note: If you still have trouble, reach out to customer support. They can help you find out what went wrong and how to fix it.

You can send money quickly and safely with the Bank of America app. You do not need to visit a branch or wait in line. The app lets you add recipients, enter details, and get notifications when your transfer goes through.

- Always double-check recipient information and review any fees before you send money.

- If you have questions or run into problems, use the app’s help or support features.

Keep your app updated for the best experience and the latest security features.

FAQ

How do you cancel a wire transfer in the Bank of America app?

You cannot cancel a wire transfer after you send it. If you made a mistake, contact Bank of America support right away. They might help if the transfer has not finished processing.

What should you do if your wire transfer is delayed?

First, check the transfer status in the app. Review all recipient details for errors. If you still see a delay, contact Bank of America support. Sometimes, weekends or holidays slow things down.

Can you send a wire transfer to Hong Kong banks using the app?

Yes, you can send money to Hong Kong banks. Make sure you have the recipient’s SWIFT code, account number, and bank address. The app will show you the current USD exchange rate before you send.

Where can you find your wire transfer history in the app?

You can view your wire transfer history by tapping ‘Activity’ or ‘Transfer History’ in the app. Here’s a quick guide:

| Step | Action |

|---|---|

| 1 | Open the app |

| 2 | Tap ‘Activity’ |

| 3 | Select ‘Transfer History’ |

Frustrated by Bank of America’s $30 domestic or $45 international wire transfer fees? BiyaPay offers a seamless alternative with fees as low as 0.5%. With “Send Today, Arrive Today,” your funds reach recipients promptly, avoiding delays from incorrect SWIFT codes or bank errors. Freely convert multiple fiat and digital currencies using real-time exchange rates for full transparency. BiyaPay’s regulated platform ensures secure transfers to Hong Kong, Europe, and beyond, with no $100,000 daily limit constraints. Sign up with BiyaPay today for fast, affordable global payments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.